Fillable Printable Sample Bankruptcy Claim Form

Fillable Printable Sample Bankruptcy Claim Form

Sample Bankruptcy Claim Form

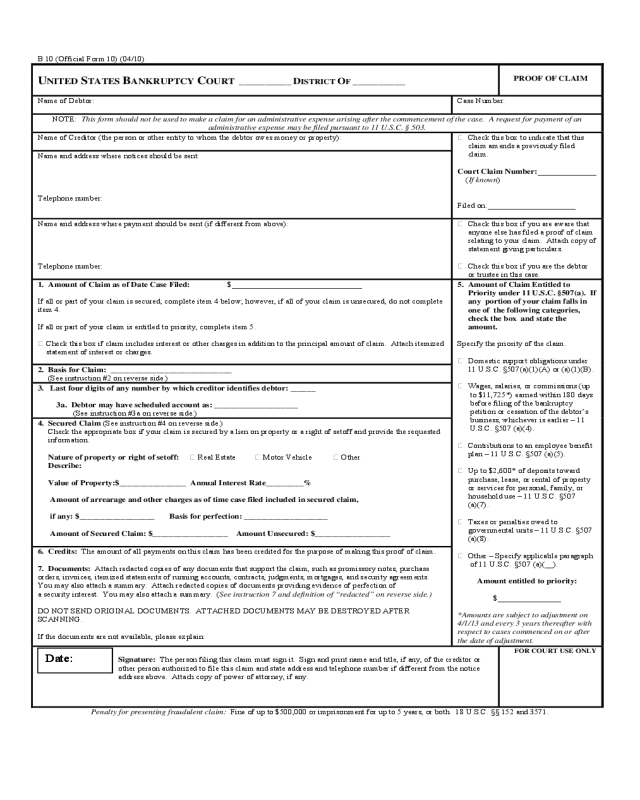

B 10 (Official Form 10) (04/10)

UNITED STATES BANKRUPTCY COURT __________ DISTRICT OF __________

PROOF OF CLAIM

Name of Debtor: Case Number:

NOTE: This form should not be used to make a claim for an administrative expense arising after the commencement of the case. A request for payment of an

administrative expense may be filed pursuant to 11 U.S.C. § 503.

Name of Creditor (the person or other entity to whom the debtor owes money or property):

Check this box to indicate that this

claim amends a previously filed

claim.

Court Claim Number:______________

(If known)

Filed on:_____________________

Name and address where notices should be sent:

Telephone number:

Name and address where payment should be sent (if different from above):

Telephone number:

Check this box if you are aware that

anyone else has filed a proof of claim

relating to your claim. Attach copy of

statement giving particulars.

Check this box if you are the debtor

or trustee in this case.

1. Amount of Claim as of Dat e Case Filed: $_______________________________

If all or part of your claim is secured, complete item 4 below; however, if all of your claim is unsecured, do not complete

item 4.

If all or part of your claim is entitled to priority, complete item 5.

Check this box if claim includes interest or other charges in addition to the principal amount of claim. Attach itemized

statement of interest or charges.

5. Amount of Claim Entitled to

Priority under 11 U.S.C. §507(a). If

any portion of your claim falls in

one of the following categories,

check the box and state the

amount.

Specify the priority of the claim.

Domestic support obligations under

11 U.S.C. §507(a)(1)(A) or (a)(1)(B).

Wages, salaries, or commissions (up

to $11,725*) earned within 180 days

before filing of the bankruptcy

petition or cessation of the debtor’s

business, whichever is earlier – 11

U.S.C. §507 (a)(4).

Contributions to an employee benefit

plan – 11 U.S.C. §507 (a)(5).

Up to $2,600* of deposits toward

purchase, lease, or rental of property

or services for personal, family, or

household use – 11 U.S.C. §507

(a)(7).

Taxes or penalties owed to

governmental units – 11 U.S.C. §507

(a)(8).

Other – Specify applicable paragraph

of 11 U.S.C. §507 (a)(__).

Amount entitled to priority:

$_______________

*Amounts are subject to adjustment on

4/1/13 and every 3 years thereafter with

respect to cases commenced on or after

the date of adjustment.

2. Basis for Claim: _____________________________

(See instruction #2 on reverse side.)

3. Last four digits of any number by which creditor identifies debtor: ______

3a. Debtor may have scheduled account as: _______________ _____

(See instruction #3a on reverse side.)

4. Secured Claim (See instruction #4 on reverse side.)

Check the appropriate box if your claim is secured by a lien on property or a right of setoff and provide the requested

information.

Nature of property or right of setoff: Real Estate Motor Vehicle Other

Describe:

Value of Property:$________________ Annual Interest Rate_________%

Amount of arrearage and other charges as of time case filed included in secured claim,

if any: $__________________ Basis for perfection: ____________________

Amount of Secured Claim: $__________________ Amount Unsecured: $__________________

6. Credits: The amount of all payments on this claim has been credited for the purpose of making this proof of claim.

7. Docum ents: Attach redacted copies of any documents that support the claim, such as promissory notes, purchase

orders, invoices, itemized statements of running accounts, contracts, judgments, mortgages, and security agreements.

You may also attach a summary. Attach redacted copies of documents providing evidence of perfection of

a security interest. You may also attach a summary. (See instruction 7 and definition of “redacted” on reverse side.)

DO NOT SEND ORIGINAL DOCUMENTS. ATTACHED DOCUMENTS MAY BE DESTROYED AFTER

SCANNING.

If the documents are not available, please explain:

D Signature: The person filing this claim must sign it. Sign and print name and title, if any, of the creditor or

other person authorized to file this claim and state address and telephone number if different from the notice

address above. Attach copy of power of attorney, if any.

FOR COURT USE ONLY

Penalty for presenting fraudulent claim: Fine of up to $500,000 or imprisonment for up to 5 years, or both. 18 U.S.C. §§ 152 and 3571.

Date:

B 10 (Official Form 10) (04/10) – Cont.

INSTRUCTIONS FOR PROOF OF CLAIM FORM

The instructions and definitions below are general explanatio ns of the law. In certain circumstances, such as bankruptcy cases not filed voluntarily by the debtor, there

may be exceptions to these general rules.

Items to be completed in Proof of Claim form

Court, Name of Debtor, and Case Number:

Fill in the federal judicial district where the bankruptcy case was filed (for

example, Central District of California), the bankruptcy debtor’s name, and the

bankruptcy case number. If the creditor received a notice of the case from the

bankruptcy court, all of this information is located at the top of the notice.

Creditor’s Name and Address:

Fill in the name of the person or entity asserting a claim and the name and address

of the person who should receive notices issued during the bankruptcy case. A

separate space is provided for the payment address if it differs from the notice

address. The creditor has a continuing obligation to keep the court informed of its

current address. See Federal Rule of Bankruptcy Procedure (FRBP) 2002(g).

1. Amount of Claim as of Dat e Case Filed:

State the total amount owed to the creditor on the date of the

Bankruptcy filing. Follow the instructions concerning whether to

complete items 4 and 5. Check the box if interest or other charges are

included in the claim.

2. Basis for Claim:

State the type of debt or how it was incurred. Examples include

goods sold, money loaned, services performed, personal

injury/wrongful death, car loan, mortgage note, and credit card. If the claim is

based on the delivery of health care goods or services, limit the disclosure of

the goods or services so as to avoid embarrassment or the

disclosure of confidential health care information. You may be required

to provide additional disclosure if the trustee or another party in interest

files an objection to your claim.

3. Last Four Digits of Any Number by Which Creditor Identifies

Debtor:

State only the last four digits of the debtor’s account or other number

used by the creditor to identify the debtor.

3a. Debtor May Have Scheduled Account As:

Use this space to report a change in the creditor’s name, a transferred

claim, or any other information that clarifies a difference between this

proof of claim and the claim as scheduled by the debtor.

4. Secured Claim:

Check the appropriate box and provide the requested information if

the claim is fully or partially secured. Skip this section if the claim is

entirely unsecured. (See DEFINITIONS, below.) State the type and

the value of property that secures the claim, attach copies of lien

documentation, and state annual interest rate and the amount past due

on the claim as of the date of the bankruptcy filing.

5. Amount of Claim Entitled to Priority Under 11 U.S.C. §507(a) .

If any portion of your claim falls in one or more of the listed

categories, check the appropriate box(es) and state the amount

entitled to priority. (See DEFINITIONS, below.) A claim may be

partly priority and partly non-priority. For example, in some of the

categories, the law limits the amount entitled to priority.

6. Credits:

An authorized signature on this proof of claim serves as an acknowledgment

that when calculating the amount of the claim, the creditor gave the debtor

credit for any payments received toward the debt.

7. Documents:

Attach to this proof of claim form redacted copies documenting the existence

of the debt and of any lien securing the debt. You may also attach a summary.

You must also attach copies of documents that evidence perfection of any

security interest. You may also attach a summary. FRBP 3001(c) and (d).

If the claim is based on the delivery of health care goods or services, see

instruction 2. Do not send original documents, as attachments may be

destroyed after scanning.

Date and Signature:

The person filing this proof of claim must sign and date it. FRBP 9011. If the

claim is filed electronically, FRBP 5005(a)(2), authorizes courts to establish

local rules specifying what constitutes a signature. Print the name and title, if

any, of the creditor or other person authorized to file this claim. State the

filer’s address and telephone number if it differs from the address given on the

top of the form for purposes of receiving notices. Attach a complete copy of

any power of attorney. Criminal penalties apply for making a false statement

on a proof of claim.

__________DEFINITIONS__________ ______INFORMATION______

Debtor

A debtor is the person, corporation, or other entity that

has filed a bankruptcy case.

Creditor

A creditor is a person, corporation, or other entity owed a

debt by the debtor that arose on or before the date of the

bankruptcy filing. See 11 U.S.C. §101 (10)

Claim

A claim is the creditor’s right to receive payment on a

debt owed by the debtor that arose on the date of the

bankruptcy filing. See 11 U.S.C. §101 (5). A claim may

be secured or unsecured.

Proof of Claim

A proof of claim is a form used by the creditor to

indicate the amount of the debt owed by the debtor on

the date of the bankruptcy filing. The creditor must file

the form with the clerk of the same bankruptcy court in

which the bankruptcy case was filed.

Secured Claim Under 11 U.S.C. §506 (a)

A secured claim is one backed by a lien on property of

the debtor. The claim is secured so long as the creditor

has the right to be paid from the property prior to other

creditors. The amount of the secured claim cannot

exceed the value of the property. Any amount owed to

the creditor in excess of the value of the property is an

unsecured claim. Examples of liens on property include

a mortgage on real estate or a security interest in a car.

A lien may be voluntarily granted by a debtor or may be

obtained through a court proceeding. In some states, a

court judgment is a lien. A claim also may be secured if

the creditor owes the debtor money (has a right to setoff).

Unsecured Claim

An unsecured claim is one that does not meet the

requirements of a secured claim. A claim may be partly

unsecured if the amount of the claim exceeds the value

of the property on which the creditor has a lien.

Claim Entitled to P riority Under 11 U.S.C. §507(a)

Priority claims are certain categories of unsecured claims

that are paid from the available money or property in a

bankruptcy case before other unsecured claims.

Redacted

A document has been redacted when the person filing it

has masked, edited out, or otherwise deleted, certain

information. A creditor should redact and use only the

last four digits of any social-security, individual’s tax-

identification, or financial-account number, all but the

initials of a minor’s name and only the year of any

person’s date of birth.

Evidence of Perfection

Evidence of perfection may include a mortgage, lien,

certificate of title, financing statement, or other

document showing that the lien has been filed or

recorded.

Ackno wledgment of Filing of Claim

To receive acknowledgment of your filing, you may

either enclose a stamped self-addressed envelope and a

copy of this proof of claim or you may access the court’s

PACER system (www.pacer.psc.uscourts.gov

) for a

small fee to view your filed proof of claim.

Offers to Purchase a Claim

Certain entities are in the business of purchasing claims

for an amount less than the face value of the claims. One

or more of these entities may contact the creditor and

offer to purchase the claim. Some of the written

communications from these entities may easily be

confused with official court documentation or

communications from the debtor. These entities do not

represent the bankruptcy court or the debtor. The

creditor has no obligation to sell its claim. However, if

the creditor decides to sell its claim, any transfer of such

claim is subject to FRBP 3001(e), any applicable

provisions of the Bankruptcy Code (11 U.S.C. § 101 et

seq.), and any applicable orders of the bankruptcy court.