Fillable Printable 2007 Wisconsin Form W-Ra - Wisconsin Department Of Revenue

Fillable Printable 2007 Wisconsin Form W-Ra - Wisconsin Department Of Revenue

2007 Wisconsin Form W-Ra - Wisconsin Department Of Revenue

CAUTION:

Do not use this Form W-RA when

submitting attachments for a 2008 or

later year electronically filed return.

Instead submit the Form W-RA that

corresponds to the return you are filing.

For example, submit the 2008 Form

W-RA for 2008 return attachments.

1.Homestead Credit (Schedule H, line 19, Schedule H-EZ, line 14) . . . . . . . . . .1.

2.Development Zone Credit (Form 1, line 30c) . . . . . . . . . . . . . . . . . . . . . . . . . .2.

3.Farmland Preservation Credit (Schedule FC, line 18) . . . . . . . . . . . . . . . . . . . .3.

4.Historic Rehabilitation Credit (Form 1, line 23) . . . . . . . . . . . . . . . . . . . . . . . . .4.

5.Technology Zone Credit (Form 1, line 30d) . . . . . . . . . . . . . . . . . . . . . . . . . . . .5.

6.Internet Equipment Credit (Form 1, line 30g) . . . . . . . . . . . . . . . . . . . . . . . . . .6.

7.Enterprise Zone Jobs Credit (Form 1, line 48) . . . . . . . . . . . . . . . . . . . . . . . . .7.

8.Dairy Manufacturing facility Investment Credit (Form 1, line 49) . . . . . . . . . . . .8.

9.Eligible Veterans and Surviving Spouses Property Tax Credit

(Form 1, line 47; Form 1A, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9.

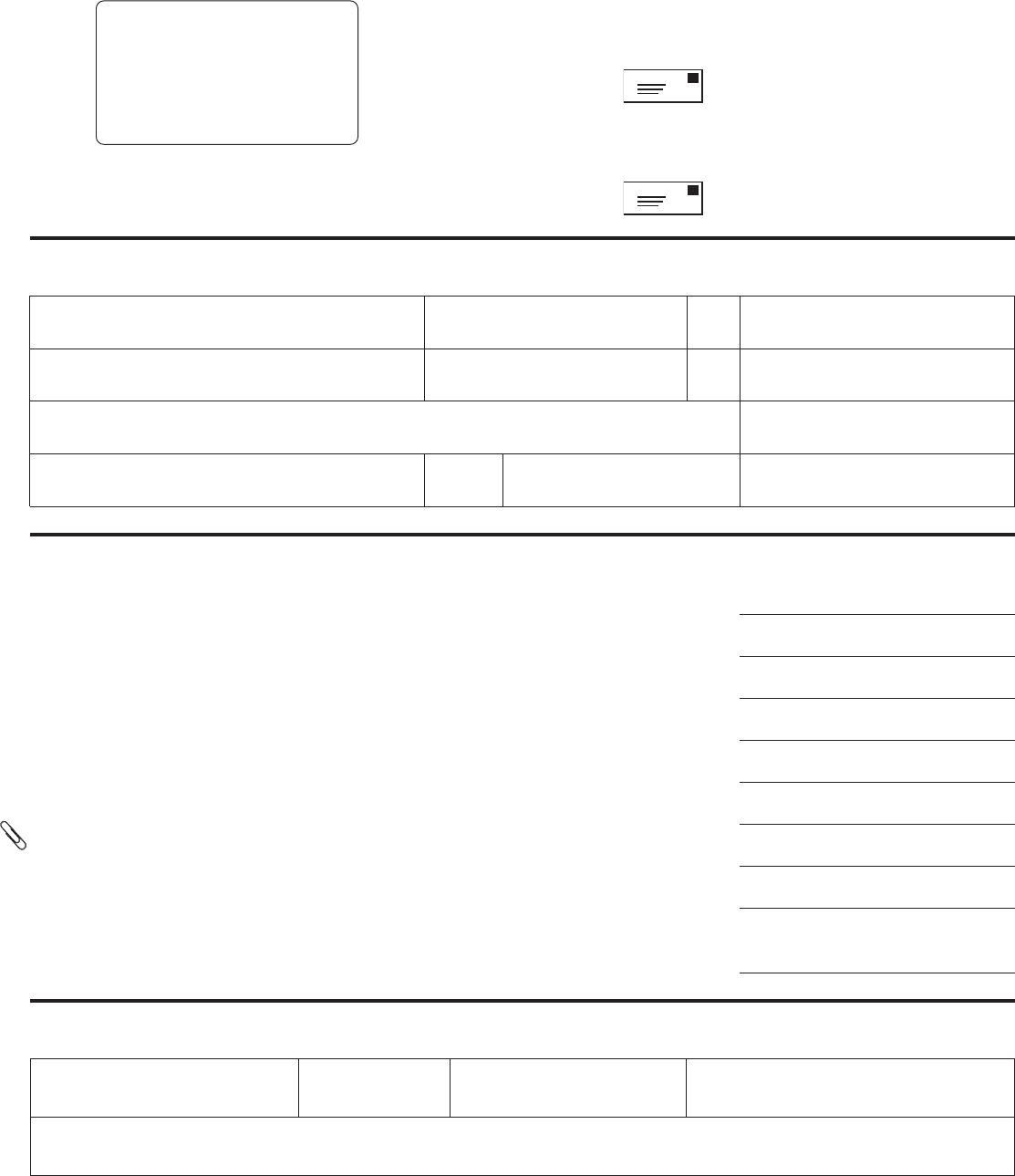

IF JOINT RETURN, SPOUSE'S LEGAL LAST NAMELEGAL FIRST NAMEM.I.SOCIAL SECURITY NUMBER

I-041i (R. 12-07)

2007 Wisconsin Form W-RA

Required Attachments for Electronic Filing

Refer to instructions on back.

II. Tax Return Information (Amounts in Whole Dollars Only)

*I1RA07991*

I. Taxpayer Information – Fill in the name, address, and social security information

PRESENT HOME ADDRESS (STREET, APARTMENT, ROUTE)DAYTIME PHONE NUMBER

CITY OR TOWNSTATEZIP CODEE-MAIL ADDRESS

LEGAL LAST NAMELEGAL FIRST NAMEM.I.SOCIAL SECURITY NUMBER

USE BLACK INK ONLY

Homestead Credit attachments – mail to:

Wisconsin Department of Revenue

PO Box 8977

Madison WI 53708-8977

PREPARER'S PTINDATEDAYTIME PHONEE-MAIL ADDRESS

III. Preparer Information

FIRM’S NAME (YOURS, IF SELF-EMPLOYED) AND ADDRESS

.00

PAPER CLIP required attachments here

.00

.00

.00

.00

.00

All other attachments – mail to:

Wisconsin Department of Revenue

PO Box 8967

Madison WI 53708-8967

See instructions for required attachments.

NOTE

Failure to mail timely to

the correct address with

all attachments will

result in refund delays.

.00

.00

.00

Instructions

Print

Clear

General Instructions

You must mail Form W-RA with the required

supporting documentation attached when you

electronically file an income tax return on

which you have claimed one or more of the

credits listed on lines 1 through 9 of Part II of

Form W-RA. You may also be instructed to

submit Form W-RA when using the Wisconsin

Free File application. Legislators making the

special section 162(h) election must mail the

W-RA when using electronic filing software

that does not submit the Model Form as part of

the electronic return. Refunds may not

complete processing until we receive the

Form W-RA when required. Be sure to mail

timely and to the correct address listed below.

Homestead Credit Claim – Within 48 hours

of receipt of your Wisconsin acknowledgment,

mail original Form W-RA along with all of the

required attachments (W-2s, W-2Gs, 1099-Rs,

original rent certificate(s), tax bill(s), legal

documents and statements) to:

Wisconsin Department of Revenue

PO Box 8977

Madison WI 53708-8977

The Form W-RA for any return including home-

stead credit should be mailed to the above

address regardless of the other credits claimed.

All Form W-RAs that do not include Homestead

should be mailed to:

Wisconsin Department of Revenue

PO Box 8967

Madison WI 53708-8967

Development Zone Credit – Within 48 hours

of receipt of your Wisconsin acknowledgment,

mail the original Form W-RA along with the

required attachments (W-2s, W-2Gs, 1099-Rs,

copy of your certification for tax benefits issued

by the Department of Commerce, a statement

with the Department of Commerce verifying

the amount of credit for environment

remediation and for job creation or retention or

Schedule 5K-1, 3K-1 or 2K-1).

Farmland Preservation Credit Claim – Within

48 hours of receipt of your Wisconsin

acknowledgment, mail the original Form W-RA

along with all of the required attachments

(W-2s, W-2Gs, 1099-Rs and all Schedule FC

attachments listed in the 2007 Schedule FC

instructions).

NOTE: DO NOT mail farmland tax relief credit

claims.

Historic Rehabilitation Credit – Within

48 hours of receipt of your Wisconsin

acknowledgment, mail the original Form W-RA

along with the required attachments (See

Schedule HR instructions, Required Attach-

ments).

Instructions for Wisconsin Form W-RA

Model Form – Wisconsin Legislators who

have made the special section 162(h)

election– If using electronic filing software

that does not submit the SPL-01 Model Form

as part of the electronic return, then within

48 hours of receipt of your Wisconsin

acknowledgement, mail the original

Form W-RA along with a copy of the 2007

Model Form.

Technology Zone Credit – Within 48 hours

of receipt of your Wisconsin acknowledgment,

mail the original Form W-RA along with the

required attachments (W-2s, W-2Gs, 1099-Rs,

copy of your certification for tax benefits issued

by the Department of Commerce, a statement

from the Department of Commerce verifying

the amount of your credits for property taxes

paid, capital investments made, and wages

paid for jobs created in a technology zone or

Schedule 5K-1, 3K-1 or 2K-1).

Internet Equipment Credit, Enterprise Zone

Jobs Credit, and Dairy Manufacturing

Facility Investment Credit – Within 48 hours

of receipt of your Wisconsin acknowledgment,

mail a copy of your certification issued by the

Department of Commerce for any of these tax

benefits. If you claim the internet equipment

credit or the enterprise zone jobs credit, you

must also submit a verification of expenses

from the Department of Commerce.

Veterans and Surviving Spouses Property

Tax Credit– Within 48 hours of receipt of

your Wisconsin acknowledgment, mail original

Form W-RA along with your real estate tax

bill(s) for all taxes paid in 2007, proof of

payment and your DVA (Wisconsin Depart-

ment of Veterans Affairs) verification, if

required.

Wisconsin Free File Tax Return – When

instructed and within 48 hours of confirmed

filing, mail original Form W-RA along with all

of the required attachments.

In All Cases – When using a mail service

provider that is NOT the US Postal Service,

deliver to Wisconsin Department of Revenue,

Mail Opening (MS 1-151), 2135 Rimrock Rd,

Madison, WI 53713.

Reminder: Keep a copy of all documentation

supporting your income tax return, schedules

and credit claims for at least 4 years.

I. Taxpayer Information

Print or type name(s), social security

number(s), address, daytime phone number,

and e-mail address (if applicable) in the area

provided. The information must match the

information filed electronically.

II. Tax Return Information

Lines 1-5. Use whole dollars only in this area.

If not applicable, leave blank.

III. Preparer Information

If your return or claim was prepared by a third

party, print or type the requested preparer

information.

Tax Due – pay by direct debit, mail or

credit card.

Direct Debit

Electronic withdrawal from checking or

savings accounts.

Mail

Send payment with a 2007 Form EPV,

Wisconsin Electronic Payment Voucher, to

Wisconsin Department of Revenue,

PO Box 930208, Milwaukee WI 53293-0208.

Credit Card

•Online at www.officialpayments.com

•By telephone call 1-800-2PAY-TAX

(1-800-272-9829).

Questions

Refund:You can usually expect your refund

within two weeks after the Wisconsin

Department of Revenue acknowledges

receipt of the return. Your refund will be

delayed if your return is selected for review.

If it has been longer than four (4) weeks, you

may check the status of your refund 24 hours

a day, seven days a week. You will need to

know your social security number and the

refund amount.

(608) 266-8100in Madison or

(414) 227-4907in Milwaukee or

1-866-WIS-RFND (1-866-947-7363)

toll-free within the U.S. or Canada

www.revenue.wi.gov

General Tax:(608) 266-2772

General E-Filing:(608) 264-6886

Forms Requests:(608) 266-1961 or

download at

www.revenue.wi.gov

Operator assistance is available Monday-

Friday from 7:45 a.m. to 4:15 p.m.

Paper Clip Your Att achment s

Refunds can be processed faster if you

use paper clips instead of staples.