Fillable Printable Cost Benefit Analysis Template, Version 2.02

Fillable Printable Cost Benefit Analysis Template, Version 2.02

Cost Benefit Analysis Template, Version 2.02

Engineering Solutions On-Line presents the

Cost Benefit Analysis Template

(with Amortization Calculator)

A product of Engineering Solutions On-Line,

a division of Armitage Consulting

Copyright 2009, Armitage Consulting, all rights reserved

Author: John Cesarone, Ph.D., P.E.

Date: May 2009

Version: 2.02

Contact Information:

e-mail:

web:

phone: 312.493.0839

fax: 504.285.0687

Note to users: feel free to use and freely copy this software template for your own use and that of

your organization or company. However, your individual license is not transferable to other organizations,

nor are you authorized to duplicated this template for sale or other gain other than internal use.

jcesarone999@gmail.com

http://EngineeringSolutions.homestead.com

Cost Benefit Analysis Template

Note to users: feel free to use and freely copy this software template for your own use and that of

your organization or company. However, your individual license is not transferable to other organizations,

nor are you authorized to duplicated this template for sale or other gain other than internal use.

Cost Benefit Analysis Template

General Instructions Page

This Cost/Benefit template will help you to create your own cost/benefit analysis of any project. As configured,

it provides Net Present Value of a project, Internal Rate of Return, and Payback Schedule. However, the paid version is easily

expanded and modified using simple Excel programming.

It is set up to operate on a year-by-year basis, but can easily be modified (paid version only) for month-by-month or any other basis if you prefer.

The chart is currently configured with 10 columns, to analyze budgets of up to 10 years long. To extend the paid version to longer projects,

merely highlight the last column, drag your selection to the right the required number of new columns, and hit Edit-Fill-Right.

For information on unlocking this file for modification, visit EngineeringSolutions.homestead.com or email jcesarone9[email protected].

To use this template, follow these steps:

STEP 1:

Go to the "Costs" page and enter your costs (see detailed instructions there)

STEP 2:

Go to the "Benefits" page and enter your benefits (see detailed instructions there)

STEP 3:

Go to the "Summary" page for CBA metrics of your project.

Charts of Costs and Benefits are also provided on the next three pages.

Bonus Step:

This latest version of the Cost Benefit Analysis template includes a Mortgage Amortization calculator on the final sheet.

This Cost/Benefit template will help you to create your own cost/benefit analysis of any project. As configured,

it provides Net Present Value of a project, Internal Rate of Return, and Payback Schedule. However, the paid version is easily

It is set up to operate on a year-by-year basis, but can easily be modified (paid version only) for month-by-month or any other basis if you prefer.

The chart is currently configured with 10 columns, to analyze budgets of up to 10 years long. To extend the paid version to longer projects,

merely highlight the last column, drag your selection to the right the required number of new columns, and hit Edit-Fill-Right.

For information on unlocking this file for modification, visit EngineeringSolutions.homestead.com or email jcesarone9[email protected].

Go to the "Benefits" page and enter your benefits (see detailed instructions there)

This latest version of the Cost Benefit Analysis template includes a Mortgage Amortization calculator on the final sheet.

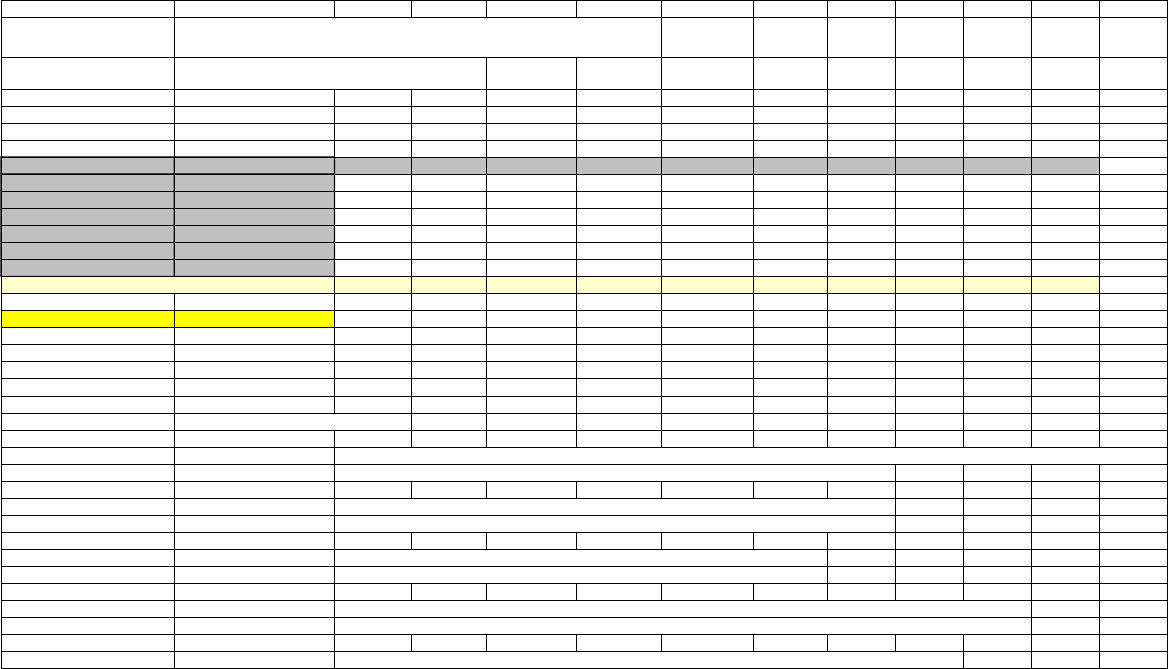

Costs

Cost Benefit Analysis Template

Cost Data Entry Page

Fiscal Year

Program Element Element Manager 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Element 1 Bill Smith $300,000 $250,000 $250,000

Element 2 Ed White $200,000 $150,000 $150,000

Element 3 Frank Burns $300,000 $250,000 $250,000

Element 4 Clay Forrester $400,000 $450,000 $500,000

Element 5 Jack Burton $150,000 $150,000 $150,000

Element 6 Mani Mahesh $400,000 $400,000 $400,000

Program Total Costs By Year $700,000 $650,000 $1,700,000 $1,000,000 $1,050,000 $0 $0 $0 $0 $0

Program Grand Total Cost $5,100,000

INSTRUCTIONS FOR THIS PAGE:

1. Enter the first year of your program in Cell C8. The next nine years will be filled in for you on this page and the following pages

(if you need more years, you can "insert" additional columns - paid version only)

2. Enter the names of your program elements in Column A, replacing "Element 1", etc.

(if you need more than six elements, you can "insert" additional rows - paid version only)

3. If you like, add extra information on each program element in Column B

(here, program element manager names have been added for illustration)

4. Enter the anticipated costs for each year for each program element in the appropriate cells. These should be

undiscounted costs, i.e., actual dollars, not equivalent dollars. Equivalence will be calculated automatically.

5. Total spending per year is shown on Row 15, and Grand Total cost for the program is on Row 17

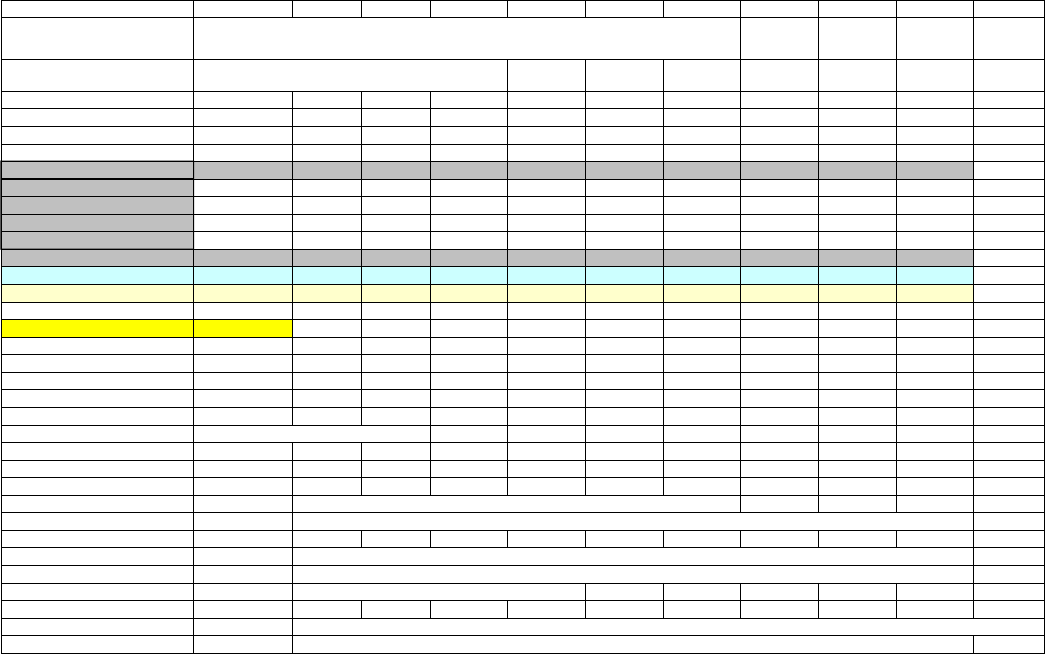

Benefits

Cost Benefit Analysis Template

Benefit Data Entry Page

Fiscal Year

Benefit Sources 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Cost Reduction $500,000 $525,000 $550,000 $600,000 $650,000 $700,000 $800,000 $1,000,000

Enhanced Revenues $250,000 $350,000 $500,000 $600,000 $750,000 $800,000 $900,000

Labor Reduction $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000

Decreased Overhead $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000

Total Benefits Per Year $0 $0 $550,000 $925,000 $1,050,000 $1,250,000 $1,400,000 $1,600,000 $1,750,000 $2,050,000

Confidence Factor 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

Benefits Claimed for Analysis $0 $0 $550,000 $925,000 $1,050,000 $1,250,000 $1,400,000 $1,600,000 $1,750,000 $2,050,000

Program Grand Total Benefit $10,575,000

INSTRUCTIONS FOR THIS PAGE:

2. Enter the sources of benefits you expect in Column A, as shown

(if you need more than four categories of benefits, feel free to insert extra rows - paid version only)

3. If desired, enter a "Confidence Factor" on Row 14 for each year; this should be between 0 and 100%,

and enables you to perform analyses of varying levels of optimism or pessimism. If you do not wish

to use this feature, leave all entries at 100%

4. Total Benefits by year, adjusted for your level of confidence, is shown on Row 15, and Grand Total on Row 17

As with our costs, these are un-discounted so far (that is, not converted to equivalent-year dollars).

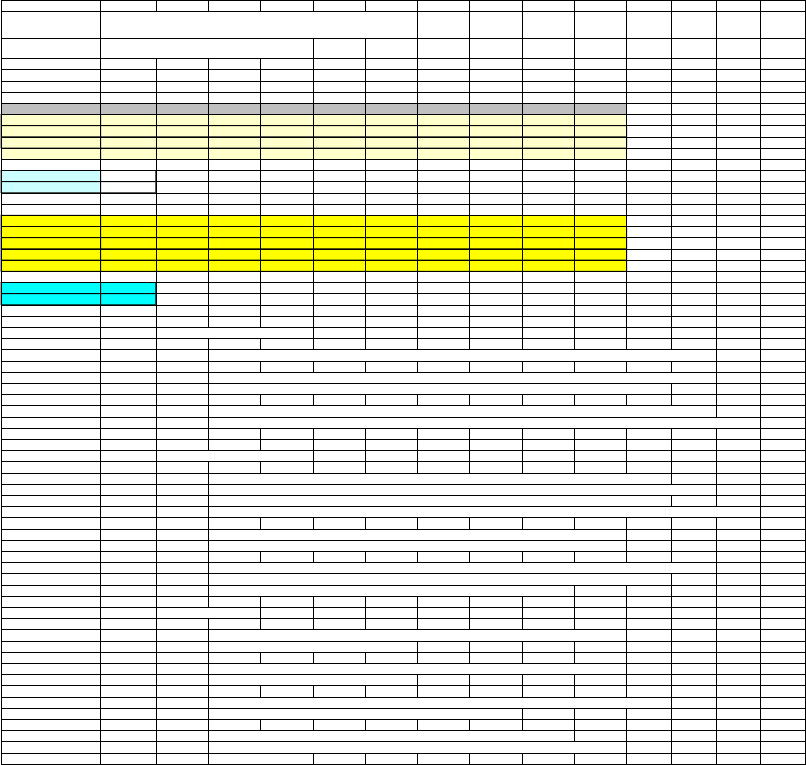

Summary

Cost Benefit Analysis Template

Results Calculation Page

Fiscal Year

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Undiscounted Flows

Costs -$700,000 -$650,000 -$1,700,000 -$1,000,000 -$1,050,000 $0 $0 $0 $0 $0

Benefits $0 $0 $550,000 $925,000 $1,050,000 $1,250,000 $1,400,000 $1,600,000 $1,750,000 $2,050,000

Net Cash Flow -$700,000 -$650,000 -$1,150,000 -$75,000 $0 $1,250,000 $1,400,000 $1,600,000 $1,750,000 $2,050,000

Discount Factors

Discount Rate 7.0%

Base Year 2009

Year Index 0 1 2 3 4 5 6 7 8 9

Discount Factor 1.0000 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439

Discounted Flows

Costs -$700,000 -$607,477 -$1,484,846 -$816,298 -$801,040 $0 $0 $0 $0 $0

Benefits $0 $0 $480,391 $755,076 $801,040 $891,233 $932,879 $996,400 $1,018,516 $1,115,064

Net -$700,000 -$607,477 -$1,004,455 -$61,222 $0 $891,233 $932,879 $996,400 $1,018,516 $1,115,064

Cumulative -$700,000 -$1,307,477 -$2,311,931 -$2,373,154 -$2,373,154 -$1,481,921 -$549,042 $447,358 $1,465,874 $2,580,938

Net Present Value $2,580,938

Internal Rate of Return 21%

INSTRUCTIONS FOR THIS PAGE:

1. The years will be automatically entered on row 8 to exactly match those on the Costs page; do not enter anything here.

2. Enter your "discount rate" in cell B14; this is the cost of money that determines the time value of your costs and benefits

(for illustration, if you were working with an interest-free loan, this would be zero; a typical value is around 8%)

3. Enter the year you will kick off the project in cell B15; this will be used as the "now" in the CBA calculations on future values

(typically, "now" means the current year, which is the year of your initial investment, but it might be different if your plans are for the future)

INTERPRETATION OF RESULTS:

Row 17 shows the discount factor; this is how much less the cash flows are worth because they are in the future

Row 19 shows the discounted costs, and Row 20 shows the discounted benefits. "Discounted" means "in year-0 dollars."

Row 21 shows the discounted net value per year, and Row 21 shows the accumulated discounted net value per year

Row 22 shows the cumulative net value for all years so far (when this becomes positive, you have completed your "payback period")

Row 24 shows the "Net Present Value" of your program; this means that the entire project is economically

Row 25 shows the Internal Rate of Return; this means, the interest rate that would make your project exactly break even.

Another way to interpret this is, if you had put the money in a bank account at this interest rate, you would get

the exact same monetary benefits as you received from performing this program

CHARTS PROVIDED:

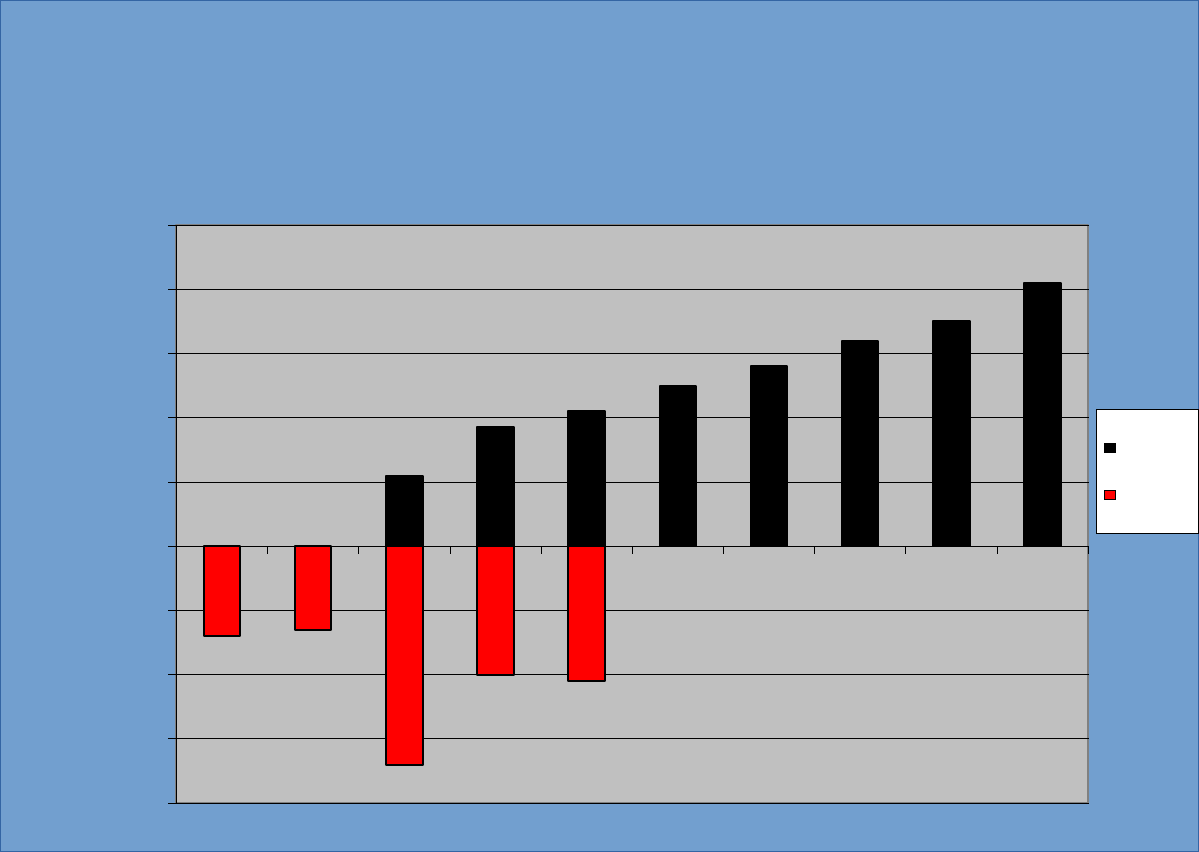

The first chart, Undiscounted Cash Flows, shows actual costs expended and benefits accrued, adjusted by

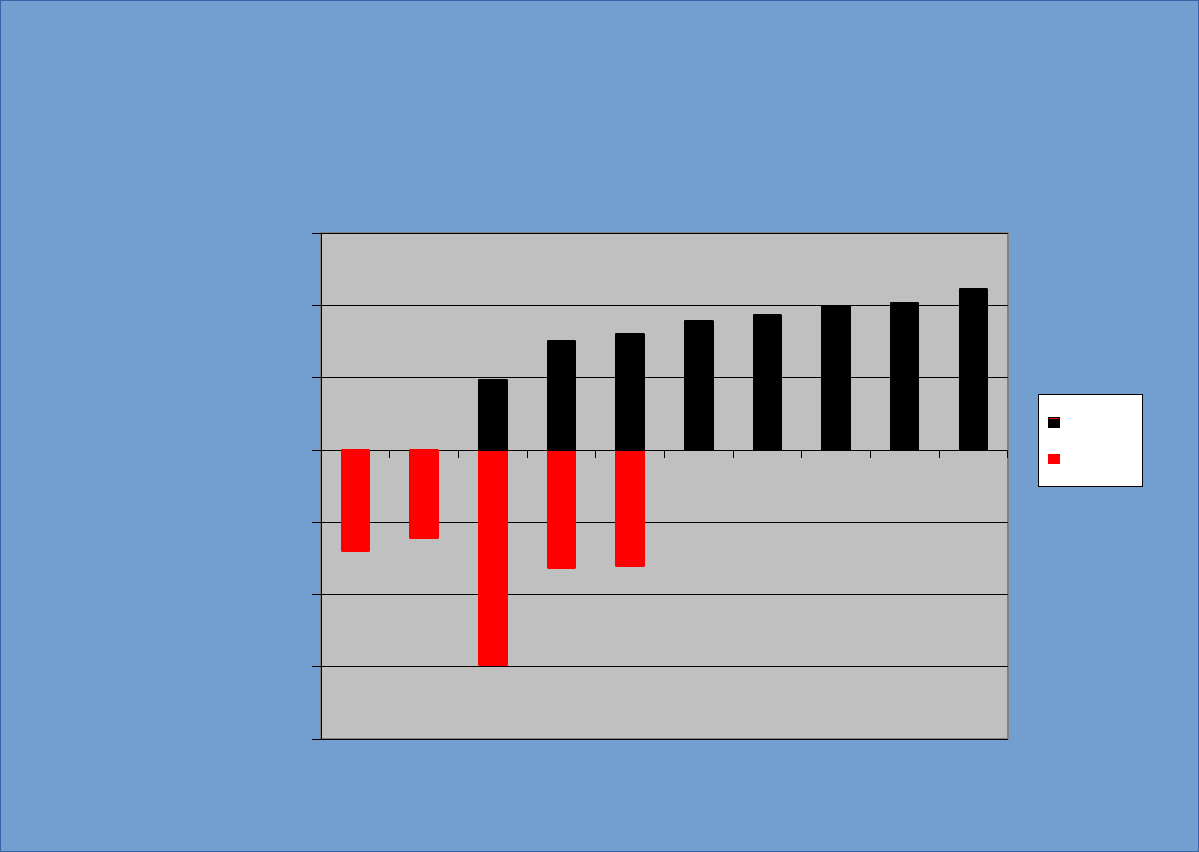

The second chart, Discounted Cash Flows, shows costs expended and benefits to be accrued, adjusted by

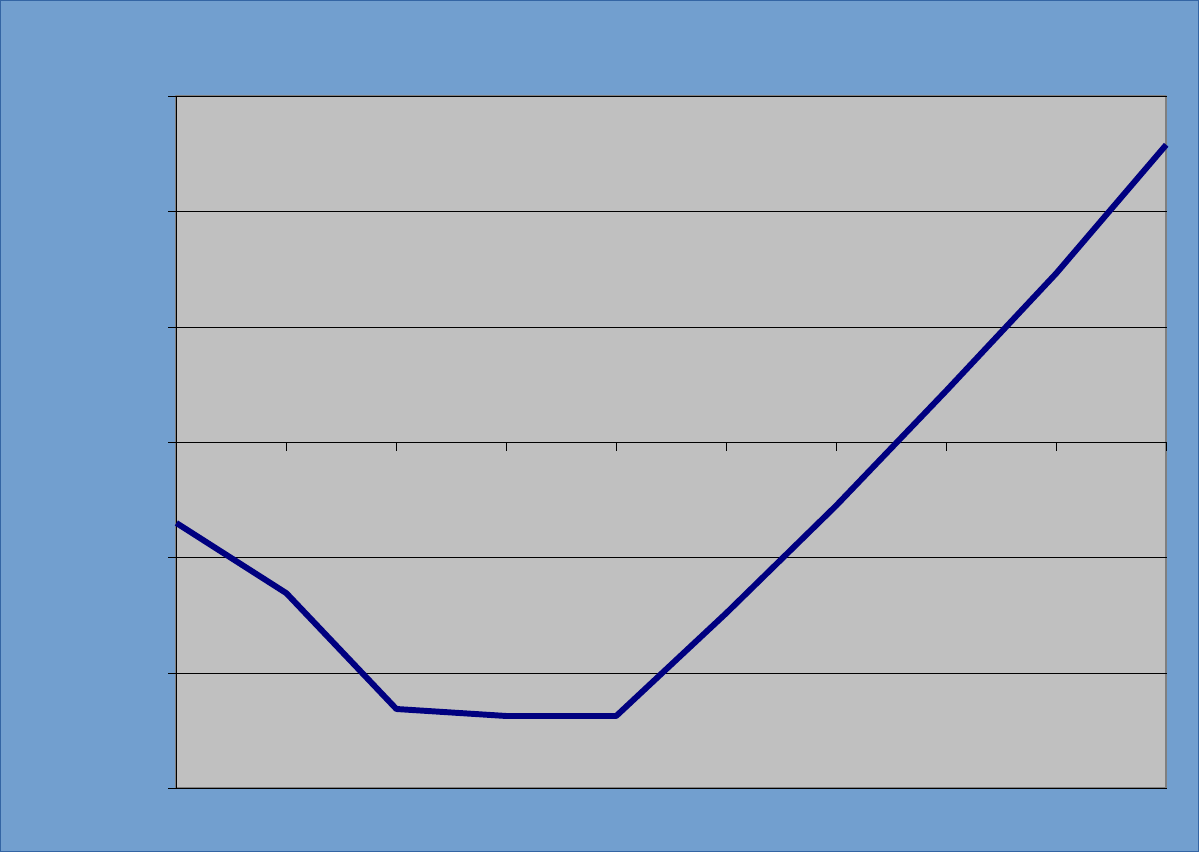

The third chart, Payback Schedule, shows benefits accrued minus costs expended, in base year dollars. When this

chart crosses above the zero line, the program has achieved profitability

Sufficient data exists in the above summary to create any other charts you desire; or contact

us at 312.266.4828 or at [email protected], or visit us at EngineeringSolutions.homestead.com

for futher assistance

equivalent to this much money in your hands right now, based on the discount rate you entered

confidence factor, in each years' current dollars

confidence factor, in base year dollars

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

-$2,000,000

-$1,500,000

-$1,000,000

-$500,000

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

Undiscounted Cash Flows

Benefits

Costs

Fiscal Year

Co sts a nd Be ne fits in Cu rre n t Ye a r Do lla rs

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

-$2,000,000

-$1,500,000

-$1,000,000

-$500,000

$0

$500,000

$1,000,000

$1,500,000

Discounted Cash Flow

Benefits

Costs

Fiscal Year

Costs a nd Be ne fits in Ba se Ye a r Dolla rs

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

-$3,000,000

-$2,000,000

-$1,000,000

$0

$1,000,000

$2,000,000

$3,000,000

Discounted Payback

Fiscal Year

Base Year Dollars

Cost Benefit Analysis Template

The Softer Stuff…..

When you write up your Cost/Benefit Analysis, the mathematics presented in the previous sheets are very handy, and can

indeed be difficult for your audience to disagree with. They are, therefore, a good argument to make in support of (or against) the project

under consideration. However, there are always non-mathematical issues that must be dealt with. While these are difficult to

incorporate into the rigorous equations, they certainly must be addressed. If you do not address them yourself, you can be

certain that one of your detractors or competitors will mention them; better to deal with them in your own way, first. In this sheet,

then, we will discuss some of the "softer stuff" or non-monetary issues that are required in a Cost/Benefit Analysis.

First and foremost, is there business out there for you to go after in the first place? You are presenting some sort of monetary benefit;

you had better be prepared to demonstrate that this business is really out there, waiting to come to you. If not, your analysis fails

from the get-go. You had better be prepared to show that you are offering something your competitors are NOT offering: better price,

higher quality, superior delivery schedule or convenience, etc. If there ARE no current suppliers, well then, how do you know that there are

any customers? In reality, this work may already have been done for you, by your Marketing department. See what they know before

you knock yourself out.

Also, consider the symbiotic effects of your proposed venture, both good and bad. Will you be cannibalizing your own business in other

areas? If your particular division makes a killing, but another division of your company is the one that gets killed, your board of directors

will NOT be impressed! On the other hand, symbiotic effects can be good; two products that go together, from the same supplier, can

boost market share for both of those products (don’t believe me? Just ask Microsoft).

Sometimes, you need to invest in a project just to stay in business at all. For instance, say you are setting up a recall center or warranty

support office. This is not intended to make money on its own, but it lets you remain in business in your core area. In that case, you don't

need to show a profit, you just need to get the job done for the minimum cost. In cases like this, your goal in a Cost/Benefit analysis is to

lose the least amount of money while meeting the technical window of the requirements. Your proposed solutions are not competing with other

revenue-generating solutions, but merely with each other to lose the least amount of cash. Note that operations of this sort are called "Cost

Centers" (as opposed to "Profit Centers") and are always looked down upon. Better to show that your project will actually make money, if at

all possible.

Finally, always consider the reputation and image of your organization. If your short-term profits soar but your good name suffers, you might be

in trouble in the long run through loss of other business. Will you be teaming with someone your customers cannot abide? Are you selling

to your best customer's prime competition? These do not necessarily make a project untenable, but they do indicate that you should give

it some serious thought.

These musings are excerpted from the article "Sell Your Project!" by John Cesarone, Ph.D., P.E., available at:

http://EngineeringSolutions.homestead.com/cba_article.html