Fillable Printable 2005 Form 1040 (Schedule D)

Fillable Printable 2005 Form 1040 (Schedule D)

2005 Form 1040 (Schedule D)

2

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Action

Revised proofs

requested

Date Signature

O.K. to print

INSTRUCTIONS TO PRINTERS

SCHEDULE D (FORM 1040), PAGE 1 of 2

MARGINS: TOP 13mm (

1

⁄2 "), CENTER SIDES. PRINTS: HEAD to HEAD

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 203mm (8") 279mm (11")

PERFORATE: (NONE)

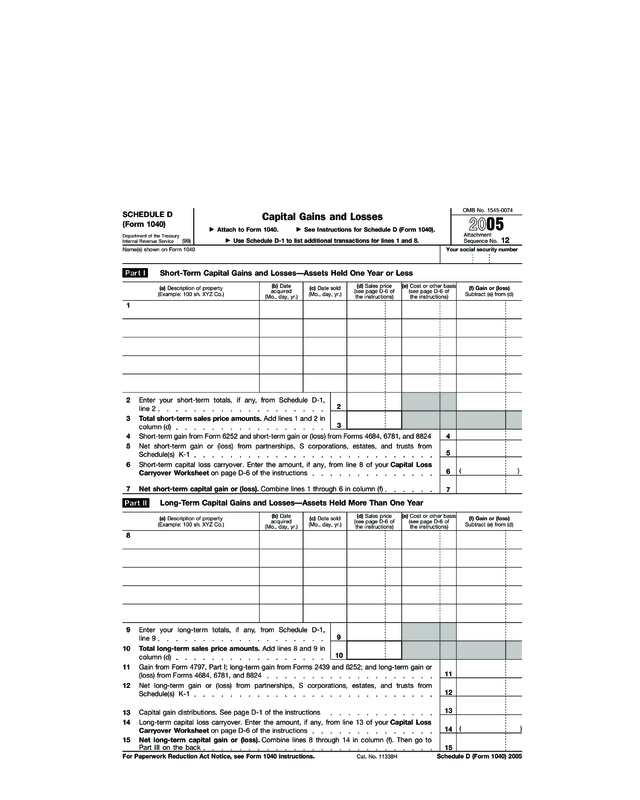

OMB No. 1545-0074

SCHEDULE D

Capital Gains and Losses

(Form 1040)

䊳

Attach to Form 1040.

䊳

See Instructions for Schedule D (Form 1040).

Department of the Treasury

Internal Revenue Service

Attachment

Sequence No.

12

䊳

Use Schedule D-1 to list additional transactions for lines 1 and 8.

Your social security numberName(s) shown on Form 1040

Short-Term Capital Gains and Losses—Assets Held One Year or Less

(f) Gain or (loss)

Subtract (e) from (d)

(e) Cost or other basis

(see page D-6 of

the instructions)

(a) Description of property

(Example: 100 sh. XYZ Co.)

(d) Sales price

(see page D-6 of

the instructions)

(c) Date sold

(Mo., day, yr.)

1

Enter your short-term totals, if any, from Schedule D-1,

line 2

2

Total short-term sales price amounts. Add lines 1 and 2 in

column (d)

3

3

5

Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824

5

6

6

Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from

Schedule(s) K-1

7

Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss

Carryover Worksheet on page D-6 of the instructions

Net short-term capital gain or (loss). Combine lines 1 through 6 in column (f)

Long-Term Capital Gains and Losses—Assets Held More Than One Year

8

Enter your long-term totals, if any, from Schedule D-1,

line 9

9

10 Total long-term sales price amounts. Add lines 8 and 9 in

column (d)

10

11

Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or

(loss) from Forms 4684, 6781, and 8824

11

12

12

13

Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from

Schedule(s) K-1

14

Capital gain distributions. See page D-1 of the instructions

14

15

Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss

Carryover Worksheet on page D-6 of the instructions

( )

Net long-term capital gain or (loss). Combine lines 8 through 14 in column (f). Then go to

Part III on the back

15

For Paperwork Reduction Act Notice, see Form 1040 instructions. Schedule D (Form 1040) 2005Cat. No. 11338H

()

4 4

Part I

Part II

13

(b) Date

acquired

(Mo., day, yr.)

2

9

(99)

(a) Description of property

(Example: 100 sh. XYZ Co.)

(c) Date sold

(Mo., day, yr.)

(b) Date

acquired

(Mo., day, yr.)

(e) Cost or other basis

(see page D-6 of

the instructions)

(d) Sales price

(see page D-6 of

the instructions)

7

(f) Gain or (loss)

Subtract (e) from (d)

20

05

2

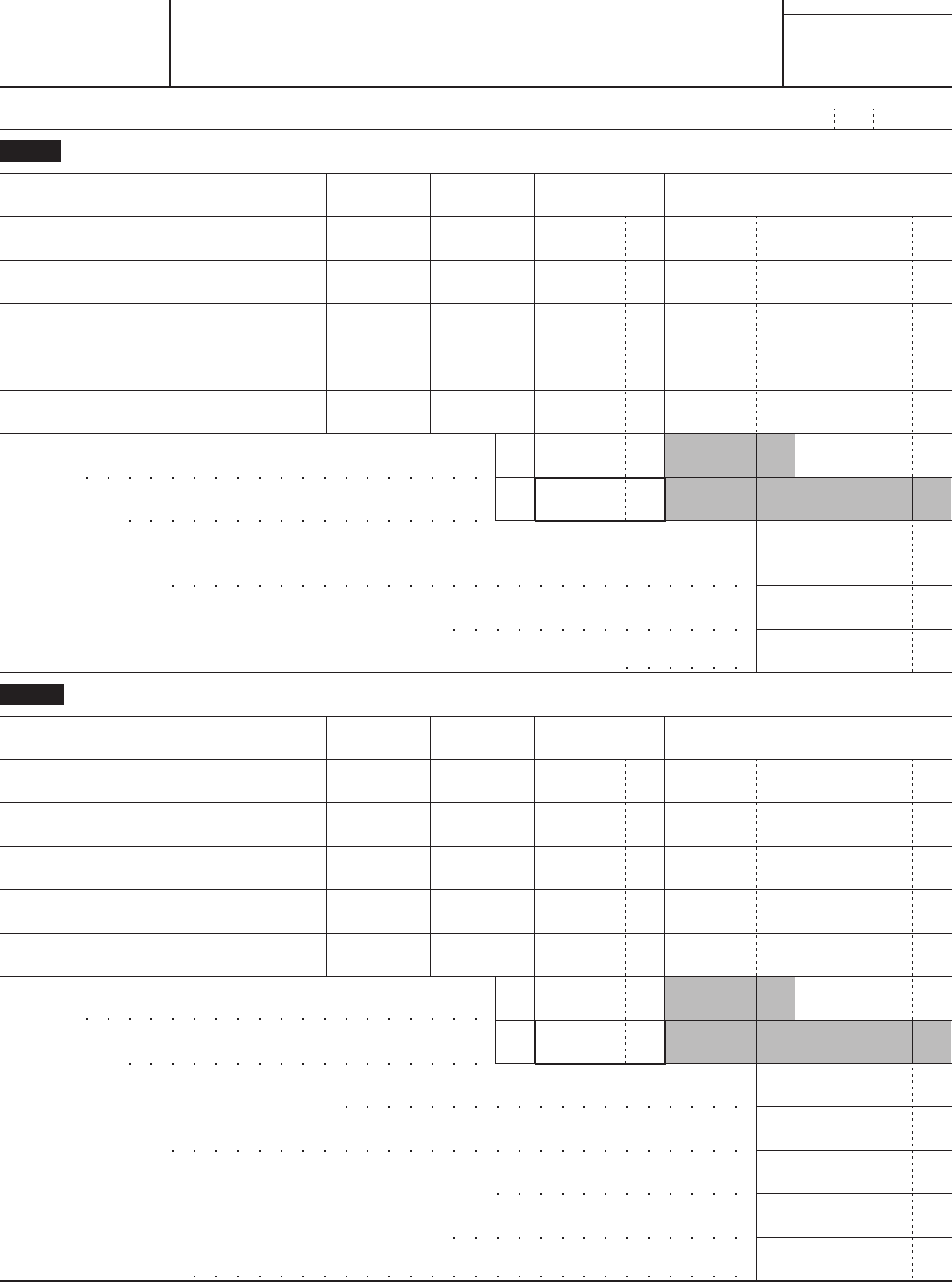

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

INSTRUCTIONS TO PRINTERS

SCHEDULE D (FORM 1040), PAGE 2 of 2

MARGINS: TOP 13mm (

1

⁄2 "), CENTER SIDES. PRINTS: HEAD to HEAD

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 203mm (8") 279mm (11")

PERFORATE: (NONE)

Schedule D (Form 1040) 2005

Summary

Combine lines 7 and 15 and enter the result. If line 16 is a loss, skip lines 17 through 20, and

go to line 21. If a gain, enter the gain on Form 1040, line 13, and then go to line 17 below

16

16

18

Part III

Page 2

18 Enter the amount, if any, from line 7 of the 28% Rate Gain Worksheet on page D-7 of the

instructions

䊳

Are lines 18 and 19 both zero or blank?

19

Schedule D (Form 1040) 2005

21

Enter the amount, if any, from line 18 of the Unrecaptured Section 1250 Gain Worksheet on

page D-8 of the instructions

䊳

20

If line 16 is a loss, enter here and on Form 1040, line 13, the smaller of:21

19

● The loss on line 16 or

● ($3,000), or if married filing separately, ($1,500)

Yes. Complete Form 1040 through line 43, and then complete the Qualified Dividends and

Capital Gain Tax Worksheet on page 38 of the Instructions for Form 1040. Do not complete

lines 21 and 22 below.

No. Complete Form 1040 through line 43, and then complete the Schedule D Tax Worksheet

on page D-9 of the instructions. Do not complete lines 21 and 22 below.

Do you have qualified dividends on Form 1040, line 9b?

22

Yes. Complete Form 1040 through line 43, and then complete the Qualified Dividends and

Capital Gain Tax Worksheet on page 38 of the Instructions for Form 1040.

No. Complete the rest of Form 1040.

( )

Are lines 15 and 16 both gains?

17

Yes. Go to line 18.

No. Skip lines 18 through 21, and go to line 22.

Note. When figuring which amount is smaller, treat both amounts as positive numbers.