Fillable Printable 2010 Schedule Eic (Form 1040A Or 1040)

Fillable Printable 2010 Schedule Eic (Form 1040A Or 1040)

2010 Schedule Eic (Form 1040A Or 1040)

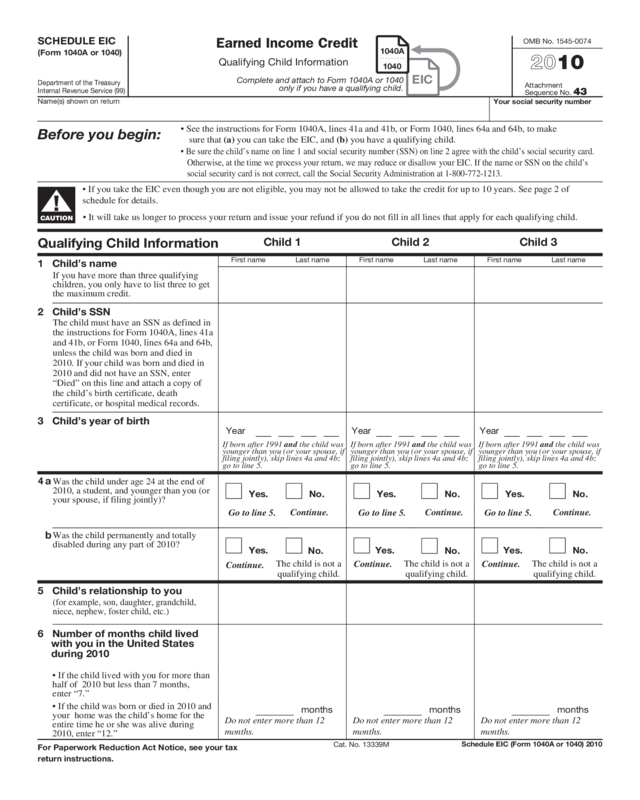

SCHEDULE EIC

(Form 1040A or 1040)

Department of the Treasury

Internal Revenue Service (99)

Earned Income Credit

Qualifying Child Information

Complete and attach to Form 1040A or 1040

only if you have a qualifying child.

1040A

. . . . . . . . . .

1040

EIC

◀

OMB No. 1545-0074

2010

Attachment

Sequence No.

43

Name(s) shown on return

Your social security number

Before you begin:

▲

!

CAUTION

• See the instructions for Form 1040A, lines 41a and 41b, or Form 1040, lines 64a and 64b, to make

sure that (a) you can take the EIC, and (b) you have a qualifying child.

• Be sure the child’s name on line 1 and social security number (SSN) on line 2 agree with the child’s social security card.

Otherwise, at the time we process your return, we may reduce or disallow your EIC. If the name or SSN on the child’s

social security card is not correct, call the Social Security Administration at 1-800-772-1213.

• If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See page 2 of

schedule for details.

• It will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child.

Qualifying Child Information

Child 1

Child 2

Child 3

1 Child’s name

If you have more than three qualifying

children, you only have to list three to get

the maximum credit.

First name Last name

First name Last name

First name Last name

2 Child’s SSN

The child must have an SSN as defined in

the instructions for Form 1040A, lines 41a

and 41b, or Form 1040, lines 64a and 64b,

unless the child was born and died in

2010. If your child was born and died in

2010 and did not have an SSN, enter

“Died” on this line and attach a copy of

the child’s birth certificate, death

certificate, or hospital medical records.

3 Child’s year of birth

Year

If born after 1991 and the child was

younger than you (or your spouse, if

filing jointly), skip lines 4a and 4b;

go to line 5.

Year

If born after 1991 and the child was

younger than you (or your spouse, if

filing jointly), skip lines 4a and 4b;

go to line 5.

Year

If born after 1991 and the child was

younger than you (or your spouse, if

filing jointly), skip lines 4a and 4b;

go to line 5.

4

a

Was the child under age 24 at the end of

2010, a student, and younger than you (or

your spouse, if filing jointly)?

Yes.

Go to line 5.

No.

Continue.

Yes.

Go to line 5.

No.

Continue.

Yes.

Go to line 5.

No.

Continue.

b

Was the child permanently and totally

disabled during any part of 2010?

Yes.

Continue.

No.

The child is not a

qualifying child.

Yes.

Continue.

No.

The child is not a

qualifying child.

Yes.

Continue.

No.

The child is not a

qualifying child.

5 Child’s relationship to you

(for example, son, daughter, grandchild,

niece, nephew, foster child, etc.)

6 Number of months child lived

with you in the United States

during 2010

• If the child lived with you for more than

half of 2010 but less than 7 months,

enter “7.”

• If the child was born or died in 2010 and

your home was the child’s home for the

entire time he or she was alive during

2010, enter “12.”

months

Do not enter more than 12

months.

months

Do not enter more than 12

months.

months

Do not enter more than 12

months.

For Paperwork Reduction Act Notice, see your tax

return instructions.

Cat. No. 13339M

Schedule EIC (Form 1040A or 1040) 2010

Schedule EIC (Form 1040A or 1040) 2010

Page

2

Purpose of Schedule

After you have figured your earned income credit

(EIC), use Schedule EIC to give the IRS information

about your qualifying child(ren).

To figure the amount of your credit or to have the IRS

figure it for you, see the instructions for Form 1040A,

lines 41a and 41b, or Form 1040, lines 64a and 64b.

TIP

You may also be able to take the additional child tax credit if your child was your dependent and under age 17 at the end of 2010.

For more details, see the instructions for line 42 of Form 1040A or line 65 of Form 1040.

Taking the EIC when not eligible. If you take the

EIC even though you are not eligible and it is

determined that your error is due to reckless or

intentional disregard of the EIC rules, you will not be

allowed to take the credit for 2 years even if you are

otherwise eligible to do so. If you fraudulently take the

EIC, you will not be allowed to take the credit for 10

years. You may also have to pay penalties.

Qualifying Child

A qualifying child for the EIC is a child who is your . . .

Son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or

a descendant of any of them (for example, your grandchild, niece, or nephew)

AND

▼

was . . .

Under age 19 at the end of 2010 and younger than you (or your spouse, if filing jointly)

or

Under age 24 at the end of 2010, a student, and younger than you (or your spouse, if filing jointly)

or

Any age and permanently and totally disabled

AND

▼

Who is not filing a joint return for 2010

or is filing a joint return for 2010 only as a claim for refund

(as defined in the instructions for Form 1040A, lines 41a and

41b, or Form 1040, lines 64a and 64b)

AND

▼

Who lived with you in the United States for more than half

of 2010. If the child did not live with you for the required time,

see Exception to time lived with you in the instructions for

Form 1040A, lines 41a and 41b, or Form 1040, lines 64a and 64b.

▲

!

CAUTION

If the child was married or meets the conditions to be a

qualifying child of another person (other than your

spouse if filing a joint return), special rules apply. For

details, see Married child or Qualifying child of more

than one person in the instructions for Form 1040A, lines

41a and 41b, or Form 1040, lines 64a and 64b.