Fillable Printable Voluntary Petition - United States Bankruptcy Court, Western District of New York

Fillable Printable Voluntary Petition - United States Bankruptcy Court, Western District of New York

Voluntary Petition - United States Bankruptcy Court, Western District of New York

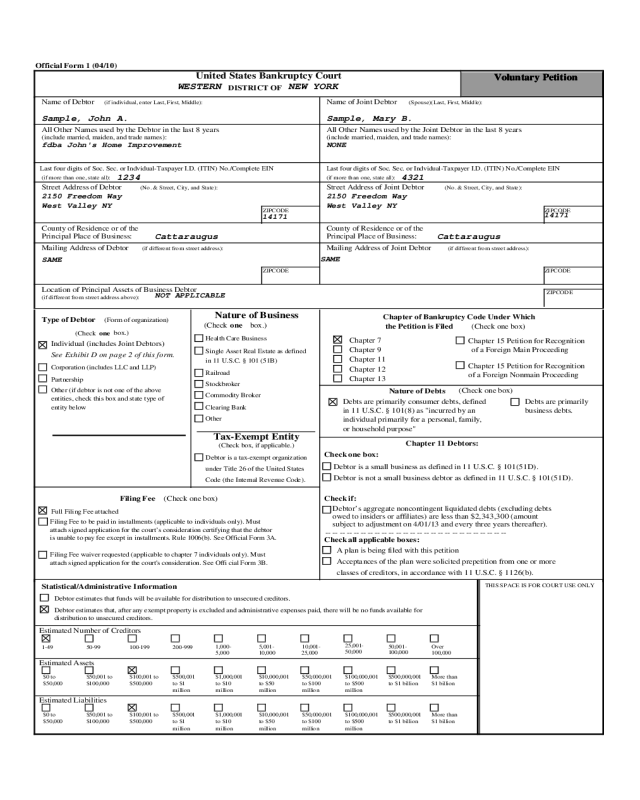

Of ficial F orm 1 (04/10)

Voluntary Peti tion

Unite d States Bankruptcy Court

DISTRICT OF

WESTERN NEW YORK

Name of Debtor

(if individual, enter Last, First, Middle):

A ll Other Name s us ed by the Debtor in the last 8 years

(include married, maiden, and trade names):

fdba John's Home Improvement

Last four digits of So c. Sec. or Indvidu al-Taxpayer I.D. (ITIN) No./Comp lete EIN

(if more than one, state all):

1234

Street Address of Debtor

(No. & Street, City, and State):

2150 Freedom Way

West Valley NY

County of Residence or of the

Principal Place of Business:

Cattaraugus

Mailing Address of Debtor

(i f different from street address):

Location of Principal Assets of Busines s Debtor

(i f different from street address above):

Name of Joint Debtor

(Spouse)(Last, First, Middle):

All Other Names used by the Joint Debtor in the last 8 years

Last four digits of So c. Sec. or Indvidu al-Taxpayer I.D. (ITIN) No./Comp lete EIN

Street Address of Joint Debtor

Mailing Address of Joint Debtor

(include married, maiden, and trade names):

NONE

(i f more than one, state all):

(No. & Street, City, and State):

County of Residence or of the

Principal Place of Business:

Cattaraugus

(i f different from street address):

4321

SAME

SAME

2150 Freedom Way

West Valley NY

NOT APPLICABLE

Sample, Mary B.Sample, John A.

ZIPCODE

ZIPCODE

14171

14171

ZIPCODE

ZIPCODE

ZIPCODE

Railroad

Stockbroker

Commodity Broker

Other (if debtor is not one of the above

Partnership

Chapter 13

Chapter 12

Chapter 15 Petition for Recognition

Chapter 9

Chapter 11

Chapter 7

Chapter of Bankruptcy Code Under Which

the Petition is Filed

(Check one box)

Natu re of Debts

Filing Fee

(Check one box)

(Check one box)

Full Filing Fee a ttached

Filing Fee to be paid in installments (applica ble to individuals only). Must

attach sig ned applica tion for the court’s consideration certifying that the debtor

is unable to pay fee except in installments. Rule 1006(b). See Official Form 3A.

Chapter 11 Debtors :

Check one box:

Debtor is not a s mall busines s debtor as de fined in 11 U.S.C. § 101(51D).

Debtor is a small busines s as def ined in 11 U.S.C. § 101(51D).

Debtor’s aggregate noncontingent liquidated debts (excluding debts

owed to insiders or af filiates) are less than $2,343,300 (amount

subject to adjustment on 4/01/13 and every three years thereafter).

Clearing Bank

entities, check this box and state type of

entity b elow

of a Foreign Nonmain Proceeding

Filing Fee waiver requested (applicable to chapter 7 individuals only ). Must

attach sig ned applica tion for the court's considera tion. See Offi cial Form 3B.

Nat ur e of Business

( Check

Health Car e Bu siness

Single Asset Rea l Estate as defined

in 11 U.S.C. § 101 (51B)

(Form of organization)

Corporation (includes LLC and LL P)

Individual (includes Joint Debtors)

Ty pe of Debtor

(Check

Chapter 15 Petition for Recognition

of a Foreign Main Proceeding

Check i f:

one

box.)

one

box.)

Check all appl icabl e boxes:

A plan is being filed with this petition

Acce ptances of the plan were solicited prepetition from one or more

classes of creditors, in acco rdance with 11 U.S.C. § 1126(b).

Debts are primarily consumer debts, defined

in 11 U .S.C. § 101(8) as "incurred by an

individual primarily for a personal, family,

Deb ts are primarily

business debts.

or household purpose"

See Exhibit D on page 2 of t his form.

O ther

Tax-Exempt Entity

(Check box, if applica ble.)

Debtor is a tax- exempt org anization

under Title 26 of the United States

Code (the Internal Revenue Code).

-- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- --

THIS SPACE IS FOR COU RT USE ONLY

Sta tistical/Adm inistrative Informa tion

Debtor estimates that funds will be ava ilable for distribution to unsecured creditors.

Debtor estimates that, after any exempt property is excluded and administrative expenses paid, there will be no funds ava ilable for

distribution to unsecur ed creditors.

Estimated Number of Creditors

Es timated Ass ets

Es timated Liabilitie s

100,000

100-199

5,000

200-999

100,000

10,000

50,000

25,000

1-49 50-99

1,000- 5,001- 10,001-

25,001-

50,001- Over

$1,000,001

to $10

million

$500,001

to $1

million

$ 0 to

$50,000

$50,001 to

$100,000

$100,001 to

$500,000

$10,000,001

to $50

million

$50,000,001

to $100

million

$100,000,001

to $500

million

$500,000,001

to $1 billion

More than

$1 billion

$ 0 to

$50,000

$50,001 to

$100,000

$100,001 to

$500,000

$500,001

to $1

million

$1,000,001

to $10

million

$10,000,001

to $50

million

$50,000,001

to $100

million

$100,000,001

to $500

million

$500,000,001

to $1 billion

More than

$1 billion

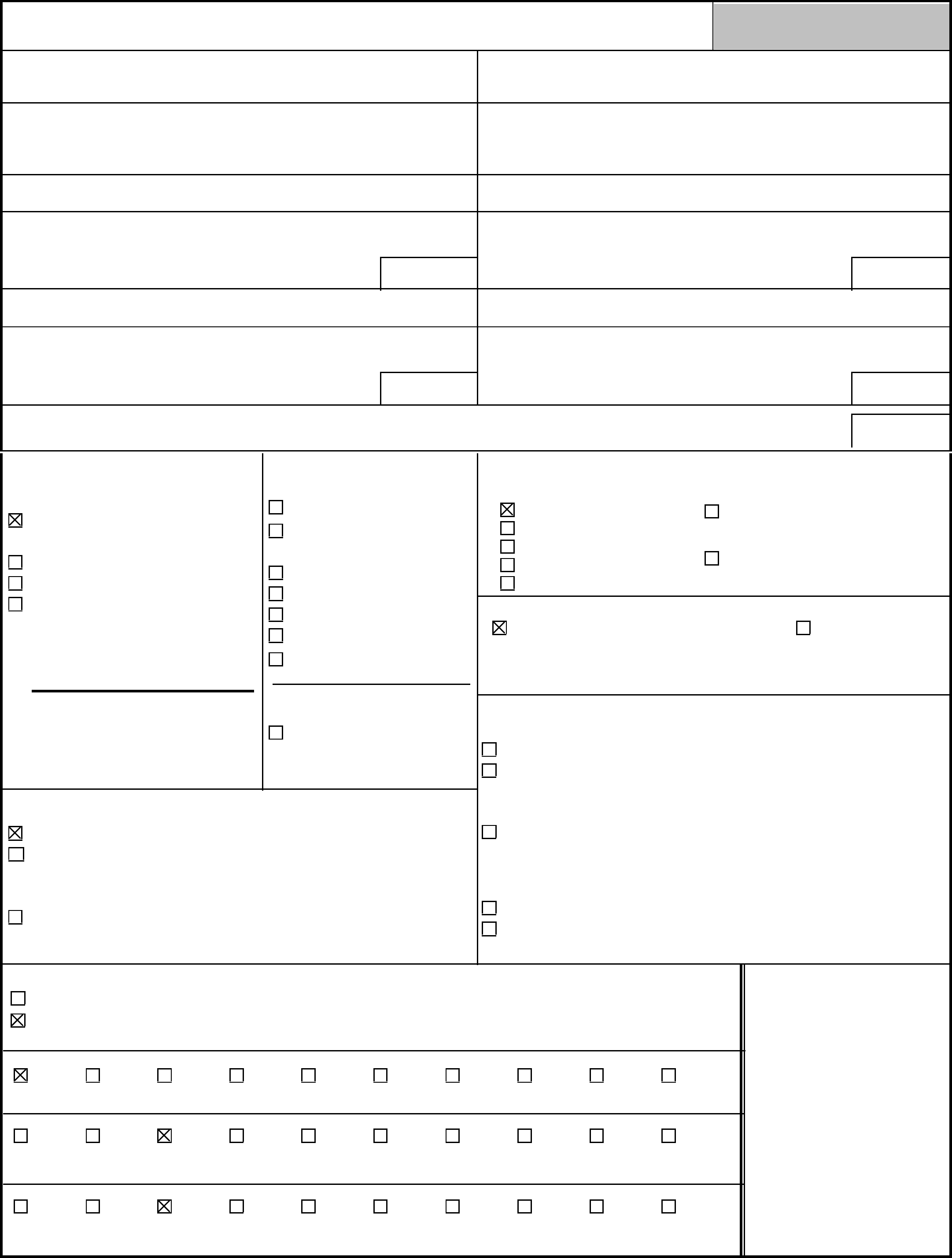

Of ficial F orm 1 (04/10)

FORM B1, Page 2

Debtor has bee n domiciled or has had a residence, principal place of business, or principal assets in this District for 180 days immediately

preceding the date of this petition or for a longer part of such 180 days than in any other District.

There is a bankruptcy case concerning debtor's aff iliate, general partner, or partnership pending in this District.

Information Regarding the Debtor - Venue

(Check any applicable box)

Name of Debtor:

District:

Case Numbe r:

Relationship:

Date F iled:

Judge:

NONE

Location Where Filed: Case Numbe r:

Date F iled:

NONE

Voluntary Peti tion

(T his page mus t be completed and filed in every case)

Name o f Debto r(s):

John A. Sample and

Mary B. Sample

or safety?

Yes, and exhibit C is attached and made a part of this petition.

No

X

Exh ibit A

(To be completed if debtor is required to file periodic reports

(e.g., forms 10K and 10Q) with the Securities and Exchange

Commission pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934 and is requesting relief under Chapter 11)

Exhibit A is attached and made a part of this petition

Exh ibit B

(To be completed if debtor is an individual

whose debts are prima rily consumer debts)

I, the attorney f or the petitioner named in the foregoing petition, declare that I

/s/ Peter D. Grubea

01/31/2011

Signat ure of At torne y for Debtor(s) Date

Exh ibit C

Does the debtor own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health

All Pri or Ban kruptcy Cases Fi led Within Last 8 Years

(If more than two, attach additional sheet)

Pending Bankruptcy Case Filed by any Spouse, Partner or A ffiliate of this Debtor

(If more than one, attach additional sheet)

required b y 11 U.S.C. §342(b).

Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in the United States in this District, or has no

principal place of busines s or ass ets in the United States but is a defendant in an action proceeding [in a federal or state court] in this District, or

the inte rests of the parties will be served in re gard to the relief sought in this District.

Exh ibit D

(To be completed by every individual debtor. If a joint petition is filed, each spouse must complete and attach a separate Exhibit D.)

Exhibit D completed and signed by the debtor is attached and made part of this petition.

Exhibit D also completed and signed by the joint debtor is attached and made a part of this petition.

If this is a join t petition:

Location Where Filed: Case Numbe r: Date F iled:

have informed the petitioner that [he or she] may proceed under chapter 7, 11, 12

or 13 of title 11, United States Code, and have explained the relief available under

each such chapter. I further certify that I have delivered to the debtor the notice

Cert ification by a Deb tor Who Resid es as a Tenant of Residential Prop erty

(Check all applicable boxes.)

(Name of landlord that obtained judgment)

(Address of landlord)

Landlord has a judgment against the debtor for possession of debtor's residence . (If box c hecked, complete the following.)

Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure the

entire monetary def ault that gave rise to the judgment f or possession, after the judgment for possession was e ntered, and

Debtor has included with this petition the deposit with the court of any rent that would become due during the 30-day

period after the f iling of the petition.

Debto r certifies that he/she has served the Landlord with this ce rtification. (11 U.S.C. § 362(l)).

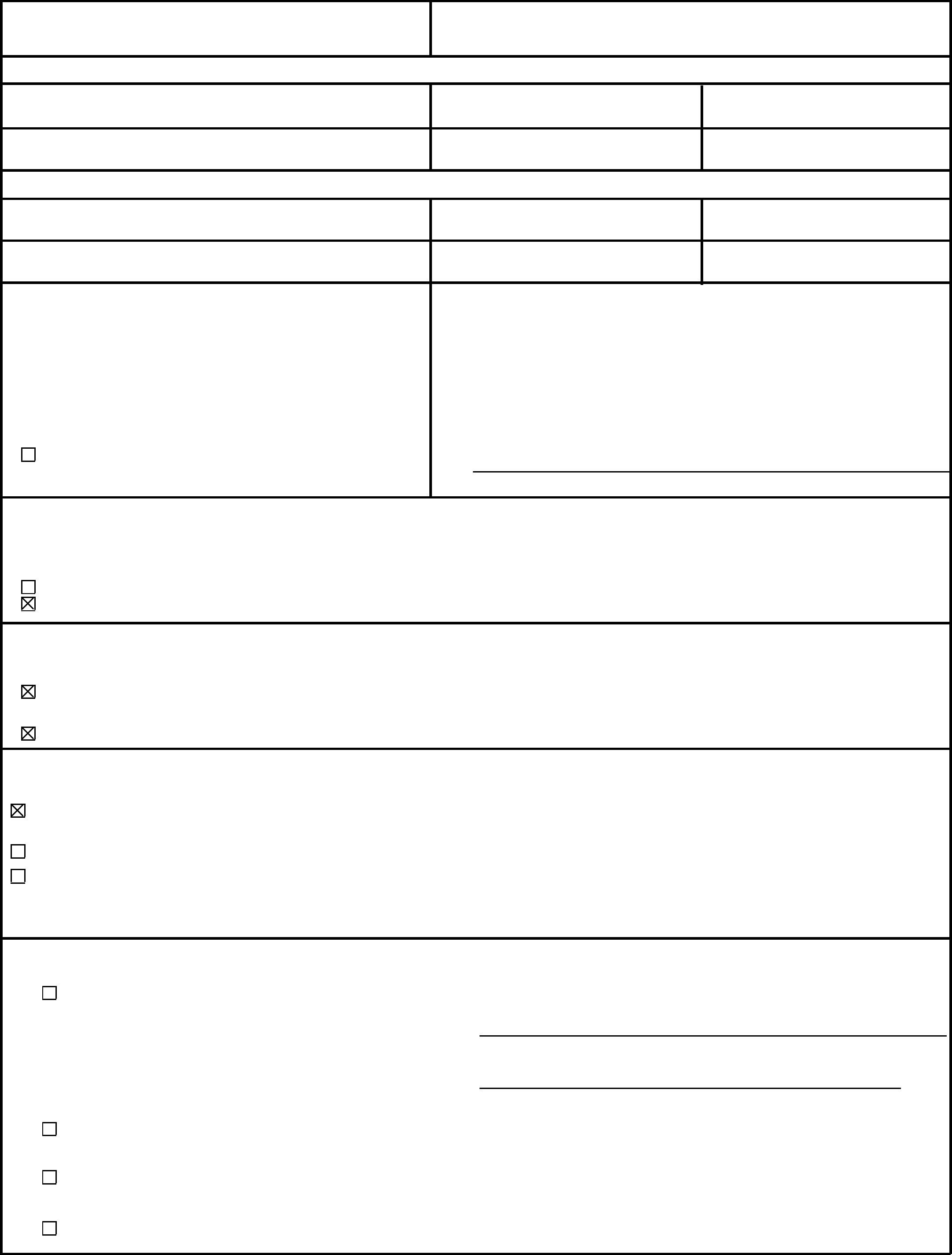

Of ficial F orm 1 (04/10)

FORM B1, Page 3

John A. Sample and

Mary B. Sample

Si gnature(s) of Debtor(s) (Ind ividua l/Joint)

Code, spec ified in this petition.

I request relief in acc ordance with th e chapter of title 11, United States

proceed under chapter 7.

understand the relief available under each such chapter, and choose to

under chapter 7, 11, 12, or 13 of title 11, U nited States Code,

and has chos en to file under chapter 7] I am aware that I may proceed

[If petitioner is an individual whose de bts are primarily consumer debts

petition is true and correct.

I declare under penalty of perjury that the information provided in this

X

X

Date

Signat ure of Debtor

Signat ure of Joint D ebtor

Telephone Numbe r (if not re presente d by at t orney)

01/31/2011

/s/ John A. Sample

/s/ Mary B. Sample

Signatures

[If no attorney represents me and no bankruptcy petition preparer

11 U.S. C. §342(b)

signs the petition] I have obtained and read the notice required by

X

(Date)

(Signature of Foreign Representative)

(Printed name of Foreign Representative)

I declare under penalty of perjury that the information provided in this

petition is true and correct, that I am the foreign representative of a debtor

in a foreign proceeding, and that I am authorized to file this petition.

Signature of a Fore ign Representative

Voluntary Peti tion

(T his page mus t be completed and filed in every case)

Name o f Debto r(s):

I request relief in acc ordance with chapte r 15 of title 11, United States

Code . Certified copies of the do cuments required by 11 U .S.C. § 1515

are attached.

Pursuant to 11 U .S.C. § 1511, I request relief in accordance with the

chapter of title 11 s pecified in th is petition. A certified copy of the

order granting recognition of the foreign main proceeding is attached.

(Check only one box.)

Signature of Attorney for Debtor(s)

Buffalo NY 14202

(716) 853-1366

Law Office of Peter D. Grubea

Peter D. Grubea

S ign atu re of Attorn ey*

S ign atu re of Non-Att orney Bankruptcy Petiti on P reparer

Telephone Numbe r

Firm Name

Date

Addres s

Printe d Na me of A ttorney for Debtor(s)

X

I declare under penalty of perjury that: (1) I am a bankruptcy petition

prep arer as defined in 11 U.S.C. § 110; (2) I prepared this do cument for

compensation and have provided the debtor with a copy of this document

Social-Security number (If the bankruptcy petition preparer is not an

ind ividual, state the S ocial- Security number of the officer, principal,

responsible person or partner of the bankruptcy petition preparer.)

(Required b y 11 U .S.C. § 110.)

Address

Printed Name and title, if any, of Bankruptcy Petition Preparer

A bankruptcy petiti on preparer’ s fai lure to comply wit h the provisions of titl e

11 and the Federal Rules of Bankruptcy Procedure may r esult in f ines or

i mprisonment or both. 11 U.S.C. § 110; 18 U.S. C. § 156.

If more than one person prepared this document, attach additional

sheets conforming to the appropriate official form for each person.

Names and Social-Security numbers of all other individuals who prepared

or ass isted in preparing this document unless the bankruptcy petition

preparer is not an individual.

X

01/31/2011

482 Delaware Ave.

/s/ Peter D. Grubea

Signature of Debtor (Corporation/Partnership)

I declare under penalty of perjury that the information provided

in this petition is true and correct, and that I have been

authorized to file this petition on behalf of the debtor.

bankruptcy petition preparers, I have given the debtor notice of the

maximum amount before preparing any document for filing for a debtor

or accepting any fee from the debtor, as required in that section. Official

Form 19 is attached.

The debtor requests the relief in accordance with the chapter of

title 11, U nited States Code, s pecified in this petition.

and the notices and information required under 11 U.S.C. §§ 110(b),

110(h), and 342(b); and, (3) if rules or guidelines have been promulgated

pursuant to 11 U .S.C. § 110(h) setting a maximum fee for services

Signat ure of Aut horize d Indiv idual

Printe d Na me of A uthoriz ed Individua l

Tit le of Authoriz ed Individua l

Date

X

Signature of bankruptcy petition preparer or off icer, principal,

respons ible person, or partner whose Social-Security number is provided

Date

*In a case in which § 707(b)(4)(D) app lies, this signature als o

constitutes a certification that the attorney has no knowledge

after an inquiry that the information in the schedules is incorrect.

B 1D (Official Form 1, Exhibit D) (12/09)

UNITED STATES BANKRUPTCY COURT

WESTERN DISTRICT OF NEW YORK

WESTERN DIVISION

In re

Debtor(s)

Case No.

(if known)

John A. Sample

and

Mary B. Sample

EXHIBIT D - INDIVIDUAL DEBTOR'S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

WA RNING: You must be able to chec k truthfully one of the five statements regarding credit counseling lis ted below. If you cannot

do so, you are not eligible to file a bankruptcy case, and the court can dismiss any case you do file. If that happens, you will lose

whatever filing fee you paid, and your creditors w ill be able to resume collection activities against you. If your case is dismissed and

you file another bankruptcy case later, you may be required to pay a second filing fee and you may have to take extra steps to stop

creditors' collection activities.

Every individual debtor must file this Exhi bit D. If a joint petition is filed, each spouse must complete and file a separate

Exhibit D. Check one of the five statements below and attach any documents as directed.

1. Within the 180 days

agency approved by the United States trustee or bankruptcy admi nistrator that outlin ed the opportunities for a vailable credit

before the filing of my bankruptcy case, I received a briefing from a credit counseling

counseling and assisted me in performing a related budget analysis, and I have a certificate from the agency describing the

services provided to me.

Attach a copy of the certificate and a copy of any debt repayment plan developed through the agency.

2. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling

agency approved by the United States trustee or bankruptcy admi nistrator that outlin ed the opportunities for a vailable credit

counseling and assisted me in performing a related budget analysis, but I do not have a certificate from the agency describing

You must file a copy of a certi ficate from the agency describing the services provided to you and

the services provided to me.

a copy of any debt repayment plan developed through the agency no later than 14 days after your bankruptcy case i s fi led.

3. I certify that I requested credit counseling services fro m an approved agency but was unable to o btain the

services during the seven days fro m the time I made my request, and the following exigent circumsta nces merit a tempora ry w aiver

of the credit counseling requi rement so I can file my bankruptcy case now.

[Summarize exigent circumstances here.]

If your certification is satisfactory to the court, you must still obtain the credit counseling briefing within the first 30 days after you

file your bankruptcy petition and promptly file a certificate from the agency that provided the counseling, together with a c opy of any

debt management plan developed through the agency. Failure to fulfill these requirements may result in dismissal of your case.

A ny extension of the 30-day deadline can be granted only for cause and is limited to a maximum of 15 days. Your case may also be

dismissed if the court is not satisfied with your reasons for filing your bankruptcy case without first receiving a credit counseling

briefing.

B 1D (Official Form 1, Exhibit D) (12/09)

4. I am not requi red to re ceive a cre dit counse ling briefing because of:

[Check the applicable statement]

[Must be accompanied by a motion for determi nation by the court.]

Incapacity. (De fined in 11 U.S.C. § 109 (h)(4) as impaired by reason of mental illness o r mental deficiency

so as to be incapable of realizing and making rational decisions with respect to financial responsibilities.);

reasonable effort, to participate in a credit counse ling briefing in person, by telephone, or through the Interne t.);

Disability. (Defined in 11 U.S.C. § 109 (h)(4) a s physica lly impaire d to the e xte nt of being unable, afte r

Active military duty in a military combat zone.

5. The United States trustee o r bankruptcy admini strator has dete rmined that the credit counseling requirement

of 11 U.S.C. § 109(h) do es not a pply in this district.

I certify under penalty of perjury that the information provided above is true and c orrect.

Signature of Debtor:

Date:

01/31/2011

/s/ John A. Sample

B 1D (Official Form 1, Exhibit D) (12/09)

UNITED STATES BANKRUPTCY COURT

WESTERN DISTRICT OF NEW YORK

WESTERN DIVISION

In re

Debtor(s)

Case No.

Chapt er

7

John A. Sample

and

Mary B. Sample

EXHIBIT D - INDIVIDUAL DEBTOR'S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

WA RNING: You must be able to chec k truthfully one of the five statements regarding credit counseling lis ted below. If you cannot

do so, you are not eligible to file a bankruptcy case, and the court can dismiss any case you do file. If that happens, you will lose

whatever filing fee you paid, and your creditors w ill be able to resume collection activities against you. If your case is dismissed and

you file another bankruptcy case later, you may be required to pay a second filing fee and you may have to take extra steps to stop

creditors' collection activities.

Every individual debtor must file this Exhi bit D. If a joint peti tion is fil ed, each spouse must complete and file a separate

Exhibit D. Check one of the five statements below and attach any documents as directed.

1. Within the 180 days

agency approved by the United States trustee or bankruptcy admi nistrator that outlin ed the opportunities for a vailable credit

before the filing of my bankruptcy case, I received a briefing from a credit counseling

counseling and assisted me in performing a related budget analysis, and I have a certificate from the agency describing the

services provided to me.

Attach a copy of the certificate and a copy of any debt repayment plan developed through the agency.

2. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit counseling

agency approved by the United States trustee or bankruptcy admi nistrator that outlin ed the opportunities for a vailable credit

counseling and assisted me in performing a relate d budget analysis, but I do not I have a certificate from the agency describing

You must file a copy of a certi ficate from the agency describing the services provided to you and

the services provided to me.

a copy of any debt repayment plan developed through the agency no later than 14 days after your bankruptcy case i s fi led.

3. I certify that I requested credit counseling services fro m an approved agency but w as unable to o btain the

services during the seven days from the time I made my re quest, and the following exigent circumstances merit a tempora ry w aiver

of the credit counseling requi rement so I can file my bankruptcy case now.

[Summarize exigent circumstances here.]

If your certification is satisfactory to the court, you must still obtain the credit counseling briefing w ithin the first 30 days

file your bankruptcy petition and promptly file a certificate from the agency that provided the counseling, together with a c opy

debt management plan developed through the agency. Failure to fulfill these requirements may result in dismissal of your

A ny extension of the 30-day deadline can be granted only for cause and is limited to a maximum of 15 days. Your case may

dismissed if the court is not satisfied with your reasons for filing your bankruptcy case without first receiving a credit

briefing.

B 1D (Official Form 1, Exhibit D) (12/09)

4. I am not requi red to re ceive a cre dit counse ling briefing because of:

[Check the applicable statement]

[Must be accompanied by a motion for determi nation by the court.]

Incapacity. (De fined in 11 U.S.C. § 109 (h)(4) as impaired by reason of mental illness o r mental deficiency

so as to be incapable of realizing and making rational decisions with respect to financial responsibilities.);

reasonable effort, to participate in a credit counse ling briefing in person, by telephone, or through the Interne t.);

Disability. (Defined in 11 U.S.C. § 109 (h)(4) a s physica lly impaire d to the e xte nt of being unable, afte r

Active military duty in a military combat zone.

5. The United States trustee o r bankruptcy admini strator has dete rmined that the credit counseling requirement

of 11 U.S.C. § 109(h) do es not a pply in this district.

I certify under penalty of perjury that the information provided above is true and c orrect.

Signature of Debtor:

Date:

01/31/2011

/s/ Mary B. Sample

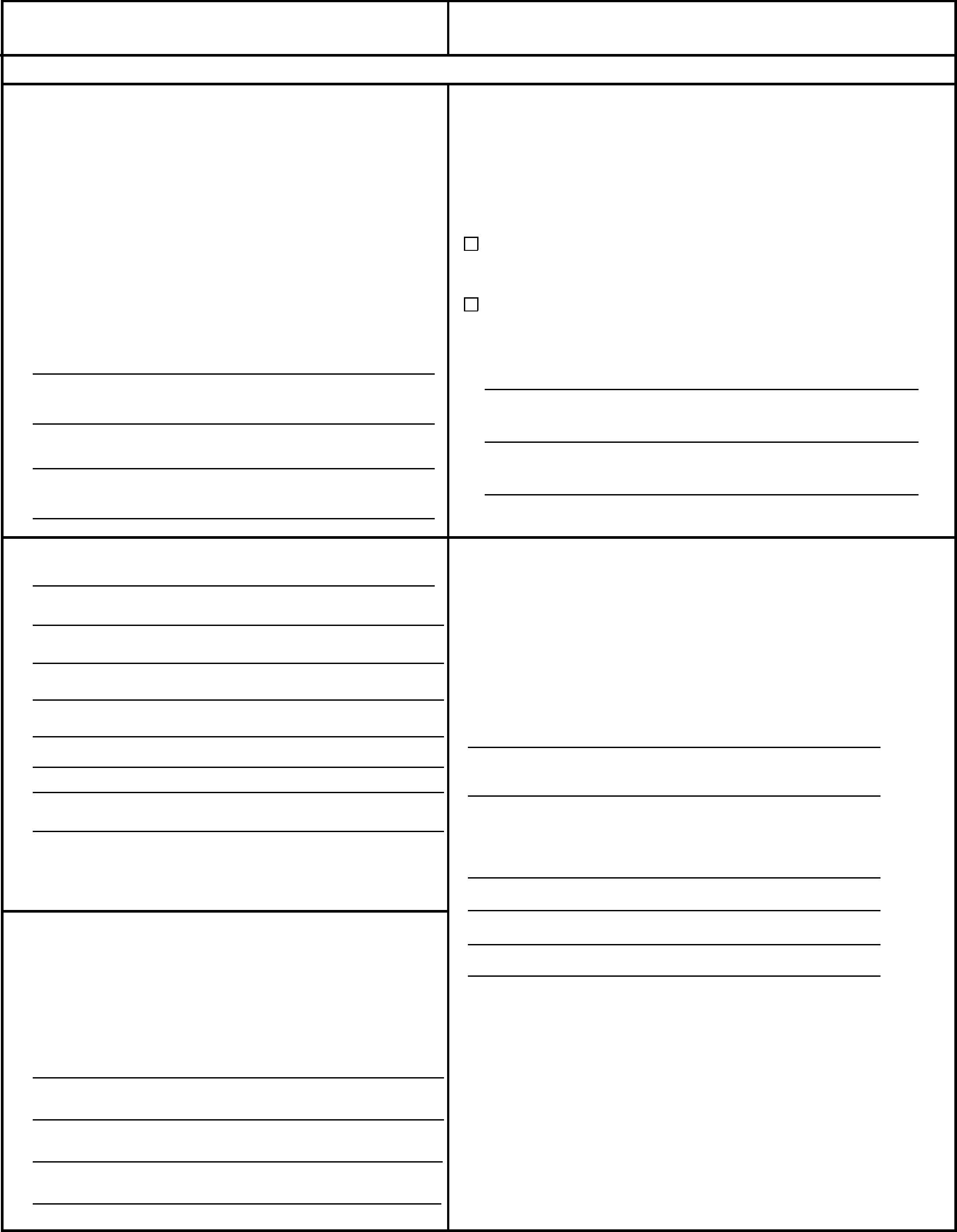

B6 Summary (Official Form 6 - Summary) (12/07)

Case No.

UNITED STATES BANKRUPTCY COURT

In re

/ Debtor

John A. Sample and Mary B. Sample

WESTERN DISTRICT OF NEW YORK

WESTERN DIVISION

Chapter

7

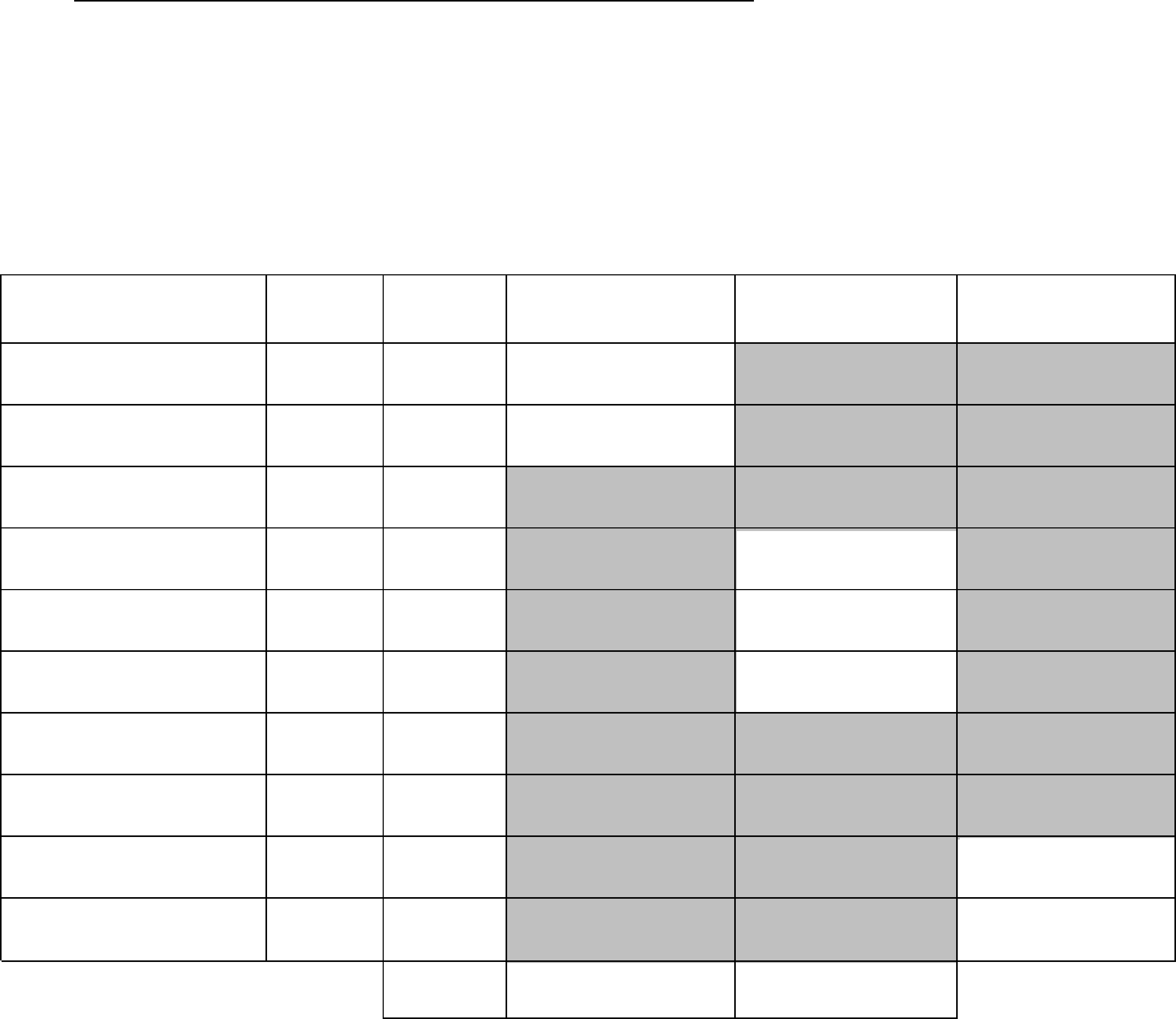

Indicate as to each schedule whether that schedule is attached and state the number of pages in each. Report the totals from Schedules A, B, D, E, F, I, and J in the

boxes provided. Add the amounts from Schedules A and B to determine the total amount of the debtor's assets. Add the amounts of all claims from Schedules D, E, and

F to determine the total amount of the debtor's liabilities. Individual debtors must also complete the "Statistical Summary of Certain Liabilities and Related Data"if they

file a case under chapter 7, 11, or 13.

SUMMARY OF SCHEDULES

NAME OF SCHEDULE

Attached

(Yes/No)

N o. of

She ets ASSETS LIA BILITIES OTH ER

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

1

4

2

2

2

3

1

1

1

2

A-Real Property

B-Personal Property

C-Property Claimed as

Exempt

D-Creditors Holding Secured

C laims

E-Creditors Holding

Unsecured Prio rity Claims

F-Creditors Holding

Unsecured Nonpriority Claims

G-Executory Contracts and

Unexpired Leases

H-Codebtors

I-Curre nt Income of Individual

Debtor(s)

J-Curre nt Expe nditures of

Individual De btor(s)

$

135,000.00

25,785.39

$

176,136.42

$

2,750.00

$

20,039.28

$

3,020.33

$

3,824.00

$

(Total of Claims on Schedule E)

198,925.70

$

160,785.39

$

TOTAL

19

B6 Summary (Official Form 6 - Summary) (12/07)

WESTERN DISTRICT OF NEW YORK

UNITED STATES BANKRUPTCY COURT

In re

/ Debtor

John A. Sample and Mary B. Sample

Chapter

7

Case No.

WESTERN DIVISION

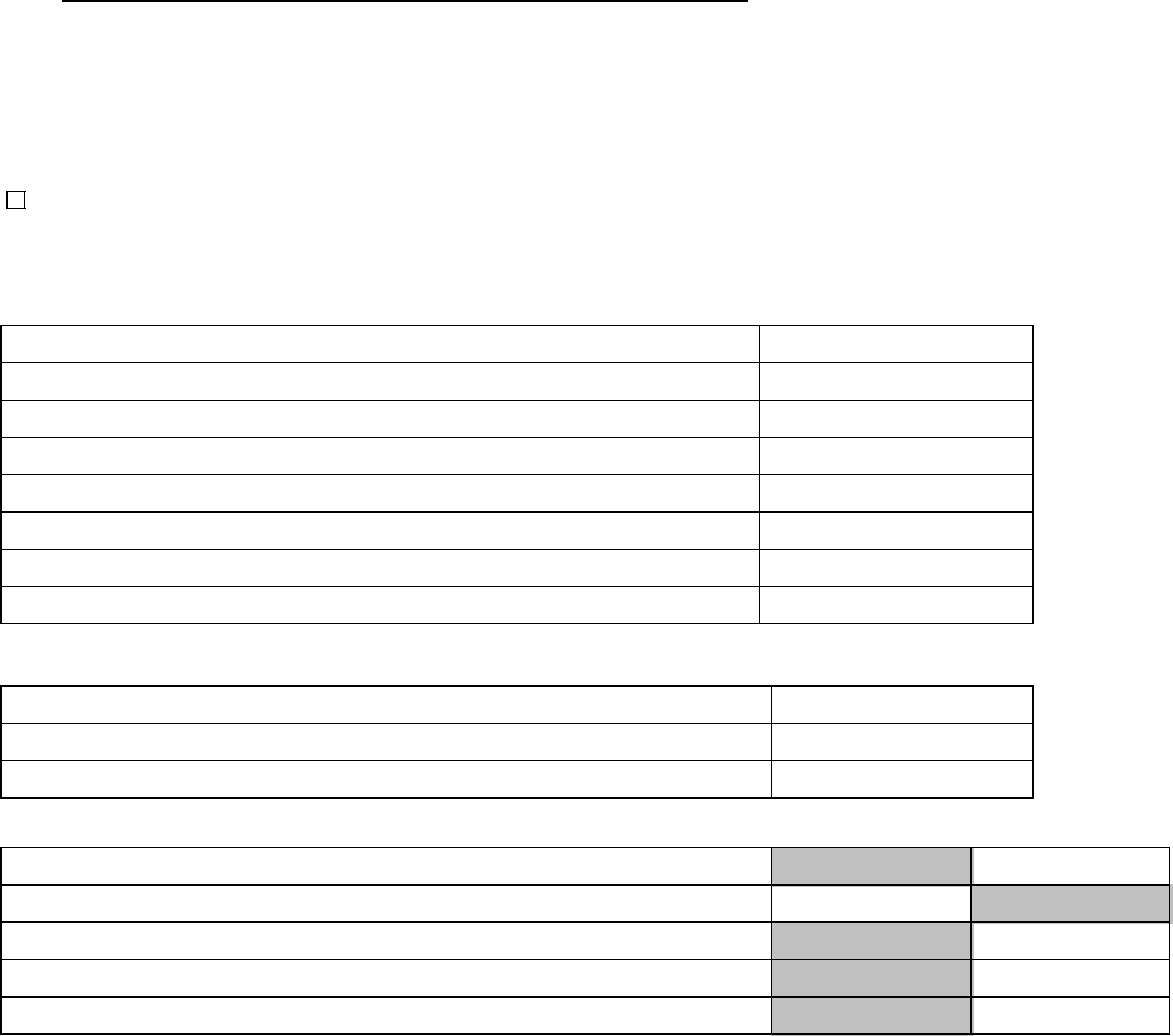

STATISTICAL SUMMARY OF CERTAIN LIABILITIES AND RELATED DATA (28 U.S.C § 159)

If you are an individual debtor whose debts are primarily consumer debts, as defined in § 101(8) of the Bankruptcy Code (11 U.S.C. § 101(8), filing a case under

Type of Liability

Domestic Support Obligations (from Schedule E)

Taxes and Certain Other Debts Owed to Governmental Units (from Schedule E)

Claims for Death or Personal Injury While Debtor Was Intoxicated (from Schedule E) (whether

disputed or undisputed)

Student Loan Obligations (from Schedule F)

Domestic Support, Separation Agreeme nt, and Divorce Decree Obligati ons Not Reported on

Schedule E

Obligations to Pension or P rofit-Sharing, and Other Simila r Obligations (from Schedule F)

TOTAL

Amount

$

$

$

$

$

$

0.00

0.00

2,750.00

2,750.00

0.00

0.00

0.00

This information is for statistical purposes only under 28 U .S.C. § 159.

$

chapter 7, 11, or 13, you must report all information requested below.

Summarize the following types of liabilities, as reported in the Schedules, and total them.

State the following:

Average Income (from Schedule I, Line 16)

Average Expenses (from Schedule J, Line 18)

Current Monthly Income (from Form 22A Line 12; OR, Form 22B Line 11; OR, Form 22C Line 20)

$

$

$

3,020.33

3,824.00

0.00

35,202.42

$1. Total from Schedule D, "UNSECURED PORTION, IF ANY" column

State the following:

2. Total from Schedule E, "AMOUNT ENTITLED TO PRIORITY" column $

2,750.00

3. Total from Schedule E, "AMOUNT NOT ENTITLED TO PRIORITY, IF ANY" column $

0.00

4. Total from Schedule F $

20,039.28

5. Total of non-priority unsecured debt (sum of 1, 3, and 4) $

55,241.70

Check this box if you are an individual debtor whose debts are NOT primarily consumer debts. You are not required to report any information here.

B6 Declaration (Official Form 6 - Declaration) (12/07)

In re

DECLARATION CONCERNING DEBTOR'S SCHEDULES

Debtor

Case No.

(if known)

DECLARATI ON UNDER PENALTY OF PERJURY BY AN INDIVIDUAL DEBTOR

John A. Sample and Mary B. Sample

I decla re under penalty of perjury that I have read the foregoing summary and schedules, co nsisting of

20

sheets, a nd tha t they are true and

correct to the best of my knowledge, information and belief.

Date: 1/31/2011

Signatur e

John A. Sample

Signa ture

Mary B. Sample

Date: 1/31/2011

/s/ John A. Sample

/s/ Mary B. Sample

[If joint case , both spouses must sign.]

Penalty for making a false sta tement or concea ling property: Fine of up to $500,000 or impriso nment for up to 5 years or both. 18 U.S.C. §§ 152 and 3571.

John A. Sample and Mary B. Sample

FORM B 6A (Official Form 6A) (12/07)

In re

Debtor(s )

Case No.

(if known)

SCHEDULE A-REAL PROPERTY

,

Do not include interests in executory contracts and unexpired leases on this schedule. List them in Schedule G-Executory

Contracts and Unexpired Leases.

Except as directed below, list all real property in which the debtor has any legal, equitable, or future interest, including all property owned as a

cotenant community property, or in which the debtor has a life estate. Include any property in which the debtor holds rights and powers

exercisable for the debtor’s own benefit. If the debtor is married, state whether the husband, wife, both, or the marital community own the property

by placing an “H,” “W,” “J,” or “C” in the column labeled “Husband, Wife, Joint, or Community.” If the debtor holds no interest in real property, write

“None” under “Description and Location of Property.”

If an entity claims to have a lien or hold a secured interest in any property, state the amount of the secured claim. See Schedule D. If no entity

claims to hold a secured interest in the property, w rite “None” in the column labeled “Amount of Se cured Claim.”

If the debtor is an individual or if a joint petition is filed, state the amount of any exemption claimed in the property only in Schedule C - Property

Claimed as Exempt.

D escription and Location of Property N ature of Debtor's

Interest in Property

Husband--H

Wife--W

Joint--J

Community--C

Current

Value

of Debtor's Interest,

in Property Without

Deducting any

Secured Claim or

Exemption

A mount of

Secured Claim

2150 Freedom Way, West Valley, NY

(value based on 2008 appraisal)

J $ 135,000.00 $ 135,000.00

No continuation sheets attached

TOTAL $

(Re port also on Summary of Schedules.)

135,000.00