Fillable Printable Purchase Money Mortgage Contract

Fillable Printable Purchase Money Mortgage Contract

Purchase Money Mortgage Contract

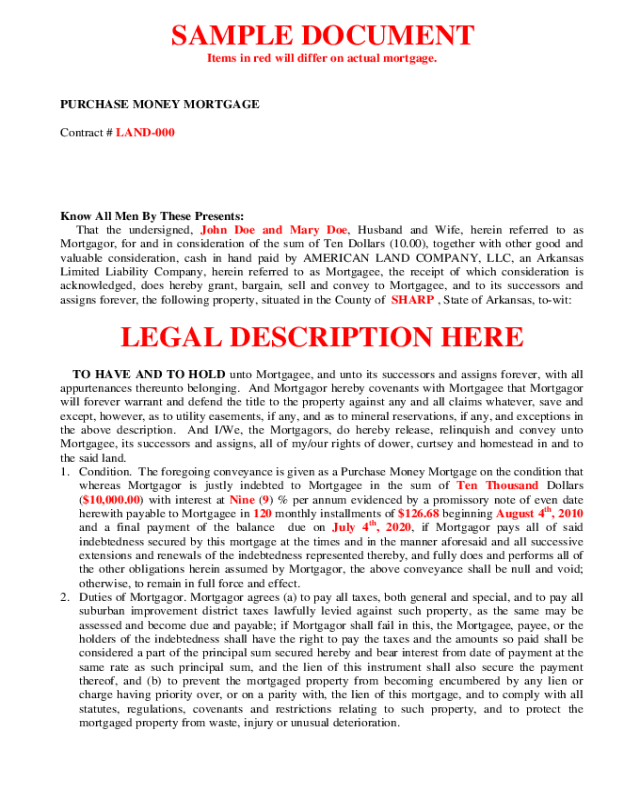

SAMPLE DOCUMENT

Items in red will differ on actual mortgage.

PURCHASE MONEY MORTGAGE

Contract # LAND-000

Know All Men By These Presents:

That the undersigned, John Doe and Mary Doe, Husband and Wife, herein referred to as

Mortgagor, for and in consideration of the sum of Ten Dollars (10.00), together with other good and

valuable consideration, cash in hand paid by AMERICAN LAND COMPANY, LLC, an Arkansas

Limited Liability Company, herein referred to as Mortgagee, the receipt of which consideration is

acknowledged, does hereby grant, bargain, sell and convey to Mortgagee, and to its successors and

assigns forever, the following property, situated in the County of SHARP , State of Arkansas, to-wit:

LEGAL DESCRIPTION HERE

TO HAVE AND TO HOLD unto Mortgagee, and unto its successors and assigns forever, with all

appurtenances thereunto belonging. And Mortgagor hereby covenants with Mortgagee that Mortgagor

will forever warrant and defend the title to the property against any and all claims whatever, save and

except, however, as to utility easements, if any, and as to mineral reservations, if any, and exceptions in

the above description. And I/We, the Mortgagors, do hereby release, relinquish and convey unto

Mortgagee, its successors and assigns, all of my/our rights of dower, curtsey and homestead in and to

the said land.

1. Condition. The foregoing conveyance is given as a Purchase Money Mortgage on the condition that

whereas Mortgagor is justly indebted to Mortgagee in the sum of Ten Thousand Dollars

($10,000.00) with interest at Nine (9) % per annum evidenced by a promissory note of even date

herewith payable to Mortgagee in 120 monthly installments of $126.68 beginning August 4

th

, 2010

and a final payment of the balance due on July 4

th

, 2020, if Mortgagor pays all of said

indebtedness secured by this mortgage at the times and in the manner aforesaid and all successive

extensions and renewals of the indebtedness represented thereby, and fully does and performs all of

the other obligations herein assumed by Mortgagor, the above conveyance shall be null and void;

otherwise, to remain in full force and effect.

2. Duties of Mortgagor. Mortgagor agrees (a) to pay all taxes, both general and special, and to pay all

suburban improvement district taxes lawfully levied against such property, as the same may be

assessed and become due and payable; if Mortgagor shall fail in this, the Mortgagee, payee, or the

holders of the indebtedness shall have the right to pay the taxes and the amounts so paid shall be

considered a part of the principal sum secured hereby and bear interest from date of payment at the

same rate as such principal sum, and the lien of this instrument shall also secure the payment

thereof, and (b) to prevent the mortgaged property from becoming encumbered by any lien or

charge having priority over, or on a parity with, the lien of this mortgage, and to comply with all

statutes, regulations, covenants and restrictions relating to such property, and to protect the

mortgaged property from waste, injury or unusual deterioration.

3. Default. At the option of the Mortgagee, payee, or the holder of the indebtedness, all sums secured

hereby may be accelerated as provided herein and the lien of this instrument shall become subject to

foreclosure by suit filed in any court of competent jurisdiction in the county in which the property is

situated in any one of the following events:

a. If default shall be made in the payment of any part of the indebtedness secured hereby or any

interest accruing on such indebtedness as same becomes due and payable according to the terms

of the original note or of any extension or renewal thereof.

b. Upon the filing of a voluntary or involuntary petition to subject Mortgagor to any bankruptcy,

debt-adjustment, receivership or other insolvency proceeding.

c. If Mortgagor shall f ail to comp ly with any agreement contained in Paragraph 2 of this mortgage.

d. If Mortgagor shall sell or convey the title to or any interest in the real property mortgaged

hereunder without the prior written consent of the Mortgagee or holder of the indebtedness.

e. If Mortgagor shall cut commercial grade tim ber or remove sub-surface minerals.

f. If Mortgagor shall do anything to the property that, in the opinion of the Mortgagee, adversely

affects the value of the property. Mortgagor specifically gives Mortgagee the right to enter the

property for the purpose of inspecting same.

It is particularly understood that the foregoing provisions will be applicable not only to the maturities

recited in the original mortgage note(s) but also to any substituted maturities created by an extension

or renewal. The failure of the holder(s) of the secured indebtedness to declare an acceleration of

maturities when a ground therefore exists, even though such forbearance may be repeated from time

to time will not constitute a waiver of the right of such holder(s) to accelerate maturities upon a

reoccurrence of the same ground therefore; nor will the act of such holder(s) in remedying any

condition resulting from Mortgagor’s default bar the holder(s) from declaring an acceleration of

maturities by reason of such default.

4. Acceleration. Upon Mortgagors’ breach of any covenant or agreement in this mortgage, the

Mortgagee shall, prior to acceleration, mail to the Mortgagor’s last known address by regular mail

(1) notice of the breach, (2) the action required to cure the breach, (3) a date not less than thirty (30)

days from the date the notice is mailed to the Mortgagor by which such breach must be cured and

(4) that failure to cure such breach before such date may result in acceleration of the sums secured

by this mortgage and foreclosure. If the breach is not cured on or before the date specified in the

notice, Mortgagee at its option may declare all of the sums secured by this mortgage to be

immediately due and payable without further demand and may foreclose the mortgage or sell the

property pursuant to its terms.

5. Waiver. Mortgagor hereby waives any and all rights of appraisement or redemption under the laws

of the State of Arkansas, and especially all right of redemption under the Act of May 8, 1899. On

default, Mortgagor agrees to payment of all expenses of foreclosure including but not limited to all

costs of documentary evidence, abstracts and title reports and reasonable attorney’s fees, not to

exceed ten per cent (10%) of the amount of principal due, plus accrued interest.

WITNESS our hand and seal on ______ day of _____________________, 2007.

____________________________(SEAL) ____________________________(SEAL)

John Doe Mary Doe

ACKNOWLEDGMENT

State of ____________________________

County of __________________________

On this the ________ day of ______________________, 2007, before me,

_____________________________________, the undersigned officer, personally appeared

John Doe and Mary Doe, known to me ( or satisfactorily proven ) to be the persons whose

names are subscribed to the within instrument and acknowledged that they executed the

same for the consideration and purposes therein contained.

In witness whereof I have hereunto set my hand and official seal.

_______________________

Notary Public

My commission expires

___________________