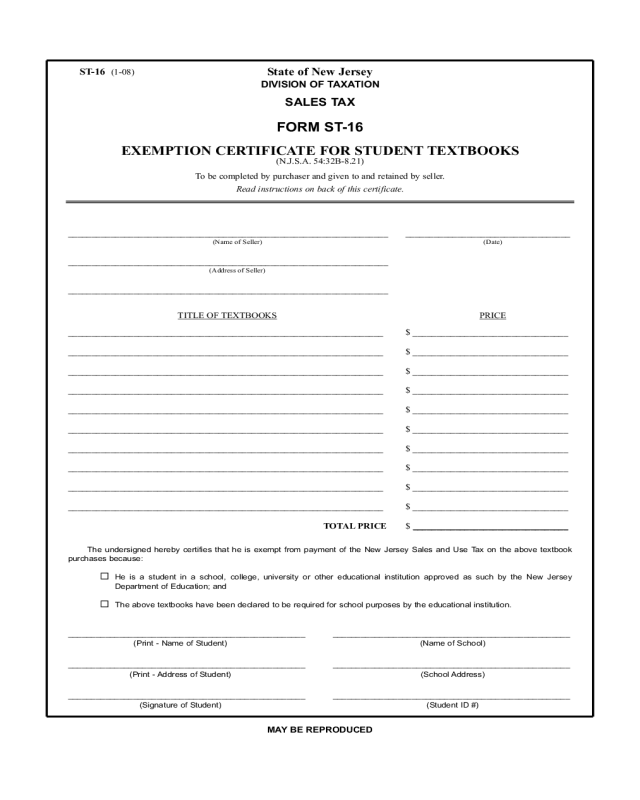

Fillable Printable Student Tax Exemption Form - New Jersey

Fillable Printable Student Tax Exemption Form - New Jersey

Student Tax Exemption Form - New Jersey

The undersigned hereby certifies that he is exempt from payment of the New Jersey Sales and Use Tax on the above textbook

purchases because:

He is a student in a school, college, university or other educational institution approved as such by the New Jersey

Department of Education; and

The above textbooks have been declared to be required for school purposes by the educational institution.

___________________________________________________ ___________________________________________________

(Print - Name of Student) (Name of School)

___________________________________________________ ___________________________________________________

(Print - Address of Student) (School Address)

___________________________________________________ ___________________________________________________

(Signature of Student) (Student ID #)

State of New Jersey

DIVISION OF TAXATION

SALES TAX

FORM ST-16

EXEMPTION CERTIFICATE FOR STUDENT TEXTBOOKS

(N.J.S.A. 54:32B-8.21)

To be completed by purchaser and given to and retained by seller.

Read instructions on back of this certificate.

MAY BE REPRODUCED

ST-16 (1-08)

____________________________________________________________________ ___________________________________

(Name of Seller) (Date)

____________________________________________________________________

(Address of Seller)

____________________________________________________________________

TITLE OF

TEXTBOOKS PRICE

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

___________________________________________________________________ $ _________________________________

TOTAL PRICE $ _________________________________

INSTRUCTIONS TO SELLERS CONCERNING

EXEMPTION CERTIFICATE FOR STUDENT TEXTBOOKS

Receipts from the sales of textbooks, for use by students, are exempt under Section 8.21 of the Sales Tax

Act (reproduced below). The educational institution should prescribe through its academic departments the

particular books that are required for school purposes. This form ST-16 should be completed by the student

purchasing the exempt textbook and retained by the bookstore.

You may accept this certificate as a basis for exempting sales of textbooks to the purchaser providing

he has:

a. properly completed this form; and,

b. presented valid proof of his enrollment in a school, college, university or other educational

institution approved as such by the New Jersey Department of Education.

N.J.S.A. 54:32B-8.21 of the New Jersey Sales and Use Tax Act exempts the following:

“Sales of school textbooks for use by students in a school, college, university or other educational

institution, approved as such by the Department of Education, when the educational institution, upon forms

and pursuant to regulations prescribed by the director, has declared the books are required for school

purposes and the purchaser has supplied the seller with the form at the time of the sale.”

For the purposes of the school textbook exemption, “textbook” means any book which the educational

institution requires students to purchase for use in one of its courses.

IMPORTANT NOTE: This certificate (Form ST-16) must be retained by the seller for auditing

purposes.

FOR MORE INFORMATION:

Call the Customer Service Center (609) 292-6400. Send an e-mail to [email protected]. Write

to: New Jersey Division of Taxation, Information and Publications Branch, PO Box 281, Trenton, NJ

08695-0281.

REPRODUCTION OF FORM

This certificate may be reproduced without permission of the Director, Division of Taxation, so long as the

text and format are unchanged. It is expected that many sellers will want to have this certificate reproduced

for their own convenience, as well as for the convenience of their customer’s.