Fillable Printable Request for Social Security Statement Sample Form

Fillable Printable Request for Social Security Statement Sample Form

Request for Social Security Statement Sample Form

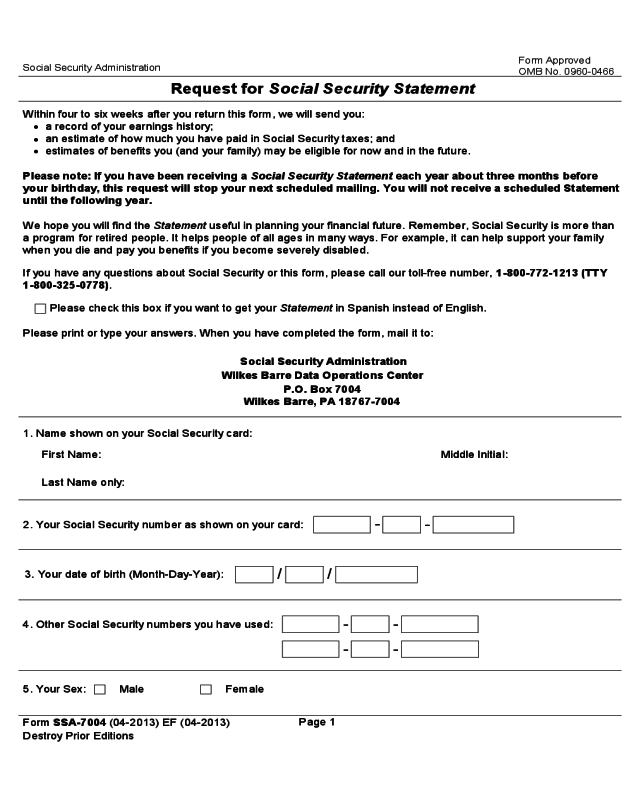

Form SSA-7004 (04-2013) EF (04-2013)

Destroy Prior Editions

Social Security Administration

Request for Social Security Statement

Form Approved

OMB No. 0960-0466

Page 1

Within four to six weeks after you return this form, we will send you:

a record of your earnings history;

an estimate of how much you have paid in Social Security taxes; and

estimates of benefits you (and your family) may be eligible for now and in the future.

•

•

•

Please note: If you have been receiving a Social Security Statement each year about three months before

your birthday, this request will stop your next scheduled mailing. You will not receive a scheduled Statement

until the following year.

We hope you will find the Statement useful in planning your financial future. Remember, Social Security is more than

a program for retired people. It helps people of all ages in many ways. For example, it can help support your family

when you die and pay you benefits if you become severely disabled.

If you have any questions about Social Security or this form, please call our toll-free number, 1-800-772-1213 (TTY

1-800-325-0778).

Please check this box if you want to get your Statement in Spanish instead of English.

Please print or type your answers. When you have completed the form, mail it to:

Social Security Administration

Wilkes Barre Data Operations Center

P.O. Box 7004

Wilkes Barre, PA 18767-7004

1. Name shown on your Social Security card:

First Name: Middle Initial:

Last Name only:

2. Your Social Security number as shown on your card:

-

-

3. Your date of birth (Month-Day-Year):

/ /

4. Other Social Security numbers you have used:

- -

- -

5. Your Sex:

Male Female

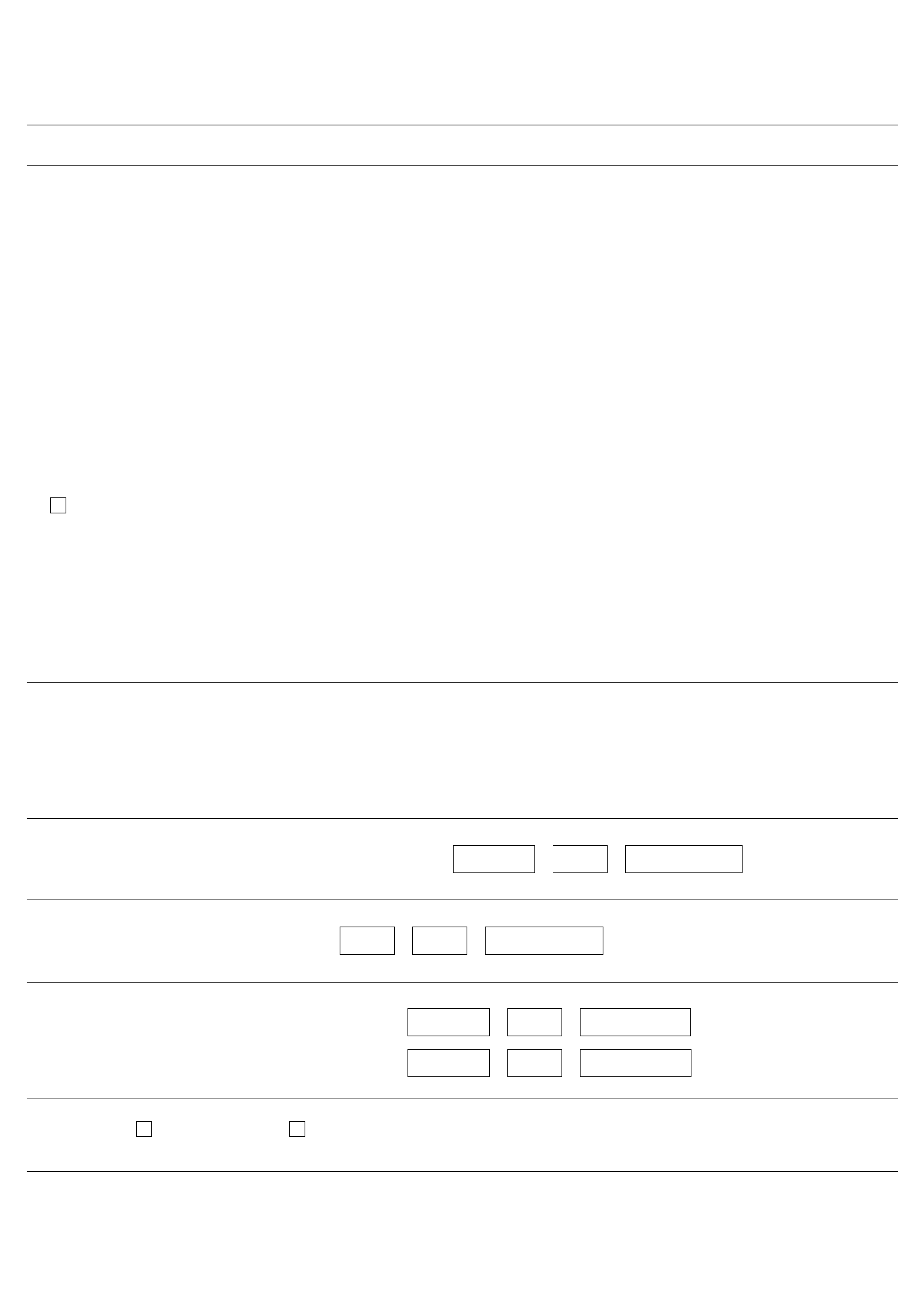

Page 2

For items 6 and 8, show only earnings covered by Social Security. Do NOT include wages from state, local, or

federal government employment that are NOT covered by Social Security or that are covered ONLY by Medicare.

6. Show your actual earnings (wages and/or net self-employment income) for last year and your estimated earnings

for this year.

A. Last year's actual earnings:

$

.

(Dollars Only)

B. This year's estimated earnings:

$

.

(Dollars Only)

7. Show the age at which you plan to stop working:

(Show only one age)

8. Below, show the average yearly amount (not your total future lifetime earnings) that you think you will earn

between now and when you plan to stop working. Include performance or scheduled pay increases or bonuses, but

not cost-of-living increases.

If you expect to earn significantly more or less in the future due to promotions, job changes, part-time work or an

absence from the work force, enter the amount that most closely reflects your future average yearly earnings.

If you don't expect any significant changes, show the same amount you are earning now (the amount in 6B).

Future average yearly earnings:

$

.

(Dollars Only)

9. Do you want us to send the Statement:

To you? Enter your name and mailing address.

To someone else (your accountant, pension plan, etc.)? Enter your name with "c/o" and the name and address

of that person or organization.

"C/O" or Street Address (Include Apt. No., P.O. Box, Rural Route)

Street Address

Street Address (If Foreign Address, enter City, Province, Postal code)

U.S. City, State, ZIP code (If Foreign Address, enter Name of Country only)

NOTICE:

I am asking for information about my own Social Security record or the record of a person I am authorized to

represent. I declare under penalty of perjury that I have examined all the information on this form, and on any

accompanying statements or forms, and it is true and correct to the best of my knowledge. I authorize you to use a

contractor to send the Social Security Statement to the person and address in item 9.

u

Please sign your name (Do Not Print)

(Area Code) Daytime Telephone Number Date

Form SSA-7004 (04-2013) EF (04-2013)

•

•

0 0

00

00

Page 3

Privacy Act Statement

Sections 205(a), 205(c)(2), and 1143(a)(2) of the Social Security Act, as amended, authorize us to collect

this information. We will use the information you provide to accurately identify your Social Security earnings

records, extract the recorded earnings history and to produce the requested statement.

Furnishing us this information is voluntary. However, failing to provide us with all or part of the information

may prevent the issuance of a Social Security account statement.

We rarely use the information you supply us for any purpose other than to identify your Social Security

earnings records and issue a Social Security account statement. We may disclose information to another

person or to another agency in accordance with approved routine uses, which include but are not limited to

the following:

1. To enable a third party or agency to assist us in establishing rights to Social Security benefits and/

or coverage;

2. To comply with Federal laws requiring the release of information from our records (e.g., to the

Government Accountability Office and Department of Veterans Affairs);

3. To make determinations for eligibility in similar health and income maintenance programs at the

Federal, State and local level; and

4. To facilitate statistical research, audit, or investigative activities necessary to assure the integrity

and improvement of our programs (e.g., to the Bureau of the Census and to private entities under

contract with us).

We also may use the information you give us in computer matching programs. Matching programs compare

our records with records kept by other Federal, State and local government agencies. Information from

these matching programs can be used to establish or verify a person's eligibility for federally-funded or

administered benefit programs and for repayment of benefits or delinquent debts under these programs.

A complete list of routine uses of the information you provided us is available in our Systems of Records

Notice entitled, Earnings Recording and Self-Employment Income System, Social Security Administration,

Office of Systems, 60-0059. This notice, additional information regarding this form, and information

regarding our programs and systems, are available online at www.socialsecurity.gov

or at your local Social

Security office.

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by Section 2 of the

Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid

Office of Management and Budget control number. We estimate that it will take about 5 minutes to read the

instructions, gather the facts and answer the questions. You may send comments on our time estimate

above to: SSA, 6401 Security Blvd., Baltimore, MD 21235-6401. Send only comments relating to our

time estimate to this address, not the completed form.

Form SSA-7004 (04-2013) EF (04-2013)

Paperwork Reduction Act Notice