Fillable Printable 2010 Form 1116

Fillable Printable 2010 Form 1116

2010 Form 1116

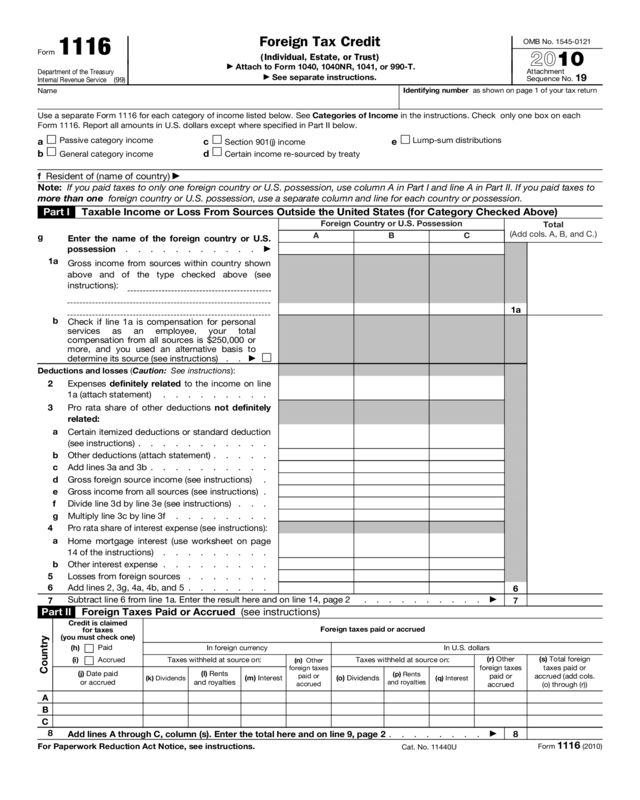

Form 1116

Department of the Treasury

Internal Revenue Service

(99)

Foreign Tax Credit

(Individual, Estate, or Trust)

▶

Attach to Form 1040, 1040NR, 1041, or 990-T.

▶

See separate instructions.

OMB No. 1545-0121

2010

Attachment

Sequence No.

19

Name

Identifying number as shown on page 1 of your tax return

Use a separate Form 1116 for each category of income listed below. See Categories of Income in the instructions. Check only one box on each

Form 1116. Report all amounts in U.S. dollars except where specified in Part II below.

a

Passive category income

b

General category income

c

Section 901(j) income

d

Certain income re-sourced by treaty

e

Lump-sum distributions

f Resident of (name of country)

▶

Note: If you paid taxes to only one foreign country or U.S. possession, use column A in Part I and line A in Part II. If you paid taxes to

more than one foreign country or U.S. possession, use a separate column and line for each country or possession.

Part I Taxable Income or Loss From Sources Outside the United States (for Category Checked Above)

Foreign Country or U.S. Possession

A B

C

Total

(Add cols. A, B, and C.)

g

Enter the name of the foreign country or U.S.

possession . . . . . . . . . . .

▶

1a

Gross income from sources within country shown

above and of the type checked above (see

instructions):

1a

b

Check if line 1a is compensation for personal

services as an employee, your total

compensation from all sources is $250,000 or

more, and you used an alternative basis to

determine its source (see instructions) . .

▶

Deductions and losses (Caution: See instructions):

2

Expenses definitely related to the income on line

1a (attach statement) . . . . . . . . .

3

Pro rata share of other deductions not definitely

related:

a

Certain itemized deductions or standard deduction

(see instructions) . . . . . . . . . . .

b Other deductions (attach statement) . . . . .

c Add lines 3a and 3b . . . . . . . . . .

d Gross foreign source income (see instructions) .

e Gross income from all sources (see instructions) .

f Divide line 3d by line 3e (see instructions) . . .

g Multiply line 3c by line 3f . . . . . . . .

4

Pro rata share of interest expense (see instructions):

a

Home mortgage interest (use worksheet on page

14 of the instructions) . . . . . . . . .

b Other interest expense . . . . . . . . .

5 Losses from foreign sources . . . . . . .

6 Add lines 2, 3g, 4a, 4b, and 5 . . . . . . .

6

7

Subtract line 6 from line 1a. Enter the result here and on line 14, page 2 . . . . . . . . . .

▶

7

Part II Foreign Taxes Paid or Accrued (see instructions)

Country

Credit is claimed

for taxes

(you must check one)

(h)

Paid

(i)

Accrued

(j) Date paid

or accrued

Foreign taxes paid or accrued

In foreign currency

Taxes withheld at source on:

(k) Dividends

(l) Rents

and royalties

(m) Interest

(n) Other

foreign taxes

paid or

accrued

In U.S. dollars

Taxes withheld at source on:

(o) Dividends

(p) Rents

and royalties

(q) Interest

(r) Other

foreign taxes

paid or

accrued

(s) Total foreign

taxes paid or

accrued (add cols.

(o) through (r))

A

B

C

8

Add lines A through C, column (s). Enter the total here and on line 9, page 2 . . . . . . . .

▶

8

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 11440U

Form 1116 (2010)

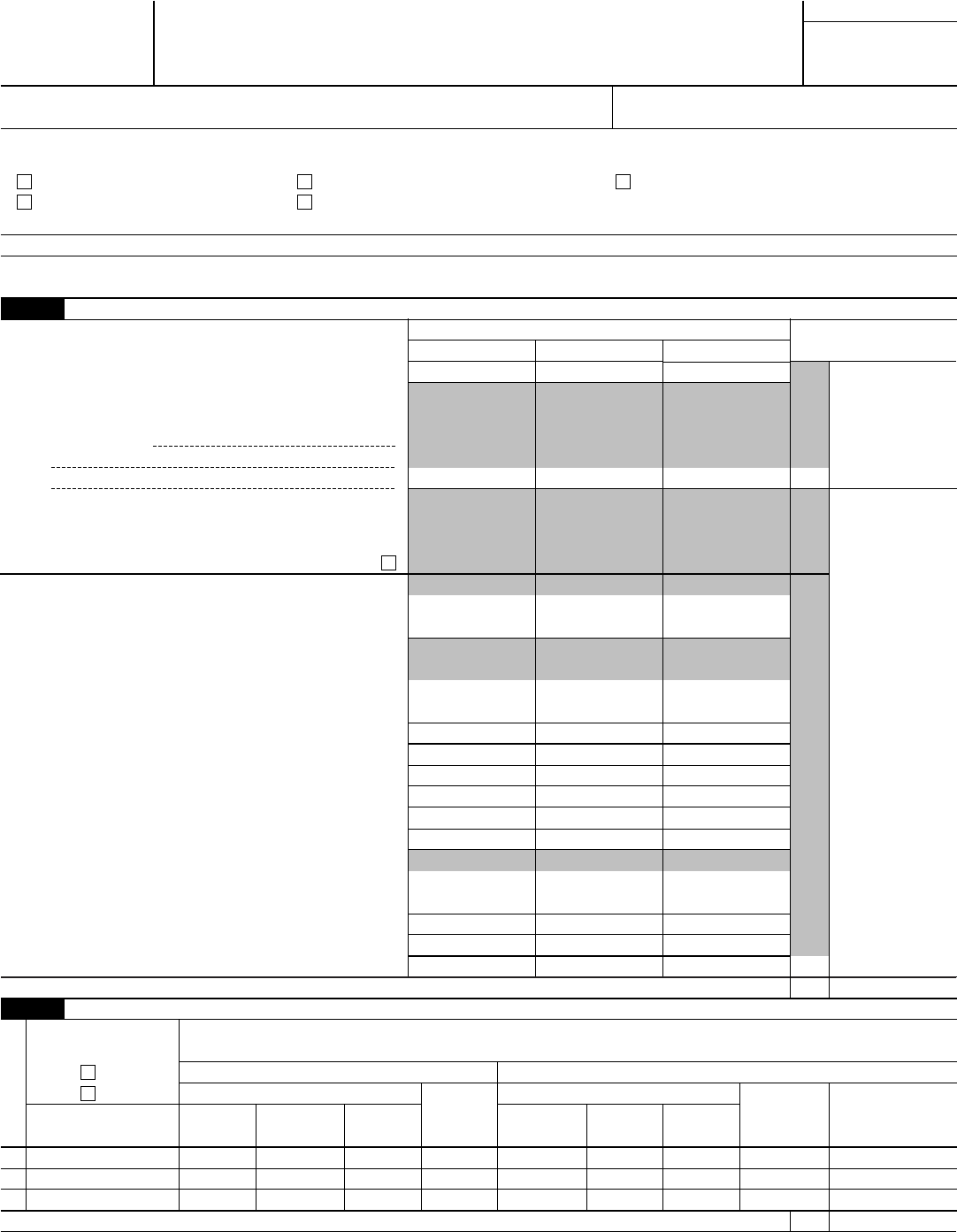

Form 1116 (2010)

Page 2

Part III Figuring the Credit

9

Enter the amount from line 8. These are your total foreign taxes paid

or accrued for the category of income checked above Part I . .

9

10 Carryback or carryover (attach detailed computation) . . . . 10

11 Add lines 9 and 10 . . . . . . . . . . . . . . .

11

12 Reduction in foreign taxes (see instructions)

12

13

Subtract line 12 from line 11. This is the total amount of foreign taxes available for credit (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Enter the amount from line 7. This is your taxable income or (loss) from

sources outside the United States (before adjustments) for the category

of income checked above Part I (see instructions)

. . . . . .

14

15 Adjustments to line 14 (see instructions) . . . . . . . . 15

16

Combine the amounts on lines 14 and 15. This is your net foreign

source taxable income. (If the result is zero or less, you have no

foreign tax credit for the category of income you checked above

Part I. Skip lines 17 through 21. However, if you are filing more than

one Form 1116, you must complete line 19.) . . . . . . .

16

17

Individuals: Enter the amount from Form 1040, line 41, or Form

1040NR, line 39. Estates and trusts: Enter your taxable income

without the deduction for your exemption . . . . . . . .

17

Caution: If you figured your tax using the lower rates on qualified dividends or capital gains, see

instructions.

18 Divide line 16 by line 17. If line 16 is more than line 17, enter “1” . . . . . . . . . . .

18

19

Individuals: Enter the amount from Form 1040, line 44. If you are a nonresident alien, enter the

amount from Form 1040NR, line 42. Estates and trusts: Enter the amount from Form 1041,

Schedule G, line 1a, or the total of Form 990-T, lines 36 and 37 . . . . . . . . . . .

19

Caution: If you are completing line 19 for separate category e (lump-sum distributions), see

instructions.

20 Multiply line 19 by line 18 (maximum amount of credit) . . . . . . . . . . . . . .

20

21

Enter the smaller of line 13 or line 20. If this is the only Form 1116 you are filing, skip lines 22

through 26 and enter this amount on line 27. Otherwise, complete the appropriate line in Part IV

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

21

Part IV

Summary of Credits From Separate Parts III (see instructions)

22 Credit for taxes on passive category income . . . . . . . 22

23 Credit for taxes on general category income . . . . . . . 23

24

Credit for taxes on certain income re-sourced by treaty . . . .

24

25 Credit for taxes on lump-sum distributions . . . . . . . . 25

26 Add lines 22 through 25 . . . . . . . . . . . . . . . . . . . . . . . 26

27 Enter the smaller of line 19 or line 26 . . . . . . . . . . . . . . . . . . . 27

28 Reduction of credit for international boycott operations. See instructions for line 12 . . . . . 28

29

Subtract line 28 from line 27. This is your foreign tax credit. Enter here and on Form 1040, line 47;

Form 1040NR, line 45; Form 1041, Schedule G, line 2a; or Form 990-T, line 40a . . . . . .

▶

29

Form 1116 (2010)