- Sample Uniform Statutory Form Power of Attorney - California

- Statutory Form Power of Attorney - New Mexico

- Statutory Power of Attorney Form - New Mexico

- Sample Power of Attorney Statutory Short Form - New York

- Statutory Short Form of General Power of Attorney - North Carolina

- Statutory Short Form Power of Attorney - Minnesota

Fillable Printable Statutory Short Form Power of Attorney - Minnesota

Fillable Printable Statutory Short Form Power of Attorney - Minnesota

Statutory Short Form Power of Attorney - Minnesota

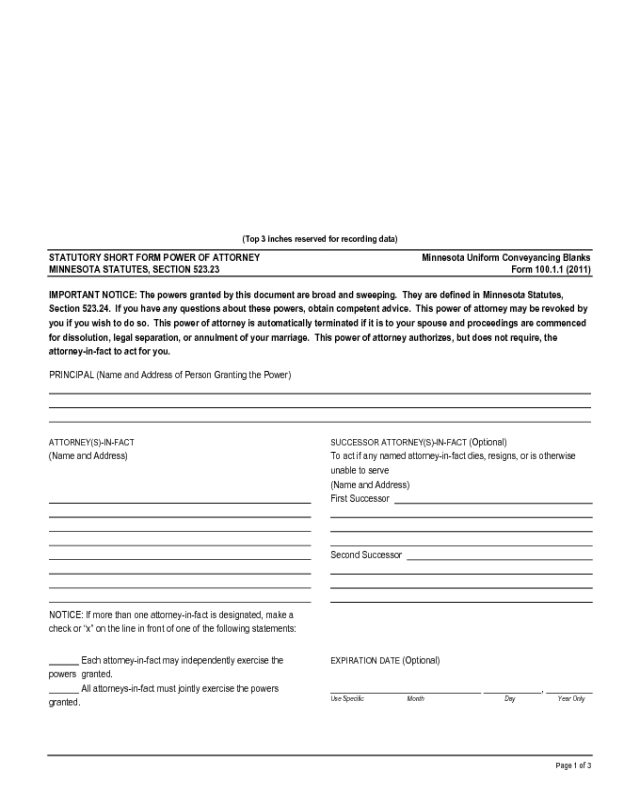

(Top 3 inches reserved for recording data)

Page 1 of 3

STATUTORY SHORT FORM POWER OF ATTORNEY

MINNESOTA STATUTES, SECTION 523.23

Minnesota Uniform Conveyancing Blanks

Form 100.1.1 (2011)

IMPORTANT NOTICE: The powers granted by this document are broad and sweeping. They are defined in Minnesota Statutes,

Section 523.24. If you have any questions about these powers, obtain competent advice. This power of attorney may be revoked by

you if you wish to do so. This power of attorney is automatically terminated if it is to your spouse and proceedings are commenced

for dissolution, legal separation, or annulment of your marriage. This power of attorney authorizes, but does not require, the

attorney-in-fact to act for you.

PRINCIPAL (Name and Address of Person Granting the Power)

ATTORNEY(S)-IN-FACT

(Name and Address)

SUCCESSOR ATTORNEY(S)-IN-FACT (Optional)

To act if any named attorney-in-fact dies, resigns, or is otherwise

unable to serve

(Name and Address)

First Successor

Second Successor

NOTICE: If more than one attorney-in-fact is designated, make a

check or “x” on the line in front of one of the following statements:

Each attorney-in-fact may independently exercise the

powers granted.

All attorneys-in-fact must jointly exercise the powers

granted.

EXPIRATION DATE

(Optional)

,

Use Specific Month Day Year Only

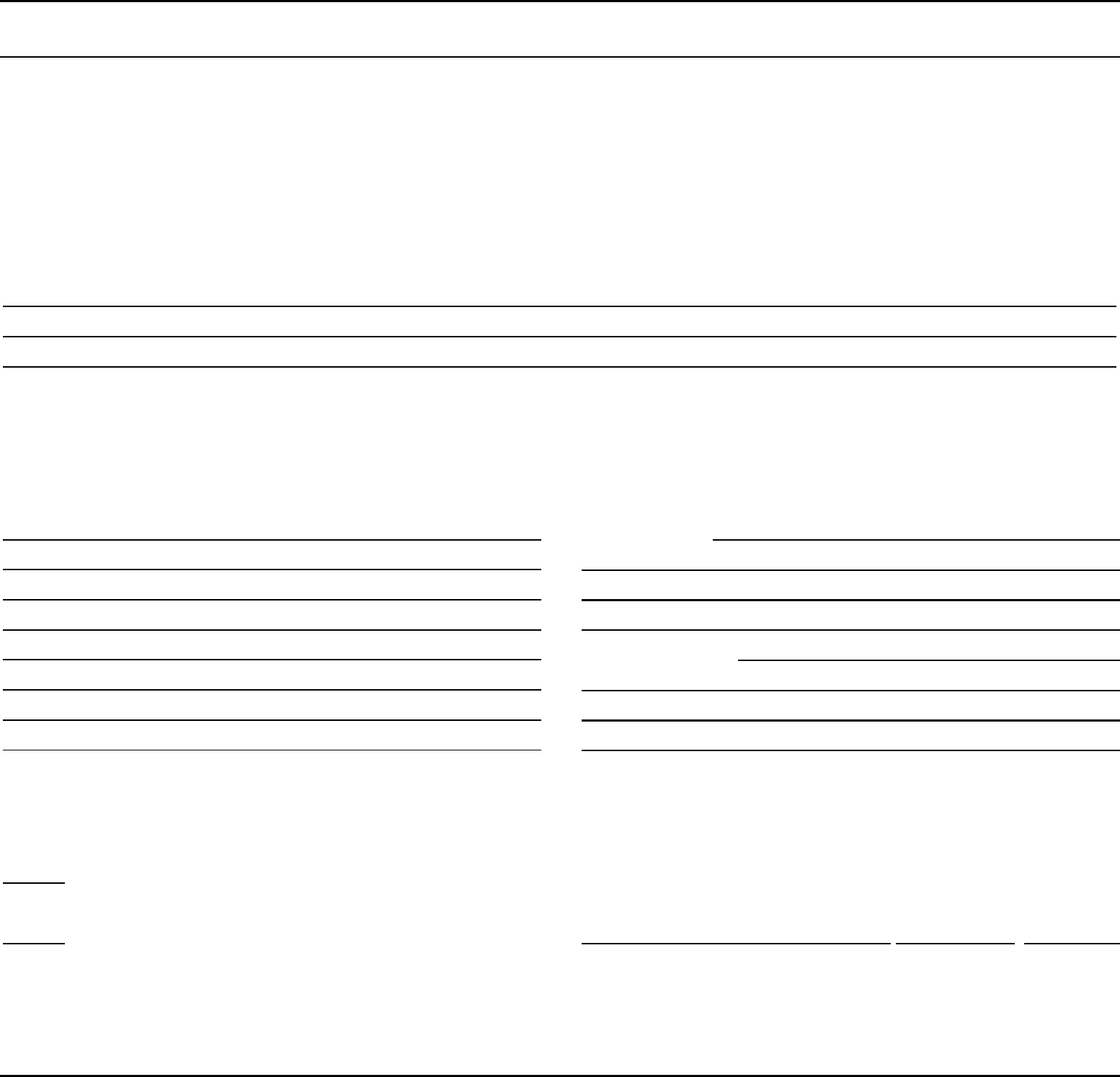

Page 2 of 3 Minnesota Uniform Conveyancing Blanks Form 100.1.1

I (the above named Principal) appoint the above named Attorney(s)-in-Fact to act as my attorney(s)-in-fact:

FIRST: To act for me in any way that I could act with respect to the following matters, as each of them is defined in Minnesota Statutes,

section 523.24:

(To grant to the attorney-in-fact any of the following powers, make a check or “x” on the line in front of each power being granted. You

may, but need not, cross out each power not granted. Failure to make a check or “x” on the line in front of the power will have the effect of

deleting the power unless the line in front of the power of (N) is checked or “x”-ed.)

Check or “x”

(A) real property transactions;

I choose to limit this power to real property in County, Minnesota, described as

follows: (Use legal description. Do not use street address.)

(If more space is needed, continue on an attachment.)

(B) tangible personal property transactions;

(C) bond, share, and commodity transactions;

(D) banking transactions;

(E) business operating transactions;

(F) insurance transactions;

(G) beneficiary transactions;

(H) gift transactions;

(I) fiduciary transactions;

(J) claims and litigation;

(K) family maintenance;

(L) benefits from military service;

(M) records, reports, and statements;

(N) all of the powers listed in (A) through (M) above and all other matters.

SECOND: (You must indicate below whether or not this Power of Attorney will be effective if you become incapacitated or incompetent.

Make a check or “x” on the line in front of the statement that expresses your intent.)

This power of attorney shall continue to be effective if I become incapacitated or incompetent.

This power of attorney shall not be effective if I become incapacitated or incompetent.

THIRD: (You must indicate below whether or not this power of attorney authorizes the attorney-in-fact to transfer your property to the

attorney-in-fact. Make a check or “x” on the line in front of the statement that expresses your intent.)

This power of attorney authorizes the attorney-in-fact to transfer my property to the attorney-in-fact.

This power of attorney does not authorize the attorney-in-fact to transfer my property to the attorney-in-fact.

Page 3 of 3 Minnesota Uniform Conveyancing Blanks Form 100.1.1

FOURTH: (You may indicate below whether or not the attorney-in-fact is required to make an accounting. Make a check or “x” on the line

in front of the statement that expresses your intent.)

My attorney-in-fact need not render an accounting unless I request it, or the accounting is otherwise required by

Minnesota Statutes, section 523.21.

My attorney-in-fact must render accountings to

(Monthly, Quarterly, Annual)

me or

(Name and Address)

during my lifetime, and a final accounting to the personal representative of my estate, if any is appointed, after my death.

In Witness Whereof I have hereunto signed my name this day of , .

(Signature of Principal)

ACKNOWLEDGEMENT OF PRINCIPAL

State of Minnesota, County of

This instrument was acknowledged before me on , by

(month/day/year) (insert name of Principal)

.

(Stamp)

(signature of notarial officer)

Title (and Rank):

My commission expires:

(month/day/year)

THIS INSTRUMENT WAS DRAFTED BY:

(insert name and address)

Specimen signature of Attorney(s)-in-Fact

(Notarization not required)