Fillable Printable Travel Voucher Template

Fillable Printable Travel Voucher Template

Travel Voucher Template

7. TRAVEL AUTHORIZATION

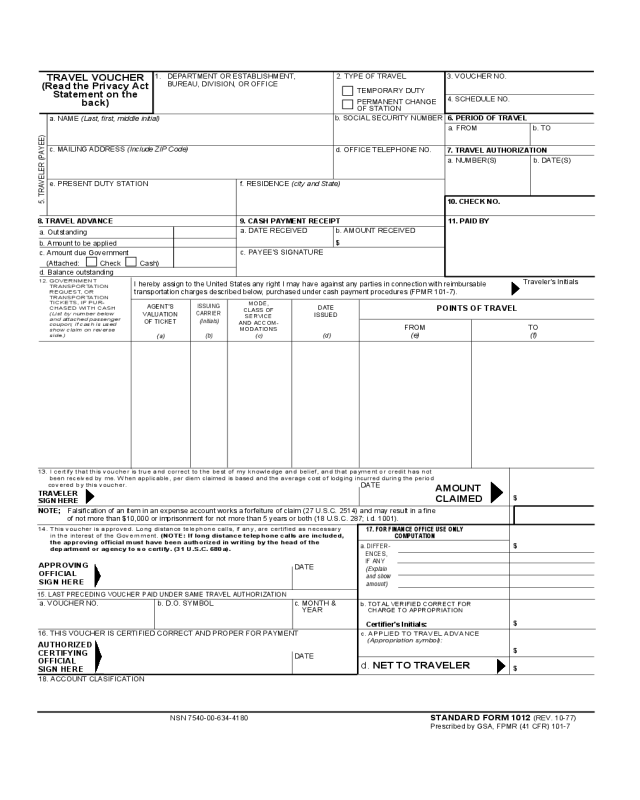

TRAVEL VOUCHER

(Read the Privacy Act

Statement on the

back)

1. DEPARTMENT OR ESTABLISHMENT,

BUREAU, DIVISION, OR OFFICE

2. TYPE OF TRAVEL

TEMPORARY DUTY

PERMANENT CHANGE

OF STATION

3. VOUCHER NO.

4. SCHEDULE NO.

a. NAME (Last, first, middle initial)

c. MAILING ADDRESS (Include ZIP Code)

e. PRESENT DUTY STATION

b. SOCIAL SECURITY NUMBER

d. OFFICE TELEPHONE NO.

6. PERIOD OF TRAVEL

a. FROM

b. TO

f. RESIDENCE (city and State)

a. NUMBER(S)

b. DATE(S)

10. CHECK NO.

8. TRAVEL ADVANCE

9. CASH PAYMENT RECEIPT 11. PAID BY

a. Outstanding

b. Amount to be applied

c. Amount due Government

(Attached:

Check Cash)

d. Balance outstanding

c. PAYEE'S SIGNATURE

12. GOVERNMENT

TRANSPORTATION

REQUEST, OR

TRANSPORTATION

TICKETS, IF PUR-

CHASED WITH CASH

(List by number below

and attached passenger

coupon; if cash is used

show claim on reverse

side.)

I hereby assign to the United States any right I may have against any parties in connection with reimbursable

transportation charges described below, purchased under cash payment procedures (FPMR 101-7).

AGENT'S

VALUATION

OF TICKET

(a)

ISSUING

CARRIER

(Initials)

(b)

MODE,

CLASS OF

SERVICE

AND ACCOM-

MODATIONS

(c)

DATE

ISSUED

(d)

POINTS OF TRAVEL

FROM

(e)

TO

(f)

a. DATE RECEIVED

b. AMOUNT RECEIVED

$

13. I certify that this voucher is true and correct to the best of my knowledge and belief, and that payment or credit has not

been received by me. When applicable, per diem claimed is based and the average cost of lodging incurred during the period

covered by this voucher.

TRAVELER

SIGN HERE

DATE

AMOUNT

CLAIMED

$

NOTE; Falsification of an item in an expense account works a forfeiture of claim (27 U.S.C. 2514) and may result in a fine

of not more than $10,000 or imprisonment for not more than 5 years or both (18 U.S.C. 287; i.d. 1001).

14. This voucher is approved. Long distance telephone calls, if any, are certified as necessary

in the interest of the Government. (NOTE: If long distance telephone calls are included,

the approving official must have been authorized in writing by the head of the

department or agency to so certify. (31 U.S.C. 680a).

APPROVING

OFFICIAL

SIGN HERE

DATE

17. FOR FINANCE OFFICE USE ONLY

COMPUTATION

a. DIFFER-

ENCES,

IF ANY

(Explain

and show

amount)

$

15. LAST PRECEDING VOUCHER PAID UNDER SAME TRAVEL AUTHORIZATION

a. VOUCHER NO. b. D.O. SYMBOL c. MONTH &

YEAR

16. THIS VOUCHER IS CERTIFIED CORRECT AND PROPER FOR PAYMENT

AUTHORIZED

CERTIFYING

OFFICIAL

SIGN HERE

DATE

18. ACCOUNT CLASIFICATION

b. TOTAL VERIFIED CORRECT FOR

CHARGE TO APPROPRIATION

c. APPLIED TO TRAVEL ADVANCE

(Appropriation symbol):

Certifier's Initials:

$

d. NET TO TRAVELER

$

$

NSN 7540-00-634-4180

STANDARD FORM 1012 (REV. 10-77)

Prescribed by GSA, FPMR (41 CFR) 101-7

Traveler's Initials

5. TRAVELER (PAYEE)

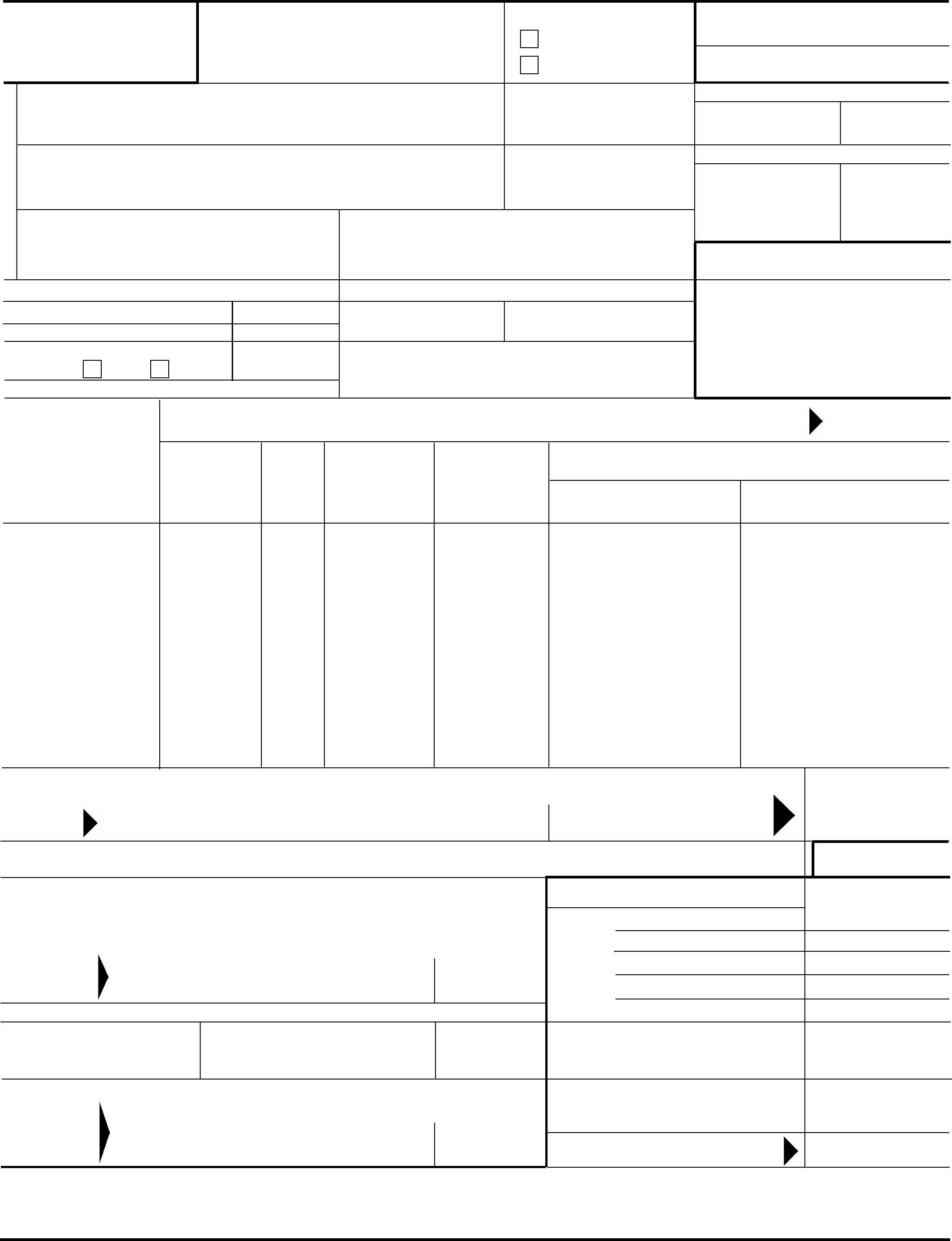

DESCRIPTION

(Departure/arrival city, per diem

computation, or other

explanations

of expense )

SCHEDULE

OF

EXPENSES

AND

AMOUNTS

CLAIMED

SUBTOTALS

TOTAL

AMOUNT

CLAIMED

DATE

TIME

ITEMIZED SUBSISTENCE EXPENSES

AMOUNT CLAIMED

Col. (c)

If the voucher includes

per diem allowances for

members of employee's

immediate family, show

member's names, ages

and relationship to em-

ployee and marital

status of children

(unless information is

shown on the travel

authorization.)

Com-

plete

only

for

actual

expense

travel

TRAVELER'S LAST NAME

TRAVEL AUTHORIZATION

NO.

Show amount incurred for each meal, including tax and tips, and

daily total meal cost.

MEALS

Show expenses, such as: laundry, cleaning and pressing clothes, tips

to bellboys, porters, etc. (other than for meals).

Complete for per diem and actual expense travel.

Show total subsistence expense incurred for actual expense travel.

Show per diem amount, limited to maximum rate, or if travel on actual

expense, show the lesser of the amount from col. (j) or maximum rate.

Show expenses, such as: taxi/limousine fares, air fare (if purchased

with cash), local or long distance telephone calls for Government

business, car rental, relocation other than subsistence, etc.

(a)

If additional space is required, continue on another SF 1012-A BACK, leaving the front blank.

(c)

INSTRUCTIONS TO TRAVELER (Unlisted items are self-explanation)

Complete this

information

if this is a

continuation

sheet

Enter grand total of columns (l), (m) and

(n), below and in item 13 on the front of

this form.

PAGE

of

TOTAL

(g)

(Hour

and

am/pm)

(b)

BREAK-

FAST

(d)

TOTAL

SUBSISTENCE

EXPENSE

(j)

NO. OF

MILES

( k)

MILEAGE

(l)

OTHER

(n)

MISCEL-

LANEOUS

SUBSIS-

TENCE

(h)

MILEAGE

RATE:

LODGING

(i)

SUBSISTENCE

(m)

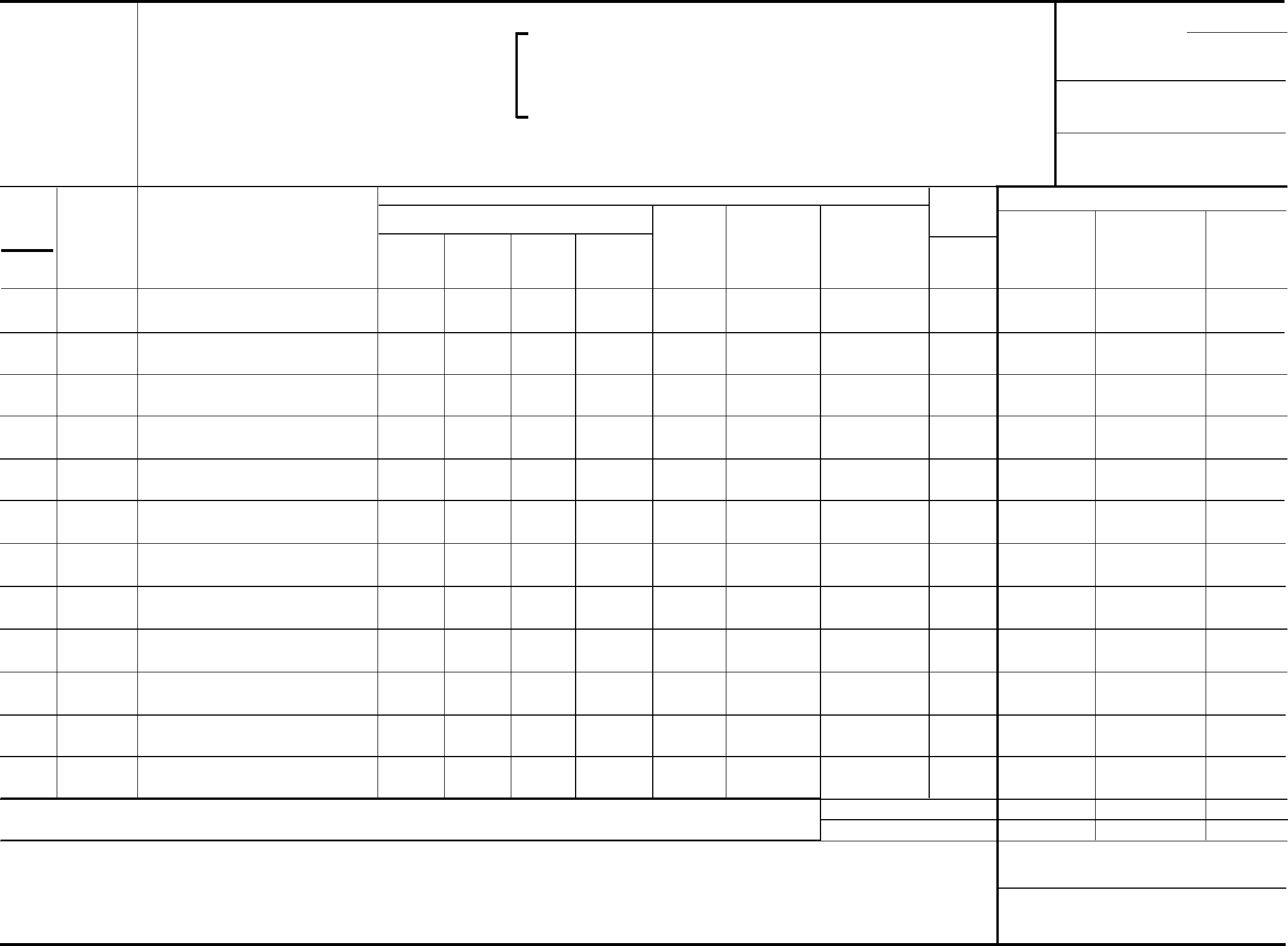

In compliance with the Privacy Act of 1974, the following information is provided: Solicitation of the information on this

form is authorized by 5 U.S.C. Chap. 57 as implemented by the Federal Travel Regulations (FPMR 101-7), E.O.

11609 of July 22, 1971, E.O. 110012 of March 27, 1962, E.O. 9397 of November 22, 1943, and 26 U.S.C. 6011(b)

and 6109. The primary purpose of the requested information is to determine payment or reimbursement to eligible

individuals for allowable travel and/or relocation expenses incurred under appropriate administrative authorization and

to record and maintain costs of such reimbursements to the Government. The information will be used by officers

and employees who have a need for information in the performance of their official duties. The information may be

disclosed to appropriate Federal, State, local, or foreign agencies when relevant to civil, criminal or regulatory

investigations or prosecutions, or when pursuant to a requirement by this agency in connection with the hiring or firing of

an employee, the issuance of a security clearance, or investigations of the per- formance of official duty while in

Government service. Your Social Security Account Number (SSN) is solicited under the authority of the Internal

Revenue Code (26 U.S.C. 6011 (b) and 6109) and E.O. 9397, November 22, 1943, for use as a taxpayer and/or

employee identification number; disclosure is MANDATORY on vouchers claiming travel and/or relocation allowance

expense reimbursement which is, or may be, taxable income. Disclosure of your SSN and other requested information is

voluntary in all other instances; however, failure to provide the information (other than SSN) required to support the claim

may result in delay or loss of reimbursement.

DINNER

(f)

LUNCH

(e)

STANDARD FORM 1012 BACK (10-77)

(h)

(i)

(j)

(m)

(n)

Col. (d)

(g)

}

►

►

►

TOTALS