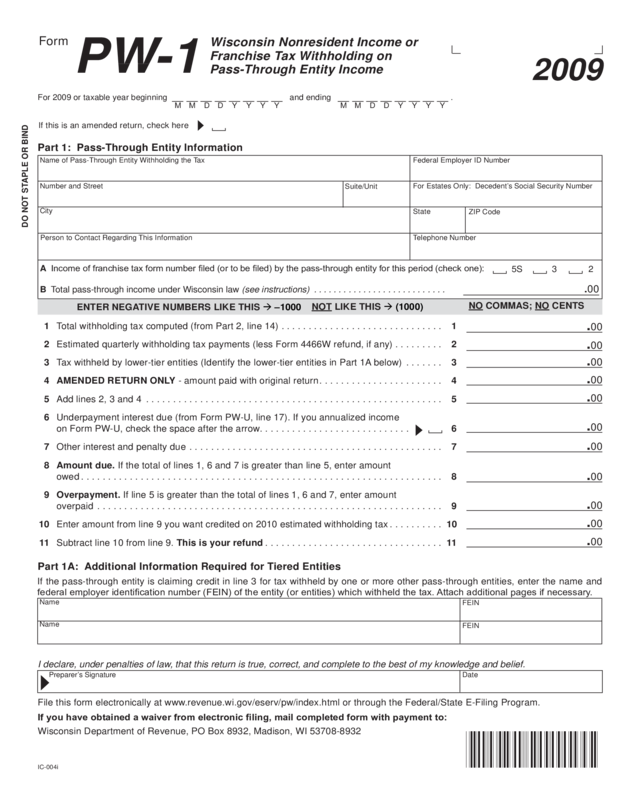

Fillable Printable 2009 Ic-004 Form Pw-1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass-Through Entity Income

Fillable Printable 2009 Ic-004 Form Pw-1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass-Through Entity Income

2009 Ic-004 Form Pw-1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass-Through Entity Income

2009

PW-1

Wisconsin Nonresident Income or

Franchise Tax Withholding on

Pass-Through Entity Income

Form

IC-004i

For 2009 or taxable year beginning and ending .

If this is an amended return, check here

M Y Y Y Y D D M

M Y Y Y Y D D M

DO NOT STAPLE OR BIND

Part 1: Pass-Through Entity Information

Name of Pass-Through Entity Withholding the Tax

Federal Employer ID Number

For Estates Only: Decedent’s Social Security Number

Number and Street

City

State

ZIP Code

Person to Contact Regarding This Information

Telephone Number

5S

3 2

1 Total withholding tax computed (from Part 2, line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Estimated quarterly withholding tax payments (less Form 4466W refund, if any) . . . . . . . . . 2

3 Tax withheld by lower-tier entities (Identify the lower-tier entities in Part 1A below) . . . . . . . 3

4 AMENDED RETURN ONLY - amount paid with original return . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 2, 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Underpayment interest due (from Form PW-U, line 17). If you annualized income

on Form PW-U, check the space after the arrow. . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Other interest and penalty due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 A

mount due. If the total of lines 1, 6 and 7 is greater than line 5, enter amount

owed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 O

verpayment. If line 5 is greater than the total of lines 1, 6 and 7, enter amount

overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

1

0 Enter amount from line 9 you want credited on 2010 estimated withholding tax . . . . . . . . . . 1

0

11 Subtract line 10 from line 9. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

1

.00

.00

.00

.00

NO COMMAS; NO CENTS

NOT LIkE ThIS (1000)

ENTER NEgATIvE NUMBERS LIkE ThIS –1000

.00

.00

.00

.00

.00

.00

.00

Part 1A: Additional Information Required for Tiered Entities

If you have obtained a waiver from electronic ling, mail completed form with payment to:

Wisconsin Department of Revenue, PO Box 8932, Madison, WI 53708-8932

If the pass-through entity is claiming credit in line 3 for tax withheld by one or more other pass-through entities, enter the name and

federal employer identication number (FEIN) of the entity (or entities) which withheld the tax. Attach additional pages if necessary.

Name

Name

FEIN

FEIN

I declare, under penalties of law, that this return is true, correct, and complete to the best of my knowledge and belief.

Preparer’s Signature Date

A Income of franchise tax form number led (or to be led) by the pass-through entity for this period (check one):

B Total pass-through income under Wisconsin law (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

File this form electronically at www.revenue.wi.gov/eserv/pw/index.html or through the Federal/State E-Filing Program.

Suite/Unit

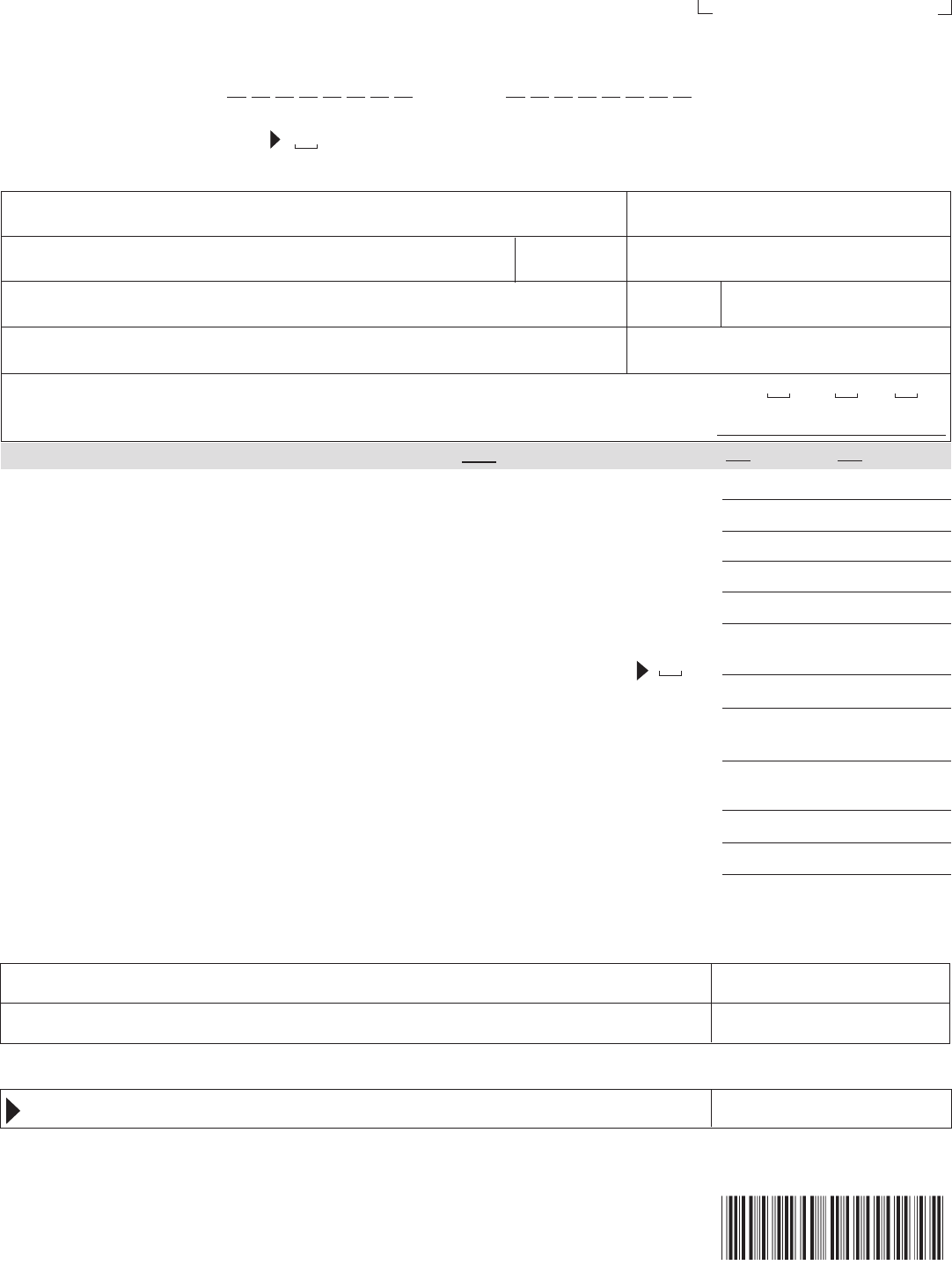

IC-004

(Note: See instructions corresponding to each column letter)

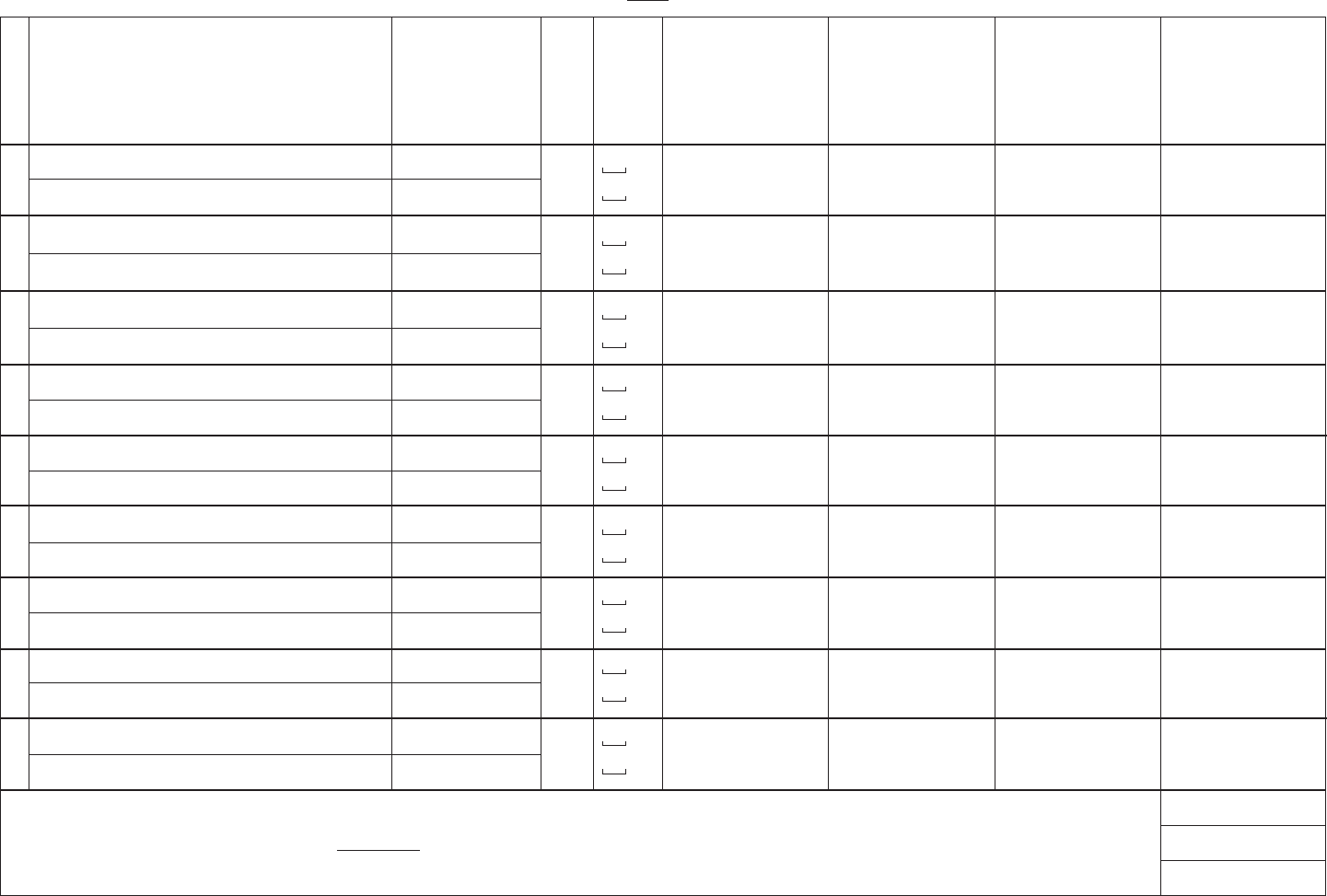

Part 2: Nonresident Shareholder, Partner, Member, or Beneciary Information

A.

Nonresident’s Name and Address

L

i

n

e

H.

Withholding

Tax

Computed

F.

Gross

Withholding

E.

Share of

Wisconsin

Taxable

Income

D.

Afdavit

Filed

C.

Tax

Form

B.

FEIN or SSN

If afdavit (Form PW-2) was led by nonresident, columns E through H are not required.

a

b

c

d

e

h

f

12 Total withholding this page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 N

umber of additional pages included . Total of line 12 amount from all additional pages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 T

otal withholding tax computed. Add lines 12 and 13. Enter total on Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g

i

Name

Address

Name

Address

Name

Address

Name

Address

Name

Address

Name

Address

Name

Address

Name

Address

Name

Address

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

FEIN

FEIN

SSN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

$

$

$

$

$

$

$

$

$

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

G.

Share of

Tax Credits

$

$

$

$

$

$

$

$

$