Fillable Printable 2010 Form 944

Fillable Printable 2010 Form 944

2010 Form 944

Name (not your trade name)

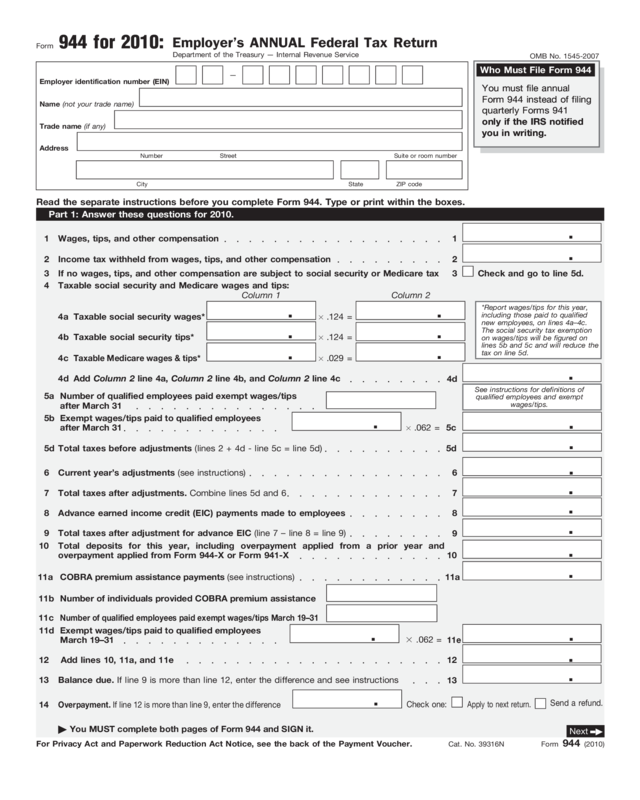

944 for 2010:

OMB No. 1545-2007

Employer’s ANNUAL Federal Tax Return

Department of the Treasury — Internal Revenue Service

Employer identification number (EIN)

Trade name (if any)

Address

Number

Street

Suite or room number

City

State

ZIP code

Form

—

Part 1: Answer these questions for 2010.

1

2

3

4

6

7

8

10

13

14

4a

4b

4c

4d

Wages, tips, and other compensation

Income tax withheld from wages, tips, and other compensation

If no wages, tips, and other compensation are subject to social security or Medicare tax

Check and go to line 5d.

Taxable social security and Medicare wages and tips:

Column 1

Column 2

Taxable social security wages*

3 .124 =

Taxable social security tips*

Taxable Medicare wages & tips*

3 .029 =

Add Column 2 line 4a, Column 2 line 4b, and Column 2 line 4c

Current year’s adjustments (see instructions)

Add lines 10, 11a, and 11e

Total taxes after adjustments. Combine lines 5d and 6

Advance earned income credit (EIC) payments made to employees

Total taxes after adjustment for advance EIC (line 7 – line 8 = line 9)

Total deposits for this year, including overpayment applied from a prior year and

overpayment applied from Form 944-X or Form 941-X

Balance due. If line 9 is more than line 12, enter the difference and see instructions

Overpayment. If line 12 is more than line 9, enter the difference

Check one:

Apply to next return.

Send a refund.

Next

3 .124 =

12

1

2

7

8

10

13

4d

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

©

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher.

Cat. No. 39316N

Form 944 (2010)

COBRA premium assistance payments (see instructions)

11a

.

Number of individuals provided COBRA premium assistance

11b

You must file annual

Form 944 instead of filing

quarterly Forms 941

only if the IRS notified

you in writing.

9

9

.

Who Must File Form 944

11a

Read the separate instructions before you complete Form 944. Type or print within the boxes.

3

© You MUST complete both pages of Form 944 and SIGN it.

6

Number of qualified employees paid exempt wages/tips

after March 31

5a

3 .062 =

.

Exempt wages/tips paid to qualified employees

after March 31

5b

5c

Number of qualified employees paid exempt wages/tips March 19–31

11c

3 .062 =

.

.

Exempt wages/tips paid to qualified employees

March 19–31

11d

11e

You must file annual

Form 944 instead of filing

quarterly Forms 941

only if the IRS notified

you in writing.

*Report wages/tips for this year,

including those paid to qualified

new employees, on lines 4a–4c.

The social security tax exemption

on wages/tips will be figured on

lines 5b and 5c and will reduce the

tax on line 5d.

.

.

5d

Total taxes before adjustments (lines 2 + 4d - line 5c = line 5d)

.

5d

See instructions for definitions of

qualified employees and exempt

wages/tips.

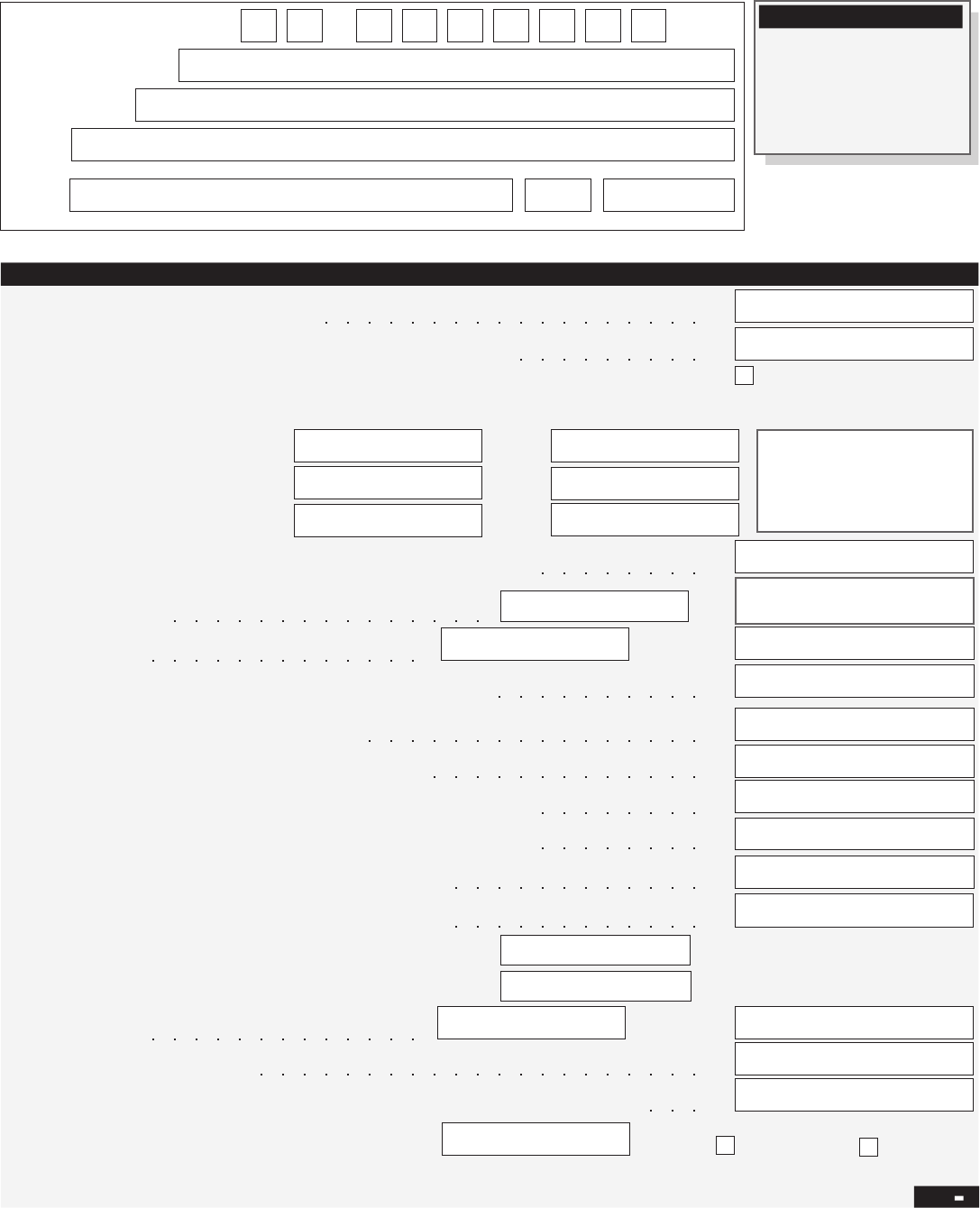

Part 2: Tell us about your tax liability for 2010.

16

15

If you made deposits of taxes reported on this form, write the state abbreviation for the state where you

made your deposits OR write MU if you made your deposits in multiple states.

Check one:

Line 9 is less than $2,500. Go to Part 3.

Line 9 is $2,500 or more. Enter your tax liability for each month. If you are a semiweekly depositor or you accumulate

$100,000 or more of liability on any day during a deposit period, you must complete Form 945-A instead of the boxes below.

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions

for details.

Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS.

Part 4: May we speak with your third-party designee?

No.

Name (not your trade name)

Employer identification number (EIN)

15a

15d

15g

15b

15e

15h

15c

15f

15i

15j

15k

15l

Total liability for year. Add lines 15a through 15l. Total must equal line 9.

.

.

.

.

.

.

.

.

.

.

.

.

.

15m

Part 3: Tell us about your business. If question 17 does NOT apply to your business, leave it blank.

17

If your business has closed or you stopped paying wages...

Check here and enter the final date you paid wages.

/ /

Jan.

Apr.

Jul.

Oct.

Feb.

Mar.

May

Jun.

Aug.

Sep.

Nov.

Dec.

Form 944 (2010)

Page

2

Yes.

Designee’s name and phone number

( ) –

Preparer’s signature

Firm’s name (or yours

if self-employed)

Address

EIN

ZIP code

PTIN

Check if you are self-employed

Date

/ /

Phone

( ) –

Part 5: Sign here. You MUST complete both pages of Form 944 and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your

name here

Print your

name here

Date

/ /

Best daytime phone

( ) –

Paid preparer use only

Print your

title here

Preparer’s name

City

State

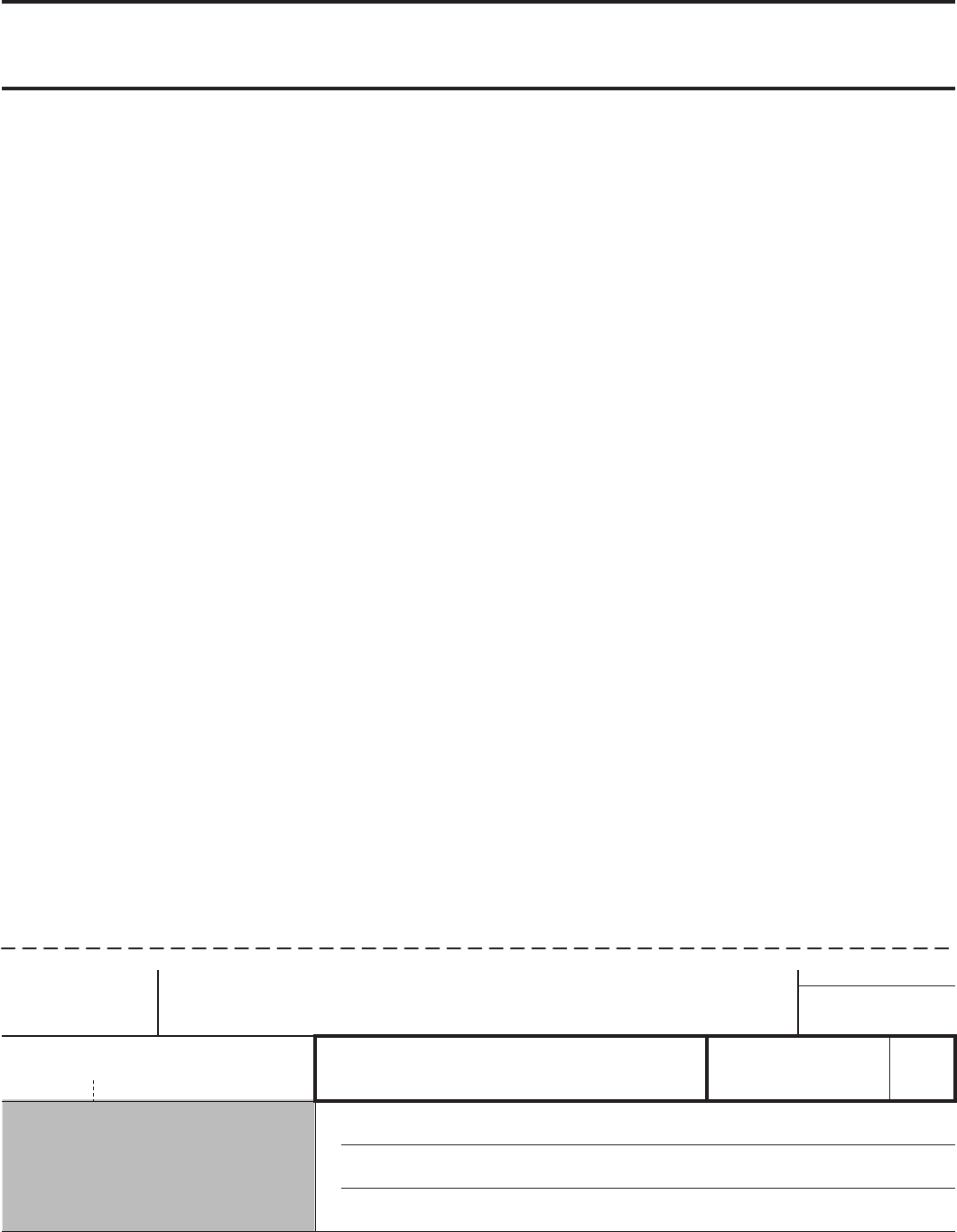

Form 944-V,

Payment Voucher

Purpose of Form

Complete Form 944-V, Payment Voucher, if you are

making a payment with Form 944, Employer’s ANNUAL

Federal Tax Return. We will use the completed voucher

to credit your payment more promptly and accurately,

and to improve our service to you.

See section 11 of Pub. 15 (Circular E) for deposit

instructions. Do not use Form 944-V to make federal

tax deposits.

Specific Instructions

Box 1—Employer identification number (EIN). If you

do not have an EIN, apply for one on Form SS-4,

Application for Employer Identification Number, and

write “Applied For” and the date you applied in this

entry space.

● Enclose your check or money order made payable to

the “United States Treasury” and write your EIN, “Form

944,” and “2010” on your check or money order. Do

not send cash. Do not staple Form 944-V or your

payment to Form 944 (or to each other).

● Detach Form 944-V and send it with your payment

and Form 944 to the address provided in the

Instructions for Form 944. Do not send a photocopy of

Form 944-V because your payment may be misapplied

or delayed.

To avoid a penalty, make your payment with your 2010

Form 944 only if one of the following applies.

Making Payments With Form 944

● Your net taxes for the year (line 9 on Form 944) are

less than $2,500 and you are paying in full with a

timely filed return.

● You are a monthly schedule depositor making a

payment in accordance with the Accuracy of Deposits

Rule. See section 11 of Pub. 15 (Circular E),

Employer’s Tax Guide, for details. In this case, the

amount of your payment may be $2,500 or more.

Caution. Use Form 944-V when making any payment

with Form 944. However, if you pay an amount with

Form 944 that should have been deposited, you may

be subject to a penalty. See Deposit Penalties in

section 11 of Pub. 15 (Circular E).

If you have your return prepared by a third party and

make a payment with that return, please provide this

payment voucher to the return preparer.

Box 3—Name and address. Enter your name and

address as shown on Form 944.

Box 2—Amount paid. Enter the amount paid with

Form 944.

Enter the amount of your payment.

©

2

Detach Here and Mail With Your Payment and Form 944.

Ä

Ä

OMB No. 1545-2007

Form

944-V

Department of the Treasury

Internal Revenue Service

Payment Voucher

Enter your employer identification

number (EIN).

3

Enter your business name (individual name if sole proprietor).

©

Do not staple this voucher or your payment to Form 944.

Enter your address.

Enter your city, state, and ZIP code.

1

Dollars

Cents

Note. You must also complete the entity information

above Part 1 on Form 944.

● You already deposited the taxes you owed for the

first, second, and third quarters of 2010, and the tax

you owe for the fourth quarter of 2010 is less than

$2,500, and you are paying, in full, the tax you owe for

the fourth quarter of 2010 with a timely filed return.

✁

✃

20

10

● Your net taxes for the third quarter are $2,500 or

more, net taxes for the fourth quarter are less than

$2,500, and you did not incur a $100,000 next-day

deposit obligation during the fourth quarter.

Otherwise, you must deposit your payment by using

the Electronic Federal Tax Payment System (EFTPS).

You are not required to provide the information

requested on a form that is subject to the Paperwork

Reduction Act unless the form displays a valid OMB

control number. Books and records relating to a form

or instructions must be retained as long as their

contents may become material in the administration of

any Internal Revenue law.

Privacy Act and Paperwork Reduction Act Notice.

We ask for the information on this form to carry out the

Internal Revenue laws of the United States. We need it

to figure and collect the right amount of tax. Subtitle C,

Employment Taxes, of the Internal Revenue Code

imposes employment taxes on wages, including income

tax withholding. This form is used to determine the

amount of the taxes that you owe. Section 6011

requires you to provide the requested information if the

tax is applicable to you. Section 6109 requires you to

provide your identification number. If you fail to provide

this information in a timely manner, or provide false or

fraudulent information, you may be subject to penalties

and interest.

Recordkeeping

The time needed to complete and file Form 944 will

vary depending on individual circumstances. The

estimated average time is:

Learning about the law or the form

Preparing the form

Copying, assembling, and sending

the form to the IRS

16 min.

12 hrs., 12 min.

40 min.

1 hr., 49 min.

If you have comments concerning the accuracy of

these time estimates or suggestions for making Form

944 simpler, we would be happy to hear from you. You

can email us at *[email protected] or write to us at:

Internal Revenue Service, Tax Products Coordinating

Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution

Ave. NW, IR-6526, Washington, DC 20224. Do not

send Form 944 to this address. Instead, see Where

Should You File? in the Instructions for Form 944.

Form 944 (2010)

Generally, tax returns and return information are

confidential, as required by section 6103. However,

section 6103 allows or requires the IRS to disclose or

give the information shown on your tax return to others

as described in the Code. For example, we may

disclose your tax information to the Department of

Justice for civil and criminal litigation, and to cities,

states, the District of Columbia, and U.S.

commonwealths and possessions for use in

administering their tax laws. We may also disclose this

information to other countries under a tax treaty, to

federal and state agencies to enforce federal nontax

criminal laws, or to federal law enforcement and

intelligence agencies to combat terrorism.