Fillable Printable Profit and Loss Statement Sample Form

Fillable Printable Profit and Loss Statement Sample Form

Profit and Loss Statement Sample Form

1 of 5

Keep these Notes (pages 1 to 2) for your information.

SU580.1404

Profit and Loss Statement

Use this form if you are a sole trader (including a subcontractor) or a partner in a partnership who has:

• commenced new employment or a new business

• changed your level of business activity or income from self-employment.

Do not use this form if:

• your previous year's financial statements are indicative of the current business profitability

• you are a wage or salary earner, a pieceworker, or you have been advised by the Australian Government

Department of Human Services that you are in an employee/employer type relationship and you must

declare your gross income

• your business operates through a private company or trust.

Purpose of this form

Check that you have answered all the questions you need to answer, and that you have signed and dated

the form.

Return this form and all additional documents to one of our Service Centres or online within 14 days to

make sure you are paid your correct entitlement.

If you cannot return all the forms or documents within 14 days, contact us for extra time.

For more information on how to access Online Services or how to lodge documents online, go to

www.

www.

humanservices.gov.au/submitdocumentsonline

Returning your forms

If you have a hearing or

speech impairment

TTY service Freecall™ 1800 810 586. A TTY phone is required to use this service.

Interpreters and

translations

If you need an interpreter or translation of any documents for our business, we can arrange this for you

free of charge.

For more information

Go to our website www.humanservices.gov.au or call us on 132 850 or visit one of our Service Centres.

To speak to us in languages other than English, call 131 202.

Note: Call charges apply – calls from mobile phones may be charged at a higher rate.

Filling in this form

• Please use black or blue pen.

•

Print in BLOCK LETTERS

.

• Mark boxes like this

with a or .

• Where you see a box like this

Go to 5

skip to the question number shown. You do not need to answer

the questions in between.

Definition of a partner

For the Department of Human Services purposes a person is considered to be your partner if you and the

person are living together, or usually live together, and are:

• married, or

• in a registered relationship (opposite-sex or same-sex), or

• in a de facto relationship (opposite-sex or same-sex).

We consider a person to be in a de facto relationship from the time they commence living with another person

as a member of a couple.

We recognise all couples, opposite-sex and same-sex.

2 of 5

SU580.1404

Notes

The following notes are provided as a guide for our assessment purposes only.

Only expenses necessarily incurred in earning business income are allowed as deductions.

For example, travel expenses incurred as part of business operations are allowable, but costs of

personal travel are not. Where the expenses are incurred for part business and part personal reasons,

only that part which relates to your business may be deducted from your business income.

Deductions for superannuation paid to an employee’s accounts are allowable in certain

circumstances. Ask us for more information.

Some legitimate deductions under tax law are not allowed for our income assessment

purposes. These include:

• Prior year losses (section 8-1 of the

Income Tax Assessment Act 1997

)

• Offsetting of losses

Losses can be offset only in some situations. Ask us for more information.

• Superannuation contributions for the sole trader or partners of the partnership

• Borrowing expenses

• Donations

• Industry concessions/incentives

– Income Equalisation Deposits/Farm Management Bonds

– income averaging

– provisions to defer taxation

– forced disposal of livestock (section 36AAA or sub-sections 36(3) to (7)

Income Tax Assessment Act 1936

(ITAA 1936))

– double wool clip (section 26BA ITAA 1936), and

– insurance received for timber or stock losses (section 26B ITAA 1936).

• Insurance

Private health insurance or premiums paid on term life, endowment or disability policies.

• Capital expenditure deductions

Some capital expenses related to primary production that are allowed for tax purposes are not

allowed as deductions for our purposes. These include:

• Equal annual deductions over 10 years under section 75A of the ITAA 1936 for expenditure before

23 August 1983 on such items as:

– clearing and preparation of land for agriculture and farming

– drainage of swamps

– soil conservation measures

– flood mitigation measures

• Water storage and reticulation expenditure (section 75B ITAA 1936)

• Fences for disease control (section 75C ITAA 1936)

• Prevention of land degradation (section 75D ITAA 1936)

• A deduction from taxable income under section 36AAA of the ITAA 1936.

• Union fees

Section 51(1) of the ITAA 1936 provides for a deduction against gross business income in respect

of union membership fees. Union fees are not allowed as a deduction for the Department of

Human Services income test assessment purposes, unless membership is a requirement for

undertaking business activities in the applicable industry.

Amount paid and claimed as an expense item may need to be declared as income of the recipient.

For example, if the business pays rent or wages to you or your partner, you will need to declare the

amount as income.

Allowable deductions

Income of recipient

3 of 5

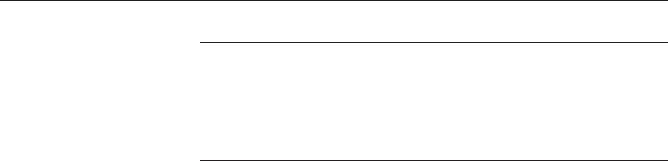

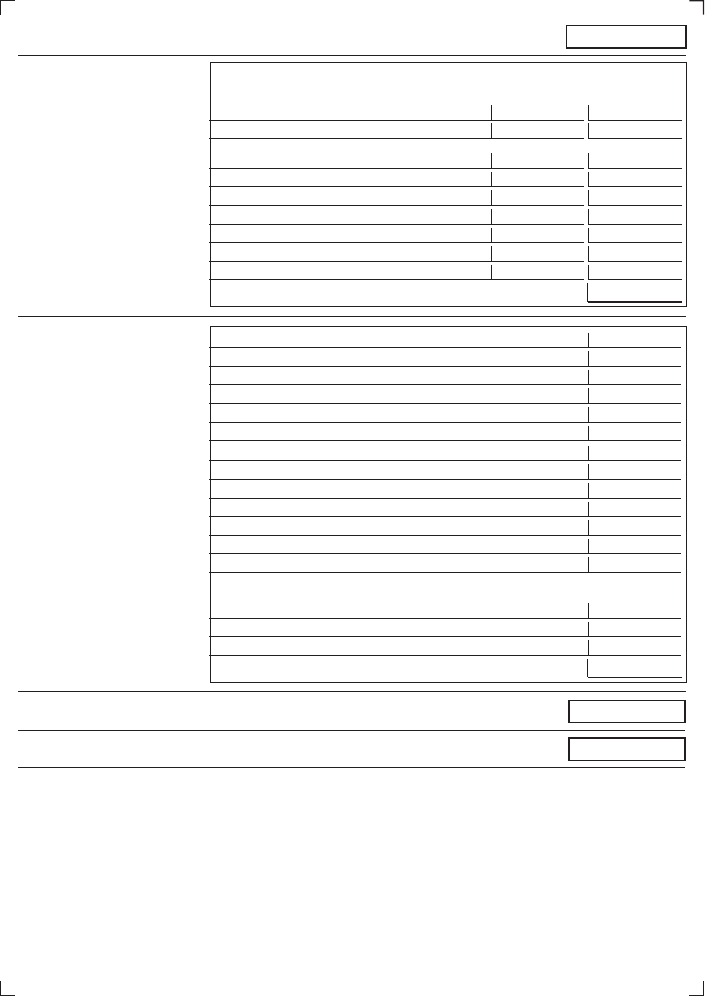

Mr

Mrs Miss Other

Family name

First given name

Second given name

Ms

/ /

SU580.1404

Your Centrelink Reference Number

3

Your name

1

Your date of birth

2

Profit and Loss Statement

/ /

Period of statement

10

/ /

to

Name of your business

4

Type of business

5

No

Yes

Are you self-employed and

operating your business as a

sole trader?

7

Go to next question

Go to 9

No

Yes

Number of business partners

Your share of income

Your partner’s share of income

%

%

No

Yes

You will need to attach copies of documents.

Your phone number

6

()

Go to the calculation sheet on the next page.

Title

Do you operate the business in

partnership with other people?

8

We need to see a copy of your

(and your partner’s) latest personal

and partnership (if applicable)

income tax return(s) and

supporting information such as

balance sheet, depreciation

schedule etc.

Have you already provided copies

of these documents to us?

9

You have indicated you are neither a sole trader nor in a partnership. Call us on 132 850 to

discuss the nature of your business and to confirm that we need this form completed.

CLK0SU580 1404

4 of 5

SU580.1404

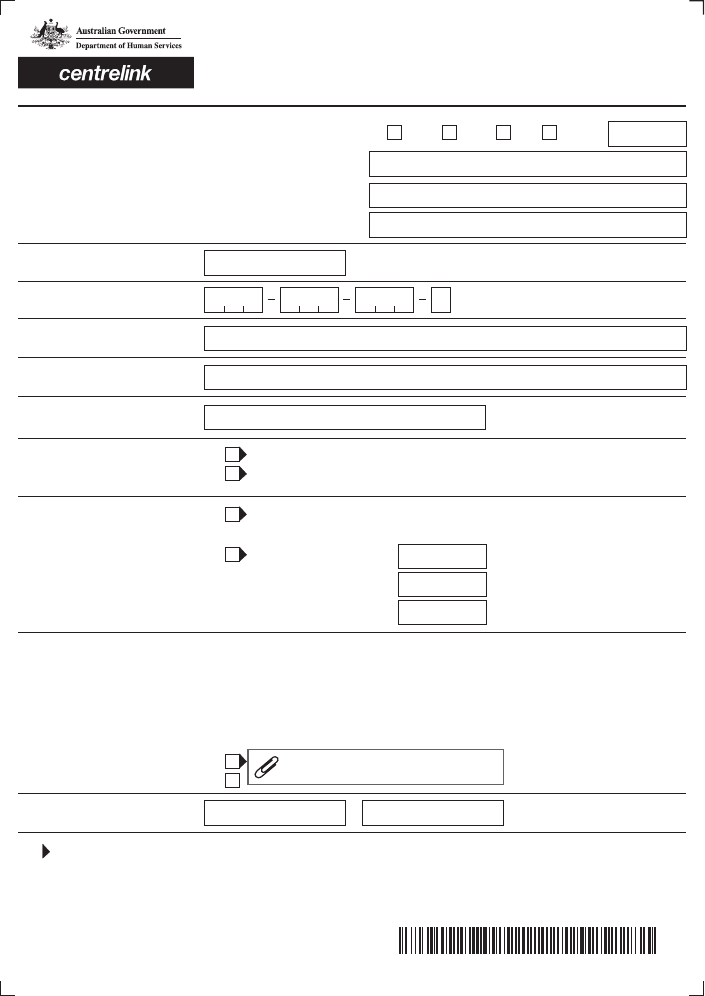

$

$

$

Accountancy (not tax agents)

Annual amount

(e.g. from tax return)

Amount for period

of statement

Depreciation (see tax return if available)

Insurance premiums (e.g. business premises, public liability,

sickness and accident, stock, motor vehicle)

Interest on money borrowed for business use

Levies, licence fees and government charges

Registration of motor vehicles less percentage of private use

Rent or rates less percentage of private use

Sub-total

(B)

Advertising

Bank charges (on business accounts)

Cost of goods sold in period — see description*

Freight, cartage and travelling expenses

Motor vehicle running costs (check tax pack for calculation)

Hire (plant and equipment)

Journals and periodicals for business use

Power cost for business use

Telephone costs for business use

Printing and stationery

Materials (hardware, chemicals, parts etc.)

Repairs and maintenance (unless included as part of motor vehicle expenses)

Wages/salary paid

Capital items (e.g. tools, office equipment)

– each item purchased for less than $300 (or up to the amount allowed

as a concession if using the Small business entity concessions)

Other (Give details – attach a separate list if needed)

Gross business income for the period of statement (A)

Other (Give details – attach a separate list if needed)

(D)

PROFIT OR LOSS

Sub-total

(C)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

11

Non variable expenses

12

Variable expenses

Amount should reflect the

period of statement

(e.g. if the statement covers a

3 month period, divide an annual

figure by 4).

*Cost of goods sold

Opening stock at start of period

plus purchases in period less

closing stock at end of period.

13

Total of all expenses (B) plus (C)

14

Net income (A) less (D)

15

5 of 5

SU580.1404

Date

I understand that:

I declare that:

• giving false or misleading information is a serious offence.

• the Australian Government Department of Human Services can make

relevant enquiries to make sure I receive my correct entitlement.

• the information provided in this form is complete and correct.

Your statement

17

Privacy and your personal information

Your personal information is protected by law, including the

Privacy Act 1988

, and is collected by the Australian Government Department

of Human Services for the assessment and administration of payments and services. This information is required to process your application

or claim.

Your information may be used by the department or given to other parties for the purposes of research, investigation or where you have

agreed or it is required or authorised by law.

You can get more information about the way in which the Department of Human Services will manage your personal information, including

our privacy policy at

www

www

.

.

humanservices.gov.au/privacy or by requesting a copy from the department.

IMPORTANT INFORMATION

16

Your signature