Fillable Printable Personal Net Worth Statement for DBE/ACDBE Program Eligibility

Fillable Printable Personal Net Worth Statement for DBE/ACDBE Program Eligibility

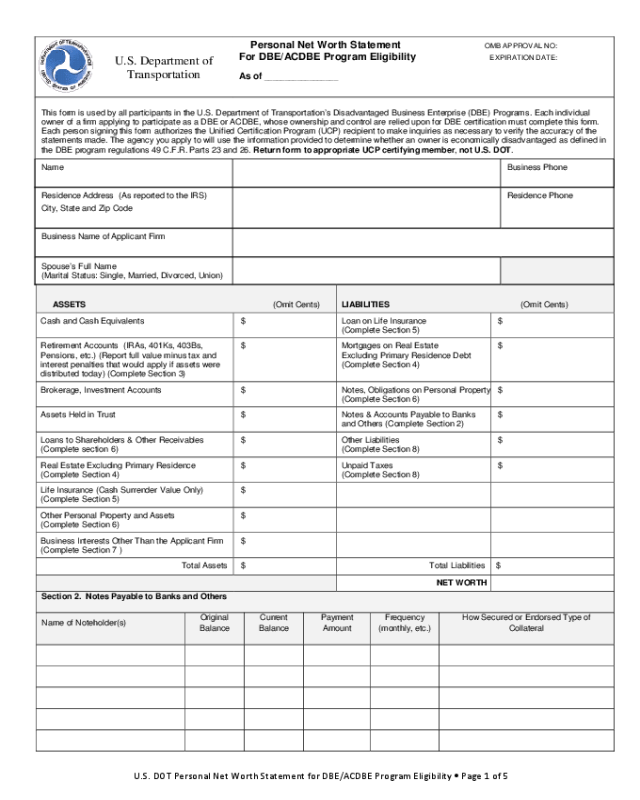

Personal Net Worth Statement for DBE/ACDBE Program Eligibility

U.S. DOT Personal Net Worth Statement for DBE/ACDBE Program Eligibility • Page 1 of 5

U.S. Department of

Transportation

Personal Net Worth Statement

OMB APPROVAL NO:

For DBE/A CDBE Program Eligibility EXPIRATION DATE:

As of __________________

This form is used by all participants i n the U.S. Department of Transportation’ s Disadvant aged B usiness E nterpris e (DBE) Programs. Each individual

owner of a firm applying to participate as a DBE or ACDBE, whose ownership and cont rol are reli ed upon for DBE certificati on must complete t his form.

Each person signing this form authorizes the Unified Certific at i on Program (UCP) recipient to make inquiries as necessary to verify the accuracy of the

statements made. The agency you apply to will use the informat i on provided to determi ne whether an owner i s economicall y disadvant aged as defined in

the DBE program regulati ons 49 C.F.R. Parts 23 and 26. Return form to appropriate UCP certifying member, not U.S. DOT.

Name Busi ness P hone

Residence Address (As reported to the IRS)

City, St ate and Zip Code

Residence Phone

Busi ness Name of Applicant Firm

Spouse’s F ull Name

(Marital St atus: Singl e, Married, Divorced, Union)

ASSETS (Omit Ce n ts)

LIABILITIES (Omit Ce n ts)

Cash and Cash Equival ents $ Loan on Life Insurance

(Compl ete S ection 5)

$

Retirement Accounts (IRAs, 401Ks, 403Bs,

Pensi ons, etc.) (Report full value minus tax and

interes t penal t i es that would apply if assets were

distributed today) (Complete Section 3)

$ Mortgages on Real Estat e

Excluding P rimary Residence Debt

(Compl ete S ection 4)

$

Brokerage, Investment Accounts $ Notes, Obl i gations

on Personal Property

(Compl ete S ection 6)

$

Assets Hel d in Trust $ Notes & Accounts Payable to Banks

and Others (Complete Section 2)

$

Loans t o Shareholders &

Other Receivables

(Complete section 6)

$ Other Liabi l iti es

(Compl ete S ection 8)

$

Real Estate Excluding Primary Residence

(Compl ete S ection 4)

$ Unpaid Taxes

(Compl ete S ection 8)

$

Life I nsuranc e (Cash Surrender Value Only)

(Compl ete S ection 5)

$

Other Personal Property and Assets

(Compl ete S ection 6)

$

Busi ness I nterests O t her Than the Applic ant Fi rm

(Compl ete S ection 7 )

$

Total Assets $ Total Li abili t i es $

NET WORTH

Sectio n 2. Notes Payable to Banks an d Others

Name of Noteholder(s )

Original

Balance

Current

Balance

Payment

Amount

Frequency

(monthly, etc.)

How Secured or Endorsed Type of

Collateral

U.S. DOT Personal Net Worth Statement for DBE/ACDBE Program Eligibility • Page 2 of 5

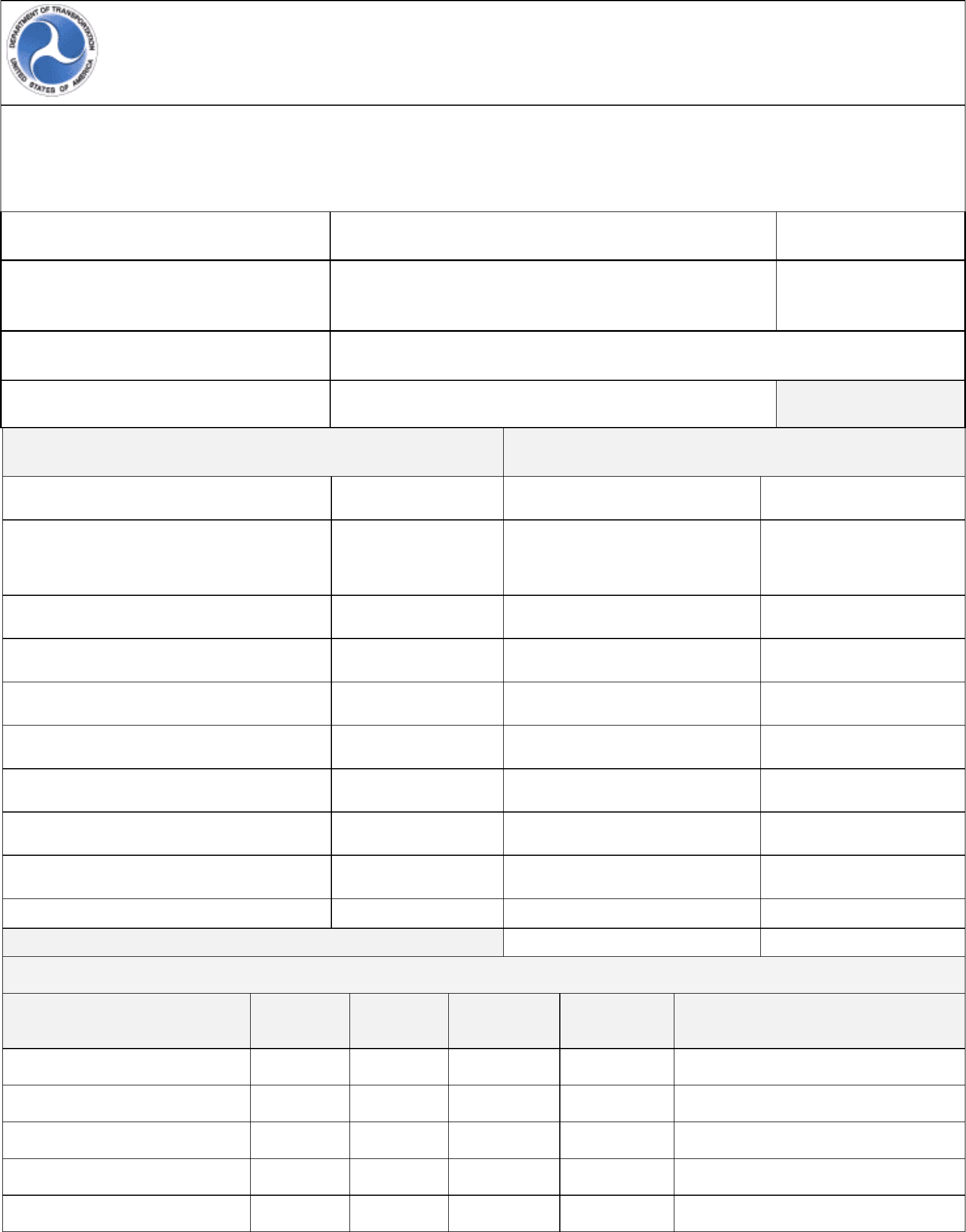

Sectio n 3. Brokerage and custodial accounts, stocks, bonds, retirement accounts. (Full Valu e) (Use attac hm ents if necessary).

Name of Security / Brokerage Account / Retirem ent

Account

Cost

Market V al ue

Quotation/Exchange

Date of

Quotation/Exchange

Total Value

Sectio n 4. Real Estate Owned (Includin g Primary Residen ce, Investment Properties, Per sonal Property Leased or Rented for Business

Purposes, Farm Properties, or any Other Income Producing property). (List each parc el separately. Add additi onal s heets if necessary).

Prim ary Resi dence

Property B

Property C

Type of Property

Address

Date Acquired and Method

of Acquisi tion (purchase,

inherit , di vorce, gif t, etc.)

Names on Deed

Purchase Price

Present Market Value

Source of Market Val uation

Name of all Mortgage

Holders

Mortgage Acc . # and

balance (as of date of form)

Equit y line of credit balance

Amount of Payment P er

Month/Year (Specify)

Section 5. Life Insurance Held (Give face amount and cash surrender value of policies, name of insurance company and beneficiari es).

Ins uranc e Company

Face Value

Cash Surrender Amount Beneficiaries Loan on Policy Inform ation

U.S. DOT Personal Net Worth Statement for DBE/ACDBE Program Eligibility • Page 3 of 5

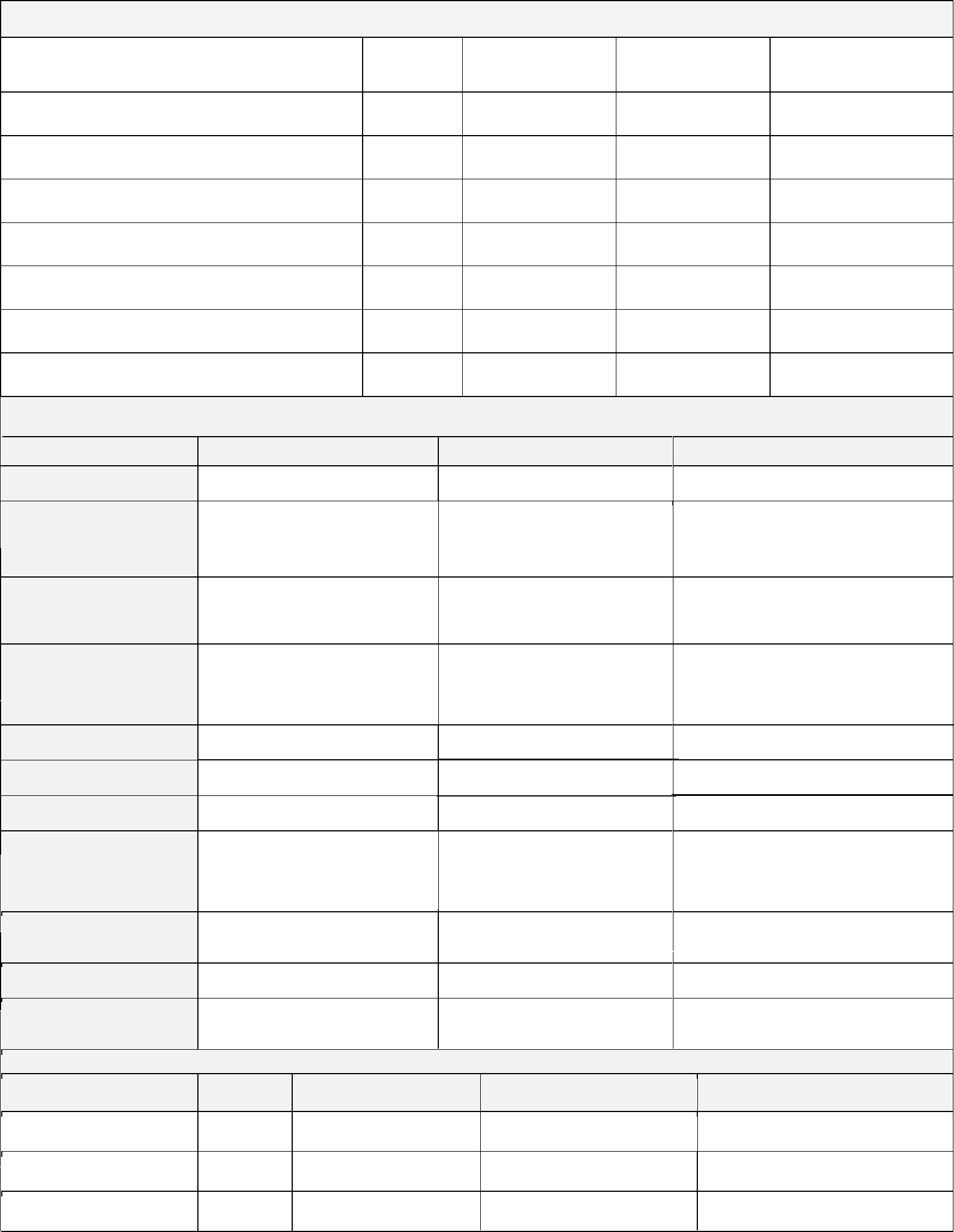

Section 6. Other Personal Property and A ssets (Use attachments as necessary)

Type of Property or Asset

Total Present

Value

Amount of

Liability

(Balance)

Is this

asset

insured?

Lien or Note amount

and Terms of

Payment

Autom obiles and V ehicl es (including recreation vehicles, motorcycles,

boats , etc. ) Include pers onally owned vehicles that are leased or rented to

business es or other indivi dual s.

Household Goods / Jewelry

Other (List )

Accounts and Notes Receivabl es

Section 7. Value o f Other Business Investmen ts, Other Businesses Owned (excluding appli can t firm)

Sole Propriet orships, General Partners, Joint Ventures, Limi ted Liability Companies, Closel y -held and Public Traded Corporations

Section 8. Other Liabilities and U npaid Taxes (Describe)

Section 9. Transfer of Assets: Have you within 2 years of this personal net worth statemen t, transferred assets to a spouse, domestic

partner, relative, or entity in which you have an ownership or beneficial interest including a trust? Yes No If yes, describe.

I declare under penalty of perjury that the information provided i n this personal net worth statem ent and supporting documents is complete, true and

correct. I certify t hat no assets have been transferred to any beneficiary for less than fair market value in the last two years. I recognize t hat the

inform at i on submitted i n this applicati on is for t he purpose of inducing certif ication approval by a government agency. I understand that a government

agency may, by means it deems appropriate, determine the accuracy and truth of the statements in the application and this pers onal net worth

statement, and I authorize such agency to cont act any entity named in the application or this personal financ i al st atement, incl udi ng the names

banking i nst itutions, credit agencies, contractors, clients, and other certifyi ng agencies f or the purpose of verifying the information suppl i ed and

determi ni ng the named firm’s eli gibil i t y. I acknowledge and agree that any mis repres entat i ons in this applic ation or in records pertaining to a contract

or subc ontract will be grounds f or termi nating any contract or subcontract which may be awarded; denial or revocat i on of certification; suspension and

debarm ent; and for initi ati ng act i on under federal and/ or state law concerning false statement, fraud or other applicable offenses.

NOTARY CERTIFICATE:

___________________________________ ___________ (Insert applic abl e st at e acknowledgm ent, aff i rm ation, or oath)

Signature (DBE/ACDBE Owner) Date

In collecting the information requested by this form, the Department of Transportation complies with Federal Freedom of Information and Privacy Act (5 U.S.C.

552 and 552a)

provisions. The Privacy Act provides comprehensive protections for your personal information. This includes how information is coll ect e d, use d, di scl o sed , st ore d, an d

disca rd ed. Y ou r inform a t ion will not be disc los ed t o thir d parties wi tho ut your consent. The information collected will be used solely to determine your firm's eligibility to

participate in the Disadvantaged Business Enterprise (DBE) Program or Airport Concessionaire DBE Programs as defined in 49 C.F.R. Parts 23 and 26. You may review

DOT’s complete Privacy Act Statement in the Federal Register published on April 11, 2000 (65 FR 19477).

U.S. DOT Personal Net Worth Statement for DBE/ACDBE Program Eligibility • Page 4 of 5

General Instructions for Completing the

Personal Net Worth Statement

for DBE/ACDBE Program Eligibility

Please do not make adjustments to your figures pursuant to

U.S. D OT regulatio ns 49 C.F.R. Parts 23 and 26. The

agency that yo u apply to will use the information provided

on your completed Per sonal Net Wo r th (PNW) Statement to

determine whether you meet the economic disadvantage

requirements of 49 C.F.R. Parts 23 and 26. If there are

discrepancies or questions regarding your form, it may be

returned to you to correct and complete again.

An ind i vidual’s personal net worth according to 49 C.F.R.

Parts 23 and 26 inc l ude s only hi s or her own sha re of asse ts

held separately, jointly, or as community property with the

individual’s spouse and excludes the following:

• Individua l’s o wners hip interest in the applic ant firm;

• Individual’s equity in his or he r primary residence;

• Tax and interest penalties that would accrue if retire ment

savings or investment s (e.g., pens ion p lans, Individ ual

Retireme nt Acco unts, 401( k) accounts, etc.) were

distrib uted a t the presen t time.

Indicate on the form, if any items are jointly owned. If the

personal net worth of the majority owner(s) of the firm

exceeds $1.32 million, as defined by 49 C.F.R. Pa rts 23 and

26, the firm is not eligib le for DBE or ACDBE certification.

If the personal net worth of the majority owner(s) exceeds

the $1.32 million cap at any time after your firm i s c e r tified ,

the firm i s no longer e ligib le fo r certificatio n. Should that

occur, it is your responsibilit y to c ontact your certifying

agency in writi ng to advise that your fi rm no lo nger quali fi es

as a DBE or ACDBE. You must fill out all line items on the

Per sonal Net Worth State ment.

If necessary, use additional sh eets of paper to report all

information and details. If yo u have any questions about

complet ing this for m, please contact one of the UCP

certi fying agencies.

Assets

All a ssets must be repo rted at their current fair market values

as of the date o f yo ur statement. Assessor’s as sessed v alue

for real estate, for example, is not acceptable. As sets hel d

in a t rust should be i ncluded.

Cash and Cash Equivalents: On page 1, enter the total

amount of cash or cash equivalents in bank accounts,

including che cking, s avings , money mar ket, certific ate s of

deposit held domestic or foreign. Provide copies of the bank

statement.

Retirement Accounts, IRA, 401Ks, 403Bs, Pensions: On

page 1, ent er t he full value minus tax and interest penalti es

that would apply if assets were d istributed as of the date of

the form. Describe the number o f shares, name of securities,

cost market value, d a te of quotation, a nd total val ue in

section 3 on page 2.

Brokerage and Custodial Accounts, Stocks, Bonds,

Retirement Accounts: Report total value on page 1, and on

page 2, section 3, enter the name of the securi ty, brokerage

account, retirement account, etc.; the cost; market value of

the asset; the date of q uo ta tion; and total value as of the date

of the PNW statement.

Assets Held in Trust: Enter the tot al va lue of the assets held

in trust on page 1, and provide the names of beneficiaries

and trustees, and other infor mation in Section 6 on page 3.

Loans to Shareholders and Other Receivables not listed:

Enter amounts loaned to you from your firm, from any other

business enti ty in which you hold an owners hi p intere s t, a nd

other receivables not listed above. Complete Section 6 on

page 3.

Real Estate: The total value of real estate excluding your

primary residence should be listed on page 1. In section 4 on

page 2, please list your primary residence in column 1,

including the address, method of acquisition, date of

acquired, names o f deed, purchase price, present fair market

value , s our c e of mar ke t val ua t i on, na mes of all mortgage

holders, mortgage account number and balance, equity line

of credit balance, and amount of payment. List this

information for all real estate held. Please ensure tha t thi s

section contains all real estate owned, includi ng rental

properties, vacation properties, commercial properties,

personal property leased or rented for business purposes,

farm properties and any other income producing properties,

etc. Attach additional sheets if needed.

Life Insurance: On page 1, e nter the cash surr ender value of

this asset. In section 5 on page 2, ent er t he name of the

insurance company, the face value of the polic y, cash

surrender value, beneficiary names, and loans on the policy.

Other Personal Property and Assets: Enter the tota l value

of personal property and assets you own on p age 1. Personal

pro perty includes motor ve hicles, b oats, traile r s, jewelry,

furniture, household goods, collectibles, clothing, and

personally owned vehicles that are leased or rented to

businesses or other individuals. In section 6 o n pa ge 3, list

these asset s and enter the present value, t he balance of any

liabilities, whether the asset is insured, a nd li en or no te

information and terms of payments. For accounts and notes

receivable, enter the total valu e of all monies owed to yo u

personall y, if any. This s hould include shareholder loans to

the applicant fir m, if those exist. If the asset is insured, you

may be as ked to provide a copy of the policy. You may also

be asked to provide a copy of any liens or notes on the

property.

Other Business Interests Other than Applicant Firm: On

page 1, enter t he total value of your other business

investments (excl uding the app licant f irm). In secti on 7 on

page 3, enter information concerning the bus i nes se s yo u

U.S. DOT Personal Net Worth Statement for DBE/ACDBE Program Eligibility • Page 5 of 5

hold an ownership in te rest in, such as sole proprie torships,

partner ships, joint ventures, co r pora tions, or limited liability

corporations (o ther than the applicant firm). Do not r e duce

the val ue o f the s e entr ies by an y lo ans fr om the outsi de firm

to the DBE/ACDBE a pplicant business.

Liabilities

Mortgages on Real Estate: Enter the total ba la nce on all

mort ga ges pa yable on real estate on page 1.

Loans on Life Insurance: En te r the total val ue of all loans

due on life insurance policies on page 1, and complete

section 5 on page 2.

Notes & Accounts Payable to Bank and Others: On page

1, sectio n 2, enter de ta ils conce r nin g any liabilit y, includi ng

name of notehol de rs, or iginal and current balances, payment

terms, and security/collater a l information. The entrie s should

include automobile i ns tallment a ccounts. This shoul d no t,

however, include any mortgag e b alances as this information

is captured in section 4. Do not include loans for your

business or mortgages for your properties in this sectio n.

You may be asked to submit copy of note/sec urity

agr eement , and the mos t recen t account statement.

Other Liabilities: On page 1, enter the total value due on all

other liabilities not listed in the previous ent ries. In sect ion

8, page 3, report the name of t he individ ual obl igated, names

of co -si gners, description o f the liability, the name of the

entity owed, the date of the obligation, payment amounts and

terms. No te : Do not i nclude co ntin gent liabilities in thi s

section. Continge nt liabilities are lia bilities that belong to

you only if an event(s) should occur. For e xamp le, if you

have co-signe d on a r ela ti ve’s loan, b ut you a re no t

responsible for the de bt until your re la tive defaults, that is a

contingent liability. Contin gent liabilities do not count

to ward your net worth u ntil they become actual liabilities.

Unpaid Taxes: Enter the total amount of all ta xes that are

cur rent ly due, b ut are unpa i d on page 1, and co mplete

section 8 on page 3. Contingent tax liabilitie s or ant ic ipated

taxes for current year should not be included. Describe in

detail the name of the individ ual obligated, names of co-

signers, the type of unpaid tax, to whom the tax is payable,

due date, amo unt, and to what proper ty, if any, the tax lien

attaches. If none, state “NONE.” Yo u must include

documentation, such as tax liens, to support the amounts.

Transfers of Assets:

Transfers of Assets: If you che cked the box indi cat ing yes

on page 3 i n thi s cat egory, provide details on all asset

transfers (withi n 2 years of the date of this personal net

worth statement) to a spo use, domestic partner, re la tive, or

enti ty i n which you have an own ership o r b eneficia l i nter est

including a trust. Include a descr iption of the asset; na mes o f

individuals on the dee d, title, note or o ther instrument

indicating ownersh ip rights; the names of individuals

receiving the assets and their relation to the transferor; the

date of the transfer; and the value or consideration received.

Submit documentation requested on the form related to the

transfer.

Affidavit

Be sure to sign and date the state ment. The Personal Net

Worth Statement mu st b e no tariz e d

.