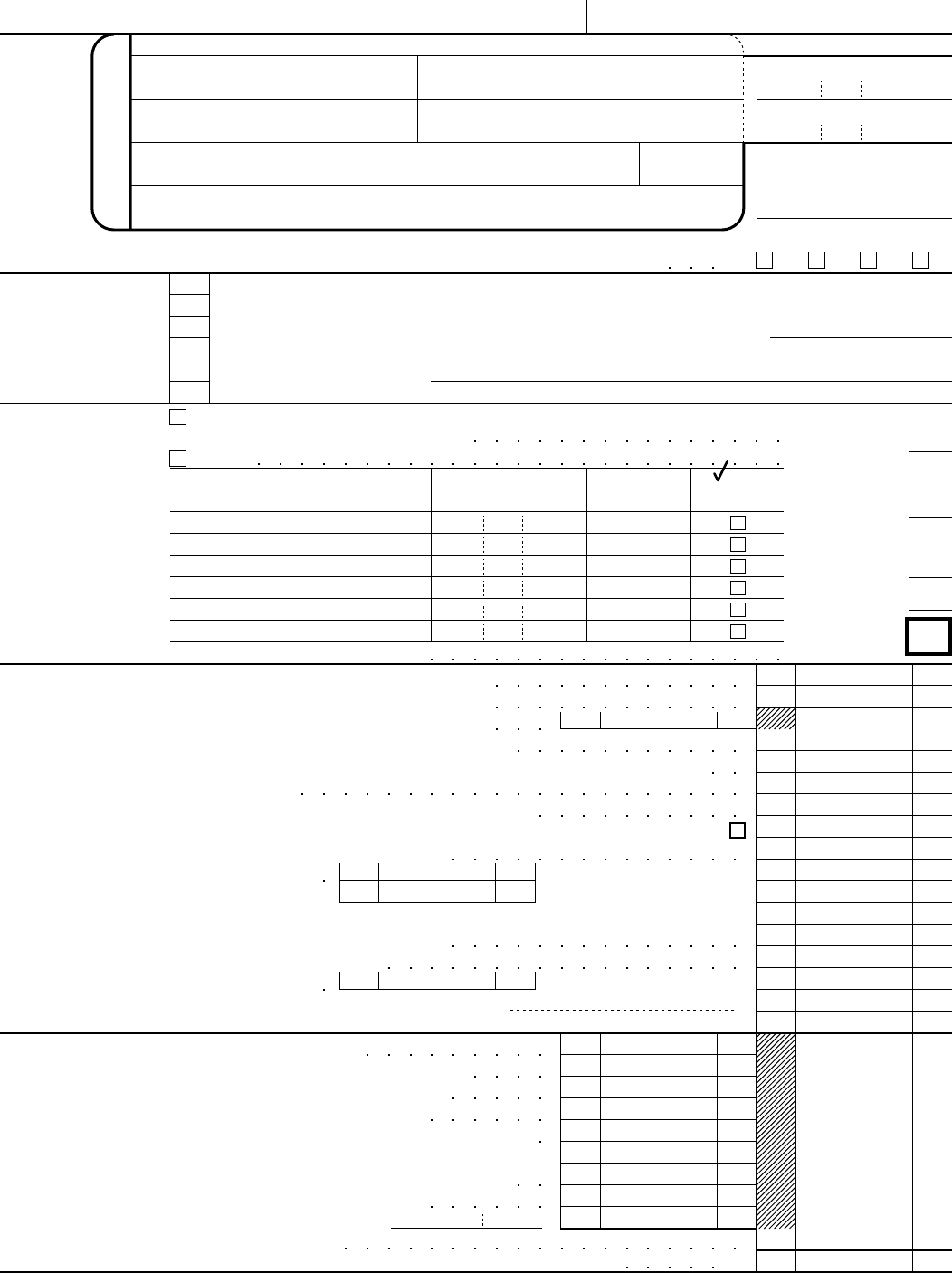

Fillable Printable 2001 Form 1040

Fillable Printable 2001 Form 1040

2001 Form 1040

Department of the Treasury—Internal Revenue Service

1040

U.S. Individual Income Tax Return

OMB No. 1545-0074

For the year Jan. 1–Dec. 31, 2001, or other tax year beginning , 2001, ending , 20

Last nameYour first name and initial Your social security number

(See

instructions

on page 19.)

L

A

B

E

L

H

E

R

E

Last name Spouse’s social security numberIf a joint return, spouse’s first name and initial

Use the IRS

label.

Otherwise,

please print

or type.

Home address (number and street). If you have a P.O. box, see page 19. Apt. no.

City, town or post office, state, and ZIP code. If you have a foreign address, see page 19.

Presidential

Election Campaign

1 Single

Filing Status

2 Married filing joint return (even if only one had income)

3

Check only

one box.

4

Qualifying widow(er) with dependent child (year spouse died

䊳

). (See page 19.)5

6a Yourself. If your parent (or someone else) can claim you as a dependent on his or her tax

return, do not check box 6a

Exemptions

Spouseb

(4) if qualifying

child for child tax

credit (see page 20)

Dependents:c

(2) Dependent’s

social security number

(3) Dependent’s

relationship to

you

(1) First name Last name

If more than six

dependents,

see page 20.

d Total number of exemptions claimed

7

Wages, salaries, tips, etc. Attach Form(s) W-27

8a

8a Taxable interest. Attach Schedule B if required

Income

8b

b Tax-exempt interest. Do not include on line 8a

Attach

Forms W-2 and

W-2G here.

Also attach

Form(s) 1099-R

if tax was

withheld.

9

9 Ordinary dividends. Attach Schedule B if required

10

10 Taxable refunds, credits, or offsets of state and local income taxes (see page 22)

11

11 Alimony received

12

12 Business income or (loss). Attach Schedule C or C-EZ

Enclose, but do

not attach, any

payment. Also,

please use

Form 1040-V.

13

13 Capital gain or (loss). Attach Schedule D if required. If not required, check here

䊳

14

14 Other gains or (losses). Attach Form 4797

15a 15b

Total IRA distributions b

Taxable amount (see page 23)

15a

16b16a

Total pensions and annuities

b

Taxable amount (see page 23)

16a

17

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

18

18 Farm income or (loss). Attach Schedule F

19

19 Unemployment compensation

20b20a

b

Taxable amount (see page 25)

20a

Social security benefits

21

21

22 Add the amounts in the far right column for lines 7 through 21. This is your total income

䊳

22

23

IRA deduction (see page 27)23

Archer MSA deduction. Attach Form 8853

25

25

One-half of self-employment tax. Attach Schedule SE

26

Self-employed health insurance deduction (see page 30)

26

27

27

Self-employed SEP, SIMPLE, and qualified plans

28

28

Penalty on early withdrawal of savings

29

29

Alimony paid b Recipient’s SSN

䊳

32

Add lines 23 through 31a

30

Subtract line 32 from line 22. This is your adjusted gross income

䊳

31a

Adjusted

Gross

Income

33

If you did not

get a W-2,

see page 21.

Form

Married filing separate return. Enter spouse’s social security no. above and full name here.

䊳

Cat. No. 11320B

䊳

其

Label

Form 1040 (2001)

IRS Use Only—Do not write or staple in this space.

Head of household (with qualifying person). (See page 19.) If the qualifying person is a child but not your dependent,

enter this child’s name here.

䊳

Other income. List type and amount (see page 27)

Moving expenses. Attach Form 3903

24

24

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 72.

No. of boxes

checked on

6a and 6b

No. of your

children on 6c

who:

Dependents on 6c

not entered above

Add numbers

entered on

lines above

䊳

● lived with you

● did not live with

you due to divorce

or separation

(see page 20)

32

31a

Student loan interest deduction (see page 28)

30

33

䊱䊱

Important!

NoYes

Note. Checking “Yes” will not change your tax or reduce your refund.

Do you, or your spouse if filing a joint return, want $3 to go to this fund?

䊳

You must enter

your SSN(s) above.

YesNo

SpouseYou

20

01

(See page 19.)

(99)

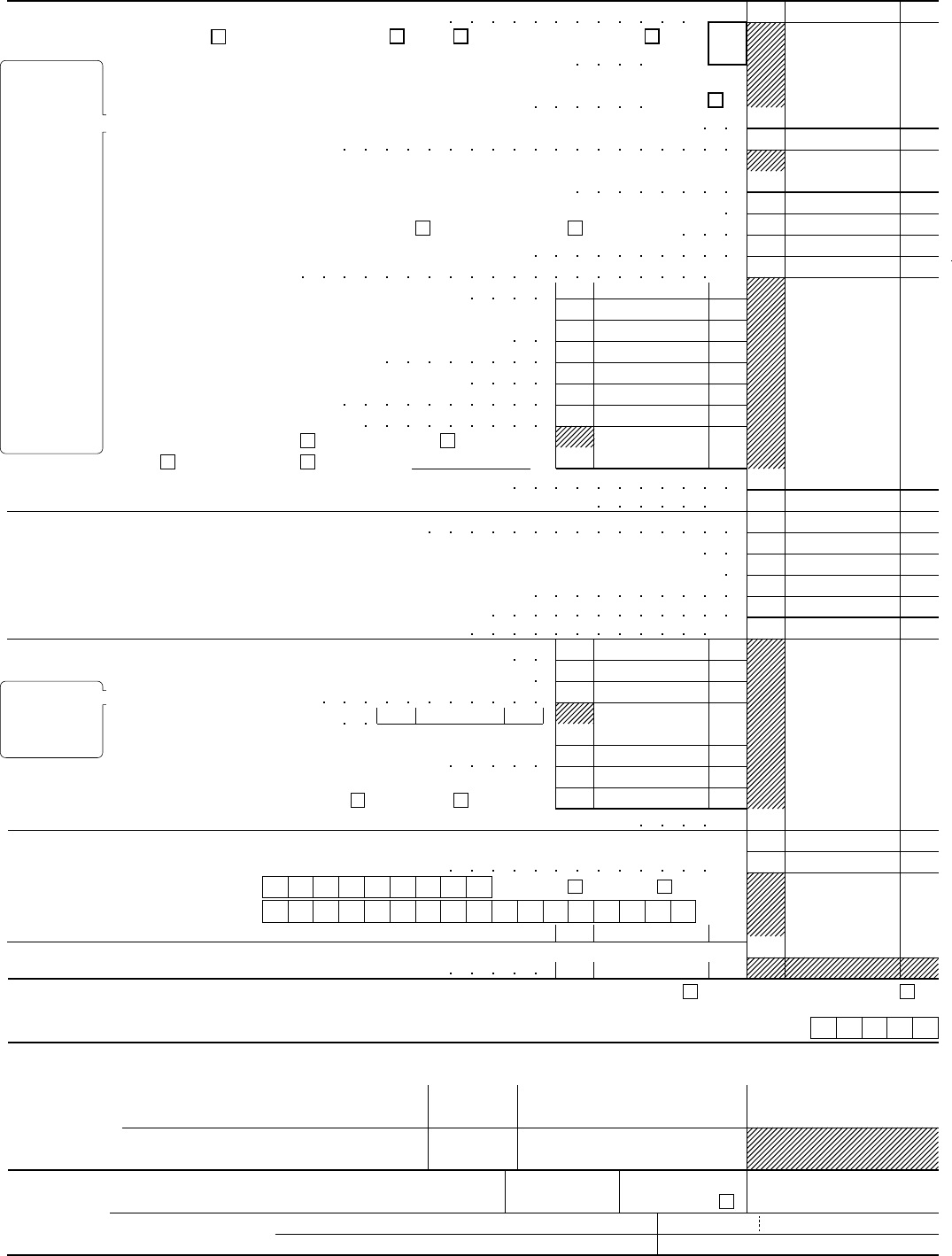

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

Add lines 59, 60, 61a, and 62 through 65. These are your total payments

䊳

Page 2

Form 1040 (2001)

Amount from line 33 (adjusted gross income)34

34

Check if:

35a

Tax and

Credits

35aAdd the number of boxes checked above and enter the total here

䊳

Single,

$4,550

If you are married filing separately and your spouse itemizes deductions, or

you were a dual-status alien, see page 31 and check here

䊳

b

35b

36

36

37

Subtract line 36 from line 3437

38

If line 34 is $99,725 or less, multiply $2,900 by the total number of exemptions claimed on

line 6d. If line 34 is over $99,725, see the worksheet on page 32

38

39

Taxable income. Subtract line 38 from line 37. If line 38 is more than line 37, enter -0-39

40

40

43

44

46

Credit for the elderly or the disabled. Attach Schedule R

47

48

Other credits from:

49

51

52

Add lines 43 through 50. These are your total credits

49

53

Subtract line 51 from line 42. If line 51 is more than line 42, enter -0-

䊳

51

Self-employment tax. Attach Schedule SE

52

Other

Taxes

54

53

67

Social security and Medicare tax on tip income not reported to employer. Attach Form 4137

56

Tax on qualified plans, including IRAs, and other tax-favored accounts. Attach Form 5329 if required

55

57

Add lines 52 through 57. This is your total tax

䊳

58

58

Federal income tax withheld from Forms W-2 and 109959

59

60

2001 estimated tax payments and amount applied from 2000 return

60

Payments

61a

64

Amount paid with request for extension to file (see page 51)

63

62

Excess social security and RRTA tax withheld (see page 51)

64

66

Other payments. Check if from

65

68a

68a

69 69

If line 66 is more than line 58, subtract line 58 from line 66. This is the amount you overpaid

70

70

Amount of line 67 you want refunded to you

䊳

Refund

71

Amount of line 67 you want applied to your 2002 estimated tax

䊳

Estimated tax penalty. Also include on line 70

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

71

You were 65 or older, Blind; Spouse was 65 or older, Blind.

a Form 3800

b

Form 8396

c Form 8801 d Form

(specify)

a Form 2439

b Form 4136

56

Household employment taxes. Attach Schedule H

57

65

Amount

You Owe

Sign

Here

DateYour signature

Keep a copy

for your

records.

DateSpouse’s signature. If a joint return, both must sign.

Preparer’s SSN or PTINDate

Preparer’s

signature

Check if

self-employed

Paid

Preparer’s

Use Only

Firm’s name (or

yours if self-employed),

address, and ZIP code

EIN

Phone no.

䊳

䊳

䊳

Your occupation

Tax (see page 33). Check if any tax is from

Amount you owe. Subtract line 66 from line 58. For details on how to pay, see page 52

䊳

b

Direct

deposit? See

page 51 and

fill in 68b,

68c, and 68d.

Routing number

Account number

c Checking SavingsType:

a Form(s) 8814

Form 4972

b

d

䊳

䊳

66

45

47

Adoption credit. Attach Form 8839

54

55

Advance earned income credit payments from Form(s) W-2

67

䊳

Child tax credit (see page 37)

Education credits. Attach Form 8863

45

46

48

Additional child tax credit. Attach Form 8812

62

63

Head of

household,

$6,650

Married filing

jointly or

Qualifying

widow(er),

$7,600

Married

filing

separately,

$3,800

Standard

Deduction

for—

Joint return?

See page 19.

Daytime phone number

()

Earned income credit (EIC)

b

Nontaxable earned income

Credit for child and dependent care expenses. Attach Form 2441

41

42

43

Alternative minimum tax (see page 34). Attach Form 6251

Add lines 40 and 41

䊳

Foreign tax credit. Attach Form 1116 if required

44

If you have a

qualifying

child, attach

Schedule EIC.

41

42

61a

Spouse’s occupation

()

Form

1040 (2001)

● People who

checked any

box on line

35a or 35b or

who can be

claimed as a

dependent,

see page 31.

● All others:

Designee’s

name

䊳

Do you want to allow another person to discuss this return with the IRS (see page 53)?

Third Party

Designee

Phone

no.

䊳 ()

Yes. Complete the following. No

Personal identification

number (PIN)

䊳

50

Rate reduction credit. See the worksheet on page 36

50

61b