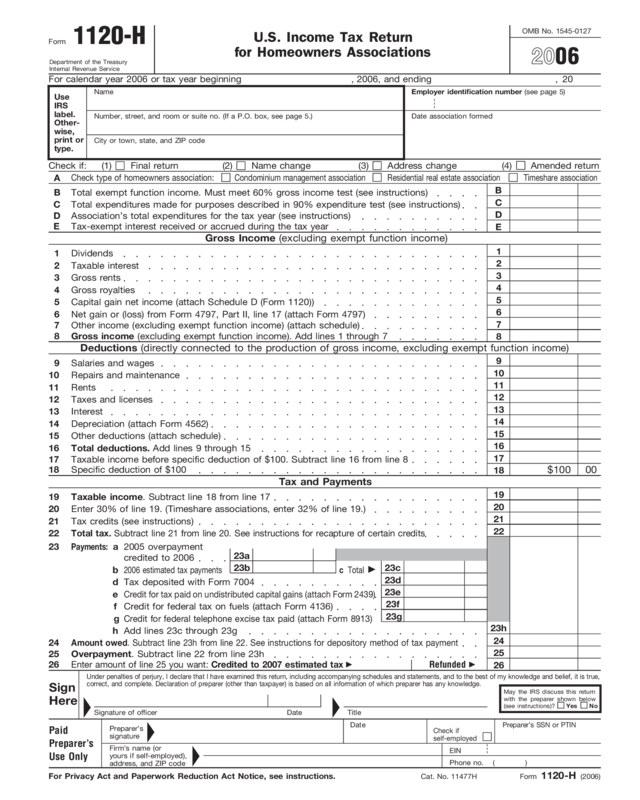

Fillable Printable 2006 Form 1120-H

Fillable Printable 2006 Form 1120-H

2006 Form 1120-H

OMB No. 1545-0127

U.S. Income Tax Return

for Homeowners Associations

1120-H

Form

Department of the Treasury

Internal Revenue Service

For calendar year 2006 or tax year beginning , 2006, and ending , 20

Employer identification number (see page 5)

Name

Use

IRS

label.

Other-

wise,

print or

type.

Number, street, and room or suite no. (If a P.O. box, see page 5.)

Date association formed

City or town, state, and ZIP code

Check if:

E

A

B

Total expenditures made for purposes described in 90% expenditure test (see instructions)

B

C

Association’s total expenditures for the tax year (see instructions)

C

Tax-exempt interest received or accrued during the tax year

D

D

Gross Income (excluding exempt function income)

1

Dividends

1

2

Taxable interest

2

3

Gross rents

3

4

Gross royalties

4

5

Capital gain net income (attach Schedule D (Form 1120))

5

6

Net gain or (loss) from Form 4797, Part II, line 17 (attach Form 4797)

6

7

Other income (excluding exempt function income) (attach schedule)

7

Gross income (excluding exempt function income). Add lines 1 through 7

8

8

Deductions (directly connected to the production of gross income, excluding exempt function income)

9

Salaries and wages

9

10

Repairs and maintenance

10

11

Rents

11

12

Taxes and licenses

12

13

Interest

13

14

Depreciation (attach Form 4562)

14

15

Other deductions (attach schedule)

15

16

16

Total deductions. Add lines 9 through 15

17

Taxable income before specific deduction of $100. Subtract line 16 from line 8

17

$100

18

Specific deduction of $100

18

19

19

Taxable income. Subtract line 18 from line 17

Tax and Payments

20

20

Enter 30% of line 19. (Timeshare associations, enter 32% of line 19.)

Tax credits (see instructions)

21

21

Total tax. Subtract line 21 from line 20. See instructions for recapture of certain credits

22

22

23

23c

23d

2006 estimated tax payments

b

23e

Tax deposited with Form 7004

d

23f

Credit for tax paid on undistributed capital gains (attach Form 2439)

e

Credit for federal tax on fuels (attach Form 4136)

f

23h

Add lines 23c through 23g

h

24

Amount owed. Subtract line 23h from line 22. See instructions for depository method of tax payment

24

Overpayment. Subtract line 22 from line 23h

25

25

Enter amount of line 25 you want: Credited to 2007 estimated tax

©

26

Refunded

©

26

Form 1120-H (2006)

2005 overpayment

credited to 2006

Cat. No. 11477H

a

c Total

©

23a

23b

Payments:

(1)

Final return

(2)

Name change

(3)

Address change

00

Check type of homeowners association:

Residential real estate association

Timeshare association

E

Condominium management association

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Title

Date

Signature of officer

Date

Preparer’s SSN or PTIN

Preparer’s

signature

Check if

self-employed

Paid

Preparer’s

Use Only

Firm’s name (or

yours if self-employed),

address, and ZIP code

EIN

Phone no. ( )

(4)

Amended return

©

©

©

©

20

06

May the IRS discuss this return

with the preparer shown below

(see instructions)?

Yes

No

Total exempt function income. Must meet 60% gross income test (see instructions)

23g

Credit for federal telephone excise tax paid (attach Form 8913)

g

Page 2

Form 1120-H (2006)

General Instructions

Section references are to the Internal

Revenue Code unless otherwise noted.

To qualify as a homeowners

association, the following must apply.

A homeowners association should

compare its total tax computed on

Form 1120-H with its total tax

computed on either Form 1120, U.S.

Corporation Income Tax Return, or

Form 1120-A, U.S. Corporation

Short-Form Income Tax Return. The

association may file the form that

results in the lowest tax.

Purpose of Form

1. A condominium management

association organized and operated to

acquire, build, manage, maintain, and

care for the property in a

condominium project substantially all

of whose units are homes for

individuals.

How To Get Forms

and Publications

A homeowners association elects to

take advantage of the tax benefits

provided by section 528 by filing a

properly completed Form 1120-H. The

election is made separately for each

tax year and generally must be made

by the due date, including extensions,

of the income tax return.

If the association does not elect to

use Form 1120-H, it must file the

applicable income tax return (Form

1120, etc.).

If the association is tax exempt

under section 501(a), do not file Form

1120-H. See section 6033 and related

regulations. If the association loses its

exempt status, see Regulations

section 1.528-8(e).

Definitions

Homeowners association. There are

three types of homeowners

associations.

● Download forms, instructions, and

publications;

● Search publications online by topic

or keyword; and

● Sign up to receive local and national

tax news by email.

● Current year forms, instructions, and

publications;

● Prior-year forms, instructions, and

publications;

Purchase the CD from National

Technical Information Service at

www.irs.gov/cdorders for $25 (no

handling fee) or call 1-877-CDFORMS

(1-877-233-6767) toll free to buy the

CD for $25 (plus a $5 handling fee).

Price is subject to change.

IRS Tax Products CD. You can order

Pub. 1796, IRS Tax Products CD, and

obtain:

Internet. You can access the IRS

website 24 hours a day, 7 days a

week, at www.irs.gov to:

● The Internal Revenue Bulletins; and

get most forms and publications at

your local IRS office.

This extension does not extend the

time to pay the tax.

Electing To File Form

1120-H

See Regulations section 1.528-4

for information regarding the

“substantially all” test for

condominium management

associations and residential real

estate management associations.

● Order IRS products online;

● Tax Map: An electronic research

tool and finding aid;

● Tax law frequently asked questions

(FAQs);

● Fill-in, print, and save features for

most tax forms;

● Toll-free and email technical

support.

Once Form 1120-H is filed, the

association cannot revoke its election

for that year unless the IRS consents.

The association may request IRS

consent by filing a ruling request. A

user fee must be paid with all ruling

requests. For more information on

ruling requests, see Rev. Proc.

2006-1. You can find this revenue

procedure on page 1 of Internal

Revenue Bulletin 2006-1 at

www.irs.gov/pub/irs-irbs/irb06-01.pdf.

3. A timeshare association (other

than a condominium management

association) organized and operated

to acquire, build, manage, maintain,

and care for the property that has

members who hold a timeshare right

to use, or a timeshare ownership

interest in, real property of the

timeshare association. A timeshare

association cannot be a condominium

management association.

Automatic 12-month extension to

make election. If the homeowners

association fails to make the

regulatory election to be treated as a

homeowners association, it can get an

automatic 12-month extension to

make the section 528 election,

provided corrective action is taken

within 12 months of the due date

(including extension) of the return. See

Regulations section 301.9100-2 for

more information.

● Tax topics from the IRS telephone

response system;

2. A residential real estate

management association organized

and operated to acquire, build,

manage, maintain, and care for a

subdivision, development, or similar

area substantially all of whose lots or

buildings are homes for individuals.

A homeowners association files Form

1120-H as its income tax return to

take advantage of certain tax benefits.

These benefits, in effect, allow the

association to exclude exempt

function income (defined later) from its

gross income.

The CD is released twice during the

year.

● The first release will ship the

beginning of January 2007.

● The final release will ship the

beginning of March 2007.

What’s New

● Homeowners associations can

request a credit for the federal

telephone excise tax paid for

nontaxable telephone service on

line 23g.

● Homeowners associations whose

principal business, office, or agency

are located in a foreign country or

U.S. possession must now file Form

1120-H at the Internal Revenue

Service Center, P.O. Box 409101,

Ogden, UT 84409.

● Research your tax questions online;

Tax rate. The taxable income of a

homeowners association that files its

tax return on Form 1120-H is taxed at

a flat rate of 30% for condominium

management associations and

residential real estate associations.

The tax rate for timeshare associations

is 32%. These rates apply to both

ordinary income and capital gains.

● At least 90% of the association’s

expenses for the tax year must

consist of expenses to acquire,

build, manage, maintain, or care for

its property, and, in the case of a

timeshare association, for activities

By phone and in person. You can

order forms and publications by

calling 1-800-TAX-FORM

(1-800-829-3676). You can also

● At least 60% of the association’s

gross income for the tax year must

consist of exempt function income

(defined later).

Page 3

Form 1120-H (2006)

Assessments or fees for a common

activity qualify but charges for

providing services do not qualify.

Examples. In general, exempt function

income includes assessments made

to:

1. Pay principal, interest, and real

estate taxes on association property.

2. Maintain association property.

3. Clear snow from public areas and

remove trash.

1. Amounts that are not includible in

the organization’s gross income other

than under section 528 (for example,

tax-exempt interest).

2. Payments from nonmembers.

3. Payments from members for

special use of the organization’s

facilities, apart from the use generally

available to all members.

4. Interest on amounts in a sinking

fund.

5. Payments for work done on

nonassociation property.

6. Members’ payments for

transportation.

Income that is not exempt function

income includes:

For more information, see

Regulations section 1.528-9.

When To File

Generally, an association must file

Form 1120-H by the 15th day of the

3rd month after the end of its tax year.

If the due date falls on a Saturday,

Sunday, or legal holiday, the

association may file on the next

business day.

Who Must Sign

If an association officer completes

Form 1120-H, the paid preparer’s

space should remain blank. Anyone

who prepares Form 1120-H but does

not charge the association should not

complete that section. Generally,

anyone who is paid to prepare the

return must sign it and fill in the “Paid

Preparer’s Use Only” area.

The paid preparer must complete

the required preparer information and:

● Sign the return in the space

provided for the preparer’s signature.

● Give a copy of the return to the

taxpayer.

Where To File

File the association’s return at the

applicable IRS address listed below.

If a return is filed on behalf of an

association by a receiver, trustee, or

assignee, the fiduciary must sign the

return, instead of the association

officer. Returns and forms signed by a

receiver or trustee in bankruptcy on

behalf of an association must be

accompanied by a copy of the order

or instructions of the court authorizing

signing of the return or form.

The return must be signed and dated

by the president, vice-president,

treasurer, assistant treasurer, chief

accounting officer, or any other

association officer (such as tax officer)

authorized to sign.

Cincinnati, OH

45999-0012

Note. A paid preparer may sign

original or amended returns by rubber

stamp, mechanical device, or

computer software program.

● Net operating loss deduction

(section 172).

● Deductions under part VIII of

subchapter B (special deductions for

corporations).

If facilities are used (or personnel

are employed) for both exempt and

nonexempt purposes, see Regulations

section 1.528-10.

Connecticut,

Delaware, District of

Columbia, Illinois,

Indiana, Kentucky,

Maine, Maryland,

Massachusetts,

Michigan, New

Hampshire,

New Jersey, New

York, North Carolina,

Ohio, Pennsylvania,

Rhode Island,

South Carolina,

Vermont, Virginia,

West Virginia,

Wisconsin

Use the following

Internal Revenue

Service Center

address:

Private delivery services. You can

use certain private delivery services

designated by the IRS to meet the

“timely mailing as timely filing/paying”

rule for tax returns and payments. See

the instructions for Form 1120 for

details.

● The association must file Form

1120-H to elect under section 528 to

be treated as a homeowners

association.

Association property. Association

property includes real and personal

property that:

1. The association holds,

2. The association’s members hold

in common,

3. The association’s members hold

privately within the association, and

4. Is owned by a governmental unit

and is used to benefit the unit’s

residents.

For more information, see

Regulations section 1.528-3.

Taxable income. Taxable income is

the excess, if any, of:

Timeshare association property

includes property related to the

timeshare project that the association

or its members have rights to use.

These rights must arise out of

recorded easements, covenants, or

other recorded instruments.

1. Gross income for the tax year,

excluding exempt function income,

over

2. Allowed deductions directly

connected with producing any gross

income except exempt function

income. Allowed deductions include a

specific $100 deduction. The following

are not allowed:

If the association’s

principal business,

office, or agency is

located in:

● No private shareholder or individual

can profit from the association’s net

earnings except by acquiring, building,

managing, or caring for association

property or by a rebate of excess

membership dues, fees, or

assessments.

provided to, or on behalf of, members

of the timeshare association.

Exempt function income. Exempt

function income consists of

membership dues, fees, or

assessments from (a) owners of

condominium housing units, (b)

owners of real property in the case of

Extension. File Form 7004,

Application for Automatic 6-Month

Extension of Time To File Certain

Business Income Tax, Information,

a residential real estate management

association, or (c) owners of timeshare

rights to use, or timeshare ownership

interests in, real property in the case

of a timeshare association. This

income must come from the members

as owners, not as customers, of the

association’s services.

and Other Returns, to request a

6-month extension of time to file.

Page 4

Form 1120-H (2006)

Accounting Methods

Figure taxable income using the

method of accounting regularly used

in keeping the association’s books

and records. In all cases, the method

used must clearly show taxable

income. Permissible methods include

cash, accrual, or any other method

authorized by the Internal Revenue

Code.

Rounding Off to Whole

Dollars

The association can round off cents to

whole dollars on its return and

schedules. If the association does

round to whole dollars, it must round

all amounts. To round, drop amounts

under 50 cents and increase amounts

from 50 to 99 cents to the next dollar

(for example, $1.39 becomes $1 and

$2.50 becomes $3).

Depository Methods of Tax

Payment

Change of Tax Year

Generally, an association must get the

consent of the IRS before changing its

tax year by filing Form 1128,

Application To Adopt, Change, or

Retain a Tax Year. However, under

certain conditions, an association can

change its tax year without getting the

consent.

Electronic deposit requirement. The

association must make electronic

deposits of all depository taxes (such

as employment tax, excise tax, and

corporate income tax) using the

Electronic Federal Tax Payment

System (EFTPS) in 2007 if:

Complete every applicable entry

space on Form 1120-H. Do not write

“See Attached” instead of completing

the entry spaces. If more space is

needed on the forms or schedules,

attach separate sheets using the same

size and format as the printed forms.

If there are supporting statements and

attachments, arrange them in the

same order as the schedules or forms

they support and attach them last.

Show the totals on the printed forms.

Enter the association’s name and EIN

on each supporting statement or

attachment.

● The total deposits of such taxes in

2005 were more than $200,000 or

● The association was required to use

EFTPS in 2006.

If the association is required to use

EFTPS and fails to do so, it may be

subject to a 10% penalty. If the

association is not required to use

EFTPS, it may participate voluntarily.

To enroll in or get more information

about EFTPS, call 1-800-555-4477. To

enroll online, visit the EFTPS website

at www.eftps.gov.

For more information on change of

tax year, see Form 1128, Regulations

section 1.442-1, and Pub. 538.

If two or more amounts must be

added to figure the amount to enter

on a line, include cents when adding

the amounts and round off only the

total.

Change in accounting method. To

change its method of accounting used

to report taxable income (for income

as a whole or for any material item)

the association must file Form 3115,

Application for Change in Accounting

Method. For more information, see

Form 3115 and Pub. 538, Accounting

Periods and Methods.

The association must pay any tax due

in full no later than the 15th day of the

3rd month after the end of the tax

year. The two methods of depositing

taxes are discussed below.

Alabama, Alaska,

Arizona, Arkansas,

California, Colorado,

Florida, Georgia,

Hawaii, Idaho, Iowa,

Kansas, Louisiana,

Minnesota,

Mississippi, Missouri,

Montana, Nebraska,

Nevada, New Mexico,

North Dakota,

Oklahoma, Oregon,

South Dakota,

Tennessee, Texas,

Utah, Washington,

Wyoming

Ogden, UT

84201-0012

Paid Preparer Authorization

If the association wants to allow the

IRS to discuss its 2006 tax return with

the paid preparer who signed it, check

the “Yes” box in the signature area of

the return. This authorization applies

only to the individual whose signature

appears in the “Paid Preparer’s Use

Only” section of the return. It does not

apply to the firm, if any, shown in that

section.

If the “Yes” box is checked, the

association is authorizing the IRS to

call the paid preparer to answer any

questions that may arise during the

processing of its return. The

association is also authorizing the paid

preparer to:

● Give the IRS any information that is

missing from the return,

● Call the IRS for information about

the processing of the return or the

status of any related refund or

payment(s), and

● Respond to certain IRS notices

about math errors, offsets, and return

preparation.

Other Forms and Statements

That May Be Required

See the Instructions for Forms 1120

and 1120-A and Pub. 542,

Corporations, for a list of other forms

and statements the association may

be required to file.

Assembling the Return

Attach Form 4136, Credit for Federal

Tax Paid on Fuels, to Form 1120-H.

Attach schedules in alphabetical order

and additional forms in numerical

order after Form 4136.

The association is not authorizing

the paid preparer to receive any

refund check, bind the association to

anything (including any additional tax

liability), or otherwise represent the

association before the IRS.

The authorization will automatically

end no later than the due date

(excluding extension) for filing the

association’s 2007 tax return. If the

association wants to expand the paid

preparer’s authorization, see Pub. 947,

Practice Before the IRS and Power of

Attorney.

A foreign country or

U.S. possession

P.O. Box 409101

Ogden, UT 84409

Depositing on time. For EFTPS

deposits to be made timely, the

association must initiate the

transaction at least 1 business day

before the date the deposit is due.

Deposits with Form 8109. If the

association does not use EFTPS,

deposit tax payments (and estimated

tax payments) with Form 8109,

Federal Tax Deposit Coupon. If you do

not have a preprinted Form 8109, use

Form 8109-B to make deposits. You

can get this form by calling

1-800-829-4933 or visiting an IRS

taxpayer assistance center. Have your

EIN ready when you call or visit.

Page 5

Form 1120-H (2006)

Specific Instructions

Name and address. Print or type the

association’s true name (as set forth in

the charter or other legal document

Period covered. File the 2006 return

for calendar year 2006, and fiscal

years that begin in 2006 and end in

2007. For a fiscal year return, fill in the

tax year space at the top of the form.

Employer identification number

(EIN). Enter the association’s EIN. If

the association does not have an EIN,

it must apply for one. An EIN may be

applied for:

The 2006 Form 1120-H can also be

used if (a) the association has a tax

year of less than 12 months that

begins and ends in 2007 and (b) the

2007 Form 1120-H is not available at

the time the association is required to

file its return.

The association must show its 2007

tax year on the 2006 Form 1120-H

and take into account any tax law

changes that are effective for tax

years beginning after 2006.

● Online—Click on the EIN link at

www.irs.gov/businesses/small. The EIN

is issued immediately once the

application information is validated.

● By telephone at 1-800-829-4933

from 7:00 a.m. to 10:00 p.m. in the

association’s local time zone.

● By mailing or faxing Form SS-4,

Application for Employer Identification

Number.

If the association receives its mail in

care of a third party (such as an

accountant or an attorney), enter on

the street address line “C/O” followed

by the third party’s name and street

address or P.O. box.

Do not send deposits directly to an

IRS office; otherwise, the association

may have to pay a penalty. Mail or

deliver the completed Form 8109 with

the payment to an authorized

depositary (a commercial bank or

other financial institution authorized to

accept federal tax deposits). Make

checks or money orders payable to

the depositary.

To help ensure proper crediting,

enter the association’s EIN, the tax

period to which the deposit applies,

and “Form 1120-H” on the check or

money order. Darken the “1120” box

under “Type of Tax” and the

appropriate “Quarter” box under “Tax

Period” on the coupon. Records of

these deposits will be sent to the IRS.

For more information, see “Marking

the Proper Tax Period” in the

instructions for Form 8109.

failure to file, negligence, fraud,

substantial valuation misstatements,

substantial understatements of tax,

and reportable transaction

understatements from the due date

(including extensions) to the date of

payment. The interest charge is

figured at a rate determined under

section 6621.

Estimated Tax, Alternative

Minimum Tax, and Certain

Tax Credits

These items do not apply to

homeowners associations electing to

file Form 1120-H. See the instructions

for line 21, later, for a list of the tax

credits that do not apply. However, a

homeowners association that does

not elect to file Form 1120-H may be

required to make payments of

estimated tax. Because the election is

not made until the return is filed, Form

1120-H provides lines for estimated

tax payments and the crediting of

overpayments against estimated tax if

payments or overpayments apply.

For more information on deposits,

see the instructions in the coupon

booklet (Form 8109) and Pub. 583,

Starting a Business and Keeping

Records.

If you prefer, you may mail the

coupon and payment to: Financial

Agent, Federal Tax Deposit

Processing, P.O. Box 970030, St.

Louis, MO 63197. Make the check or

money order payable to “Financial

Agent.”

Late filing of return. In addition to

losing the right to elect to file Form

1120-H, a homeowners association

that does not file its tax return by the

due date, including extensions, may

be penalized 5% of the unpaid tax for

each month or part of a month the

return is late, up to a maximum of

25% of the unpaid tax. The minimum

penalty for a return that is over 60

days late is the smaller of the tax due

or $100. The penalty will not be

imposed if the association can show

that the failure to file on time was due

to reasonable cause. Associations that

file late should attach a statement

explaining the reasonable cause.

Other penalties. Other penalties can

be imposed for negligence, substantial

understatement of tax, reportable

transaction understatements, and

fraud. See sections 6662, 6662A, and

6663.

Late payment of tax. An association

that does not pay the tax when due

generally may be penalized

1

⁄ 2 of 1%

of the unpaid tax for each month or

part of a month the tax is not paid, up

to a maximum of 25% of the unpaid

tax. The penalty will not be imposed if

the association can show that the

failure to pay on time was due to

reasonable cause.

Caution: If the association owes tax

when it files Form 1120-H, do not

include the payment with the tax

return. Instead, mail or deliver the

payment with Form 8109 to an

authorized depositary, or use EFTPS, if

applicable.

Interest. Interest is charged on taxes

paid late even if an extension of time

to file is granted. Interest is also

charged on penalties imposed for

Interest and Penalties

creating it), address, and EIN on the

appropriate lines. Include the suite,

room, or other unit number after the

street address. If a preaddressed label

is used, include this information on the

label. If the Post Office does not

deliver mail to the street address and

the association has a P.O. box, show

the box number instead.

● To amend a previously filed Form

1120-H, file a corrected Form 1120-H

and check the “Amended return” box.

Note. If a change in address occurs

after the return is filed, use Form

8822, Change of Address, to notify the

IRS of the new address.

● If the association has changed its

address since it last filed a return

(including a change to an “in care of”

address), check the box for “Address

change”.

● If the association changed its name

since it last filed a return, check the

box for “Name change”.

Final return, name change, address

change, or amended return.

If the association has not received

its EIN by the time the return is due,

write “Applied for” in the space for the

EIN. For more details, see Pub. 583.

Note. The online application process

is not yet available for associations

with addresses in foreign countries or

Puerto Rico.

● If the association ceases to exist,

file Form 1120-H and check the “Final

return” box.

Item A. Type of homeowners

association. See Definitions on

page 2.

Page 6

Form 1120-H (2006)

If you have comments concerning

the accuracy of these time estimates

or suggestions for making this form

simpler, we would be happy to hear

from you. You can write to the Internal

Revenue Service, Tax Products

Coordinating Committee,

SE:W:CAR:MP:T:T:SP, 1111

Constitution Ave. NW, IR-6406,

Washington, DC 20224. Do not send

the tax form to this office. Instead, see

Where To File on page 3.

Item B. 60% gross income test. At

least 60% of the association’s gross

income for the tax year must consist

of exempt function income (see

Definitions on page 2).

Item C. 90% expenditure test. At

least 90% of the association’s

expenditures for the tax year must

consist of expenses to acquire, build,

manage, maintain, and care for

property, and in the case of a

timeshare association, for activities

provided to, or on behalf of, members

of the timeshare association. Include

current and capital expenditures. Use

the association’s accounting method

to figure the total.

Include:

1. Salary for an association manager

or secretary.

2. Expenses for gardening, paving,

street signs, security guards, and

property taxes assessed on

association property.

3. Current operating and capital

expenditures for tennis courts,

swimming pools, recreation halls, etc.

4. Replacement costs for common

buildings, heating, air conditioning,

elevators, etc.

Do not include expenditures for

property that is not association

property. Also, do not include

investments or transfers of funds held

to meet future costs. An example

would be transfers to a sinking fund to

replace a roof, even if the roof is

association property.

Line 22. If the association must

recapture any of the low-income

housing credit (or the qualified electric

vehicle or new markets credit), include

the amount of the recapture in the

total for line 22. To the right of the

entry space, write “LIH”, “QEV”, or

“NMC”, “recapture”, and the amount.

For details, see Form 8611, Recapture

of Low-Income Housing Credit;

Regulations section 1.30-1 (regarding

the qualified electric vehicle credit); or

Form 8874, New Markets Credit.

Enter the total amount of credits on

line 21 and attach the appropriate

form(s).

● General business credit (Form

3800). However, it does not include

the investment credit.

● Foreign tax credit (Form 1118).

● Qualified electric vehicle credit

(Form 8834).

Item E. Show any tax-exempt interest

received or accrued. Include any

exempt-interest dividend received as a

shareholder in a mutual fund or other

regulated investment company.

Line 15. Other deductions. Expenses,

depreciation, and similar items must

not only qualify as items of deduction,

but must also be directly connected

with the production of gross income to

be deductible in computing the

unrelated taxable income.

Line 21. Tax credits. The association

may qualify for the following tax

credits:

The time needed to complete and

file this form will vary depending on

individual circumstances. The

estimated average time is:

Recordkeeping 11 hr., 57 min.

Learning about the

law or the form 5 hr., 19 min.

Preparing the form 13 hr., 12 min.

Copying, assembling,

and sending the form

to the IRS 2 hr., 9 min.

Privacy Act and Paperwork

Reduction Act Notice. We ask for the

information on this form to carry out

the Internal Revenue laws of the

United States. You are required to

give us the information. We need it to

ensure that you are complying with

these laws and to allow us to figure

and collect the right amount of tax.

Section 6109 requires return preparers

to provide their identifying numbers on

the return.

You are not required to provide the

information requested on a form that

is subject to the Paperwork Reduction

Act unless the form displays a valid

OMB control number. Books or

records relating to a form or its

instructions must be retained as long

as their contents may become material

in the administration of any Internal

Revenue law. Generally, tax returns

and return information are confidential,

as required by section 6103.

Item D. Enter the association’s total

expenditures for the tax year including

those expenditures directly related to

exempt function income. Use the

association’s accounting method to

figure the entry for item D.

Line 23g. Credit for federal

telephone excise tax paid. If the

association was billed after February

28, 2003, and before August 1, 2006,

for the federal telephone excise tax on

long distance or bundled service, the

association may be able to request a

credit for the tax paid. The association

had bundled service if its local and

long distance service was provided

under a plan that does not separately

state the charge for local service. The

association cannot request the credit if

it has already received a credit or

refund from its service provider. If the

association requests the credit, it

cannot ask its service provider for a

credit or refund and must withdraw

any request previously submitted to its

provider.

Backup withholding. If the

association had income tax withheld

from any payments it received

because, for example, it failed to give

the payer its correct EIN, include the

amount withheld in the total for line

23h. This type of withholding is called

backup withholding. Show the amount

withheld in the blank space in the

right-hand column between lines 22

and 23h, and write “Backup

Withholding”.

The association can request the

credit by attaching Form 8913, Credit

for Federal Telephone Excise Tax

Paid, showing the actual amount the

association paid. The association also

may be able to request the credit

based on an estimate of the amount

paid. See Form 8913 for details. In

either case, the association must keep

records to substantiate the amount of

the credit requested.