Fillable Printable Spousal Consent Form - Miami

Fillable Printable Spousal Consent Form - Miami

Spousal Consent Form - Miami

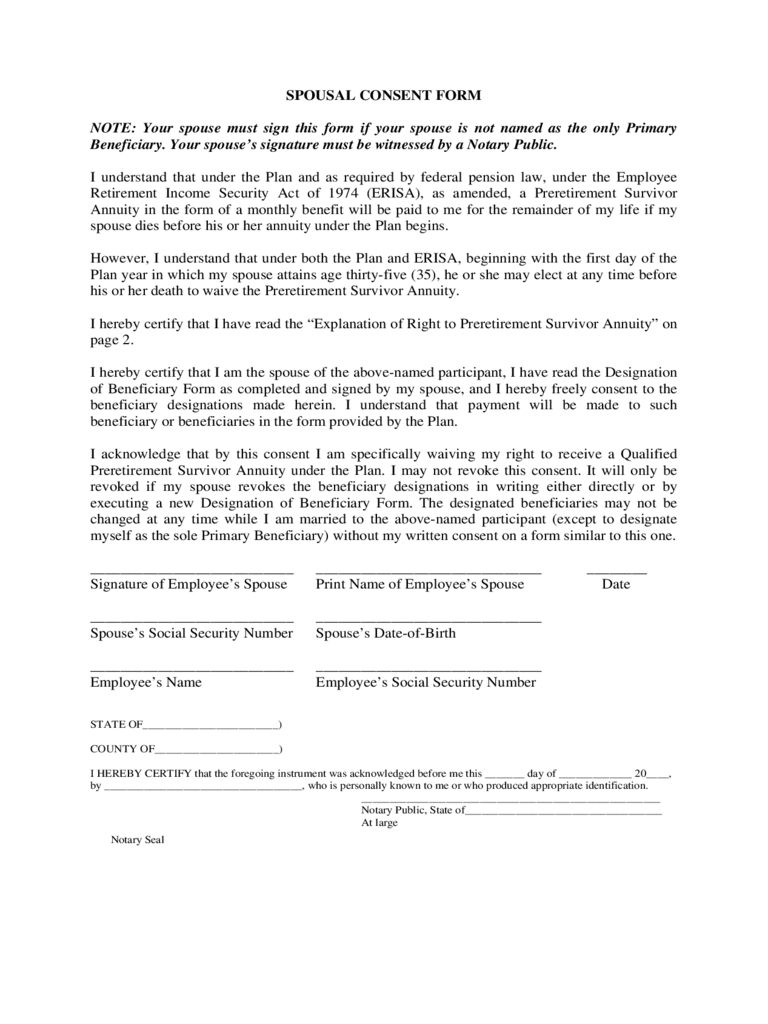

SPOUSAL CONSENT FORM

NOTE: Your spouse must sign this form if your spouse is not named as the only Primary

Beneficiary. Your spouse’s signature must be witnessed by a Notary Public.

I understand that under the Plan and as required by federal pension law, under the Employee

Retirement Income Security Act of 1974 (ERISA), as amended, a Preretirement Survivor

Annuity in the form of a monthly benefit will be paid to me for the remainder of my life if my

spouse dies before his or her annuity under the Plan begins.

However, I understand that under both the Plan and ERISA, beginning with the first day of the

Plan year in which my spouse attains age thirty-five (35), he or she may elect at any time before

his or her death to waive the Preretirement Survivor Annuity.

I hereby certify that I have read the “Explanation of Right to Preretirement Survivor Annuity” on

page 2.

I hereby certify that I am the spouse of the above-named participant, I have read the Designation

of Beneficiary Form as completed and signed by my spouse, and I hereby freely consent to the

beneficiary designations made herein. I understand that payment will be made to such

beneficiary or beneficiaries in the form provided by the Plan.

I acknowledge that by this consent I am specifically waiving my right to receive a Qualified

Preretirement Survivor Annuity under the Plan. I may not revoke this consent. It will only be

revoked if my spouse revokes the beneficiary designations in writing either directly or by

executing a new Designation of Beneficiary Form. The designated beneficiaries may not be

changed at any time while I am married to the above-named participant (except to designate

myself as the sole Primary Beneficiary) without my written consent on a form similar to this one.

___________________________ ______________________________ ________

Signature of Employee’s Spouse Print Name of Employee’s Spouse Date

___________________________ ______________________________

Spouse’s Social Security Number Spouse’s Date-of-Birth

___________________________ ______________________________

Employee’s Name Employee’s Social Security Number

STATE OF________________________)

COUNTY OF______________________)

I HEREBY CERTIFY that the foregoing instrument was acknowledged before me this _______ day of _____________ 20____,

by ___________________________________, who is personally known to me or who produced appropriate identification.

_____________________________________________________

Notary Public, State of___________________________________

At large

Notary Seal

Explanation of Right to Preretirement Survivor Annuity

The law requires that you be informed about benefits under the Retirement Plan for Employees

of the University of Miami (the “Plan”) which may become payable if you die before retirement.

Generally, if you are married and if you die before payment of benefits under the Plan has begun,

federal law requires that the value of any benefits otherwise payable under the Plan be paid in the

form of a Preretirement Survivor Annuity to your spouse. This is an annuity form of payment

providing your spouse with a series of monthly payments over his or her life. The precise dollar

amount of the annuity will depend upon the value of your vested benefit under the Plan and your

and your spouse’s ages.

However, beginning with the first day of the Plan year in which you attain age 35, you may elect

at any time before your death to waive the Preretirement Survivor Annuity by designating

someone other than your spouse to be your beneficiary for some or all of the benefits payable

under the Plan as a result of your death.

In order for any such election to be valid, however, your spouse must consent in writing to any

waiver that you elect. In addition, your spouse’s consent must be witnessed by a notary public. If

you are not married, or if your spouse cannot be located or is otherwise unavailable, written

spousal consent may not be necessary if you are able to establish such facts or circumstances to

the satisfaction of the Plan Administrator. Also, if the present value of the Preretirment Survivor

Annuity is $3,500 or less, the value of such annuity will be immediately distributed in a lump

sum to your spouse.

You may revoke any waiver anytime before your death by designating your spouse as the sole

beneficiary, and, if you do, the Preretirement Survivor Annuity will be restored for your spouse

unless you properly make a new waiver election prior to your death.

It is important that you and your spouse understand your rights and obligations concerning the

Plan benefit in the event of your death. You should direct any questions to the Plan

Administrator. Also, because a spouse has certain rights to the Plan benefit upon your death, you

should immediately inform the Plan Administrator of any change in your marital status.