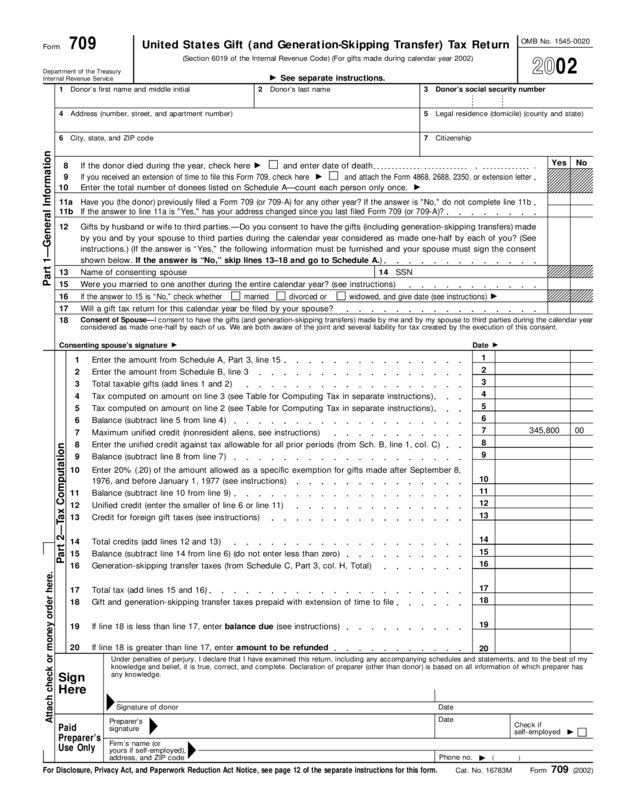

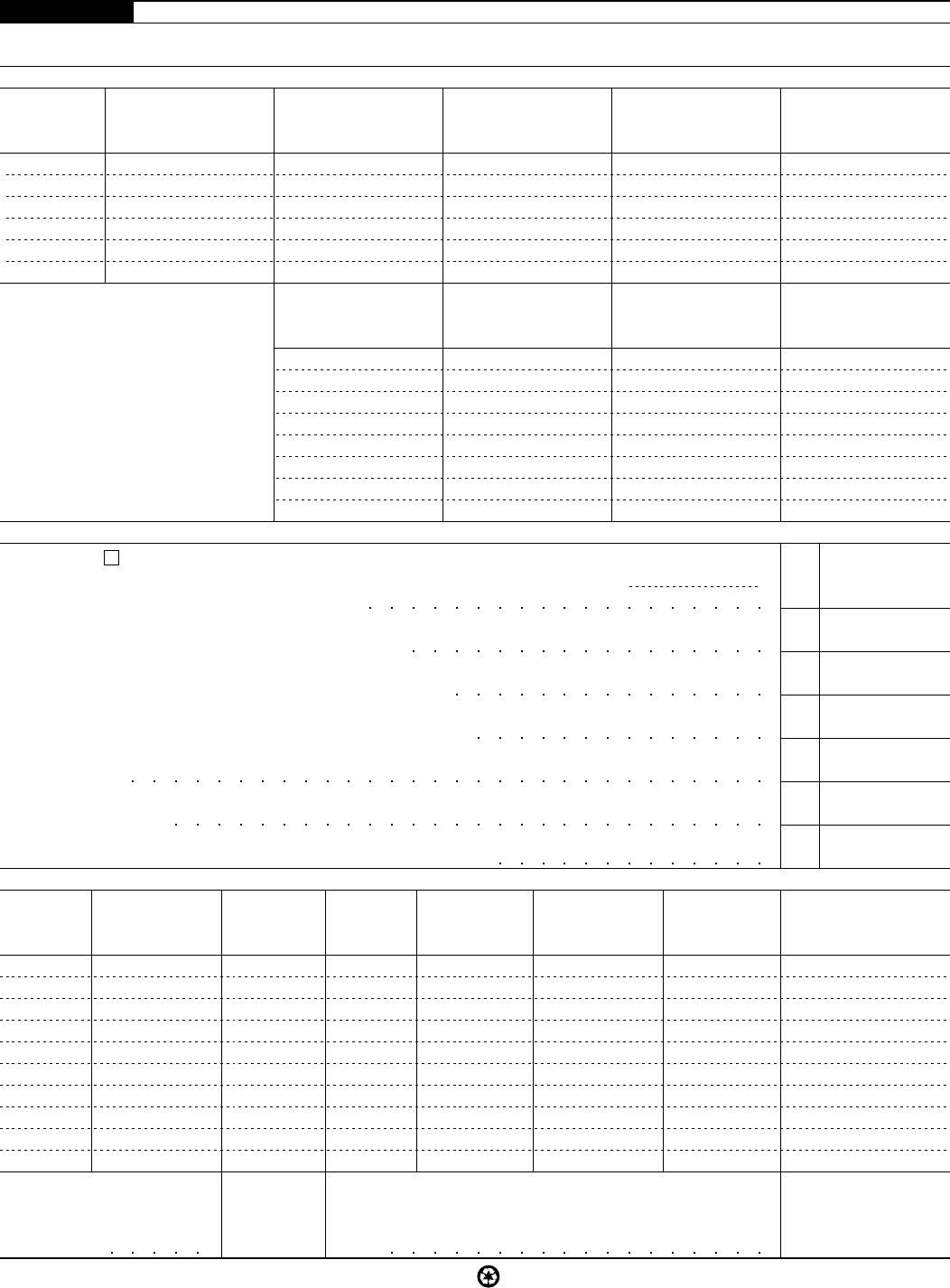

Fillable Printable 2002 Form 709

Fillable Printable 2002 Form 709

2002 Form 709

United States Gift (and Generation-Skipping Transfer) Tax Return

Form 709

(Section 6019 of the Internal Revenue Code) (For gifts made during calendar year 2002)

OMB No. 1545-0020

Department of the Treasury

Internal Revenue Service

See separate instructions.

12Donor’s last nameDonor’s first name and middle initial Donor’s social security number3

Address (number, street, and apartment number)4 5 Legal residence (domicile) (county and state)

6 City, state, and ZIP code Citizenship7

NoYes

If the donor died during the year, check here

and enter date of death , .8

9

If you received an extension of time to file this Form 709, check here

and attach the Form 4868, 2688, 2350, or extension letter

Enter the total number of donees listed on Schedule A—count each person only once.

10

11a

Have you (the donor) previously filed a Form 709 (or 709-A) for any other year? If the answer is "No," do not complete line 11b

12 Gifts by husband or wife to third parties.—Do you consent to have the gifts (including generation-skipping transfers) made

by you and by your spouse to third parties during the calendar year considered as made one-half by each of you? (See

instructions.) (If the answer is “Yes,” the following information must be furnished and your spouse must sign the consent

shown below. If the answer is “No,” skip lines 13–18 and go to Schedule A.)

13 Name of consenting spouse 14 SSN

15 Were you married to one another during the entire calendar year? (see instructions)

Part 1—General Information

16

If the answer to 15 is “No,” check whether

Will a gift tax return for this calendar year be filed by your spouse?17

Consent of Spouse—I consent to have the gifts (and generation-skipping transfers) made by me and by my spouse to third parties during the calendar year

considered as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent.

18

Date

Consenting spouse’s signature

1

1 Enter the amount from Schedule A, Part 3, line 15

2

2 Enter the amount from Schedule B, line 3

3

3 Total taxable gifts (add lines 1 and 2)

4

4 Tax computed on amount on line 3 (see Table for Computing Tax in separate instructions)

5

5 Tax computed on amount on line 2 (see Table for Computing Tax in separate instructions)

6

6 Balance (subtract line 5 from line 4)

345,800 007

7 Maximum unified credit (nonresident aliens, see instructions)

8

8 Enter the unified credit against tax allowable for all prior periods (from Sch. B, line 1, col. C)

9

9 Balance (subtract line 8 from line 7)

10 Enter 20% (.20) of the amount allowed as a specific exemption for gifts made after September 8,

1976, and before January 1, 1977 (see instructions)

10

11

11 Balance (subtract line 10 from line 9)

12

12 Unified credit (enter the smaller of line 6 or line 11)

13

13 Credit for foreign gift taxes (see instructions)

14

14 Total credits (add lines 12 and 13)

15

Part 2—Tax Computation

15 Balance (subtract line 14 from line 6) (do not enter less than zero)

16

16 Generation-skipping transfer taxes (from Schedule C, Part 3, col. H, Total)

17

17 Total tax (add lines 15 and 16)

18

18 Gift and generation-skipping transfer taxes prepaid with extension of time to file

19

19 If line 18 is less than line 17, enter balance due (see instructions)

If line 18 is greater than line 17, enter amount to be refunded 20

20

Attach check or money order here.

Form 709 (2002)

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 12 of the separate instructions for this form.

Cat. No. 16783M

If the answer to line 11a is "Yes," has your address changed since you last filed Form 709 (or 709-A)?

11b

divorced or widowed, and give date (see instructions)

married

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has

any knowledge.

Sign

Here

DateSignature of donor

Date

Preparer’s

signature

Check if

self-employed

Paid

Preparer’s

Use Only

Firm’s name (or

yours if self-employed),

address, and ZIP code

Phone no. ()

20

02

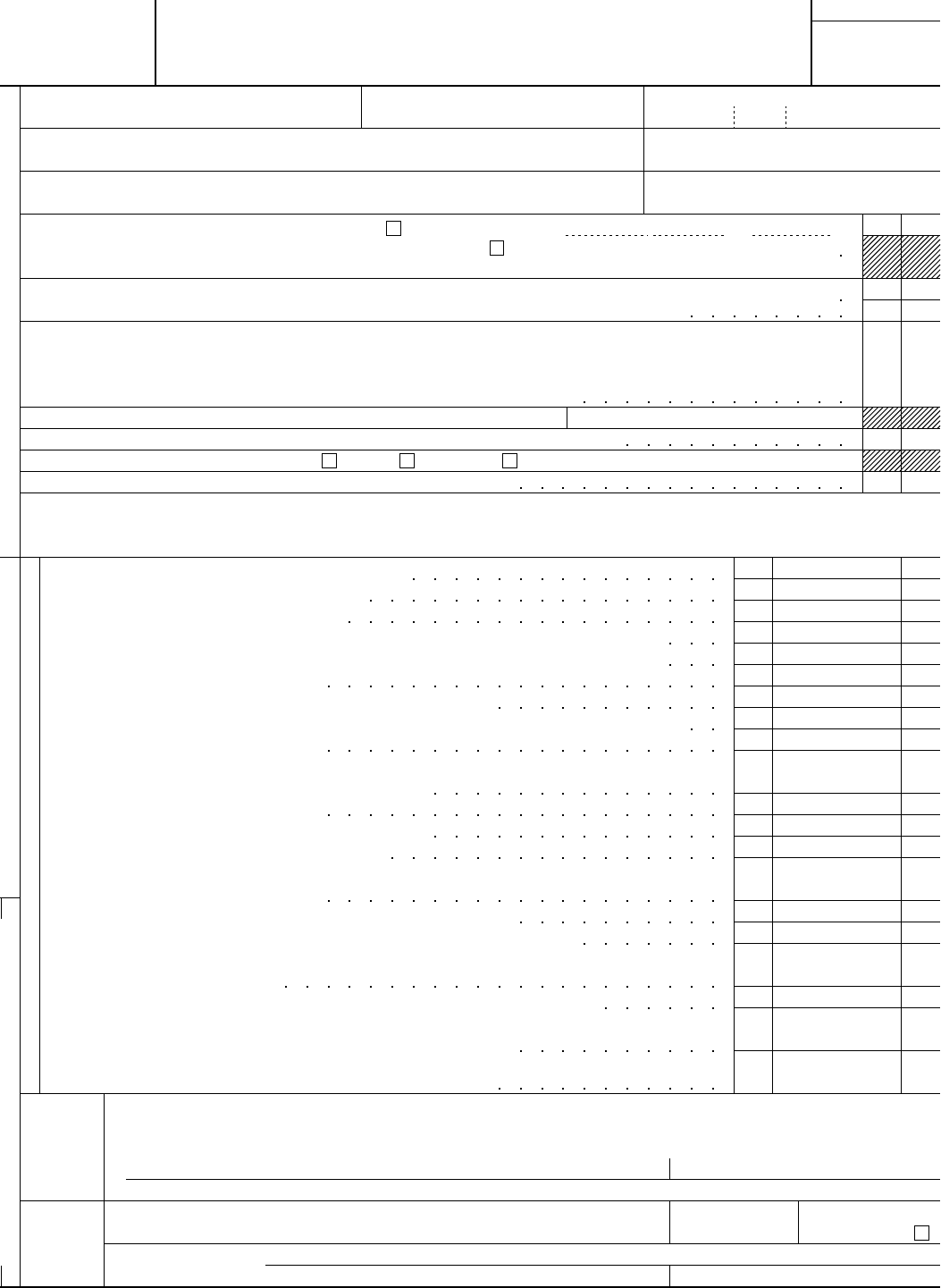

SCHEDULE A

Page 2Form 709 (2002)

Computation of Taxable Gifts (Including Transfers in Trust)

Part 1—Gifts Subject Only to Gift Tax. Gifts less political organization, medical, and educational exclusions—see instructions

E

Value at

date of gift

D

Date

of gift

C

Donor’s adjusted

basis of gift

A

Item

number

1

Part 2—Gifts That are Direct Skips and are Subject to Both Gift Tax and Generation-Skipping Transfer Tax. You must list the gifts

in chronological order. Gifts less political organization, medical, and educational exclusions—see instructions. (Also list here direct skips

that are subject only to the GST tax at this time as the result of the termination of an “estate tax inclusion period.” See instructions.)

E

Value at

date of gift

D

Date

of gift

C

Donor’s adjusted

basis of gift

A

Item

number

1

Part 3—Taxable Gift Reconciliation

1

Total value of gifts of donor (add totals from column E of Parts 1 and 2)1

2

One-half of items attributable to spouse (see instructions)2

3

Balance (subtract line 2 from line 1)3

4

Gifts of spouse to be included (from Schedule A, Part 3, line 2 of spouse’s return—see instructions)4

If any of the gifts included on this line are also subject to the generation-skipping transfer tax, check

here

and enter those gifts also on Schedule C, Part 1.

5

Total gifts (add lines 3 and 4)

5

6

Total annual exclusions for gifts listed on Schedule A (including line 4, above) (see instructions)

6

7

Total included amount of gifts (subtract line 6 from line 5)7

Deductions (see instructions)

Gifts of interests to spouse for which a marital deduction will be claimed, based

on items

of Schedule A

8

8

9

Exclusions attributable to gifts on line 89

10

Marital deduction—subtract line 9 from line 810

11

Charitable deduction, based on items less exclusions11

12

Total deductions—add lines 10 and 1112

13

Subtract line 12 from line 713

14

Generation-skipping transfer taxes payable with this Form 709 (from Schedule C, Part 3, col. H, Total)

14

Taxable gifts (add lines 13 and 14). Enter here and on line 1 of the Tax Computation on page 115

15

(If more space is needed, attach additional sheets of same size.)

B

B

● Donee’s name and address

● Relationship to donor (if any)

● Description of gift

● If the gift was made by means of a trust, enter trust’s EIN and

attach a description or copy of the trust instrument (see instructions)

● If the gift was of securities, give CUSIP number

● Donee’s name and address

● Relationship to donor (if any)

● Description of gift

● If the gift was made by means of a trust, enter trust’s EIN and

attach a description or copy of the trust instrument (see instructions)

● If the gift was of securities, give CUSIP number

Does the value of any item listed on Schedule A reflect any valuation discount? If the answer is “Yes,” see instructions Yes No

Total of Part 1 (add amounts from Part 1, column E)

Total of Part 2 (add amounts from Part 2, column E)

Check here if you elect under section 529(c)(2)(B) to treat any transfers made this year to a qualified state tuition program as made

ratably over a 5-year period beginning this year. See instructions. Attach explanation.

B

A

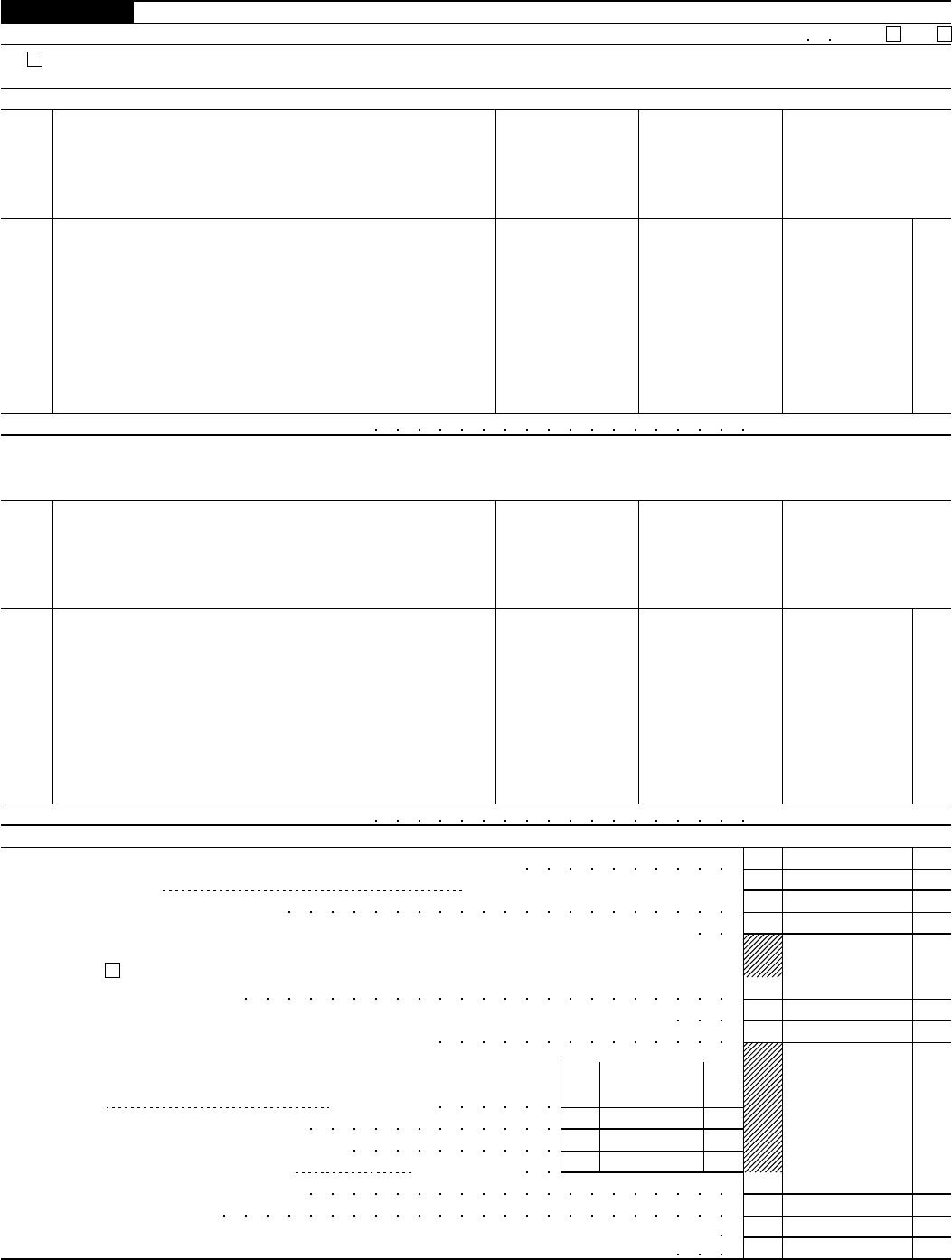

Form 709 (2002)

SCHEDULE B

SCHEDULE A

Page 3Form 709 (2002)

Computation of Taxable Gifts (continued)

16 Terminable Interest (QTIP) Marital Deduction. (See instructions for line 8 of Schedule A.)

17 Election Out of QTIP Treatment of Annuities

Check here if you elect under section 2523(f)(6) NOT to treat as qualified terminable interest property any joint and survivor annuities that

are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). (See instructions.)

Enter the item numbers (from Schedule A) for the annuities for which you are making this election

Gifts From Prior Periods

D

Amount of specific

exemption for prior

periods ending before

January 1, 1977

C

Amount of unified

credit against gift tax

for periods after

December 31, 1976

A

Calendar year or

calendar quarter

(see instructions)

E

Amount of

taxable gifts

B

Internal Revenue office

where prior return was filed

1

Totals for prior periods

1

2

Amount, if any, by which total specific exemption, line 1, column D, is more than $30,0002

Total amount of taxable gifts for prior periods (add amount, column E, line 1, and amount, if any, on

line 2). (Enter here and on line 2 of the Tax Computation on page 1.)

3

3

(If more space is needed, attach additional sheets of same size.)

If a trust (or other property) meets the requirements of qualified terminable interest property under section 2523(f), and

a. The trust (or other property) is listed on Schedule A, and

b. The value of the trust (or other property) is entered in whole or in part as a deduction on line 8, Part 3 of Schedule A,

then the donor shall be deemed to have made an election to have such trust (or other property) treated as qualified terminable interest property

under section 2523(f).

If less than the entire value of the trust (or other property) that the donor has included in Part 1 of Schedule A is entered as a deduction on

line 8, the donor shall be considered to have made an election only as to a fraction of the trust (or other property). The numerator of this fraction

is equal to the amount of the trust (or other property) deducted on line 10 of Part 3, Schedule A. The denominator is equal to the total value of

the trust (or other property) listed in Part 1 of Schedule A.

If you answered “Yes” on line 11a of page 1, Part 1, see the instructions for completing Schedule B. If you answered “No,” skip to the Tax

Computation on page 1 (or Schedule C, if applicable).

If you make the QTIP election (see instructions for line 8 of Schedule A), the terminable interest property involved will be included in your

spouse’s gross estate upon his or her death (section 2044). If your spouse disposes (by gift or otherwise) of all or part of the qualifying life

income interest, he or she will be considered to have made a transfer of the entire property that is subject to the gift tax (see Transfer of Certain

Life Estates on page 4 of the instructions).

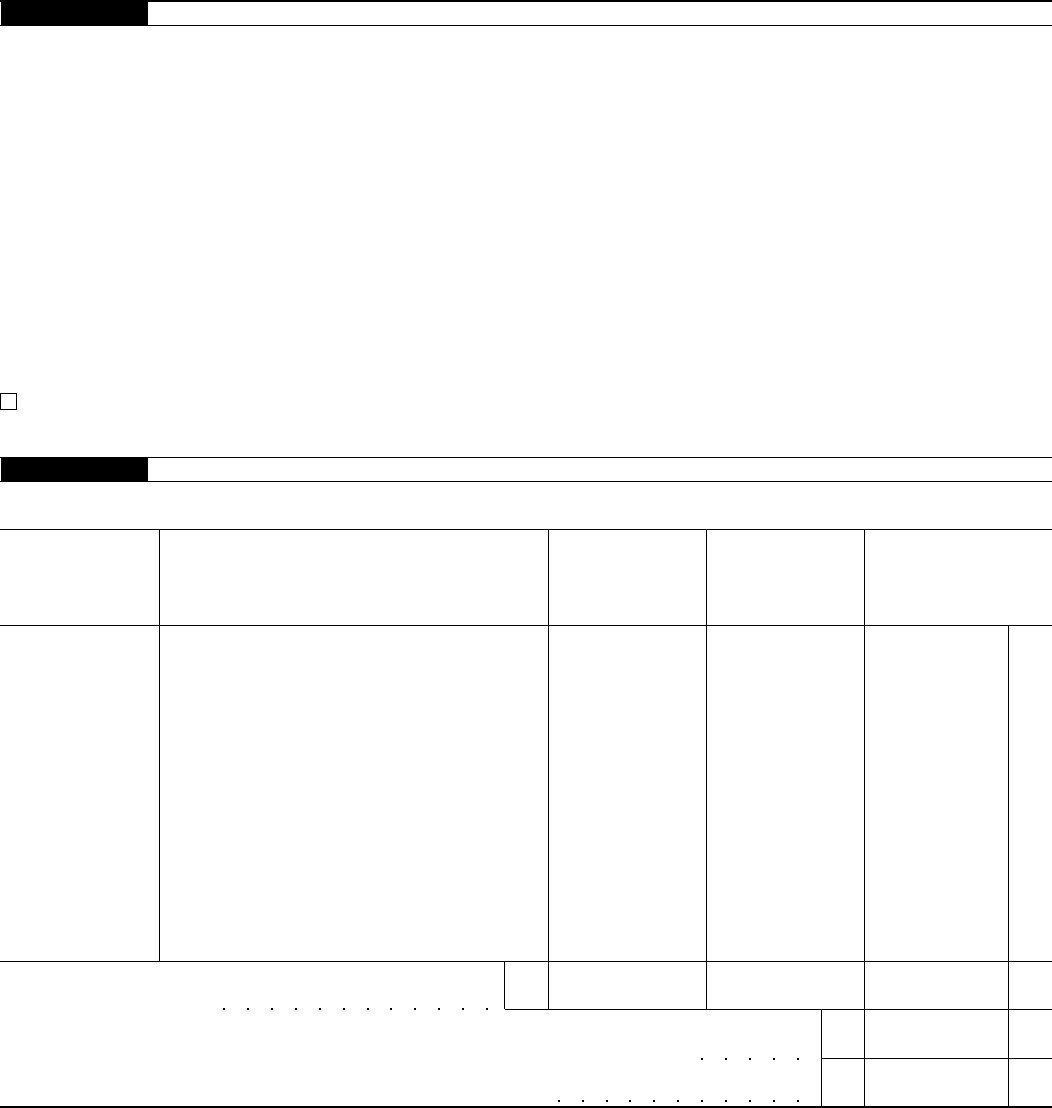

Form 709 (2002)

Form 709 (2002) Page 4

Part 2—GST Exemption Reconciliation (Section 2631) and Section 2652(a)(3) Election

Check box

if you are making a section 2652(a)(3) (special QTIP) election (see instructions)

Enter the item numbers (from Schedule A) of the gifts for which you are making this election

1

Maximum allowable exemption (see instructions)1

2

2 Total exemption used for periods before filing this return

3

3 Exemption available for this return (subtract line 2 from line 1)

4

4 Exemption claimed on this return (from Part 3, col. C total, below)

5 Exemption allocated to transfers not shown on Part 3, below. You must attach a Notice of Allocation. (See

instructions.)

5

6

Add lines 4 and 56

7

7 Exemption available for future transfers (subtract line 6 from line 3)

Part 3—Tax Computation

H

Generation-Skipping

Transfer Tax

(multiply col. B by col. G)

G

Applicable Rate

(multiply col. E

by col. F)

F

Maximum Estate

Tax Rate

E

Inclusion Ratio

(subtract col. D

from 1.000)

D

Divide col. C

by col. B

B

Net transfer

(from Schedule C,

Part 1, col. F)

C

GST Exemption

Allocated

A

Item No.

(from Schedule

C, Part 1)

1 50% (.50)

2

3

4

5

6

Total exemption claimed. Enter

here and on line 4, Part 2,

above. May not exceed line 3,

Part 2, above

Total generation-skipping transfer tax. Enter here, on line 14 of

Schedule A, Part 3, and on line 16 of the Tax Computation on

page 1

(If more space is needed, attach additional sheets of same size.)

SCHEDULE C

Computation of Generation-Skipping Transfer Tax

Note: Inter vivos direct skips that are completely excluded by the GST exemption must still be fully reported

(including value and exemptions claimed) on Schedule C.

Part 1—Generation-Skipping Transfers

F

Net Transfer

(subtract col. E

from col. D)

C

Split Gifts

(enter

1

⁄2 of col. B)

(see instructions)

B

Value

(from Schedule A,

Part 2, col. E)

A

Item No.

(from Schedule A,

Part 2, col. A)

E

Nontaxable

portion of transfer

D

Subtract col. C

from col. B

1

2

3

4

5

6

Value included

from spouse’s

Form 709

Split gifts from

spouse’s Form 709

(enter item number)

If you elected gift splitting and your spouse

was required to file a separate Form 709

(see the instructions for “Split Gifts”), you

must enter all of the gifts shown on

Schedule A, Part 2, of your spouse’s Form

709 here.

S-

In column C, enter the item number of each

gift in the order it appears in column A of

your spouse’s Schedule A, Part 2. We have

preprinted the prefix “S-” to distinguish your

spouse’s item numbers from your own when

you complete column A of Schedule C,

Part 3.

S-

S-

S-

S-

In column D, for each gift, enter the amount

reported in column C, Schedule C, Part 1, of

your spouse’s Form 709.

S-

S-

S-

Net transfer

(subtract col. E

from col. D)

Nontaxable

portion of transfer

50% (.50)

50% (.50)

50% (.50)

50% (.50)

50% (.50)

50% (.50)

50% (.50)

50% (.50)

50% (.50)

Form 709 (2002)