Fillable Printable Recording and Endorsement Page - Suffolk County

Fillable Printable Recording and Endorsement Page - Suffolk County

Recording and Endorsement Page - Suffolk County

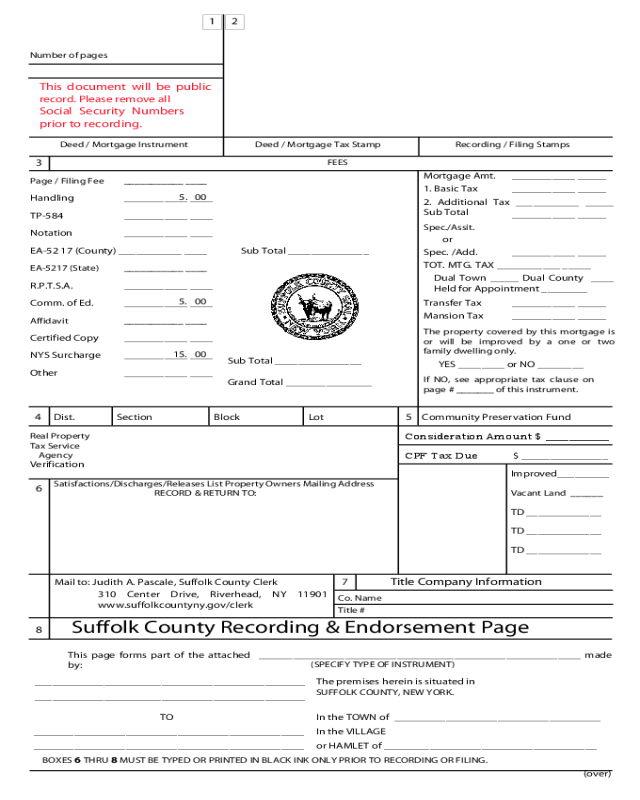

8

Suffolk County Recording & Endorsement Page

This page forms part of the attached ________________________________________________________ made

by:

(SPECIFY TYPE OF INSTRUMENT)

_______________________________________________ The premises herein is situated in

_______________________________________________

SUFFOLK COUNTY, NEW YORK.

TO In the TOWN of ____________________________________

_______________________________________________ In the VILLAGE

_______________________________________________ or HAMLET of _____________________________________

BOXES 6 THRU 8 MUST BE TYPED OR PRINTED IN BLACK INK ONLY PRIOR TO RECORDING OR FILING.

Page / Filing Fee ___________ ____

Handling ___________ ____

TP-584 ___________ ____

Notation ___________ ____

EA-52 17 (County) ___________ ____ Sub Total ______________

EA-5217 (State) ___________ ____

R.P.T.S.A. ___________ ____

Comm. of Ed. ___________ ____

Affidavit ___________ ____

Certified Copy ___________ ____

NYS Surcharge ___________ ____

Sub Total _______________

Other ___________ ____

Grand Total _______________

Deed / Mortgage Instrument Deed / Mortgage Tax Stamp Recording / Filing Stamps

3

FEES

(over)

1

Number of pages

This document will be public

record. Please remove all

Social Security Numbers

prior to recording.

2

5. 00

5. 00

Mortgage Amt. ___________ _____

1. Basic Tax ___________ _____

2. Additional Tax ___________ _____

Sub Total

___________ _____

Spec./Assit.

or

Spec. /Add. ___________ _____

TOT. MTG. TAX ___________ _____

Dual Town _____ Dual County ____

Held for Appointment ________

Transfer Tax ___________ _____

Mansion Tax ___________ _____

The property covered by this mortgage is

or will be improved by a one or two

family dwelling only.

YES ________ or NO ________

If NO, see appropriate tax clause on

page # _______ of this instrument.

4

Dist. Section Block Lot

5

Community Preservation Fund

Consideration Amount $ ___________

CPF Tax Due

$ _______________

Real Property

Tax Service

Agency

Verification

Improved_________

Vacant Land ______

TD _____________

TD _____________

TD _____________

7

Title Company Information

Co. Name

Title #

Satisfactions/Discharges/Releases List Property Owners Mailing Address

RECORD & RETURN TO:

6

15. 00

Mail to: Judith A. Pascale, Suffolk County Clerk

310 Center Drive, Riverhead, NY 11901

www.suffolkcountyny.gov/clerk

IMPORT

ANT NOTICE

If the document you've just recorded is your SA

TISFACTION OF MOR TGAGE, please be aware of

the following:

If a portion of your monthly mortgage payment included your property taxes, *you will now need to

contact your local T

own T ax Receiver so that you may be billed dir ectly for all future property tax

statements.

Local property taxes are payable twice a year: on or before January 10th and on or before May 31st.

Failure to make payments in a timely fashion could result in a penalty.

Please contact your local Town Tax Receiver with any questions regarding property tax

payment.

Babylon Town Receiver of Taxes Riverhead Town Receiver of Taxes

200 East Sunrise Highway 200 Howell Avenue

North Lindenhurst, N.Y. 11757 Riverhead, N.Y. 11901

(631) 957-3004 (631) 727-3200

Brookhaven Town Receiver of Taxes Shelter Island Town Receiver of Taxes

One Independence Hill Shelter Island Town Hall

Farmingville, N.Y. 11738 Shelter Island, N.Y. 11964

(631) 451-9009 (631) 749-3338

East Hampton Town Receiver of Taxes Smithtown Town Receiver of Taxes

300 Pantigo Place 99 West Main Street

East Hampton, N.Y. 11937 Smithtown, N.Y. 11787

(631) 324-2770 (631) 360-7610

Huntington Town Receiver of Taxes Southampton Town Receiver of Taxes

100 Main Street 116 Hampton Road

Huntington, N.Y. 11743 Southampton, N.Y. 11968

(631) 351-3217 (631) 283-6514

Islip Town Receiver of Taxes Southold Town Receiver of Taxes

40 Nassau Avenue 53095 Main Street

Islip, N.Y. 11751 Southold, N.Y. 11971

(631) 224-5580 (631) 765-1803

Sincerely,

Judith A. Pascale

Suffolk County Clerk

dw

2/99

12-0104.. 06/06kd