Fillable Printable SF 3106

Fillable Printable SF 3106

SF 3106

Federal Employees

Retirement System

Application For Refund of Retirement Deductions

Federal Employees Retirement System

To avoid delay in payment:

(1) Complete both sides of application in full; (2) Type or print in ink.

Form Approved:

OMB Number 3206-0170

See the attached sheets for instructions and information

concerning your application for refund of retirement

deductions and a Privacy Act Statement.

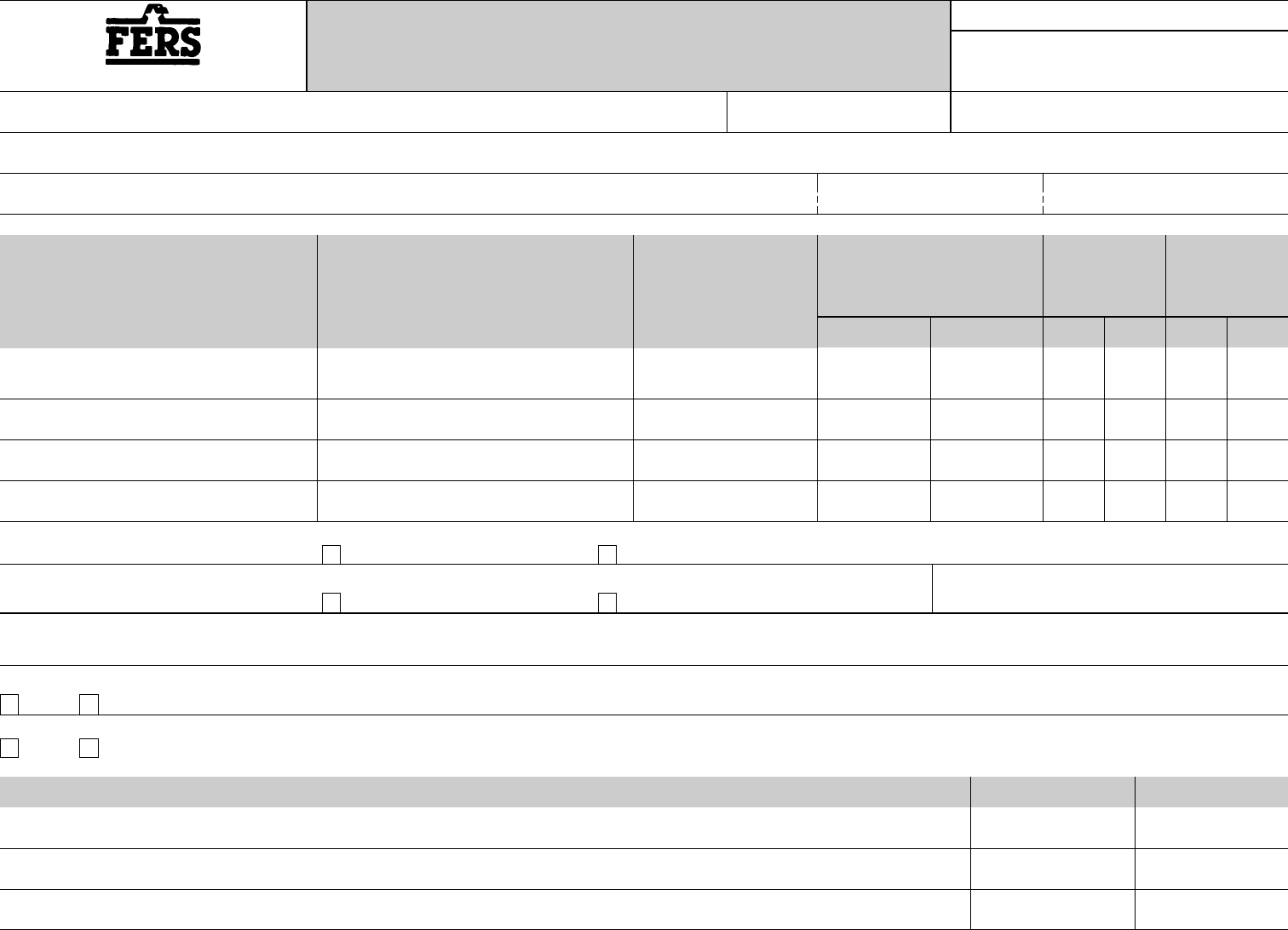

1. Name (last, first, middle) 2. Date of birth (mm/dd/yyyy) 3. Social Security Number

4. List all other names you have used (including maiden name, if applicable.)

5. Your address (number and street, city, state and ZIP Code) - We cannot authorize payment if this address is erased or otherwise changed.

Telephone no. (including area code)

( )

Email Address

6. List below all of your civilian and military service for the United States Government. Attach a continuation sheet with your name and Social Security Number if necessary.

Department or Agency

(Including bureau, branch, or division

where employed)

Location of Employment

(City, State and ZIP Code)

and Payroll Office Number

(if known)

Title of Position

(Indicate if the

position was civilian [c]

or military [m])

Periods of Service

Indicate whether

retirement

deductions were

withheld from your

salary. (Check one)

Have you paid

deposit or redeposit

for any period

including

military service?

(Check one)

Beginning Date

(mm/dd/yyyy)

Ending Date

(mm/dd/yyyy) Withheld

Not

Withheld

Fully or

Partially

Not

Paid

7. Have you accepted any further employment with the Federal government or the Government of the District of Columbia (or arranged for such employment) to become effective within 31 days from the ending date of your last

period of service?

Yes, continue with item 8.

No, skip items 8, 9, and 10. Continue with item 11.

8. If you answered "Yes" to Item 7, are Federal Employees Retirement System or Civil Service Retirement System deductions being withheld from your salary during

such employment?

Yes No

9. Date of new appointment (mm/dd/yyyy)

(Expected date if not yet reemployed.)

10. Department or agency, including bureau, or division, and location (City, State, ZIP Code) where you are (or will be) employed.

11. Are you now married? If "Yes," complete SF 3106A, Current/Former Spouse's Notification of Application for Refund of Retirement Deductions, or other required information described in this package.

No Yes, list the name of your current spouse:

12. Have you been divorced?

Yes

If your answer is "yes" and you have at least 18 months of creditable civilian service, complete an SF 3106A (attached) for each living former spouse to whom you were married for at least 9 months. List

the former spouses in the space given below.

No

Name of former spouse(s) Date of marriage

(mm/dd/yyyy)

Date of divorce

(mm/dd/yyyy)

Continue on Reverse

SF 3106 (page 1)

U.S. Office of Personnel Management

Revised September 2013

CSRS/FERS Handbook for Personnel and Payroll Offices

(You MUST complete both sides of this application.)

Previous editions are not usable

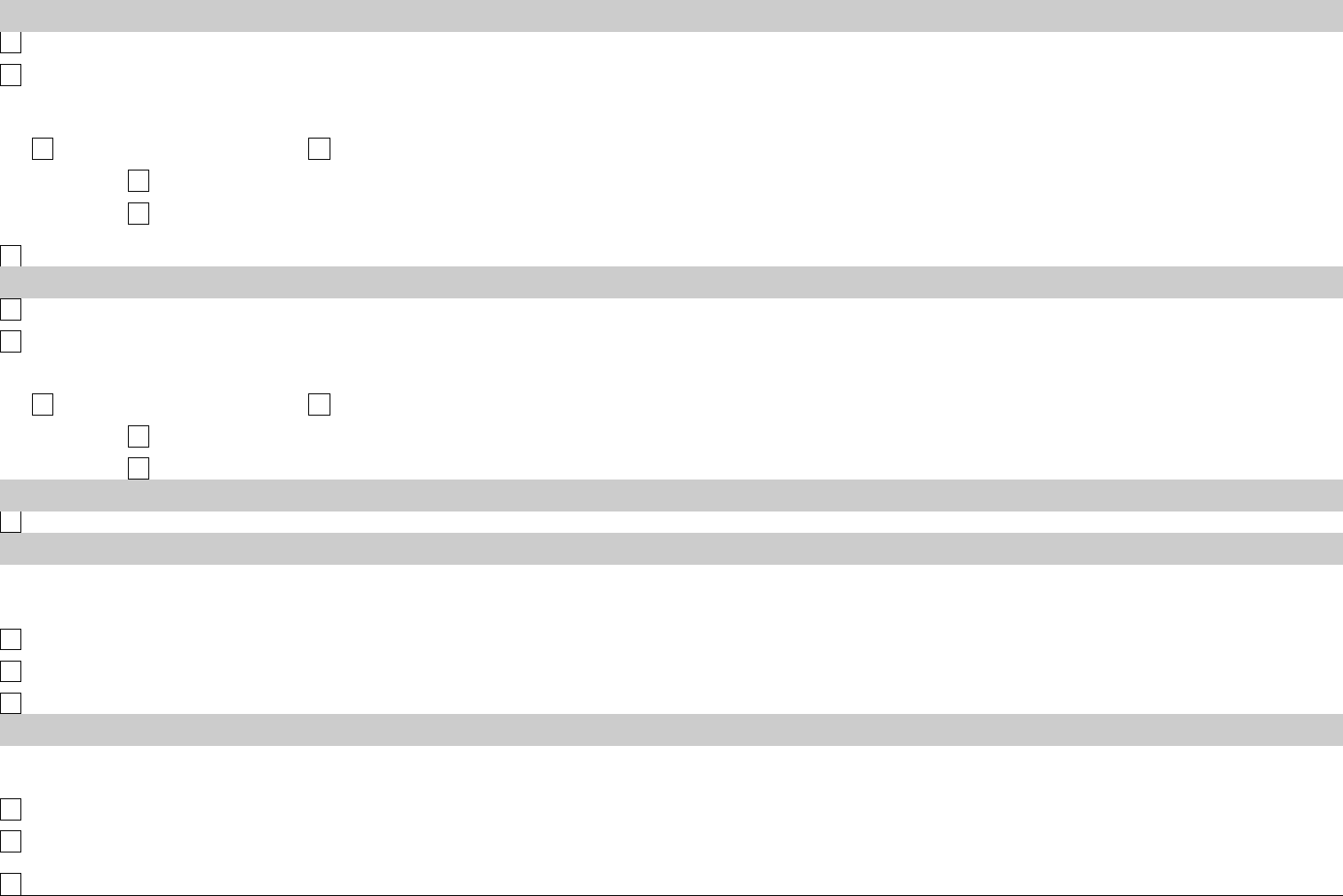

13. Indicate how you wish to have your refund paid to you if it is $200 or more. If your refund is less than $200, the Office of Personnel Management (OPM) cannot roll it over. It will be paid directly to you via Direct Deposit. Please

carefully read all of the information provided with this form, including the Special Tax Notice Regarding Rollovers, before you make your decision. An error in completing this form could delay your payment or cause payment in a

manner you did not intend. If you elect to roll over less than 100% of your refund, the total amount you roll over to any one organization must be at least $500. Make one choice in each section below, unless you need additional

information. If you need additional information before making this election, check the box in the last section.

Pay ALL by check made payable to me, with 20% Federal Income Tax Withholding.

Pay the INTEREST PORTION (Taxable Portion) of my Refund

Pay ALL by check made payable to my Individual Retirement Arrangement (IRA) or Eligible Employer Plan. (Your financi al institution or employer plan must complete the financial institution certification form in this package.)

Name of Financial Institution or Employer Plan ________________________________________________________________________________________________________________________________

This rollover is to a Roth IRA Withhold 20% Federal income tax from amount rolled over to Roth IRA

Mail the check

to the above institution or plan.

to me. I will deliver the check to the above institution or plan.

Pay ALL to my Thrift Savings Plan Account. (You must sign and submit form TSP-60, Request for a Transfer Into the TSP, to OPM. Form TSP-60 is available on the internet at www.tsp.gov.)

Pay the CONTRIBUTION PORTION (After-Tax Portion) of my Refund – (The Thrift Savings Plan will not accept this portion of your refund.)

Pay ALL by check made payable to me.

Name of Financial Institution or Employer Plan________________________________________________________________________________________________________________________________

This rollover is to a Roth IRA

Pay ALL by check made payable to my IRA or Eligible Employer Plan. (Your financial institution or employer plan must complete the financial institution certification form in this package.)

Withhold 20% Federal income tax from amount rolled over to Roth IRA

Mail the check to the above institution or plan.

I elect to have my refund computed and a rollover package with all my options sent to me before I decide how it should be paid. (Electing this option delays payment of your refund at least an additional 30 days.)

to me. I will deliver the check to the above institution or plan.

Federal benefits payments will be made electronically by Direct Deposit into a savings or checking account or by a Direct Express debit card provided by the Department of the Treasury. This does not apply to you if your permanent

payment address is outside the United States in a country not accessible via direct deposit.

I Need Additional Information Before I Decide

Payment Instructions

Please select one of the following:

Please send my survivor annuity payments directly to my checking or savings account. (Go to item X.)

Please send my survivor annuity payments to my Direct Express debit card. (Go to Item 14 [Applicant Certification].)

My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express. (Go to Item 14 [Applicant Certification].)

Public Law 104-134 requires that most Federal payments be paid by Direct Deposit through Electronic Funds Transfer (EFT) into a savings or checking account at a financial institution. However, if receiving your payment

electronically would cause you a financial hardship, or a hardship because you have a disability, or because of a geographic, language or literacy barrier, you may invoke your legal right to a waiver of the Direct Deposit requirement,

and continue to receive your payment by check. Therefore, you must select one of the following:

Direct Deposit

Please send my annuity payments directly to my checking or savings account.

Receiving my annuity payment(s) electronically would cause me a financial hardship, or a hardship because of a disability, or because of a geographic, language or literacy barrier. I hereby invoke my legal right to a waiver of the

Direct Deposit requirements of Public Law 104-134. Please send me my payments by check.

My permanent payment address is outside the United States in a country not accessible via direct deposit.

Continue to the next page of this form

SF 3106 (reverse of page 1)

(You MUST complete all sides for both pages of this application.)

Revised September 2013

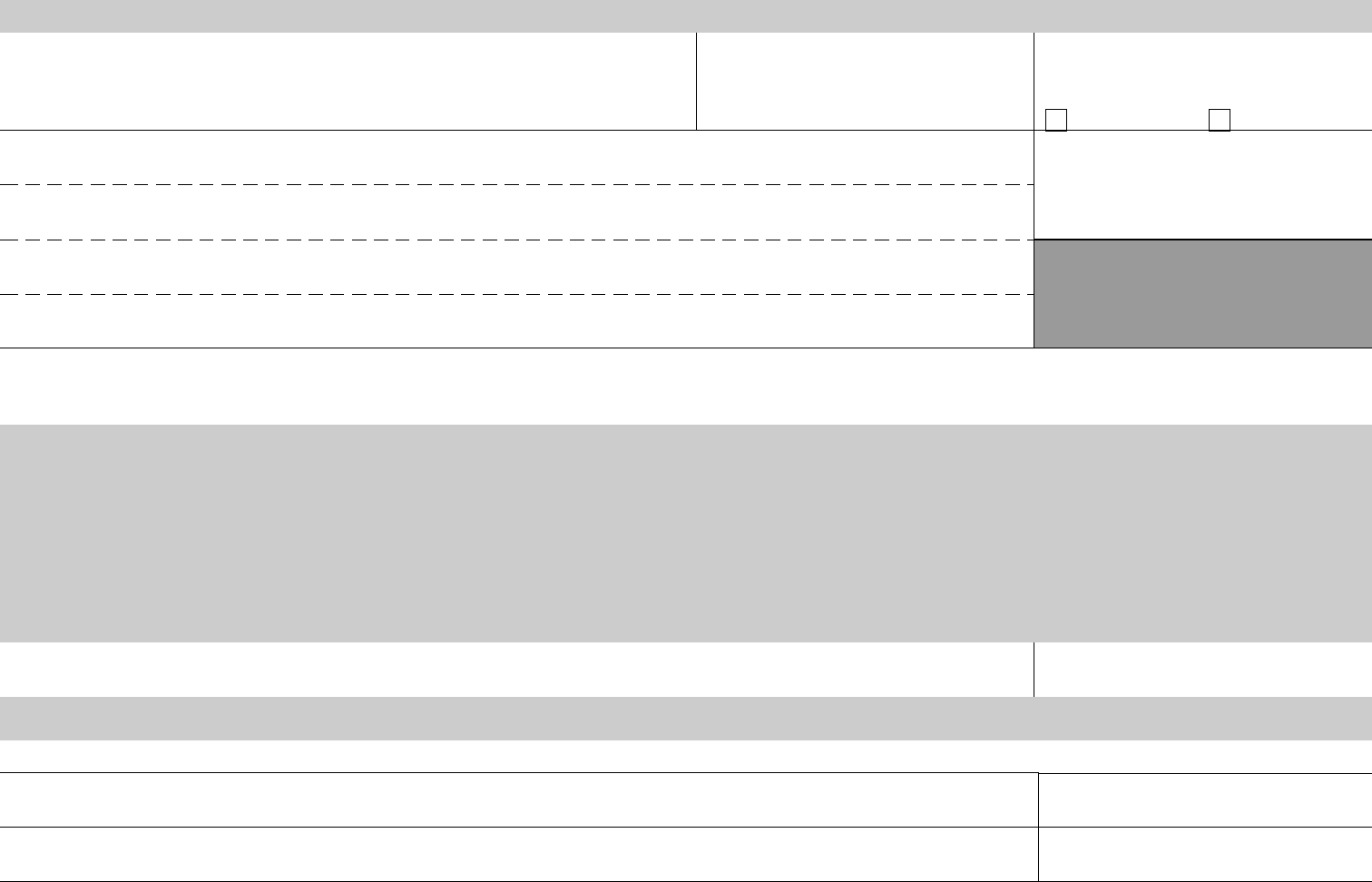

Direct Deposit (continued)

Financial institution routing number (You may obtain this number by calling your bank, credit union, or

savings institution. This number is very important. We cannot pay by direct deposit without it. We suggest

you call your financial institution to verify this number.)

Checking or savings account number What kind of account is this?

Checking

Savings

Name and address of your financial institution Telephone number of your financial institution

(including area code)

( )

Special Note: If you prefer, you may attach a cancelled personal check that shows the information requested above, instead of filling in the requested financial institution information. If you attach your

personal check, it is especially important that you contact your bank, credit union, or savings institution to confirm that the information on the check is the correct information for direct deposit. (Some

institutions, especially credit unions, use different routing numbers on checks.) OPM can use this information to start paying you by direct deposit.

14.

Applicant Certification: I understand that I am not legally entitled to receive a refund if I am reemployed or otherwise assigned to a position under the Federal Employees Retirement System or Civil Service Retirement System

within 31 days of separating from my most recent position. I agree to notify OPM if I am employed again within this time period and to return or repay any refund paid to me if it is determined that I was not legally entitled to

that refund.

I understand that if I was not employed under the Federal Employees Retirement System on/after October 28, 2009, payment of a refund will result in permanent forfeiture of any retirement rights that are based on the

period(s) of Federal Employees Retirement System service which the refund covers, as explained in this package.

I hereby certify that all statements in this application, including any information I have given elsewhere in this form, are true to the best of my belief and knowledge and that the tax withholding election made here reflects my

wishes.

I understand that if I was employed under the Federal Employees Retirement System on/after October 28, 2009, the service covered by the refund cannot be used in the computation of my FERS annuity unless I redeposit

the refund with interest. If I do not redeposit the refund, the service can still be used toward eligibility for a FERS annuity benefit, but not in the computation of the benefit. I understand that I must be reemployed under

FERS to pay the redeposit.

Signature

Date (mm/dd/yyyy)

Warning: Any intentional false statement in this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years,

or both. (18 U.S.C. 1001)

For agency use only: I certify that this agency received this Standard Form 3106 on the date shown.

Signature of agency official

Date received (mm/dd/yyyy)

Title

Agency Payroll Office number

Continue on Reverse

SF 3106 (page 2)

(You MUST complete all sides of this application.)

Revised September 2013

Certification by Financial Institution or Eligible Employer Plan

If Applicant Elects to Roll Over a Refund of Retirement Deductions

This must be completed by your financial institution or eligible employer plan.

Name of applicant (last, first, middle) Social Security Number

Name of institution or employer plan Account number

Certification: My signature below confirms the account number for the individual named in item 1 on the first

page of this form. As a representative of the financial institution or plan named above, I certify that this

institution or plan agrees to accept the funds described above as a direct trustee-to-trustee transfer from the Office

of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as defined in the Internal

Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated above.

Address of institution or employer plan

Typed or printed name of certifying representative Phone number (including area code)

( )

Signature of certifying representative

Date of certification (mm/dd/yyyy)

Certification by Financial Institution or Eligible Employer Plan

If Applicant Elects to Roll Over a Refund of Retirement Deductions

This must be completed by your financial institution or eligible employer plan.

Name of applicant (last, first, middle) Social Security Number

Name of institution or employer plan Account number

Certification: My signature below confirms the account number for the individual named in item 1 on the first

page of this form. As a representative of the financial institution or plan named above, I certify that this

institution or plan agrees to accept the funds described above as a direct trustee-to-trustee transfer from the Office

of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as defined in the Internal

Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated above.

Address of institution or employer plan

Typed or printed name of certifying representative Phone number (including area code)

( )

Signature of certifying representative

Date of certification (mm/dd/yyyy)

Instructions for Rollover to the Federal Retirement Thrift Savings Plan

The Thrift Savings Plan (TSP) will not accept non-taxable (post-tax) monies. You must have an open TSP account. Before the Office of Personnel

Management (OPM) can complete a rollover to your Thrift Savings account, you must sign and submit Form TSP-60, Request for a Transfer Into the

TSP, to OPM. Submit both the TSP-60 and this form, SF 3106, at the same time. OPM will complete its portion of the form and fax it to the Thrift

Savings office for processing. The form must be approved by the Thrift Savings Board and the Board must notify OPM to transfer the funds.

Form TSP-60 is available on the internet at www.tsp.gov.

SF 3106 (reverse of page 2)

Revised September 2013

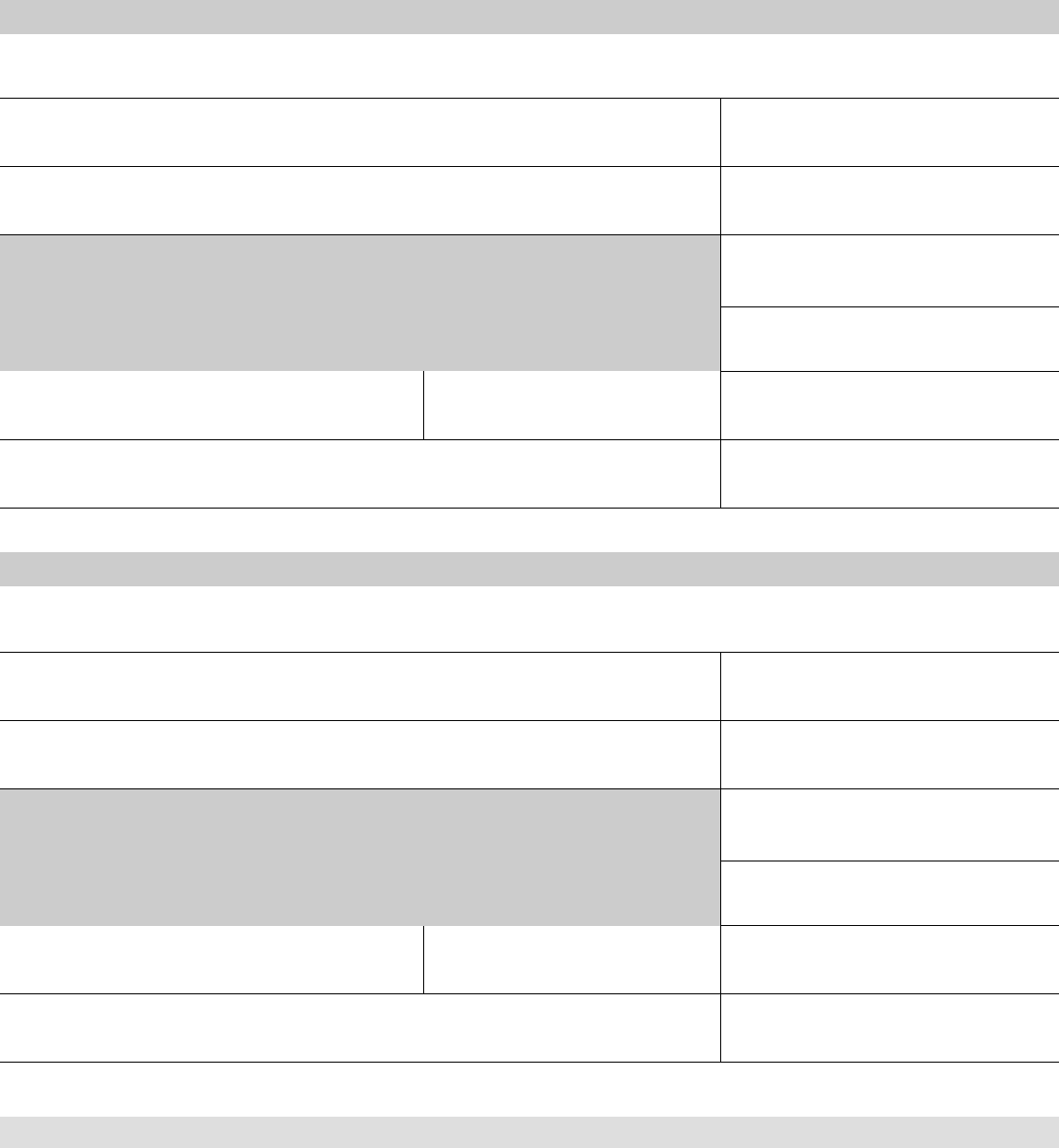

Current/Former Spouse's Notification of Application for Refund of Retirement Deductions

Under the Federal Employees Retirement System

If you apply for a refund of retirement deductions, you must notify your current spouse. Also, you must notify any former spouse if the following

conditions apply: (1) You have 18 months of creditable civilian service; and (2) You were married to the former spouse for at least 9 months. Refer to

the information and instructions given on this form.

Part 1 - To Be Completed By Applicant

Instructions: To notify each current or former spouse of your application for a refund of your retirement deductions, complete Part 1 with your name,

date of birth and Social Security Number and have the current or former spouse complete Part 2. The current or former spouse's signature must be

witnessed in Part 3. You may not be a witness. After Parts 2 and 3 have been completed, the form must be returned to you for attachment to your

refund application. (Use a separate form for current spouse and each former spouse.)

Name (last, first, middle) Date of birth (mm/dd/yyyy) Social Security Number

Part 2 - To Be Completed by Current or Former Spouse

Instructions: Complete Part 2 and have two witnesses complete Part 3 and then return the form to the applicant. Payment of the refund of

retirement deductions will end any entitlement you may have to a survivor annuity or portion of any annuity to which the applicant would otherwise

have been entitled. If a court order expressly relates to the applicant's retirement deductions and you believe that payment of the refund would end a

court-ordered entitlement you have to a survivor annuity or to a portion of an annuity to which the above-named person is entitled, see the

information provided below regarding such court orders. (Complete Part 2 and have the witnesses complete Part 3 even if you are submitting a court

order.)

Name (type or print legibly)

Signature (do not print)

I have read the paragraph above

and I understand that the

above-named individual is applying

for a refund of retirement

deductions under the Federal

Employees Retirement System.

Part 3 - To Be Completed by Witnesses

Date signed (mm/dd/yyyy)

We, the undersigned, certify that Part 2 of this form was signed by the current or former spouse of the person named in Part 1 in our presence.

Signature Date signed (mm/dd/yyyy) Signature Date signed (mm/dd/yyyy)

Name of witness (type or print legibly) Name of witness (type or print legibly)

Address (number and street) Address (number and street)

City, state and ZIP code City, state and ZIP code

Information About Sending Court Orders to the Office of Personnel Management (OPM)

If you are legally separated or divorced from the applicant, you should know that a

refund would end your potential entitlement to a survivor annuity and to any portion

of any annuity to which the applicant would be entitled. If you have a court order

that expressly relates to any portion of the applicant’s retirement deductions, you

should send a copy of the court order to OPM with a cover letter giving:

1. The name, date of birth, and Social Security Number of the person applying for

the refund;

2. Your statement that the court order has not been amended, superseded, or set

aside.

3. Your name, date of birth, and mailing address; and

4.

If the court order states that any payments to you are subject to termination

upon your remarriage, a statement that either (1) you have remarried and the

date of the remarriage, or (2) that you have not remarried and that you will

notify OPM within 15 days of a remarriage should you remarry in the future.

If the court order gives you a survivor annuity after the death of the applicant, also

attach a copy of your birth certificate, if available.

The court order can be honored only if it is received before the refund is paid to

the applicant. Payment of the refund will end any entitlement you may have to a

survivor annuity or a portion of any annuity to which the applicant would otherwise

have been entitled. Payment of the refund will also end any eligibility you have to

coverage under the Federal Employees Health Benefits Program. Send a copy of the

court order and your cover letter to the following address and complete the blocks

below:

Office of Personnel Management

Federal Employees Retirement System

Attn: Refund

P.O. Box 45

Boyers, PA 16017-0045

NOTE: A former spouse who remarries before reaching age 55 is not entitled to a

survivor annuity. (Termination of the remarriage does not restore a former spouse’s

entitlement to a survivor annuity.) Remarriage does not affect a former spouse’s

court-ordered right to receive a portion of any annuity during the annuitant’s

lifetime, unless the court order provides otherwise. A former spouse may also lose

entitlement according to the court order.

I believe I have a court order that meets the criteria described above. I am immediately submitting a copy of the court order and the required cover

letter to the address provided above.

Today's Date (mm/dd/yyyy)Date of court order (mm/dd/yyyy)Signature (do not print)

U.S. Office of Personnel Management

SF 3106A

CSRS/FERS Handbook for Personnel and Payroll Offices

Revised September 2013

Previous editions are not usable.

Notification To Current and Former Spouses of Your Refund Application

The Federal Employees Retirement law provides that your retirement

contributions may be refunded to you only if you notify the following

persons that you are applying for a refund:

•

any current spouse (including any person from whom you are

legally separated) and

•

any former spouse who is still living.

You are not required to notify a former spouse if you were not married

to that person for a total of at least 9 months or you do not have a total

of at least 18 months of creditable civilian service.

You should provide a copy of Standard Form 3106A, Current/Former

Spouse’s Notification of Application for Refund of Retirement

Deductions (this form, front and back), to (1) your current spouse,

if any, and (2) if you have at least 18 months of creditable civilian

service, each former spouse that meets the above criteria. The current

and/or former spouse(s) must sign the form and have the signature

witnessed by two persons. You cannot be one of the witnesses.

Additional copies of the SF 3106A should be available from your

employing office or you can photocopy both sides of the form

for each spouse/former spouse. SF 3106A is also a part of the

SF 3106 forms package which is found on our website at

www.opm.gov/retirement-services.

In addition, the law provides that payment of your refund is subject to

the terms of any court order (related to a divorce or legal separation)

that expressly relates to any portion of your refund, if the payment of

the refund would end the entitlement of a spouse or former spouse to a

survivor annuity or a portion of your annuity. A court order cannot bar

payment of a refund if you do not have a future annuity entitlement

under the Federal Employees Retirement System.

Attach all signed and witnessed notification forms to your refund

application.

If your current or former spouse refuses to acknowledge the

notification or you are otherwise unable to obtain the acknowledgment,

you must submit one of the following:

1. Affidavits signed by two individuals who witnessed your attempt

to personally notify the current or former spouse. The witnesses

must attest that they saw you give or try to give (personally) the

notification form to your current or former spouse to whom your

purpose should have been clear.

or 2.

The current mailing address of the current or former spouse.

(You may use the box at the end of this column to give the

address.) The Office of Personnel Management (OPM) will

attempt to notify (by certified mail return receipt requested) the

current or former spouse at the address you give. OPM will not

pay you the refund until we receive the signed return receipt.

If the notice is undeliverable at the address you give, your refund

may not be paid unless you subsequently show that the

notification requirement should be waived as described below.

If you decide you want OPM to make notification, it will cause

a 6- to 8-week delay in the payment of your refund.

If you do not know the current whereabouts of a spouse or former

spouse, OPM may waive the requirement to notify that person. A

waiver may be granted if you submit with your refund application:

1.

A determination by a court or administrative agency empowered

to make such determinations that the person is missing; or

2.

Notarized statements from yourself and two other persons (one of

whom is unrelated to you) stating that the person’s whereabouts

are unknown and detailing efforts to locate the person.

I have been unable to notify the following current or former

spouse. (Enter name and current mailing address, including

ZIP Code, of the current or former spouse.)

Privacy Act Statement

5 U.S.C. 8424 authorizes solicitation of this information. The information you furnish will be used to identify records properly associated with your application for

Federal benefits, to obtain additional information if necessary, to determine and allow present or future benefits, and to maintain a uniquely identifiable claim file. The

information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local, or

other charitable or social security administrative agencies in order to determine benefits under their programs, to obtain information necessary for determination or

continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies

when they are investigating a violation or potential violation of civil or criminal law.

Executive Order 9397 (November 22, 1943) authorizes use of the Social Security Number to distinguish between the applicant and people with similar names. Failure

to furnish the requested data may result in our inability to refund the retirement deductions.

Public Burden Statement

We estimate that this form takes an average of 5 minutes to complete, including the time for reviewing instructions, getting the needed data, and reviewing the

completed form. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the Office of Personnel

Management, Retirement Services Publications Team (3206-0170), Washington, D.C. 20415-3430. The OMB Number 3206-0170 is currently valid. OPM may not

collect this information, and you are not required to respond, unless this number is displayed.

Reverse of SF 3106A

Revised September 2013

PRINT

CLEAR

SAVE

We estimate that this form takes an average of 30 minutes to complete, including the

time for reviewing instructions, getting the needed data, and reviewing the completed

form. Send comments regarding our estimate or any other aspect of this form,

including suggestions for reducing completion time, to the Office of Personnel

Management, Retirement Services Publications Team (3206-0170), Washington,

D.C. 20415-3430. The OMB Number 3206-0170 is currently valid. OPM may not

collect this information, and you are not required to respond, unless this number is

displayed.

You must complete Question 13 on the refund application, instructing us

how to pay any refund you may be due to receive. Since we cannot tell you

how much your refund will be until we receive your application and

complete the calculation, you can instruct us to prepare an election form

telling you the amount you can roll over (if it is over $200) after we

compute the benefit. If you ask for this detailed information, your case will

be held until we send and receive your written election, usually a delay of

payment of at least 30 days.

Instructions For Completion of Your Application For Refund of Retirement Deductions

Privacy Act Statement

Solicitation of this information is authorized by the Civil Service Retirement law

(Chapter 83, title 5, U.S. Code) and the Federal Employees Retirement law (Chapter

84, title 5, U.S. Code). The information you furnish will be used to identify records

properly associated with your application for Federal benefits, to obtain additional

information if necessary, to determine and allow present or future benefits, and to

maintain a uniquely identifiable claim file. The information may be shared and is

subject to verification, via paper, electronic media, or through the use of computer

matching programs, with national, state, local or other charitable or social security

administrative agencies in order to determine benefits under their programs, to obtain

information necessary for determination or continuation of benefits under this

program, or to report income for tax purposes. It may also be shared and verified, as

noted above, with law enforcement agencies when they are investigating a violation

or potential violation of civil or criminal law.

Where to File Your Application

1. If you have been separated 30 days or less, this application should be

forwarded to the office in which you were last employed. If you need to

check on the status of your application, first verify that your former

agency has sent it, along with your records, to OPM.

2. If you have been separated more than 30 days, forward this application

to the Office of Personnel Management, Federal Employees Retirement

System, P.O. Box 45, Boyers, PA 16017-0045.

3. If you want to withdraw your Thrift Savings Plan account balance, ask

your agency for information. This is not the form you would use.

Public Burden Statement

If your refund is less than $200, we are not required to withhold 20% of the

interest for Federal income tax and we cannot roll over any of the amount.

You can still roll over an amount equal to the refund personally after we

send the payment to you.

Executive Order 9397 (November 22, 1943) authorizes use of the Social Security

Number to distinguish between you and people with similar names. Failure to furnish

the requested data may result in our inability to determine your eligibility to receive a

refund of retirement deductions.

If you elect to roll over any portion of the refund into an IRA or eligible

employer plan, your financial institution or employer plan must complete

the certification found in this package, before we can process your election.

Two certification forms are provided, since you can roll your refund over to

two different institutions. If you elect to roll over less than 100% of your

retirement deductions, the total amount you roll over to any one

organization must be at least $500.

More information is given in the Special Tax Notice Regarding Rollovers,

found in this package. Consult a qualified tax advisor or the Internal

Revenue Service if you need more information on tax matters. OPM

cannot provide you with tax publications or tax advice. You should be

aware that distributions made from the plan to which the rollover is made

may be subject to different restrictions and tax consequences than those that

apply to distributions from OPM.

If you do not complete an election, and your refund is $200 or more, we

will pay your refund directly to you and will withhold 20% of any interest

payable for Federal income tax. You have the option to roll over part or all

of the refund yourself within 60 days after you receive the payment. If

your refund is less than $200, we will pay your refund directly to you and

no tax will be withheld.

SF 3106 Instructions (page 1)

Revised September 2013

If you want to roll your whole refund into an eligible employer plan, you

are responsible for selecting a plan that accounts separately for the taxable

and non-taxable portions. Please note that the Federal Retirement Thrift

Savings Plan will accept the taxable portion of your refund (interest

portion), but will not accept the non-taxable portion (actual retirement

contributions).

You must complete questions 1 through 14 on the refund application.

Additionally, your financial institution(s) must complete the Certification

by Financial Institution or Eligible Employer Plan found in this package,

if you elect to roll over the refund into an individual retirement arrange-

ment (IRA) or eligible employer plan. Your current and/or living former

spouse(s) must each complete a separate SF 3106A to document notifica-

tion of your application if you are or have been married.

1.

2.

Special Information for Applicant

Transfers to FERS

Federal Tax Information

Applicants are permitted to roll over their refund of retirement contributions

to an IRA or an eligible employer plan. The actual retirement contributions

are not taxable. However, any interest paid on the contributions is taxable.

If OPM pays the interest to you, 20% Federal income tax must be withheld.

If the taxable portion is rolled over, we will not withhold any Federal income

tax, unless it is rolled over to a Roth IRA and you elect to have 20% tax

withheld on this form. If you roll your whole refund into an IRA, you are

responsible for accounting separately for the taxable and non-taxable portions.

If you have deductions creditable under CSRS and receive a refund, you can

pay back the amount of the CSRS deductions plus interest if you are later

reemployed in the Federal government. The CSRS service can be used in

determining length of service for annuity eligibility even if you do not repay

the money. If you want only a refund of your CSRS deductions and not

your FERS deductions, attach a signed statement to your completed

application.

Completion of this application will authorize OPM to refund all retirement

deductions to your credit under both FERS and CSRS. Any interest payable

is computed using the rules for the retirement system under which the

deductions are credited.

For additional information, see the FERS Transfer Handbook (RI 90-3)

which is available from your agency and on our website at

www.opm.gov/retirement-services/publications-forms.

If you were employed under the Federal Employees Retirement System

(FERS) on or after October 28, 2009, you must repay any refund you

receive of your FERS deductions in order to receive credit for the service

in the computation of your annuity. If you do not repay the refund, the

service will be excluded from your annuity computation, but it will still

be used to determine your length of service for annuity eligibility

purposes.

A refund of retirement deductions cannot be paid prior to 31 days after

the date of separation from a position subject to FERS or the Civil

Service Retirement System (CSRS) or within 31 days before the earliest

commencing date of any annuity for which you are eligible, including an

annuity which must be reduced for age.

For additional information about your benefits if you decide not to apply

for this refund, see the booklet FERS (RI 90-1), which is available from

your agency.

3.

4.

5.

6.

If you were not employed under FERS on or after October 28, 2009,

payment of a refund of your FERS deductions will permanently eliminate

your retirement rights for the period(s) of FERS service which the

refund covers. This includes a refund of any deposit you have paid for

military service performed after 1956. You will not be permitted to pay

the money back, even if you are later reemployed in the government.

The service involved cannot be used in computing annuity benefits that

you may later become entitled to receive under FERS nor can it be used

in determining length of service for annuity eligibility purposes.

Payment of the refund will end eligibility any former spouse(s) may

have to coverage under the Federal Employees Health Benefits Program.

Payment of the refund does not, however, affect credit for leave or other

non-retirement purposes.

Interest will be paid on your FERS refund at the same rate earned by

government securities if the period(s) of service which the refund covers

totals more than one year.

Do not offer this application to a person or a financial institution as

collateral or security for a loan. A former employee must apply for a

refund personally and payment must be made directly to him or her

(except direct rollovers, as described in the Federal Tax Information

section). However, outstanding debts to the U.S. Government can, at the

Government’s request, be withheld from a refund, provided all legal

requirements are met.

Payment of a refund is prohibited if you are currently employed in a

position subject to FERS or CSRS deductions or will be eligible to retire

within 31 days from the date of OPM’s receipt of the refund application.

Special Tax Notice Regarding Rollovers

Your refund consists of a taxable portion (any interest payable) and

an after-tax portion (the actual retirement contributions that you paid

into the retirement system). This notice explains how you can

continue to defer federal income tax on the interest payable on your

refund payment from the Federal Employees Retirement System

(FERS) and contains important information you will need before you

decide how to receive your refund.

This notice is provided to you because your refund is eligible for

rollover by you or the Office of Personnel Management (OPM) to

a traditional Individual Retirement Arrangement (IRA), a Roth IRA

or an eligible employer plan. A rollover is a payment by you or

OPM of all or part of your benefit to an eligible employer plan or

IRA. A rollover to a traditional IRA or eligible employer plan allows

you to continue to postpone taxation of that benefit until it is paid to

you. You cannot postpone taxation of the taxable portion of your

refund if you roll it over to a Roth IRA. Your payment cannot be

rolled over to a SIMPLE IRA or a Coverdell Education Savings

Account (formerly known as an education IRA). An "eligible

employer plan" includes a plan qualified under section 401(a) of the

Internal Revenue Code, including a 401(k) plan, profit-sharing plan,

defined benefit plan, stock bonus plan and money purchase plan; a

section 403(a) annuity plan; a section 403(b) tax-sheltered annuity;

and an eligible section 457(b) plan maintained by a governmental

employer (governmental 457 plan).

An eligible employer plan is not legally required to accept a rollover.

Before you decide to roll over your payment to an employer plan, you

should find out whether the plan accepts rollovers and, if so, the types

of distributions it accepts as a rollover. You should also find out

about any documents that are required to be completed before the

receiving plan will accept a rollover. Even if a plan accepts rollovers,

it might not accept rollovers of certain types of distributions, such as

after-tax amounts. The portion of your refund that represents your

actual retirement contributions, is an after-tax amount. (The interest

payable on this amount is a taxable amount.) If this is the case, you

may wish instead to roll your distribution over to a traditional IRA or

Roth IRA or split your rollover amount between the employer plan in

which you will participate and a traditional or Roth IRA. If an

employer plan accepts your rollover, the plan may restrict subsequent

distributions of the rollover amount or may require your spouse's

consent for any subsequent distribution. A subsequent distribution

from the plan that accepts your rollover may also be subject to

different tax treatment than distributions from OPM. Check with the

administrator of the plan that is to receive your rollover prior to

making the rollover.

If you have a Federal Retirement Thrift Savings Plan account, you

may roll over the taxable portion (interest portion) of your refund

into that account. The Thrift Savings Plan (TSP) will not accept

non-taxable monies (the actual retirement contributions that are being

refunded). To accomplish a rollover to the TSP, you will need to

submit form TSP-60 to us. See Part II, Direct Rollover for more

information.

Summary

There are two ways you may be able to receive a refund that is

eligible for rollover.

1) Your refund payment can be made directly to a traditional or Roth

IRA that you establish or to an eligible employer plan that will

accept it and hold it for your benefit ("DIRECT ROLLOVER"); or

2) The payment can be PAID TO YOU.

If you choose a DIRECT ROLLOVER of your refund:

• The interest portion of your payment (the taxable portion) will not

be taxed in the current year and no income tax will be withheld,

if it is rolled over to a traditional IRA or eligible employer plan.

• The taxable portion of your payment made directly to your Roth

IRA is taxable income in the year in which the rollover is paid.

OPM will not withhold income tax unless you elect that 20% tax be

withheld in item 13 on this form.

• You choose whether your refund payment will be made directly to

your traditional IRA, a Roth IRA or to an eligible employer plan

that accepts your rollover. Your payment cannot be rolled over

to a SIMPLE IRA or a Coverdell Education Savings Account.

• The interest portion of your payment (the taxable portion), if rolled

over to a traditional IRA or eligible employer plan, will be taxed

later when you take it out of the traditional IRA or the eligible

employer plan. Depending on the type of plan, the later distribution

may be subject to different tax treatment than it would be if you

received a taxable distribution from OPM. You must pay tax on

the taxable portion rolled into a Roth IRA in the year in which the

rollover is made.

If you choose to have your refund PAID TO YOU:

• You will receive 80% of the interest portion (taxable amount) of the

payment, because OPM is required to withhold 20% of that amount

and send it to the IRS as income tax withholding to be credited

against your taxes. You will receive all of your actual retirement

contributions, since taxes have already been paid on this amount.

• The interest portion of your payment will be taxed in the current

year unless you roll it over. If you receive the payment before age

59-1/2, you may have to pay an additional 10% tax.

• You can roll over all or part of the refund payment by paying it to

your traditional IRA, a Roth IRA or to an eligible employer plan

that accepts your rollover within 60 days after you receive the

payment. The amount of the interest portion rolled over will not be

taxed until you take it out of the traditional IRA or the eligible

employer plan. You cannot postpone taxation of amounts rolled into

a Roth IRA, even if you roll it over to a Roth IRA within 60 days.

• If you want to roll over 100% of the payment, you must find other

money to replace the 20% of the taxable portion (interest amount)

that was withheld. If you roll over only the 80% of the interest

amount that you received, you will be taxed on the 20% that was

withheld and that is not rolled over.

Your Right to Waive the 30-Day Notice Period

Generally, neither a direct rollover nor a payment to you can be made

until at least 30 days after your receipt of this notice. Thus, after

receiving this notice, you have at least 30 days to consider whether or

not to have your withdrawal directly rolled over. If you do not wish to

wait until this 30-day notice period ends before forwarding your refund

application to your former agency or OPM, you may waive the notice

period by making an election indicating whether or not you wish to

make a direct rollover.

More Information

I. Payments That Can and Cannot Be Rolled Over

Refund payments are "eligible rollover distributions." This means that

they can be rolled over to a traditional IRA, a Roth IRA or to an

eligible employer plan that accepts rollovers. They cannot be rolled

over to a SIMPLE IRA or a Coverdell Education Savings Account.

Both the taxable portion (interest) and the after-tax portion (actual

retirement contributions) can be rolled over.

After-tax Contributions. After-tax contributions (your actual retirement

contributions, excluding any interest paid) may be rolled into either a

traditional IRA, a Roth IRA or to certain employer plans that accept

rollovers of the after-tax contributions. The following rules apply:

a) Rollover into a traditional IRA or a Roth IRA. You can roll over

your after-tax contributions to a traditional IRA or Roth IRA either

directly or indirectly. The actual retirement contributions being

refunded to you are after-tax contributions. You do not owe any tax

on this amount. Only the interest portion is taxable.

If you roll over after-tax contributions to a traditional IRA or a Roth

IRA, it is your responsibility to keep track of, and report to the IRS

on the applicable forms, the amount of these after-tax contributions.

This will enable the nontaxable amount of any future distributions

from the traditional IRA to be determined.

Once you roll over your after-tax contributions to a traditional IRA

or a Roth IRA, those amounts CANNOT later be rolled over to an

employer plan.

b) Rollover into an Employer Plan. You can roll over after-tax

contributions to an employer plan using a direct rollover if the other

plan provides separate accounting for amounts rolled over,

including separate accounting for the after-tax employee

contributions and earnings on those contributions. You CANNOT

roll over after-tax contributions to a governmental 457 plan. If you

want to roll over your after-tax contributions to an employer plan

that accepts these rollovers, you cannot have the after-tax

contributions paid to you first. You must instruct OPM to make a

direct rollover on your behalf. Also, you cannot first roll over

after-tax contributions to a traditional or a Roth IRA and then roll

over that amount into an employer plan.

SF 3106 Instructions (page 2)

Revised September 2013

II. Direct Rollover

A DIRECT ROLLOVER is a direct payment of your refund to a

traditional individual retirement arrangement (IRA), a Roth IRA or an

eligible employer plan that will accept it. You can choose a DIRECT

ROLLOVER of all or any portion of your refund, as described in Part I

on the previous page. You are not taxed on the taxable portion of your

payment (interest amount) for which you choose a DIRECT

ROLLOVER to a traditional IRA or eligible employer plan until you

later take it out of the traditional IRA or eligible employer plan. You

are taxed on any taxable portion rolled into a Roth IRA in the year in

which the rollover is made.

No income tax withholding is required for any taxable portion of your

refund for which you choose a DIRECT ROLLOVER to a traditional

IRA or employer plan. You cannot choose a DIRECT ROLLOVER if

your refund payment is less than $200.

DIRECT ROLLOVER to a Traditional IRA or a Roth IRA. You can

open a traditional IRA or a Roth IRA to receive the direct rollover.

If you choose to have your refund paid directly to a traditional IRA

or a Roth IRA, contact an IRA sponsor (usually a financial institution)

to find out how to have your payment made in a direct rollover to a

traditional IRA or a Roth IRA at that institution. If you are unsure of

how to invest your money, you can temporarily establish a traditional

IRA to receive the payment. However, in choosing a traditional IRA,

you may want to make sure that the traditional IRA you choose will

allow you to move all or a part of your payment to another traditional

IRA or Roth IRA at a later date, without penalties or other limitations.

See IRS Publication 590, Individual Retirement Arrangements, for

more information on traditional IRAs and Roth IRAs (including limits

on how often you can roll over between IRAs).

DIRECT ROLLOVER to an Eligible Employer Plan. If you are

employed by a new employer that has an eligible employer plan, and

you want a direct rollover to that plan, ask the plan administrator of

that plan whether it will accept your rollover. An eligible employer

plan is not legally required to accept a rollover. Even if your new

employer's plan does not accept a rollover, you can choose a DIRECT

ROLLOVER to a traditional or Roth IRA. If the employer plan accepts

your rollover, the plan may provide restrictions on the circumstances

under which you may later receive a distribution of the rollover amount

or may require spousal consent to any subsequent distribution. Check

with the plan administrator of that plan before making your decision.

Change in Tax Treatment Resulting from a DIRECT ROLLOVER.

The tax treatment of any payment from the eligible employer plan or

IRA receiving your DIRECT ROLLOVER might be different than if

you received your benefit in a taxable distribution directly from the

Office of Personnel Management (OPM).

Direct Rollover to the Thrift Savings Plan (TSP). If you choose to roll

part or all of the taxable portion of your distribution into your TSP

account, you need to submit form TSP-60, Request for Transfer Into the

TSP, along with your refund application. This form is available on the

internet at www.tsp.gov. Fill out your portion of the form; we will

complete our portion and fax it to the TSP office for processing.

The form must be approved by the Thrift Savings Board and the Board

must notify OPM to transfer the funds.

III. Payment Paid to You

If your payment can be rolled over (see Part I on the previous page) but

the payment is made directly to you, the interest portion is subject to

20% federal income tax withholding (state tax withholding may also

apply). The payment is taxed in the year you receive it unless, within

60 days, you roll it over to an IRA or an eligible employer plan that

accepts rollovers. If you do not roll it over, special tax rules may apply.

Income Tax Withholding:

Mandatory Withholding. If any portion of your payment can be rolled

over under Part I on the previous page and you do not elect to make a

DIRECT ROLLOVER, OPM is required by law to withhold 20% of the

interest portion (taxable amount). This amount is sent to the Internal

Revenue Service (IRS) as federal income tax withholding. For

example, if you can roll over a taxable payment of $10,000, only

$8,000 will be paid to you because OPM must withhold $2,000 as

income tax. However, when you prepare your income tax return for the

year, unless you make a rollover within 60 days (see "Sixty-Day

Rollover Option" below), you must report the full $10,000 as a taxable

payment from OPM. You must report the $2,000 as tax withheld, and it

will be credited against any income tax you owe for the year. There

will be no income tax withholding if your payments for the year are less

than $200.

Sixty-Day Rollover Option. If you receive a payment that can be rolled

over under Part I on the previous page, you can still decide to roll over

all or part of it to a traditional IRA, a Roth IRA or to an eligible

employer plan that accepts rollovers. If you decide to roll it over, you

must contribute the amount of the payment you received to a traditional

IRA or Roth IRA or eligible employer plan within 60 days after you

receive the payment. The portion of your payment that is rolled over

will not be taxed until you take it out of the traditional IRA or the

eligible employer plan.

You can roll over to a traditional IRA, a Roth IRA or to an eligible

employer plan, up to 100% of your payment that can be rolled over

under Part I on the previous page, including an amount equal to the

20% of the taxable portion that was withheld, if you choose to have the

20% withheld from the rollover amount. If you choose to roll over

100%, you must find other money within the 60-day period to

contribute to the traditional IRA or the eligible employer plan, to

replace the 20% that was withheld. On the other hand, if you roll over

only the 80% of the taxable portion that you received, you will be taxed

on the 20% that was withheld.

Example: The taxable portion of your payment that can be rolled over

under Part I on the previous page, is $10,000, and you choose to have it

paid to you. You will receive $8,000, and $2,000 will be sent to the

IRS as income tax withholding. Within 60 days after receiving the

$8,000, you may roll over the entire $10,000 to a traditional IRA or an

eligible employer plan. To do this, you roll over the $8,000 you

received from OPM, and you will have to find $2,000 from other

sources (your savings, a loan, etc.). In this case, the entire $10,000 is

not taxed until you take it out of the traditional IRA or an eligible

employer plan. If you roll over the entire $10,000, when you file your

income tax return you may get a refund of part or all of the $2,000

withheld.

If, on the other hand, you roll over only $8,000, the $2,000 you did not

roll over is taxed in the year it was withheld. When you file your

income tax return, you may get a refund of part of the $2,000 withheld.

(However, any refund is likely to be larger if you roll over the entire

$10,000.)

Additional 10% Tax If You Are under Age 59-1/2. If you receive a

payment before you reach age 59-1/2 and you do not roll it over, then,

in addition to the regular income tax, you may have to pay an extra tax

equal to 10% of the taxable portion of the payment. The additional

10% tax generally does not apply to (1) payments that are paid after

you separate from service with your employer during or after the year

you reach age 55, (2) payments that are paid because you retire due to

disability, (3) payments that are paid directly to the government to

satisfy a Federal tax levy, (4) payments that are paid to an alternate

payee under a qualified domestic relations order, or (5) payments that

do not exceed the amount of your deductible medical expenses. See

IRS Form 5329 for more information on the additional 10% tax.

Additional Tax Information

This notice summarizes only the federal (not state and local) tax rules

that might apply to your payment. The rules described above are

complex and contain many conditions and exceptions that are not

included in this notice. Therefore, you may want to consult with the

IRS or a professional tax advisor before you take a payment of your

refund from OPM. You can find more specific information on the tax

treatment of payments from qualified employer plans in IRS

Publication 575, Pension and Annuity Income, and IRS Publication

590, Individual Retirement Arrangements. For an overview of the tax

consequences of payments from the Civil Service Retirement System

and Federal Employees Retirement System, you can also consult IRS

Publication 721, Tax Guide to U.S. Civil Service Retirement Benefits.

These publications are available from your local IRS office, on the

IRS's website at www.irs.gov, or by calling 1-800-TAX-FORMS.

SF 3106 Instructions (reverse of page 2)

Revised September 2013