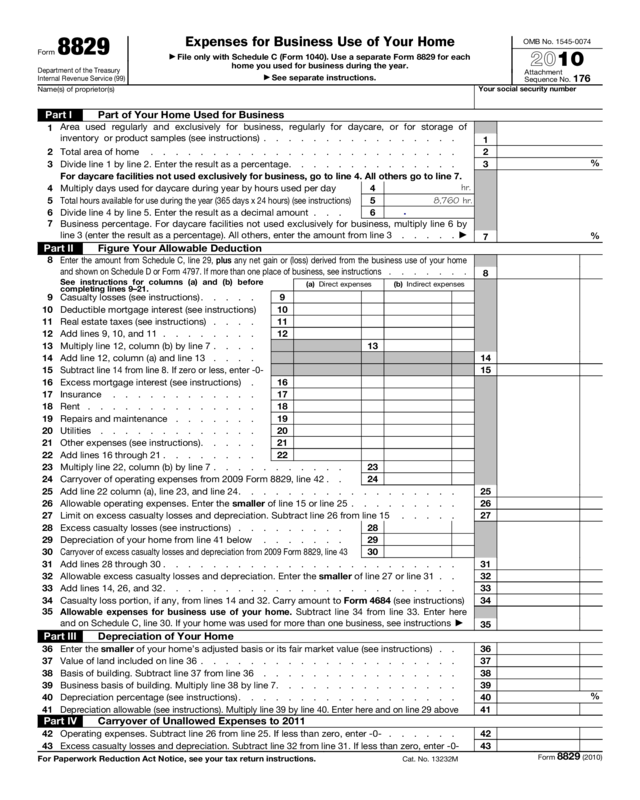

Fillable Printable 2010 Form 8829

Fillable Printable 2010 Form 8829

2010 Form 8829

Form 8829

Department of the Treasury

Internal Revenue Service (99)

Expenses for Business Use of Your Home

▶

File only with Schedule C (Form 1040). Use a separate Form 8829 for each

home you used for business during the year.

▶

See separate instructions.

OMB No. 1545-0074

2010

Attachment

Sequence No.

176

Name(s) of proprietor(s)

Your social security number

Part I Part of Your Home Used for Business

1

Area used regularly and exclusively for business, regularly for daycare, or for storage of

inventory or product samples (see instructions) . . . . . . . . . . . . . . . .

1

2 Total area of home . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Divide line 1 by line 2. Enter the result as a percentage. . . . . . . . . . . . . . 3

%

For daycare facilities not used exclusively for business, go to line 4. All others go to line 7.

4 Multiply days used for daycare during year by hours used per day

4

hr.

5

Total hours available for use during the year (365 days x 24 hours) (see instructions)

5

8,760 hr.

6 Divide line 4 by line 5. Enter the result as a decimal amount . . .

6

.

7

Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by

line 3 (enter the result as a percentage). All others, enter the amount from line 3 . . . . .

▶

7

%

Part II Figure Your Allowable Deduction

8

Enter the amount from Schedule C, line 29, plus any net gain or (loss) derived from the business use of your home

and shown on Schedule D or Form 4797. If more than one place of business, see instructions . . . . . . .

8

See instructions for columns (a) and (b) before

completing lines 9–21.

(a) Direct expenses (b) Indirect expenses

9 Casualty losses (see instructions). . . . . 9

10 Deductible mortgage interest (see instructions)

10

11 Real estate taxes (see instructions) . . . .

11

12 Add lines 9, 10, and 11 . . . . . . . .

12

13 Multiply line 12, column (b) by line 7 . . . .

13

14 Add line 12, column (a) and line 13 . . . .

14

15

Subtract line 14 from line 8. If zero or less, enter -0-

15

16 Excess mortgage interest (see instructions) .

16

17 Insurance . . . . . . . . . . . .

17

18 Rent . . . . . . . . . . . . . .

18

19 Repairs and maintenance . . . . . . .

19

20

Utilities . . . . . . . . . . . . .

20

21 Other expenses (see instructions). . . . .

21

22 Add lines 16 through 21 . . . . . . . .

22

23 Multiply line 22, column (b) by line 7 . . . . . . . . . . . 23

24 Carryover of operating expenses from 2009 Form 8829, line 42 . . 24

25 Add line 22 column (a), line 23, and line 24. . . . . . . . . . . . . . . . . . 25

26 Allowable operating expenses. Enter the smaller of line 15 or line 25 . . . . . . . . . 26

27 Limit on excess casualty losses and depreciation. Subtract line 26 from line 15 . . . . . 27

28 Excess casualty losses (see instructions) . . . . . . . . . 28

29 Depreciation of your home from line 41 below . . . . . . . 29

30

Carryover of excess casualty losses and depreciation from 2009 Form 8829, line 43

30

31 Add lines 28 through 30 . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Allowable excess casualty losses and depreciation. Enter the smaller of line 27 or line 31 . . 32

33 Add lines 14, 26, and 32. . . . . . . . . . . . . . . . . . . . . . . . 33

34 Casualty loss portion, if any, from lines 14 and 32. Carry amount to Form 4684 (see instructions) 34

35

Allowable expenses for business use of your home. Subtract line 34 from line 33. Enter here

and on Schedule C, line 30. If your home was used for more than one business, see instructions

▶

35

Part III Depreciation of Your Home

36 Enter the smaller of your home’s adjusted basis or its fair market value (see instructions) . . 36

37 Value of land included on line 36 . . . . . . . . . . . . . . . . . . . . . 37

38 Basis of building. Subtract line 37 from line 36 . . . . . . . . . . . . . . . . 38

39 Business basis of building. Multiply line 38 by line 7. . . . . . . . . . . . . . . 39

40 Depreciation percentage (see instructions). . . . . . . . . . . . . . . . . . 40

%

41

Depreciation allowable (see instructions). Multiply line 39 by line 40. Enter here and on line 29 above

41

Part IV Carryover of Unallowed Expenses to 2011

42 Operating expenses. Subtract line 26 from line 25. If less than zero, enter -0- . . . . . . 42

43

Excess casualty losses and depreciation. Subtract line 32 from line 31. If less than zero, enter -0-

43

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13232M

Form 8829 (2010)