Fillable Printable Public Service Loan Forgiveness Form Sample

Fillable Printable Public Service Loan Forgiveness Form Sample

Public Service Loan Forgiveness Form Sample

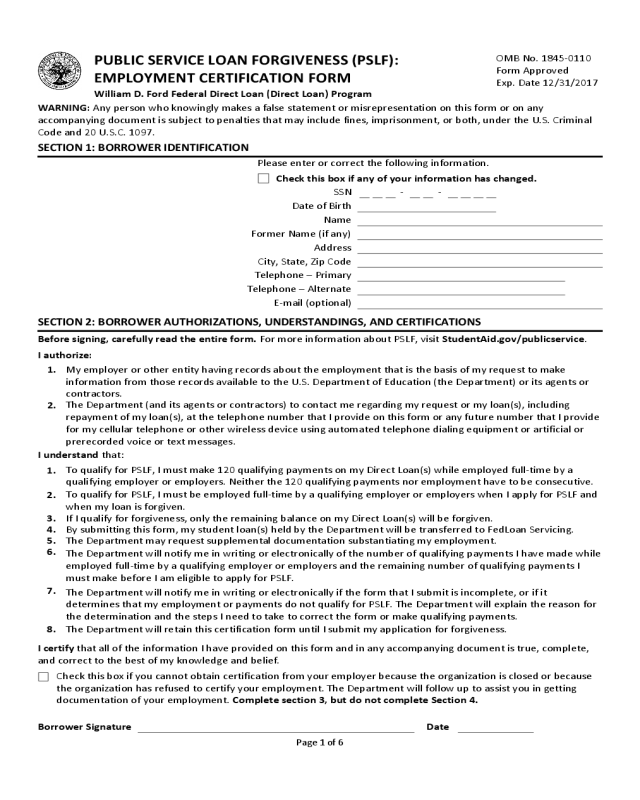

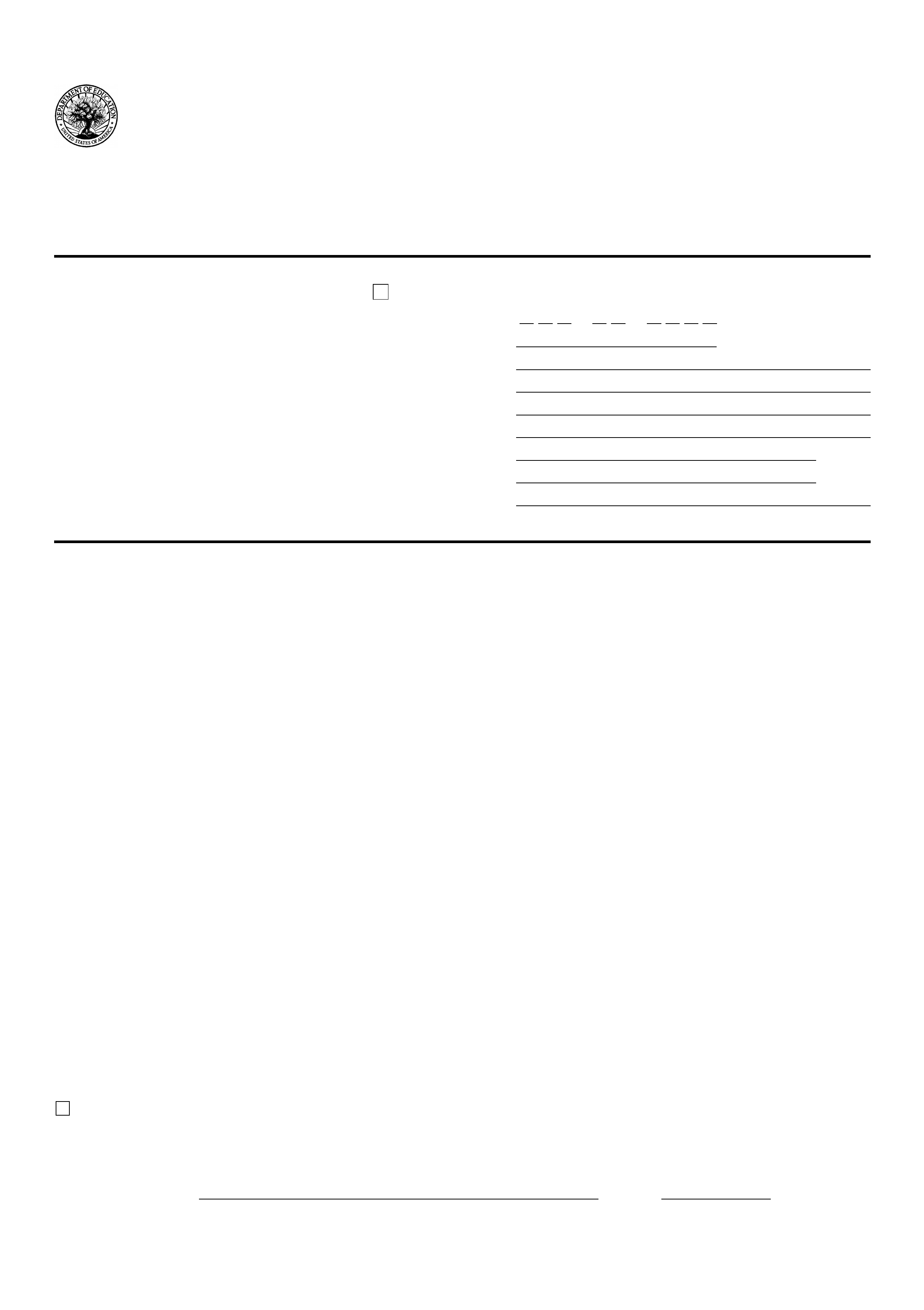

PUBLIC SERVICE LOAN FORGIVENESS (PSLF):

EMPLOYMENT CERTIFICATION FORM

William D. Ford Federal Direct Loan (Direct Loan) Program

OMB No. 1845-0110

Form Approved

Exp. Date 12/31/2017

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any

accompanying document is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal

Code and 20 U.S.C. 1097.

SECTION 1: BORROWER IDENTIFICATION

SECTION 2: BORROWER AUTHORIZATIONS, UNDERSTANDINGS, AND CERTIFICATIONS

Before signing, carefully read the entire form. For more information about PSLF, visit StudentAid.gov/publicservice.

1.

My employer or other entity having records about the employment that is the basis of my request to make

information from those records available to the U.S. Department of Education (the Department) or its agents or

contractors.

2.

The Department (and its agents or contractors) to contact me regarding my request or my loan(s), including

repayment of my loan(s), at the telephone number that I provide on this form or any future number that I provide

for my cellular telephone or other wireless device using automated telephone dialing equipment or artificial or

prerecorded voice or text messages.

I certify that all of the information I have provided on this form and in any accompanying document is true, complete,

and correct to the best of my knowledge and belief.

Borrower Signature Date

Page 1 of 6

Please enter or correct the following information.

Check this box if any of your information has changed.

SSN

Name

Address

City, State, Zip Code

Telephone – Primary

E-mail (optional)

Telephone – Alternate

- -

Check this box if you cannot obtain certification from your employer because the organization is closed or because

the organization has refused to certify your employment. The Department will follow up to assist you in getting

documentation of your employment. Complete section 3, but do not complete Section 4.

I authorize:

Date of Birth

Former Name (if any)

I understand that:

1.

To qualify for PSLF, I must make 120 qualifying payments on my Direct Loan(s) while employed full-time by a

qualifying employer or employers. Neither the 120 qualifying payments nor employment have to be consecutive.

2.

To qualify for PSLF, I must be employed full-time by a qualifying employer or employers when I apply for PSLF and

when my loan is forgiven.

3. If I qualify for forgiveness, only the remaining balance on my Direct Loan(s) will be forgiven.

4. By submitting this form, my student loan(s) held by the Department will be transferred to FedLoan Servicing.

5. The Department may request supplemental documentation substantiating my employment.

6.

The Department will notify me in writing or electronically of the number of qualifying payments I have made while

employed full-time by a qualifying employer or employers and the remaining number of qualifying payments I

must make before I am eligible to apply for PSLF.

7.

The Department will notify me in writing or electronically if the form that I submit is incomplete, or if it

determines that my employment or payments do not qualify for PSLF. The Department will explain the reason for

the determination and the steps I need to take to correct the form or make qualifying payments.

8. The Department will retain this certification form until I submit my application for forgiveness.

Page 2 of 6

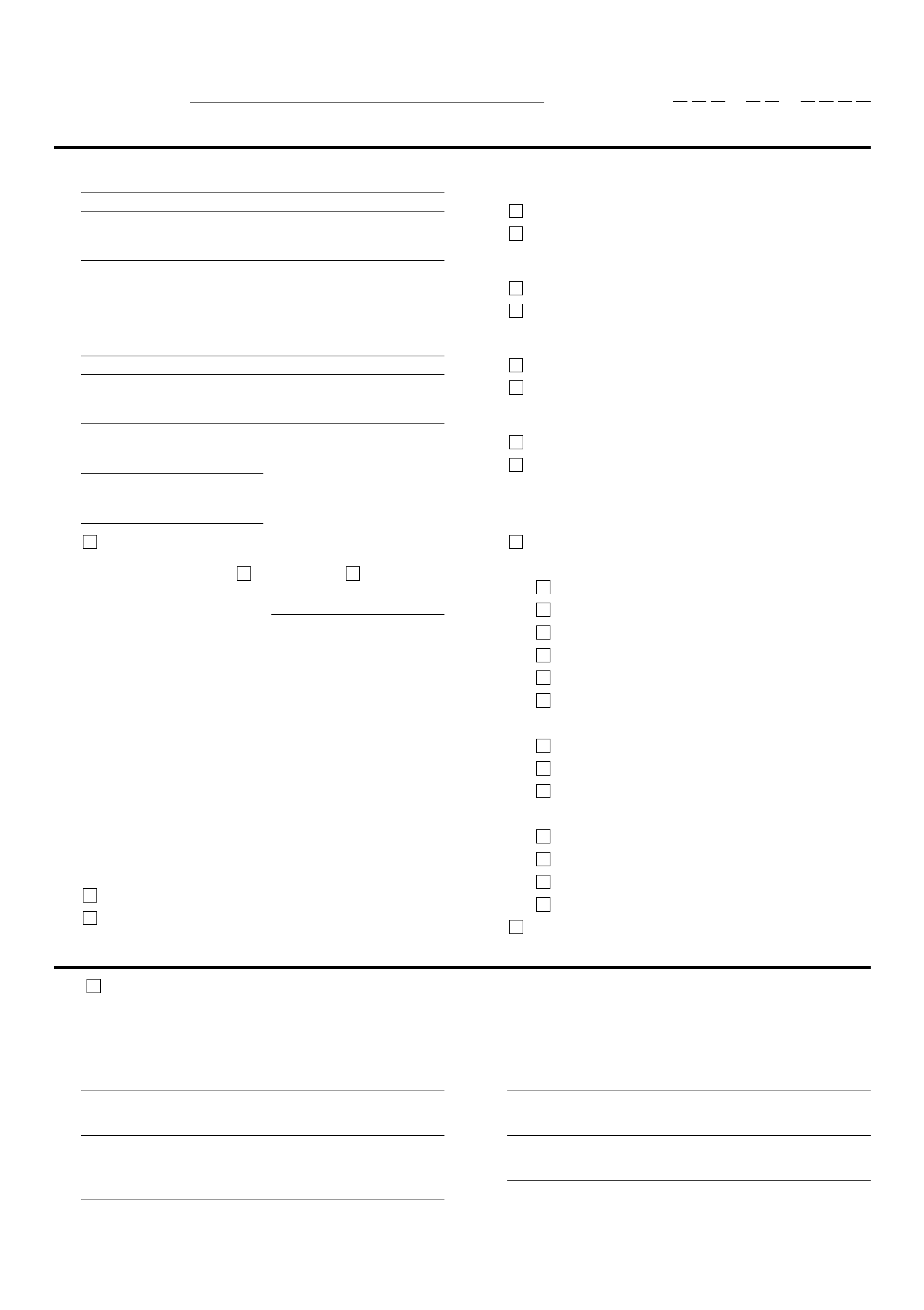

SECTION 3: EMPLOYMENT INFORMATION (TO BE COMPLETED BY THE BORROWER OR EMPLOYER)

Borrower Name: Borrower SSN:

- -

1. Employer Name:

2. Federal Employer Identification Number (EIN):

Your employer's EIN may be found on your Wage and

Tax Statement (W-2).

3. Employer Address:

Employer Website (if any):4.

5. Employment Begin Date:

OR

6. Employment End Date:

Still employed.

7. Employment Status:

Full-Time Part-Time

Include vacation, leave time, or any leave taken

under the Family Medical Leave Act of 1993. If your

employer is a 501(c)(3) or a not-for-profit

organization, do not include any hours you spent on

religious instruction, worship services, or

proselytizing.

Hours Per Week (Average):

8.

A governmental organization is a Federal, State, local,

or Tribal government organization, agency, or entity,

a public child or family service agency, a Tribal

college or university, or the Peace Corps or

AmericCorps.

Is your employer a governmental organization?

9.

10. Is your employer a tax-exempt organization under

section 501(c)(3) of the Internal Revenue Code?

Yes - Skip to Section 4.

No - Continue to Item 11.

14. Does your employer provide any of the below

services?

Yes - Select all the services your employer

provides and then continue to Section 4.

Emergency management

Public service for individuals with disabilities

Public education

No - Your employer does not qualify.

Other school-based services

School library services

Public library services

Public health (see definition of "public

service organization" in Section 6)

Public service for the elderly

Early childhood education (see definition of

"public service organization" in Section 6)

Public interest legal services (see Section 6)

Law enforcement (see Section 6)

Public safety

Military service (see Section 6)

13. Is your employer a labor union?

Yes - Your employer does not qualify.

No - Continue to Item 14.

12. Is your employer a partisan political organization?

Yes - Your employer does not qualify.

No - Continue to Item 13.

11. Is your employer a not-for-profit organization?

Yes - Continue to Item 12.

No - Your employer does not qualify.

Yes - Skip to Section 4

No - Continue to Item 10

SECTION 4: EMPLOYER CERTIFICATION (TO BE COMPLETED BY THE EMPLOYER)

15.

I certify that the information in Section 3 is true, complete, and correct to the best of my knowledge and belief

and that I am an authorized official (see Section 6) of the organization named in Section 3.

Complete Items 16-21

.

Authorized Official's Name:

Date:

Authorized Official's Email:

Authorized Official's Phone:16.

Authorized Official's Signature:18.

Authorized Official's Title:17.

Note: If any of the information is crossed out or altered in Section 3, you must initial those changes.

19.

21.

20.

SECTION 5: INSTRUCTIONS FOR COMPLETING THE FORM

Page 3 of 6

You may submit information about multiple employers by submitting one copy of Sections 1 and 2 (Page 1), and one

copy of Sections 3 and 4 (Page 2) per employer. When completing this form, type or print using dark ink. Enter dates as

month-day-year (mm-dd-yyyy). Use only numbers. Example: March 14, 2014 = 03-14-2014. If any information is crossed

out or altered in Section 3, it must be initialed by your employer. For more information about PSLF and how to use this

SECTION 6: DEFINITIONS

AmeriCorps position means a position approved by the

Corporation for National and Community Service under

Section 123 of the National and Community Service Act

of 1990 (42 U.S.C. 12573).

o

An annual average of at least 30 hours per week or,

for a contractual or employment period of at least 8

months, an average of 30 hours per week; or

o

Unless the qualifying employment is with two or more

employers, the number of hours the employer

considers full time.

Full-time means working in qualifying employment in

one or more jobs for the greater of:

Peace Corps position

means a full-time assignment under

the Peace Corps Act as provided for under 22

U.S.C. 2504.

Military service for uniformed members of the U.S.

Armed Forces or the National Guard means “active duty”

service or “full-time National Guard duty” as defined in

Section 101(d)(1) and (d)(5) of Title 10 of the United

States Code, but does not include active duty for training

or attendance at a service school. For civilians, military

service means service on behalf of the U. S. Armed

Forces or the National Guard performed by an employee

of a public service organization.

Law enforcement means service performed by an

employee of a public service organization that is publicly

funded and whose principal activities pertain to crime

prevention, control or reduction of crime, or the

enforcement of criminal law.

An on-time payment is a payment made no more than

15 days after the due date for the payment.

An employee means an individual who is hired and paid

by a public service organization.

Eligible loans are loans that are not in default and made

under the William D. Ford Federal Direct Loan (Direct

Loan) Program.

An authorized official is an official of a public service

organization (including AmeriCorps or the Peace Corps)

who has access to the borrower’s employment or service

records and is authorized by the public service

organization to certify the employment status of the

organization’s employees or former employees, or the

service of AmeriCorps or Peace Corps volunteers.

A Tribal college or university; or

o

A public child or family service agency;

o

A Federal, State, local or Tribal government

organization, agency or entity;

o

A non-profit organization under Section 501(c)(3) of

the Internal Revenue Code that is exempt from

taxation under Section 501(a) of the Internal

Revenue Code;

o

A private organization (that is not a business

organized for profit, a labor union, or a partisan

political organization) that provides at least one of

the following public services:

(1)

emergency

management,

(2)

military service,

(3)

public safety,

(4)

law enforcement,

(5)

public interest law services,

(6)

early childhood education (including licensed or

regulated child care, Head Start, and State funded

pre-kindergarten),

(7)

public service for individuals

with disabilities and the elderly,

(8)

public health

(including nurses, nurse practitioners, nurses in a

clinical setting, and full-time professionals engaged

in health care practitioner occupations and health

support occupations, as such terms are defined by

the Bureau of Labor Statistics),

(9)

public education,

(10)

public library services,

(11)

school library

services, or

(12)

other school-based services.

o

A public service organization is:

Public interest law

refers to legal services provided by a

public service organization that are funded in whole or in

part by a local, State, Federal, or Tribal government.

Any other Direct Loan repayment plan, but only if

payments are at least equal to the monthly

payment amount that would be required under

the Standard Repayment Plan with a 10-year

repayment period.

o

The 10-Year Standard Repayment Plan (Standard

Repayment Plan with a maximum 10-year

repayment period); and

o

The Income-Contingent Repayment Plan;

o

The Pay As You Earn Plan;

o

The Income-Based Repayment Plan;

o

Qualifying repayment plans include:

Qualifying employment includes an AmeriCorps

position, a Peace Corps position, or employment at a

public service organization.

Qualifying payments are separate, on-time, full

monthly payments made on a Direct Loan after

October 1, 2007 under a qualifying repayment plan.

form, visit StudentAid.gov/publicservice. Return the completed form to the address shown in Section 7.

SECTION 7: WHERE TO SEND THE COMPLETED FORM

SECTION 8: IMPORTANT INFORMATION ABOUT PSLF

Return the completed form to:

U.S. Department of Education

FedLoan Servicing Or Fax to: 717-720-1628

P.O. Box 69184

Harrisburg, PA 17106-9184

If you need help completing this form, call: 855-265-4038

If you are calling internationally, call: 717-720-1985 If you

use a telecommunication device for the hearing or

speach impaired: (TTY), dial: 711 and enter 800-699-2908

when prompted.

You may obtain loan forgiveness under this program if:

You make 120 qualifying payments (see “Payment

Eligibility”);

On eligible loans (see “Loan Eligibility”);

While working in qualifying employment (see

“Employment Eligibility”).

Payment Eligibility

To receive PSLF, you must make 120 on-time, full,

scheduled, separate monthly payments on your Direct

Loans under a qualifying repayment plan after October 1,

2007.

On-time payments are those that are received by the

Department no later than 15 days after the scheduled

payment due date.

Full payments are payments on your Direct Loan in an

amount that equals or exceeds the amount you are

required to pay each month under your repayment

schedule. If you make a payment that is less than what you

are required to pay for that month, that month's payment

will not count as one of the required 120 qualifying

payments. If you make multiple, partial payments in a

month and the total of those partial payments equals or

exceeds the required full monthly payment amount, those

payments will count as one qualifying payment.

Scheduled payments are those that are made while you are

in repayment. They do not include payments made while

your loans are in an in-school or grace status, in a

deferment or forbearance period, or if your loan is “paid

ahead” because you have made prepayment.

You must make separate monthly payments. Lump sum

payments or payments you make as advance payments for

future months do not count as more than one qualifying

payment. If you wish to make a payment in excess of your

scheduled monthly payment, follow the instructions on

your bill for providing payment instructions, and notate

that your payment is not intended to cover future

installments. Otherwise, your excess payment may affect

your ability to make future qualifying payments.

If you were an AmeriCorps or Peace Corps volunteer, you

may receive credit for making qualifying payments if you

make a lump sum payment by using all or part of a Segal

Education Award or Peace Corps transition payment. The

Department will consider the lump sum payment you

have made as the equivalent of qualifying payments

equal to the lesser of (1) the number of payments

resulting after dividing the amount of the lump sum

payment by the monthly payment amount you would

have made under one of the qualifying repayment plans

listed below; or (2) 12 payments.

Peace Corps volunteers making an eligible lump sum

payment must do so within 6 months of the Employment

End Date, as reported in Section 3.

Your payments must be made under a qualifying

repayment plan. Qualifying repayment plans include:

The Income-Based Repayment (IBR) Plan;

§

§

The Pay As You Earn Repayment Plan;

§

The Income Contingent Repayment (ICR) Plan;

§

The 10-Year Standard Repayment Plan; or

§

Any other Direct Loan repayment plan, but only

payments that are at least equal to the monthly

payment amount that would be required under the

10-Year Standard Repayment Plan.

Though repayment plans other than the IBR, Pay As You

Earn, and ICR Plan are qualifying repayment plans for

PSLF, you must enter IBR, Pay As You Earn, or ICR to

have a remaining balance to forgive after becoming

eligible for PSLF. Otherwise, your loans will be fully

repaid within 10 years. To apply for these plans, visit

StudentLoans.gov.

IMPORTANT: The Standard Repayment Plan for Direct

Consolidation Loans made on or after July 1, 2006 have

repayment periods of different lengths. Monthly

payments you make under the Standard Repayment Plan

on such Direct Consolidation Loans are only qualifying

payments if the loans have a 10-year repayment period

(which would only occur if your total education

indebtedness is less than $7,500).

Loan Eligibility

Only Direct Loan Program loans that are not in default

are eligible for PSLF. Loans you received under the

Federal Family Education Loan (FFEL) Program, the

Federal Perkins Loan (Perkins Loan) Program, or any

other student loan program are not eligible for PSLF.

Page 4 of 6

Page 5 of 6

SECTION 8: IMPORTANT INFORMATION ABOUT PSLF (CONTINUED)

If you have FFEL Program or Perkins Loan Program loans,

you may consolidate them into a Direct Consolidation Loan

to take advantage of PSLF. However, payments made on

your FFEL Program or Perkins Loan Program loans before

you consolidated them, even if they were made under a

qualifying repayment plan, do not count as qualifying PSLF

payments. In addition, if you made qualifying payments on a

Direct Loan and then consolidate it into a Direct

Consolidation Loan, you must start over making qualifying

payments on the new Direct Consolidation Loan. If you

consolidate your FFEL Program or Perkins Loan Program

loans into a Direct Consolidation Loan to take advantage of

PSLF and do not have any Direct Loans, do not submit this

form until you have consolidated your loans. The

application for Direct Consolidation Loans contains a

section that allows you to indicate that you are

consolidating your loans for PSLF. You can consolidate your

you don't know what type of federal student loans you

have, check the National Student Loan Data System (NSLDS)

Employment Eligibility

To qualify for PSLF, you must be an employee of a

qualifying organization. An employee is someone who is

hired and paid by the organization. You may physically

perform your work at a qualifying or non-qualifying

organization, so long as your employer is a qualifying

organization. If you are a contracted employee, the

organization that hired and pays you must qualify, not the

organization where you perform your work. The type or

nature of employment with the organization does not

matter for PSLF purposes.

A qualifying organization is a Federal, State, or local

government agency, entity, or organization or a tax-exempt

organization under Section 501(c)(3) of the Internal

Revenue Code (IRC). Service in an AmeriCorps or Peace

Corps position is also qualifying employment. The type of

services that these organizations provide does not matter

for PSLF purposes.

A private not-for-profit organization that is not a tax-

exempt organization under Section 501(c)(3) of the IRC may

be a qualifying organization if it provides certain specified

public services. These services include emergency

management, military service, public safety, or law

enforcement services; public health services; public

education or public library services; school library and other

school-based services; public interest law services; early

childhood education; public service for individuals with

disabilities and the elderly. The organization must not be a

business organized for profit, a labor union, or a partisan

political organization.

Employment as a member of the U.S. Congress is not

qualifying employment.

You must be employed full-time by your employer.

Generally, you must meet your employer's definition of

full-time. However, for PSLF purposes, that definition

must be at least an annual average of 30 hours per

week. For purposes of the full-time requirement, your

qualifying employment at a 501(c)(3) organization or a

not-for-profit organization does not include time spent

participating in religious instruction, worship services, or

any form of proselytizing.

If you are a teacher, or other employee of a public service

organization, under contract for at least eight out of 12

months, you meet the full-time standard if you work an

average of at least 30 hours per week during the

contractual period and receive credit by your employer

for a full year's worth of employment.

If you are employed in more than one qualifying part-time

job simultaneously, you may meet the full-time

employment requirement if you work a combined average

of at least 30 hours per week with your employers.

Vacation or leave time provided by the employer or leave

taken for a condition that is a qualifying reason for leave

under the Family and Medical Leave Act of 1993, 29,

U.S.C. 2612(a)(1) and (3) is equivalent to hours worked in

qualifying employment.

Other Important Information

The submission of this form before you apply for PSLF is

optional. However, if you wait to submit this form until

you apply for PSLF, you will be required to submit one

form for each employer that you want considered toward

your eligibility for PSLF.

If you submit this form and your employer qualifies, all of

your loans held by the Department will be transferred to

FedLoan Servicing. FedLoan Servicing will then determine

how many qualifying payments you made during the

period of qualifying employment within the dates

provided in Section 3.

You are not permitted to apply the same period of

service to receive PSLF and the Teacher Loan Forgiveness,

Service in Areas of National Need, and Civil Legal

Assistance Attorney Student Loan Repayment programs.

No borrower will be eligible for PSLF until October 2017

at the earliest. An application for PSLF will be made

available at a later time.

federal student loans online by visiting StudentLoans.gov. If

at nslds.ed.gov .

SECTION 9: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. 552a)

requires that the following notice be provided to you:

The authorities for collecting the requested information

from and about you are §421 et seq. and §451 et seq. of

the Higher Education Act of 1965, as amended (20 U.S.C.

1071 et seq. and 20 U.S.C. 1087a et seq.) and the

authorities for collecting and using your Social Security

Number (SSN) are §§428B(f) and 484(a)(4) of the HEA (20

U.S.C. 1078-2(f) and 1091(a)(4)) and 31 U.S.C. 7701(b).

Participating in the Federal Family Education Loan (FFEL)

Program or the William D. Ford Federal Direct Loan

(Direct Loan) Program and giving us your SSN are

voluntary, but you must provide the requested

information, including your SSN, to participate.

The principal purposes for collecting the information on

this form, including your SSN, are to verify your identity,

to determine your eligibility to receive a loan or a benefit

on a loan (such as a deferment, forbearance, discharge, or

forgiveness) under the FFEL and/or Direct Loan Programs,

to permit the servicing of your loan(s), and, if it becomes

necessary, to locate you and to collect and report on your

loan(s) if your loan(s) become delinquent or defaults. We

also use your SSN as an account identifier and to permit

you to access your account information electronically.

The information in your file may be disclosed, on a case-

by-case basis or under a computer matching program, to

third parties as authorized under routine uses in the

appropriate systems of records notices. The routine uses

of this information include, but are not limited to, its

disclosure to federal, state, or local agencies, to private

parties such as relatives, present and former employers,

business and personal associates, to consumer reporting

agencies, to financial and educational institutions, and to

guaranty agencies in order to verify your identity, to

determine your eligibility to receive a loan or a benefit on

a loan, to permit the servicing or collection of your

loan(s), to enforce the terms of the loan(s), to investigate

possible fraud and to verify compliance with federal

student financial aid program regulations, or to locate you

if you become delinquent in your loan payments or if you

default. To provide default rate calculations, disclosures

may be made to guaranty agencies, to financial and

educational institutions, or to state agencies. To provide

financial aid history information, disclosures may be made

to educational institutions. To assist program

administrators with tracking refunds and cancellations,

disclosures may be made to guaranty agencies, to

financial and educational institutions, or to federal or

state agencies. To provide a standardized method for

educational institutions to efficiently submit student

enrollment status, disclosures may be made to guaranty

agencies or to financial and educational institutions. To

counsel you in repayment efforts, disclosures may be

made to guaranty agencies, to financial and educational

institutions, or to federal, state, or local agencies.

In the event of litigation, we may send records to the

Department of Justice, a court, adjudicative body,

counsel, party, or witness if the disclosure is relevant and

necessary to the litigation. If this information, either

alone or with other information, indicates a potential

violation of law, we may send it to the appropriate

authority for action. We may send information to

members of Congress if you ask them to help you with

federal student aid questions. In circumstances involving

employment complaints, grievances, or disciplinary

actions, we may disclose relevant records to adjudicate

or investigate the issues. If provided for by a collective

bargaining agreement, we may disclose records to a

labor organization recognized under 5 U.S.C. Chapter 71.

Disclosures may be made to our contractors for the

purpose of performing any programmatic function that

requires disclosure of records. Before making any such

disclosure, we will require the contractor to maintain

Privacy Act safeguards. Disclosures may also be made to

qualified researchers under Privacy Act safeguards.

Paperwork Reduction Notice. According to the

Paperwork Reduction Act of 1995, no persons are

required to respond to a collection of information unless

such collection displays a valid OMB control number. The

valid OMB control number for this information collection

is 1845-0110. Public reporting burden for this collection

of information is estimated to average 30 minutes per

response, including time for reviewing instructions,

searching existing data resources, gathering and

maintaining the data needed, and completing and

reviewing the collection of information. The obligation to

respond to this collection is required to obtain a benefit

in accordance with 34 CFR 685.219. If you have

comments or concerns regarding the status of your

individual submission of this form, please contact

FedLoan Servicing directly (see Section7).

Page 6 of 6