Fillable Printable Small Business Loan Application - TD Bank

Fillable Printable Small Business Loan Application - TD Bank

Small Business Loan Application - TD Bank

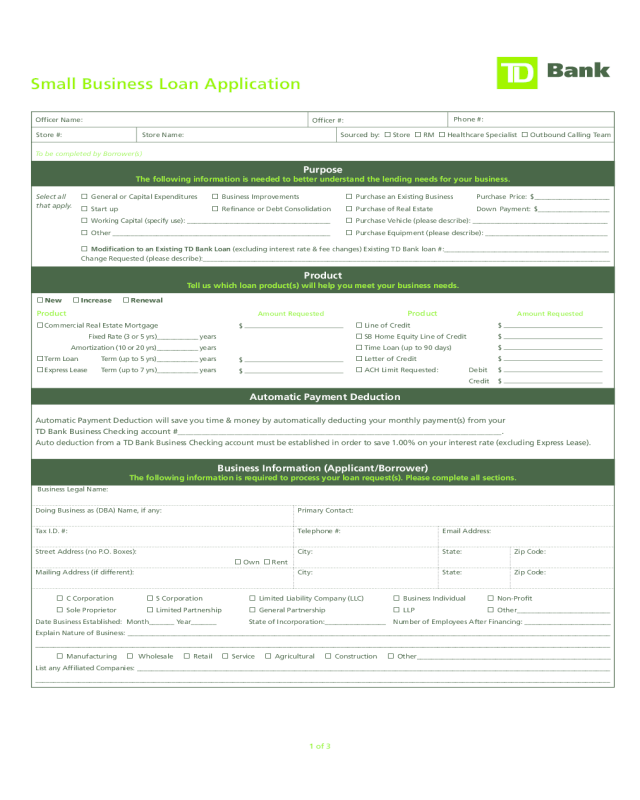

Small Business Loan Application

Purpose

The following information is needed to better understand the lending needs for your business.

Modification to an Existing TD Bank Loan (excluding interest rate & fee changes) Existing TD Bank loan #:______________________________________________

Change Requested (please describe):_______________________________________________________________________________________________________________

Select all

that apply.

General or Capital Expenditures Business Improvements Purchase an Existing Business Purchase Price: $_____________________

Start up Refinance or Debt Consolidation Purchase of Real Estate Down Payment: $____________________

Working Capital (specify use):

________________________________________ Purchase Vehicle (please describe): _____________________________________

Other

____________________________________________________________

Purchase Equipment (please describe): __________________________________

Automatic Payment Deduction

Automatic Payment Deduction will save you time & money by automatically deducting your monthly payment(s) from your

TD Bank Business Checking account #_______________________________________________________________________________.

Auto deduction from a TD Bank Business Checking account must be established in order to save 1.00% on your interest rate (excluding Express Lease).

Amount Requested

$

$

$

$

$

$

Amount Requested

$

$

$

Product

Line of Credit

SB Home Equity Line of Credit

Time Loan (up to 90 days)

Letter of Credit

ACH Limit Requested: Debit

Credit

Officer Name:

Store #:

Sourced by: Store RM Healthcare Specialist Outbound Calling Team

Phone #:

C Corporation S Corporation Limited Liability Company (LLC) Business Individual Non-Profit

Sole Proprietor Limited Partnership General Partnership LLP Other__________________________

Date Business Established: Month_______ Year_______ State of Incorporation:_________________ Number of Employees After Financing: ________________________

Explain Nature of Business: _______________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________________

Manufacturing Wholesale Retail Service Agricultural Construction Other______________________________________________________

List any Affiliated Companies: ____________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________________

Business Legal Name:

Doing Business as (DBA) Name, if any: Primary Contact:

Tax I.D. #: Telephone #: Email Address:

Street Address (no P.O. Boxes): City: State: Zip Code:

Mailing Address (if different): City: State: Zip Code:

Own Rent

Officer #:

Store Name:

1 of 3

Product

Tell us which loan product(s) will help you meet your business needs.

Business Information (Applicant/Borrower)

The following information is required to process your loan request(s). Please complete all sections.

To be completed by Borrower(s)

New Increase Renewal

Product

Commercial Real Estate Mortgage

Fixed Rate (3 or 5 yrs)____________ years

Amortization (10 or 20 yrs)____________ years

Term Loan Term (up to 5 yrs)____________ years

Express Lease Term (up to 7 yrs)____________ years

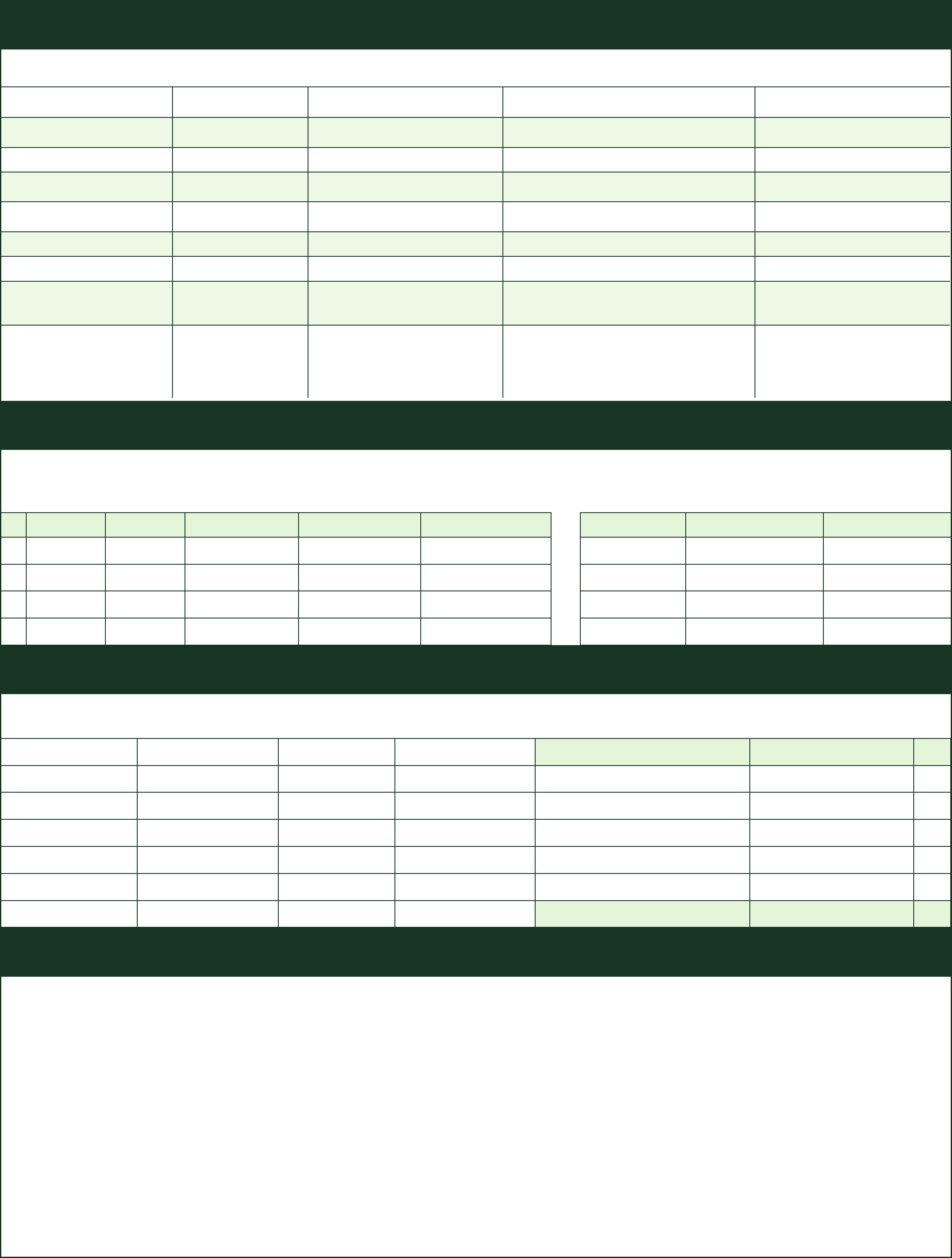

Collateral Current Value Current Lien(s)

Describe Collateral

(If real estate also provide address)

Owner Name(s)

TD Bank

CD Savings

$___________________

Marketable Securities

$___________________

Equipment

New Used

$___________________

Vehicle

New Used

$___________________

Accounts Receivable

$___________________

Inventory

$___________________

Owner Occupied Real Estate

Residential

Commercial

$___________________

Investment Real Estate

Residential

Commercial

Mixed Use

Other

$___________________

Business Obligations Business Deposit Relationships

*

Creditor Loan Type Current Balance Monthly Payment Collateral Deposit Type Bank Name Current Balance

$ $

CHK SAV

$

$ $

CHK SAV

$

$ $

CHK SAV

$

$ $

CHK SAV

$

Please provide details on an additional page to any question with a YES response.

Yes No 1. Is the applicant party to any lawsuit or subject to outstanding judgments?

Yes No 2. Is the applicant party to taxes or credit obligations past due?

Amount: $____________________ Payable to: __________________________________________________________________________________________

Yes No 3. Has the applicant ever filed personal bankruptcy or served as an officer in a company that declared bankruptcy?

Yes No 4. Is the applicant presently under indictment or probation or parole, or ever been charged or convicted for any criminal offense other than

a minor motor vehicle violation?

Yes No 5. Is the applicant a political party, a campaign, a candidate, a public official or foreign political official or an immediate family member of

such an official, or a business entity formed by or for the benefit of any public official.

If yes, name, relationship, & position of official: ______________________________________________________________________________________

Yes No 6. Is the applicant or an owner an employee of TD Bank, N.A. or one of its affiliates?

If yes, name of employee: __________________________________________________________________________________________________________

Yes No 7. Is the applicant engaged in Internet Gambling?

If yes, what type of Internet Gambling does the applicant participate in? _______________________________________________________________

Include all business loans & business deposit relationships (including existing accounts with TD Bank). Do not include rent on office space or other facilities.

(Attach additional sheets if necessary.) *Please indicate in the first column below which obligations are being refinanced with this application.

CHECK ONLY the following collateral that is being offered to secure your Small Business loan request(s). Current Value, Lien(s), description & owner name(s)

are required for all pledged collateral.

Collateral to Secure your Small Business Loan

The following information will help us better understand the assets being pledged to secure your business loan request(s).

Business Obligations/Deposit Relationships

The following information is required to process your application & will help us get a complete view of your current banking relationships.

Business Financials

The following information provides us details about the financial background of your business.

Declarations

The following questions are required to process your Small Business loan request.

Cash $ Accounts Payable $ GROSS SALES/REVENUE $ (+)

Accounts Receivable $ Notes Payable $ Cost of Goods Sold $ (-)

Inventory $ Credit Card Debt $ Owner’s Salary $ (-)

Machinery/Equipment $ Automotive Loans $ Interest Expense $ (-)

Automobiles $ Mortgages $ Depreciation $ (-)

Real Estate $ Other $ Remaining Expense $ (-)

Other $ BUSINESS NET INCOME / (NET LOSS) $ (=)

Business Financials (Applicant/Borrower)

Balance Sheet as of: ____/_____/_____

Income as reported on

most recent tax return fiscal year ending: _____/_____/_____

2 of 3

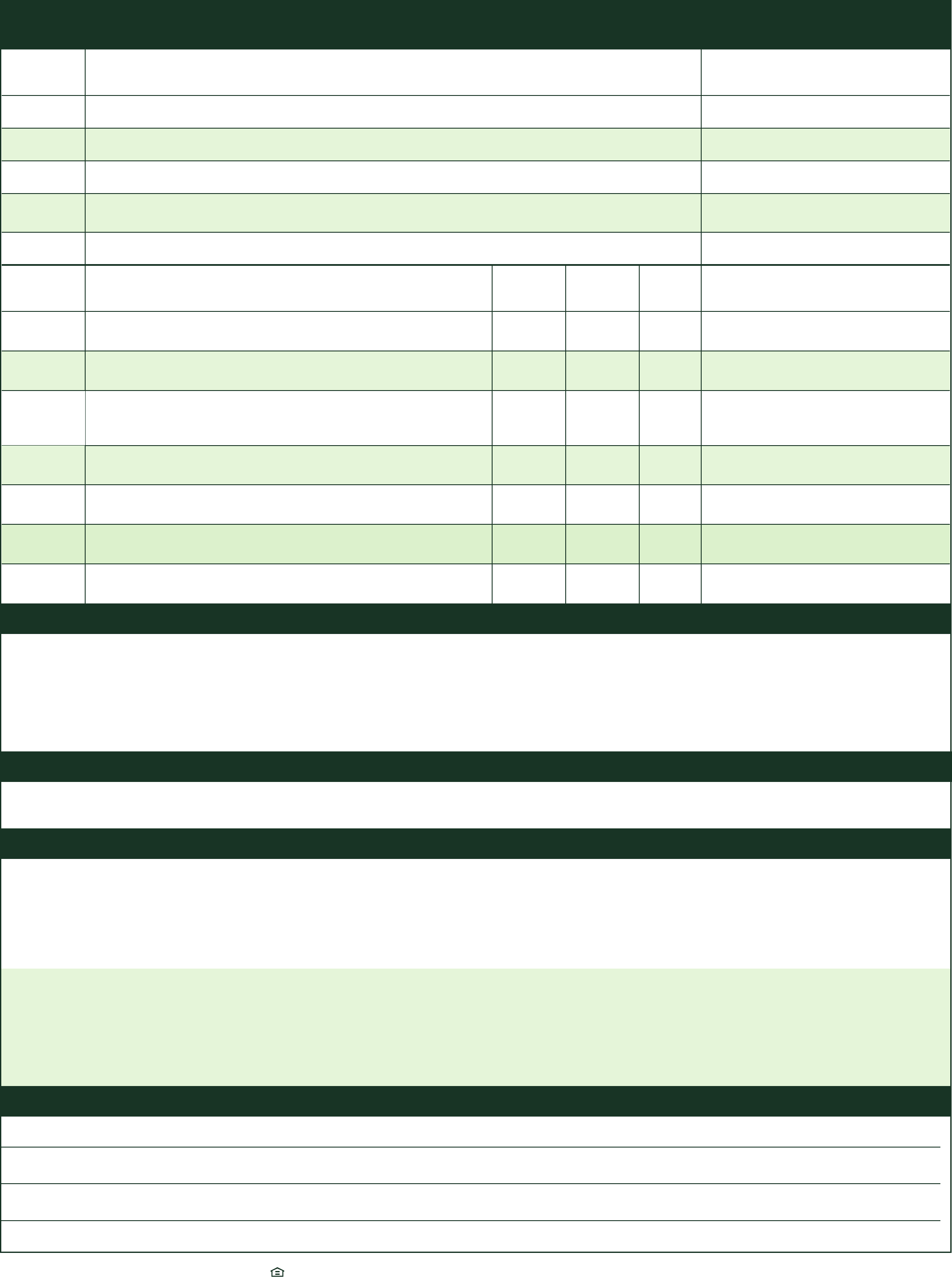

Owner/Guarantor:

Form of ID: ID Number: Expiration Date:

Signature of Employee Verifying ID: X

The undersigned certifies that I intend to apply for Credit in the manner indicated in this application and certify that everything stated in this application and on any attachment is correct. The Lender may keep this application

whether or not it is approved. I certify that the credit being applied for will be used for business purposes. My signature also certifies that the information on this application and all supporting documents is true, that

my intent is to apply for business purpose credit in which the use of the proceeds will not be used to secure a dwelling or for home improvements, and that I am aware that this application is not a commitment to lend.

Applicant may be required to submit additional information to process this request for credit. My signature authorizes and requests Lender to share the information provided on this application, together with the results

of this investigation of the credit and financial condition of the company and each applicant, with the U.S. Small Business Administration (“SBA”) and/or TD Equipment Finance Inc. (“Lessor”) in order to allow Lender and

Lessor to offer the credit product best suited to the company and each of the owner’s/guarantor’s financing needs.

Representation

Name of Business (please print)

___________________________________________________________________________________________________________________________________________________________

Name of Authorized Signer (please print) Authorized Signature

___________________________________________________________________

X______________________________________________________ Date_______/_______/_______

Credit Application Checklist

Bank Employee must initial next to each line item to validate that they have supplied the required documentation. If any items are omitted reasons why must be included.

Other Products & Services

3 of 3

No Yes Would you like to apply for Overdraft Protection for your TD Bank Business Checking account? If yes, please provide your

TD Bank Business Checking account

#: __________________________________________________________________________________________.

If your request for overdraft protection is approved you may enter into the Bank’s Small Business Overdraft Protection Agreement.

No Yes Would you like to learn more about TD Digital Express for Small Business, a Remote Deposit Capture service which allows you to make check

deposits by scanning checks to be deposited without ever leaving your office?

Bank

Employee

initials

Required Documentation Reason for Omission

__

Small Business Loan Application – Completed, signed & dated.

__

Attached sheet providing details to Declaration questions answered YES on page 2.

__

Copy of Purchase & Sales Agreement/Bill of Sale, if applicable.

__

For investment real estate transactions, a schedule of all property owned showing year purchased,

purchase price, outstanding loans & payments, & gross rents & expenses.

__

For all applicants except non-profits a Personal Financial Statement must be completed.

Bank

Employee

initials

Required Financial Documentation

$50,000.01–

$100,000

$100,000.01–

$250,000

Over

$250,000

Reasons for Omission

__

One (1) year current business federal tax return (complete with

all schedules) or Accountant prepared Financial Statement.

X

__

One (1) year personal federal tax return - Complete with all

schedules for each guarantor.

X X

__

Interim YTD business financial statement (balance sheet &

income statement) if the application date is more than

(six) 6 months beyond fiscal year end.

X X

__

Two (2) year current business federal tax return (complete with

all schedules) or Accountant prepared Financial Statement.

X

__

Accounts Receivable aging report if loan is for working capital

purposes or secured by accounts receivable.

X X

__

Two (2) year personal federal tax return - Complete with

all schedules for each guarantor.

X

__

Three (3) year current business federal tax return (complete with

all schedules) or Accountant prepared Financial Statement.

X

Bank deposits FDIC insured. | TD Bank, N.A. | Equal Housing Lender

62-16214 (12/13)

We may order an appraisal to determine the property’s value and charge you for this appraisal. In the event the property is a 1 to 4 family residential

property, we will promptly give you a copy of any such appraisal, even if your loan does not close.

Right to a Copy of Appraisal

To Be Completed By Bank Employee