Fillable Printable Superannuation Transfer ATO Form

Fillable Printable Superannuation Transfer ATO Form

Superannuation Transfer ATO Form

IN-CONFIDENCE – when completed

BEFORE COMPLETING THIS FORM

n Read the important information below.

n Check that the fund you are transferring your benefits TO

can accept this transfer.

WHEN COMPLETING THIS FORM

n Refer to these instructions where a question shows a

message like this:

n Print clearly in BLOCK LETTERS.

AFTER COMPLETING THIS FORM

n Sign the authorisation.

n Attach the appropriately certified proof of identity documents.

n Review the checklist below.

n Send the request form to your fund.

IMPORTANT INFORMATION

This transfer may close your account (you will need to

check this with your FROM fund).

This form can NOT be used to:

n transfer part of the balance of your superannuation benefits

n transfer benefits if you don’t know where your

superannuation is

n transfer benefits from multiple funds on this one form – a

separate form must be completed for each fund you wish

to transfer superannuation from

n change the fund to which your employer pays contributions

on your behalf

n open a superannuation account, or

n transfer benefits under certain conditions or circumstances,

for example if there is a superannuation agreement under

the Family Law Act 1975 in place.

CHECKLIST

Have you read the important information?

Have you considered where your future employer

contributions will be paid?

Have you checked your TO fund can accept the transfer?

Have you completed all of the mandatory fields on the form?

Have you signed and dated the form?

Have you attached the certified documentation including

any linking documents if applicable?

WHAT HAPPENS TO MY FUTURE

EMPLOYER CONTRIBUTIONS?

Using this form to transfer your benefits will not change the

fund to which your employer pays your contributions and may

close the account you are transferring your benefits FROM.

If you wish to change the fund into which your contributions

are being paid, you will need to speak to your employer about

Choice. For the appropriate forms and information about whether

you are eligible to choose the fund to which your employer

contributions are made, visit www.superchoice.gov.au or call

the Australian Taxation Office on 13 10 20.

THINGS YOU NEED TO CONSIDER WHEN

TRANSFERRING YOUR SUPERANNUATION

When you transfer your superannuation, your entitlements under

that fund may cease. You need to consider all relevant information

before you make a decision to transfer your superannuation.

If you ask for information, your superannuation provider must

give it to you. Some of the points you may consider are:

n Fees – your FROM fund must give you information about

any exit or withdrawal fees. If you are not aware of the fees

that may apply, you should contact your fund for further

information before completing this form. The fees could

include administration fees as well as exit or withdrawal fees.

Your TO fund may also charge entry or deposit fees on transfer.

Differences in fees funds charge can have a significant effect

on what you will have to retire on. For example, a 1% increase

in fees may significantly reduce your final benefit.

n Death and disability benefits – your FROM fund may insure you

against death, illness or an accident which leaves you unable to

return to work. If you choose to leave your current fund, you may

lose any insurance entitlements you have. Other funds may not

offer insurance, or may require you to pass a medical examination

before they cover you. When considering a new fund, you may

wish to check the costs and amount of any cover offered.

WHAT HAPPENS IF I DO NOT QUOTE MY

TAX FILE NUMBER (TFN)?

You are not obligated to provide your TFN to your

superannuation fund. However, if you do not provide your TFN,

your fund may be taxed at the highest marginal tax rate plus

the Medicare levy on contributions made to your account in the

year, compared to the concessional tax rate of 15%. Your fund

may deduct this additional tax from your account.

If your superannuation fund does not have your TFN, you will not

be able to make personal contributions to your superannuation

account. Choosing to quote your TFN will also make it easier to

keep track of your superannuation in the future.

Under the Superannuation Industry (Supervision) Act 1993, your

superannuation fund is authorised to collect your TFN, which will

only be used for lawful purposes. These purposes may change

in the future as a result of legislative change. The TFN may

be disclosed to another superannuation provider, when your

benefits are being transferred, unless you request in writing that

your TFN is not to be disclosed to any other trustee.

TRANSFERS TO SELF MANAGED

SUPERANNUATION FUNDS

You may use this form to transfer your benefits to your own self

managed superannuation fund (SMSF).

You should be aware that SMSFs are subject to the same rules

and restrictions as other funds, when benefits are to be paid out.

In particular, superannuation benefits in a SMSF are required

to be ‘preserved’, meaning they are not generally able to be

accessed until you are over age 55 and retired.

The trustee of your FROM fund may be able to request further

information from you about your status as a member, a trustee

or a director of a corporate trustee of your SMSF, if there are

multiple transfer requests to your SMSF. Penalties may apply

for providing false or misleading information.

Completing the request to transfer whole balance

of superannuation benefits between funds form

JS 6676‑03.2007

Page 1

By completing this form, you will request the transfer of the WHOLE balance of your superannuation benefits between funds.

This form can NOT be used to transfer part of the balance of your superannuation benefits.

This form will NOT change the fund to which your employer pays your contributions. The Standard Choice Form must be used

by you to change funds.

IN-CONFIDENCE – when completed

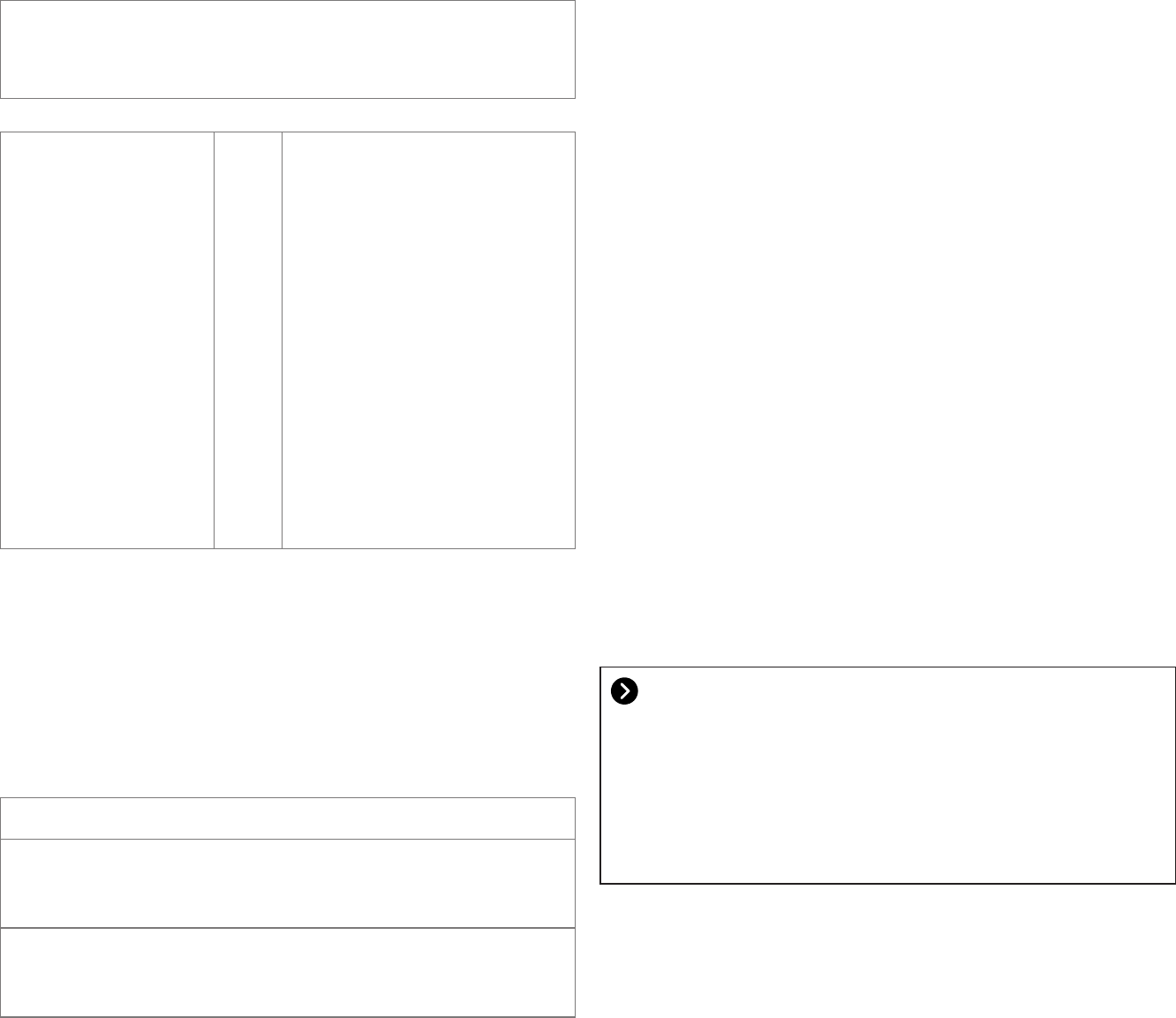

Completing proof of identity

You will need to provide documentation with this transfer request

to prove you are the person to whom the superannuation

entitlements belong.

ACCEPTABLE DOCUMENTS

The following documents may be used.

EITHER

One of the following documents only:

n driver’s licence issued under State or Territory law

n passport.

OR

One of the following

documents:

n birth certificate or

birth extract

n citizenship

certificate issued by

the Commonwealth

n pension card

issued by

Centrelink that

entitles the person

to financial benefits.

AND

One of the following

documents:

n letter from Centrelink

regarding a Government

assistance payment

n notice issued by

Commonwealth, State or

Territory Government or

local council within the past

twelve months that contains

your name and residential

address. For example:

– Tax Office Notice of

Assessment

– Rates notice from local

council.

HAvE YOU CHANGED YOUR NAME OR ARE YOU

SIGNING ON BEHALF OF ANOTHER PERSON?

If you have changed your name or are signing on behalf of the

applicant, you will need to provide a certified linking document.

A linking document is a document that proves a relationship

exists between two (or more) names.

The following table contains information about suitable linking

documents.

Purpose Suitable linking documents

Change of

name

Marriage certificate, deed poll or change

of name certificate from the Births, Deaths

and Marriages Registration Office.

Signed on

behalf of the

applicant

Guardianship papers or Power of Attorney.

CERTIFICATION OF PERSONAL DOCUMENTS

All copied pages of ORIGINAL proof of identification documents

(including any linking documents) need to be certified as true

copies by any individual approved to do so (see below).

The person who is authorised to certify documents must sight

the original and the copy and make sure both documents are

identical, then make sure all pages have been certified as true

copies by writing or stamping ‘certified true copy’ followed by

their signature, printed name, qualification (eg Justice of the

Peace, Australia Post employee, etc) and date.

The following can certify copies of the originals as true and

correct copies:

n a permanent employee of Australia Post with five or more

years of continuous service

n a finance company officer with five or more years of

continuous service (with one or more finance companies)

n an officer with, or authorised representative of, a holder of an

Australian Financial Services Licence (AFSL), having five or

more years continuous service with one or more licensees

n a notary public officer

n a police officer

n a registrar or deputy registrar of a court

n a Justice of the Peace

n a person enrolled on the roll of a State or Territory Supreme

Court or the High Court of Australia, as a legal practitioner

n an Australian consular officer or an Australian diplomatic officer

n a judge of a court

n a magistrate, or

n a Chief Executive Officer of a Commonwealth court.

WHERE DO I SEND THE FORM?

You can send your completed and signed form with your

certified proof of identity documents to either fund.

MORE INFORMATION

For more information about superannuation, visit the:

n Australian Securities and Investments Commission website

at www.fido.asic.gov.au, or

n Australian Taxation Office website at www.ato.gov.au/super

For more information about this form, phone the Australian

Taxation Office on 13 10 20.

Page 2

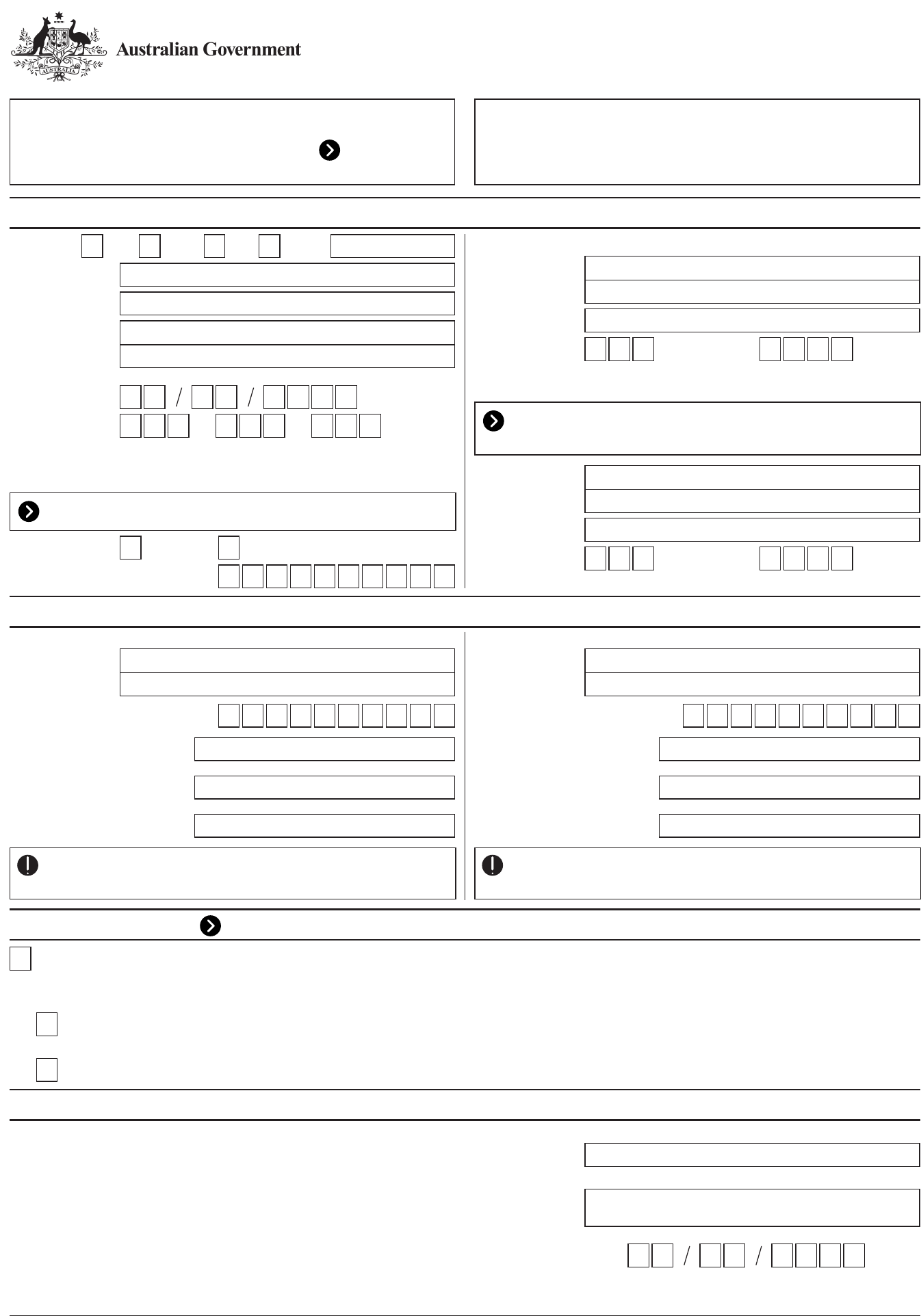

Request to transfer whole balance of

superannuation benefits between funds

under the Superannuation Industry (Supervision) Act 1993

JS 6676‑03.2007

IN-CONFIDENCE – when completed

Page 3

cOMPlETINg THIS FORM

n Read the important information pages

n Refer to instructions where indicated with a

n This form is only for whole (not part) balance transfers.

AFTER cOMPlETINg THIS FORM

n Sign the authorisation

n Send form and certified proof of identity documents to either

your FROM or TO fund.

* Denotes mandatory field. If you do not complete all of the mandatory fields, there may be a delay in processing your request.

Authorisation

Day Month Year

*Date

*Signature

*Name (Print in BLOCK LETTERS)

By signing this request form I am making the following statements:

n I declare I have fully read this form and the information completed is true and correct

n I am aware I may ask my superannuation provider for information about any fees or

charges that may apply, or any other information about the effect this transfer may have

on my benefits, and do not require any further information.

n If the TO fund is a self managed superannuation fund (SMSF), I confirm that I am

a member, trustee or director of a corporate trustee of the SMSF.

n I discharge the superannuation provider of my FROM fund of all further liability

in respect of the benefits paid and transferred to my TO fund.

I request and consent to the transfer of superannuation as described above and authorise

the superannuation provider of each fund to give effect to this transfer.

I have attached a certified copy of my driver’s licence or passport

OR

Birth/Citizenship Certificate or Centrelink Pension Card

Centrelink payment letter or Government or local council notice (<1 year old) with name and address

I have attached certified copies of both:

AND

*Proof of identity

See ‘Completing proof of identity’

Personal details

Residential address

*Suburb

*State/territory *Postcode

*Address

*Family name

Title: Mr

Mrs Miss Ms Other

*Given names

Other/previous

names

*Date of birth

Day Month Year

Tax file number

*Gender FemaleMale

*Contact phone number

Under the Superannuation Industry (Supervision) Act 1993, you are

not obliged to disclose your tax file number, but there may be tax

consequences.

See ‘What happens if I do not quote my tax file number?’

Previous address

Suburb

State/territory Postcode

Address

If you know that the address held by your FROM fund is different

to your current residential address, please give details below.

Fund details

*Fund phone numberFund phone number

Membership or

account number

Superannuation Product

Identification Number (SPIN)

FROM

*Fund name

If you have multiple account numbers with this fund, you must

complete a separate form for each account you wish to transfer.

Australian business

number (ABN)

*Membership or

account number

Superannuation Product

Identification Number (SPIN)

TO

*Fund name

You must check with your TO fund to ensure they can accept

this transfer.

Australian business

number (ABN)