Fillable Printable Sample Motor Tax Renewal Form

Fillable Printable Sample Motor Tax Renewal Form

Sample Motor Tax Renewal Form

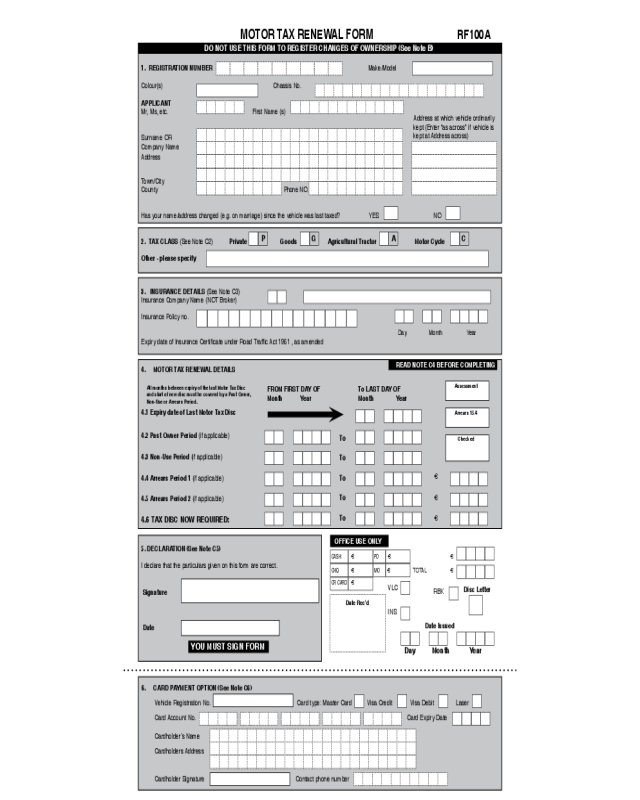

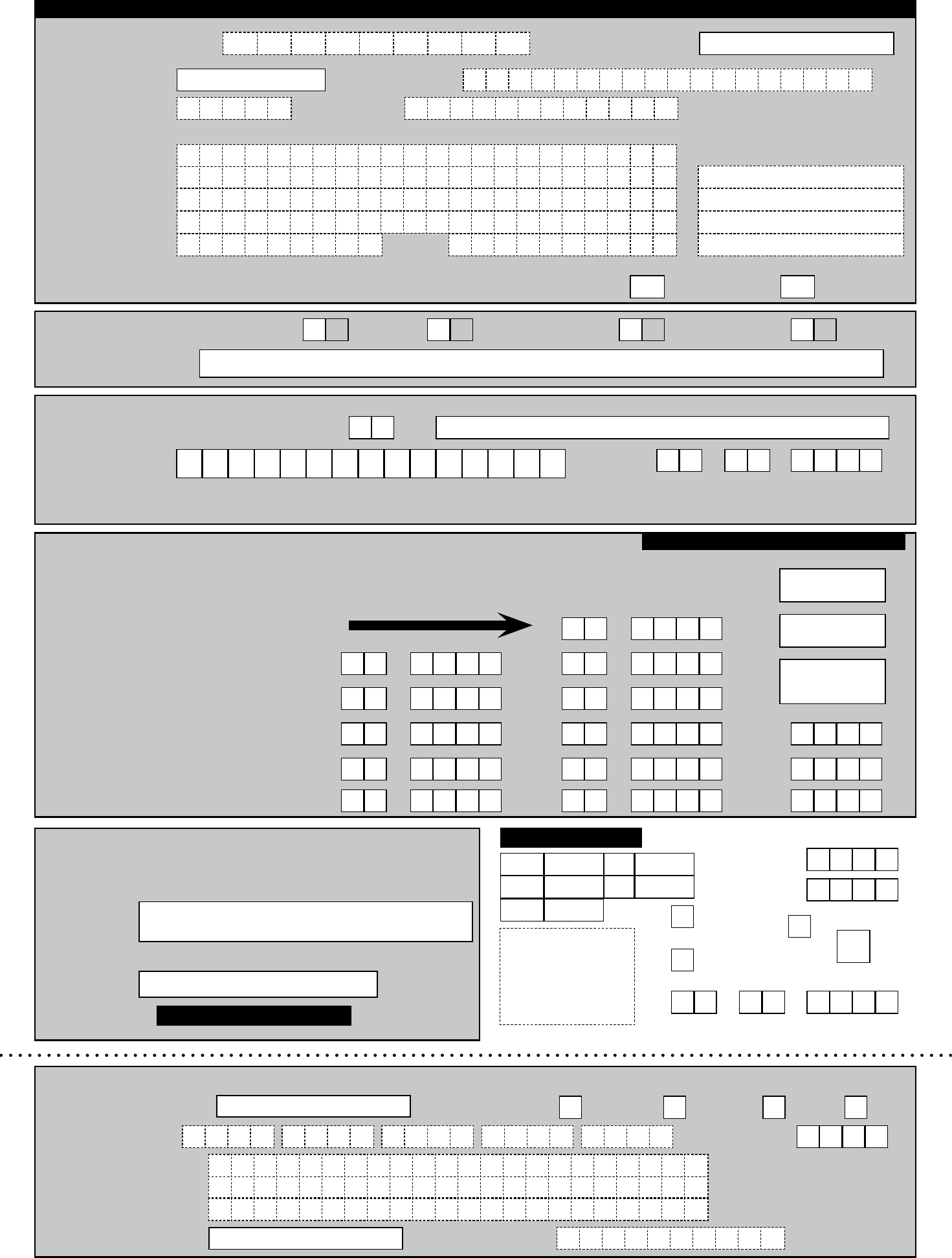

6. CARD PAYMENT OPTION (See Note C6)

Vehicle Registration No. Card type: Master Card Visa Credit Visa Debit Laser

Card Account No. Card Expiry Date

Cardholder’s Name

Cardholders Address

Cardholder Signature Contact phone number

Address at which vehicle ordinarily

kept (Enter “as across” if vehicle is

kept at Address across)

DO NOT USE THIS FORM TO REGISTER CHANGES OF OWNERSHIP (See Note B)

1. REGISTRATION NUMBER Make/Model

Colour(s) Chassis No.

APPLICANT

Mr, Ms, etc. First Name (s)

Surname OR

Company Name

Address

Town/City

County Phone NO.

Has your name/address changed (e.g. on marriage) since the vehicle was last taxed? YES NO

RF100A

MOTOR TAX RENEWAL FORM

OFFICE USE ONLY

CASH € PO € €

CHQ € MO € TOTAL €

CR CARD €

Date Rec’d

VLC

INS

RBK

Disc Letter

Date Issued

Day Month Year

5. DECLARATION (See Note C5)

I declare that the particulars given on this form are correct.

Signature

Date

YOU MUST SIGN FORM

3. INSURANCE DETAILS (See Note C3)

Insurance Company Name (NOT Broker)

Insurance Policy no.

Day Month Year

Expiry date of Insurance Certicate under Road Trafc Act 1961 , as amended

All months between expiry of the last Motor Tax Disc

and start of new disc must be covered by a Past Owner,

Non-Use or Arrears Period.

READ NOTE C4 BEFORE COMPLETING

4. MOTOR TAX RENEWAL DETAILS

4.1 Expiry date of Last Motor Tax Disc

4.2 Past Owner Period (if applicable)

4.3 Non-Use Period (if applicable)

4.4 Arrears Period 1 (if applicable)

4.5 Arrears Period 2 (if applicable)

4.6 TAX DISC NOW REQUIRED:

2. TAX CLASS (See Note C2) Private

P

Goods

G

Agricultural Tractor

A

Motor Cycle

C

Other - please specify

FROM FIRST DAY OF

Month Year

To LAST DAY OF

Month Year

To

To

To

To

To

€

€

€

Assessment

Arrears 15/4

Checked

If the ownership of the vehicle has changed since it was last taxed, you are NOT liable for the arrears period from the expiry of the last tax

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal is in

respect of a goods vehicle you must produce a Weight Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

not exceed 3,500kg (DGVW) or (ii) a recovery vehicle, it is necessary to complete form (i) RF111A or (ii) RF111B available from the Motor Tax Office.

You MUST complete Section 1. Section 1 CANNOT be used to register a change of ownership of any kind - see Note B above. Enter the name

and address of the person in whose name the vehicle is to be licensed. If the vehicle is not being licensed in the name of a person but rather a trader /

registered company special attention is required to ensure that the company name and not the trading name is used. The company name must be the

same as that stated on the company’s Certification of Incorporation and will in most cases have “Limited” in the name. If the trader is not an

Incorporated company, the form must be completed and signed in the name of a person.

or New owner details on the Vehicle Registration Certificate and

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co. Clare.

/ Registration

Certificate to the Motor Dealer.

County Council / City Council and crossed “Motor Tax Account”. DO NOT SEND CASH THROUGH THE POST. Contact your local Motor Tax

Office for clarification of the appropriate Motor Tax rates or other payment methods. Payments can also be made by credit / debit card. (Motor

Tax Rates are available on Aertel Page 454 (RTE 2) or at www.motortax.ie, and select Motor Tax Rates.)

, and a Weight Docket if ownership has changed since it was last taxed.

If the ownership of the vehicle has changed since it was last taxed, you are NOT liable for the arrears period from the expiry of the last tax

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal is in

respect of a goods vehicle you must produce a Weight Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

not exceed 3,500kg (DGVW) or (ii) a recovery vehicle, it is necessary to complete form (i) RF111A or (ii) RF111B available from the Motor Tax Office.

You MUST complete Section 1. Section 1 CANNOT be used to register a change of ownership of any kind - see Note B above. Enter the name

and address of the person in whose name the vehicle is to be licensed. If the vehicle is not being licensed in the name of a person but rather a trader /

registered company special attention is required to ensure that the company name and not the trading name is used. The company name must be the

same as that stated on the company’s Certification of Incorporation and will in most cases have “Limited” in the name. If the trader is not an

Incorporated company, the form must be completed and signed in the name of a person.

or New owner details on the Vehicle Registration Certificate and

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co. Clare.

/ Registration

Certificate to the Motor Dealer.

County Council / City Council and crossed “Motor Tax Account”. DO NOT SEND CASH THROUGH THE POST. Contact your local Motor Tax

Office for clarification of the appropriate Motor Tax rates or other payment methods. Payments can also be made by credit / debit card. (Motor

Tax Rates are available on Aertel Page 454 (RTE 2) or at www.motortax.ie, and select Motor Tax Rates.)

, and a Weight Docket if ownership has changed since it was last taxed.

If the ownership of the vehicle has changed since it was last taxed, you are NOT liable for the arrears period from the expiry of the last tax

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal is in

respect of a goods vehicle you must produce a Weight Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

not exceed 3,500kg (DGVW) or (ii) a recovery vehicle, it is necessary to complete form (i) RF111A or (ii) RF111B available from the Motor Tax Office.

You MUST complete Section 1. Section 1 CANNOT be used to register a change of ownership of any kind - see Note B above. Enter the name

and address of the person in whose name the vehicle is to be licensed. If the vehicle is not being licensed in the name of a person but rather a trader /

registered company special attention is required to ensure that the company name and not the trading name is used. The company name must be the

same as that stated on the company’s Certification of Incorporation and will in most cases have “Limited” in the name. If the trader is not an

Incorporated company, the form must be completed and signed in the name of a person.

or New owner details on the Vehicle Registration Certificate and

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co. Clare.

/ Registration

Certificate to the Motor Dealer.

County Council / City Council and crossed “Motor Tax Account”. DO NOT SEND CASH THROUGH THE POST. Contact your local Motor Tax

Office for clarification of the appropriate Motor Tax rates or other payment methods. Payments can also be made by credit / debit card. (Motor

Tax Rates are available on Aertel Page 454 (RTE 2) or at www.motortax.ie, and select Motor Tax Rates.)

, and a Weight Docket if ownership has changed since it was last taxed.

C3 Section 3

C4 Section 4

4.1 to 4.6

4.4

4.2, 4.3

4.1

4.4, 4.5 If there are elapsed months since the expiry of the last Motor Tax disc or off the road declaration, which was not covered by a Past Owner Period,

arrears are due. Enter a continuous period of arrears in the boxes provided at 4.4 on the form. If the arrears period is broken, enter the details using the

boxes 4.4 and 4.5 on the form. Enter relevant amount of arrears.

4.6 Enter the renewal period you require and the relevant fee in the boxes provided. Renewal options of 3 months, 6 months or one year are available

unless the annual fee is less than €119 in which case, only a renewal period of one year is available.

C5 Section 5- The signature on the application must be that of the owner of the vehicle (dened in Section 130 of the Finance Act, 1992 as the Keeper of

the vehicle). In the case of companies registered under the Companies Act 1963, the signature must be that of the Managing Director or Secretary. Where a

private rm is concerned, one of the partners’ signatures must be inserted.

C6 Section 6 - Complete this section if payment is being made by Credit Card or Debit Card. Card type: Please note Laser cards are not acceptable for

postal applications. Cardholder’s name – enter as it appears on the card.

D. What should accompany this form

You MUST include the following with application:

• Fee - You must include a cheque or postal order for the correct fee (including arrears where appropriate), made payable to the appropriate County

Council/Borough Councils and crossed “Motor Tax Account”. DO NOT SEND CASH THROUGH THE POST. Contact your local Motor Tax Ofce for

clarication of the appropriate Motor Tax rates or other payment methods.

• Goods or Recovery Declaration, if applicable (see Note 4.2) and a Weight Docket if ownership has changed since it was last taxed.

• PSV (plate) Licence - Public Service Vehicles only.

• Article 60 Licence - School Buses only.

ADDITIONAL REQUIREMENTS

A Certicate of Roadworthiness (CRW) must be in force in order to tax Goods Vehicles, Trailers, Buses and Ambulances over one year old.

DISCLOSURE OF DATA

Computer data based on this document may be subject to disclosure under Section 60 of the Finance Act, 1993 (No. 13 of 1993) as amended by Section

86 of the Finance Act, 1994 (No. 13 of 1994) and regulations made thereunder. List of disclosees is registered with the Data Protection Commissioner -

REF 721/A

WARNING - FALSE DECLARATIONS

Any person making a false declaration, or who subsequently fails to notify any changes in the licensing particulars now furnished, including disposal of the

vehicle is liable to heavy penalties. A licensing authority may require appropriate evidence as to the accuracy of particulars declared.

NOTE: AN IRISH VERSION OF THIS FORM IS ALSO AVAILABLE AT MOTOR TAX OFFICES AND GARDA STATIONS.

4.1 September 2013, enter

this as

0 9 2 0 1 3

4.2

4.3 If the vehicle is currently declared off the road enter the period of non-use in the boxes provided.

If the ownership of the vehicle has changed since it was last taxed, you are NOT liable for the arrears period from the expiry of the last tax

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal is in

respect of a goods vehicle you must produce a Weight Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

not exceed 3,500kg (DGVW) or (ii) a recovery vehicle, it is necessary to complete form (i) RF111A or (ii) RF111B available from the Motor Tax Office.

You MUST complete Section 1. Section 1 CANNOT be used to register a change of ownership of any kind - see Note B above. Enter the name

and address of the person in whose name the vehicle is to be licensed. If the vehicle is not being licensed in the name of a person but rather a trader /

registered company special attention is required to ensure that the company name and not the trading name is used. The company name must be the

same as that stated on the company’s Certification of Incorporation and will in most cases have “Limited” in the name. If the trader is not an

Incorporated company, the form must be completed and signed in the name of a person.

or New owner details on the Vehicle Registration Certificate and

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co. Clare.

/ Registration

Certificate to the Motor Dealer.

County Council / City Council and crossed “Motor Tax Account”. DO NOT SEND CASH THROUGH THE POST. Contact your local Motor Tax

Office for clarification of the appropriate Motor Tax rates or other payment methods. Payments can also be made by credit / debit card. (Motor

Tax Rates are available on Aertel Page 454 (RTE 2) or at www.motortax.ie, and select Motor Tax Rates.)

, and a Weight Docket if ownership has changed since it was last taxed.

If sold PRIVATELY, complete Part B of the Vehicle Licensing Certicate or New Owner Details on the Vehicle Registration Certicate and send

to Driver and Vehicle Computer Services Division, Department of Transport, Tourism and Sport, Shannon Town Centre, Co. Clare.

If sold to a MOTOR DEALER, complete Form RF105 (form is available from Motor Dealer) and send to Driver and Vehicle Computer Services

Division, Department of Transport, Tourism and Sport, Shannon Town Centre, Co. Clare and give the Vehicle Licensing Certicate to the

Motor Dealer.