Fillable Printable Uniform Application for Broker-Dealer Registration

Fillable Printable Uniform Application for Broker-Dealer Registration

Uniform Application for Broker-Dealer Registration

OMB APPROVAL

OMB Number: 3235-0012

Expires:

August 31, 2016

Estimated average burden

hours per response. . . . . . . 2.75

per amendment . . . . . . . . 0.33

Form BD

Uniform Application

for

Broker-Dealer Registration

Persons who respond to the collection of information contained

in this form are not required to respond unless the form displays

SEC1490 (1-08)

a currently valid OMB control number.

FORM BD INSTRUCTIONS

A. GENERAL INSTRUCTIONS

1. Form BD is the Uniform Application for Broker-Dealer Registration. Broker-Dealers must file this form to register with the

Securities and Exchange Commission, the self-regulatory organizations, and jurisdictions through the Central Registration

Depository (“CRD”) system, operated by FINRA.

2. UPDATING – By law, the applicant must promptly update Form BD information by submitting amendments whenever the

information on file becomes inaccurate or incomplete for any reason.

3. CONTACT EMPLOYEE – The individual listed as the contact employee must be authorized to receive all compliance

information, communications, and mailings, and be responsible for disseminating it within the applicant’s organization.

4. GOVERNMENT SECURITIES ACTIVITIES

A. Broker-dealers registered or applicants applying for registration under Section 15(b) of the Exchange Act that conduct (or

intend to conduct) a government securities business in addition to other broker-dealer activities (if any) must file a notice

on Form BD by answering “yes” to Item 2B.

B. Section 15C of the Securities Exchange Act of 1934 requires sole government securities broker-dealers to register with the

SEC. To do so, answer “yes” to Item 2C if conducting only a government securities business.

C. Broker-dealers registered under Section 15(b) of the Exchange Act that cease to conduct a government securities business

must file notice when ceasing their activities in government securities. To do so, file an amendment to Form BD and answer

“yes” to ltem 2D.

NOTE: Broker-dealers registered under Section 15C may register under Section 15(b) by filing an amendment to Form BD and

answering “yes” to Items 2A and 2D. By doing so, broker-dealer expressly consents to withdrawal of broker-dealer’s

registration under 15C of the Exchange Act.

5. FEDERAL INFORMATION LAW AND REQUIREMENTS – An agency may not conduct or sponsor, and a person is not required

to respond to, a collection of information unless it displays a currently valid control number. Section 15, 15B, 15C, 17(a) and 23(a)

of the Exchange Act authorize the Commission to collect the Information on this Form from registrants. See 15 U.S.C. 78o, 78o-

4, 78o-5, 78-q and 78w. Filing of this Form is mandatory; however the social security number information, which aids in identifying

the applicant, is voluntary. The principal purpose of this Form is to permit the Commission to determine whether the applicant

meets the statutory requirement to engage in the securities business. The Form also is used by applicants to register as broker-

dealers with certain self-regulatory organizations and all of the states. The Commission and the Financial Industry Regulatory

Authority, Inc. maintain the files of the information on this Form and will make the information publicly available. Any member

of the public may direct to the Commission any comments concerning the accuracy of the burden estimate on application facing

page of this Form, and any suggestions for reducing this burden. This collection of information has been reviewed by the Office

of Management and Budget in accordance with the clearance requirements of 44 U.S.C. §3507. The information contained in

this form is part of a system of records subject to the Privacy Act of 1974, as amended. The Securities and Exchange Commission

has published in the Federal Register the Privacy Act Systems of Records Notice for these records.

B. PAPER FILING INSTRUCTIONS (FIRST TIME APPLICANTS FILING WITH CRD AND WITH SOME JURISDICTIONS)

1. FORMAT

A. A full paper Form BD is required when the applicant is filing with the CRD for the first time. In addition, some jurisdictions

may require a separate paper filing of Form BD. The applicant should contact the appropriate jurisdiction(s) for specific filing

requirements.

B. Attach an Execution Page (Page 1) with original manual signatures to the initial Form BD filing.

C. Type all information.

D. Give the name of the broker-dealer and date on each page.

E. Use only the current version of Form BD and its Schedules or a reproduction of them.

2. DISCLOSURE REPORTING PAGE (DRP) – Information concerning the applicant or control affiliate that relates to the

occurrence of an event reportable under Item 11 must be provided on the applicant’s appropriate DRP(BD). If a control affiliate

is an individual or organization registered through the CRD, such control affiliate need only complete Part I of the applicant’s

appropriate DRP(BD). Details of the event must be submitted on the control affiliate’s appropriate DRP(BD) or DRP(U-4). Attach

a copy of the fully completed DRP(BD), or DRP(U-4) previously submitted. If a control affiliate is an individual or organization not

registered through the CRD, provide complete answers to all of the items on the applicant’s appropriate DRP(BD).

3. SCHEDULES A, B AND C – File Schedules A and B only with initial applications for registration. Use Schedule C to update

Schedules A and B. Individuals not required to file a Form U-4 (individual registration) with the CRD system who are listed on

Schedules A, B, or C must attach page 2 of Form U-4. The applicant broker-dealer must be listed in Form U-4 Item 20 or 21.

Signatures are not required.

4. SCHEDULE D – Schedule D provides additional space for explaining answers to Item 1C(2), and ‘’yes’’ answers to items 5, 7,

8, 9,10,12, and 13 of Form BD.

C. ELECTRONIC FILING INSTRUCTIONS (APPLICANTS/ REGISTERED BROKER-DEALERS FILING AMENDMENTS WITH CRD)

1. FORMAT

A. Items 1-13 must be answered and all fields requiring a response must be completed before the filing will be accepted.

B. Applicant must complete the execution screen certifying that Form BD and amendments thereto have been executed

properly and that the information contained therein is accurate and complete.

C. To amend information, applicant must update the appropriate Form BD screens.

D. A paper copy, with original manual signatures, of the initial Form BD filing and amendments to Disclosure Reporting Pages

(DRPs BD) must be retained by the applicant and be made available for inspection upon a regulatory request.

2. DISCLOSURE REPORTING PAGE (DRP) – Information concerning the applicant or control affiliate that relates to the

occurrence of an event reportable under Item 11 must be provided on the applicant’s appropriate DRP(BD). If a control affiliate

is an individual or organization registered through the CRD, such control affiliate need only complete the control affiliate name

and CRD number of the applicant’s appropriate DRP(BD). Details for the event must be submitted on the control affiliate’s

appropriate DRP(BD) or DRP(U-4). If a control affiliate is an individual or organization not registered through the CRD, provide

complete answers to all of the questions and complete all fields requiring a response on the applicant’s appropriate DRP(BD)

screen.

3. DIRECT AND INDIRECT OWNERS – Amend the Direct Owners and Executive Officers screen and the Indirect Owners screen

when changes in ownership occur. Control affiliates that are individuals who are not required to file a Form U-4 (individual

registration) with the CRD must complete page 2 of Form U-4 (i.e., submit/file the information elicited by the Personal Data,

Residential History, and Employment and Personal History sections of that Form). The applicant broker-dealer must be listed

in Form U-4 Item 20 or 21.

The CRD mailing address for questions and correspondence is:

NASAA/FINRA CENTRAL REGISTRATION DEPOSITORY

P.O. BOX 9495

GAITHERSBURG, MD 20898-9495

EXPLANATION OF TERMS

(The following terms are italicized throughout this form.)

1. GENERAL

APPLICANT – The broker-dealer applying on or amending this form.

CONTROL – The power, directly or indirectly, to direct the management or policies of a company, whether through ownership of

securities, by contract, or otherwise. Any person that (i) is a director, general partner or officer exercising executive responsibility (or

having similar status or functions); (ii) directly or indirectly has the right to vote 25% or more of a class of a voting security or has the

power to sell or direct the sale of 25% or more of a class of voting securities; or (iii) in the case of a partnership, has the right to receive

upon dissolution, or has contributed, 25% or more of the capital, is presumed to control that company. (This definition is used solely

for the purpose of Form BD.)

JURISDICTION – A state, the District of Columbia, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, or any subdivision or

regulatory body thereof.

PERSON – An individual, partnership, corporation, trust, or other organization.

SELF-REGULATORY ORGANIZATION – Any national securities or commodities exchange or registered securities association, or

registered clearing agency.

2. FOR THE PURPOSE OF ITEM 5 AND SCHEDULE D

SUCCESSOR - An unregistered entity that assumes or acquires substantially all of the assets and liabilities, and that continues the

business of, a registered predecessor broker-dealer, who ceases its broker-dealer activities. [See Securities Exchange Act Release

No. 31661 (December 28, 1992), 58 FR 7 (January 4, 1993)]

3. FOR THE PURPOSE OF ITEM 11 AND THE CORRESPONDING DISCLOSURE REPORTING PAGES (DRPs)

CONTROL AFFILIATE – A person named in Items 1A, 9 or in Schedules A, B or C as a control person or any other individual or

organization that directly or indirectly controls, is under common control with, or is controlled by, the applicant, including any current

employee except one performing only clerical, administrative, support or similar functions, or who, regardless of title, performs no

executive duties or has no senior policy making authority.

INVESTMENT OR INVESTMENT-RELATED – Pertaining to securities, commodities, banking, insurance, or real estate (including,

but not limited to, acting as or being associated with a broker-dealer, municipal securities dealer, government securities broker or

dealer, issuer, investment company, investment adviser, futures sponsor, bank, or savings association).

INVOLVED – Doing an act or aiding, abetting, counseling, commanding, inducing, conspiring with or failing reasonably to supervise

another in doing an act.

FOREIGN FINANCIAL REGULATORY AUTHORITY – Includes (1) a foreign securities authority; (2) other governmental body or

foreign equivalent of a self-regulatory organization empowered by a foreign government to administer or enforce its laws relating to

the regulation of investment or investment-related activities; and (3) a foreign membership organization, a function of which is to

2

regulate the participation of its members in the activities listed above.

PROCEEDING – Includes a formal administrative or civil action initiated by a governmental agency, self-regulatory organization or

a foreign financial regulatory authority; a felony criminal indictment or information (or equivalent formal charge); or a misdemeanor

criminal information (or equivalent formal charge). Does not include other civil litigation, investigations, or arrests or similar charges

effected in the absence of a formal criminal indictment or information (or equivalent formal charge).

CHARGED – Being accused of a crime in a formal complaint, information, or indictment (or equivalent formal charge).

ORDER – A written directive issued pursuant to statutory authority and procedures, including orders of denial, suspension, or

revocation; does not include special stipulations, undertakings or agreements relating to payments, limitations on activity or other

restrictions unless they are included in an order.

FELONY – For jurisdictions that do not differentiate between a felony and a misdemeanor, a felony is an offense punishable by a

sentence of at least one year imprisonment and/or a fine of at least $1,000. The term also includes a general court martial.

MISDEMEANOR – For jurisdictions that do not differentiate between a felony and a misdemeanor, a misdemeanor is an offense

punishable by a sentence of less than one year imprisonment and/or a fine of less than $1,000. The term also includes a special court

martial.

FOUND – Includes adverse final actions, including consent decrees in which the respondent has neither admitted nor denied the

findings, but does not include agreements, deficiency letters, examination reports, memoranda of understanding, letters of caution,

admonishments, and similar informal resolutions of matters.

MINOR RULE VIOLATION – A violation of a self-regulatory organization rule that has been designated as “minor’’ pursuant to a plan

approved by the U.S. Securities and Exchange Commission. A rule violation may be designated as “minor’’ under a plan if the

sanction imposed consists of a fine of $2,500 or less, and if the sanctioned person does not contest the fine. (Check with the

appropriate self-regulatory organization to determine if a particular rule violation has been designated as “minor” for these purposes).

ENJOINED – Includes being subject to a mandatory injunction, prohibitory injunction, preliminary injunction, or a temporary

restraining order.

3

FORM BD

PAGE 1

(Execution Page)

UNIFORM APPLICATION FOR BROKER-DEALER REGISTRATION

Date:____________________ SEC File No: 8- __________________ Firm CRD No.: _______________

OFFICIAL USE

OFFICIAL

USE

ONLY

WARNING: Failure to keep this form current and to file accurate supplementary information on a timely basis, or the failure to keep accurate books

and records or otherwise to comply with the provisions of law applying to the conduct of business as a broker-dealer would violate the

Federal securities laws and the laws of the jurisdictions and may result in disciplinary, administrative, injunctive or criminal action.

INTENTIONAL MISSTATEMENTS OR OMISSIONS OF FACTS MAY CONSTITUTE CRIMINAL VIOLATIONS.

APPLICATION AMENDMENT

1. Exact name, principal business address, mailing address, if different, and telephone number of applicant:

A. Full name of applicant (if sole proprietor, state last, first and middle name):

B. IRS Empl. Ident. No.:

C. (1) Name under which broker-dealer business primarily is conducted, if different from Item 1A.

(2) List on Schedule D, Page1, Section I any other name by which the firm conducts business and where it is used.

D. If this filing makes a name change on behalf of the applicant, enter the new name and specify whether the name change is of the

applicant name (1A) or business name (1C):

Please check above.___________________________________________________________________________________________________________________

E. Firm main address: (Do not use a P.O. Box)

______________________________________________________________________________________________________________________________

(Num

ber

and Street)

(City) (State/Country)

(Zip+4/Postal Code)

Branch offices or other business locations must be reported on Schedule E.

F. Mailing address, if different:

______________________________________________________________________________________________________________________________

G. Business Telephone Number:

___________ ________________________________

(Area Code) (Telephone Number)

H. Contact Employee:

______________________________________________________________ ___________ _________________________________

(Name and Title) (Area Code) (Telephone Number)

EXECUTION:

For the purposes of complying with the laws of the State(s) designated in Item 2 relating to either the offer or sale of securities or commodities, the undersigned and applicant hereby certify that the applicant

is in compliance with applicable state surety bonding requirements and irrevocably appoint the administrator of each of those State(s) or such other person designated by law, and the successors in such office,

attorney for the applicant in said State(s), upon whom may be served any notice, process, or pleading in any action or proceeding against the applicant arising out of or in connection with the offer or sale of

securities or commodities, or out of the violation or alleged violation of the laws of those State(s), and the applicant hereby consents that any such action or proceeding against the applicant may be commenced

in any court of competent jurisdiction and proper venue within said State(s) by service of process upon said appointee with the same effect as if applicant were a resident in said State(s) and had lawfully been

served with process in said State(s).

The applicant consents that service of any civil action brought by or notice of any proceeding before the Securities and Exchange Commission or any self-regulatory organization in connection with the applicant’s

broker-dealer activities, or of any application for a protective decree filed by the Securities Investor Protection Corporation, may be given by registered or certified mail or confirmed telegram to the applicant’s

contact employee at the main address, or mailing address if different, given in Items 1E and IF.

The undersigned, being first duly sworn, deposes and says that he/she has executed this form on behalf of, and with the authority of, said applicant. The undersigned and applicant represent that the information

and statements contained herein, including exhibits attached hereto, and other information filed herewith, all of which are made a part hereof, are current, true and complete. The undersigned and applicant further

represent that to the extent any information previously submitted is not amended such information is currently accurate and complete.

__________________________ _______________________________________________________________________________

Date (MM/DD/YYYY) Name of Applicant

By: _____________________________________________________ __________________________________________________________________

Signature Print Name and Title

Subscribed and sworn before me this _________ day of __________________________ , _________ b y ______________________________________

Year Notary Public

My Commision expires ________________________ County of ____________________________ State of _______________________________

This page must always be completed in full with original, manual signature and notarization.

To amend, circle items being amended. Affix notary stamp or seal where applicable.

DO NOT WRITE BELOW THIS LINE - FOR OFFICIAL USE ONLY

__________________________________________________________________________________________________________________

OFFICIAL

USE

OFFICIAL USE

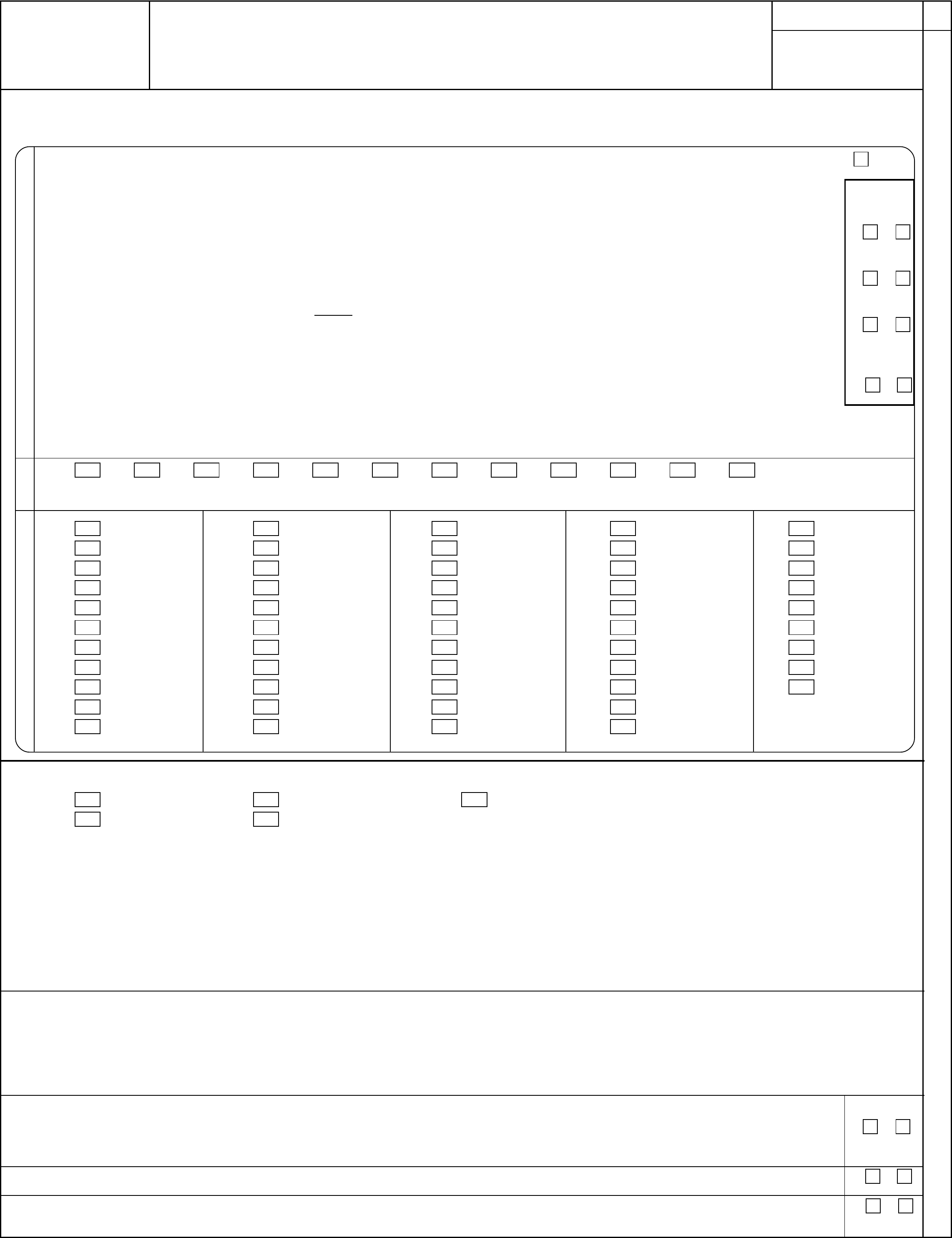

FORM BD

ONLY

ApplicantName:______________________________________________________________________

PAGE 2

Date:____________________ Firm CRD No.: _______________

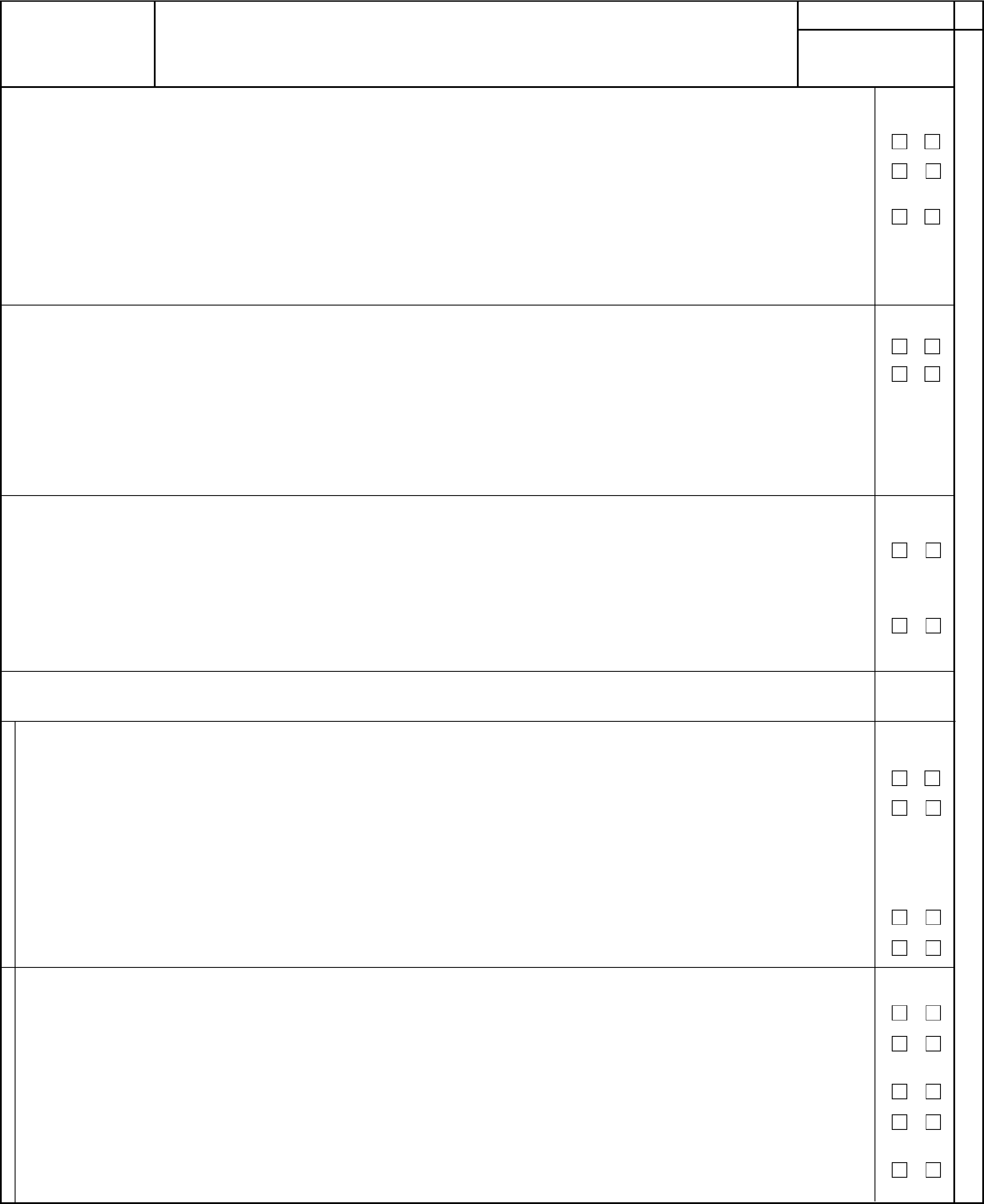

2. Indicate by checking the appropriate box(es) each governmental authority, organization, or jurisdiction in which the applicant is

registered or registering as a broker-dealer.

If applicant is registered or registering with the SEC, check here and answer Items 2A through 2D below.

YES NO

A. Is applicant registered or registering as a broker-dealer under Section 15(b) or Section 15B of the

Securities Exchange Act of 1934? ..................................................................................................................................

B. Is applicant registered or registering as a broker-dealer under Section 15(b) of the Securities Exchange

Act of 1934 and also acting or intending to act as a government securities broker or dealer? ..................................

C. Is applicant registered or registering

solely as a government securities broker or dealer under Section

15C of the Securities Exchange Act of 1934? ................................................................................................................

Do not answer “yes” to Item 2C if applicant answered “yes” to Item 2A or Item 2B.

D. Is applicant ceasing its activities as a government securities broker or dealer? .........................................................

If applicant answers “yes” to Items 2A and 2D, applicant expressly consents to the withdrawal of its registration

as a government securities broker or dealer under Section 15C of the Securities Exchange Act of 1934. See “Instructions.”

___________________________________

AMEX BSE CBOE CHX NSX FINRA NQX NYSE PHLX ARCA ISE OTHER (specify)

Alabama Hawaii Michigan North Carolina Texas

Alaska Idaho Minnesota North Dakota Utah

Arizona Illinois Mississippi Ohio Vermont

Arkansas Indiana Missouri Oklahoma Virgin Islands

California Iowa Montana Oregon Virginia

Colorado Kansas Nebraska Pennsylvania Washington

Connecticut Kentucky Nevada Puerto Rico West Virginia

Delaware Louisiana New Hampshire Rhode Island Wisconsin

District of Columbia Maine New Jersey South Carolina Wyoming

Florida Maryland New Mexico South Dakota

Georgia Massachusetts New York Tennessee

SRO SECURITIES AND EXCHANGE COMMISSIONJURISDICTION

3. A. Indicate legal status of applicant.

Corporation Sole Proprietorship Other (specify) _________________________________

Partnership Limited Liability Company

B. Month applicant’s fiscal year ends: _______________

C. If other than a sole proprietor, indicate date and place applicant obtained its legal status (i.e., state or country where incorporated,

where partnership agreement was filed, or where applicant entity was formed):

State/Country of formation: ____________________________________ Date of formation: ___________________________

(MM/DD/YYYY)

Schedule A and, if applicable, Schedule B must be completed as part of all initial applications. Amendments to these schedules

must be provided on Schedule C.

4. If applicant is a sole proprietor, state full residence address and Social Security Number.

Social Security Number: __ __ __ – __ __ __ – __ __ __ __

(Number and Street) (City) (State/Country) (Zip+4/Postal Code)

5. Is applicant at the time of this filing succeeding to the business of a currently registered broker-dealer? YES NO

Do not report previous successions already reported on Form BD. .....................................................................................

If “Yes,” contact CRD prior to submitting form; complete appropriate items on Schedule D, Page 1, Section lll.

6. Does applicant hold or maintain any funds or securities or provide clearing services for any other broker or dealer? ...

7. Does applicant refer or introduce customers to any other broker or dealer? .....................................................................

If “Yes,”complete appropriate items on Schedule D, Page 1, Section IV.

FORM BD

PAGE 3

ApplicantName:______________________________________________________________________

Date:____________________ Firm CRD No.: _______________

OFFICIAL USE

OFFICIAL

USE

ONLY

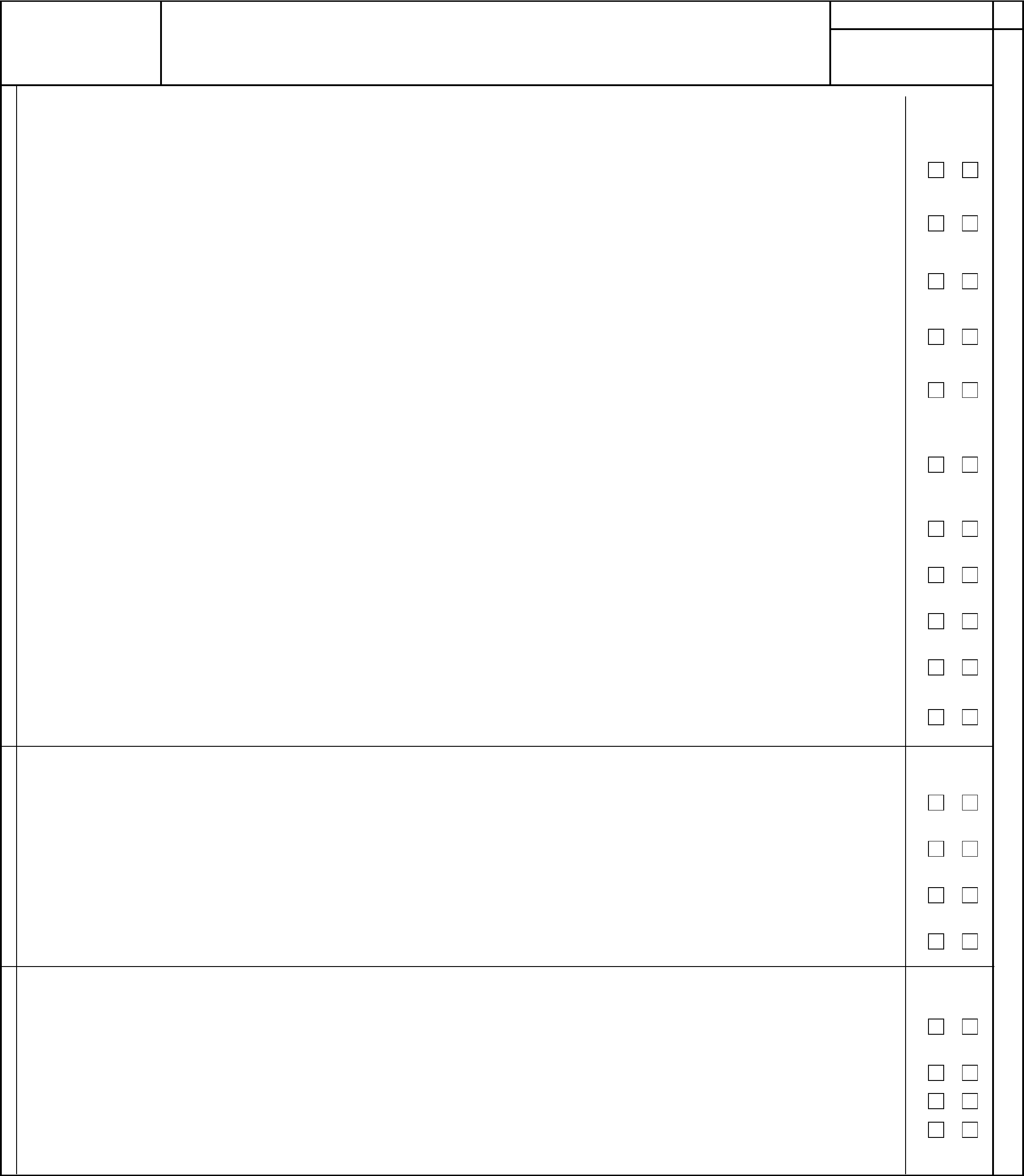

8. Does applicant have any arrangement with any other person, firm, or organization under which: YES NO

A. any books or records of applicant are kept or maintained by such other person, firm or organization? ...................

B. accounts, funds, or securities of the applicant are held or maintained by such other person, firm, or organization?

C. accounts, funds, or securities of customers of the applicant are held or maintained by such other person, firm or

organization? ...................................................................................................................................................................

For purposes of 8B and 8C, do not include a bank or satisfactory control location as defined in paragraph (c) of

Rule 15c3-3 under the Securities Exchange Act of 1934 (17 CFR 240.15c3-3).

if “Yes” to any part of Item 8, complete appropriate items on Schedule D, Page 1, Section IV.

9. Does any person not named in Item 1 or Schedules A, B, or C, directly or indirectly:

A. control the management or policies of the applicant through agreement or otherwise? ............................................

B. wholly or partially finance the business of applicant? ...................................................................................................

Do not answer “Yes” to 9B if the person finances the business of the applicant through: 1) a public offering of securities

made pursuant to the Securities Act of 1933; 2) credit extended in the ordinary course of business by suppliers, banks,

and others; or 3) a satisfactory subordination agreement, as defined in Rule 15c3-1 under the Securities Exchange Act

of 1934 (17 CFR 240.15c3-1).

If “Yes’’ to any part of Item 9, complete appropriate items on Schedule D, Page 1, Section IV.

10. A. Directly or indirectly, does applicant control, is applicant controlled by, or is applicant under common control with,

any partnership, corporation, or other organization that is engaged in the securities or investment advisory

business? .........................................................................................................................................................................

If “Yes” to Item 10A, complete appropriate items on Schedule D, Page 2, Section V.

B. Directly or indirectly, is applicant controlled by any bank holding company, national bank, state member bank of

the Federal Reserve System, state non-member bank, savings bank or association, credit union, or foreign bank? ..

If “Yes” to Item 10B, complete appropriate items on Schedule D, Page 3, Section VI.

11. Use the appropriate DRP for providing details to “yes” answers to the questions in Item 11. Refer to the Explanation of

Terms section of Form BD Instructions for explanations of italicized terms.

CRIMINAL DISCLOSURE

A. In the past ten years has the applicant or a control affiliate:

(1) been convicted of or pled guilty or nolo contendere (“no contest’’) in a domestic, foreign or military court

to any felony? ...........................................................................................................................................................

(2) been charged with any felony? ...............................................................................................................................

B. In the past ten years has the applicant or a control affiliate:

(1) been convicted of or pled guilty or nolo contendere (“no contest’’) in a domestic, foreign or military court to

a misdemeanor involving: investments or an investment-related business, or any fraud, false statements

or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or a conspiracy

to commit any of these offenses? ...........................................................................................................................

(2) been charged with a misdemeanor specified in 11B(1)? .......................................................................................

REGULATORY ACTION DISCLOSURE

C. Has the U.S. Securities and Exchange Commission or the Commodity Futures Trading Commission ever:

(1) found the applicant or a control affiliate to have made a false statement or omission? .......................................

(2) found the applicant or a control affiliate to have been involved in a violation of its regulations or statutes? ......

(3) found the applicant or a control affiliate to have been a cause of an investment-related business having its

authorization to do business denied, suspended, revoked, or restricted? ...........................................................

(4) entered an order against the applicant or a control affiliate in connection with investment-related activity? ......

(5) imposed a civil money penalty on the applicant or a control affiliate, or ordered the applicant or a control

affiliate to cease and desist from any activity? .......................................................................................................

OFFICIAL

USE

OFFICIAL USE

FORM BD

ONLY

ApplicantName:______________________________________________________________________

PAGE 4

Date:____________________ Firm CRD No.: _______________

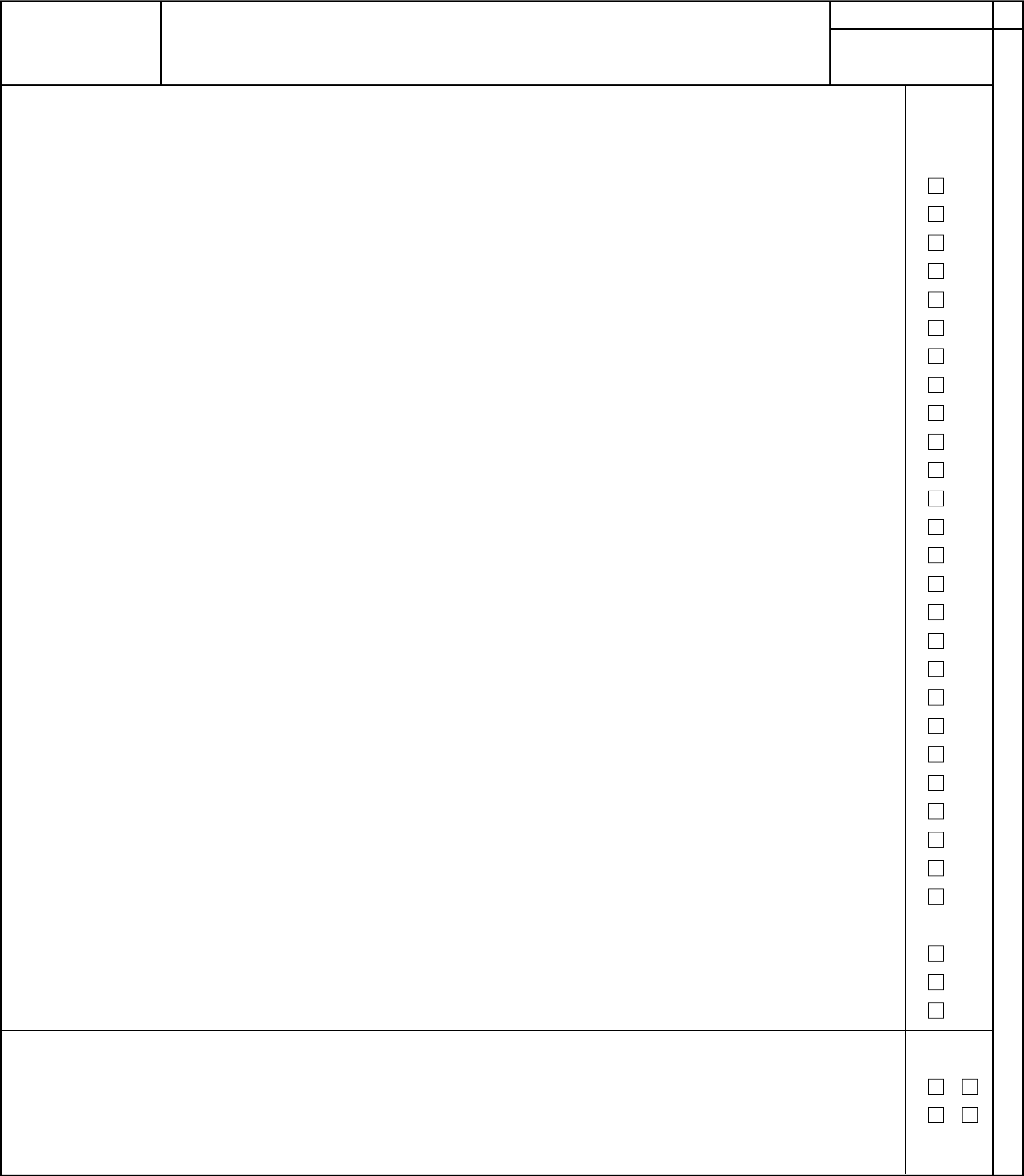

CIVIL JUDICIAL DISCLOSURE

FINANCIAL DISCLOSURE

REGULATORY ACTION DISCLOSURE

D. Has any other federal regulatory agency, any state regulatory agency, or foreign financial regulatory authority: YES NO

(1) ever found the applicant or a control affiliate to have made a false statement or omission or been dishonest,

unfair, or unethical? .................................................................................................................................................

(2) ever found the applicant or a control affiliate to have been involved in a violation of investment-related

regulations or statutes? ...........................................................................................................................................

(3) ever found the applicant or a control affiliate to have been a cause of an investment-related business having

its authorization to do business denied, suspended, revoked, or restricted? ......................................................

(4) in the past ten years, entered an order against the applicant or a control affiliate in connection with an

investment-related activity? .....................................................................................................................................

(5) ever denied, suspended, or revoked the applicant’s or a control affiliate’s registration or license or otherwise,

by order, prevented it from associating with an investment-related business or restricted its activities? ..........

E. Has any self-regulatory organization or commodities exchange ever:

(1) found the applicant or a control affiliate to have made a false statement or omission? .......................................

(2) found the applicant or a control affiliate to have been involved in a violation of its rules (other than a violation

designated as a “minor rule violation’’ under a plan approved by the U.S. Securities and Exchange

Commission)? ..........................................................................................................................................................

(3) found the applicant or a control affiliate to have been the cause of an investment-related business having its

authorization to do business denied, suspended, revoked, or restricted? ...........................................................

(4) disciplined the applicant or a control affiliate by expelling or suspending it from membership, barring or

suspending its association with other members, or otherwise restricting its activities? ......................................

F. Has the applicant’s or a control affiliate’s authorization to act as an attorney, accountant, or federal contractor ever

been revoked or suspended? .........................................................................................................................................

G. Is the applicant or a control affiliate now the subject of any regulatory proceeding that could result in a “yes”

answer to any part of 11C, D, or E? ...............................................................................................................................

H. (1) Has any domestic or foreign court:

(a) in the past ten years, enjoined the applicant or a control affiliate in connection with any investment-related

activity?..............................................................................................................................................................

(b) ever found that the applicant or a control affiliate was involved in a violation of investment-related statutes

or regulations? ..................................................................................................................................................

(c) ever dismissed, pursuant to a settlement agreement, an investment-related civil action brought against

the applicant or control affiliate by a state or foreign financial regulatory authority? .....................................

(2) Is the applicant or a control affiliate now the subject of any civil proceeding that could result in a “yes” answer

to any part of 11H(1)? ..............................................................................................................................................

I. In the past ten years has the applicant or a control affiliate of the applicant ever been a securities firm or a control

affiliate of a securities firm that:

(1) has been the subject of a bankruptcy petition? .....................................................................................................

(2) has had a trustee appointed or a direct payment procedure initiated under the Securities Investor Protection

Act? ...........................................................................................................................................................................

J. Has a bonding company ever denied, paid out on, or revoked a bond for the applicant? .........................................

K. Does the applicant have any unsatisfied judgments or liens against it? ......................................................................

FORM BD

PAGE 5

ApplicantName:______________________________________________________________________

Date:____________________ Firm CRD No.: _______________

OFFICIAL USE

OFFICIAL

USE

ONLY

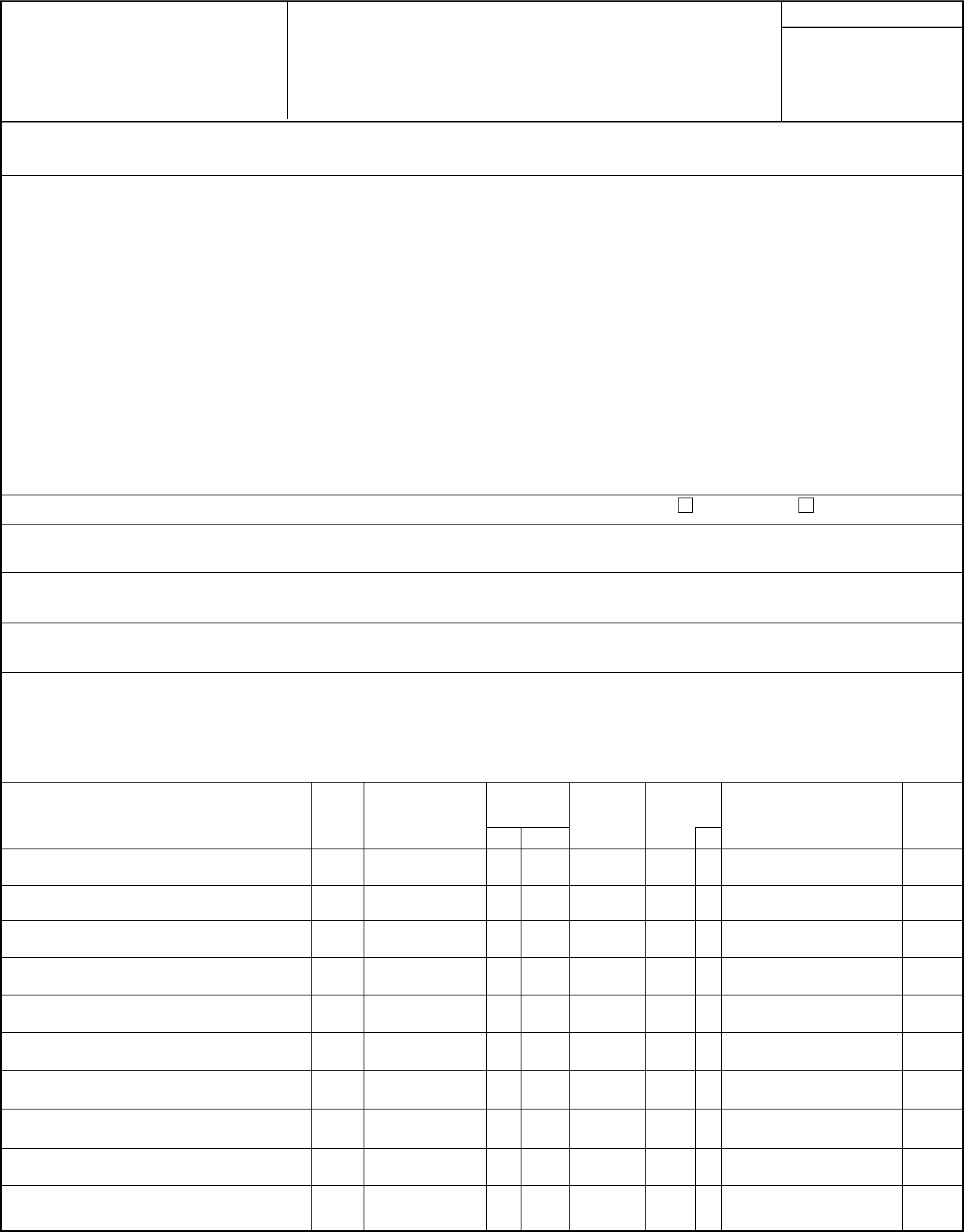

12. Check types of business engaged in (or to be engaged in, if not yet active) by applicant. Do not check any

category that accounts for (or is expected to account for) less than 1% of annual revenue from the securities

or investment advisory business.

A. Exchange member engaged in exchange commission business other than floor activities ...................................... EMC

B. Exchange member engaged in floor activities .............................................................................................................. EMF

C. Broker or dealer making inter-dealer markets in corporate securities over-the-counter ............................................. IDM

D. Broker or dealer retailing corporate equity securities over-the-counter ....................................................................... BDR

E. Broker or dealer selling corporate debt securities ........................................................................................................ BDD

F. Underwriter or selling group participant (corporate securities other than mutual funds) ........................................... USG

G. Mutual fund underwriter or sponsor ............................................................................................................................... MFU

H. Mutual fund retailer ......................................................................................................................................................... MFR

I. 1. U.S. government securities dealer .......................................................................................................................... GSD

2. U.S. government securities broker ......................................................................................................................... GSB

J. Municipal securities dealer ............................................................................................................................................. MSD

K. Municipal securities broker. ............................................................................................................................................ MSB

L . Broker or dealer selling variable life insurance or annuities ......................................................................................... VLA

M. Solicitor of time deposits in a financial institution.......................................................................................................... SSL

N. Real estate syndicator. . .................................................................................................................................................. RES

O. Broker or dealer selling oil and gas interests ................................................................................................................ OGI

P. Put and call broker or dealer or option writer ................................................................................................................ PCB

Q. Broker or dealer selling securities of only one issuer or associate issuers (other than mutual funds) ...................... BIA

R. Broker or dealer selling securities of non-profit organizations (e.g., churches, hospitals) ......................................... NPB

S. Investment advisory services .......................................................................................................................................... IAD

T. 1. Broker or dealer selling tax shelters or limited partnerships in primary distributions .......................................... TAP

2. Broker or dealer selling tax shelters or limited partnerships in the secondary market ........................................ TAS

U. Non-exchange member arranging for transactions in listed securities by exchange member ................................... NEX

V. Trading securities for own account ................................................................................................................................ TRA

W. Private placements of securities ..................................................................................................................................... PLA

X. Broker or dealer selling interests in mortgages or other receivables ........................................................................... MRI

Y. Broker or dealer involved in a networking, kiosk or similar arrangement with a:

1. bank, savings bank or association, or credit union ............................................................................................... BNA

2. insurance company or agency ................................................................................................................................ INA

Z. Other (give details on Schedule D, Page 1, Section II) .................................................................................................. OTH

13. A. Does applicant effect transactions in commodity futures, commodities or commodity options as a broker for

others or as a dealer for its own account? .............................................................................................................

B. Does applicant engage in any other non-securities business? .............................................................................

If “yes,” describe each other business briefly on Schedule D, Page 1, Section ll.

YES NO

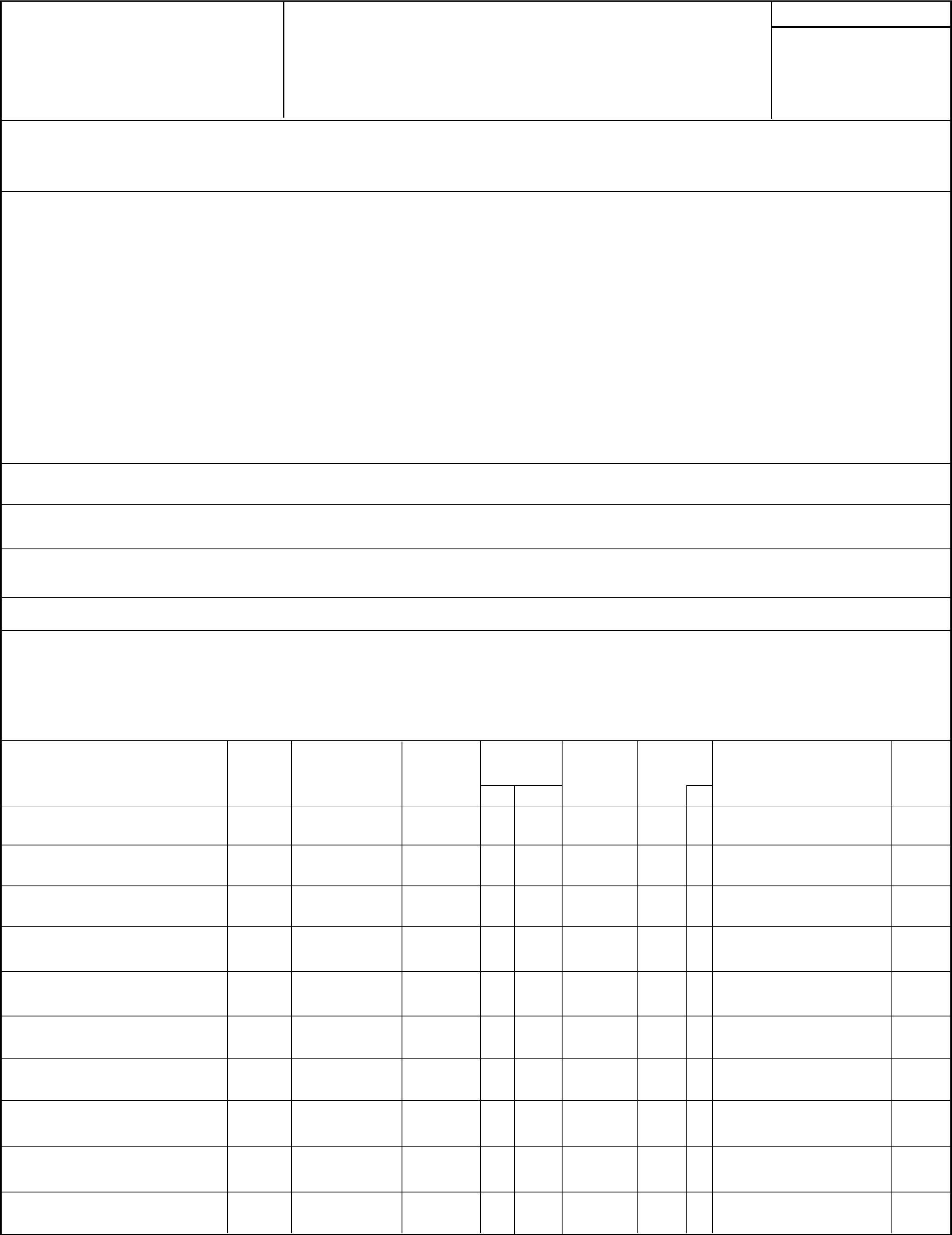

Schedule A of FORM BD

OFFICIAL USE

DIRECT OWNERS AND Applicant Name:_____________________________________________

EXECUTIVE OFFICERS

(Answer for Form BD Item 3)

Date:____________________ Firm CRD No.: _______________

1. Use Schedule A only in new applications to provide information on the direct owners and executive officers of the applicant. Use Schedule

B in new applications to provide information on indirect owners. File all amendments on Schedule C. Complete each column.

2. List below the names of:

(a) each Chief Executive Officer, Chief Financial Officer, Chief Operations Officer, Chief Legal Officer, Chief Compliance Officer, Director,

and individuals with similar status or functions;

(b) in the case of an applicant that is a corporation, each shareholder that directly owns 5% or more of a class of a voting security of the

applicant, unless the applicant is a public reporting company (a company subject to Sections 12 or 15(d) of the Securities Exchange

Act of 1934);

Direct owners include any person that owns, beneficially owns, has the right to vote, or has the power to sell or direct the sale of, 5%

or more of a class of a voting security of the applicant. For purposes of this Schedule, a person beneficially owns any securities (i)

owned by his/her child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-

law, daughter-in-law, brother-in-law, or sister-in-law, sharing the same residence; or (ii) that he/she has the right to acquire, within

60 days, through the exercise of any option, warrant or right to purchase the security.

(c) in the case of an applicant that is a partnership, all general partners and those limited and special partners that have the right to receive

upon dissolution, or have contributed, 5% or more of the partnership’s capital; and

(d) in the case of a trust that directly owns 5% or more of a class of a voting security of the applicant, or that has the right to receive upon

dissolution, or has contributed, 5% or more of the applicant’s capital, the trust and each trustee.

(e) in the case of an applicant that is a Limited Liability Company (“LLC”), (i) those members that have the right to receive upon

dissolution, or have contributed, 5% or more of the LLC’s capital, and (ii) if managed by elected managers, all elected managers.

3. Are there any indirect owners of the applicant required to be reported on Schedule B?

Yes No

4. In the “DE/FE/I” column, enter “DE” if the owner is a domestic entity, or enter “FE” if owner is an entity incorporated or domiciled in a foreign

country, or enter “I” if the owner is an individual.

5. Complete the “Title or Status” column by entering board/management titles; status as partner, trustee, sole proprietor, or shareholder;

and for shareholders, the class of securities owned (if more than one is issued).

6. Ownership codes are: NA - less than 5% B - 10% but less than 25% D - 50% but less than 75%

A - 5% but less than 10% C - 25% but less than 50% E - 75% or more

7. (a) In the “Control Person” column, enter “Yes” if person has “control” as defined in the instructions to this form, and enter “No” if the

person does not have control. Note that under this definition most executive officers and all 25% owners, general partners, and

trustees would be “control persons”.

(b) In the “PR” column, enter “PR” if the owner is a public reporting company under Sections 12 or 15(d) of the Securities Exchange Act

of 1934.

Date Title or

Control

CRD No. If None:

Official

FULL LEGAL NAME

DE/FE/I

Title or Status

Status Acquired

Ownership

Person

S.S. No., IRS Tax No.

Use

(Individuals: Last Name, First Name, Middle Name)

Code

or Employer ID.

Only

MM YYYY PR

Schedule B of FORM BD

OFFICIAL USE

INDIRECT OWNERS ApplicantName:_____________________________________________

(Answer for Form BD Item 3)

Date:____________________ Firm CRD No.: _______________

1. Use Schedule B only in new applications to provide information on the indirect owners of the applicant. Use Schedule A in new

applications to provide information on direct owners. File all amendments on Schedule C. Complete each column.

2. With respect to each owner listed on Schedule A, (except individual owners), list below:

(a) in the case of an owner that is a corporation, each of its shareholders that beneficially owns, has the right to vote, or has the power

to sell or direct the sale of, 25% or more of a class of a voting security of that corporation;

For purposes of this Schedule, a person beneficially owns any securities (i) owned by his/her child, stepchild, grandchild, parent,

stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law,

sharing the same residence; or (ii) that he/she has the right to acquire, within 60 days, through the exercise of any option, warrant

or right to purchase the security.

(b) in the case of an owner that is a partnership, all general partners and those limited and special partners that have the right to receive

upon dissolution, or have contributed, 25% or more of the partnership’s capital; and

(c) in the case of an owner that is a trust, the trust and each trustee.

(d) in the case of an owner that is a Limited Liability Company (“LCC”), (i) those members that have the right to receive upon dissolution,

or have contributed, 25% or more of the LLC’s capital, and (ii) if managed by elected managers, all elected managers.

3. Continue up the chain of ownership listing all 25% owners at each level. Once a public reporting company (a company subject to Sections

12 or 15(d) of the Securities Exchange Act of 1934) is reached, no ownership information further up the chain of ownership need be given.

4. In the “DE/FE/I” column, enter “DE” if the owner is a domestic entity, or enter “FE” if owner is an entity incorporated or domiciled in a foreign

country, or enter “I” if the owner is an individual.

5. Complete the “Status” column by entering status as partner, trustee, shareholder, etc., and if shareholder, class of securities owned (if

more than one is issued).

6. Ownership codes are: C - 25% but less than 50% D - 50% but less than 75% E - 75% or more F - Other General Partners

7. (a) In the “Control Person” column, enter “Yes” if person has “control” as defined in the instructions to this form, and enter “No” if the

person does not have control. Note that under this definition most executive officers and all 25% owners, general partners, and

trustees would be“control persons”.

(b) In the “PR” column, enter “PR” if the owner is a public reporting company under Sections 12 or 15(d) of the Securities Exchange Act

of 1934.

Date

Control

CRD No. If None:

Official

FULL LEGAL NAME DE/FE/I Entity in Which Status Acquired Ownership Person S.S. No., IRS Tax No. Use

(Individuals: Last Name, First Name, Interest is Owned Status Code or Employer ID. Only

Middle Name) MM YYYY PR