Fillable Printable Pension Withdrawal Form - New Jersey

Fillable Printable Pension Withdrawal Form - New Jersey

Pension Withdrawal Form - New Jersey

CW-0493-0702

STATE OF NEW JERSEY

DIVISION OF PENSIONS AND BENEFITS

Public Employees' Retirement System

Teachers' Pension and Annuity Fund

Police and Firemen's Retirement System

State Police Retirement System

APPLICATION FOR WITHDRAWAL

PO Box 295

Trenton, NJ 08625-0295

FREQUENTLY ASKED QUESTIONS

1. Who is eligible to withdraw?

To withdraw the balance of your pension contributions

in a lump sum, you must have resigned your position

and no longer be employed in a covered position.

Withdrawal is not permitted by law if you are on a leave

of absence granted by your employer.

An employee who is receiving periodic Workers’ Com-

pensation benefits as the result of an injury incurred in

public employment is considered an active employee

and an active member of the pension fund. If you are

receiving Workers’ Compensation benefits, or have a

case pending, applying for withdrawal from the pension

fund could jeopardize your rights to benefits. In such

cases, the Division will require that you complete an

additional retirement benefit waiver form.

If you were dismissed from your position and are in the

process of appealing that dismissal, you cannot with-

draw your contributions until a decision has been ren-

dered or your appeal is withdrawn.

If you hold more than one position covered under the

pension fund (multiple membership), you cannot with-

draw until you have terminated all employment covered

by the pension fund.

2. What is inactive membership?

When you resign your position, you may leave your

contributions on deposit and continue an inactive mem-

bership in the fund for a maximum period of two years.

Should you return to active service in a position cov-

ered by the pension fund before the expiration of your

membership, you may reactivate your account with the

same service credit established at the time you ceased

employment.

The period during which you were inactive will not

count as service credit for retirement.

If your position was abolished due to a layoff, your

employer must notify the Division of Pensions and Ben-

efits in writing, and your membership in the fund can

remain inactive for a maximum of ten years (five years

for PFRS members).

3. How do I apply for withdrawal?

You must complete Part One and Part Two of the Appli-

cation for Withdrawal. Be sure to sign and date your

application.

Your former employer is responsible for the Employer‘s

Certification for Withdrawal form. Your withdrawal claim

cannot be paid until your former employer has complet-

ed this form.

If you are a member of the New Jersey State Employ-

ees Deferred Compensation Plan or Supplemental

Annuity Collective Trust (SACT), you must file separate

applications for withdrawal from those plans. You can

obtain an application by calling the Deferred Compen-

sation Plan at (609) 292-3605, or SACT at (609) 633-

2031.

4. What happens to my Group Life Insurance when I

withdraw?

Group Life Insurance coverage will expire 31 days after

your termination of employment. You may convert all or

any part of your insurance to an individual policy by

contacting the Prudential Insurance Company of Amer-

ica, Inc. at 1-800-262-1112.

Contributions made for Contributory Group Life Insur-

ance are not refundable upon termination of employ-

ment.

5. If I am taking another job in New Jersey govern-

ment, must I withdraw?

If you are terminating employment to accept another

position covered by any government agency in New

Jersey (except federal government), you may transfer

your account. Please call the Office of Client Services

at (609) 292-7524 for more information.

6. I have 10 years of service credit, but have not

reached normal retirement age. Must I withdraw?

If you have established at least 10 years of service

credit and have not reached normal retirement age, you

can apply for Deferred Retirement, whereby you begin

collecting a monthly pension at the normal retirement

age. Call the Benefits Information Library at (609) 777-

1931 and request catalog item 210 for information

about Deferred Retirement.

Normal retirement age for the Public Employees'

Retirement System (PERS) and the Teachers' Pension

and Annuity Fund (TPAF) is 60. Normal retirement age

for the Police and Firemen's Retirement System

(PFRS) or the State Police Retirement System (SPRS)

is 55.

You are not eligible for Deferred Retirement if you with-

draw your contributions.

7. What is payable when I withdraw?

If you terminate employment or cease to be an employ-

ee for any reason other than death or retirement, you

shall receive all of the accumulated deductions stand-

ing to your credit in your individual account less any

outstanding loan balance.

Withdrawing members of the PERS or TPAF who have

at least three years of contributing membership service

at the time the service ceases will have interest credit-

ed.

No interest is payable to withdrawing members of the

PFRS or SPRS.

CW-0493-0201q

1

DO NOT RETURN THE APPLICATION WITHOUT COMPLETING PART TWO.

2

INSTRUCTIONS FOR COMPLETING THE WITHDRAWAL APPLICATION

PART ONE AND PART TWO OF THE APPLICATION FOR WITHDRAWAL are to be complet-

ed by the member and signed. The application should then be returned to the Division of

Pensions and Benefits. If you have difficulty completing this form, please call the Division

of Pensions and Benefits, Office of Client Services at (609) 292-7524 for assistance. The

Division of Pensions and Benefits cannot give tax advice.

P

ART ONE:

ITEM 2 — ADDRESS

Withdrawal checks must be mailed. They cannot be picked up at the Division of Pensions

and Benefits. If you move between the time you file the application and the check is

mailed, you may change your address by contacting the Division’s Office of Client Ser-

vices at (609) 292-7524.

ITEMS 5 and 6 — RETIREMENT SYSTEM/MEMBER NUMBER

Be sure to indicate your retirement system and membership number. If you are not sure,

consult your personnel, payroll office, or look on your annual Personal Benefits Statement.

ITEM 9 — REASON FOR TERMINATION

You must indicate the reason and date of your termination. See Question #1 of the Fre-

quently Asked Questions for information on dismissal.

ITEM 10 — WORKERS’ COMPENSATION CASES

If you are receiving Workers’ Compensation benefits, the Division is required to send

you an additional retirement benefit waiver form which you must complete and return

before we can process your withdrawal.

ITEM 11 — WAIVER OF RETIREMENT BENEFITS

Please read the instructions on the application and the information in Question #6 of the

Frequently Asked Questions carefully before completing this waiver. If you have 10 years

of membership credit or are age 58 or older (PERS and TPAF) and do not complete this

item, you will be required to complete and return a separate benefit waiver form before we

can process your withdrawal.

P

ART TWO: ROLLOVER ELECTION — SELECTION OF PAYMENT TYPE

If Part Two is not completed or completed incorrectly, the Division of Pensions and Benefits will

make your total payment payable to you and withhold 20% federal income tax on the taxable por-

tion of your payment.

Please carefully read the payment selection information on the following page, the instructions

on the application, and Fact Sheet #27 — The Taxability and Mandatory Withholding of Income

Tax from your Pension Distribution before completing this portion of your application. Your selec-

tion in Part Two of the application can not be changed once your application has been processed.

Call the Automated Information System at (609) 777-1777 to hear your approximate taxable

amount and other information concerning withdrawal.

(

continued on next page)

(PART TWO continued from previous page)

Selection 1 - If you choose this selection, the Division of Pensions and Benefits will make your

benefit check payable to you at the address listed in Part 1. 20% of the taxable portion

of your payment will be withheld as federal income tax.

Selection 2 - If you choose this selection, there will be a direct rollover of the entire taxable

and non-taxable portion of your payment. This selection is onl

y open to those

whose taxable portion is $200 or more. You must insert the name of the financial insti-

tution or employer plan that will accept your rollover. The Division of Pensions and Bene-

fits will mail a check to you which will be made payable to the institution or employer plan

you selected to accept your rollover.

Selection 3 - If you choose this selection, there will be a direct rollover of the entire taxable

portion of your payment. This selection is onl

y open to those whose taxab

le portion

is $200 or more

.

You must insert the name of the financial institution or employer plan

that will accept your rollover. The Division of Pensions and Benefits will mail a check to

you representing the taxable portion of your payment which will be made payable to the

institution or employer plan you selected to accept your rollover. If part of your payment

is non-taxable, a second check for the non-taxable portion will be made payable to you.

Selection 4 - If you choose this selection, there will be a direct rollover of part of the taxable

portion of your payment. This selection is onl

y open to those whose taxable portion

is $200 or more. You must insert the dollar amount you wish to roll over and the name

of the financial institution or employer plan that will accept your rollover. Any remaining

portion of your taxable amount will be paid to you in a separate check, less 20% for fed-

eral tax, along with any non-taxable amount.

Selection 5 - If you choose this selection, there will be a direct rollover of the entire taxable

portion of your payment, along with a portion of your non-taxable payment. This

selection is only open to those whose taxable portion is $200 or more. You must

insert the dollar amount of the non-taxable portion that you wish to roll over and the name

of the financial institution or employer plan that will accept your rollover. The remaining

portion of your non-taxable amount will be paid to you in a separate check.

P

ART THREE: SIGNATURE

Be sure to sign and date your application. For your own protection, unsigned applications

will not be processed. The Division cannot accept photocopies or facsimiles of complet-

ed applications.

NOTE: If you are a participant in the Supplemental Annuity Collective Trust (SACT) or New

Jersey State Employees Deferred Compensation Plan (NJSEDCP), and are with-

drawing all accumulated salary deductions in the retirement system, a separate applica-

tion to withdraw from these plans must be filed and submitted to the Division of Pensions

and Benefits. To obtain an application please call (609) 633-2031 for SACT or (609) 292-

3605 for NJSEDCP.

EMPLO

YER CERTIFICATION

The Employer Certification for Withdrawal form must be filled out by your former

employer after you have terminated employment. While the employer’s certifi-

cation does not have to accompany your Application for Withdrawal, WE CAN-

NOT PROCESS YOUR APPLICATION UNTIL WE RECEIVE THE EMPLOYER'S CER-

TIFICATION.

3

CW-0493-0702

State of New Jersey — Department of the Treasury

Division of Pensions and Benefits, PO Box 295, Trenton, NJ 08625-0295 — (609) 292-7524

APPLICATION FOR WITHDRAWAL

Please read instructions carefully before completing the application.

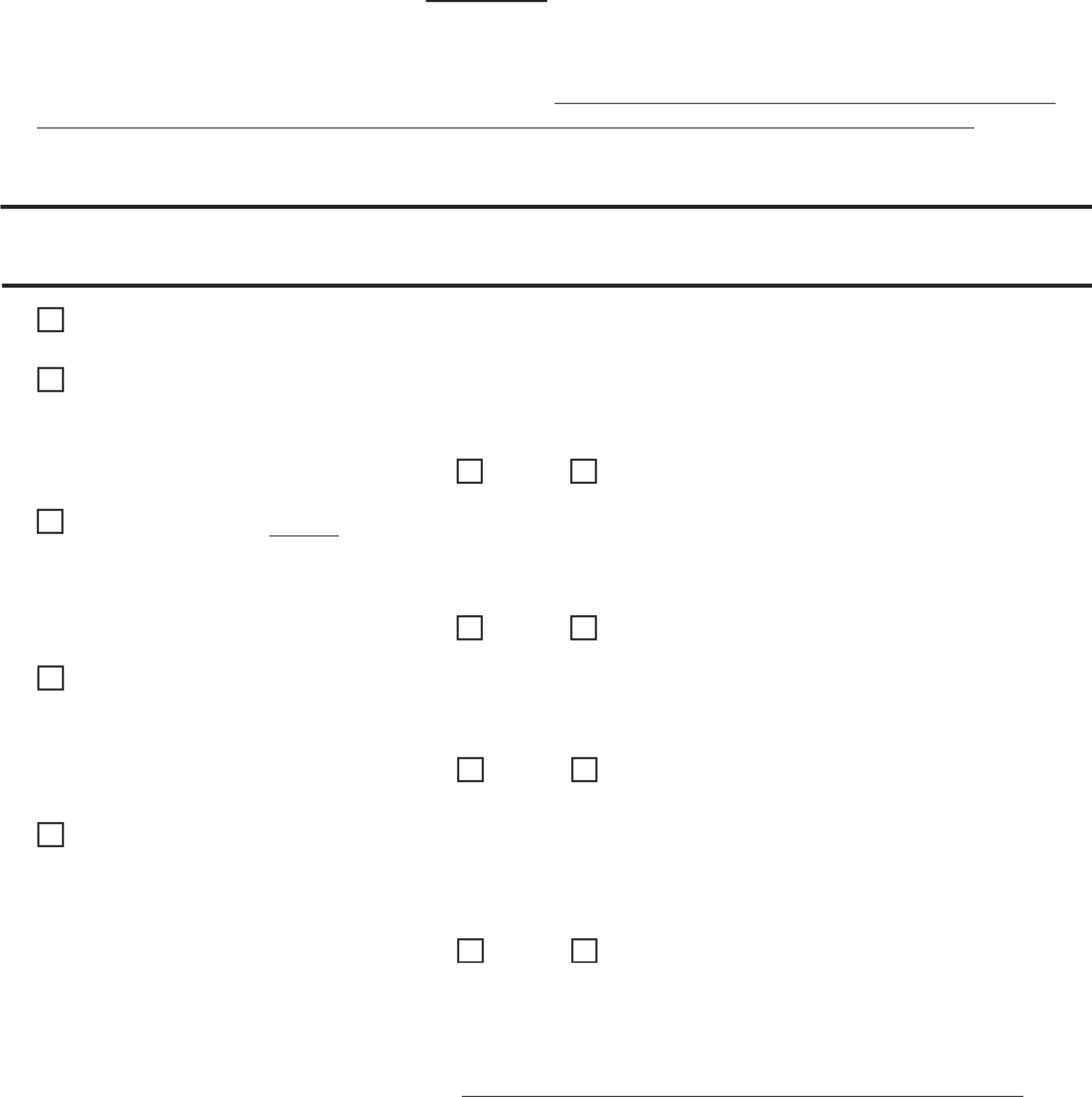

PART ONE: To be completed by member. Please print.

1. Name _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

FIRST MIDDLE INITIAL LAST

2. Mailing Address _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

STREET APT. NO.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

CITY STATE ZIP CODE

3. Daytime Telephone No. (__________) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

AREA CODE

4. D a t e o f B i r t h _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

MONTH DAY YEAR

5. I am a member of (check one only):

Public Employees’ Retirement System

Teachers’ Pension and Annuity Fund

Police and Firemen’s Retirement System

State Police Retirement System

6. Member No. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

7. Social Security No. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

8. Employer _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

9. Please indicate the reason and date you terminated employment Resigned Dismissed

Date: _______/_______/_______

MONTH, DAY, YEAR

10. I AM, or AM NOT receiving periodic benefits under a claim filed for Workers’ Compensation based on an

injury incurred as a result of service performed in public employment.

I DO, or DO NOT have a Workers’ Compensation claim or litigation pending.

11. Members having 10 or more years of membership credit or who are within 2 years of normal retirement age must

waive any monthly retirement benefits by completing the waiver below. This item must be completed before

your application can be processed. If you do not complete the waiver, you will receive an estimate of the retire-

ment and group life insurance benefits for which you would be eligible and a benefit waiver form which must be

completed and returned before we can process your withdrawal. Any member who is at least age 60 (for PERS

and TPAF) or at least age 55 (for PFRS and SPRS) will automatically receive an estimate of retirement

benefits and waiver form to complete.

Although I am eligible for retirement, I elect to withdraw my pension contributions and hereby waive my

right to receive a lifetime monthly allowance and group life insurance at retirement in favor of receiving a

refund of my pension contributions now.

______________________________________________

(You must sign here)

PLEASE COMPLETE SIDE 2

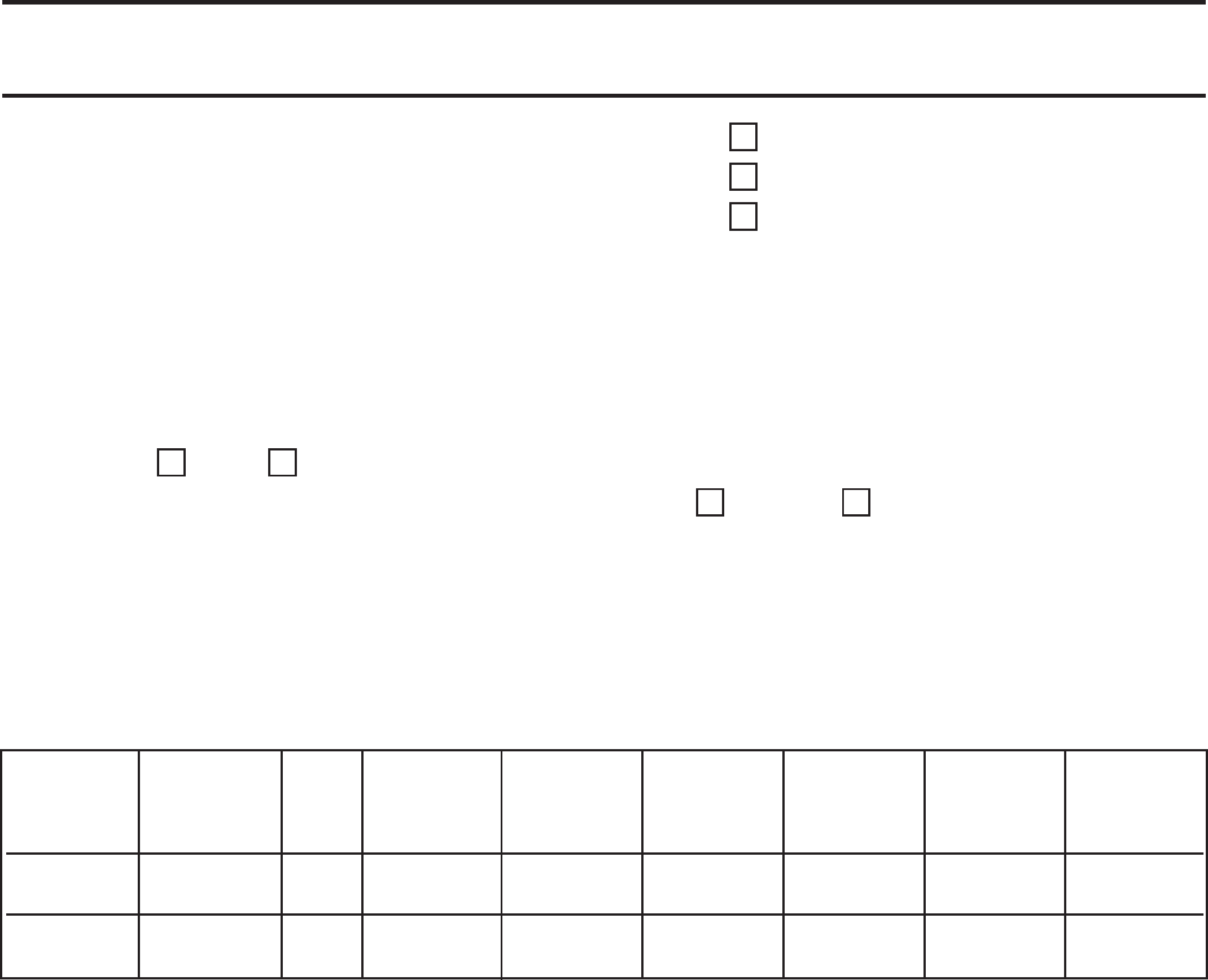

Member’s Name ________________________________________________ Member No. _____________________

PART TWO: To be completed by member. Please print

.

Please carefully read the following section and indicate your choice by checking one of the boxes below

(this selection is irrevocable once made). For an explanation of these selections read the instructions for

Part Two in Completing the Withdrawal Application. If P

art Two is not completed or is completed incor-

rectly, the Division of Pensions and Benefits will automatically withhold 20% federal income tax.

Call the

Automated Information System at (609) 777-1777 to hear your approximate taxable amount and other infor-

mation concerning withdrawal.

IMPORTANT: YOUR SELECTION IS IRREVOCABLE.

Rollover is only available if the taxable portion of your payment is $200 or more.

1. Withhold 20% federal income tax on the taxable portion of my payment.

2. Roll over the entire payment including any after tax contributions to:

Print the name of the financial

institution or employer plan ___________________________________________________________________

This is an: IRA Employer Plan

3. Roll over the entire taxab

le portion of my payment to:

Print the name of the financial

institution or employer plan ___________________________________________________________________

This is an: IRA Employer Plan

4. Roll over $_______________ (dollar amount) of the taxable portion of my payment to:

Print the name of the financial

institution or employer plan ___________________________________________________________________

This is an: IRA Employer Plan

5. Roll over the entire taxable portion and $_______________ (dollar amount) of the non-taxable portion of

my payment to:

Print the name of the financial

institution or employer plan ___________________________________________________________________

This is an: IRA Employer Plan

PART 3: I have read both the letter and fact sheet sent with this form. I understand that the Division of Pensions and Ben-

efits will act upon my choice in Part Two. I under

stand my selection in Part Two cannot be changed.

_______________________________________________________________ ____________________________

Signature Date

CW-0493-0702

CW-0493-0702

State of New Jersey — Department of the Treasury

Division of Pensions and Benefits, PO Box 295, Trenton, NJ 08625-0295 — (609) 292-7524

EMPLOYER’S CERTIFICATION FOR WITHDRAWAL

THIS FORM MUST BE COMPLETED BY FORMER EMPLOYER

1. Name of Member __________________________________________________________________________

2. Membership No. __________________________ 3. Social Security No. __________________________

This certification will be used to calculate the payment due to the member.

DO NOT COMPLETE THIS FORM UNTIL THE LAST DEDUCTION FROM SALARY HAS BEEN MADE.

resigned

I certify that _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ was dismissed (no appeal pending)

NAME OF FORMER EMPLOYEE

was dismissed (appeal pending)

from this organization on __________________. The last pension deduction was made _______________________________.

DATE BIWEEKLY PAY PERIOD / YEAR OR

MONTH/ YEAR*

*State employers must enter the number of the pay period and the year of the last pension deduction.

All other employers must enter the month and year of the last pension deduction and be sure to sub-

mit that deduction for the entire month.

The employee IS, or IS NOT receiving periodic benefits under a claim filed for Workers’ Compensation based on an

injury incurred as a result of service performed in public employment and DOES, or DOES NOT have a Workers’ Com-

pensation claim or litigation pending.

CERTIFICATION OF SALARY DEDUCTIONS

ONLY TO BE COMPLETED FOR ANY UNPOSTED PENSION CONTRIBUTIONS

I certify that the following deductions have been made from the employee's salary during the last two quarterly periods ending

with the current quarter. State biweekly reporting agencies must attach a completed Supplemental Biweekly Certification of

Employing Agency or a screen print of the Centralized Payroll History screen in lieu of completing this item.

Signature of

Certifying Officer _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Date _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Employing Agency _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Telephone Number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(INCLUDE AREA CODE)

BASE SALARY

SUBJECT TO FULL ARREARS TOTAL

QUARTER CONTRIBUTIONS RATE PENSION LOAN BACK AND/OR PENSION SACT

ENDING THIS QUARTER (%) CONTRIBUTION REPAYMENT DEDUCTIONS PURCHASES CONTRIBUTIONS YES OR NO

$$$$$$

$$$$$$

INSTRUCTIONS FOR COMPLETING THE EMPLOYER’S CERTIFICATION

This certification must be completed by the employer when a member files an

application for withdrawal of pension contributions. Failure to provide this

information will delay processing of the member's application for withdrawal.

If you need assistance in completing this certification, call the Division of Pen-

sions and Benefits’ Office of Client Services at (609) 292-7524 weekdays

between 9:00 a.m. and 4 p.m. (except State holidays).

ITEMS REQUIRING SPECIAL

ATTENTION

REASON FOR LEAVING

You must indicate the member’s reason for leaving. Place an (X) the box next to “resigned,” or if the member was

dismissed, you must also indicate with an (X) if the dismissal has an appeal pending or no appeal pending. This infor-

mation is required before processing the withdrawal application.

TERMINATION DATE

A member must terminate employment before this certification can be submitted to the Division of Pensions and

Benefits. Include the date of termination and the date of the last pension deduction. State biweekly reporting agen-

cies must enter the number and year of the last pay period of the last pension deduction. All other employ-

ers must enter the month and year of the last pension deduction.

WORKER’S COMPENSATION

Please indicate if the member was receiving periodic benefits under a claim filed for Worker’s Compensation. Place

an (X) in the block to indicate if the member IS or IS NOT receiving these benefits. You must also indicate with an

(X) if the member DOES or DOES NOT have a Worker’s Compensation claim or litigation pending. This information

is required before processing the withdrawal application.

SALARY DEDUCTIONS

Indicate the following: (1) quarter ending, (2) amount of monthly base salary subject to contributions, (3) full rate of

contribution, (4) the dollar amount of the deduction, (5) loan repayment amount (if any), (6) back deductions, (7)

arrears or purchase deductions, (8) the total pension contributions (include all deductions for the quarter), and (9)

answer “yes” or “no” to whether the member contributed to the Supplemental Annuity Collective Trust (SACT).

SUBMIT THIS CERTIFICATION TO: WITHDRAWAL SECTION

DIVISION OF PENSIONS AND BENEFITS

PO BOX 295

TRENTON NJ 08625-0295