Fillable Printable Sample of Church Contribution Receipt (Cash Only)

Fillable Printable Sample of Church Contribution Receipt (Cash Only)

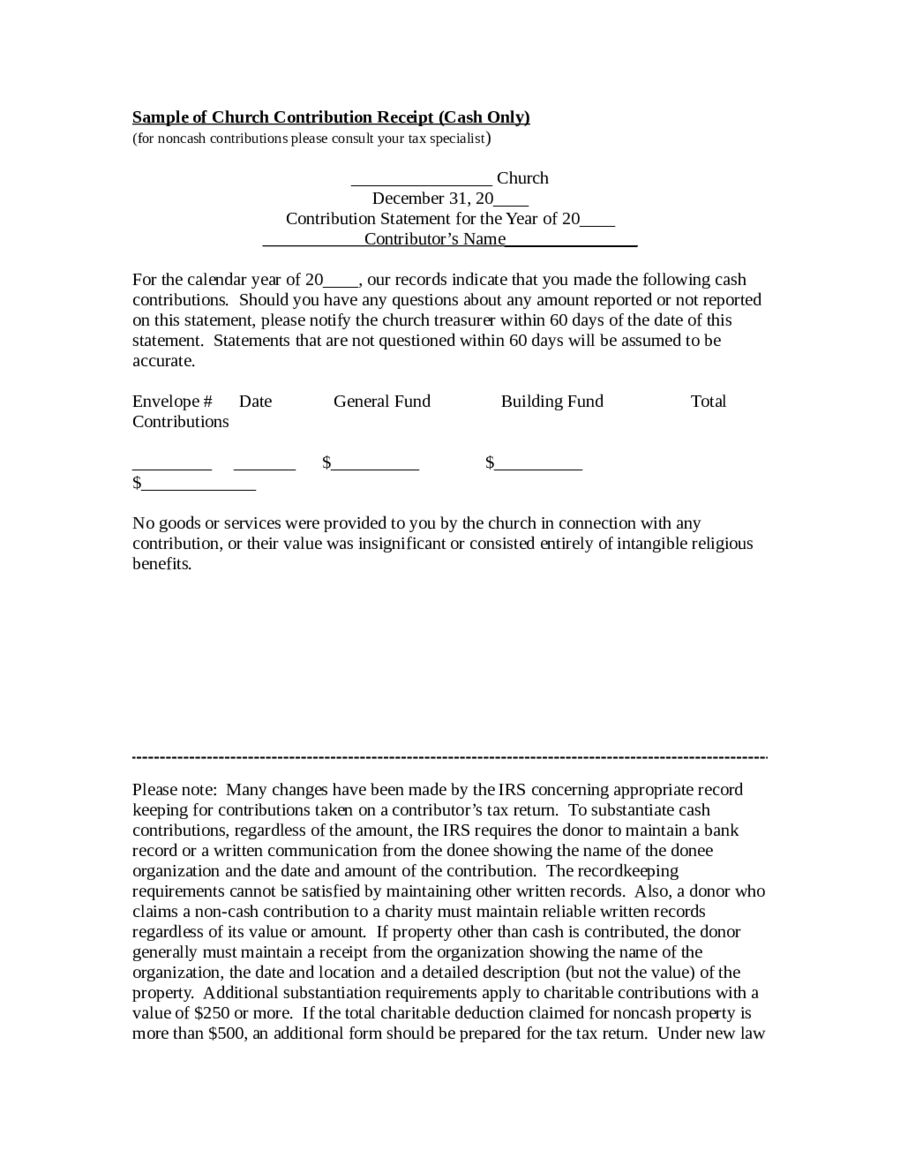

Sample of Church Contribution Receipt (Cash Only)

Sample of Church Contribution Receipt (Cash Only)

(for noncash contributions please consult your tax specialist)

________________ Church

December 31, 20____

Contribution Statement for the Year of 20____

Contributor’s Name_______________

For the calendar year of 20____, our records indicate that you made the following cash

contributions. Should you have any questions about any amount reported or not reported

on this statement, please notify the church treasurer within 60 days of the date of this

statement. Statements that are not questioned within 60 days will be assumed to be

accurate.

Envelope # Date General Fund Building Fund Total

Contributions

_________ _______ $__________ $__________

$_____________

No goods or services were provided to you by the church in connection with any

contribution, or their value was insignificant or consisted entirely of intangible religious

benefits.

Please note: Many changes have been made by the IRS concerning appropriate record

keeping for contributions taken on a contributor’s tax return. To substantiate cash

contributions, regardless of the amount, the IRS requires the donor to maintain a bank

record or a written communication from the donee showing the name of the donee

organization and the date and amount of the contribution. The recordkeeping

requirements cannot be satisfied by maintaining other written records. Also, a donor who

claims a non-cash contribution to a charity must maintain reliable written records

regardless of its value or amount. If property other than cash is contributed, the donor

generally must maintain a receipt from the organization showing the name of the

organization, the date and location and a detailed description (but not the value) of the

property. Additional substantiation requirements apply to charitable contributions with a

value of $250 or more. If the total charitable deduction claimed for noncash property is

more than $500, an additional form should be prepared for the tax return. Under new law

no deduction is allowed for a contribution of clothing or household items unless the

clothing or household item is in good used condition or better.

U.S. Treasury Circular 230 Notice: Any tax advice contained in this communication (including any attachments) was not intended or

written to be used, and cannot be used, for the purpose of (a) avoiding penalties that may be imposed under the Internal Revenue Code

or by any other applicable tax authority; or (b) promoting, marketing or recommending to another party any tax-related matter

addressed herein. We provide this disclosure on all outbound correspondence to assure compliance with new standards of professional

practice, pursuant to which certain tax advice must satisfy requirements as to form and substance.