Fillable Printable Texas Affidavit of Motor Vehicle Gift Transfer

Fillable Printable Texas Affidavit of Motor Vehicle Gift Transfer

Texas Affidavit of Motor Vehicle Gift Transfer

(SEAL)

SWORN TO and SUBSCRIBED before me on this the ______ day of _________________ A.D. _______ .

Year Model Make VehicleIdenticationNumber(VIN)

Name Phone (area code and number)

Mailing address

City State ZIP code

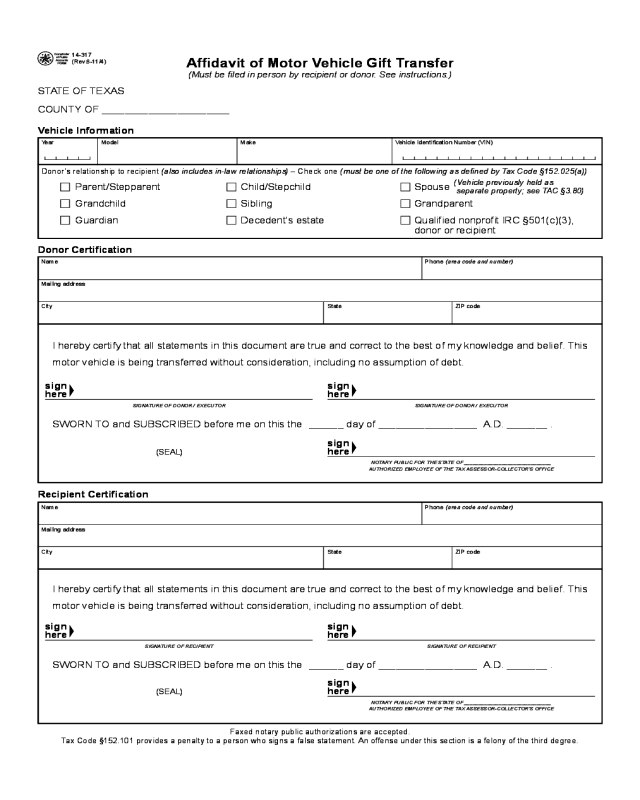

Afdavit of Motor Vehicle Gift Transfer

14-317

(Rev.6-11/4)

STATE OF TEXAS

COUNTY OF ______________________

Donor Certication

Vehicle Information

I herebycertifythatallstatementsinthisdocumentaretrueandcorrecttothebestofmyknowledgeandbelief.This

motorvehicleisbeingtransferredwithoutconsideration,includingnoassumptionofdebt.

(SEAL)

SWORN TO and SUBSCRIBED before me on this the ______ day of _________________ A.D. _______ .

Recipient Certication

Name Phone (area code and number)

Mailing address

City State ZIP code

I herebycertifythatallstatementsinthisdocumentaretrueandcorrecttothebestofmyknowledgeandbelief.This

motorvehicleisbeingtransferredwithoutconsideration,includingnoassumptionofdebt.

Donor’srelationshiptorecipient(also includes in-law relationships) – Check one (must be one of the following as dened by Tax Code §152.025(a))

Parent/Stepparent Child/Stepchild Spouse

Grandchild Sibling Grandparent

Guardian Decedent’sestate QualiednonprotIRC§501(c)(3),

donororrecipient

SIGNATURE OF RECIPIENT

NOTARY PUBLIC FOR THE STATE OF ______________________________

AUTHORIzEd EmPLOYEE OF THE TAx ASSESSOR-COLLECTOR’S OFFICE

SIGNATURE OF dONOR / ExECUTORSIGNATURE OF dONOR / ExECUTOR

SIGNATURE OF RECIPIENT

NOTARY PUBLIC FOR THE STATE OF ______________________________

AUTHORIzEd EmPLOYEE OF THE TAx ASSESSOR-COLLECTOR’S OFFICE

Faxednotarypublicauthorizationsareaccepted.

TaxCode§152.101providesapenaltytoapersonwhosignsafalsestatement.Anoffenseunderthissectionisafelonyofthethirddegree.

(Vehicle previously held as

separate property; see TAC §3.80)

sign

here

sign

here

sign

here

sign

here

sign

here

sign

here

(must be led in person by recipient or donor. See instructions.)

Form 14-317 (Back)(Rev.6-11/4)

Instructions for Filing Form 14-317, Afdavit of Motor Vehicle Gift Transfer

Who Must File –

Thisafdavitmustbeledinpersonbyeithertherecipientofthegiftorthepersonfromwhomthegiftisreceived.If

inherited,eithertherecipientorthepersonauthorizedtoactonbehalfoftheestatemustletheform.

AmotorvehicletitleserviceorPowerofAttorneymay notbeusedtolethisafdavit.

Identication Required –

ThepersonlingtheafdavitmustpresentoneoftheformsofidenticationdocumentslistedbelowtotheTaxAssessor-

Collectoratthetimeofling.Theidenticationprovidedmustbeissuedtoandbearaphotographofthepersonlingthe

afdavitandmustbeunexpired.

• adriver’slicenseorpersonalidenticationcardissuedbythisstateoranotherstateoftheUnitedStates;

• anoriginalpassportissuedbytheUnitedStatesoraforeigncountry;

• anidenticationcardorsimilarformofidenticationissuedbytheTexasDepartmentofCriminalJustice;

• aUnitedStatesMilitaryidenticationcard;

• oranidenticationcardordocumentissuedbytheUnitedStatesDepartmentofHomelandSecurityortheUnited

StatesCitizenshipandImmigrationServicesagency.

Eligible Gift Transfers –

Toqualifytobetaxedasagift($10),avehiclemustbereceivedfromthefollowingeligibleparties:

• spouse(separatepropertyonly–vehiclesheldascommunitypropertyarenotsubjecttothetax);

• parentorstepparent;

• father/mother-in-laworson/daughter-in-law;

• grandparent/grandparent-in-laworgrandchild/grandchild-in-law;

• childorstepchild;

• sibling/brother-in-law/sister-in-law;

• guardian;

• decedent’sestate(inherited);or

• anonprotserviceorganizationqualifyingunderSection501(c)(3),IRC(gifttaxapplieswhentheentityiseither

thedonororrecipient).

AmotorvehiclereceivedoutsideofTexasfromaneligibledonormayalsoqualifyasagiftwhenbroughtintoTexas.

Allothermotorvehicletransfers,includingthosemadewithoutpaymentofconsideration,aredenedassales and may

besubjecttoStandardPresumptiveValue(SPV)procedures.SeeTaxCodeSec.152.0412,StandardPresumptive

Value;UseByTaxAssessor-CollectorandRule3.79,StandardPresumptiveValue.

Documenting Additional Eligible Donor Relationships –

TheParent/StepparentcheckboxappliesalsotoaFather/Mother-in-Lawgift;theChild/Stepchildcheckboxappliesalso

toaSon/Daughter-in-Lawgift;theSiblingcheckboxappliesalsotoaBrother/Sister-in-Lawgift;andtheGrandparent

checkboxappliesalsotoaGrandparent-in-Lawgift.

When and Where to File –

AttimeoftitletransferwiththeCountyTaxAssessor-Collector.DonotsendthecompletedformtotheComptrollerof

PublicAccounts.

Documents Required –

InadditiontocompletingApplication For Texas Certicate of Title,Form130-U,boththedonorandpersonreceiving

thevehiclemustcompleteForm14-317,Afdavit of motor Vehicle Gift Transfer,describingthetransactionandthe

relationshipbetweenthedonorandrecipient.ThecountyTACorstaffmembermayacknowledgethedonororrecipient’s

signatureinlieuofformalnotarization,providedthatthepersonwhosesignatureisbeingacknowledgedispresentand

signstheafdavitinfrontofthecountyTACorstaffmember.Anotaryfromanotherstatemaynotarizethisdocument.A

faxedcopyisacceptabledocumentationforoneofthequaliedparties.

Ifthegifttransferistheresultofaninheritance,theexecutorshouldsignthegiftafdavitas“donor.”Ifthetransferis

completedusinganAfdavit of Heirship for a motor Vehicle(TxDMV-VTR262),onlyoneheirisrequiredtosignasdonor.

Whentherearemultipledonorsorrecipientssigning,additionalcopiesofForm14-317shouldbeusedtodocument

signaturesandnotaryacknowledgements.

Questions –

Ifyouhavequestionsorneedmoreinformation,contacttheComptroller’sofceat(800)252-1382oremail

[email protected].Rule3.80,MotorVehiclesTransferredasaGiftorforNoConsideration,explainsthelaw

anditsprovisionsandisavailableontheComptroller’swebsiteatwww.window.state.tx.us.