Fillable Printable Sole Custody Worksheet - Colorado

Fillable Printable Sole Custody Worksheet - Colorado

Sole Custody Worksheet - Colorado

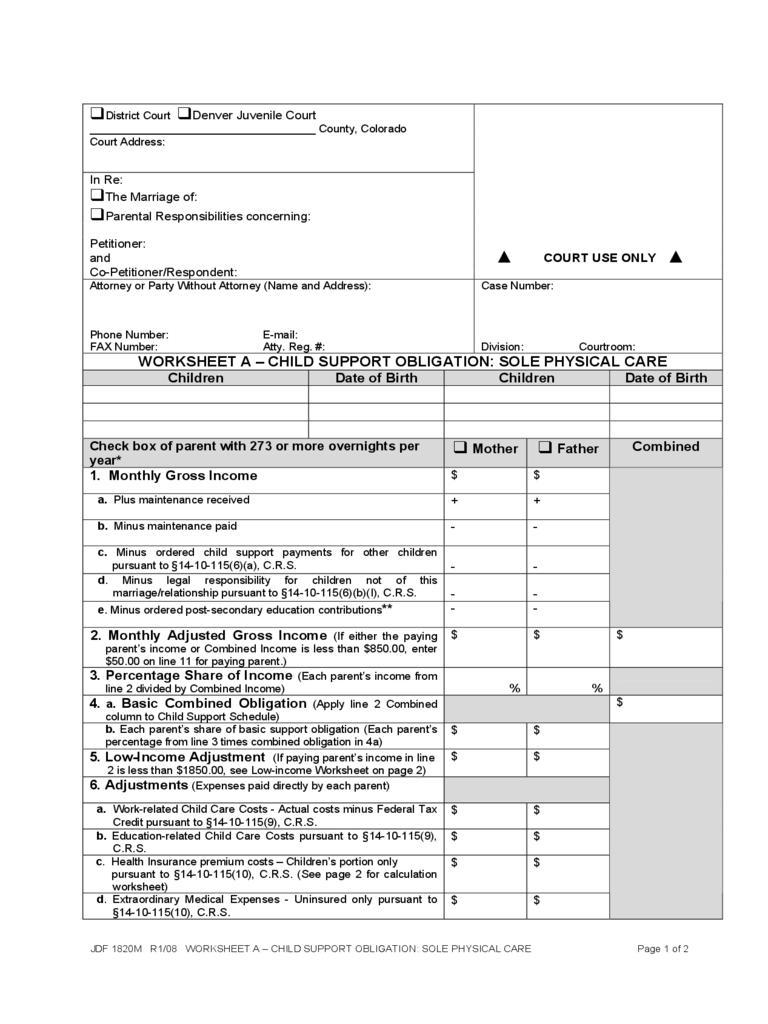

JDF 1820M R1/08 WORKSHEET A – CHILD SUPPORT OBLIGATION: SOLE PHYSICAL CARE Page 1 of 2

District Court Denver Juvenile Court

____________________________________ County, Colorado

Court Address:

In Re:

The Marriage of:

Parental Responsibilities concerning:

Petitioner:

and

Co-Petitioner/Respondent:

COURT USE ONLY

Attorney or Party Without Attorney (Name and Address): Case Number:

Phone Number: E-mail:

FAX Number: Atty. Reg. #: Division: Courtroom:

WORKSHEET A – CHILD SUPPORT OBLIGATION: SOLE PHYSICAL CARE

Children Date of Birth Children Date of Birth

Check box of parent with 273 or more overnights per

year*

Mother Father

Combined

1. Monthly Gross Income

$ $

a. Plus maintenance received

+ +

b. Minus maintenance paid

- -

c. Minus ordered child support payments for other children

pursuant to §14-10-115(6)(a), C.R.S.

-

-

d. Minus legal responsibility for children not of this

marriage/relationship pursuant to §14-10-115(6)(b)(I), C.R.S.

-

-

e. Minus ordered post-secondary education contributions**

- -

2. Monthly Adjusted Gross Income (If either the paying

parent’s income or Combined Income is less than $850.00, enter

$50.00 on line 11 for paying parent.)

$ $ $

3. Percentage Share of Income (Each parent’s income from

line 2 divided by Combined Income)

%

%

4. a. Basic Combined Obligation (Apply line 2 Combined

column to Child Support Schedule)

$

b. Each parent’s share of basic support obligation (Each parent’s

percentage from line 3 times combined obligation in 4a)

$ $

5. Low-Income Adjustment (If paying parent’s income in line

2 is less than $1850.00, see Low-income Worksheet on page 2)

$ $

6. Adjustments (Expenses paid directly by each parent)

a. Work-related Child Care Costs - Actual costs minus Federal Tax

Credit pursuant to §14-10-115(9), C.R.S.

$ $

b. Education-related Child Care Costs pursuant to §14-10-115(9),

C.R.S.

$ $

c. Health Insurance premium costs – Children’s portion only

pursuant to §14-10-115(10), C.R.S. (See page 2 for calculation

worksheet)

$ $

d. Extraordinary Medical Expenses - Uninsured only pursuant to

§14-10-115(10), C.R.S.

$ $

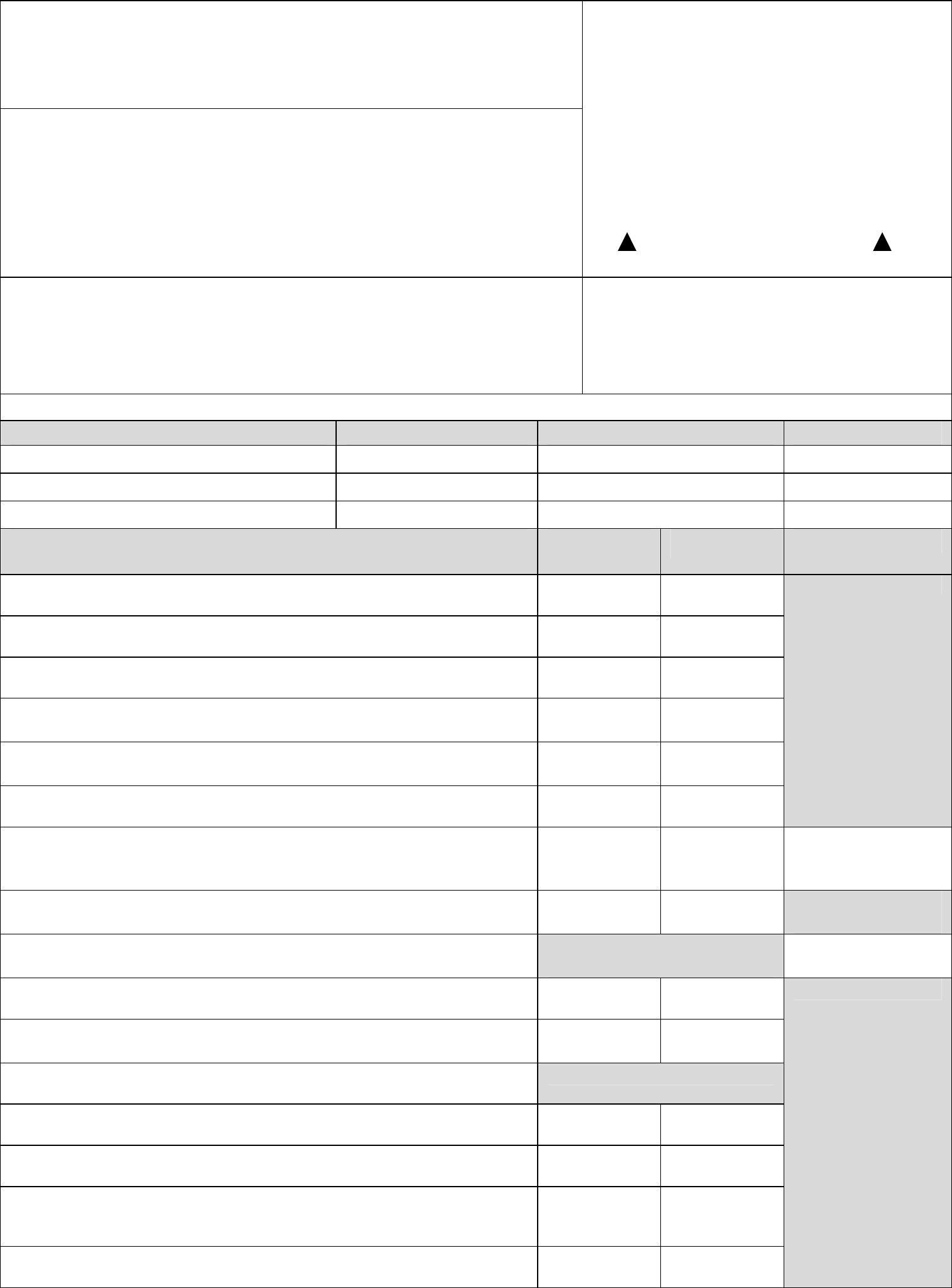

JDF 1820M R1/08 WORKSHEET A – CHILD SUPPORT OBLIGATION: SOLE PHYSICAL CARE Page 2 of 2

e. Extraordinary Expenses - Agreed to by parents or by order of

the Court pursuant to §14-10-115(11)(a), C.R.S.

$ $

f. Minus Extraordinary Adjustments pursuant to §14-10-115(11)(b),

C.R.S.

$ $

7. Total Adjustments (For each column, add 6a, 6b, 6c, 6d and

6e. Subtract line 6f then add two totals for Combined column

amount

)

$ $ $

8. Each Parent’s Fair Share of Adjustments (Line 7

Combined column times line 3 for each parent)

$ $

9. Each Parent’s Share of Total Child Support

Obligation

(Add lines 4b (or line 5 if less) and line 8 for each

parent)

$ $

10. Paying Parent’s Adjustment (Enter line 7 for parent

with less parenting time only)

$ $

11. Recommended Child Support Order (Subtract line 10

from line 9 for the paying parent only. Leave receiving parent

column blank)

$ $

Comments:

*The children reside with one parent for 273 or more overnights per year. If this is not the case, use Worksheet B.

**This adjustment applies only to modification of child support orders entered between 7/1/91 and 7/1/97 that provide

for post-secondary education expenses pursuant to § 14-10-115(15)(c), C.R.S.

Prepared by:

Signature: ________________________________Print Name: ___________________________

Date:

Low-Income Adjustment Worksheet

If the parents’ combined monthly adjusted gross income is more than $850.00 and the monthly adjusted gross income

of the parent with fewer overnights per year is less than $1850.00, use this calculation worksheet to determine the

adjustment allowed for that parent.

Low-income Adjustment Calculation

Adjusted monthly gross income of parent with fewer overnights (paying parent) from line 2

$ minus $900.00 = $ times 40% (.40) = $

Plus one of the following, according to number of children

1 child = $75.00 2 children = $150.00 3 children = $225.00

4 children = $275.00 5 children = $325.00 6 or more children = $350.00 + $

Low-income adjustment amount (#5 on worksheet) $

If this amount is less than the amount on line 4b (on page 1) for the parent with fewer overnights per year, this parent

qualifies for the Low-income Adjustment. Enter this amount on line 5 in that parent’s column on page 1. If this

number is a negative or zero, enter zero.

Heath Insurance Premium Calculation

If the actual amount of the health insurance premium that is attributable to the child(ren) who are the subject of

this order is not available or cannot be verified, the total cost of the premium should be divided by the number of

persons covered by the policy to determine a per person cost. This amount is then multiplied by the number of

children who are the subject of this order and are covered by the policy. This amount is then entered on line 6c on

page 1 of this form.

$ ÷ = $ x =

Total Number of Per Person Cost Number of Children’s Portion of

Premium Persons Covered Children Who Cost of Health

by the Policy Are the Subject Insurance Premium

of this Order (Enter on line 6c)