Fillable Printable 2010 Form 1040-V

Fillable Printable 2010 Form 1040-V

2010 Form 1040-V

2010

Form 1040-V

Department of the Treasury

Internal Revenue Service

What Is Form 1040-V and Do You Have To

Use It?

It is a statement you send with your check or money

order for any balance due on the “Amount you owe” line

of your 2010 Form 1040, Form 1040A, or Form 1040EZ.

Using Form 1040-V allows us to process your payment

more accurately and efficiently. We strongly encourage

you to use Form 1040-V, but there is no penalty if you do

not.

How To Fill In Form 1040-V

Line 1. Enter your social security number (SSN). If you are

filing a joint return, enter the SSN shown first on your

return.

Line 2. If you are filing a joint return, enter the SSN shown

second on your return.

Line 3. Enter the amount you are paying by check or

money order.

Line 4. Enter your name(s) and address exactly as shown

on your return. Please print clearly.

How To Prepare Your Payment

• Make your check or money order payable to the “United

States Treasury.” Do not send cash.

• Make sure your name and address appear on your

check or money order.

• Enter your daytime phone number and your SSN on

your check or money order. If you are filing a joint return,

enter the SSN shown first on your return. Also enter

“2010 Form 1040,” “2010 Form 1040A,” or “2010 Form

1040EZ,” whichever is appropriate.

• To help us process your payment, enter the amount on

the right side of your check like this: $ XXX.XX. Do not

use dashes or lines (for example, do not enter “$ XXX—”

or “$ XXX

xx

/100”).

How To Send In Your 2010 Tax Return,

Payment, and Form 1040-V

• Detach Form 1040-V along the dotted line.

• Do not staple or otherwise attach your payment or Form

1040-V to your return or to each other. Instead, just put

them loose in the envelope.

• Mail your 2010 tax return, payment, and Form 1040-V to

the address shown on the back that applies to you.

Cat. No. 20975C

Form 1040-V (2010)

▼

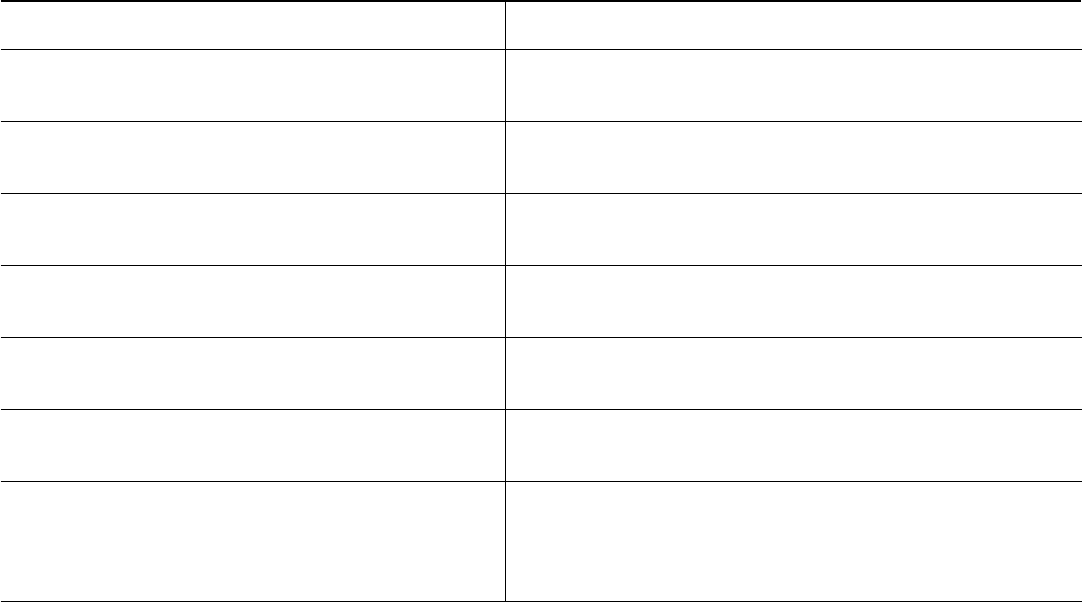

Detach Here and Mail With Your Payment and Return

▼

Form

1040-V

Department of the Treasury

Internal Revenue Service (99)

Payment Voucher

▶

Do not staple or attach this voucher to your payment or return.

OMB No. 1545-0074

2010

Print or type

1 Your social security number (SSN)

2 If a joint return, SSN shown second

on your return

3 Amount you are

paying by check

or money order

Dollars

Cents

4

Your first name and initial

Last name

If a joint return, spouse’s first name and initial Last name

Home address (number and street)

Apt. no.

City, town or post office, state, and ZIP code (If a foreign address, enter city, province or state, postal code, and country.)

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 20975C

Form 1040-V (2010)

Page 2

IF you live in . . .

THEN use this address:

Florida or Georgia

Internal Revenue Service

P.O. Box 105017

Atlanta, GA 30348-5017

Alabama, Kentucky, Louisiana, Mississippi, Tennessee, Texas Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Alaska, Arizona, California, Colorado, Hawaii, Idaho, Nevada,

New Mexico, Oregon, Utah, Washington, Wyoming

Internal Revenue Service

P.O. Box 7704

San Francisco, CA 94120-7704

Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota,

Montana, Nebraska, North Dakota, Oklahoma, South Dakota,

Wisconsin

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Delaware, District of Columbia, Maryland, Missouri, Ohio, Rhode

Island, Virginia, West Virginia

Internal Revenue Service

P.O. Box 970011

St. Louis, MO 63197-0011

Connecticut, Maine, Massachusetts, New Hampshire, New

Jersey, New York, North Carolina*, Pennsylvania, South Carolina*,

Vermont

Internal Revenue Service

P.O. Box 37008

Hartford, CT 06176-0008

A foreign country, American Samoa, or Puerto Rico (or are

excluding income under Internal Revenue Code section 933), or

use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563,

or are a dual-status alien or nonpermanent resident of Guam or

the Virgin Islands**

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303 USA

* If you live in North Carolina or South Carolina, and are filing after June 30, 2011, use: Internal Revenue Service, P.O. Box 105017, Atlanta, GA 30348-5017.

** Permanent residents of Guam or the Virgin Islands should not use Form 1040-V.