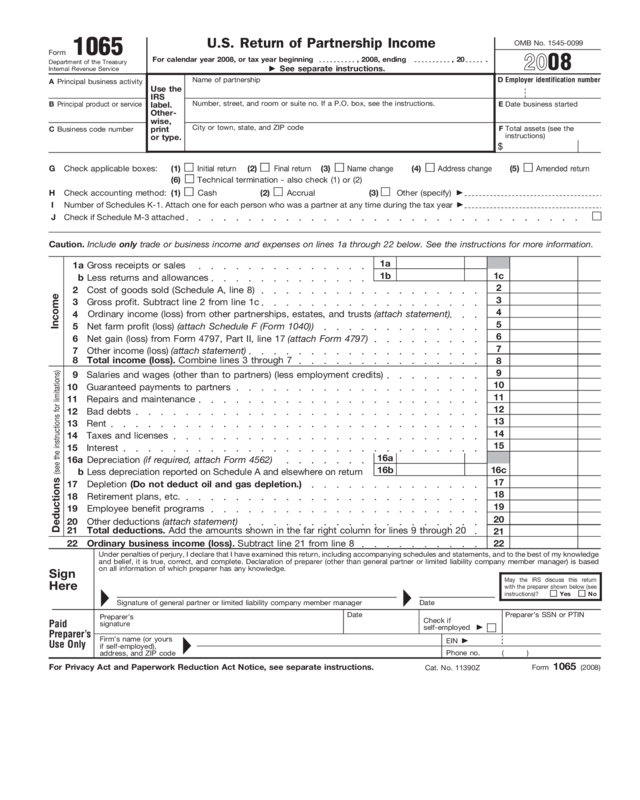

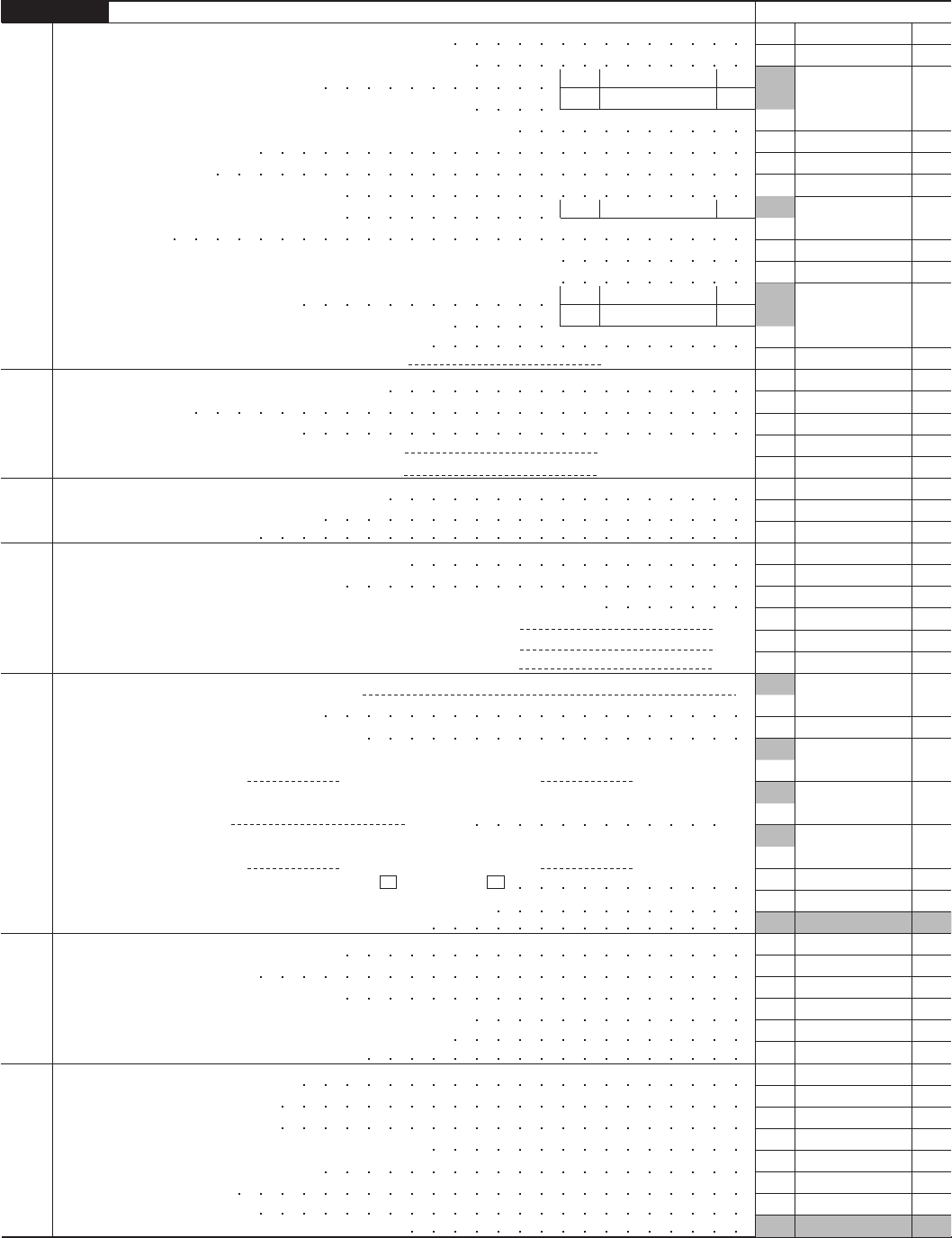

Fillable Printable 2008 Form 1065

Fillable Printable 2008 Form 1065

2008 Form 1065

OMB No. 1545-0099

U.S. Return of Partnership Income

1065

Form

Department of the Treasury

Internal Revenue Service

©

See separate instructions.

Name of partnership

A

Principal business activity

D

Employer identification number

Use the

IRS

label.

Other-

wise,

print

or type.

Number, street, and room or suite no. If a P.O. box, see the instructions.

Principal product or service

B

E

Date business started

City or town, state, and ZIP code

Business code number

C

F

Total assets (see the

instructions)

$

Final return

(2)

Initial return

(1)

Check applicable boxes:

G

(3)

Name change

Accrual

(2)

Cash

(1)

Check accounting method:

H

(3)

Other (specify)

©

Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year

©

I

Caution. Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information.

1a

a

1

Gross receipts or sales

1c

1b

b

Less returns and allowances

2

2

Cost of goods sold (Schedule A, line 8)

3

3

Gross profit. Subtract line 2 from line 1c

4

Ordinary income (loss) from other partnerships, estates, and trusts (attach statement)

4

Income

5

5

Net farm profit (loss) (attach Schedule F (Form 1040))

6

6

Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797)

7

7

Other income (loss) (attach statement)

8

Total income (loss). Combine lines 3 through 7

8

9

Salaries and wages (other than to partners) (less employment credits)

10

Guaranteed payments to partners

10

11

Rent

13

12

Interest

15

13

Taxes and licenses

14

14

Bad debts

12

15

Repairs and maintenance

11

16a

Depreciation (if required, attach Form 4562)

16a

16c

16b

Less depreciation reported on Schedule A and elsewhere on return

b

17

Depletion (Do not deduct oil and gas depletion.)

17

19

18

Retirement plans, etc.

Employee benefit programs

21

19

Other deductions (attach statement)

Deductions

(see the instructions for limitations)

Total deductions. Add the amounts shown in the far right column for lines 9 through 20

20

20

Ordinary business income (loss). Subtract line 21 from line 8

21

22

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than general partner or limited liability company member manager) is based

on all information of which preparer has any knowledge.

Sign

Here

Date

Signature of general partner or limited liability company member manager

Preparer’s SSN or PTIN

Date

Preparer’s

signature

Check if

self-employed

©

Paid

Preparer’s

Use Only

Firm’s name (or yours

if self-employed),

address, and ZIP code

Form 1065 (2008)

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11390Z

18

22

©

©

EIN

©

Phone no. ( )

For calendar year 2008, or tax year beginning , 2008, ending , 20 .

9

(4)

Address change

May the IRS discuss this return

with the preparer shown below (see

instructions)?

Yes

No

©

Check if Schedule M-3 attached

J

(5)

Amended return

(6)

Technical termination - also check (1) or (2)

20

08

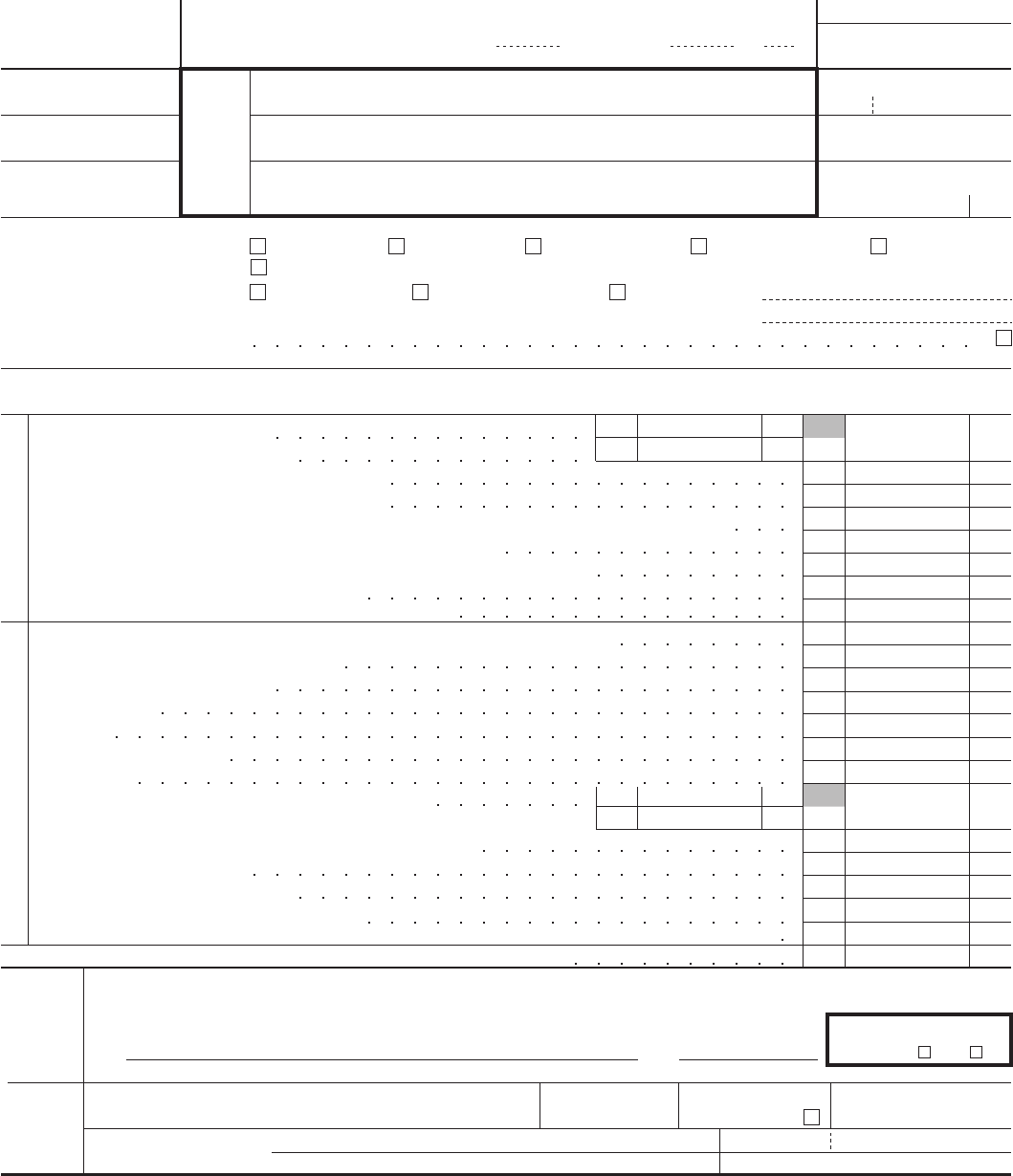

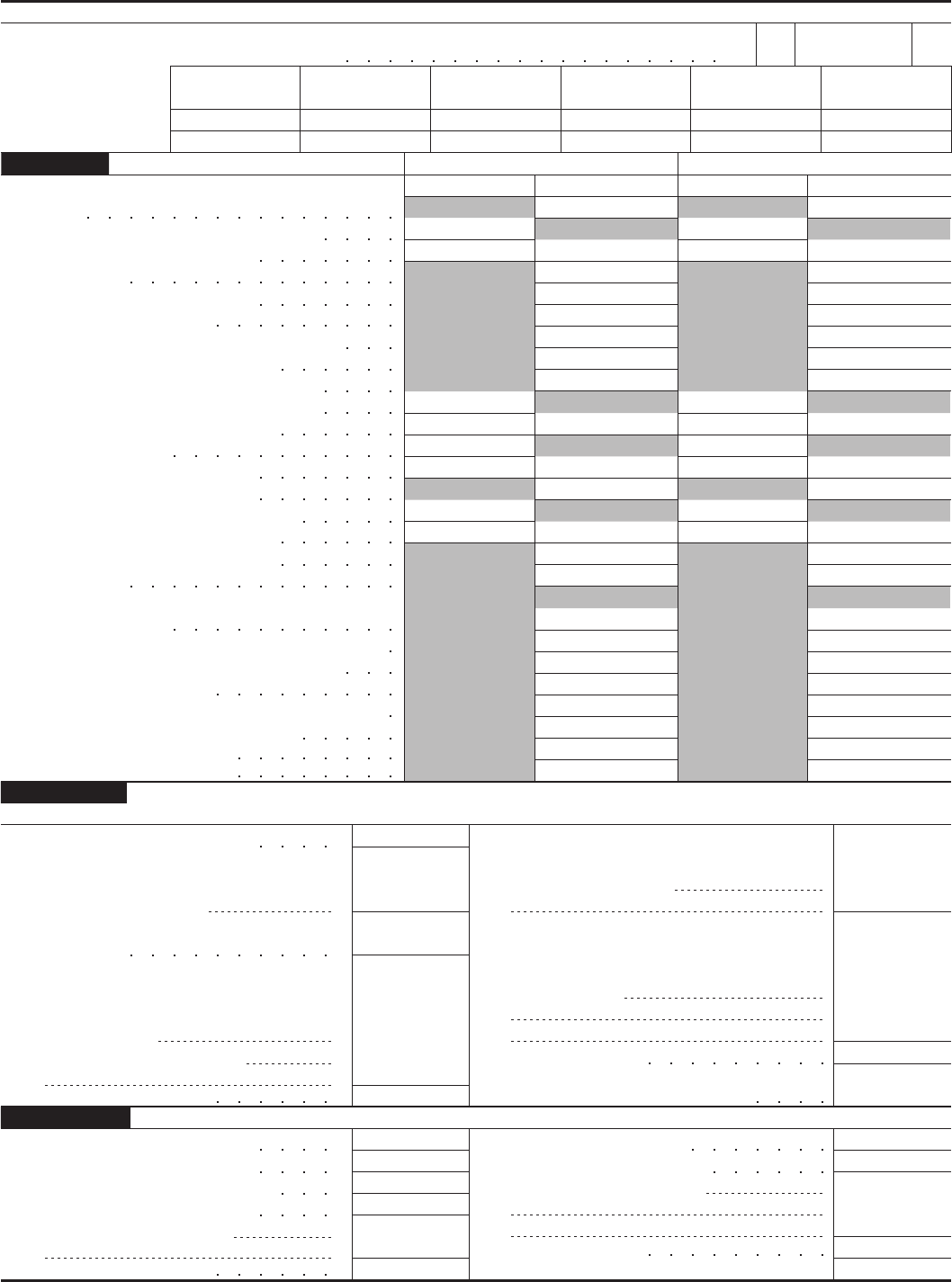

Form 1065 (2008)

Page 2

No

Yes

1

At any time during the tax year, was any partner in the partnership a disregarded entity, a partnership (including

an entity treated as a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner),

or a nominee or similar person?

2

At the end of the tax year:

3

What type of entity is filing this return? Check the applicable box:

Domestic general partnership

Domestic limited partnership

Domestic limited liability company

a

b

Other

©

c

d

Domestic limited liability partnership

f

Form 1065 (2008)

Foreign partnership

e

Other Information

Schedule B

Cost of Goods Sold (see the instructions)

Schedule A

Inventory at beginning of year

1

1

Purchases less cost of items withdrawn for personal use

2

2

Cost of labor

Additional section 263A costs (attach statement)

4

Other costs (attach statement)

4

Inventory at end of year

5

5

6

7

7

8

8

9a

Cost of goods sold. Subtract line 7 from line 6. Enter here and on page 1, line 2

Check all methods used for valuing closing inventory:

b

Cost as described in Regulations section 1.471-3

c

Check this box if there was a writedown of “subnormal” goods as described in Regulations section 1.471-2(c)

©

Check this box if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970)

©

d

e

If “Yes,” attach explanation.

Do the rules of section 263A (for property produced or acquired for resale) apply to the partnership?

Was there any change in determining quantities, cost, or valuations between opening and closing inventory?

3

3

6

Total. Add lines 1 through 5

(i)

(ii)

(iii)

Lower of cost or market as described in Regulations section 1.471-4

Other (specify method used and attach explanation)

©

Yes

Yes

No

No

a

Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), or trust own, directly

or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership? For rules of constructive

ownership, see instructions. If “Yes,” complete (i) through (v) below

(v) Maximum

Percentage Owned in

Profit, Loss, or Capital

(iii) Type of

Entity

(ii) Employer

Identification

Number (if any)

(i) Name of Entity

(iv) Country of

Organization

b

Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the

partnership? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (iv) below

(iv) Maximum

Percentage Owned in

Profit, Loss, or Capital

(ii) Social Security Number or

Employer Identification Number

(if any)

(i) Name of Individual or Estate

(iii) Country of

Citizenship

(see instructions)

At the end of the tax year, did the partnership:

4

a

Own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of stock

entitled to vote of any foreign or domestic corporation? For rules of constructive ownership, see instructions. If “Yes,”

complete (i) through (iv) below

(iv) Percentage

Owned in Voting

Stock

(ii) Employer Identification

Number (if any)

(i) Name of Corporation

(iii) Country of

Incorporation

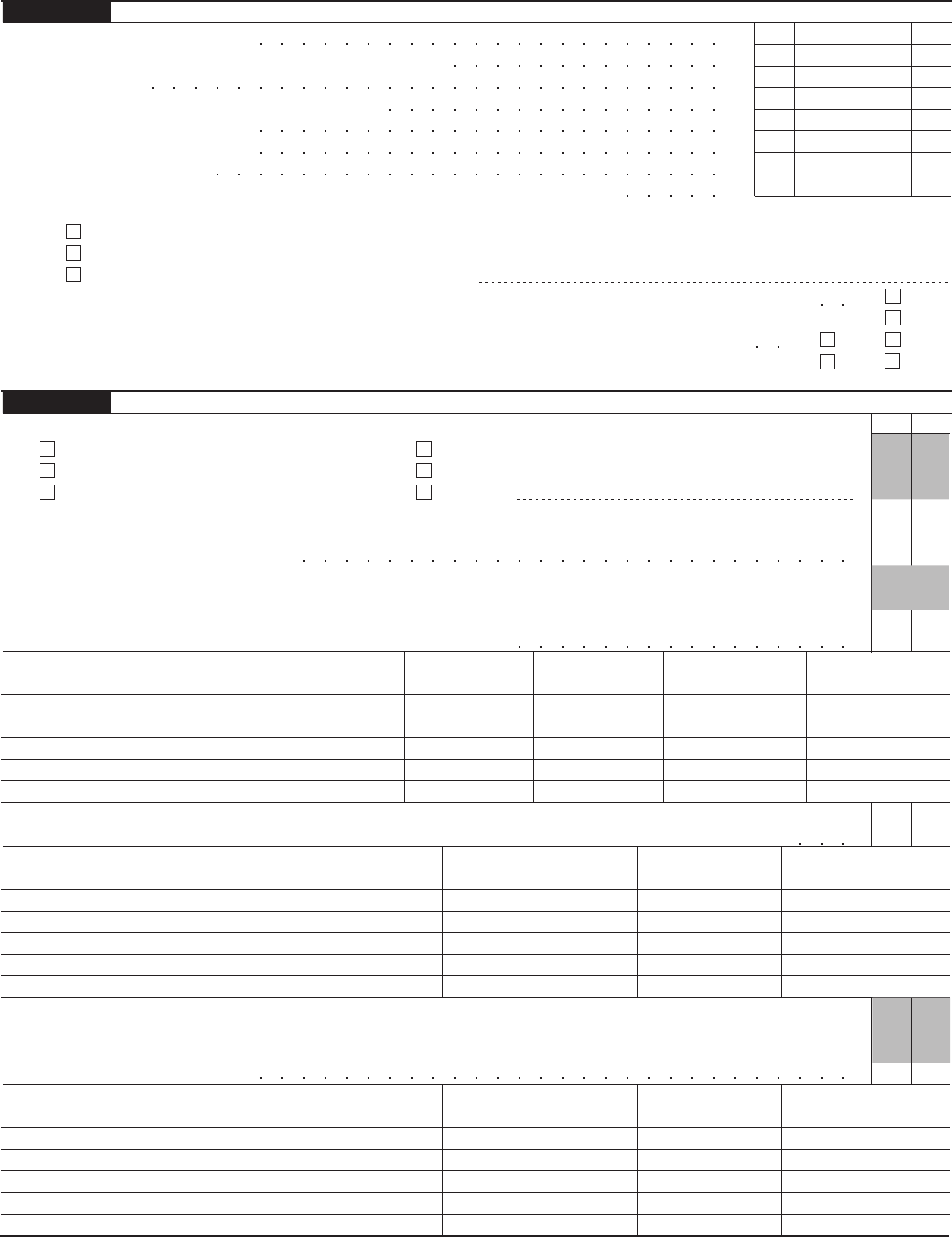

Form 1065 (2008)

Page 3

5

Did the partnership file Form 8893, Election of Partnership Level Tax Treatment, or an election statement under

section 6231(a)(1)(B)(ii) for partnership-level tax treatment, that is in effect for this tax year? See Form 8893 for

more details

Form 1065 (2008)

If the partnership is required to file Form 8858, Information Return of U.S. Persons With Respect To Foreign

Disregarded Entities, enter the number of Forms 8858 attached. See instructions

©

6

Does the partnership satisfy all four of the following conditions?

The partnership’s total receipts for the tax year were less than $250,000.

a

The partnership’s total assets at the end of the tax year were less than $1 million.

b

Schedules K-1 are filed with the return and furnished to the partners on or before the due date (including extensions)

for the partnership return.

c

The partnership is not filing and is not required to file Schedule M-3

d

If “Yes,” the partnership is not required to complete Schedules L, M-1, and M-2; Item F on page 1 of Form 1065;

or Item L on Schedule K-1.

Does the partnership have any foreign partners? If “Yes,” enter the number of Forms 8805, Foreign Partner’s

Information Statement of Section 1446 Withholding Tax, filed for this partnership.

©

7

Is this partnership a publicly traded partnership as defined in section 469(k)(2)?

8

During the tax year, did the partnership have any debt that was cancelled, was forgiven, or had the terms

modified so as to reduce the principal amount of the debt?

Has this partnership filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

information on any reportable transaction?

10

At any time during calendar year 2008, did the partnership have an interest in or a signature or other

authority over a financial account in a foreign country (such as a bank account, securities account, or

other financial account)? See the instructions for exceptions and filing requirements for Form TD F

90-22.1, Report of Foreign Bank and Financial Accounts. If “Yes,” enter the name of the foreign

country.

©

11

At any time during the tax year, did the partnership receive a distribution from, or was it the grantor of, or

transferor to, a foreign trust? If “Yes,” the partnership may have to file Form 3520, Annual Return To Report

Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. See instructions

12a

Is the partnership making, or had it previously made (and not revoked), a section 754 election?

See instructions for details regarding a section 754 election.

Did the partnership make for this tax year an optional basis adjustment under section 743(b) or 734(b)? If “Yes,”

attach a statement showing the computation and allocation of the basis adjustment. See instructions

b

Is the partnership required to adjust the basis of partnership assets under section 743(b) or 734(b) because of a substantial

built-in loss (as defined under section 743(d)) or substantial basis reduction (as defined under section 734(d))? If “Yes,”

attach a statement showing the computation and allocation of the basis adjustment. See instructions

c

No

Yes

(v) Maximum

Percentage Owned in

Profit, Loss, or Capital

(iii) Type of

Entity

(ii) Employer

Identification

Number (if any)

(i) Name of Entity

(iv) Country of

Organization

15

16

9

Enter below the general partner designated as the tax matters partner (TMP) for the tax year of this return:

Identifying number

of TMP

Name of

designated

TMP

Address of

designated

TMP

©

©

©

Designation of Tax Matters Partner (see instructions)

17

Enter the number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships,

attached to this return.

©

13

Check this box if, during the current or prior tax year, the partnership distributed any property received in a

like-kind exchange or contributed such property to another entity (including a disregarded entity)

©

14

At any time during the tax year, did the partnership distribute to any partner a tenancy-in-common or other

undivided interest in partnership property?

Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss,

or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial

interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below

b

Form 1065 (2008)

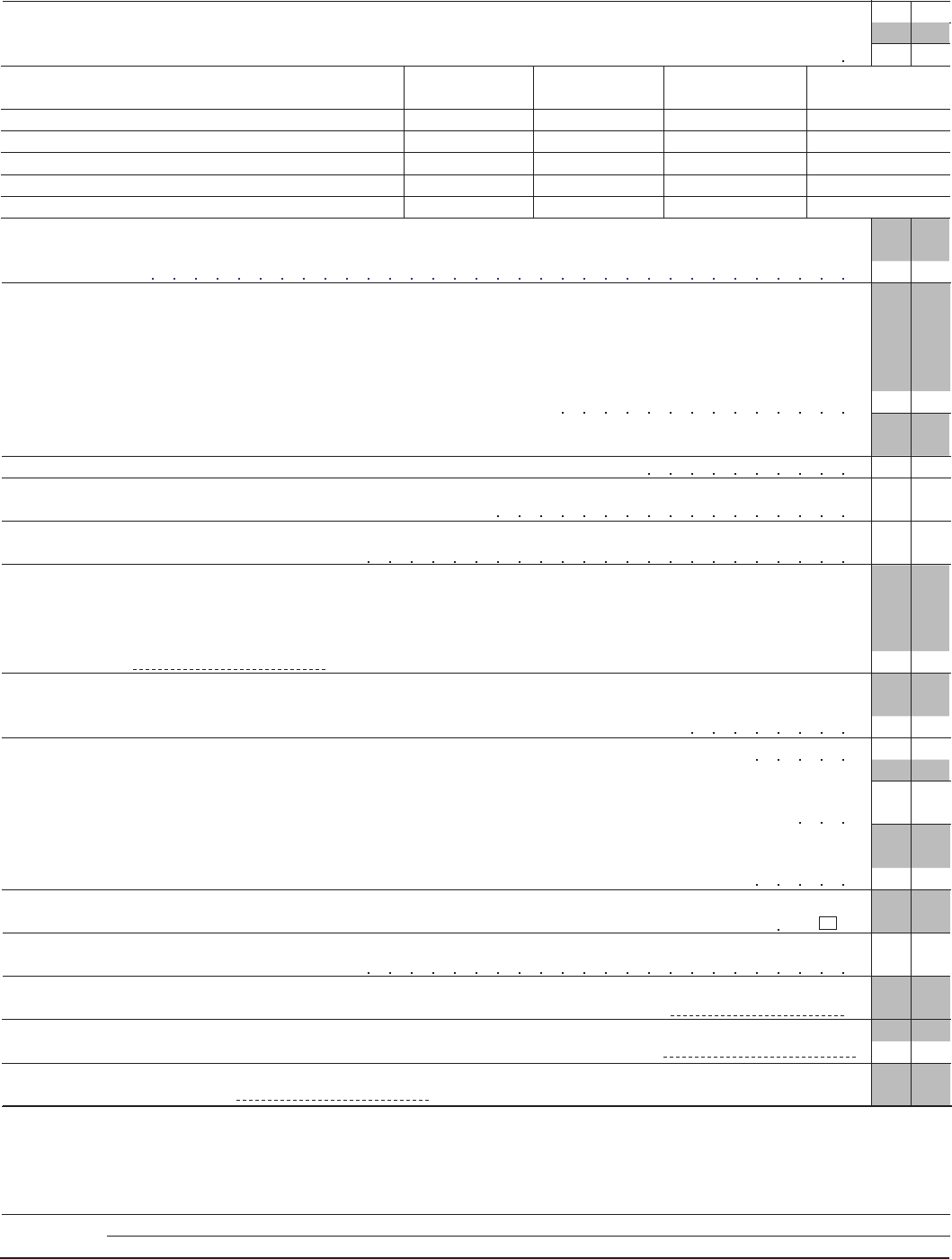

Page 4

Form 1065 (2008)

Partners’ Distributive Share Items

Ordinary business income (loss) (page 1, line 22)

1

1

Net rental real estate income (loss) (attach Form 8825)

2

2

3a

Other gross rental income (loss)

3a

Expenses from other rental activities (attach statement)

b

3b

Other net rental income (loss). Subtract line 3b from line 3a

c

3c

Guaranteed payments

4

Interest income

4

Royalties

Income (Loss)

5

5

6

7

Other income (loss) (see instructions) Type

7

8

8

9a

Section 179 deduction (attach Form 4562)

9a

10

10

Deductions

11

12

Low-income housing credit (section 42(j)(5))

Credits

13b

Qualified rehabilitation expenditures (rental real estate) (attach Form 3468)

c

Other rental real estate credits (see instructions)

d

Other rental credits (see instructions)

e

Other credits (see instructions)

13a

12

14a

Net earnings (loss) from self-employment

14a

14b

Gross farming or fishing income

b

Self-

Employ-

ment

c

Gross nonfarm income

14c

17a

16b

b

16c

Post-1986 depreciation adjustment

c

d

Depletion (other than oil and gas)

f

Alternative

Minimum Tax

(AMT) Items

Other AMT items (attach statement)

Name of country or U.S. possession

©

16a

Foreign gross income sourced at partnership level

c

Deductions allocated and apportioned at partner level

d

e

Deductions allocated and apportioned at partnership level to foreign source income

f

Foreign Transactions

18a

18a

Other Information

Schedule K

Adjusted gain or loss

19a

20a

Other tax-exempt income

Nondeductible expenses

b

Gross income from all sources

g

Passive category

©

Total amount

16h

h

Gross income sourced at partner level

Net short-term capital gain (loss) (attach Schedule D (Form 1065))

Dividends: a Ordinary dividends

Net long-term capital gain (loss) (attach Schedule D (Form 1065))

6a

b

Net section 1231 gain (loss) (attach Form 4797)

b Qualified dividends

c

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gain (attach statement)

6b

9c

9b

b

c

d

Contributions

Investment interest expense

Section 59(e)(2) expenditures: (1) Type

©

Other deductions (see instructions)

(2) Amount

©

13a

15a

b

Low-income housing credit (other)

f

15b

15c

15d

15e

15a

15f

General category

©

Other

©

Interest expense

©

Other

©

16f

i

j

k

Passive category

©

General category

©

Other

©

16k

Oil, gas, and geothermal properties—gross income

Oil, gas, and geothermal properties—deductions

e

17a

17b

17c

17d

17e

17f

l

m

Total foreign taxes (check one): Paid Accrued

Reduction in taxes available for credit (attach statement)

16m

b

c

Tax-exempt interest income

Distributions of other property

b

Distributions of cash and marketable securities

Investment expenses

b

Investment income

c

Other items and amounts (attach statement)

18b

18c

19a

19b

20a

20b

11

©

13c(2)

13d

©

n

Other foreign tax information (attach statement)

16l

Type ©

Type ©

Type ©

Type ©

Page 5

Form 1065 (2008)

Balance Sheets per Books

Beginning of tax year

End of tax year

Assets

(d)

(c)

(b)

(a)

1

Cash

2a

Trade notes and accounts receivable

b

Less allowance for bad debts

3

Inventories

4

U.S. government obligations

Tax-exempt securities

5

Other current assets (attach statement)

6

Mortgage and real estate loans

7

Other investments (attach statement)

8

Buildings and other depreciable assets

9a

Less accumulated depreciation

b

Depletable assets

10a

Less accumulated depletion

b

Land (net of any amortization)

11

Intangible assets (amortizable only)

12a

Less accumulated amortization

b

Other assets (attach statement)

13

Total assets

14

Liabilities and Capital

15

Accounts payable

16

Mortgages, notes, bonds payable in less than 1 year

17

Other current liabilities (attach statement)

18

All nonrecourse loans

19

Mortgages, notes, bonds payable in 1 year or more

20

Other liabilities (attach statement)

21

Partners’ capital accounts

22

Total liabilities and capital

Reconciliation of Income (Loss) per Books With Income (Loss) per Return

Note. Schedule M-3 may be required instead of Schedule M-1 (see instructions).

1

Net income (loss) per books

2

Income included on Schedule K, lines 1, 2, 3c,

5, 6a, 7, 8, 9a, 10, and 11, not recorded on

books this year (itemize):

4

Expenses recorded on books this year not

included on Schedule K, lines 1 through

13d, and 16l (itemize):

a

Depreciation $

b

Travel and entertainment $

5

Add lines 1 through 4

6

Income recorded on books this year not included

on Schedule K, lines 1 through 11 (itemize):

a

Tax-exempt interest $

7

Deductions included on Schedule K, lines 1

through 13d, and 16l, not charged against

book income this year (itemize):

a

Depreciation $

8

Add lines 6 and 7

9

Income (loss) (Analysis of Net Income (Loss),

line 1). Subtract line 8 from line 5

Analysis of Partners’ Capital Accounts

1

Balance at beginning of year

2

Capital contributed: a Cash

3

Net income (loss) per books

4

Other increases (itemize):

5

Add lines 1 through 4

6

Distributions: a Cash

b

Property

7

Other decreases (itemize):

8

Add lines 6 and 7

9

Balance at end of year. Subtract line 8 from line 5

Schedule L

Schedule M-1

Schedule M-2

3

Guaranteed payments (other than health

insurance)

Net income (loss). Combine Schedule K, lines 1 through 11. From the result, subtract the sum of

Schedule K, lines 12 through 13d, and 16l

1

(ii) Individual

(active)

Analysis by

partner type:

(v) Exempt

organization

(i) Corporate

(iv) Partnership

(vi) Nominee/Other

General partners

Analysis of Net Income (Loss)

Limited partners

1

2

b

a

(iii) Individual

(passive)

Form 1065 (2008)

b Property