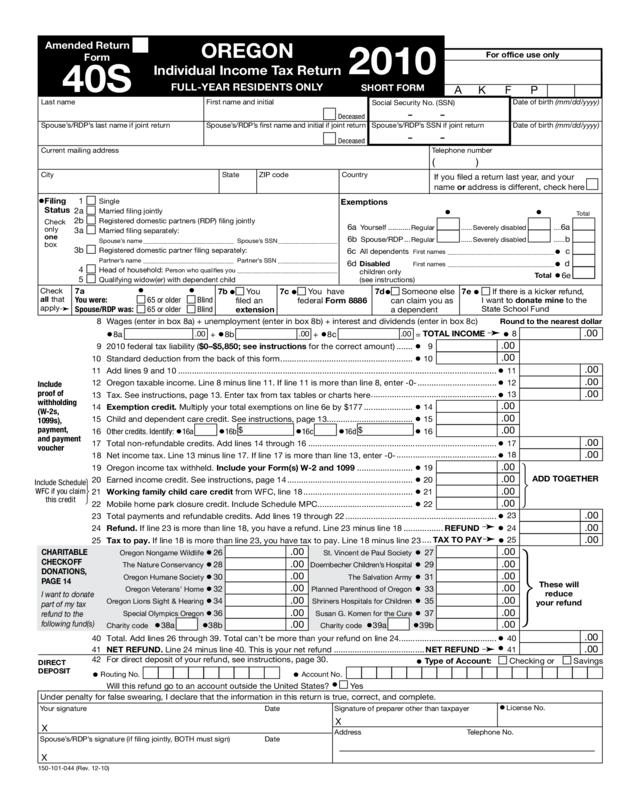

Fillable Printable 2010 Form 40S, Oregon Individual Income Tax Return (Short Form), 150-101-044

Fillable Printable 2010 Form 40S, Oregon Individual Income Tax Return (Short Form), 150-101-044

2010 Form 40S, Oregon Individual Income Tax Return (Short Form), 150-101-044

8 Wages (enter in box 8a) + unemployment (enter in box 8b) + interest and dividends (enter in box 8c)

•

8a +

•

8b +

•

8c =

TOTAL INCOME

➛

•

8

9 2010 federal tax liability ($0–$5,850; see instructions for the correct amount) .......

•

9

10 Standard deduction from the back of this form .........................................................

•

10

11 Add lines 9 and 10 .........................................................................................................................................

•

11

12 Oregon taxable income. Line 8 minus line 11. If line 11 is more than line 8, enter -0- ..................................

•

12

13 Tax. See instructions, page 13. Enter tax from tax tables or charts here

......................................................

•

13

14 Exemption credit. Multiply your total exemptions on line 6e by $177 .....................

•

14

15 Child and dependent care credit. See instructions, page 13.....................................

•

15

16 Other credits. Identify:

•

16a

•

16b

$

•

16c

•

16d

$

•

16

17 Total non-refundable credits. Add lines 14 through 16 .................................................................................

•

17

18 Net income tax. Line 13 minus line 17. If line 17 is more than line 13, enter -0-

...........................................

•

18

19 Oregon income tax withheld. Include your Form(s) W-2 and 1099 ........................

•

19

20 Earned income credit. See instructions, page 14 ......................................................

•

20

21 Working family child care credit from WFC, line 18 ...............................................

•

21

22 Mobile home park closure credit. Include Schedule MPC .........................................

•

22

23 Total payments and refundable credits. Add lines 19 through 22 .................................................................

•

23

24 Refund. If line 23 is more than line 18, you have a refund. Line 23 minus line 18 ................. REFUND

➛

•

24

25 Tax to pay. If line 18 is more than line 23, you have tax to pay. Line 18 minus line 23

.... TAX TO PAY

➛

•

25

Oregon Nongame Wildlife

•

26 St. Vincent de Paul Society

•

27

The Nature Conservancy

•

28 Doernbecher Children’s Hospital

•

29

Oregon Humane Society

•

30 The Salvation Army

•

31

Oregon Veterans’ Home

•

32

Planned Parenthood of Oregon

•

33

Oregon Lions Sight & Hearing

•

34 Shriners Hospitals for Children

•

35

Special Olympics Oregon

•

36 Susan G. Komen for the Cure

•

37

Charity code

•

38a

•

38b Charity code

•

39a

•

39b

40 Total. Add lines 26 through 39. Total can’t be more than your refund on line 24..........................................

•

40

41 NET REFUND. Line 24 minus line 40. This is your net refund .......................................NET REFUND

➛

• 41

42 For direct deposit of your refund, see instructions, page 30.

Will this refund go to an account outside the United States? • Yes

These will

reduce

your refund

Include

proof of

withholding

(W-2s,

1099s),

payment,

and payment

voucher

Round to the nearest dollar

Include Schedule

WFC if you claim

this credit

Signature of preparer other than taxpayerYour signature Date

Address Telephone No.

X

X

Spouse’s/RDP’s signature (if filing jointly, BOTH must sign) Date

X

•

License No.

Under penalty for false swearing, I declare that the information in this return is true, correct, and complete.

DIRECT

DEPOSIT

•

Routing No.

•

Account No.

•

Type of Account:

Checking or Savings

ADD TOGETHER

CHARITABLE

CHECKOFF

DONATIONS,

PAGE 14

I want to donate

part of my tax

refund to the

following fund(s)

7e

•

If there is a kicker refund,

I want to donate mine to the

State School Fund

Date of birth (mm/dd/yyyy)

Date of birth (mm/dd/yyyy)

.00

.00 .00.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Last name First name and initial

Social Security No. (SSN)

– –

Spouse’s/RDP’s last name if joint return Spouse’s/RDP’s first name and initial if joint return Spouse’s/RDP’s SSN if joint return

– –

Telephone numberCurrent mailing address

City State ZIP code

If you filed a return last year, and your

name or address is different, check here

( )

Country

For office use only

.00

.00

A K F P

Deceased

Deceased

.00

.00

.00

.00

.00

.00

150-101-044 (Rev. 12-10)

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

SHORT FORM

2010

Form

40S

FULL-YEAR RESIDENTS ONLY

OREGON

Individual Income Tax Return

Amended Return

•

1 Single

2a Married ling jointly

2b Registered domestic partners (RDP) ling jointly

3a Married ling separately:

Spouse’s name _____________________________ Spouse’s SSN ___________________

3b Registered domestic partner ling separately:

Partner’s name _____________________________ Partner’s SSN ___________________

4 Head of household: Person who qualies you ________________________________

5 Qualifying widow(er) with dependent child

Filing

Status

Check

only

one

box

Exemptions

6a

Yourself ...........Regular ......Severely disabled ....6a

6b Spouse/RDP ...Regular ......Severely disabled ......b

6c All dependents First names __________________________________

•

c

6d

Disabled First names __________________________________

•

d

children only

(see instructions)

Total

Total

6e

•

••

7d

•

Someone else

can claim you as

a dependent

7c

•

You have

federal Form 8886

7b

•

You

filed an

extension

Check

all that

apply

➛

7a

• •

You were: 65 or older Blind

Spouse/RDP was: 65 or older Blind

Clear Form

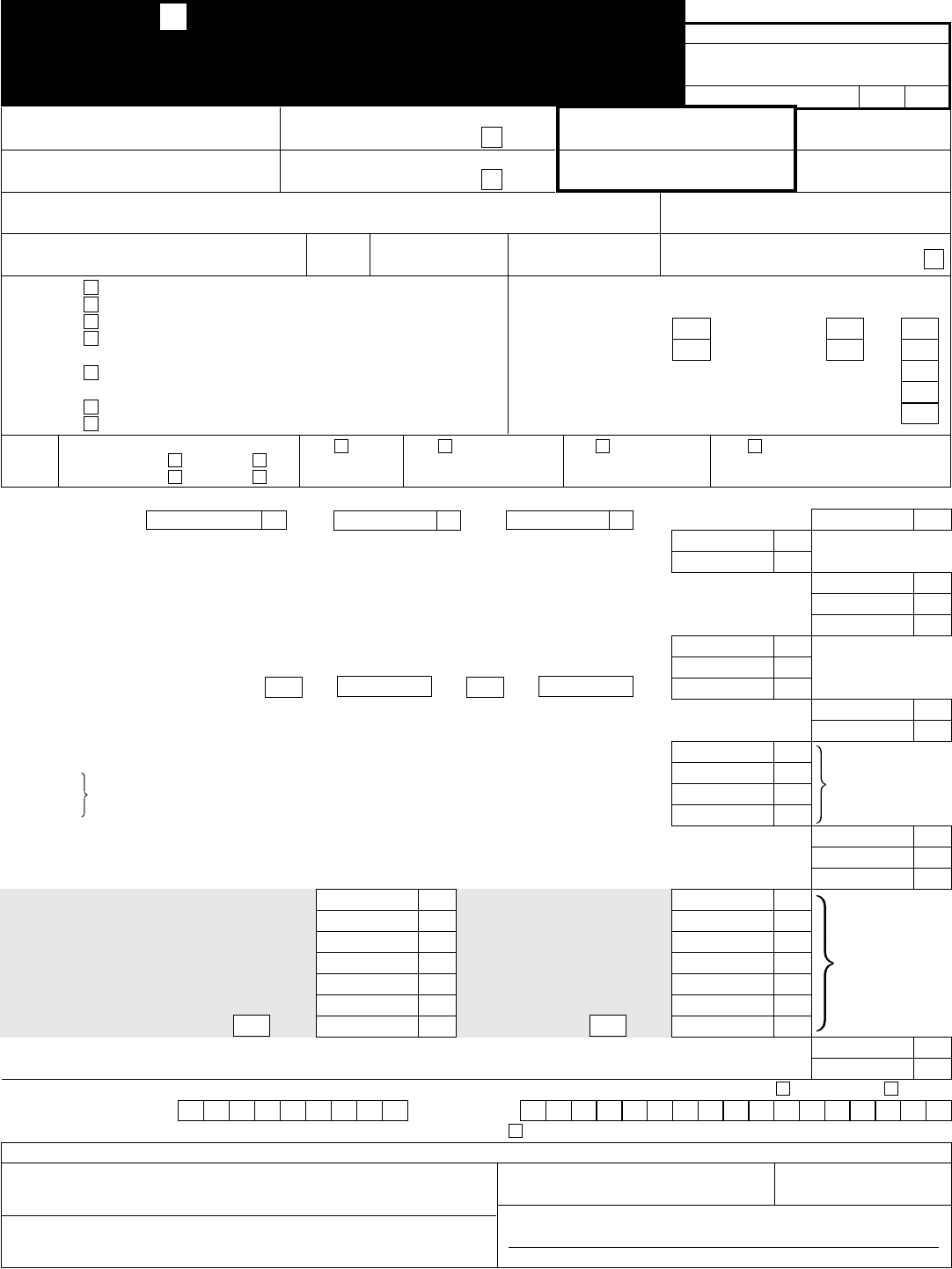

How to figure your standard deduction

• Standard deduction. Unless you are claimed as a dependent, or are age 65 or older, or blind, your

standard deduction is based on your filing status as follows:

Single .............................................................................................................. $1,950

Married/RDP filing jointly ............................................................................. 3,900

Married/RDP filing separately

If spouse/RDP claims standard deduction .............................................. 1,950

If spouse/RDP claims itemized deductions ............................................. -0-

Head of household ........................................................................................ 3,140

Qualifying widow(er) ..................................................................................... 3,900

• Standard deduction—Dependents. If you can be claimed as a dependent on another person’s return,

your standard deduction is limited to the larger of:

— Your earned income plus $300, up to the maximum allowed for your filing status, shown above, or

— $950.

This limit applies even if you can be, but are not, claimed as a dependent on another person’s return. See

the standard deduction worksheet for single dependents on page 13, or contact us if you are a married/RDP

dependent.

• Standard deduction—Age 65 or older, or blind. If you are age 65 or older, or blind, you are entitled to

a larger standard deduction based on your filing status:

1. Are you:

65 or older? Blind?

If claiming spouse’s/RDP’s exemption, is your spouse/RDP:

65 or older? Blind?

2.

• Standard deduction—Nonresident aliens. The standard deduction for nonresident aliens, as defined

by federal law, is -0-.

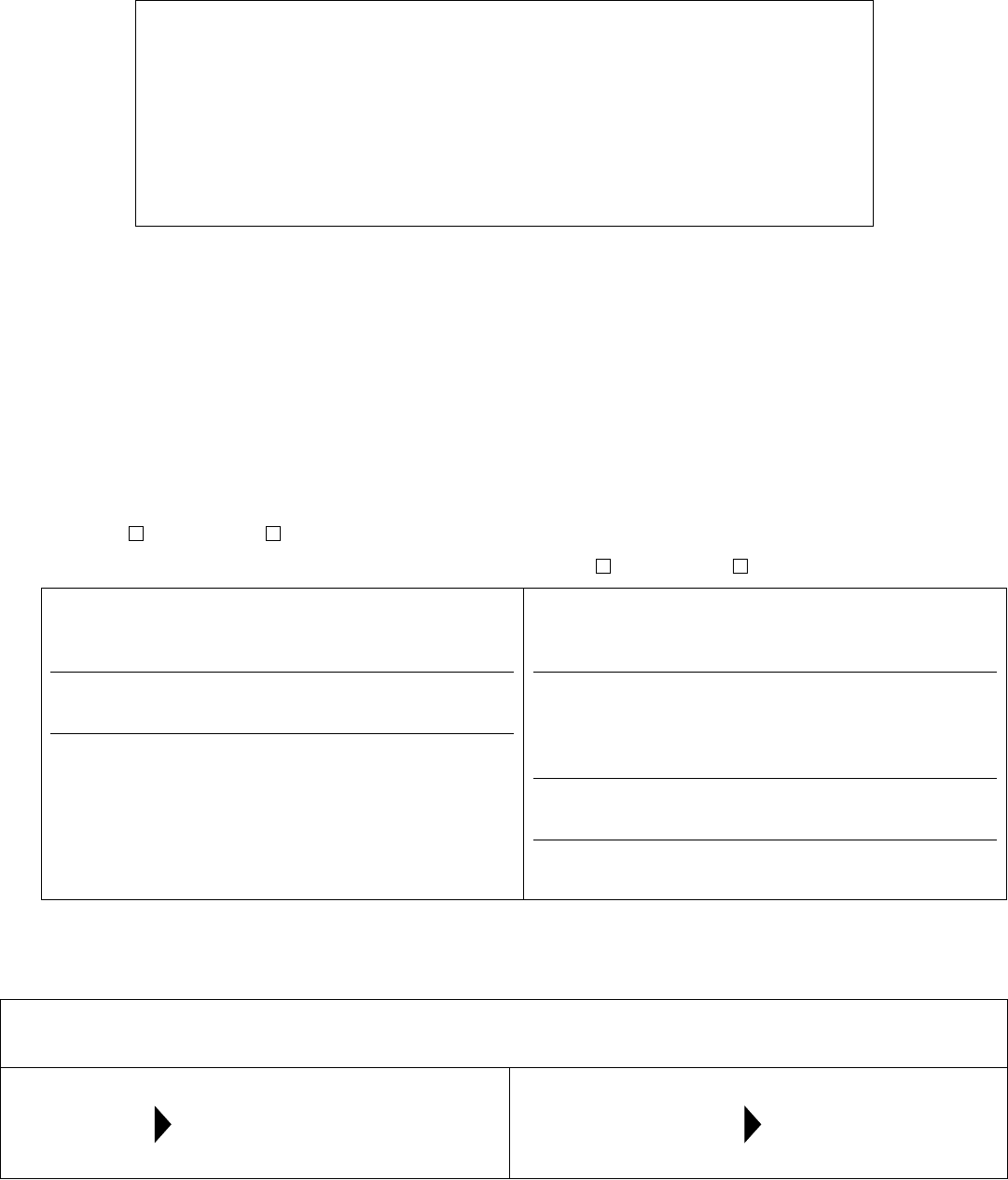

Page 2 — 2010 Form 40S

If you owe, make your check or money order payable to the Oregon Department of Revenue.

Write your daytime telephone number and “2010 Oregon Form 40S” on your check or money order.

Include your payment, along with the payment voucher on page 29, with this return.

If your And the number Then your

filing of boxes checked standard

status is... in step 1 above is... deduction is...

Single

1 $3,150

2 4,350

Married/RDP

1 4,900

filing

2 5,900

jointly

3 6,900

4 7,900

If your And the number Then your

filing of boxes checked standard

status is... in step 1 above is... deduction is...

Married/RDP

1 $2,950

filing

2 3,950

separately

3 4,950

4 5,950

Head of 1 4,340

household 2 5,540

Qualifying 1 4,900

widow(er) 2 5,900

Oregon Department of Revenue

PO Box 14555

Salem OR 97309-0940

Mail REFUND returns

and NO-TAX-DUE

returns to

Mail

TAX-TO-PAY

returns to

REFUND

PO Box 14700

Salem OR 97309-0930

150-101-044 (Rev. 12-10)