Fillable Printable Sample Land Contract - New York

Fillable Printable Sample Land Contract - New York

Sample Land Contract - New York

1

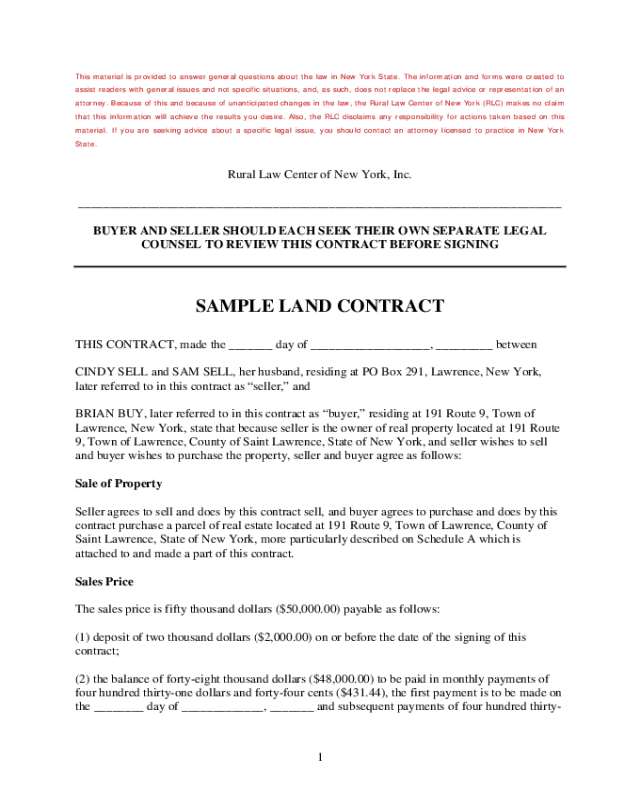

This material is provided to answer general questions about the law in New York State. The information and forms were created to

assist readers with general issues and not specific situations, and, as such, does not replace the legal advice or representation of an

attorney. Because of this and because of unanticipated changes in the law, the Rural Law Center of New York (RLC) makes no claim

that this information will achieve the results you desire. Also, the RLC disclaims any responsibility for actions taken based on this

material. If you are seeking advice about a specific legal issue, you should contact an attorney licensed to practice in New York

State.

Rural Law Center of New York, Inc.

_____________________________________________________________________________

BUYER AND SELLER SHOULD EACH SEEK THEIR OWN SEPARATE LEGAL

COUNSEL TO REVIEW THIS CONTRACT BEFORE SIGNING

SAMPLE LAND CONTRACT

THIS CONTRACT, made the _______ day of ___________________, _________ between

CINDY SELL and SAM SELL, her husband, residing at PO Box 291, Lawrence, New York,

later referred to in this contract as “seller,” and

BRIAN BUY, later referred to in this contract as “buyer,” residing at 191 Route 9, Town of

Lawrence, New York, state that because seller is the owner of real property located at 191 Route

9, Town of Lawrence, County of Saint Lawrence, State of New York, and seller wishes to sell

and buyer wishes to purchase the property, seller and buyer agree as follows:

Sale of Property

Seller agrees to sell and does by this contract sell, and buyer agrees to purchase and does by this

contract purchase a parcel of real estate located at 191 Route 9, Town of Lawrence, County of

Saint Lawrence, State of New York, more particularly described on Schedule A which is

attached to and made a part of this contract.

Sales Price

The sales price is fifty thousand dollars ($50,000.00) payable as follows:

(1) deposit of two thousand dollars ($2,000.00) on or before the date of the signing of this

contract;

(2) the balance of forty-eight thousand dollars ($48,000.00) to be paid in monthly payments of

four hundred thirty-one dollars and forty-four cents ($431.44), the first payment is to be made on

the ________ day of _____________, _______ and subsequent payments of four hundred thirty-

2

one dollars and forty-four cents ($431.44) are to be made on the first (1

st

) day of each succeeding

month, the payments to be credited first toward the payment of accrued interest at seven percent

(7%) interest per year and the balance to the reduction of principal. An amortization schedule is

attached and made part of this land contract.

Right to Prepay

Buyer has the right to prepay this debt or any additional sums to reduce the principal at any time

without penalty.

Personal Property

The personal property described as follows is included in the purchase price. Seller states that

seller is the owner of the following personal property and that no money is owed on this

property. Seller states that no other party has a security interest in the following personal

property. Buyer, unless otherwise specified in this contract accepts the following personal

property in “as is”

Buildings

All buildings on the premises at 191 Route 9, Town of Lawrence, County of Saint Lawrence,

State of New York are included in the sale. Seller states that all buildings on the premises are

owned by seller.

Possession

Possession of the subject premises shall be given to buyer on the date of this agreement unless

otherwise agreed by the parties.

Real Estate Taxes, Water Bills and Sewer Charges

The real estate taxes, water bills, and sewer charges shall be prorated as of the date of signing of

this contract. Seller agrees to pay all the real estate taxes, water bills, and sewer charges that

come due prior to the date of the signing of this contract. Seller agrees to provide proof of

payment to buyer for all real estate taxes, water bills, and sewer charges. Buyer agrees to pay all

the real estate taxes and assessments, water rents, and any sewer charges, that shall be taxed or

assessed upon the premises from the date of the signing of this contract.

Fire and Other Insurances

Buyer agrees to insure the premises and to keep the premises insured pursuant to a standard

policy against loss by fire and damage by other dangers, together with liability coverage in the

standard form. The insurance policy coverage must be in an amount not less than the amount

due on this contract. Buyer agrees to name seller as an additional insured on the property and to

provide seller with a copy of the insurance binder.

3

Condemnation

In the event of the condemnation or taking by eminent domain of any interest that is the subject

of this contract, buyer shall be made a party to any related proceedings, and buyer alone shall

decide the amount of any award to be accepted or whether the amount of such award shall be

determined by trial in the courts. The amount of such award by agreement, or after trial or

otherwise, shall be paid to seller, but the amount shall be applied as an additional payment

toward the remaining principal. If the amount of the award is greater than the remaining

principal, seller shall pay to buyer the difference between the amount of the award and the

remaining principal.

Challenging of Taxes

Buyer shall have the right to contest or review by legal proceedings or in any other manner that

buyer may deem suitable, free of expense to seller, but if necessary, in the name of seller, any

increase in real estate taxes or assessment with respect to any fiscal period ending after the date

of this contract. In any such proceedings, seller agrees to execute the documents as may be

necessary for the purpose of the contest, and buyer shall have the right to bring such proceedings

in his or her own name or in the name of the seller.

Inspection

Buyer agrees that a full inspection of the premises has been made and that the seller shall not be

held to any promise respecting the condition of any improvements on the premises other than

what is written in this agreement. The premises are sold to buyer “as is” unless seller otherwise

agrees in this contract to make repairs and/or improvements by specific dates. Seller has

provided the buyer with a copy of the Property Condition Disclosure Statement which is required

in the State of New York by the Property Condition Disclosure Act.

Improvements/Repairs

Seller agrees to make the following repairs and/or improvements to the property by the dates

indicated. If these repairs and/or improvements are not made by the dates indicated, buyer shall

be entitled to the return of the deposit of two thousand dollars ($2,000.00), and buyer shall be

entitled, but not required, to be released from the obligations under this contract.

Existing Conditions

Seller shall convey the premises subject to all covenants; conditions; restrictions; easements of

record; fire and building codes; land use, zoning, and environmental protection regulations; and

any state of facts which any inspection and/or accurate survey may show, provided that title is

not made unmarketable by any of the above. Seller agrees to provide a copy of a professional

survey map to buyer at or before the signing of this contract if such map is available.

4

Buyer Default

Buyer is in default in the event the monthly payment is not made within ninety (90) days of the

monthly due date or in the event insurance or taxes are not paid within ninety (90) days after

notice to buyer to pay the insurance or taxes.

Seller’s Remedy

If buyer defaults, seller shall have the right to proceed to protect his or her legal interest using

any and all available legal means. Pursuant to New York State law, seller shall not proceed on

default in village, town, or city court.

Seller Default

Seller is in default if seller does not provide buyer with warranty deed within thirty (30) days of

final payment. If buyer must take legal action to enforce this contract and the court decision is

made in favor of buyer, seller shall be liable for buyer’s attorney fees and court costs.

Transfer of Deed

Seller agrees to complete, sign and hold in escrow in his/her attorney’s office, a Warranty Deed

conveying a good and marketable title to the premises described in this contract, except for

encumbrances that may be caused by the acts or omissions of buyer after the parties sign this

contract. Seller agrees to complete and sign the following documents at the time of the signing

of this contract: Combined Real Estate Transfer Tax Return and Credit Line Mortgage (TP-584),

Natural Person Mortgagee Affidavit of Exemption, All Inclusive Affidavit, Real Property

Transfer Report (RP-5217), Certificate of Non-foreign Status, Smoke Alarm Affidavit, Septic

System Affidavit, and Water Affidavit. Seller agrees to present these documents to buyer at the

time of the signing of this contract.

Seller agrees to deliver the Warranty Deed to buyer within thirty (30) days of the receipt of the

final payment pursuant to this contract. The deed shall be the usual warranty deed and in proper

statutory short form for recording. It shall be duly executed and acknowledged by seller at

seller’s expense, so as to convey to buyer the fee simple interest of the premises, free of all liens

and encumbrances. An escrow agreement naming the agent and assigning custody of the signed

documents will be signed by both parties.

Seller agrees to obtain at seller’s expense an abstract of title covering forty (40) years showing

clear and marketable title and to provide this abstract of title to buyer at or before the signing of

this contract. Seller further agrees to carry out a ten-year real property tax search and to provide

the results of this search to the buyer at or before the signing of this contract.

Notices

Notices, demands, or requests made between buyer and seller must be in writing and may be

delivered in person or sent by first class mail to the addresses set forth on page one (1) of this

5

contract unless notice of an address change has been provided to the other party in writing. If

seller provides written notice of a change of address to buyer, or buyer provides written notice of

a change of address to seller, the updated address must be used.

Parties Bound by this Contract

This contract shall apply to and bind the heirs, executors, administrators, legal representatives,

successors, and assigns of the respective parties to this contract.

Assignment

Buyer shall have the right to assign this contract or convey any of the rights in this contract.

Interpretation of Contract

This contract shall be governed by, construed, and endorsed in accordance with the laws of the

State of New York. If any provision of this contract is held invalid, illegal, void or

unenforceable by any rule, law, administrative order, or judicial decision, all other provisions of

the contract shall remain in full force.

Modification

This contract may not be changed by simply talking about desired changes. Changes can only

occur upon written agreement signed by both parties.

Smoke Detecting Alarm Devices

If the premises described in this documents contain a one- or two-family dwelling used as a

residence, seller agrees that, at least five (5) days prior to delivery of the deed, an operative

single station smoke detecting alarm device that complies with New York State Uniform Fire

Prevention and Building Code shall be installed in each dwelling unit.

Seller’s Residency

If seller is a United States resident for federal and state income tax purposes, seller shall establish

by affidavit, which seller will deliver to buyer, that seller is a United States resident for federal

and state income tax purposes. If seller is not a United States resident for federal and state

income tax purposes, seller will arrange and pay for appropriate compliance with the certification

or withholding requirements of a portion of the sale price, as contemplated by the tax law.

Entire Agreement

This contract contains all agreements of the parties to this contract. There are no promises,

agreements, terms, conditions, warranties, representations, or statements, other than those

contained in this contract.

6

Consent

Where consent of seller is required, seller must respond within thirty (30) days to any request by

buyer for such consent. If seller fails to respond within thirty (30) days to buyer’s request, buyer

may understand that seller’s consent has been granted.

Late Charge

If any payment is overdue more than fifteen (15) days, an additional charge will be due to seller

to cover the cost of delay. This late charge will be ten dollars ($10.00).

Seller’s Affirmation

Seller knows of no other party who has an interest in the property that has not been disclosed to

buyer in this contract.

Seller has not been divorced since acquiring the real estate and has not been known by any other

name in the last ten (10) years except ________________________________.

Seller affirms that no proceedings in bankruptcy or receivership have been instituted by or

against seller within the last ten (10) years and seller has not made an assignment for the benefit

of creditors, nor has any security interest that secured payment or the performance of any

obligation been given by seller, or been granted, in any personal property or fixtures placed or

installed on the premises.

Seller agrees not to declare bankruptcy until after the deed has been transferred to buyer.

Seller affirms there is no action pending in any state or federal court in the United States nor is

there any state or federal court judgment, tax lien of any kind against seller that would constitute

a lien or charge upon the real estate.

Seller affirms there are no delinquent real estate taxes, or water and sewer charges owing.

Seller affirms that no labor, service, or materials have been furnished for the improvement of the

real estate during the last eight months, or if such labor, service, or materials have been

furnished, payment for the improvements has been made in full.

Seller agrees not to borrow any money against the property.

Seller agrees to take all actions to prevent any lien being placed against the property.

Seller agrees that if any lien or judgment is placed on the property pursuant to any action brought

against seller, seller shall discharge the lien or judgment before final payment is made or reduce

the purchase price by the amount of the lien or judgment.

Recording

7

The parties agree that this contract shall be recorded in the County Clerk’s Office along with all

other required documents. Parties further agree to take whatever steps necessary to complete the

documents required for filing.

The parties have duly executed this land contract.

Cindy Sell, Seller

Sam Sell, Seller

Brian Buy, Bu yer

State of New York )

) ss.:

County of _________ )

On the ___day of ___________ in the year _____, before me, the undersigned, a notary public in

and for the State of New York, personally appeared __________________________, personally

known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose

name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they

executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the

instrument, the individual(s), or the person on behalf of which the individual(s) acted, executed

the instrument.

___________________________

Signature of Notary Public

8

State of New York )

) ss.:

County of _________ )

On the ___day of ___________ in the year _____, before me, the undersigned, a notary public in

and for the State of New York, personally appeared __________________________, personally

known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose

name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they

executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the

instrument, the individual(s), or the person on behalf of which the individual(s) acted, executed

the instrument.

___________________________

Signature of Notary Public

State of New York )

) ss.:

County of _________ )

On the ___day of ___________ in the year _____, before me, the undersigned, a notary public in

and for the State of New York, personally appeared __________________________, personally

known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose

name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they

executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the

instrument, the individual(s), or the person on behalf of which the individual(s) acted, executed

the instrument.

___________________________

Signature of Notary Public