Fillable Printable Personal Loan Application

Fillable Printable Personal Loan Application

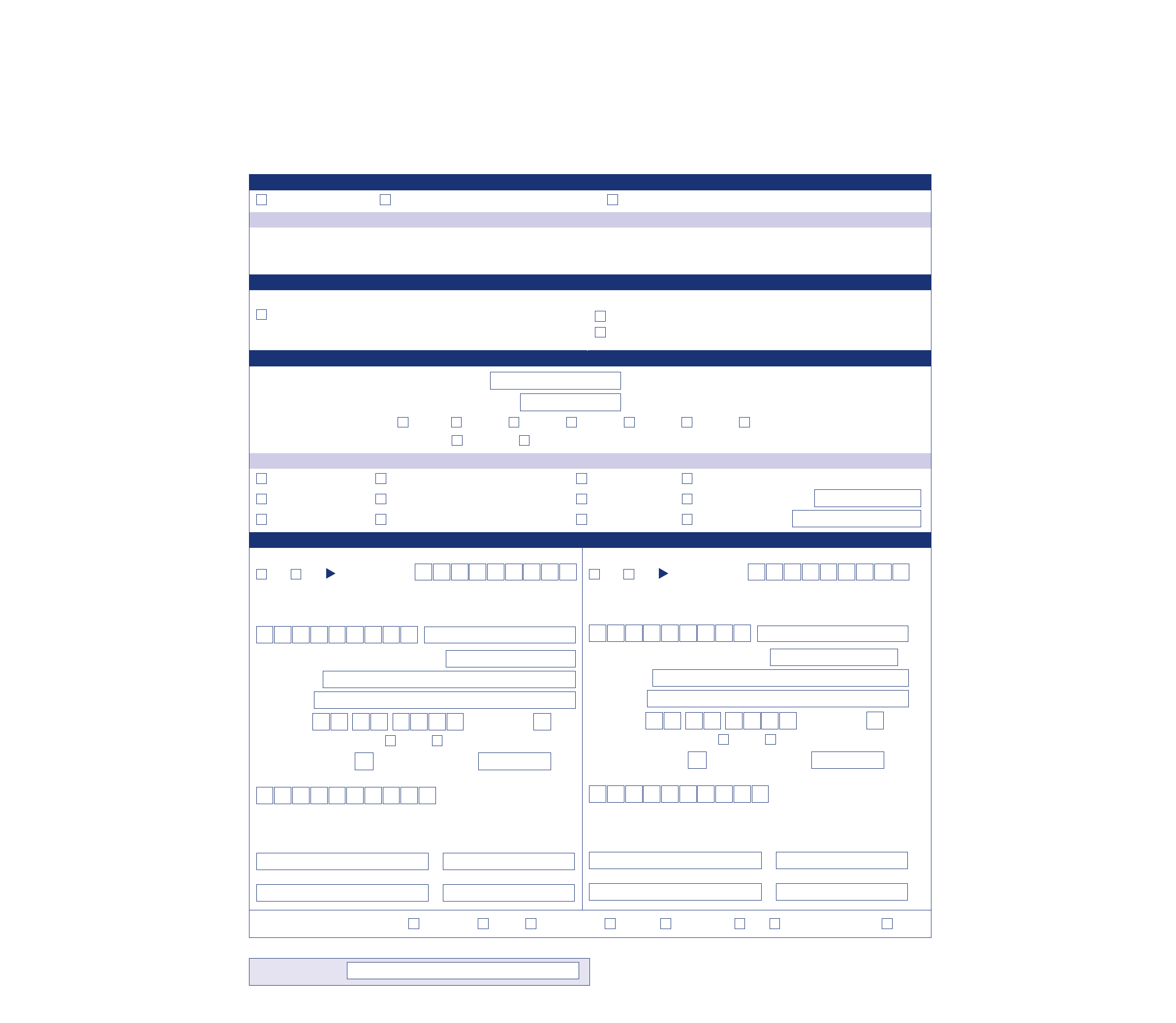

Personal Loan Application

Before we can open an account, we are legally required to verify your identity if you are not an existing ME Bank customer. We may do this electronically using

reliable and independent data sources. We will contact you to request identification documents if we cannot verify your identity electronically.

PERSONAL LOAN APPLICATION.

ME BANK USE ONLY:

MS CODE

(leave blank if

same as Applicant 1)

1.

To apply you must have a good credit rating and be:

at least 18 years of age

applying in personal name(s) (not as a company)

an Australian citizen or permanent resident

Completing the form

Step 1 Complete the application form. You also have the option to apply for an EveryDay Transaction Account with an ME Bank Personal Loan.

Step 2 Ensure that all applicants have signed the Declaration.

Step 3 Ensure that your application includes all required supporting documentation as described below.

For faster approval, please include the documents listed below with your application

All applications must include:

Proof of income – payslip (less than 4 weeks old) , PAYG summary,

if self employed last 2 years tax return and last Tax Assessment Notice

(less than 18 months old) , rental agreement etc.

If consolidating debts:

credit cards or store cards - your most recent statement

loans - your most recent statement for all loans being paid out

Your loan requirements

How much would you like to borrow?

($5,000 - $50,000)

$

(Establishment fee will be deducted from the disbursed amount.)

If your loan is for a purchase, how much are you contributing?

$

What loan term would you like?

1 year 2 years

3 years

4 years

5 years

6 years

7 years

Select the frequency of your loan repayments: Fortnightly Monthly

What is the purpose of the loan? (Tick all that apply. Please note, Personal Loans cannot be used for business purposes.)

Debt consolidation Domestic furniture/Appliance purchase Renovations Travel

Refinance New car purchase Used car purchase Investment – please specify

Motorcycle/Scooter Boat/Caravan/Trailer Other vehicle

Other – please specify

Personal details – Applicant 1 Personal details – Applicant 2

Are you an existing ME Bank customer?

No

Yes Account number

New ME Bank customers - please nominate a password which we will request

for identification purposes when you contact us.

Password (5-9 characters) Mother’s maiden name

Title (Mr/Mrs/Miss/Ms/other) - please specify

Given name(s)

Family name

Date of birth

D

D

M

M

Y

Y

Y

Y

Gender (M or F)

Marital status (please tick one)

Single Married/Domestic partner

Number of dependents Age of each dependent

Driver's licence number (new ME Bank customers only)

Are you a member of an industry super fund or union? From time to time we

may make product offers to members of eligible super funds or unions.

Union name Union membership number

Super fund name Superfund membership number

Are you an existing ME Bank customer?

No

Yes Account number

New ME Bank customers - please nominate a password which we will request for

identification purposes when you contact us.

Password (5-9 characters) Mother’s maiden name

Title (Mr/Mrs/Miss/Ms/other) - please specify

Given name(s)

Family name

Date of birth

D

D

M

M

Y

Y

Y

Y

Gender (M or F)

Marital status (please tick one)

Single Married/Domestic partner

Number of dependents Age of each dependent

Driver's licence number

(new ME Bank customers only)

Are you a member of an industry super fund or union? From time to time we may

make product offers to members of eligible super funds or unions.

Union name Union membership number

Super fund name Superfund membership number

How did you hear about ME Bank? Super fund Union

Family/Friend

Internet

Outdoor ads

TV

Newspaper/Magazine

Mail

2.

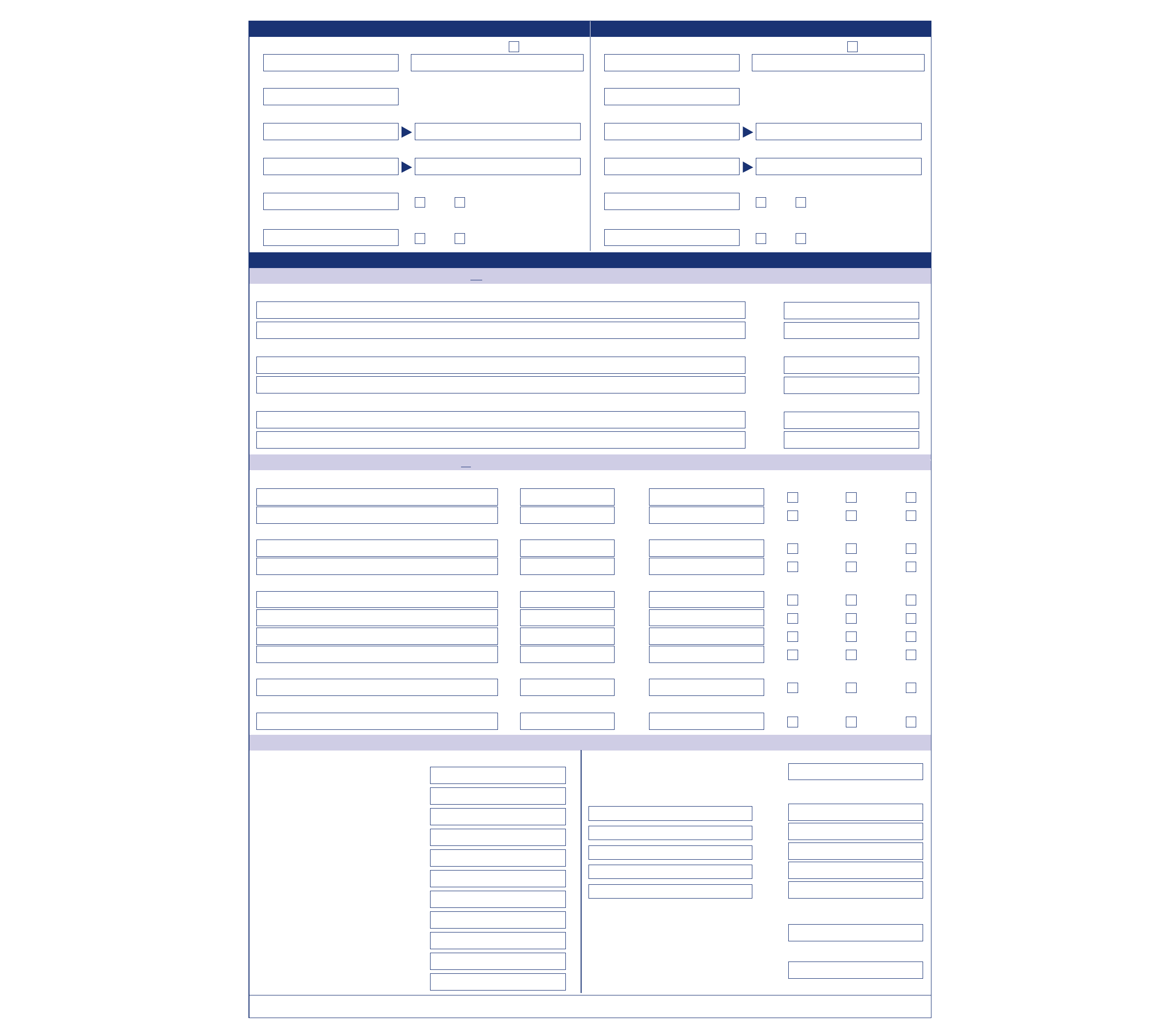

Contact details - Applicant 1 Contact details - Applicant 2

What is your residential status?

(please tick one)

Own my home Have a mortgage Renting

Boarding Living with parent(s)

Residential address (P.O. Box addresses are not acceptable)

State Postcode

How long have you lived at this address?

*

years months

* If you have lived at your current address for less than 2 years please provide

details of your previous residential address below.

Previous residential address

(if at current address for less than two years)

State Postcode

How long did you live at this address? years months

Preferred daytime contact

Mobile

Mobile

Home phone

(

)

Home

Work phone

(

)

Work

Email

What is your residential status?

(please tick one)

Own my home Have a mortgage Renting

Boarding Living with parent(s)

Residential address (P.O. Box addresses are not acceptable)

State Postcode

How long have you lived at this address?

*

years months

* If you have lived at your current address for less than 2 years please provide

details of your previous residential address below.

Previous residential address

(if at current address for less than two years)

State Postcode

How long did you live at this address? years months

Preferred daytime contact

Mobile

Mobile

Home phone

(

)

Home

Work phone

(

)

Work

Email

Employment details - Applicant 1 Employment details - Applicant 2

Your current employment details (please tick one) Your current employment details (please tick one)

Full time

Part time

Casual

Home duties

Retired

Self-employed

Student

Unemployed

Occupation

(e.g. builder, mechanic, nurse)

Employer’s name

(company name)

Employer’s address

State Postcode

Please advise your employer that we will contact them to verify your income.

Employer’s contact number

(mobile number not accepted)

How long have you worked there?

(

)

*

years months

* If you have been in your current employment for less than 2 years, please provide details of your

previous employment below.

Full time

Part time

Casual

Home duties

Retired

Self-employed

Student

Unemployed

Occupation

(e.g. builder, mechanic, nurse)

Employer’s name

(company name)

Employer’s address

State Postcode

Please advise your employer that we will contact them to verify your income.

Employer’s contact number

(mobile number not accepted)

How long have you worked there?

(

)

*

years months

* If you have been in your current employment for less than 2 years, please provide details of your

previous employment below.

If self-employed If self-employed

Business name

ABN Duration

*

years months

* If you have been in your current employment for less than 2 years, please provide details of your

previous employment below.

Accountant’s name and address

State Postcode

Accountant’s contact number

(mobile number not accepted)

(

)

Business name

ABN Duration

*

years months

* If you have been in your current employment for less than 2 years, please provide details of your

previous employment below.

Accountant’s name and address

State Postcode

Accountant’s contact number

(mobile number not accepted)

(

)

Previous employment details (if in current employment less than two years) Previous employment details (if in current employment less than two years)

Full time

Part time

Casual

Home duties

Retired

Self-employed

Student

Unemployed

Occupation (e.g. builder, mechanic, nurse)

Employer’s name (company name)

Please advise your previous employer that we will contact them to verify this information.

Employer’s contact number

(mobile number not accepted)

How long did you work there?

(

)

years months

Full time

Part time

Casual

Home duties

Retired

Self-employed

Student

Unemployed

Occupation (e.g. builder, mechanic, nurse)

Employer’s name (company name)

Please advise your previous employer that we will contact them to verify this information.

Employer’s contact number

(mobile number not accepted)

How long did you work there?

(

)

years months

3.

Income details - Applicant 1 Income details - Applicant 2

Gross annual salary/wages

(before tax)

Do you Salary Package? Yes (please specify)

$

Annual overtime

$

Other annual income

(e.g. dividends, allowances)

Specify type

$

Other annual income

(e.g. dividends, allowances)

Specify type

$

Annual rental income Have you ever been declared bankrupt?

$

Yes No

Total gross annual income Do you have a HECS/HELP debt?

$

Yes No

Gross annual salary/wages

(before tax)

Do you Salary Package? Yes (please specify)

$

Annual overtime

$

Other annual income

(e.g. dividends, allowances)

Specify type

$

Other annual income

(e.g. dividends, allowances)

Specify type

$

Annual rental income Have you ever been declared bankrupt?

$

Yes No

Total gross annual income Do you have a HECS/HELP debt?

$

Yes No

Financial position (if applying in joint names, please ensure financial details represent the combined position of both applicants)

Assets

(What do you own? If owned jointly with someone not on this application - your share.)

Real estate

(please supply the address)

Value

State Postcode

$

State Postcode

$

Savings or deposit accounts (please provide the name of financial institution(s)) Balance

$

$

Other assets (please describe e.g. household contents, motor vehicle, superannuation) Value

$

$

Liabilities (What do you owe? If owed jointly with someone not on this application - your share)

Home loans

(please provide the name of financial institution(s))

Monthly payment Amount owing/Payout amount Pay out Pay out & close No

$

$

$

$

Personal loans

(please provide the name of financial institution(s))

Monthly payment Amount owing/Payout amount Pay out Pay out & close No

$

$

$

$

Credit/Store cards

(please provide the name of financial institution(s))

Credit limit Amount owing/Payout amount Pay out Pay out & close No

$

$

$

$

$

$

$

$

Overdrafts

(please provide the name of financial institution(s))

Credit limit Amount owing/Payout amount Pay out Pay out & close No

$

$

Other liabilities

(e.g. HECS/HELP, car leases)

Monthly payment Amount owing/Payout amount Pay out Pay out & close No

$

$

Ongoing expenses: (What are your monthly expenses? If applying in joint names, please ensure your ongoing expenses represent the combined position of both applicants.)

Living expenses:

Insurance

(e.g. medical, vehicle, home)

$

Utilities

(e.g. water, electricity, gas)

$

Phone/Internet

$

Medical

$

Rates

$

Travel

(e.g. vehicle running cost, public transport)

$

Education/Childcare

$

Food

$

Clothing

$

Entertainment

$

Total of Living expenses (A)

$

Rent/Board (B)

If no rent or board paid please write $0

$

Other expenses

(e.g. child support, gifts)

$

$

$

$

$

Total of Other expenses (C)

$

Total Ongoing Expenses (A + B + C)

$

Would you like this loan to pay out any of the following? (please tick the appropriate box)

4.

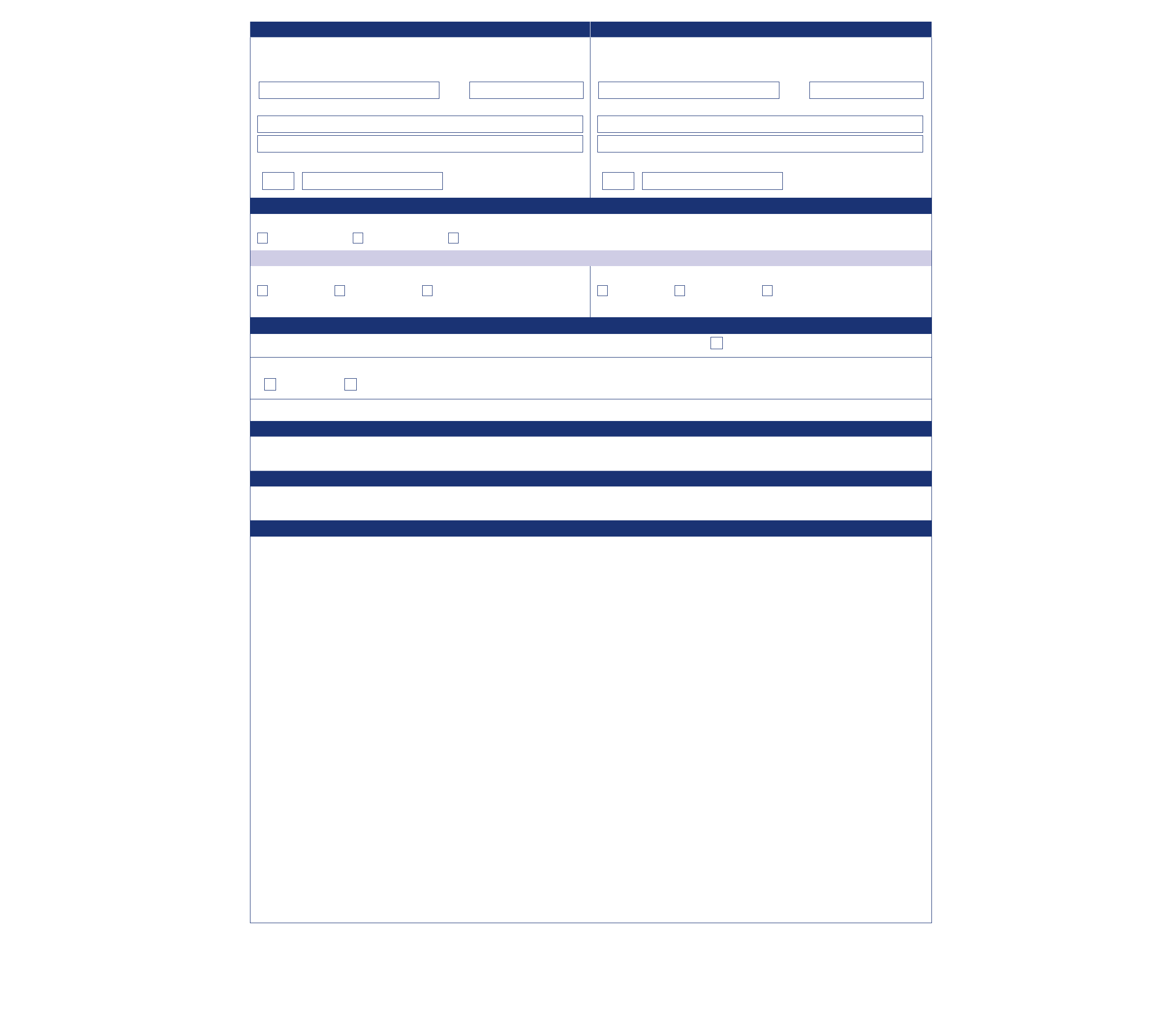

Details of a relative of friend not living with you

(they must live in Australia)

Details of a relative of friend not living with you

(they must live in Australia)

We may contact your friend/relative regarding your whereabouts if we are unable to

locate you.

Surname First name

Residential address (P.O. Box addresses are not acceptable)

State Postcode

Phone number

(

)

We may contact your friend/relative regarding your whereabouts if we are unable

to locate you.

Surname First name

Residential address (P.O. Box addresses are not acceptable)

State Postcode

Phone number

(

)

EveryDay Transaction Account Application

(optional) - To apply you must be at least 16 years of age.

I/We would like to apply for an EveryDay Transaction Account.

Applicant 1 only Applicant 2 only Joint Applicants

Debit MasterCard

®

(If you do not specify a colour, you will be given a lime green card by default)

Applicant 1 - Please choose the colour of your new card

Lime Green Metallic Silver Pink

The Pink card is in support of the National Breast Cancer Foundation.

Applicant 2 - Please choose the colour of your new card

Lime Green Metallic Silver Pink

The Pink card is in support of the National Breast Cancer Foundation.

Insurance

I/We would like ME Bank's insurance partner, QBE Insurance (Australia) Limited to contact me/us to discuss: Motor Vehicle Insurance

I/We authorise ME Bank to provide contact information contained within this application to ME Bank's insurance partner, QBE Insurance (Australia) Limited.

Applicant 1 Applicant 2

ME Bank will receive a commission for insurance products subsequently purchased following referral of your details to QBE Insurance (Australia) Limited

Customer relations

At ME Bank, we are committed to building a reputation for excellence in customer service that includes delivering on our promises. If for some reason our service

does not meet your expectations, please contact us to find out about our dispute resolution procedures. ME Bank is a member of the Financial Ombudsman Service.

Financial Claims Scheme

Your account is covered by the Financial Claims Scheme (Scheme). You may be entitled to payment under the Scheme. Payments made under the Scheme are subject to a

limit for each depositor. Information about the Scheme can be obtained from the APRA website at www.apra.gwov.au and the APRA hotline on 1300 55 88 49.

Privacy Notice

a) Your privacy is important to Members Equity Bank Limited ("ME Bank"). We observe the Australian Privacy Principles and the Privacy Act 1988 (Cth).

b) Regardless of when or how the information is collected, your personal information may be shared between, and used by, us and our subsidiaries and associated

companies for the purposes of assessing your application, establishing and administering your loan account, and for related purposes including:

• verifying your identity;

• consideration of any other application made by you to ME Bank for financial products or services;

• customer relations including management of our relationship with you and market or customer satisfaction research and product development. If you are a

member of or have a product with an alliance partner (including superannuation fund, union, insurer, the Co-op or other third party that we have arrangements

with), we may also use your information for the purpose of providing benefits to you or to obtain aggregate information for statistical or research purposes;

• compliance with legislative and regulatory requirements (including without limitation the Anti-Money Laundering and Counter-Terrorism Financing Act 2006

(Cth) and payment systems requirements);

• our internal operations including record keeping, risk management, auditing purposes, training, securitisation, credit scoring, file reviews and portfolio

analysis;

• information technology systems development and testing;

• arrangements with other organisations to provide services in relation to our products and services (for example, we may arrange for mailing houses to

distribute loan statements to customers);.

• to investigate, resolve and prevent complaints;

• conducting fraud assessments;

• reporting and data analytics, including for regulatory, management, statistical or research purposes; and

• marketing, including pre-screening assessments by a third party service provider for marketing purposes.

c) We may also disclose your personal information for those purposes to organisations such as:

• if the information is credit information (including repayment history information), credit reporting bodies;

• our related entities, service providers and alliance partners (for example a union, superannuation fund, insurer, the Co-op or other third party that we have

arrangements with);

• our agents (for example debt collection agencies), contractors and external advisers (for example, our lawyers and auditors);

• your referees, including your employer (to confirm details about you);

• any person acting on your behalf, including your legal and financial advisers;

• government and other regulatory bodies, law enforcement bodies and courts;

• external complaint resolution bodies (for example, the Financial Ombudsman Service);

• rating agencies;

• payment system operators; and

• other financial institutions and credit providers.

5.

Privacy Notice (continued)

d) If we previously obtained your consent, ME Bank may disclose the following personal information to an alliance partner with which ME Bank has arrangements

with for that alliance partner to contact you about other products or services that you may be interested in. The types of personal information we may disclose

are:

• your name and contact details;

• if you expressed an interest in receiving information about insurance, your loan amount;

• any membership number given to you by that alliance partner (if applicable); and

• the types of products or services that you obtain from ME Bank.

e) We may use information we receive about you from our alliance partners, such as insurers, to assist our staff in better identifying the products and services that

may be relevant to you and for marketing and administrative purposes.

f) We may at any time do any of the following things where permitted by the Privacy Act in connection with the collection, use and/or disclosure of credit

information (including repayment history information) for a consumer credit related purpose:

• seek and use credit reporting information we receive from a credit reporting body about you or credit eligibility information , being information that we derive

from information we receive about you from a credit reporting body:

• to assess an application for consumer credit (including, if applicable, for the provision of credit to you);

• to collect overdue payments from you;

• for a securitisation related purpose;

• for our internal management purposes that are directly related to the management of consumer credit; and

• in circumstances where we reasonably believe that you have committed a serious credit infringement.

• give credit information to a credit reporting body (including identification information, repayment history information, the fact that you have applied to us

for credit and the amount, the type or the amount of consumer credit provided by us, the account opening date or the closing date for consumer credit, that

payments are overdue or no longer overdue, that you have committed a serious credit infringement);

• give credit eligibility information about you to any Australian credit provider for the purpose of collecting overdue payments or in circumstances where ME

Bank believes that you have committed a serious credit infringement;

• give credit eligibility information about you to an enforcement body in circumstances where we believe that you have committed a serious credit infringement;

• give credit eligibility information about you to another person or body in connection with securitisation arrangements for the purpose of purchasing, funding or

managing or processing an application for the credit or undertaking a credit enhancement;

• give credit eligibility information to an external dispute resolution scheme (i.e. the Financial Ombudsman Service) where required in connection with a

complaint;

• give credit information to a debt collection agency for the purpose of collecting overdue payments; and

• give credit eligibility information about you to an entity for the purposes of considering whether to accept an assignment of debt or purchase of an interest in

ME Bank.

Please refer to ME Bank's Privacy and Credit Reporting Policy for more information about:

• the meaning of the terms ‘credit information’, ‘credit eligibility information’ and ‘credit reporting information’; and

• the kinds of personal information, credit information and credit eligibility information that ME Bank collects and holds about you. That Policy

also sets out the purpose for which ME Bank collects, holds, uses and discloses personal information, credit information and credit eligibility

information.

g) ME Bank, our subsidiaries and associated companies may also use and disclose to our alliance partners your personal information for marketing purposes, such

as keeping you up to date about our other products and services. If you do not wish to receive these updates, please contact us. You do not need to contact us if

you have previously informed us that you do not wish to receive information on other products and services.

h) We may disclose your personal information to our third party services providers for them to help us provide banking and related services to you. Our third party

service providers may store or access your personal information overseas, including in the USA and United Kingdom, as well as those countries listed in our

Privacy and Credit Reporting Policy from time to time.

i) We may also disclose your Personal Information to Veda Advantage Information Services and Solutions Limited (Veda) or other credit reporting bodies as set out

in our Privacy and Credit Reporting Policy from time to time. A copy of Veda's Credit Reporting Policy can be obtained by contacting Veda at Veda Information

Services & Solutions Ltd, PO Box 964, North Sydney NSW 2059 or through their website at www.veda.com.au/privacy.

j) You should be aware that:

• credit reporting bodies may include the information in reports provided to credit providers to assist them to assess your credit worthiness;

• if you fail to meet your payment obligations in relation to consumer credit, or commit serious credit infringement, we may disclose this to a credit reporting

body;

• you can request a credit reporting body not to use your credit reporting personal information for the purposes of pre-screening or direct marketing by us; and

• you can request a credit reporting body not to use or disclose your credit reporting personal information if you believe on reasonable grounds that you have

been (or are likely to be) a victim of fraud.

k) ME Bank's Privacy and Credit Reporting Policy contains additional information about:

• how you can request us to provide you access to any personal information, or credit eligibility information we hold about you;

• how you can seek correction of personal information, credit information or credit eligibility information we hold about you;

• how you may complain about a breach by us of the Australian Privacy Principles, Part IIIA of the Privacy Act and the Credit Reporting Code; and

• how we will deal with such a complaint.

l) ME Bank's Privacy and Credit Reporting Policy is available at www.mebank.com.au or on request by:

• phoning 13 15 63 during normal business hours;

• writing to the Privacy Officer, ME Bank, GPO Box 1345, Melbourne Vic 3001; or

• by emailing privacy@mebank.com.au.

m) We may make changes to our Privacy and Credit Reporting Policy from time to time for any reason. We do this by updating the Privacy and Credit Reporting Policy

and recommend that you review it on a regular basis.

6.

Verifying your identity

If you are not an existing ME Bank customer before we can open an account we are legally required to verify your identity. We may do this electronically using

reliable and independent data sources. We will contact you to request identification documents if we cannot verify your identity electronically.

Credit Information File This is one of the best electronic data sources we can use to verify your identity. We will not access your credit rating or credit history. We

will only check your name, address and date of birth against those held on Dunn & Bradstreet’s Credit Information File.

If you consent to ME Bank using your Credit Information File to help verify your identity then you need to read and accept the following terms and conditions.

By ticking this box you consent to ME Bank disclosing your name, residential address and date of birth to a credit reporting agency to assist us to verify your

identity. We will request and the credit reporting agency may provide an assessment of whether the personal information provided matches (in whole or in part)

personal information contained in a credit information file held by the credit reporting agency. In preparing the assessment the credit reporting agency may use

the personal information about you and other individuals contained in their credit information files. No other information about your credit information file will be

provided to ME Bank. If you don’t want your identity verified using your credit information file we will try to verify your identity from other electronic data sources.

Declaration

By signing below, I/we declare that:

1) All information provided in this application is true and correct and I/we authorise ME Bank to verify this information (this includes contacting my/our employer or

accountant to verify my/our income).

2) If this application is approved it will be subject to the Personal Loan Terms and Conditions.

3) If I/we have elected to open an EveryDay Transaction Account:

• I/we have read the EveryDay Transaction Account Fees and Charges guide and that I/we have received any further fees and charges information requested

from ME Bank;

• I/we agree to comply with the ME Bank EveryDay Transaction Account Terms and Conditions (including the Privacy Statement in Part C) and the Electronic

Access Terms and Conditions;

• I/we request ME Bank send me/us a debit MasterCard

®

as specified in this application;

• I/we understand that for joint applicants, the signing authority for the account is ‘any to sign’.

4) I/We have informed the third parties nominated in this form that:

• I/We have provided their personal details to ME Bank and they can gain access to this information;

• ME Bank will use and disclose their information for the purposes set out in this form; and

• if their personal information is not supplied to ME Bank, that ME Bank may not be able to assess my/our Personal Loan application.

5) I/We agree and consent to my credit information, credit eligibility information, credit reporting information and personal information being collected, used and

disclosed in the manner and for the purposes set out in the Privacy Notice in this application form and section 16 of the ME Bank Personal Loan terms and

conditions.

6) I/We acknowledge that ME Bank may send SMS updates to my mobile phone number regarding the status of my application.

7) I/We also understand that for joint applicants the signing authority for the account(s) is 'any to sign'.

8) ME Bank may use and disclose my/our personal information to help ME Bank and any of its subsidiaries or associated companies to provide or tell me/us about

other products and services which may be of interest to us.

If you do not want ME Bank or its subsidiaries or associated companies to use the personal information contained in your application form to provide such

information to you, simply contact ME Bank during normal business hours on 13 15 63 or insert a cross in the relevant box Applicant 1 Applicant 2

Signature of all applicants:

Applicant 1 Print name Signature Date

D

D

M

M

Y

Y

Applicant 2 Print name Signature Date

D

D

M

M

Y

Y

WE’RE HERE TO HELP.

For further information on what’s in this booklet or to find

out more about ME Bank’s straightforward, transparent

products and real service please get in contact.

MEBANK.COM.AU

13 15 63