Fillable Printable Wages Notice Request Bonus Pay (De4807)

Fillable Printable Wages Notice Request Bonus Pay (De4807)

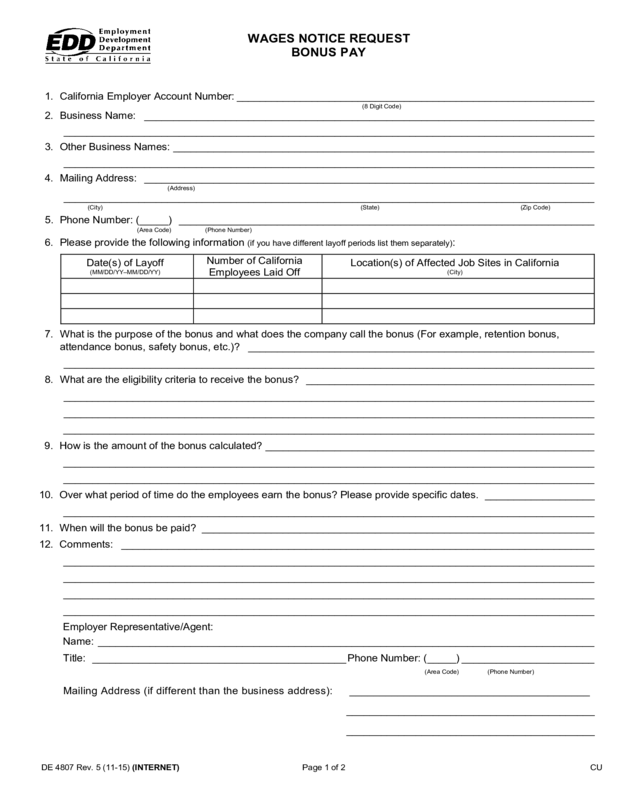

Wages Notice Request Bonus Pay (De4807)

DE 4807 Rev. 5 (11-15) (INTERNET) Page 1 of 2 CU

1. California Employer Account Number: ______________________________________________________________

(8 Digit Code)

2. Business Name: ______________________________________________________________________________

____________________________________________________________________________________________

3. Other Business Names: _________________________________________________________________________

____________________________________________________________________________________________

4. Mailing Address: ______________________________________________________________________________

(Address)

____________________________________________________________________________________________

(City) (State) (Zip Code)

5. Phone Number: (_____) ________________________________________________________________________

(Area Code) (Phone Number)

6. Please provide the following information (if you have different layoff periods list them separately):

Date(s) of Layoff

(MM/DD/YY–MM/DD/YY)

Number of California

Employees Laid Off

Location(s) of Affected Job Sites in California

(City)

7. What is the purpose of the bonus and what does the company call the bonus (For example, retention bonus,

attendance bonus, safety bonus, etc.)? ____________________________________________________________

____________________________________________________________________________________________

8. What are the eligibility criteria to receive the bonus? __________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

9. How is the amount of the bonus calculated? _________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

10. Over what period of time do the employees earn the bonus? Please provide specific dates. ___________________

____________________________________________________________________________________________

11. When will the bonus be paid? ____________________________________________________________________

12. Comments: __________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

Employer Representative/Agent:

Name: ______________________________________________________________________________________

Title: ____________________________________________ Phone Number: (_____) _______________________

(Area Code) (Phone Number)

Mailing Address (if different than the business address): ________________________________________

___________________________________________

___________________________________________

WAGES NOTICE REQUEST

BONUS PAY

DE 4807 Rev. 5 (11-15) (INTERNET) Page 2 of 2 CU

INSTRUCTIONS FOR WAGES NOTICE REQUEST

BONUS PAY

The Employment Development Department will prepare a Wages Notice based on the information you provide. The

Department issues a Wages Notice to reduce the number of calls to employers and to promote consistent decisions

from Department staff regarding payments received by unemployment insurance claimants. The Wages Notice will

provide Department staff with general information regarding the bonus payment and a determination of whether the

payment will affect the claimants’ eligibility for unemployment insurance benefits.

The Department will also mail you a copy of the Wages Notice for your records.

1. CALIFORNIA EMPLOYER ACCOUNT NUMBER – Enter your California state employer account number.

2. BUSINESS NAME – Enter the name by which your business is known.

3. OTHER BUSINESS NAMES – Enter other names by which your business is known and which your employees may

report as their employer.

4. MAILING ADDRESS – Provide business mailing address.

5. PHONE NUMBER – Enter business phone number including area code.

6. If you have different layoff periods list them separately.

DATE(S) OF LAYOFF – Enter the date(s) you laid off or plan to lay off the employees. If layoffs will occur over a

period of time and you do not have specific dates, you may indicate anticipated beginning and ending dates.

Example: 02/05/14 – 06/30/14

NUMBER OF CALIFORNIA EMPLOYEES LAID OFF – Enter the total number of employees who work in

California and will be laid off during the period indicated.

LOCATION(S) OF AFFECTED JOB SITES IN CALIFORNIA – Enter the name(s) of the California city(ies) where

the job site(s) affected by the layoff is (are) located. If several job sites throughout California are affected you may

indicate “statewide” rather than listing the individual job sites.

7. Enter what the company calls the bonus and explain the purpose for the payment. Example: Safety bonus; to

provide compensation for not having any accidents during the calendar year.

8. Explain who is eligible to receive the bonus and what they must do to receive it. Example: Hourly employees who

work in the production department and exceed their employee quarterly production standards are eligible to receive

the bonus.

9. Explain how the amount of the bonus the employees receive is calculated. Examples: $.25 per unit for the first

500 units produced and $.30 per unit for any additional units produced; 2 percent of the employee’s base wages

earned during the quarter.

10. Indicate during what specific time period the employees performed the services which made them eligible for the

bonus. Example: Bonus based on work performed during the harvest season which began May 2, 2014, and

ended August 28, 2014.

11. Indicate when employees will receive the bonus payment. If you have different groups which will be paid on

different dates, please list work group and respective payment date. Example: Hourly employees paid 09/03/14;

salaried employees paid 08/31/14.

12. COMMENTS – Provide any additional information regarding the bonus that you feel is important and can assist

the Department in determining if the bonus will affect the employees’ eligibility for unemployment insurance

benefits.

For more information about completing this form, please call (916) 403-6358 and ask to speak to a representative in

the Wages Notice Group.

You may FAX the completed form to (916) 449-2192, or mail to Employment Development Department, UI Integrity and

Accounting Division, MIC 16A, Wages Notice Group, P.O. Box 2228, Rancho Cordova, CA 95741-2228.