Fillable Printable The Pension Service Claim Sample Form

Fillable Printable The Pension Service Claim Sample Form

The Pension Service Claim Sample Form

D648 11/14 P1 of 12

Claim for Service Pension or

Income Support Supplement

Part B – Income and Assets

Claimant

Partner

Are dependent children included in this claim?

Two part claim

This is

Part B

of a two part claim form. To avoid delays in

processing your claim, please ensure both

Part B

and

Part A

are lodged together.

Completing this form

If you want to

know more

about the different types of income and

assets, please refer to the booklet About Claiming Service Pension or

About Claiming Income Support Supplement.

If your income and assets are complex, you may choose to use (at your

own expense) an accountant or financial adviser to help you complete

this form, but you (and your partner) must sign it.

If you

need more space

to answer questions, please provide an

attachment with the required details.

Please

tick

the appropriate boxes.

Please use

black

or

blue pen

.

If you have a partner

You must provide details of your partner’s income and assets in this

form, even if:

•

your partner is not claiming; or

•

your partner is already in receipt of service pension or income

support supplement.

You are asked to show whether you or your partner own an income or

asset item. Tick the ‘You’ box or the ‘Partner’ box. If it is owned jointly,

tick both boxes.

Privacy notice

Your personal information is protected by law, including the Privacy Act

1988. Your personal information may be collected by the Department of

Veterans’ Affairs (DVA) for the delivery of government programs for war

veterans, members of the Australian Defence Force, members of the

Australian Federal Police and their dependants.

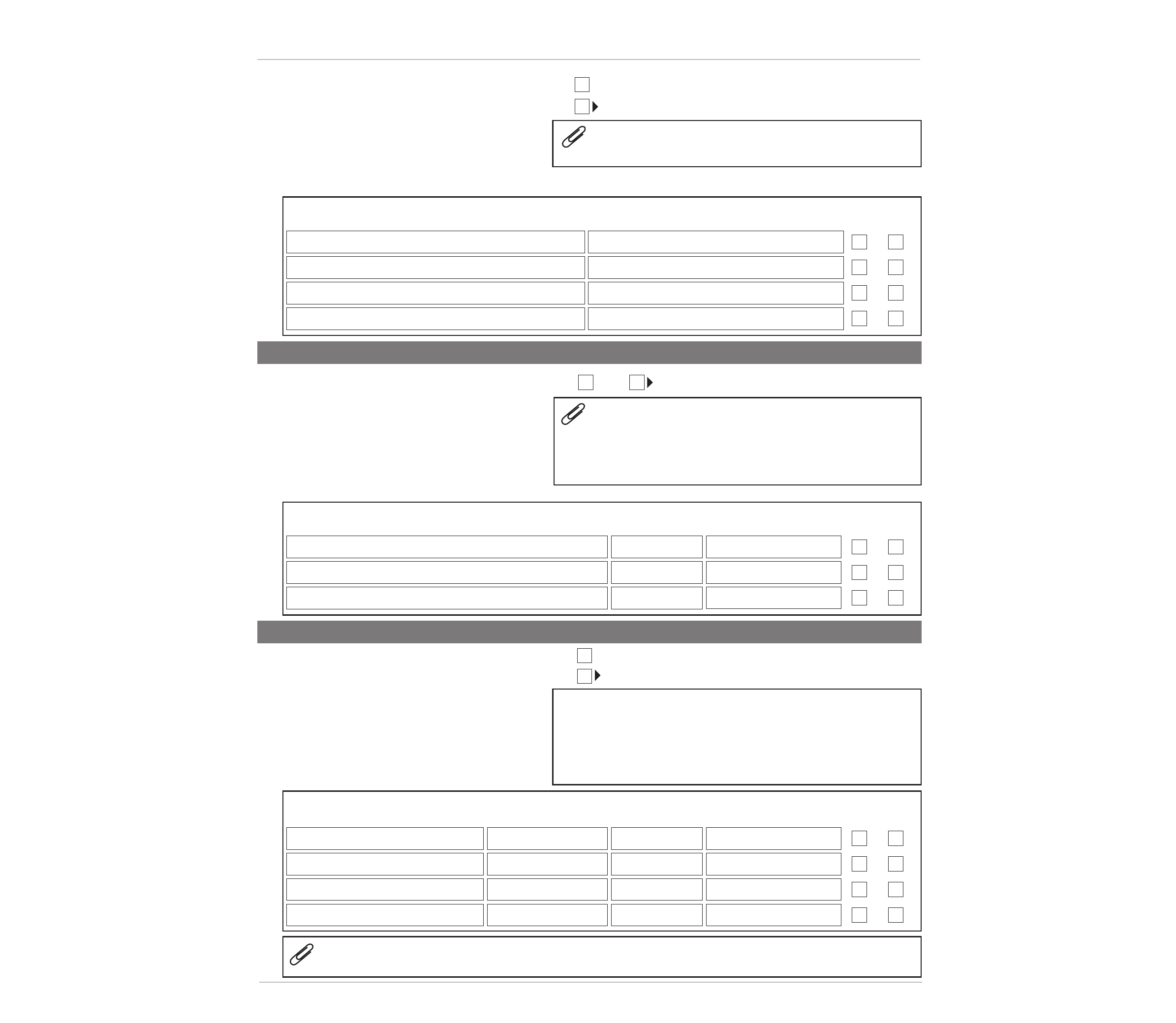

Family name Date of birth File number (if known)Given name(s)

No Yes

$

$

$

$

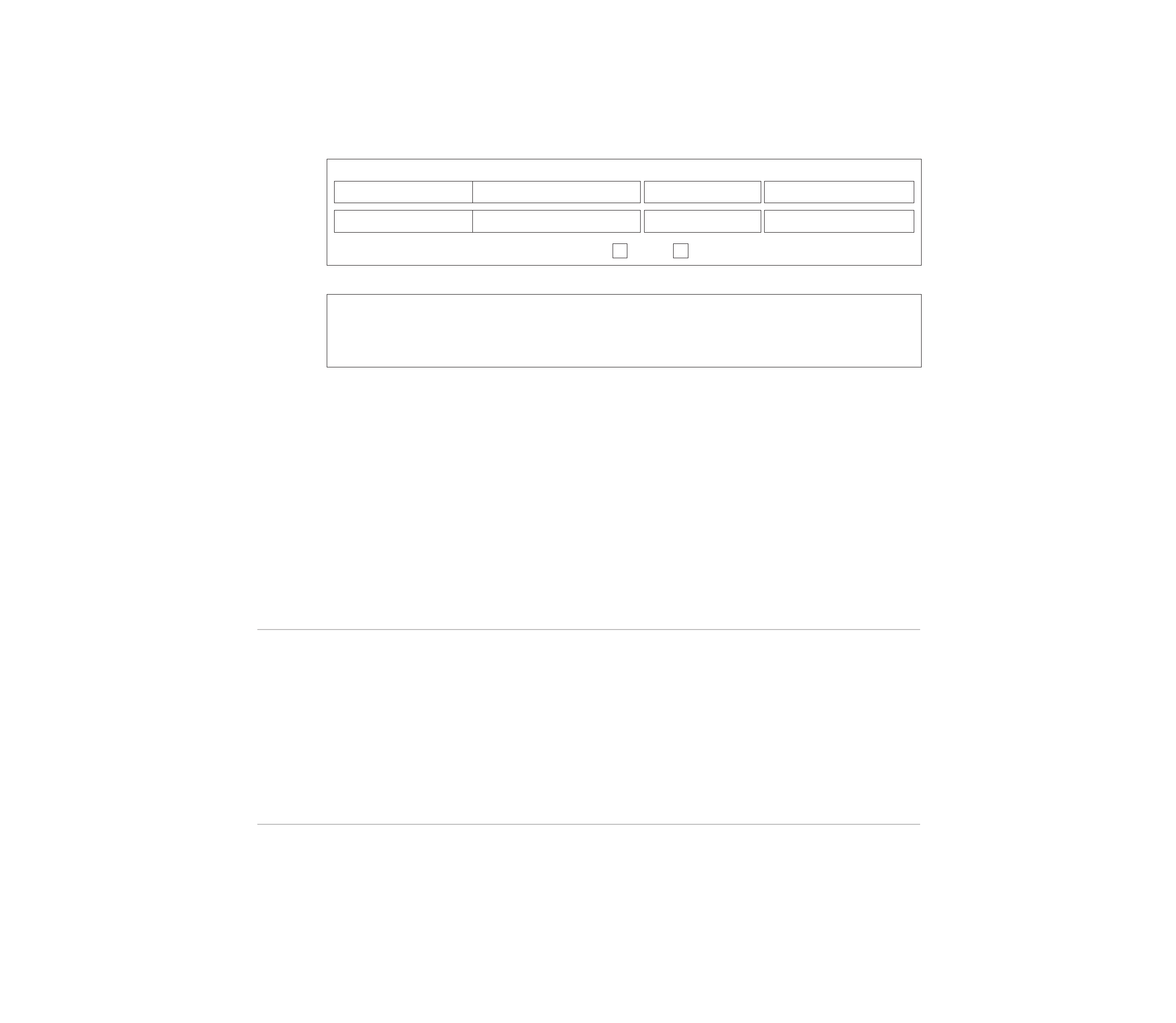

SECTION

A Income and assets

D648 11/14 P2 of 12

Bank accounts

1 Give details of all your (and/or your partner’s)

bank, building society and credit union accounts

Include: term deposits, joint accounts, accounts you

hold under any other name or money held in church

or charitable development funds.

Include details of the account your pension will be

paid into.

Do NOT include bonds or debentures. You will be

asked about these in a later question.

Account number or

Name of institution Name(s) in which account is held term deposit number Type of account Current balance

If you have money held in a church or charity account,

please attach a statement or document confirming details.

Yes

No

Cash holdings

2 Do you (and/or your partner) have cash holdings

totalling more than $2,000?

This does NOT include cash you have for shopping

and other day-to-day expenses.

Cash holdings means notes and coins you have in a

safety deposit box, or you are holding instead of

putting it into a bank account, or someone else is

looking after for you.

Amount owned by you

Amount owned by your partner

Yes

No

Shares

3 Do you (and/or your partner) own any shares,

options, rights, convertible notes or other

securities?

This includes listed and unlisted shares.

It includes shares traded in Australian and overseas

markets, and in exempt stock markets.

Give details

Total number Owned by:

Name of company Type of share of shares You Partner

Please attach a certified copy of the latest statement or

schedule detailing your share holding for each company.

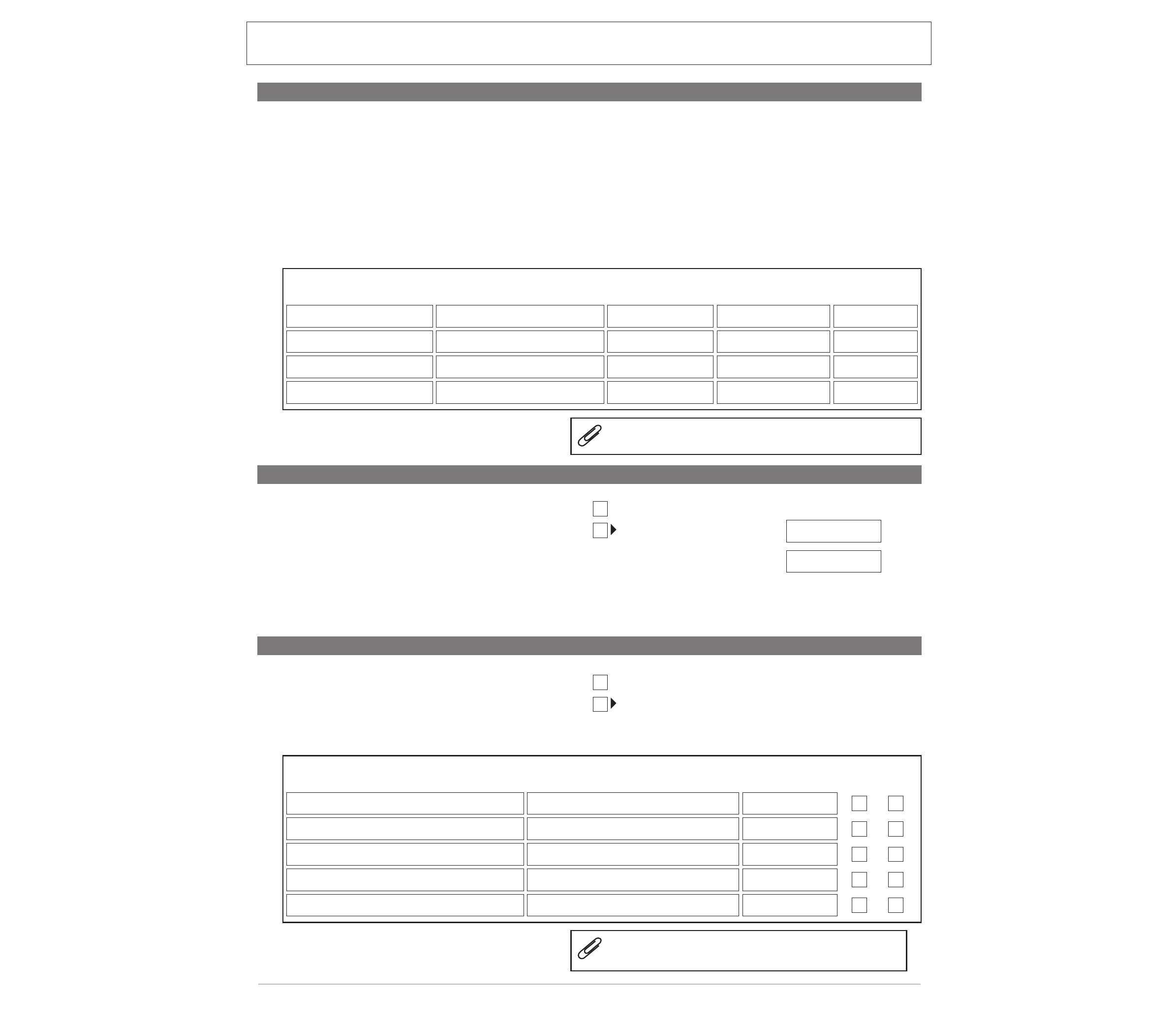

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P3 of 12

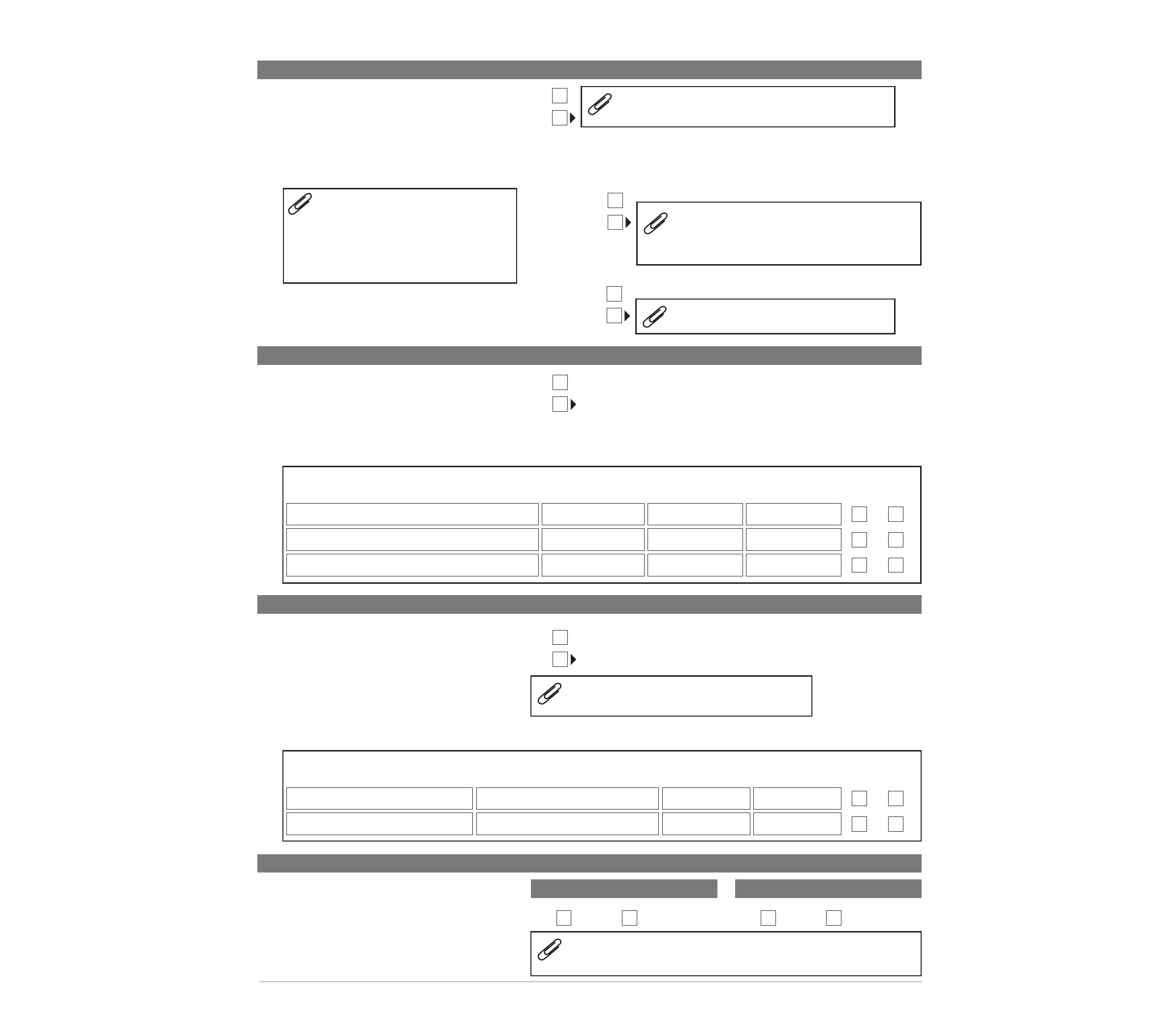

Yes

No

Bonds/debentures

4

Do you (and/or your partner) have any

bonds or debentures?

This includes bonds and debentures offered

by finance companies, public companies,

Government or Government business

enterprises, banks and financial institutions

in Australia and overseas.

Do NOT include friendly society bonds or

insurance bonds. You will be asked about

these in a later question.

Give details

Money invested with Certificate or Series Number Invested in name(s) of Current balance

Yes

No

Money on loan

5 Do you (and/or your partner) have money

on loan to anyone (including family

members) or money on loan to a private

trust or company?

Give details

Balance Lent by:

Name of the person to whom the money is loaned Date lent outstanding

You Partner

For each loan, please attach a certified copy

of a document which gives details.

Managed investments

6 Do you (and/or your partner) have any

managed investments?

Managed investments include investment

trusts, personal investment plans, insurance

bonds and friendly society bonds.

Do NOT include any life insurance policies.

Do NOT include superannuation or rollover

investments. You will be asked about these

in a later question.

Do NOT include bonds and debentures (you

should have listed these at Question 4).

Give details

Owned by:

Investment product

You Partner

For each managed investment owned by you (and/or your partner),

you

must

attach a certified copy of the latest documents which provide

details (e.g. certificate with number of units or account balance).

Yes

No

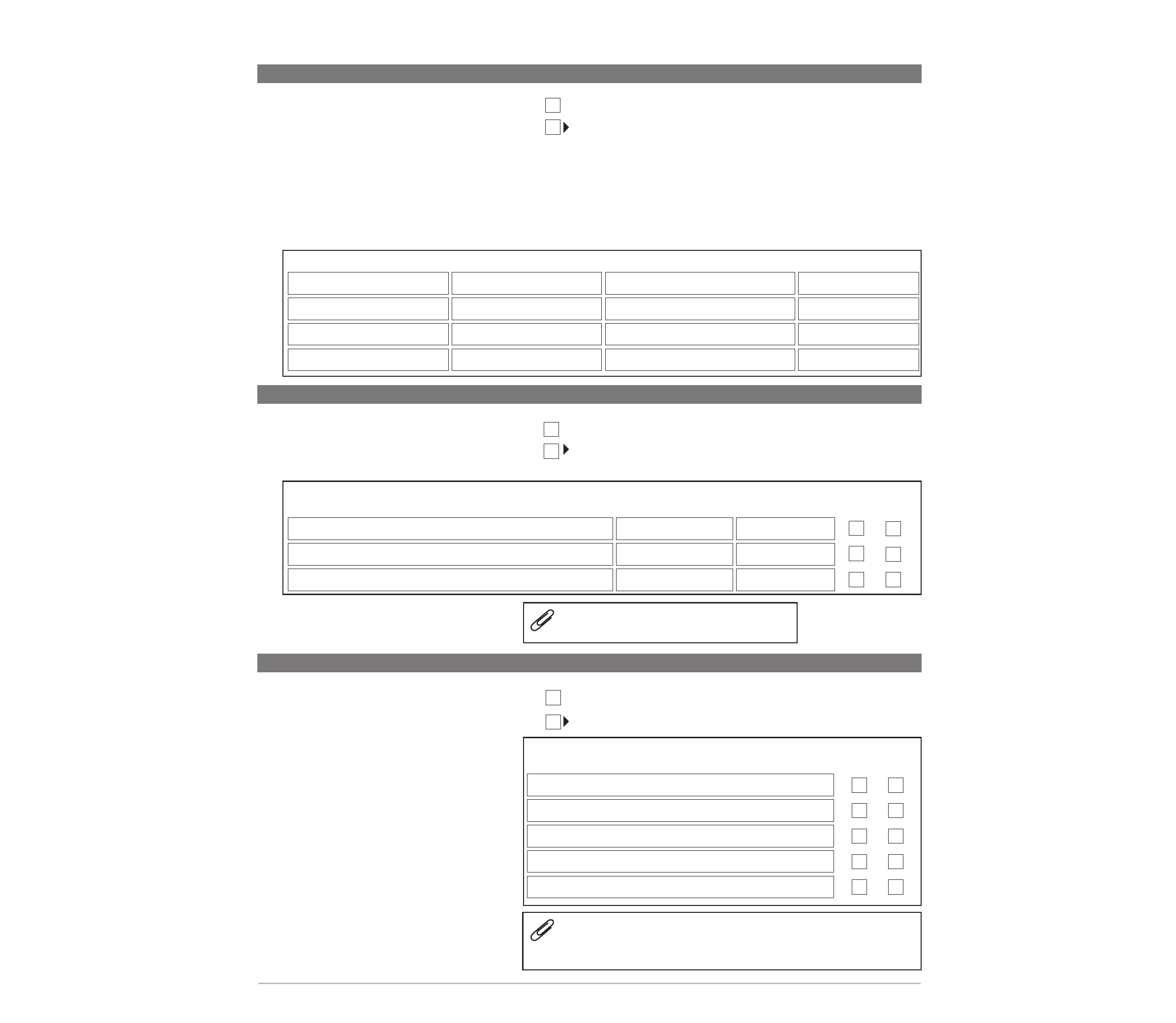

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P4 of 12

Yes

No

7

Do you (and/or your partner) have any money

in a superannuation fund where your fund is

in the accumulation phase and not paying

you a pension?

Superannuation funds include retail, industry

corporate, employer or public sector funds and

retirement savings accounts.

Do NOT include a self managed superannuation

fund. You will be asked about this in another question.

You must attach a certified copy of the latest statement for

each fund.

Give details

Owned by:

Name of institution/fund manager Investment product

You Partner

ComSuper, DFRB and any other defined benefit superannuation payments

8 Do you (and/or your partner) receive or are

you entitled to receive or are you presently

applying for superannuation defined benefit

income, pension or disability payments?

(Examples of defined benefit superannuation

fund payments include ComSuper pension,

Defence Force Retirement Benefits pension,

Military Super pension, State Super pension,

bank employee super).

Give details

Please attach your latest statement of benefit from the paying

authority. If your payment includes a tax free component, you

must also provide evidence of the amount from the paying

authority. A tax free component may be allowed as a

deduction against your gross payment.

Paid to:

Name of superannuation payment Start date Reference number

You Partner

Income streams other than defined benefit superannuation payments

9 Do you (or your partner) receive income from

an income stream?

An income stream is a regular series of

payments which may be made for a lifetime or

fixed period by:

• a financial institution

• a superannuation fund

• a retirement savings account.

Give details

Paid to:

Name of product provider Type of income stream Start date Product reference number

You Partner

Types of income streams include:

• account-based pension/allocated pension

• transition to retirement pension

• market linked pension/term allocated pension

• immediate annuity/account-based annuity

• superannuation pension (non-defined benefit).

Please attach a certified copy of documents which provide the latest details of each income stream — your provider

should be able to provide you with an ‘income stream schedule’ for each income stream product.

Yes

No

Yes

No

D648 11/14 P5 of 12

Yes

No

SECTION

A continued

INCOME AND ASSETS

Self managed superannuation funds

10 Are you (and/or your partner) a member of

a self managed superannuation fund

(SMSF) or a small APRA fund (SAF)?

These are superannuation funds you have

set up yourself ( also referred to as Do It

Yourself or DIY Funds).

Please attach a copy of the latest tax return for the

fund and the member statement.

Please attach a copy of documents which

provide the latest details of each income stream

and an ‘income stream schedule’ for each

income stream product.

Do you (and/or your partner) draw an income stream from

the SMSF or SAF in the form of an account-based or

allocated pension, transition to retirement pension, market

linked pension, lifetime or life expectancy pension/annuity?

Please attach full documentation in

respect of SMSF or SAF

investments. Contact your nearest

DVA office if you require more

information about what should be

provided.

Please attach a copy of the latest council

rates notice for each property.

Does the SMSF or SAF hold any real estate?

Gifts

In the last 5 years have you (and/or your

partner) given away, sold for less than

their value, or surrendered a right to, any

cash, assets, property or income?

This includes forgiven loans and shares in

private companies.

Give details

What you gave away or sold for less than its Gift made by:

value (e.g. money, car, second home, land, farm)

Date given or sold What it was worth What you got for it You Partner

12 Do you (and/or your partner) have any

money invested in, or do you receive income

from, any other investments not declared

elsewhere on this form?

Include all overseas investments not declared

elsewhere on this form.

Do NOT include real estate in Australia, private

trusts, private companies or business. You will

be asked about these in later questions.

Other investments

Give details

For each investment, please attach a certified

copy of a document which gives details.

Current value Income received Owned by:

Type of investment Name of organisation/company of investment in last 12 months

You Partner

Yes

No

11

Employment

13

Do you or your partner CURRENTLY

receive any income from work?

Do NOT include income from

self-employment. You will be asked

about this later in the form.

YOU YOUR PARTNER

For each employment, attach a completed Employment Report

form (D518).

No Yes No Yes

Yes

No

Yes

No

Yes

No

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P6 of 12

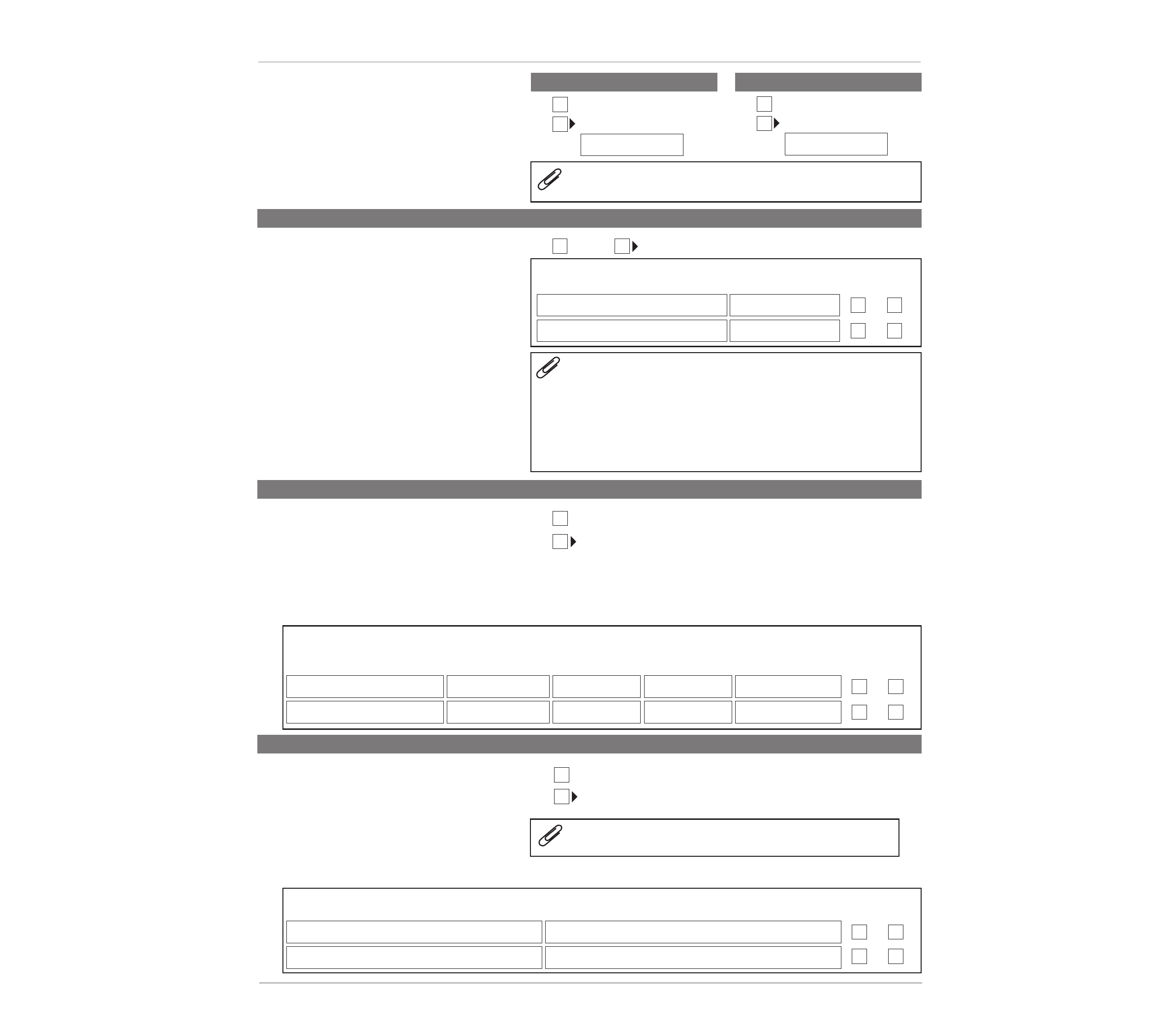

YesNo

14

In the last 12 months, have you or your

partner stopped working for any

employers?

Including self-employment.

YOU YOUR PARTNER

Date ceased

Date ceased

For each employer, please attach the Employment Separation

Certificate or complete the Retirement Benefits form (D531).

Income from an agency outside Australia

15 Do you (or your partner) receive income

from an agency outside Australia?

This includes overseas pensions (e.g. British

social security, armed forces, public service

and war pensions), benefits, allowances,

superannuation, compensation and war

related payments.

Please note: If you are eligible for an

overseas payment but don’t receive it, then

you must apply and advise DVA when you

receive it.

Give details

Paid to:

Type of payment Country who pays it

You Partner

For each payment, attach a certified copy of the latest document,

which shows the payment amount in the foreign currency and the

frequency of the payment. The document should also provide a

breakdown of the amounts included (e.g. for British social security

pension - attendance allowance, basic pension, graduated

retirement benefit etc.).

The document must be in English. If necessary, provide a

translation by an accredited translator.

Yes

No

Money from boarders or lodgers

16 Do you (and/or your partner) receive

money from any boarders or lodgers living

with you?

This includes boarders or lodgers who live

with you or in accommodation at the property

you live in (e.g. granny flat).

Do NOT include immediate family members

(son, daughter, parent).

Give details

Number of Amount paid for

Relationship to you meals you board or lodging Date boarder or Paid to:

Name of boarder/lodger

(e.g. friend, nephew) provide each day each fortnight lodger started paying

You Partner

Yes

No

No

Yes

Other payments

17 Do you (or your partner) receive any

payments from any other sources?

Other sources include:

• gratuities

• payment in kind, such as non-monetary

payments for services

• income from an estate

• any other income you have not included

elsewhere on this form.

For each type of payment, attach a certified copy of a

document which gives details.

Yes

No

Give details

Paid to:

Type of payment

Who pays it?

You Partner

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P7 of 12

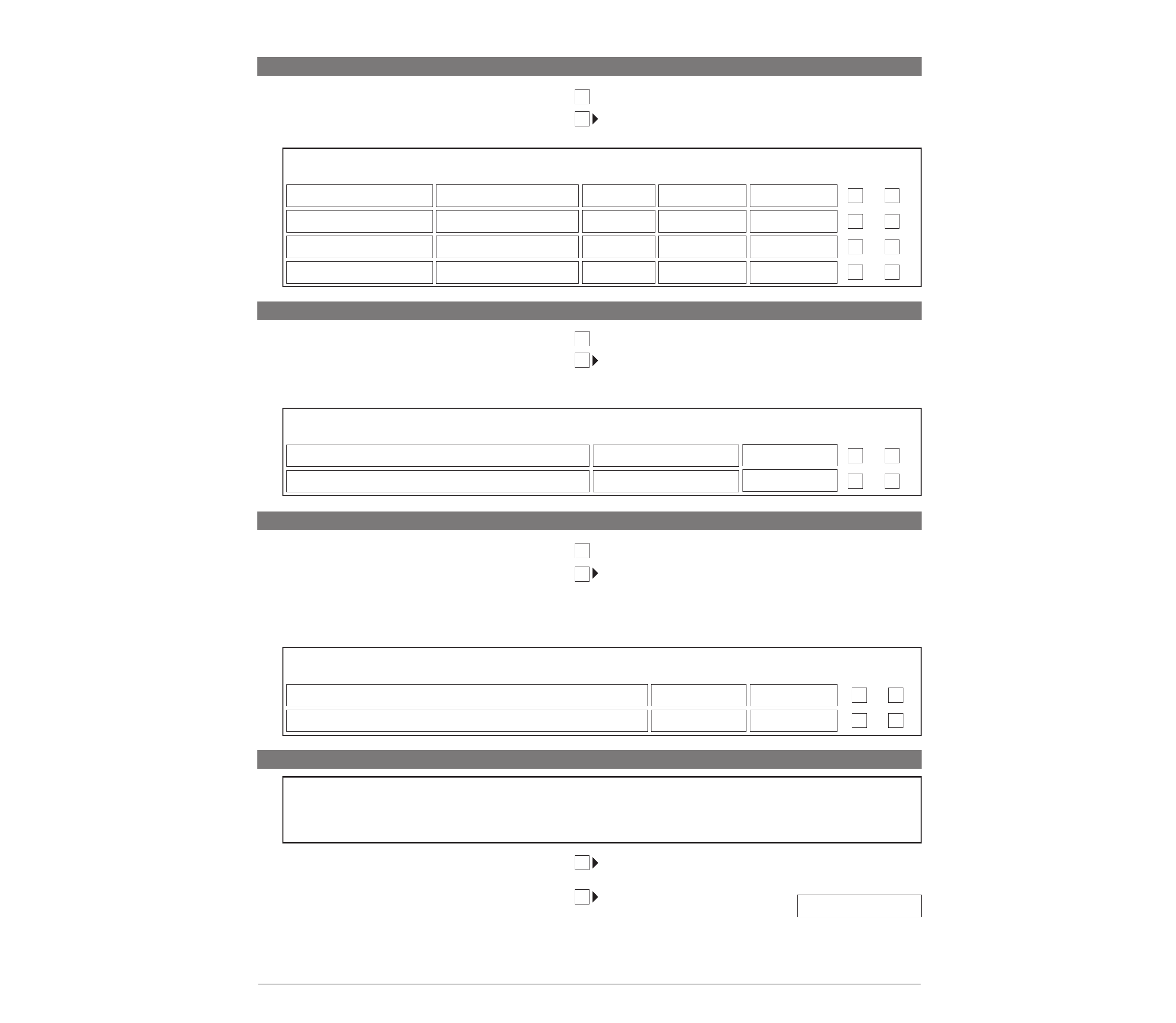

Yes

No

Vehicles

18 Do you (and/or your partner) own any motor

vehicles, boats, caravans or trailers?

Do NOT include a boat or caravan you live in, or

any farming or business vehicles.

Give details

Owned by:

Make (e.g. Ford) Model (e.g. Laser) Year Resale value Amount owing

You Partner

Life insurance policies

19 Do you (and/or your partner) have an

insurance policy that can be cashed in?

Do NOT include details of insurance bonds or

friendly society bonds in this question. You

should have given details of these in Question 6.

Give details

Owned by:

Name of insurance company Policy number Surrender value

You Partner

Other assets

20

Do you (and/or your partner) have any other

assets which you have not already told us

about?

Include valuable or collectible items such as

jewellery, antiques or bullion that are not included in

your Household contents value at Question 21

Give details

Current

Owned by:

Description of asset

market value

Amount owing

You Partner

Yes

No

Yes

No

Household contents

Household contents include all usual furniture such as soft furnishings (e.g. curtains), electrical appliances other than

fixtures such as stoves and built-in items. Personal effects include jewellery for personal use and hobby collections (e.g.

stamps, coins). The net market value of your household contents and personal effects is what you would get if you sold

them on the open market (less any debt or encumbrances). It is not the replacement or insured value.

$10,000 will be held as the value of

your contents and personal effects

What is the net market value of

your (and your partner’s) household

contents and personal effects?

$

21 Do you wish to declare a net market value

(resale value) for your household contents

and personal effects?

Yes

No

Go to question 28

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P8 of 12

Leaving your home

If you leave your home and do not receive income in respect of it, your pension will not be affected for up to:

• 12 months - if you have left your home temporarily; or

• 24 months - if you have been given an extension of time by DVA to acquire your home; or

• 2 years - while you receive care or provide care.

While you are in residential aged care, paying an accommodation charge or an accommodation bond wholly or partially by

periodic instalment, and renting out your former home, the value of your home and the rent received will not affect your pension.

If you leave your home because:

• it was sold; or

• it was lost or damaged (including by a disaster)

and you intend to acquire a new home, or repair the old home, you can continue to be considered a homeowner for up to 12

months.

In these situations, the sale or insurance/compensation proceeds that you intend to use to acquire the home are also

disregarded from the assets test for up to 12 months. The time period can be extended for up to an additional 12 months, if you

are experiencing delays in acquiring your home.

22 Have you sold your home

within the last 2 years?

Do you intend to use part or all of the home sale proceeds to buy or build a new

home?

Please attach documents providing details of the home sale (such as a

solicitor’s settlement letter)

23 Do you own your own home

but you and/or your partner

live somewhere else?

24 Who has left your home?

25

Have you and/or your

partner left your home:

When do you and/or your partner expect to

return to your home?

Is the temporary absence because your home was lost or damaged?

You may be contacted by DVA to request further

details

26 Is the home you left:

Occupied rent free

Occupied by you or your partner

Occupied by carer of other family member(s) (e.g. dependent child)

Left vacant

How much rent do you receive?

$

What date was the property let?

What is the balance of the mortgage owing (if any)?

What is the interest payable on the mortgage?

Is the rental money being used to pay for accommodation

charges for you and/or your partner in an aged care facility?

Yes

No

Let

Please attach mortgage contract or other document showing the balance of the

mortgage, tax returns (if you have them) and a list of the expenses involved in

letting the property (e.g. rates, agent’s fees, taxes, repairs, insurance).

Other—please specify

Permanently

Temporarily

No Yes

You Your partner You and your partner

per fortnight

%

YesNo

Yes

No

Yes

No

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P9 of 12

27 Have you and/or your partner moved

in with someone to provide care or to

be cared for?

Provide care Name of the person cared for

Be cared for Name of the care provider

Date you and/or your partner moved in to

provide care/be cared for?

How long will you and/or your partner be staying?

Long term or permanently

Short term or for respite care When do you and/or your

partner expect to leave?

Yes

No

Go to question

28

Please attach evidence of the need for a substantial level of

care (such as a doctor’s certificate).

Yes

No

Maintenance paid to a former partner

28 Do you (and/or your partner) pay

maintenance to a former partner?

Do NOT include maintenance paid for

any children.

How much per fortnight

Attach a certified copy of the deed or court agreement, or

other document which shows it is legally enforceable.

You pay Partner pays

Real estate details

29 If you own the home you live in (this

includes paying it off), does it stand

on a property larger than 2 hectares

(5 acres)?

Please complete and attach a Farm / Hobby Farm form

(D526), then go

30 Please tick the box which describes

the use of your property

PRIVATE AND

DOMESTIC

PURPOSES

If the property is on more than one title,

please complete and attach a Real

Estate form (D524) for each title other

than the title of your principal home.

COMMERCIAL USE

Please complete and attach a

Farm/Hobby Farm form (D526).

31 Do you (and/or your partner) own or

have an interest in any real estate in

Australia or overseas?

Do NOT include:

• your home;

• real estate owned or held by a

business, private company or

private trust – you will be asked

about these in a later question.

Yes

No

to Question

Yes

No

Please complete and attach a Real Estate form (D524) for

each property. In this form, you are asked to provide a

number of other documents such as a certified copy of your

last income tax return.

30.

SECTION

A continued

INCOME AND ASSETS

D648 11/14 P10 of 12

YesNo

Compensation and damages

32

Have you (and/or your partner)

received or are you receiving

compensation in relation to service

with the Australian Defence Force?

This includes compensation under the

Safety, Rehabilitation and Compensation

Act 1988 (SRCA), Defence Act 1903 and

the Military Rehabilitation and

Compensation Act 2004 (MRCA).

Type of payment

33 Have you (and/or your partner)

received or are you receiving or able

to claim any other compensation,

insurance or damages as a result of

injury, illness or accident?

This includes salary continuance,

income protection payments and Dust

Diseases Board payments. Claim may

be for:

• accident at work;

• work related illness;

• motor vehicle accident; or

• public liability.

Please complete and attach a Compensation form (D541)

for each injury, illness or accident.

Private company/private trust/business

34 Are you or have you (and/or your

partner) been involved in a private

trust in the last 5 years?

You may be, or have been a trustee,

an appointor or a beneficiary.

You may have made a loan to a

private trust, made a gift of cash,

assets or property to a private trust in

the last 5 years, relinquished control of

a private trust, a private annuity, a life

interest, or an interest in a deceased

estate.

Please complete and attach the Private Trust form (D601).

A separate form must be used for each trust.

If you do not have this form or you require additional forms,

contact DVA.

Have you or your partner ever contributed to a Special

Disability Trust?

Please complete and attach the Special

Disability Trust form (D9059). A separate

form must be used for each trust.

If you do not have this form or you require

additional forms, contact DVA.

36

Are you (and/or your partner)

involved in any other type of

business (this includes a farm)?

As a:

• sole trader;

• partnership; or

• subcontractor.

35 Are you or have you (and/or your

partner) been involved in a private

company in the last 5 years?

You may be, or have been a director

or a shareholder.

You may have made a loan to a

private company, transferred shares in

a private company, or made a gift of

cash, assets or property to a private

company.

Please complete and attach the Private Company form

(D600). A separate form must be used for each company.

If you do not have this form or you require additional forms,

contact DVA.

Please complete and attach the Details of Business

form (D525) or the Farm / Hobby Farm form (D526).

A separate form must be used for each business. In

these forms, you are asked to provide a number of

other documents such as a certified copy of your last

income tax return.

If you do not have this form or you require additional

forms, contact DVA.

Yes

No

Yes

No

Yes

No

YesNo

Yes

No

SECTION

B Attachment checklist

D648 11/14 P11 of 12

You must attach documents as evidence of your answers to some of the questions.

You must provide

certified copies

(see ‘Who can certify copies of documents’ in the

booklet About Claiming Service Pension or About Claiming Income Support

Supplement), or

original

documents can be sighted and verified by a DVA officer.

If any of your documents are in a language other than English, you must also provide

translations into English by an accredited translator.

If you do not have a form that you need, contact your nearest DVA or VAN office.

Use this checklist to make sure you have attached all the relevant documents.

Question

1

For money held in a church or charity account, a statement or document

3

Latest statement or schedule detailing your share holdings

5

Loan documents

6

Managed investment certificates or similar documents

7

8

Latest statement of benefits document from the paying authority

9

Latest ‘income stream schedule’ for each income stream product

Latest statements for superannuation fund investments

10

Tax returns and member statements for SMSF and SAF funds; latest ‘income

stream schedule’ for each income stream product; and latest council rates notices

for real estate held by those funds

12

Documents with details of investments

13

Attach Employment Report form (D518)

14

Attach Employment Separation Certificate or Retirement Benefits form (D531)

15

Documents with details of overseas agency payments

17

Documents with details of other payments

22

Documents providing details of the home sale

26

Mortgage contract, tax returns and list of letting expenses

27

Evidence of the need for a substantial level of care

28

Deed, court agreement or other document

29

Attach Farm /Hobby Farm form (D526)

30

Attach Real Estate form (D524) or Farm/Hobby Farm form (D526)

31

Attach Real Estate form (D524)

33

Attach Compensation form (D541)

34

Attach Private Trust form (D601)

34

Attach Special Disability Trust form (D9059)

35

Attach Private Company form (D600)

36

Attach Business details form (D525) or Farm / Hobby Farm form

(D526)

Please complete SECTIONS C and D on the next page