Fillable Printable Statutory Declaration of Taxation - Australia

Fillable Printable Statutory Declaration of Taxation - Australia

Statutory Declaration of Taxation - Australia

WHEN TO COMPLETE THIS

STATUTORY DECLARATION

Have you attempted to obtain the following from your payer?

n Your payment summary.

n A copy of your payment summary.

n A letter stating details of your income and the amount

oftax withheld.

If you have not attempted to obtain this information,

youshould do so before proceeding any further.

You should complete this statutory declaration when you

cannotobtain orlocate the following payment summaries:

n PAYG payment summary – individual non‑business

(NAT 0046)

n PAYG payment summary – employment termination payment

(NAT 70868)

n PAYG payment summary – superannuation lump sum

(NAT 70947)

n PAYG payment summary – superannuation income stream

(NAT 70987).

Payment summary information may

beavailableinpre‑lling service

Payment summary information is generally available through the

pre-filling service in e‑tax or by contacting your tax agent. If your

information is not available in the pre-filling service, and you do

not have your payment summary, you should complete this

statutory declaration.

For more information on the pre-filling service, visit our

website at www.ato.gov.au/etaxprefilling

MAKING A STATUTORY DECLARATION

You can make a declaration if you are an individual person

and the declaration relates to your own income tax return.

n Use a separate declaration for each income year

(1 July to 30 June).

n Use a separate declaration for each payment summary.

n Complete all the relevant sections. Ensure all details

about your payments and the amounts withheld are included.

If you do not complete all the details, you may not be allowed

a credit for the amount that was withheld from your payments

when your tax return is processed. If you do not know the

required details, print ‘UNKNOWN’.

WHAT TO DO WITH YOUR

COMPLETED DECLARATION

Use the information in this declaration to complete your

tax return or amendment request. If you do not have to lodge

this declaration, you must keep it with your records.

If you have any documents showing amounts were

withheld from payments you received (for example, payslips,

pay envelopes or time sheets), keep those documents with

this declaration.

You do not have to lodge this declaration with your tax return

or amendment request unless you have completed it in place

of the ETP payment summary (NAT 2605) for 2007 and prior

financial years.

PRIVACY

We are authorised by the Income Tax Assessment Act 1936 to

ask for the information on this form. We need this information to

help us correctly identify your records. Where authorised by law,

we may give this information to other government agencies that

administer laws relevant to your particular situation. It is not an

offence not to quote your tax file number (TFN).

If at any time you find your payment summary, and the

amounts shown on it are the same as the amounts you are

claiming on this declaration, keep the payment summary

with your records. However, if any of the amounts shown on

your payment summary are different to the amounts you are

claiming on this declaration, you must use the payment

summary amounts on your tax return.

If you have already lodged your tax return, you must

request an amendment. To do this, write to us and ask us

to replace the amount you have already claimed with the

amount shown on the payment summary.

Write to us at:

Australian Taxation Office

PO Box 3004

PENRITH NSW 2740

Statutory declaration

NAT 4135–11.2012

MAKING AND SIGNING THE DECLARATION

Under the Statutory Declarations Act 1959, you can make

a declaration before:

n a person who is currently licensed or registered under a

law to practise in one of the following occupations

– chiropractor

– dentist

– legal practitioner

– medical practitioner

– nurse

– optometrist

– patent attorney

– pharmacist

– physiotherapist

– psychologist

– trade marks attorney, or

– veterinary surgeon

n a person who is enrolled on the Supreme Court roll of a

State or Territory or the High Court of Australia as a legal

practitioner (however described), or

n one of the following people

– an agent of the Australian Postal Corporation who is in

charge of an office supplying postal services to the public

– an Australian Consular Officer or Australian Diplomatic

Officer (within the meaning of the Consular Fees Act 1955)

– a bailiff

– a bank officer with five or more continuous years of service

– a building society officer with five or more years of

continuous service

– a chief executive officer of a Commonwealth court

– a clerk of a court

– a Commissioner for Affidavits

– a Commissioner for Declarations

– a credit union officer with five or more years of

continuous service

– an employee of the Australian Trade Commission who is

- in a country or place outside Australia

- authorised under paragraph 3(d) of the Consular Fees

Act 1955, and

- exercising his or her function in that place

– an employee of the Commonwealth who is

- in a country or place outside Australia

- authorised under paragraph 3(c) of the Consular Fees

Act 1955, and

- exercising his or her function in that place

– a fellow of the National Tax Accountants’ Association

– a finance company officer with five or more years of

continuous service

– a holder of a statutory office not specified in another item

in this list

– a judge of a court

– a Justice of the Peace

– a magistrate

– a marriage celebrant registered under Subdivision C of

Division 1 of Part IV of the Marriage Act 1961

– a master of a court

– a member of Chartered Secretaries Australia

– a member of Engineers Australia, other than at the

grade of student

– a member of the Association of Taxation and

Management Accountants

– a member of the Australasian Institute of Mining

and Metallurgy

– a member of the Australian Defence Force who is

- an officer

- a non-commissioned officer within the meaning of

the Defence Force Discipline Act 1982 with 5 or

more years of continuous service, or

- a warrant officer within the meaning of that Act

– a member of the Institute of Chartered Accountants in

Australia, the Australian Society of Certified Practising

Accountants or the National Institute of Accountants

– a member of

- the Parliament of the Commonwealth

- the Parliament of a State

- a Territory legislature, or

- a local government authority of a state or territory

– a minister of religion registered under Subdivision A

of Division 1 of Part IV of the Marriage Act 1961

– notary public

– a permanent employee of the Australian Postal Corporation

with five or more years of continuous service who is

employed in an office supplying postal services to the public

– a permanent employee of one of the following with five or

more years of continuous service who is not specified in

another item in this list

- the Commonwealth or a Commonwealth authority

- a state or territory or a state or territory authority, or

- a local government authority

– a person before whom a statutory declaration may be

made under the law of the state or territory in which the

declaration is made

– a police officer

– a registrar or deputy registrar of a court

– a senior executive service employee of

- the Commonwealth or a Commonwealth authority, or

- a state or territory or a state or territory authority

– a sheriff

– a sheriff’s officer, or

– a teacher employed on a full-time basis at a school or

tertiary education institution.

Page 1

Sensitive (when completed)

NAT 4135–11.2012

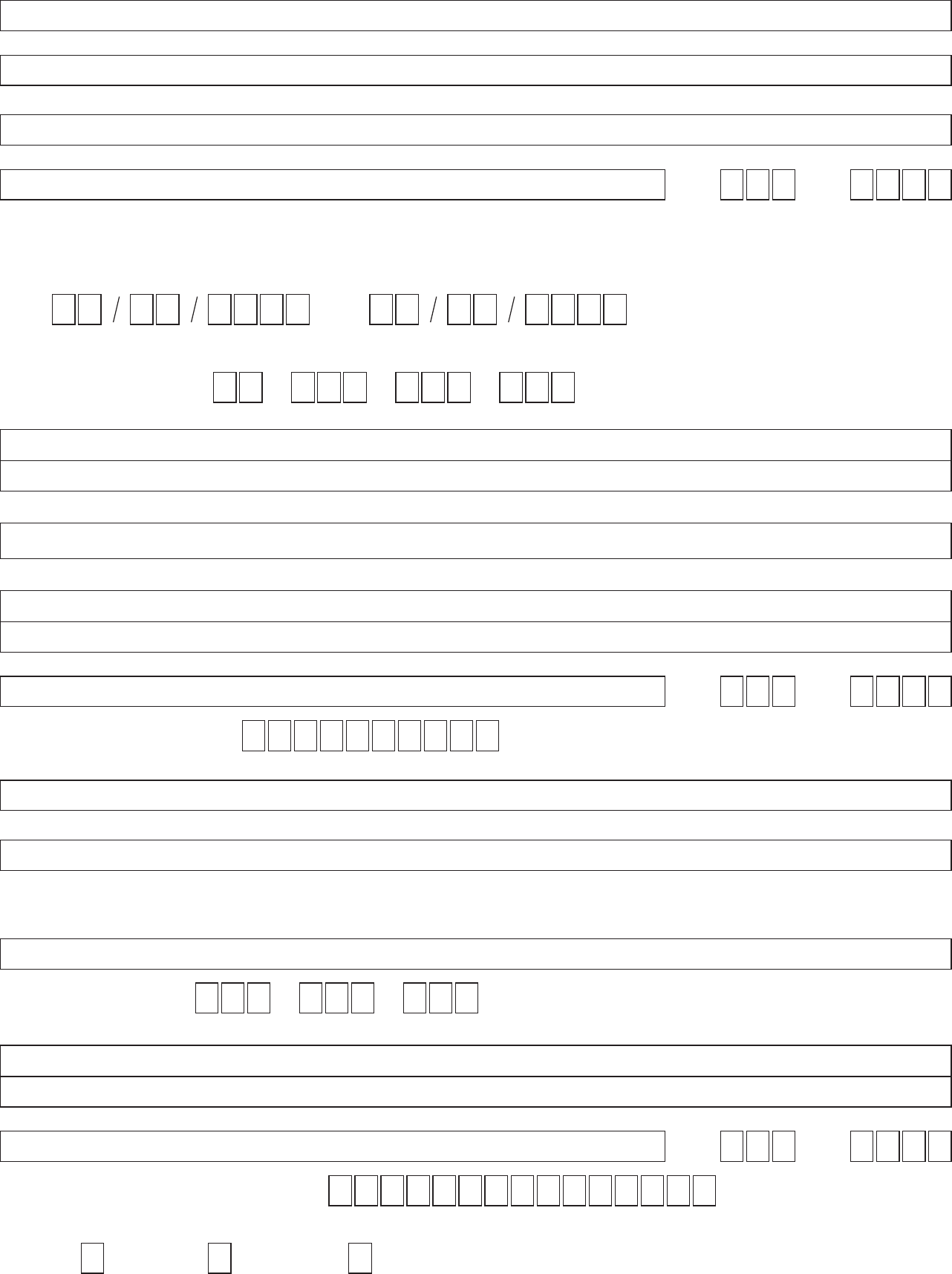

Statutory declaration

Statutory Declarations Act 1959

Your full name

Occupation

Suburb/town/locality State/territory Postcode

Address

I,

of

make the following declaration under the Statutory Declarations Act 1959:

1 I am not in possession of the payment summary for the period:

Day Month Year

From

Day Month Year

to

2 Payer details

Australian business number

Full name

Trading name (if applicable)

Full business address

Name of person who made the payments (ie payer)

Business hours phone number

Nature of business

Suburb/town/locality State/territory Postcode

3 Payment details

Name under which I was paid

My tax file number (TFN)

Location where work was performed

If the payment was made by your employer, what was the basis of your employment?

CasualPart-time Full-time

Personnel or payroll number (if applicable)

Suburb/town/locality State/territory Postcode

Page 2

Sensitive (when completed)

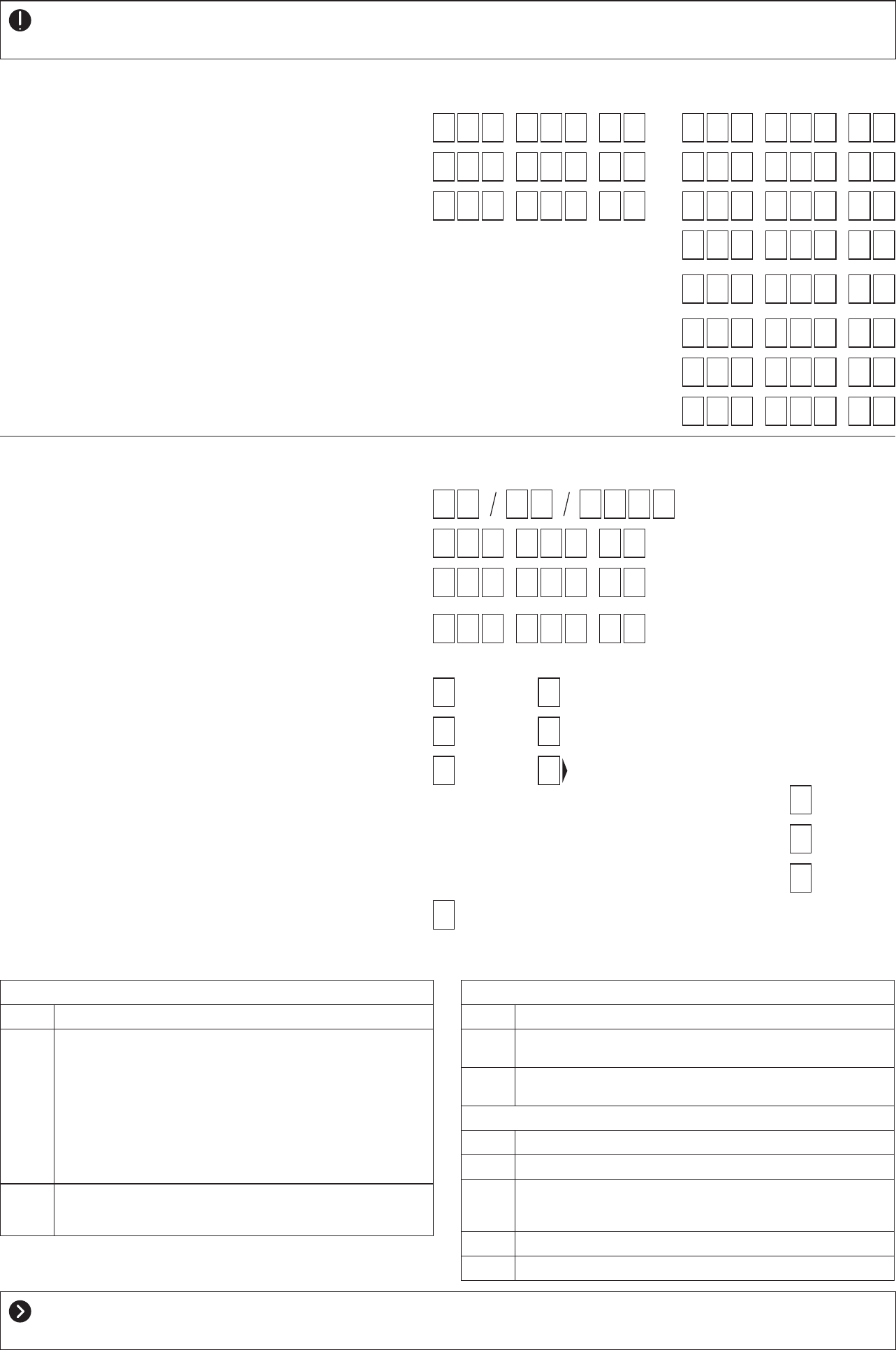

Remember, you must only complete one of the three sections on pages 2–3.

If you do not know the exact amounts, provide estimates.

Complete this section if the payment should be on a PAYG payment summary – individual non‑business

Weekly Total (1 July–30 June)

$

,

.

$

,

.

Amount of gross payments

(before any amounts were withheld)

$

,

.

$

,

.

Amount of net payments (after any amounts were withheld)

$

,

.

$

,

.

Amount of any allowances received

$

,

.

Reportable fringe benefits amount

$

,

.

Reportable employer superannuation contributions

$

,

.

Exempt foreign employment income

$

,

.

Amount of lump sum payments (other than eligible or employment

termination payments, or superannuation lump sum payments)

$

,

.

Total tax withheld from the above payments

Complete this section if the payments should be on a PAYG payment summary – employment

termination payment

$

,

.

Employment termination payment – taxable component

$

,

.

Employment termination payment – tax-free component

$

,

.

Total tax withheld from the above payments

For 2011–12 and prior financial years:

No Yes

Is this a transitional termination payment?

No Yes

Is this payment part of a payment made in an

earlier income year for the same termination?

Is this payment a death benefit? No Yes

Dependant

Indicate the type of death benefit:

Non-dependant

Trustee of deceased estate

Date of payment

Day Month Year

For 2012–13 and future financial years:

Employment termination payment (ETP) code

Read through all the codes before selecting one that describes the type of payment. If more than one code applies to the

payment, you will need to complete a separate payment summary for each code.

Life benet ETP

CODE DESCRIPTION

R

ETP made because of one of the following:

n early retirement scheme

n genuine redundancy

n invalidity

n compensation for

– personal injury

– unfair dismissal

– harassment

– discrimination

O Other ETP not described by R, for example, golden

handshake, gratuity, payment in lieu of notice, payment for

unused sick leave, payment for unused rostered days off

Multiple payments for same termination

CODE DESCRIPTION

S You made a code R payment to your employee in a

previousincome year for the same termination

P You made a code O payment to your employee in a

previousincome year for the same termination

Death benet ETP

CODE DESCRIPTION

D

Death benet ETP paid to a dependant of the deceased

B Death benet ETP paid to a non-dependant of the deceased

and you made a termination payment tothenon-dependant

in a previous income year forthesame termination

N

Death benet ETP paid to a non-dependant of the deceased

T Death benet ETP paid to a trustee of the deceased estate

For more information, refer to How to complete the PAYG payment summary – employment termination payment

(NAT70996-07.2012) on our website at www.ato.gov.au

Page 3

Sensitive (when completed)

Complete this section if the payments should be on a PAYG payment summary – superannuation lump

sum or PAYG payment summary – superannuation income stream

$

,

.

Taxable component – taxed element of a superannuation lump sum payment

$

,

.

Taxable component – untaxed element of a superannuation lump sum payment

$

,

.

Taxable component – taxed element of a superannuation income stream

$

,

.

Taxable component – untaxed element of a superannuation income stream

$

,

.

Taxable component – taxed element of a superannuation income stream lump sum

in arrears payment

$

,

.

Taxable component – untaxed element of a superannuation income stream lump sum

in arrears payment

$

,

.

Tax-free component

$

,

.

Total tax withheld from the above payments

Is this superannuation lump sum payment a death benefit? No Yes Indicate the type of death benefit:

Non-dependant

Trustee of deceased estate

I understand that a person who intentionally makes a false statement in a statutory declaration is guilty of an offence under

section 11 of the Statutory Declarations Act 1959, and I believe that the statements in this declaration are true in every particular.

Signature of person making the declaration

Declared at

on day

of

YearMonth

Before me

Signature of person before whom the declaration is made

Full name of person before whom the declaration is made

Qualification of person before whom the declaration is made

(see page 2 ‘Making and signing the declaration’)

Address of person before whom the declaration is made

Note 1 A person who intentionally makes a false statement in a statutory declaration is guilty of an offence, the

punishment for which is imprisonment for a term of 4 years – see section 11 of the Statutory Declarations Act 1959.

Note 2 Chapter 2 of the Criminal Code applies to all offences against the Statutory Declarations Act 1959 –

see section 5A of the Statutory Declarations Act 1959.

Page 4

Sensitive (when completed)