Fillable Printable Terms of Reference Template

Fillable Printable Terms of Reference Template

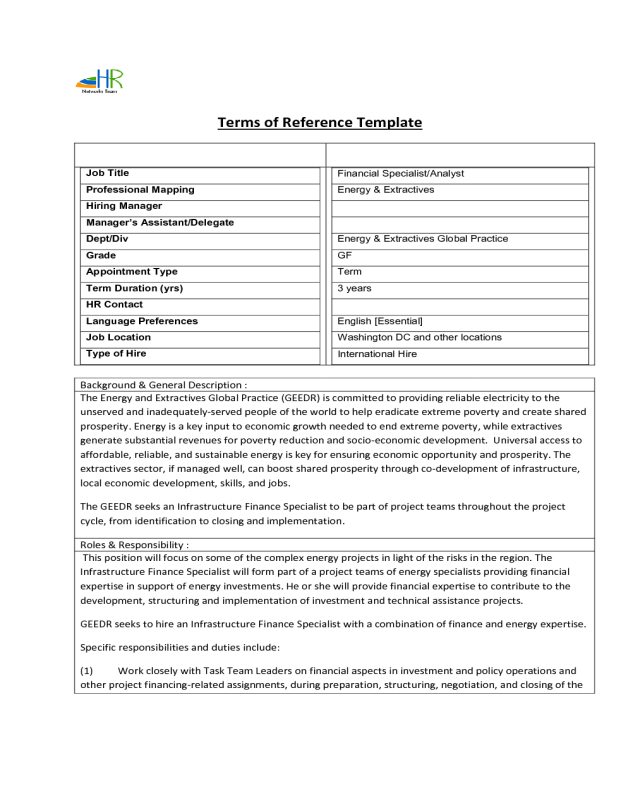

Terms of Reference Template

Terms of Reference Template

Job Title

Professional Mapping

Hiring Manager

M anager’s Assistan t/Del egat e

Dept/Div

Grade

Appointment Type

Term Duration (yrs)

HR Contact

Language Preferences

Job Location

Type o f Hire

Financial Specialist/Analyst

Energy & Extrac tives

Energy & Extractives Global Practice

GF

Term

3 year s

Eng lis h [ Es s ential]

Washington DC and other locations

International Hire

Background & General Description :

The Energy and Extractives Global Practice (GEEDR) is committed to providing reliable electricity to the

unserved and inadequately-served people of the world to help eradicate extreme poverty and create shared

prosperity. Energy is a key input to economic growth needed to end extreme poverty, while extractives

generate substantial revenues for poverty reduction and socio-economic development. Universal access to

affordable, reliable, and sustainable energy is key for ensuring economic opportunity and prosperity. The

extractives sector, if managed well, can boost shared prosperity through co-development of infrastructure,

local economic development, skills, and jobs.

The GEEDR seeks an Infrastructure Finance Specialist to be part of project teams throughout the project

cycle, from identification to closing and implementation.

Roles & Responsibility :

This position will focus on some of the complex energy projects in light of the risks in the region. The

Infrastructure Finance Specialist will form part of a project teams of energy specialists providing financial

expertise in support of energy investments. He or she will provide financial expertise to contribute to the

development, structuring and implementation of investment and technical assistance projects.

GEEDR seeks to hire an Infrastructure Finance Specialist with a combination of finance and energy expertise.

Specific responsibilities and duties include:

(1) Work closely with Task Team Leaders on financial aspects in investment and policy operations and

other project financing-related assignments, during preparation, structuring, negotiation, and closing of the

transactions.

(2) Work with other member of project teams to conduct financial analysis and due diligence for energy

finance operations.

(3) Draft project related documentation in collaboration with LEG and other relevant units, finalize the

terms and condition of Bank’s support. Contribute to the operational documents and provide support for

internal processing, review transaction agreements, and coordinate across project components with other

team members.

(4) Develop and execute financial models for project structuring and financial analysis.

(5) Contribute and conduct analysis of financial viability of projects

(6) Advise on the viability of energy projects carried out by private sector entities, including in terms of

financial and economic sustainability.

Selection Criteria:

Advanced university degree in areas such as international business or economics with further

financial/economics training (Masters in Finance or MBA or equivalent);

- At least five years of relevant professional experience, with sound understanding of lending

operations and project financing in purely public sector projects and in PPP transactions;

- Experience in project finance transactions is preferred;

- Experience in multiple regions of operations of the World Bank is preferred;

- Strong analytical and modeling skills with full knowledge of Excel functions;

- Experience in power sector financing, including a good command of key issues relating to sector

economics, market structure, renewables and regulation;

- Excellent communication skills, both oral and written;

- Proven ability to interact and communicate effectively with senior staff and clients;

- Understanding of World Bank’s operational and procurement procedures will be a distinct

advantage.

- Hands-on project management experience, an ability to efficiently manage a large number of

activities simultaneously, a flair for problem-solving and an ability to self-navigate through complex

bureaucratic environments.

- Ability to work flexibly on a range of assignments, and prioritize a variety of complex evolving tasks;

- Ability to deal sensitively in a multicultural environment and build effective work relations with

clients and colleagues;

- Willingness and ability to travel extensively; and

- Oral and written fluency in English. In addition, one of the other Bank language (Arabic, French,

Spanish, Chinese, Portuguese, Russian) is preferable.

Competencies:

Energy Finance - Working knowledge of a range of financing alternatives and financial instruments; can

conduct a range of infrastructure financial analyses.

Infrastructure Public-Private Partnerships - Working knowledge of Public-Private Partnerships

business/operating models; can conduct a range of financial and business case analyses.

Energy Policy, Strategy, and Institutions – working knowledge of energy policies, strategies, institutions, and

regulations.

Knowledge and Experience in Development Arena - Understands project financing process; distills

operationally relevant recommendations/lessons for clients.

Integrative Skills - Working to develop an integrated view across all facets of energy financing.

Lead and Innovate- Develops innovative solutions.

Deliver Results for Clients- Proactively addresses clients’ stated and unstated needs.

Collaborate Within Teams and Across Boundaries- Collaborates across boundaries, gives own perspective

and willingly receives diverse perspectives.

Create, Apply and Share Knowledge- Applies knowledge across WBG to strengthen solutions for internal

and/or external clients.

Make Smart Decisions- Interprets a wide range of information and pushes to move forward

.