Fillable Printable Prenuptial Agreement Form Printable

Fillable Printable Prenuptial Agreement Form Printable

Prenuptial Agreement Form Printable

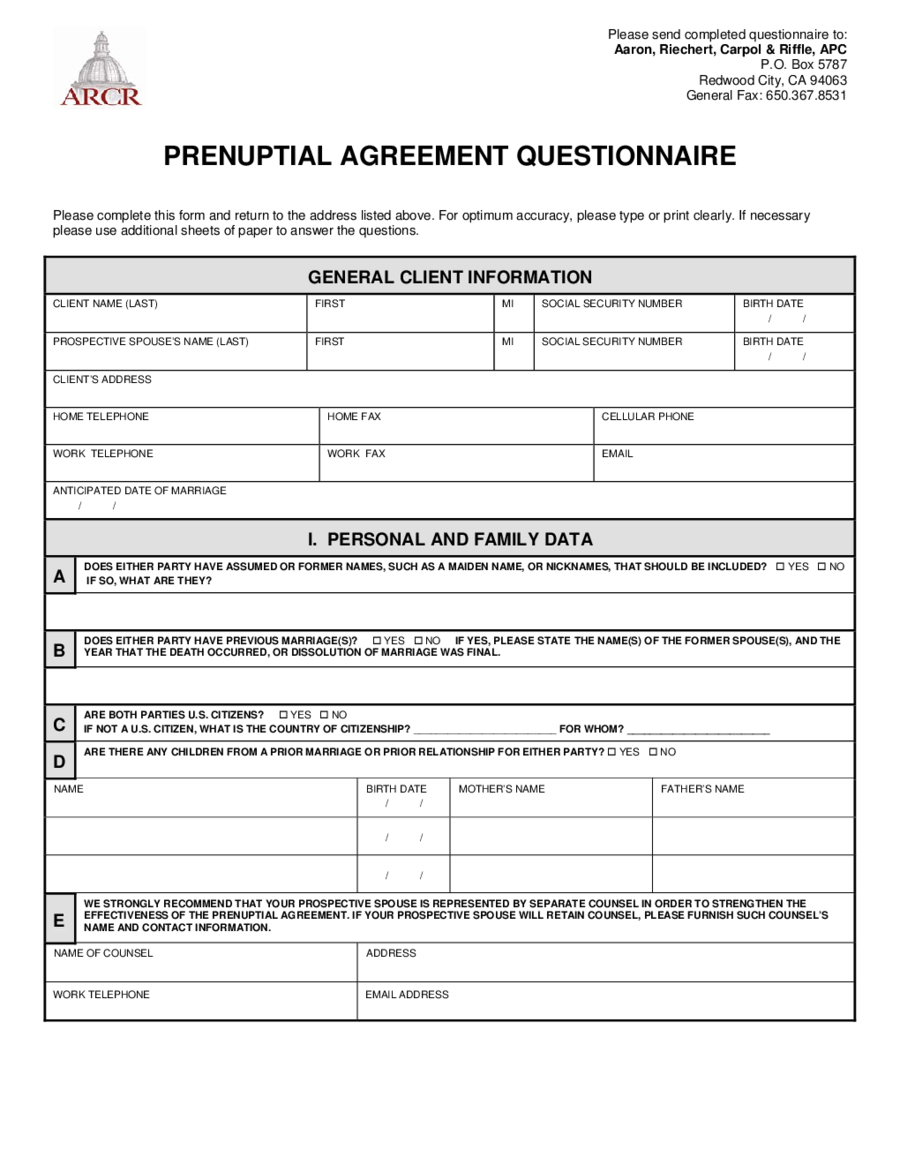

Please send completed ques tionnaire to:

Aaron, Riechert, Carpol & Riffle, APC

P.O. Box 5787

Redwood City, CA 94063

General Fax: 650.367.8531

PRENUPTIAL AGREEMENT QUESTIONNAIRE

Please complete this form and return to the address listed above. For optimum accuracy, please type or print clearl y. If necessary

please use additional sheets o f paper to answer the questions.

GENERAL CLIENT INFORMATION

CLIENT NAME (LAST) FIRST MI SOCIAL SECURITY NUMBER BIRTH DATE

/ /

PROSPECTIVE SPOUSE’S NAME (LAST) FIRST MI SOCIAL SECURITY NUMBER BIRTH DATE

/ /

CLIENT’S ADDRESS

HOME TELEPHONE HOME FAX CELLULAR PHONE

WORK TELEPHONE WORK FAX EMAIL

ANTICIPATED DATE OF MARRIAGE

/ /

I. PERSONAL AND FAMILY DATA

A

DOES EITHER PARTY HAVE ASSUMED OR FORMER NAMES, SUCH AS A MAIDEN NAME, OR NICKNAMES, THAT SHOULD BE INCLUDED? YES NO

IF SO, WHAT ARE THEY?

B

DOES EITHER PARTY HAVE PREVIOUS MARRIAGE(S)? YES NO IF YES, PLEASE STATE THE NAME(S) OF THE FORMER SPOUSE(S), AND THE

YEAR THAT THE DEATH OCCURRED, OR DISSOLUTION OF MARRIAGE WAS FINAL.

C

ARE BOTH PARTIES U.S. CITIZENS? YES NO

IF NOT A U.S. CITIZEN, WHAT IS THE COUNTRY OF CITIZENSHIP? _________________________ FOR WHOM? _________________________

D

ARE THERE ANY CHILDREN FROM A PRIOR MARRIAGE OR PRIOR RELATIONSHIP FOR EITHER PARTY? YES NO

NAME BIRTH DATE

/ /

MOTHER’S NAME FATHER’S NAME

/ /

/ /

E

WE STRONGLY RECOMMEND THAT YOUR PROSPECTIVE SPOUSE IS REPRESENTED BY SEPARATE COUNSEL IN ORDER TO STRENGTHEN THE

EFFECTIVENESS OF THE PRENUPTIAL AGREEMENT. IF YOUR PROSPECTIVE SPOUSE WILL RETAIN COUNSEL, PLEASE FURNISH SUCH COUNSEL’S

NAME AND CONTACT INFORMATION.

NAME OF COUNSEL ADDRESS

WORK TELEPHONE

EMAIL ADDRESS

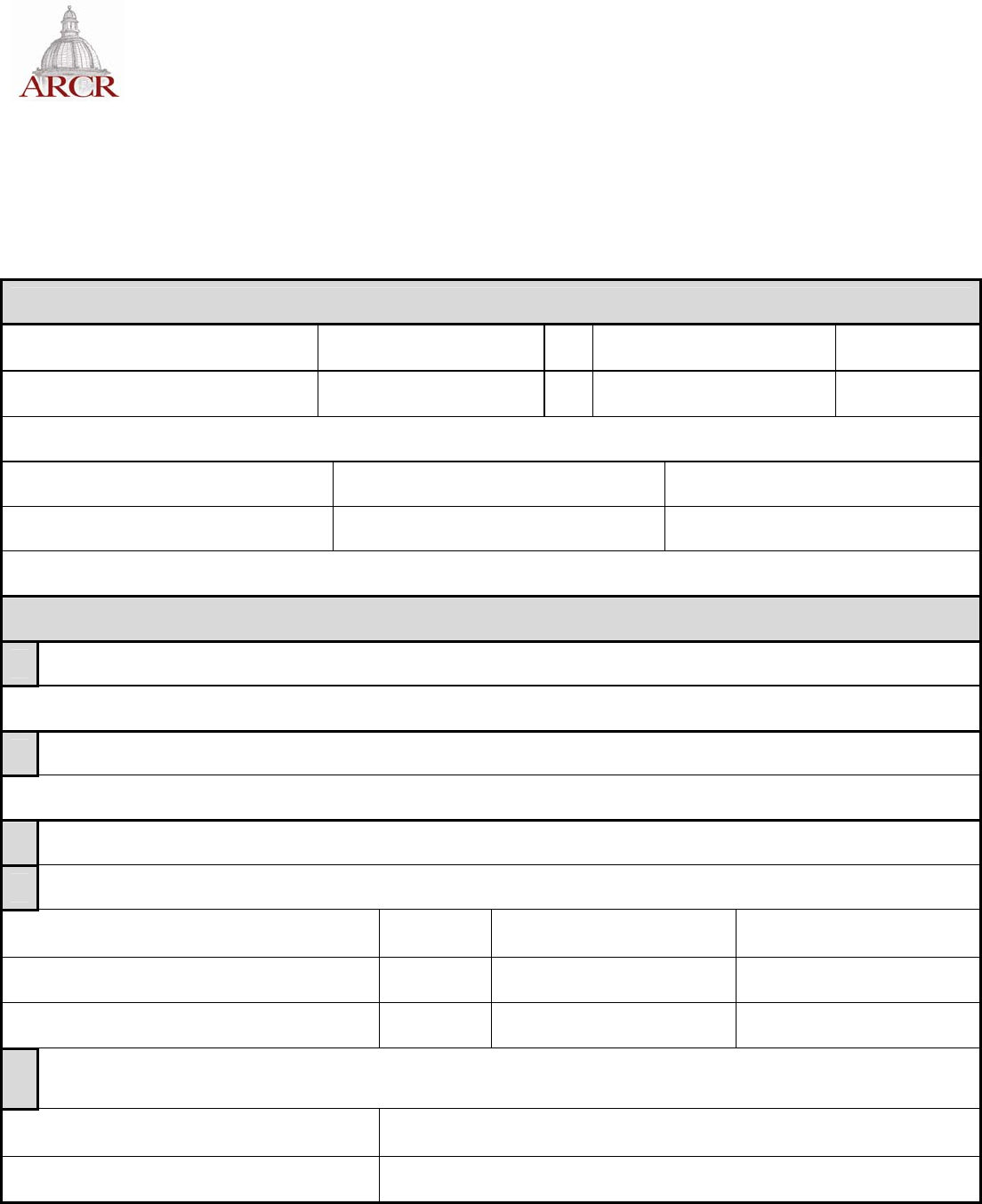

Estate Planning Questionnaire page 2 of 5

II. CLIENT’S ASSETS & OTHER FINANCIAL INFORMATION

A

REAL ESTATE. IF POSSIBLE, PLEASE PROVIDE COPIES OF THE DEEDS (NOT DEEDS OF TRUST).

ADDRESS TITLE IS HELD AS FOLLOWS: FAIR MARKET VALUE

$

AMOUNT OWED

$

$ $

$ $

B

IRAS (INDIVIDUAL RETIREMENT ACCOUNTS)

NAME OF INSTITUTION AND OWNER ACCOUNT NUMBER VALUE

$

DESIGNATED BENEFICIARY

$

$

C

OTHER RETIREMENT PLANS (INCLUDING PENSI ONS AND DEFERRED COMPENSATION)

NAME OF PLAN PARTICIPANT VALUE

$

DESIGNATED BENEFICIARY

$

D

LIFE INSURANCE AND ANNUITIES

NAME OF COMPANY ACCOUNT NUMBER FACE AMOUNT

$

DESIGNATED BENEFICIARY

$

$

E

STOCKS AND BONDS. LIST BELOW OR PROVIDE COPIES OF RECENT STATEMENTS OR CERTIFICATES.

NAME OF SECURITY OR BROKERAGE TITLE OF ACCOUNT IS AS FOLLOWS: NUMBER OF SHARES

(IF APPLICABLE)

CURRENT VALUE

$

$

$

F

CASH

NAME OF FINANCIAL INSTITUTION TITLE OF ACCOUNT IS AS FOLLOWS: ACCOUNT NUMBER CURRENT

BALANCE

$

$

$

G

INCOME

ANNUAL SALARY OF CLIENT

$

ANNUAL SALARY OF PROSPECTIVE SPOUSE

$

DO YOU HAVE INCOME FROM OTHER SOURCES? YES NO IF YES, PLEASE LIST.

SOURCE OF INCOME ANNUAL AMOUNT

$

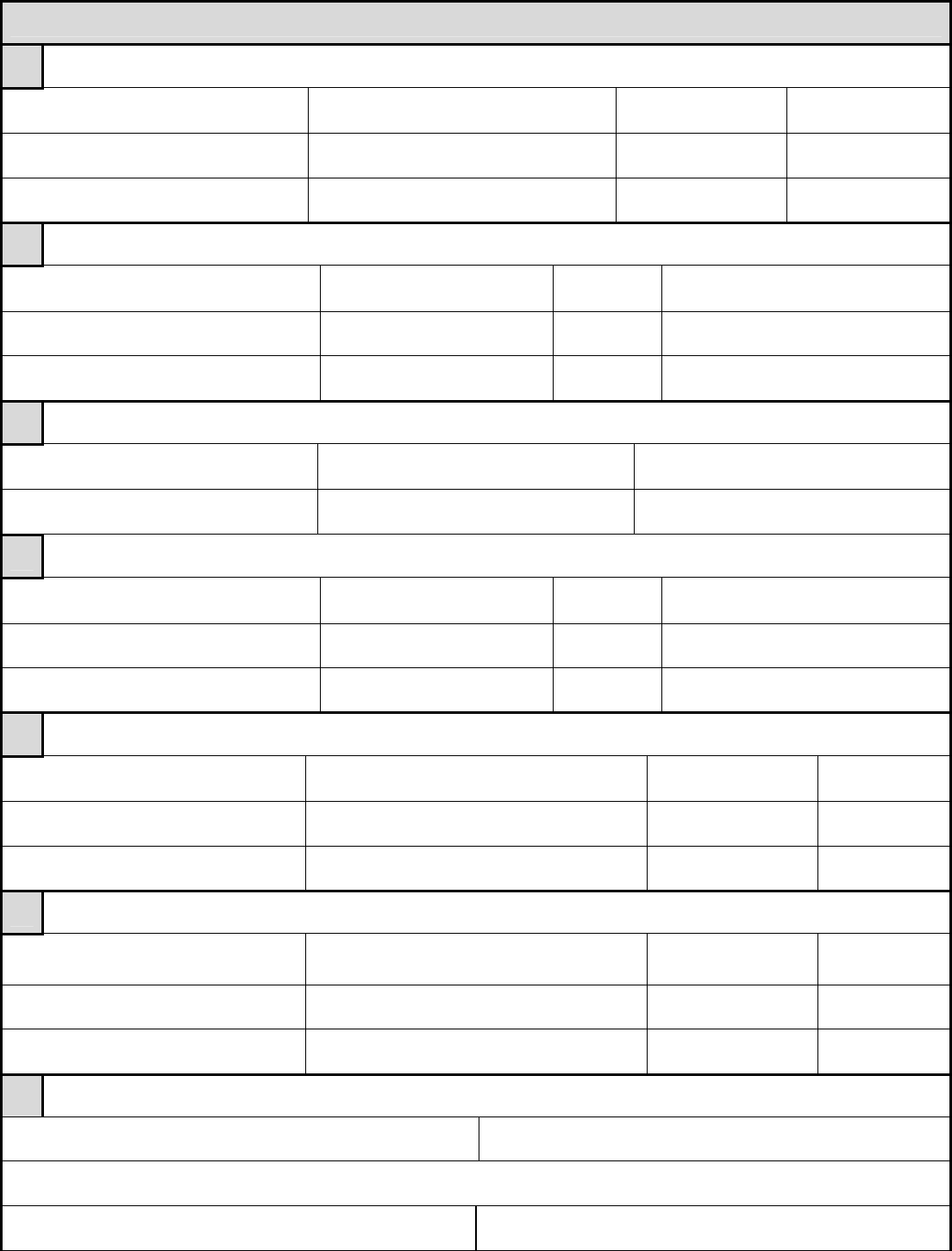

Estate Planning Questionnaire page 3 of 5

H

OTHER ASSETS (E.G. PARTNERSHIPS, OTHER BUSINESS INTEREST, OR HIGHLY VALUED AUTOMOBILES, ANTIQUES, ART, JEWELRY, ETC.)

ASSET FAIR MARKET VALUE

$

$

$

I

DOES EITHER PARTY EXPECT TO INHERIT PROPERTY? YES NO WHO? ________________________________ __

IF YES, PLEASE LIST THE ESTIMATED VALUE: $____________

J

ASIDE FROM ANY MORTGAGES OR DEEDS OF TRUST FROM REAL ESTATE, DO YOU HAVE ANY DEBT? YES NO

IF YES, PLEASE LIST.

$

$

K

DO YOU HOLD ANY ASSETS IN JOINT TENANCY WITH YOUR PROSPECTIVE SPOUSE? YES NO

IF YES, PLEASE LIST.

L

DO YOU HOLD ANY ASSETS IN JOINT TENANCY WITH SOMEONE OTHER THAN YOUR SPOUSE OR JOINTLY WITH ANOTHER PARTY? YES NO

IF YES, PLEASE LIST.

III. PROPERTY

THE DEFINITION OF SEPARATE PROPERTY CAN AFFECT WHAT PROPERTY EACH PARTY CONTROLS DURING THE MARRIAGE, AND THEIR RIGHTS IN THE

EVENT OF A DIVORCE OR WHEN ONE SPOUSE DIES.

UNDER CALIFORNIA LAW, THE DEFINITION OF SEPARATE PROPERTY AUTOMATICALLY INCLUDES PROPERTY ACQUIRED BY A PARTY PRIOR TO THE

MARRIAGE AND PROPERTY ACQUIRED (AT ANY TIME) BY GIFT OR INHERITANCE. IN ADDITION, IN MOST CIRCUMSTANCES, SEPARATE PROPERTY ALSO

INCLUDES ANDY RENTS AND PROFITS FROM THE SEPARATE PROPERTY DEFINED ABOVE.

ALTERNATIVELY, COMMUNITY PROPERTY REFERS TO ALL OTHER PROPERTY ACQUIRED DURING MARRIAGE BY EITHER SPOUSE AS A RESULT OF HIS OR

HER EFFORT (E.G. EMPLOYMENT COMPENSATION).

A PREMARITAL AGREEMENT CAN CONFIRM AND ALSO CHANGE THE CHARACTERIZATION OF PROPERTY DEPENDING ON THE PARTIES’ AGREEMENT.

A

PLEASE CHECK WHICH PROPERTY YOU WOULD LIKE TO REMAIN SEPARATE PROPERTY

PROPERTY ACQUIRED BY GIFT OR

INHERITANCE

PROPERTY ACQUIRED BEFORE MARRAIGE COMPENSATION FOR PERSONAL SERVICES

DURING MARRIAGE

INCOME DERIVED FROM SEPARATE

PROPERTY

RETIREMENT OR PENSION BENEFITS OWNED

BEFORE MARRAIGE

RETIREMENT OR PENSION BENEFITS

ACQUIRED DURING MARRAIGE

THE PROCEEDS OF THE SALE OF SEPARATE

PROPERTY

PROPERTY ACQUIRED IN EXCHANGE FOR

SEPARATE PROPERTY OR ACQUIRED WITH THE

SALE OF SEPARATE PROPERTY

INCREASES IN THE VALUE OF YOUR

SEPARATE PROPERTY ASSESTS CAUSED BY

YOUR EFFORTS DURING MARRIAGE

B

YOU MAY ACQUIRE JOINT OR MARITAL PROPERTY, SUCH AS A HOME ACQUIRED IN BOTH YOUR NAMES AND GIFTS. CHECK IF YOU ANTICPATE THE

FOLLOWING:

YOU MAY ACQUIRE SOME COMMUNITY PROPERTY WITH YOUR PROSPECTIVE SPOUSE.

YOU DO NOT INTEND TO CREATE ANY COMMUNITY PROPERTY ALTHOUGH DOING SO IS POSSIBLE.

NO PROPERTY ACQUIRED DURING MARRIAGE IS TO BE TREATED AS COMMUNITY PROPERTY (UNLESS THE PARTIES SIGN A SEPARATE WRITING

IDENTIFYING SUCH AS COMMUNITY PROPERTY).

ALL PROPERTY YOU ACQUIRE DURING MARRIAGE, UNLESS FALLING WITHIN THE DEFINITION OF SEPARATE PROPERTY, SHOULD BE TREATED AS

COMMUNITY PROPERTY.

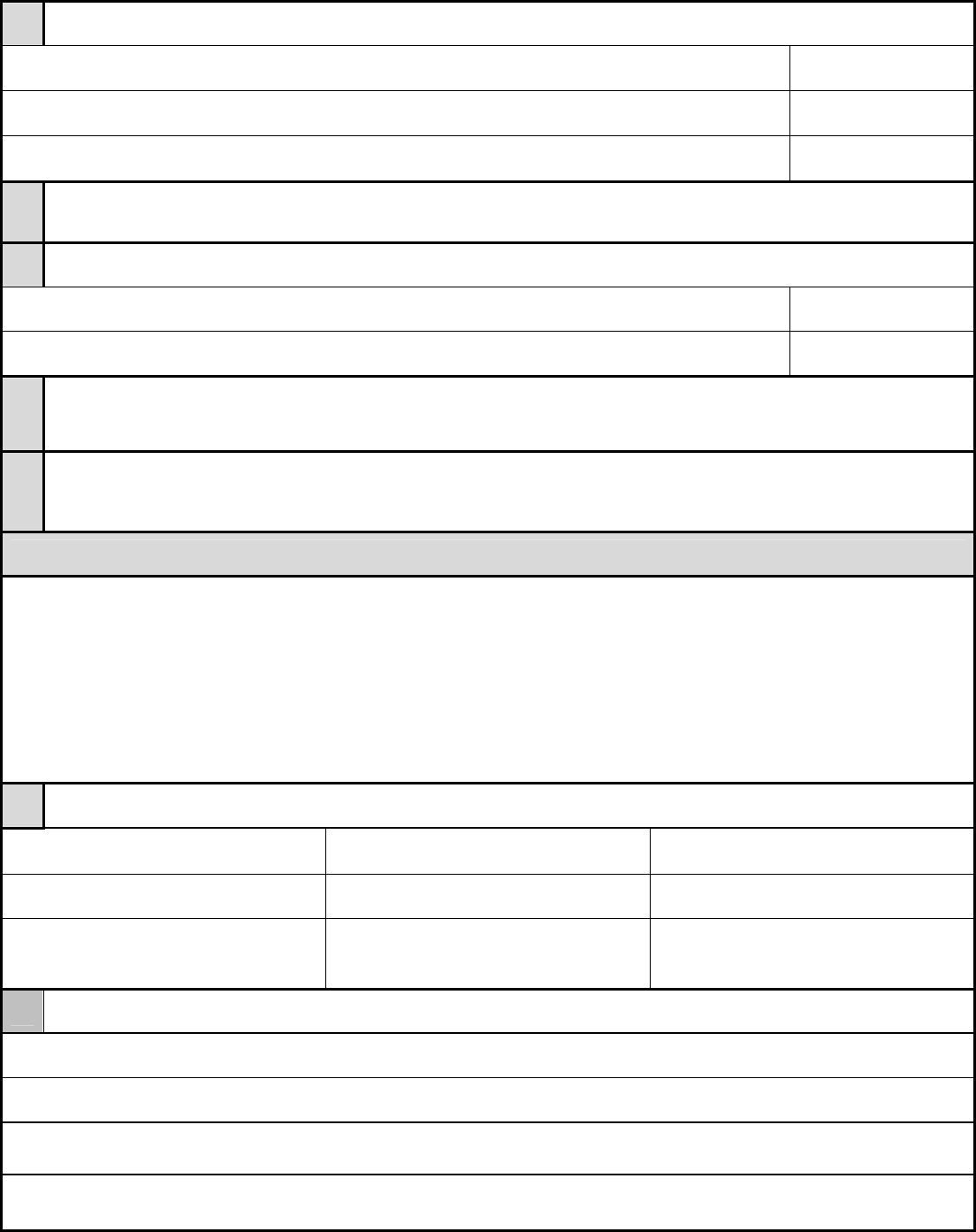

Estate Planning Questionnaire page 4 of 5

C

RECHARACTERIZATION OF PROPERTY

DO YOU WANT TO SPECIFY THAT IF YOU COMMINGLE YOUR SEPARATE PROPERTY TO ACQUIRE NEW PROPERTY, THE INTERESTS OF THE PARTIES ARE TO

REMAIN SEPARATE PROPERTY (IN PROPORTION TO THE AMOUNT CONTRIBUTED BY EACH)? YES NO

DO YOU WANT TO SPECIFY THAT YOUR SEPARATE PROPERTY CAN ONLY BE RECLASSIFIED AS COMMUNITY PROPERTY BY A WRITING EXECUTED BY THE

OWNER OF THE SEPARATE PROPERTY? YES NO

IF YOU CONTRIBUTE SEPARATE PROPERTY TO ACQUIRE AN ASSET TO BE HELD IN THE NAMES OF YOU AND YOUR PROSPECTIVE SPOUSE, DO YOU WISH

TO RECEIVE YOUR SEPARATE PROPERTY BACK IN THE EVENT OF DISSOLUTION OF MARRIAGE? YES NO

IF YES, DO YOU WANT TO RECEIVE INTEREST OR APPRECIATION ON THE SEPARATE PROPERTY YOU RECEIVE BACK?

D

LIVING EXPENSES

WITH REGARD TO LIVING EXPENSES (E.G. FOOD, CLOTHING, MEDICAL INSURANCE, TRAVEL, AND ENTERTAINMENT), THE EXPENSES ARE TO BE

SHARED BY THE PARTIES AS THEY MAY LATER AGREE

SHARED EQUALLY

PAID SOLELY BY ONE PARTY (HUSBAND ____ WIFE _____)

SHARED UNEQUALLY WITH THE AMOUNTS OR PROPORTIONS TO BE SPECIFIED IN THE AGREEMENT (E.G. BY FRACTION OR PERCENTAGE, FIXED

AMOUNT, PROPORTION TO INCOME, ETC).

THE AGREEMENT WILL BE SILENT

WILL THE PARTIES ESTABLISH A JOINT CHECKING ACCOUNT FOR HOUSEHOLD AND LIVING EXPENSES YES NO

JOINT ACCOUNT WITH DEPOSITS BECOMING COMMUNITY PROPERTY

THE PARTIES WILL LATER AGREE ABOUT FUNDING AN ACCOUNT

AGREEMENT WILL STATE THE AMOUNTS TO BY FUNDED AND BY WHOM WITH DEPOSITS BECOMING COMMUNITY PROPERTY

IF DEPOSITS INTO THE JOINT CHECKING ACCOUNT ARE INSUFFICIENT TO COVER THE LIVING EXPENSES, HOW WILL THIS BE RESOLVED?

IV. AGREEMENT PROVISIONS

A

MARITAL RESIDENCE

WHERE WILL THE MARITAL HOME BE LOCATED?

ADDRESS

WHO OWNS THIS PROPERTY?

DO YOU EVER INTEND TO TRANSFER ANY OWNERSHIP INTEREST IN THIS MARITAL RESIDENCE TO YOUR PROSPECTIVE SPOUSE? YES NO

DO YOU ANTICIPATE ANY IMPROVEMENTS TO THIS PROPERTY IN THE FUTURE? YES NO

IF YES, HOW DO YOU INTEND TO PAY THE DEBT ONCE YOU ARE MARRIED?

IS THERE AN ENCUMBRANCE ON THIS PROPERTY? YES NO

IF YES, HOW DO YOU INTEND TO PAY THE DEBT ONCE YOU ARE MARRIED? PROPERTY TAX AND HOMEOWNER’S INSURANCE?

B

SPOUSAL SUPPORT

DO YOU WANT YOUR PROSPECTIVE SPOUSE TO AGREE TO A WAIVER OF SPOUSAL SUPPORT? YES NO

DO YOU WANT YOUR PROSPECTIVE SPOUSE TO AGREE TO A LIMITATION OF SPOUSAL SUPPORT? YES NO

IF YES, WHAT LIMITATION?

DO YOU WANT YOUR PROSPECTIVE SPOUSE TO AGREE TO A LUMP SUM PAYMENT OF SPOUSAL SUPPORT? YES NO

IF YES, WHAT LUMP SUM?

C

GIFTS

ARE GIFTS TO THE OTHER SPOUSE TO BE THAT SPOUSE’S SEPARATE PROPERTY? OR TO REMAIN COMMUNITY PROPERTY?

D

INCOME TAX RETURNS

WITH REGARD TO FILING INCOME TAX RETURNS,

THE PARTIES WILL FILE JOINT RETURNS AND THE COST OF PREPARATION AND ANY TAX LIABILITY WILL BE PAID EQUALLY BY THE PARTI ES

THE PARTIES WILL FILE JOINT RETURNS AND THE COST OF PREPARATION AND ANY TAX LIABILITY WILL BE APPORTIONED BASED ON THE SPOUSE’S

INCOME

THE PARTIES WILL FILE JOINT RETURNS AND THE COST OF PREPARATION AND ANY TAX LIABILITY WILL BE PAID BY ___________________________

THE PARTIES WILL FILE SEPARATE TAX RETURNS AND EACH WILL BE RESPONSIBLE FOR THE COST OF PREPARATION AND ANY TAX LIABILITY

THE AGREEMENT WILL BE SILENT ON THE SUBJECT

Estate Planning Questionnaire page 5 of 5

E

DEBTS

WITH REGARD TO EXISTING DEBTS

EACH PARTY IS EXPRESSLY RESPONSIBLE TO PAY HIS OR HER OWN EXISTING DEBTS AT THE TIME OF THE MARRIAGE

ONE PARTY ________ WILL PAY ALL THE DEBTS OF THE OTHER SPOUSE ___________

THE AGREEMENT WILL BE SILENT ON THE SUBJECT

V. MISCELLANEOUS

A

PRIOR AGREEMENTS

HAVE YOU AGREED TO LEAVE YOUR PROSPECTIVE SPOUSE ANY SPECIFIC PROPERTY IN YOUR ESTATE PLAN (I.E. WILL OR TRUST)? YES NO

HAVE YOU AGREED TO NAME YOUR PROSPECTIVE SPOUSE AS BENEFICIARY OF ANY LIFE INSURANCE PROCEEDS? YES NO

HAVE YOU AGREED TO NAME YOUR PROSPECTIVE SPOUSE ANY MONEY? YES NO

HAVE YOU AGREED TO NAME YOUR PROSPECTIVE SPOUSE AS BENEFICIARY OF ANY EMPLOYMENT BENEFITS? YES NO

HAVE YOU AGREED TO OWN ANY ASSETS JOINTLY WITH YOUR SPOUSE WITH RIGHT OF SURVIVORSHIP? YES NO

HAVE YOU AGREED TO TRANSFER ANY OF YOUR PROPERTY TO YOUR PROSPECTIVE SPOUSE? YES NO

B

RIGHTS UPON DEATH OF PARTY

IN CALIFORNIA, THERE ARE CERTAIN RIGHTS AND BENEFITS A SPOUSE IS ENTITLED TO ONCE THE OTHER SPOUSE DIES. THESE RIGHTS INCLUDE, BUT ARE

NOT LIMITED TO, THE RIGHT TO A FAMILY ALLOWANCE, THE RIGHT TO LIVE IN THE MARITAL RESIDENCE, THE RIGHT TO ACT AS AN EXECUTOR OF AN

ESTATE.

DO YOU WANT YOUR PROSPECTIVE SPOUSE TO AGREE TO A COMPLETE WAIVER OF RIGHTS UPON YOUR DEATH UNLESS THERE IS A WRITING EXECUTED

AFTER THE DATE OF THE MARRIAGE? YES NO