Fillable Printable Small Business Loan Application Form

Fillable Printable Small Business Loan Application Form

Small Business Loan Application Form

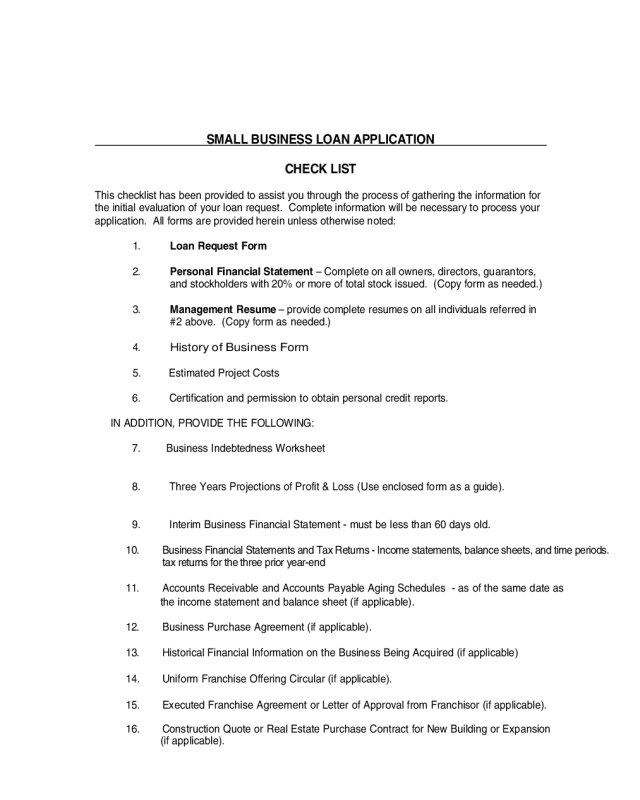

SMALL BUSINESS LOAN APPLICATION

CHECK LIST

This checklist has been provided to assist you through the process of gathering the information for

the initial evaluation of your loan request. Complete information will be necessary to process your

application. All forms are provided herein unless otherwise noted:

1. Loan Request Form

2. Personal Financial Statement – Complete on all owners, directors, guarantors,

and stockholders with 20% or more of total stock issued. (Copy form as needed.)

3. Management Resume – provide complete resumes on all individuals referred in

#2 above. (Copy form as needed.)

4. History of Business Form

5. Estimated Project Costs

6. Certification and permission to obtain personal credit reports.

IN ADDITION, PROVIDE THE FOLLOWING:

7. Business Indebtedness Worksheet

8. Three Years Projections of Profit & Loss (Use enclosed form as a guide).

9. Interim Business Financial Statement - must be less than 60 days old.

10. Business Financial Statements and Tax Returns - Income statements, balance sheets, and time periods.

tax returns for the three prior year-end

11. Accounts Receivable and Accounts Payable Aging Schedules - as of the same date as

the income statement and balance sheet (if applicable).

12. Business Purchase Agreement (if applicable).

13. Historical Financial Information on the Business Being Acquired (if applicable)

14. Uniform Franchise Offering Circular (if applicable).

15. Executed Franchise Agreement or Letter of Approval from Franchisor (if applicable).

16. Construction Quote or Real Estate Purchase Contract for New Building or Expansion

(if applicable).

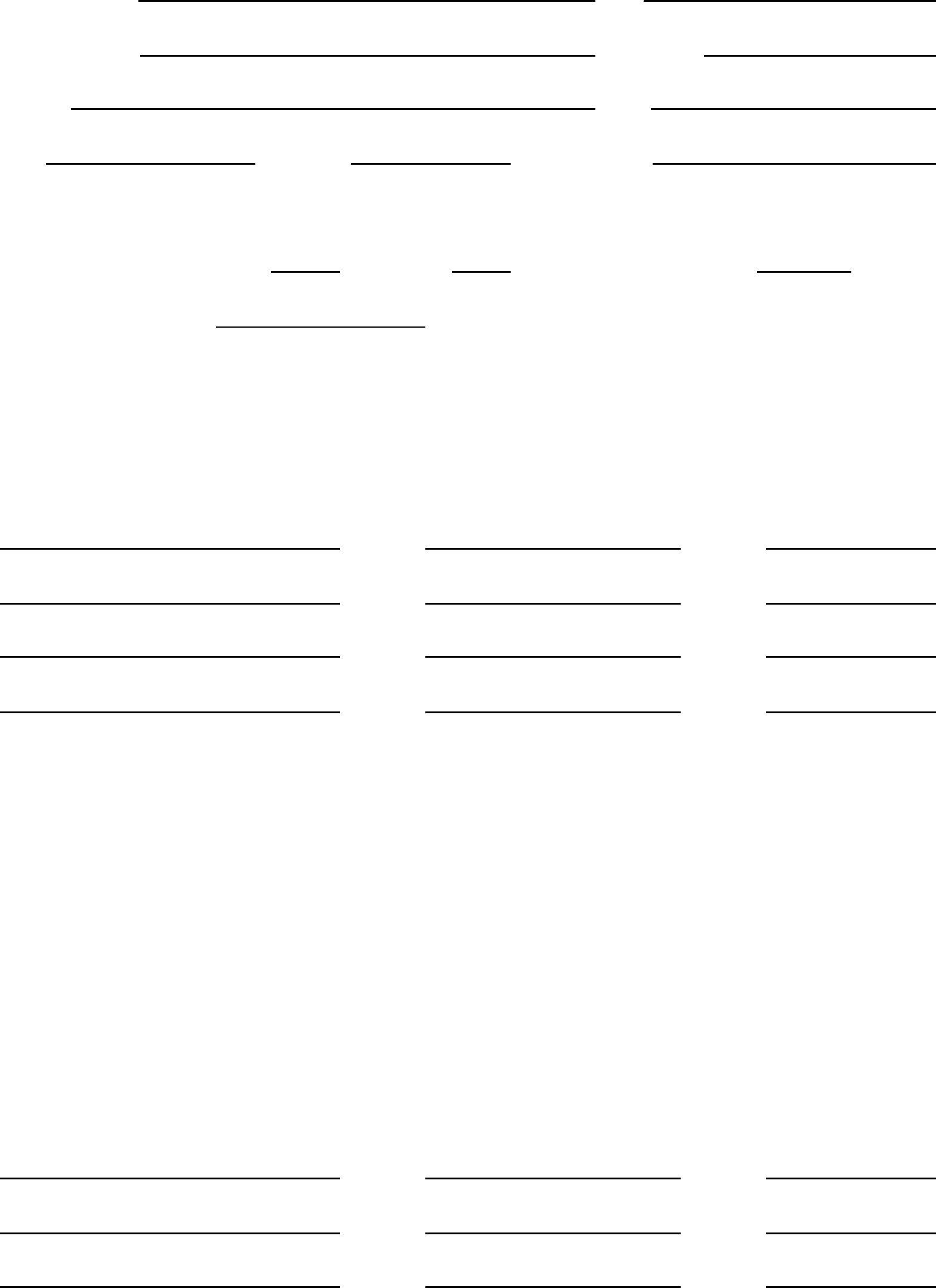

SMALL BUSINESS LOAN REQUEST FORM

APPLICANT COMPANY

Individual Name Title

Company Name Telephone

Address City

State Zip Code Email Address

Type of Entity: Corporation Partnership Proprietorship Not-for-profit LLC

Number of Employees: Existing After Loan Date Business Established

Business Tax ID Number

OWNERSHIP OF APPLICANT COMPANY

List below all owners, co-owners, and stockholders of the business.

NAME TITLE % of Ownership

Are any of the above presently under indictment, on parole, or probation? Yes No

Have any of the above ever been charged with or arrested for any criminal offense other than a minor vehicle violation

(including offenses which have been dismissed, discharged, or nolle prosequi)? Yes No

Have any of the above ever been convicted, placed on pretrial diversion, or placed on any form of probation, including

adjudication withheld pending probation for any criminal offense other than a minor vehicle violation? Yes No

AFFILIATES

List below all business concerns in which the applicant company or any of the individuals listed in the ownership

section above have any ownership.

COMPANY NAME OWNER (Applicant Company or Individual) % of OWNERSHIP

MANAGEMENT INFORMATION

Please fill in all spaces, use full first, middle, and maiden names. If an item is not applicable, please indicate so.

PERSONAL

Name SS#

First Middle Maiden Last

Date of Birth Place of Birth

Residence Address

STREET CITY STATE ZIP

Lived at this address since Telephone #: (home) (business)

Prior Address

STREET CITY STATE ZIP

Lived there from To

MONTH & YEAR MONTH & YEAR

Are you a U.S. Citizen? Yes No If no, give Alien Registration Number

EDUCATION

DATES DID YOU TYPE OF

NAME & LOCATION FROM TO MAJOR GRADUATE DEGREE

MILITARY SERVICE BACKGROUND

Branch From To Honorable Discharge?

Rank at time of Discharge

WORK EXPERIENCE (List chronologically, beginning with present employment)

Company Name/Location

From To Title

Duties

Company Name/Location

From To Title

Duties

Note: You may include additional information on a separate exhibit

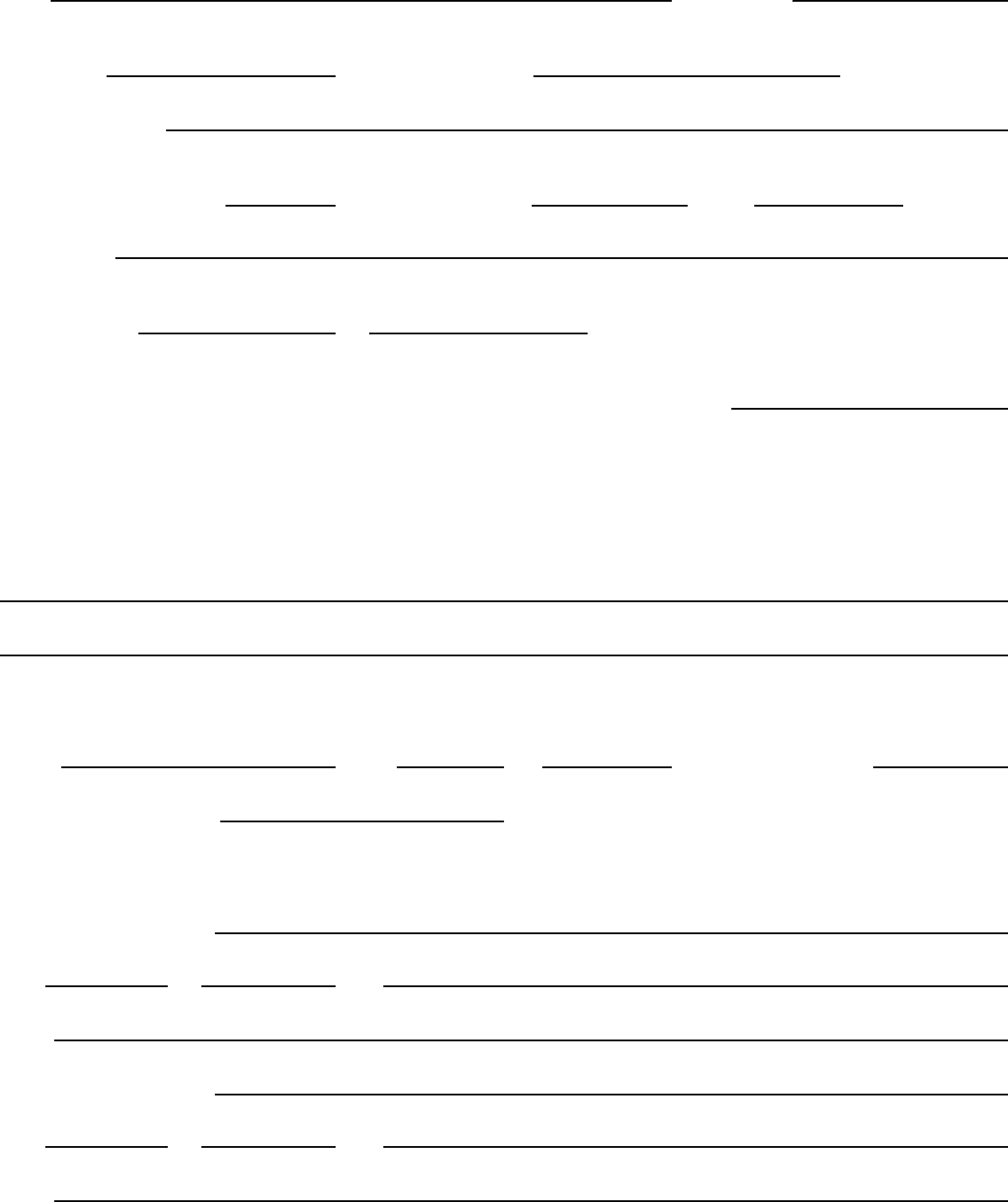

HISTORY OF BUSINESS

Nature of Business

Types of Products/Services

Customer Profile

List Key Customers List Major Competitors

Major Past Accomplishments

Future Plans for Growth/Expansion

How will this loan benefit your company?

Will the funding of this loan create new employment opportunities? If so, state how:

(Use separate attachments to answer questions if necessary)

ESTIMATED PROJECT COSTS

Land acquisition $

New building construction $

Land and building acquisition $

Building improvements or repairs $

Acquisition of machinery/equipment $

Inventory purchase $

Working capital (including accounts payable) $

Acquisition of all or part of an existing business $

Payoff bank loan $

Other debt payment $

Franchise fee $

Closing costs (approximately 5% of the loan amount $

Cost overrun contingency (usually 10% of project cost, as a minimum) $

TOTAL PROJECT AMOUNT $

LESS OWN CASH/EQUITY TO BE INJECTED $< >

TOTAL LOAN REQUESTED FOR PROJECT $

NOTE:

If you are purchasing a business, please provide a copy of the buy-sell agreement, including a list of assets being

purchased and their approximate values.

If you are purchasing real estate, please provide a copy of the sales contract.

If you are constructing a building, please provide a copy of the plans and contracts/bids for work. Please note: you will

probably need to use a registered “Class A” contractor.

If you are refinancing loans, credit lines and/or credit cards, please provide the interest rate, term, monthly payment,

collateral, and any other pertinent information.

If you are purchasing a franchise, please provide a copy of the franchise agreement and Virginia franchise circular.

Comments:

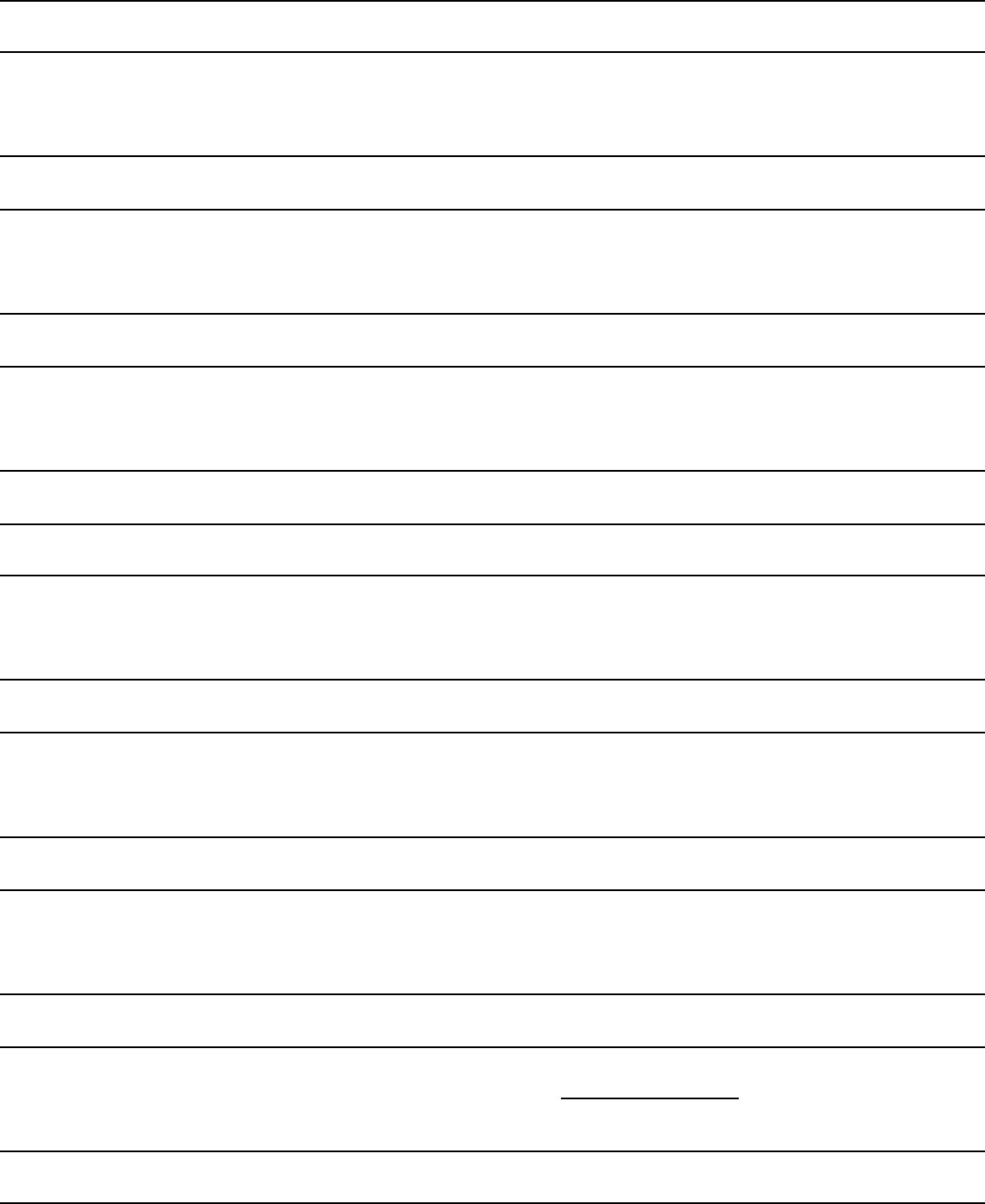

PROFIT & LOSS PROJECTIONS

Applicant’s Name

YEAR #1 YEAR #2 YEAR #3

$ % $ % $ %

($000’S)

INCOME

Gross Receipts

Cost of Goods Sold

GROSS PROFIT

EXPENSES

Officer Salaries

(if a corporation)

Employee Wages

Accounting & Legal Fees

Advertising

Rent

Depreciation

Supplies

Electricity

Telephone

Interest

Repairs

Taxes

Insurance

Bad Debts

Miscellaneous

Other (explain)

TOTAL EXPENSES

NET PROFIT BEFORE TAXES

LESS: INCOME TAXES

NET PROFIT AFTER TAXES

LESS: WITHDRAWALS

(if proprietorship or partnership)

REMAINING NET PROFIT

FOR LOAN REPAYMENT

Note: please attach assumptions upon which the income and expenses were calculated.

I Certify the foregoing data represents the potential annual earnings , to the best of my knowledge.

SIGNATURE TITLE DATE

BUSINESS INDEBTEDNESS WORKSHEET

Please furnish the following information on all installment debts, credit cards,

mortgages, lines of credit or other financing. Indicate by an asterisk if the items are to

be paid by this financing request. Use additional sheets if necessary.

To Whom Payable

Original

Amount

Original

Date

Current

Balance

Interest

Rate

Maturity

Date

Monthly

Payment Security

Current

or Past

Due

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #

Acct. #