Fillable Printable Vehicle Bill of Sale Form - Arkansas

Fillable Printable Vehicle Bill of Sale Form - Arkansas

Vehicle Bill of Sale Form - Arkansas

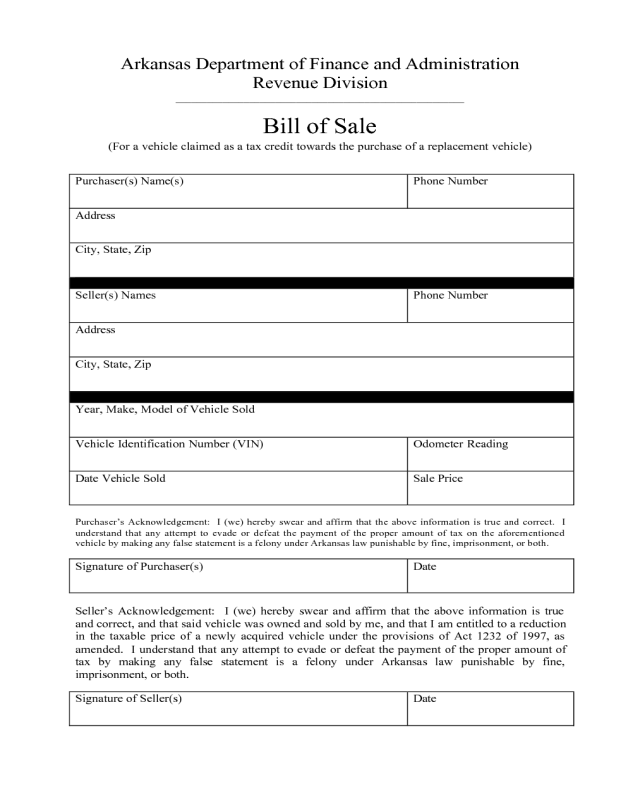

Arkansas Department of Finance and Administration

Revenue Division

_______________________________________________________

Bill of Sale

(For a vehicle claimed as a tax credit towards the purchase of a replacement vehicle)

Purchaser(s) Name(s) Phone Number

Address

City, State, Zip

Seller(s) Names Phone Number

Address

City, State, Zip

Year, Make, Model of Vehicle Sold

Vehicle Identification Number (VIN) Odometer Reading

Date Vehicle Sold Sale Price

Purchaser’s Acknowledgement: I (we) hereby swear and affirm that the above information is true and correct. I

understand that any attempt to evade or defeat the payment of the proper amount of tax on the aforementioned

vehicle by making any false statement is a felony under Arkansas law punishable by fine, imprisonment, or both.

Signature of Purchaser(s) Date

Seller’s Acknowledgement: I (we) hereby swear and affirm that the above information is true

and correct, and that said vehicle was owned and sold by me, and that I am entitled to a reduction

in the taxable price of a newly acquired vehicle under the provisions of Act 1232 of 1997, as

amended. I understand that any attempt to evade or defeat the payment of the proper amount of

tax by making any false statement is a felony under Arkansas law punishable by fine,

imprisonment, or both.

Signature of Seller(s) Date

INSTRUCTIONS

CREDIT FOR SALE OF USED VEHICLE

Pursuant to Act 1232 of 1997, as amended by Act 1047 of 2001, both the seller and

buyer must sign their names to the bill of sale on page 1 of this form in order for the

seller to receive a credit. Please remember that a copy should be given to both the

purchaser and seller.

IMPORTANT: A settlement payment received from an insurance company does

not qualify as a sale for this credit.

The law provides for a sales and use tax credit for new and used motor vehicles,

trailers, or semi trailers purchased on or after January 1, 1998, if within 45 days either

before or after the date of purchase, the consumer sells a used motor vehicle, trailer or

semi trailer. The calculation of the tax due is done in the same manner as the trade-in

credit that is available to those consumers who trade-in a vehicle. Only a consumer

whose name is on the title of the vehicle sold can take the credit. A consumer means

any private individual, business, organization or association. The credit cannot be

transferred to a consumer who did not have title to the vehicle that was sold.

How to take the Credit - This credit is taken directly at your local Revenue Office when

registering a vehicle if the old vehicle has already been sold. To receive immediate tax

savings, simply present a copy of the bill of sale found on the opposite page to your

local Revenue Office when registering the new vehicle.

Important: If the taxpayer claiming the credit fails to provide a bill of sale signed by all

parties to the transaction which reflects the total consideration paid to the seller for the

vehicle, tax shall be due on the total consideration paid for the new or used vehicle,

trailer or semi trailer without any deduction for the value of the item sold.

_____________________

For those consumers who sell a vehicle after registering and paying tax on another

vehicle, then a refund may be requested. To receive a refund, pick up a refund claim

form from your local Revenue Office when registering your new vehicle. Remember

that a copy of the bill of sale for the vehicle sold will also be required in order to receive

a refund. Important: If a vehicle is sold after registering the other vehicle, the sale must

take place within 45 days of the date the other vehicle was purchased.