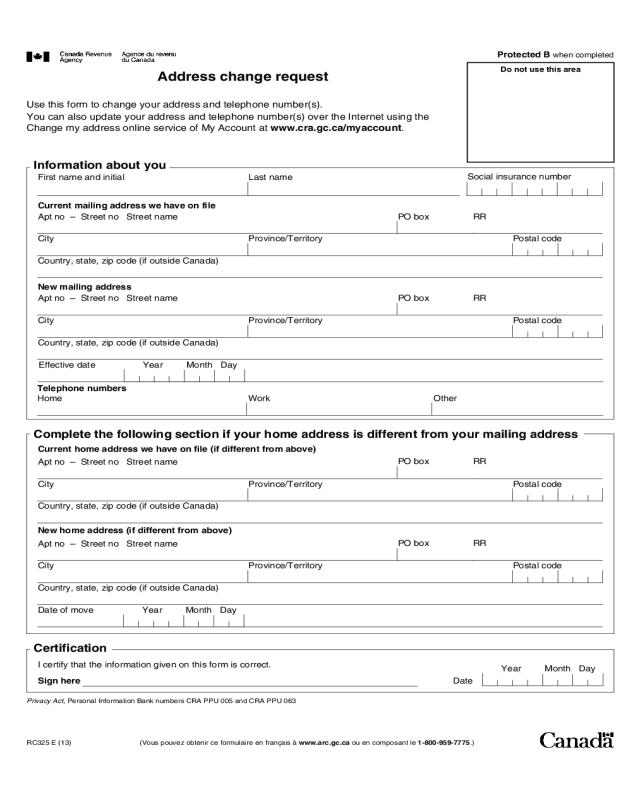

Fillable Printable Sample CRA Change of Address Form

Fillable Printable Sample CRA Change of Address Form

Sample CRA Change of Address Form

Protected B when completed

Address change request

Do not use this area

Use this form to change your address and telephone number(s).

You can also update your address and telephone number(s) over the Internet using the

Change my address online service of My Account at www.cra.gc.ca/myaccount.

First name and initial Last name

Social insurance number

Current mailing address we have on file

Apt no – Street no Street name PO box RR

City Province/Territory Postal code

Country, state, zip code (if outside Canada)

New mailing address

Apt no – Street no Street name PO box RR

City Province/Territory Postal code

Country, state, zip code (if outside Canada)

Effective date

Year Month Day

Telephone numbers

Home Work Other

Information about you

Current home address we have on file (if different from above)

Apt no – Street no Street name

PO box RR

City Province/Territory Postal code

Country, state, zip code (if outside Canada)

New home address (if different from above)

Apt no – Street no Street name

PO box RR

City Province/Territory Postal code

Country, state, zip code (if outside Canada)

Date of move

Year Month Day

Complete the following section if your home address is different from your mailing address

I certify that the information given on this form is correct.

Sign here

Date

Year Month Day

Certification

Privacy Act, Personal Information Bank numbers CRA PPU 005 and CRA PPU 063

RC325 E (13)

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou en composant le 1-800-959-7775.)

Purpose of this form

Complete this form to notify us of a change in your mailing address or your home address or of a change in your telephone number(s).

You cannot use this form:

•

to notify us of a change of name

•

to notify us of a change in your date of birth

•

if you have not filed an income tax and benefit return with the Canada Revenue Agency

Why is it important?

When you tell us your new address in advance:

•

you can avoid a disruption in receiving your benefit payments, such as GST/HST credit payments (including certain related

provincial payments), universal child care benefit payments, and Canada child tax benefit payments (including certain related

provincial or territorial payments), as well as working income tax benefit advance payments.

More information

•

If you do not have a social insurance number but you already got an individual tax number or a temporary taxation number,

continue to use the tax number you have been issued.

•

Indicate your home or mailing address if it is different from what it was when you last dealt with us.

•

Send your completed form to your local office listed below:

Jonquière Tax Centre

PO Box 1900 Stn LCD

Jonquière QC G7S 5J1

Shawinigan-Sud Tax Centre

PO Box 3000 Stn Main

Shawinigan-Sud QC G9N 7S6

St.John's Tax Centre

PO Box 12071 Stn A

St. John's NL A1B 3Z1

Sudbury Tax Centre

PO Box 20000 Stn A

Sudbury ON P3A 5C1

Summerside Tax Centre

102 – 275 Pope Road

Summerside PE C1N 5Z7

Surrey Tax Centre

9755 King George Boulevard

Surrey BC V3T 5E1

Winnipeg Tax Centre

PO Box 14005 Stn Main

Winnipeg MB R3C 0E3

International Tax Services Office

Post Office Box 9769 Stn T

Ottawa ON K1G 3Y4

CANADA