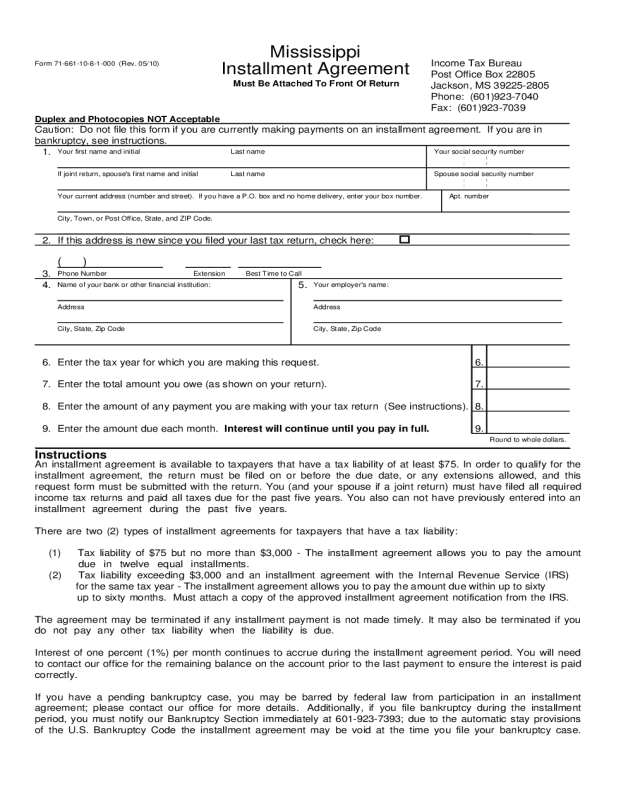

Fillable Printable Sample Form for Installment Agreement

Fillable Printable Sample Form for Installment Agreement

Sample Form for Installment Agreement

Income Tax Bureau

Post Office Box 22805

Jackson, MS 39225-2805

Phone: (601)923-7040

Fax: (601)923-7039

4.

3.

If this address is new since you filed your last tax return, check here:

Instructions

Spouse social security number

Your social security number

Apt. number

If joint return, spouse's first name and initial

Extension

Last name

Last name

City, Town, or Post Office, State, and ZIP Code.

Your current address (number and street). If you have a P.O. box and no home delivery, enter your box number.

1.

2.

Form 71-661-10-8-1-000 (Rev. 05/10)

()

Your employer's name:

Phone Number

5.

Address

City, State, Zip Code

Your first name and initial

Name of your bank or other financial institution:

Address

City, State, Zip Code

Caution: Do not file this form if you are currently making payments on an installment agreement. If you are in

bankruptcy, see instructions.

Best Time to Call

7.

8.

9.Enter the amount due each month. Interest will continue until you pay in full.

Enter the total amount you owe (as shown on your return).

6.

7.

8.

9.

Enter the amount of any payment you are making with your tax return (See instructions).

Round to whole dollars.

6.

Mississippi

Installment Agreement

Must Be Attached To Front Of Return

Duplex and Photocopies NOT Acceptable

Enter the tax year for which you are making this request.

An installment agreement is available to taxpayers that have a tax liability of at least $75. In order to qualify for the

installment agreement, the return must be filed on or before the due date, or any extensions allowed, and this

request form must be submitted with the return. You (and your spouse if a joint return) must have filed all required

income tax returns and paid all taxes due for the past five years. You also can not have previously entered into an

installment agreement during the past five years.

There are two (2) types of installment agreements for taxpayers that have a tax liability:

(1) Tax liability of $75 but no more than $3,000 - The installment agreement allows you to pay the amount

dueintwelveequalinstallments.

(2) Tax liability exceeding $3,000 and an installment agreement with the Internal Revenue Service (IRS)

for the same tax year - The installment agreement allows you to pay the amount due within up to sixty

up to sixty months. Must attach a copy of the approved installment agreement notification from the IRS.

The agreement may be terminated if any installment payment is not made timely. It may also be terminated if you

do not pay any other tax liability when the liability is due.

Interest of one percent (1%) per month continues to accrue during the installment agreement period. You will need

to contact our office for the remaining balance on the account prior to the last payment to ensure the interest is paid

correctly.

If you have a pending bankruptcy case, you may be barred by federal law from participation in an installment

agreement; please contact our office for more details. Additionally, if you file bankruptcy during the installment

period, you must notify our Bankruptcy Section immediately at 601-923-7393; due to the automatic stay provisions

of the U.S. Bankruptcy Code the installment agreement may be void at the time you file your bankruptcy case.