Fillable Printable 2008 Form 1040 (Schedule Se)

Fillable Printable 2008 Form 1040 (Schedule Se)

2008 Form 1040 (Schedule Se)

OMB No. 1545-0074

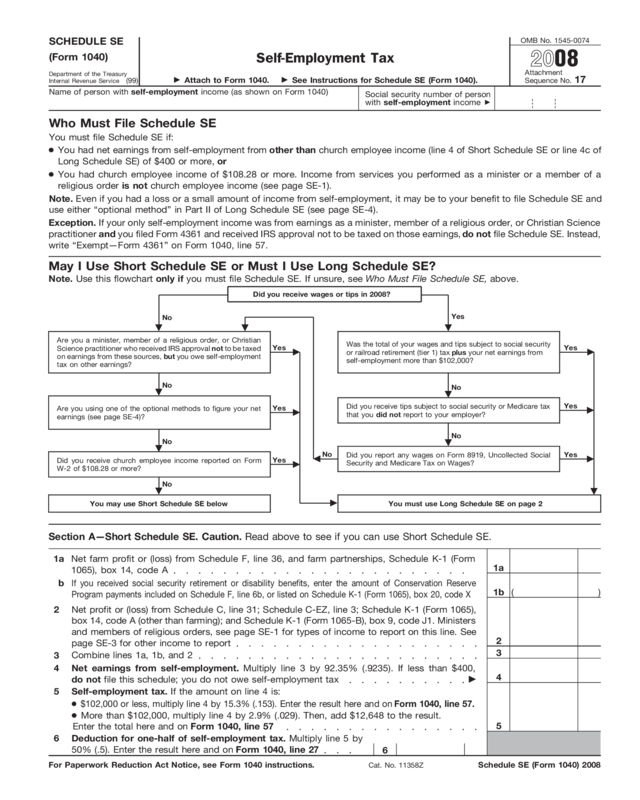

SCHEDULE SE

Self-Employment Tax

(Form 1040)

Department of the Treasury

Internal Revenue Service

Attachment

Sequence No. 17

©

Attach to Form 1040.

©

See Instructions for Schedule SE (Form 1040).

Name of person with self-employment income (as shown on Form 1040)

Social security number of person

with self-employment income

©

Who Must File Schedule SE

You must file Schedule SE if:

● You had net earnings from self-employment from other than church employee income (line 4 of Short Schedule SE or line 4c of

Long Schedule SE) of $400 or more, or

Exception. If your only self-employment income was from earnings as a minister, member of a religious order, or Christian Science

practitioner and you filed Form 4361 and received IRS approval not to be taxed on those earnings, do not file Schedule SE. Instead,

write “Exempt—Form 4361” on Form 1040, line 57.

Section A—Short Schedule SE. Caution. Read above to see if you can use Short Schedule SE.

If you received social security retirement or disability benefits, enter the amount of Conservation Reserve

Program payments included on Schedule F, line 6b, or listed on Schedule K-1 (Form 1065), box 20, code X

b

1b

Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065),

box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code J1. Ministers

and members of religious orders, see page SE-1 for types of income to report on this line. See

page SE-3 for other income to report

2

2

3

Combine lines 1a, 1b, and 2

3

Net earnings from self-employment. Multiply line 3 by 92.35% (.9235). If less than $400,

do not file this schedule; you do not owe self-employment tax

©

4

4

5

Self-employment tax. If the amount on line 4 is:

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Schedule SE (Form 1040) 2008

● You had church employee income of $108.28 or more. Income from services you performed as a minister or a member of a

religious order is not church employee income (see page SE-1).

Cat. No. 11358Z

Deduction for one-half of self-employment tax. Multiply line 5 by

50% (.5). Enter the result here and on Form 1040, line 27

● $102,000 or less, multiply line 4 by 15.3% (.153). Enter the result here and on Form 1040, line 57.

● More than $102,000, multiply line 4 by 2.9% (.029). Then, add $12,648 to the result.

Enter the total here and on Form 1040, line 57

May I Use Short Schedule SE or Must I Use Long Schedule SE?

Did you receive wages or tips in 2008?

Was the total of your wages and tips subject to social security

or railroad retirement (tier 1) tax plus your net earnings from

self-employment more than $102,000?

Did you receive tips subject to social security or Medicare tax

that you did not report to your employer?

Are you using one of the optional methods to figure your net

earnings (see page SE-4)?

Are you a minister, member of a religious order, or Christian

Science practitioner who received IRS approval not to be taxed

on earnings from these sources, but you owe self-employment

tax on other earnings?

Did you receive church employee income reported on Form

W-2 of $108.28 or more?

You may use Short Schedule SE below

You must use Long Schedule SE on page 2

Ä

Ä

Yes

Ä

Yes

Ä

Ä

Ä

No

No

No

No

Yes

Ä

Yes

Ä

Yes

Ä

Yes

Ä

Ä

Ä

Ä

Ä

No

Note. Even if you had a loss or a small amount of income from self-employment, it may be to your benefit to file Schedule SE and

use either “optional method” in Part II of Long Schedule SE (see page SE-4).

6

5

6

(99)

Note. Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE, above.

Did you report any wages on Form 8919, Uncollected Social

Security and Medicare Tax on Wages?

Ä

Yes

No

Ä

Ä

No

20

08

Net farm profit or (loss) from Schedule F, line 36, and farm partnerships, Schedule K-1 (Form

1065), box 14, code A

1a

1a

( )

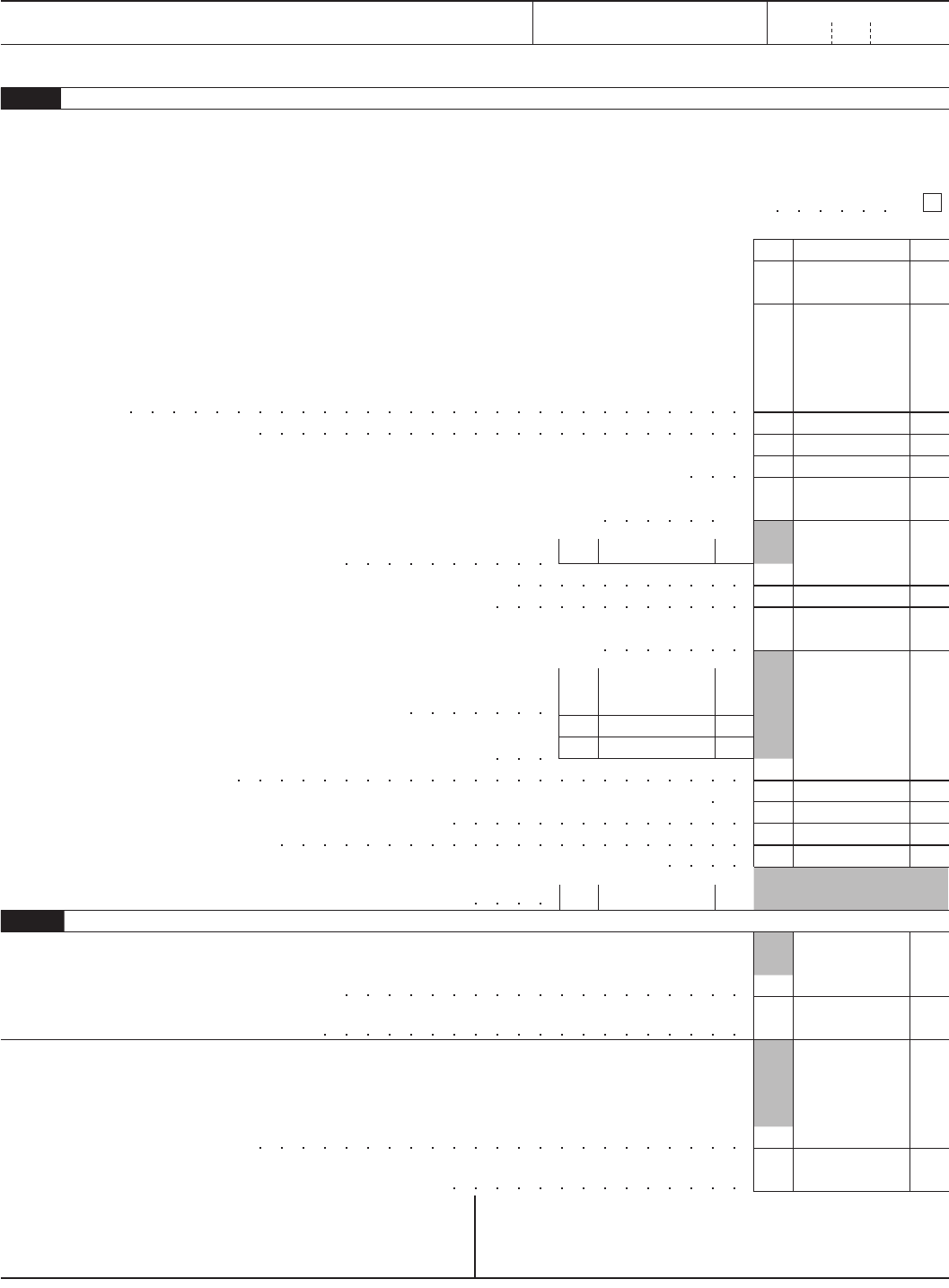

Page 2

Attachment Sequence No. 17

Schedule SE (Form 1040) 2008

Name of person with self-employment income (as shown on Form 1040)

Social security number of person

with self-employment income

©

Section B—Long Schedule SE

A

If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you

had $400 or more of other net earnings from self-employment, check here and continue with Part I

©

Note. If your only income subject to self-employment tax is church employee income, skip lines 1 through 4b. Enter -0- on line

4c and go to line 5a. Income from services you performed as a minister or a member of a religious order is not church employee

income. See page SE-1.

Self-Employment Tax

1a

Net farm profit or (loss) from Schedule F, line 36, and farm partnerships, Schedule K-1 (Form 1065),

box 14, code A. Note. Skip lines 1a and 1b if you use the farm optional method (see page SE-4)

1a

2

Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box

14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code J1. Ministers and

members of religious orders, see page SE-1 for types of income to report on this line. See page

SE-3 for other income to report. Note. Skip this line if you use the nonfarm optional method (see

page SE-4)

2

3

3

Combine lines 1a, 1b, and 2

4a

4

a

If line 3 is more than zero, multiply line 3 by 92.35% (.9235). Otherwise, enter amount from line 3

4b

If you elect one or both of the optional methods, enter the total of lines 15 and 17 here

b

c

Combine lines 4a and 4b. If less than $400, stop; you do not owe self-employment tax. Exception.

If less than $400 and you had church employee income, enter -0- and continue

©

4c

6

102,000 00

Maximum amount of combined wages and self-employment earnings subject to social security

tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2008

5a

7

Total social security wages and tips (total of boxes 3 and 7 on Form(s)

W-2) and railroad retirement (tier 1) compensation. If $102,000 or

more, skip lines 8b through 10, and go to line 11

8a

b

Unreported tips subject to social security tax (from Form 4137, line 10)

8b

8d

d

Add lines 8a, 8b, and 8c

8a

Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11

©

9

9

10

10

Self-employment tax. Add lines 10 and 11. Enter here and on Form 1040, line 57

Optional Methods To Figure Net Earnings (see page SE-4)

4,200 00

14

Maximum income for optional methods

14

Enter the smaller of: two-thirds (

2

⁄ 3 ) of gross farm income

1

(not less than zero) or $4,200. Also

include this amount on line 4b above

15

15

16

Subtract line 15 from line 14

16

Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits

3

were less

than $4,548 and also less than 72.189% of your gross nonfarm income,

4

and (b) you had net earnings

from self-employment of at least $400 in 2 of the prior 3 years.

17

17

3

From Sch. C, line 31; Sch. C-EZ, line 3; Sch. K-1 (Form 1065), box

14, code A; and Sch. K-1 (Form 1065-B), box 9, code J1.

1

From Sch. F, line 11, and Sch. K-1 (Form 1065), box 14, code B.

4

From Sch. C, line 7; Sch. C-EZ, line 1; Sch. K-1 (Form 1065), box 14,

code C; and Sch. K-1 (Form 1065-B), box 9, code J2.

2

From Sch. F, line 36, and Sch. K-1 (Form 1065), box 14, code

A—minus the amount you would have entered on line 1b had you not

used the optional method.

Multiply the smaller of line 6 or line 9 by 12.4% (.124)

Multiply line 6 by 2.9% (.029)

Enter your church employee income from Form W-2. See page SE-1

for definition of church employee income

Multiply line 5a by 92.35% (.9235). If less than $100, enter -0-

Net earnings from self-employment. Add lines 4c and 5b

5a

5b

b

6

7

11

12

11

Farm Optional Method. You may use this method only if (a) your gross farm income

1

was not more

than $6,300, or (b) your net farm profits

2

were less than $4,548.

Enter the smaller of: two-thirds (

2

⁄ 3 ) of gross nonfarm income

4

(not less than zero) or the amount

on line 16. Also include this amount on line 4b above

Part I

Part II

Caution. You may use this method no more than five times.

Deduction for one-half of self-employment tax. Multiply line 12 by

50% (.5). Enter the result here and on Form 1040, line 27

13

13

Schedule SE (Form 1040) 2008

12

c

Wages subject to social security tax (from Form 8919, line 10)

8c

If you received social security retirement or disability benefits, enter the amount of Conservation Reserve

Program payments included on Schedule F, line 6b, or listed on Schedule K-1 (Form 1065), box 20, code X

b

1b

( )