Fillable Printable 2012 Form 100S - Franchise Tax Board

Fillable Printable 2012 Form 100S - Franchise Tax Board

2012 Form 100S - Franchise Tax Board

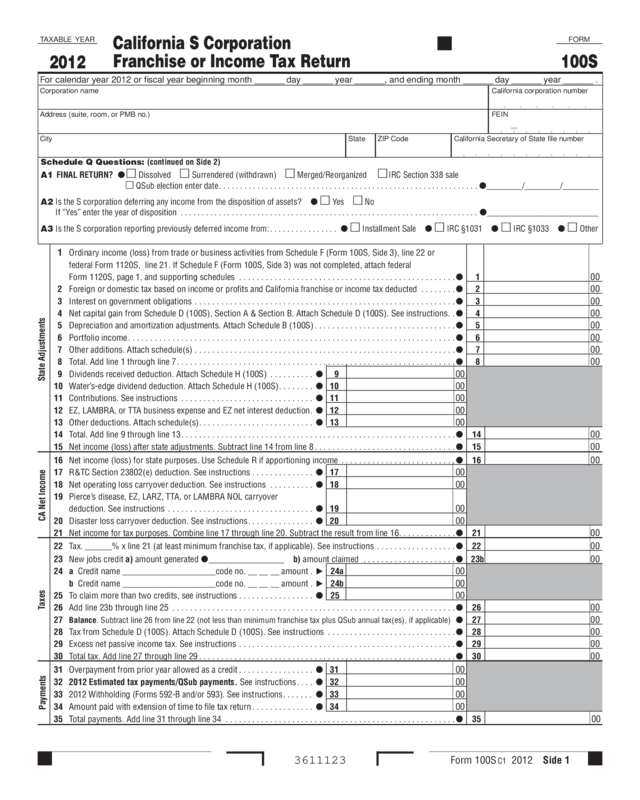

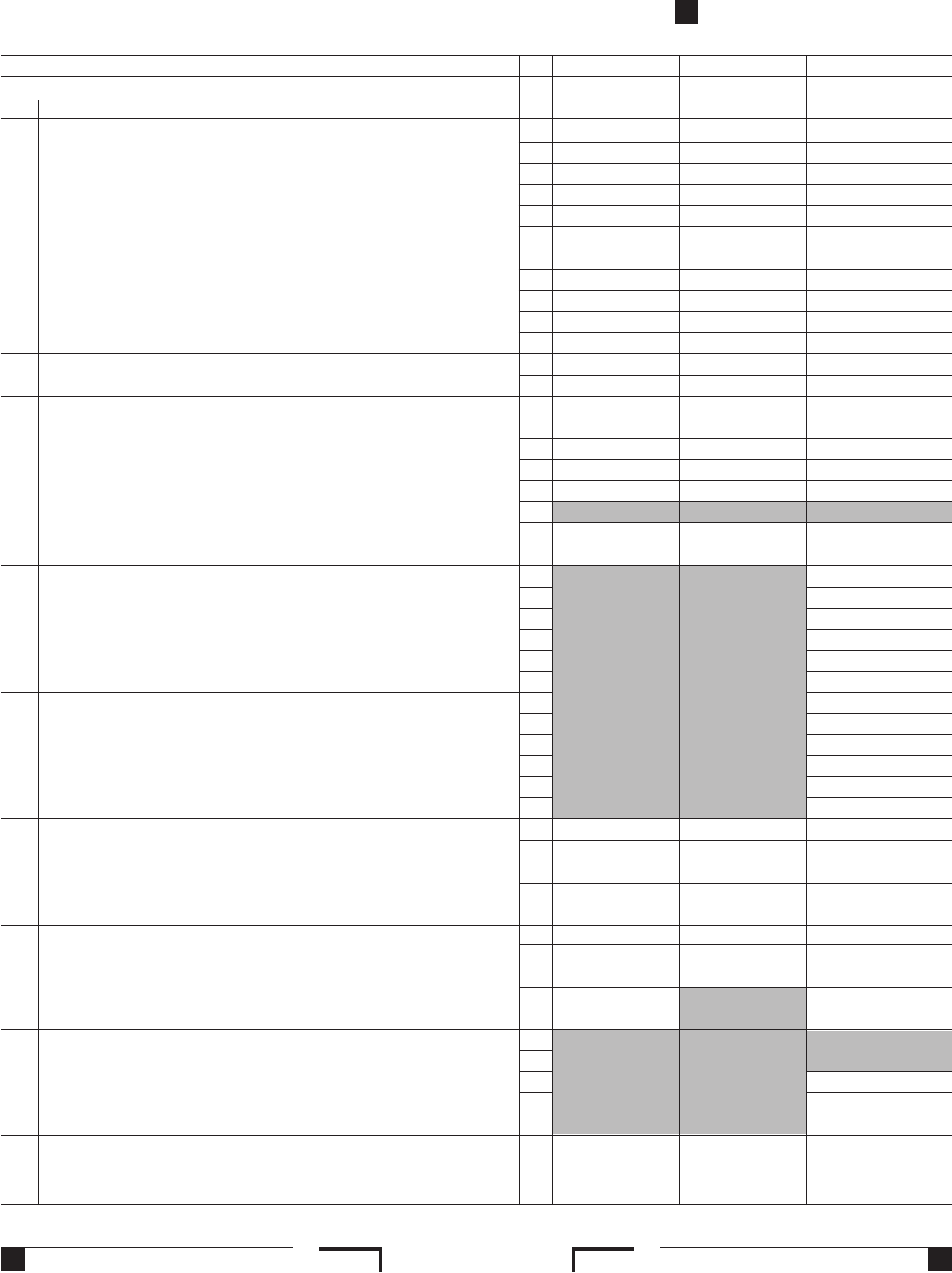

Form 100S C1 2012 Side 1

California S Corporation

Franchise or Income Tax Return

TAXABLE YEAR

2012

For calendar year 2012 or fiscal year beginning month ______ day ______ year ______, and ending month ______ day ______ year ______ .

3611123

FORM

100S

State Adjustments

CA Net Income

Taxes

Payments

Schedule Q Questions: (continued on Side 2)

A1 FINAL RETURN? Dissolved Surrendered (withdrawn) Merged/Reorganized IRC Section 338 sale

QSub election enter date.............................................................

________/________/________

A2 Is the S corporation deferring any income from the disposition of assets? Yes No

If “Yes” enter the year of disposition

......................................................................

_________________________

A3 Is the S corporation reporting previously deferred income from: ................ Installment Sale IRC §1031 IRC §1033 Other

Corporation name California corporation number

Address (suite, room, or PMB no.) FEIN

City State ZIP Code California Secretary of State file number

16 Net income (loss) for state purposes. Use Schedule R if apportioning income ..........................

16 00

17 R&TC Section 23802(e) deduction. See instructions . . . . . . . . . . . . . .

17 00

18 Net operating loss carryover deduction. See instructions ..........

18 00

19 Pierce’s disease, EZ, LARZ, TTA, or LAMBRA NOL carryover

deduction. See instructions .................................

19 00

20 Disaster loss carryover deduction. See instructions...............

20 00

21 Net income for tax purposes. Combine line 17 through line 20. Subtract the result from line 16.............

21 00

22 Tax. ______% x line 21 (at least minimum franchise tax, if applicable). See instructions ..................

22 00

23 New jobs credit a) amount generated

_________________ b) amount claimed .....................

23b 00

24 a Credit name _____________________code no. __ __ __ amount . 24a 00

b Credit name _____________________code no. __ __ __ amount . 24b 00

25 To claim more than two credits, see instructions .................

25 00

26 Add line 23b through line 25 ................................................................

26 00

27 Balance. Subtract line 26 from line 22 (not less than minimum franchise tax plus QSub annual tax(es), if applicable)

27 00

28 Tax from Schedule D (100S). Attach Schedule D (100S). See instructions .............................

28 00

29 Excess net passive income tax. See instructions .................................................

29 00

30 Total tax. Add line 27 through line 29 ..........................................................

30 00

31 Overpayment from prior year allowed as a credit .................

31 00

32 2012 Estimated tax payments/QSub payments. See instructions....

32 00

33

2012 Withholding (Forms 592-B and/or 593). See instructions.......

33 00

34 Amount paid with extension of time to file tax return ..............

34 00

35 Total payments. Add line 31 through line 34 ....................................................

35 00

1 Ordinary income (loss) from trade or business activities from Schedule F (Form 100S, Side 3), line 22 or

federal Form 1120S, line 21. If Schedule F (Form 100S, Side 3) was not completed, attach federal

Form 1120S, page 1, and supporting schedules .................................................

1 00

2 Foreign or domestic tax based on income or profits and California franchise or income tax deducted ........

2 00

3 Interest on government obligations ...........................................................

3 00

4 Net capital gain from Schedule D (100S), Section A & Section B. Attach Schedule D (100S). See instructions..

4 00

5 Depreciation and amortization adjustments. Attach Schedule B (100S) ................................

5 00

6 Portfolio income..........................................................................

6 00

7 Other additions. Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 00

8 Total. Add line 1 through line 7...............................................................

8 00

9 Dividends received deduction. Attach Schedule H (100S) ..........

9 00

10 Water’s-edge dividend deduction. Attach Schedule H (100S)........

10 00

11 Contributions. See instructions ..............................

11 00

12 EZ, LAMBRA, or TTA business expense and EZ net interest deduction.

12 00

13 Other deductions. Attach schedule(s)..........................

13 00

14 Total. Add line 9 through line 13..............................................................

14 00

15 Net income (loss) after state adjustments. Subtract line 14 from line 8 ................................

15 00

Get 100S Booklet to see the instructions for the 100S Form

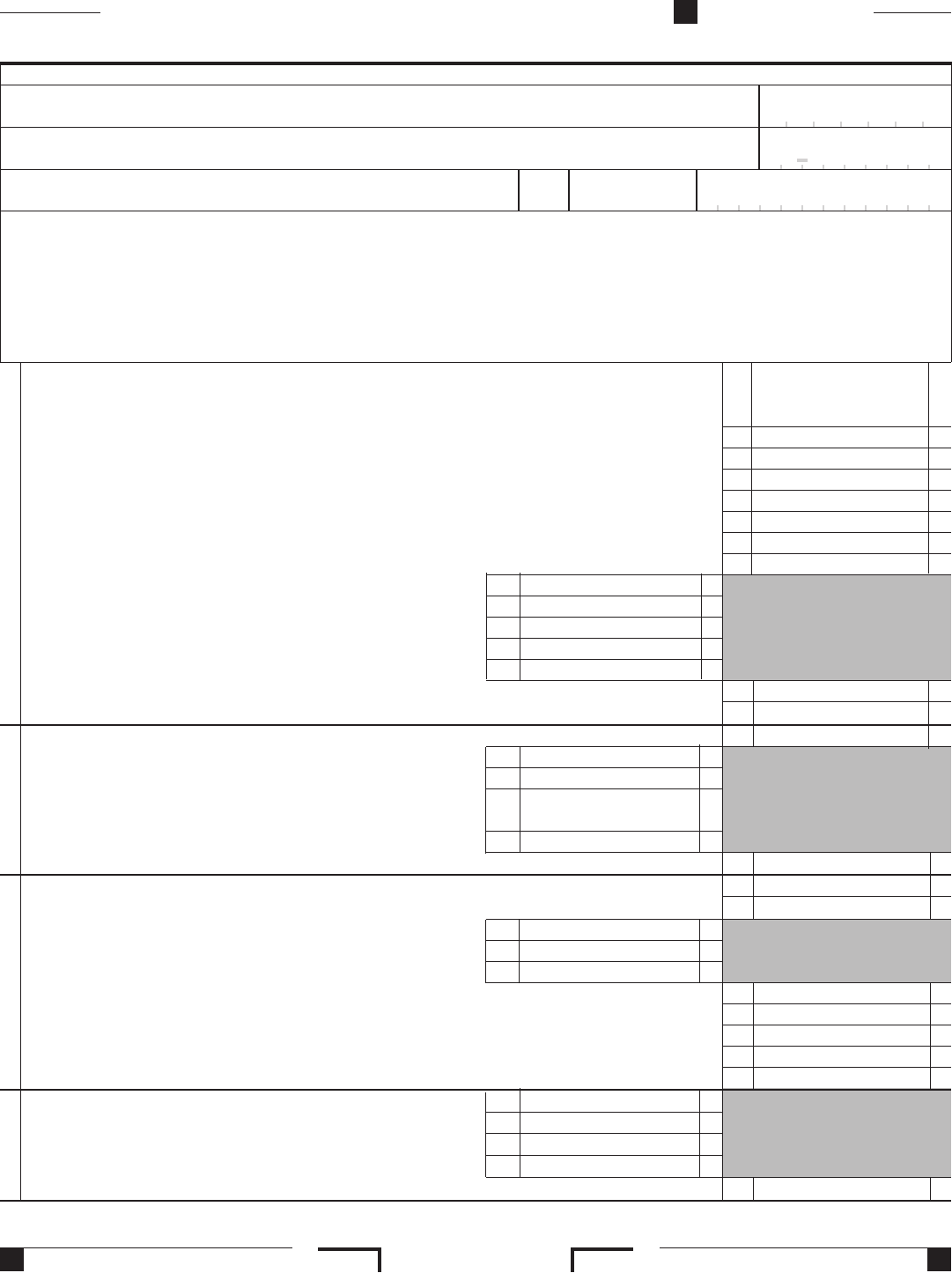

Side 2 Form 100S C1 2012 (REV 01-13)

3612123

For Privacy Notice, get form FTB 1131.

Refund or Amount Due

Schedule Q Questions (continued from Side 1)

B 1. During this taxable year, did another person or legal entity

acquire control or majority ownership (more than a

50% interest) of this corporation or any of its subsidiaries

that owned California real property (i.e., land, buildings),

leased such property for a term of 35 years or more, or

leased such property from a government agency for

any term? ................................. Yes No

2. During this taxable year, did this corporation or any of its

subsidiaries acquire control or majority ownership (more

than a 50% interest) in another legal entity that owned

California real property (i.e., land, buildings), leased such

property for a term of 35 years or more, or leased such

property from a government agency for any term? ..... Yes No

3. During this taxable year, has more than 50% of the voting

stock of this corporation cumulatively transferred in one or

more transactions after an interest in California real

property (i.e., land, buildings) was transferred to it that was

excluded from property tax reassessment under Revenue

and Taxation Code section 62(a)(2) and it was not reported

on a previous year’s tax return? .................. Yes No

(Yes requires filing of statement, penalties may apply– see instructions.)

C Principal business activity code.

(Do not leave blank): .....................

Business activity ________________________________________________

Product or service _______________________________________________

D Is this S corporation filing on a water’s-edge basis

pursuant to R&TC Sections 25110 and 25113 for

the current taxable year?............................ Yes No

E Does this tax return include Qualified

Subchapter S Subsidiaries? ......................... Yes No

F Date incorporated:________/________/________

Where: State Country________________________________

G Maximum number of shareholders in the S corporation

at any time during the year: ________________________________

H Date business began in California or date income was first derived

from California sources: ________/________/________

I Is the S corporation under audit by the IRS or has

it been audited in a prior year? ....................... Yes No

J Effective date of federal S election: ________/________/________

L Accounting method: (1) Cash (2) Accrual (3) Other

M Location of principal

accounting records: _______________________________________________

N “Doing business as’’ name. (See instructions):

______________________________________________________________

O Have all required information returns (e.g., federal

Form 1099, 8300 and state Forms 592, 592-B etc.)

been filed with the Franchise Tax Board? ........... N/A Yes No

P Is this S corporation apportioning income to California

using Schedule R? ................................ Yes No

Q Has the S corporation included a reportable transaction

or listed transaction within this return?

(See instructions for definitions)...................... Yes No

If “Yes,” complete and attach federal Form 8886, for each transaction.

R Did this S corporation file the federal

Schedule M-3(Form 1120S)? ........................ Yes No

S Is form FTB 3544A attached to the return? .............. Yes No

1 LIFO recapture due to S corporation election (IRC Section 1363(d)

deferral: $__________________________) ........................................... 1 00

2 Interest computed under the look-back method for completed long-term contracts (attach form FTB 3834) 2 00

3 Interest on tax attributable to installment: a) Sales of certain timeshares and residential lots........... 3a 00

b) Method for nondealer installment obligations ............ 3b 00

4 IRC Section 197(f)(9)(B)(ii) election ....................................................... 4 00

5 Credit recapture name:________________________________________________________________ . 5 00

6 Combine line 1 through line 5. Revise the amount on line 36 or line 37 above, whichever applies,

by this amount. Write “Schedule J’’ to the left of line 36 or line 37 ................................ 6 00

Schedule J Add-On Taxes and Recapture of Tax Credits. See instructions.

36 Franchise or income tax due. If line 30 is more than line 35, subtract line 35 from line 30. Go to line 39 ....

36 00

37 Overpayment. If line 35 is more than line 30, subtract line 30 from line 35............................

37 00

38 Amount of line 37 to be credited to 2013 estimated tax ...........................................

38 00

39 Use Tax. This is not a total line. See instructions................

39 00

40 Refund. If the sum of line 38 and line 39 is less than 37, then subtract the result from line 37. ............

40 00

See instructions to have the refund directly deposited. a Routing number .................

_ _ 40a

b Type: Checking

Savings

c Account number ..........................

_ _ 40c

41 a Penalties and interest. b

Check if estimate penalty computed using Exception B or C. See instructions

41a 00

42 Total amount due. Add line 36, line 38, line 39, and line 41a, then subtract line 37 from the result ......... 42 00

Sign

Here

Paid

Preparer’s

Use Only

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

PTIN

Firm’s name (or yours,

if self-employed)

and address

Telephone

( )

May the FTB discuss this return with the preparer shown above? See instructions .................. Yes No

Preparer’s

signature

Date

Check if self-

employed

Signature

of officer

Title Date

Telephone

( )

FEIN

Officer’s email address (optional)

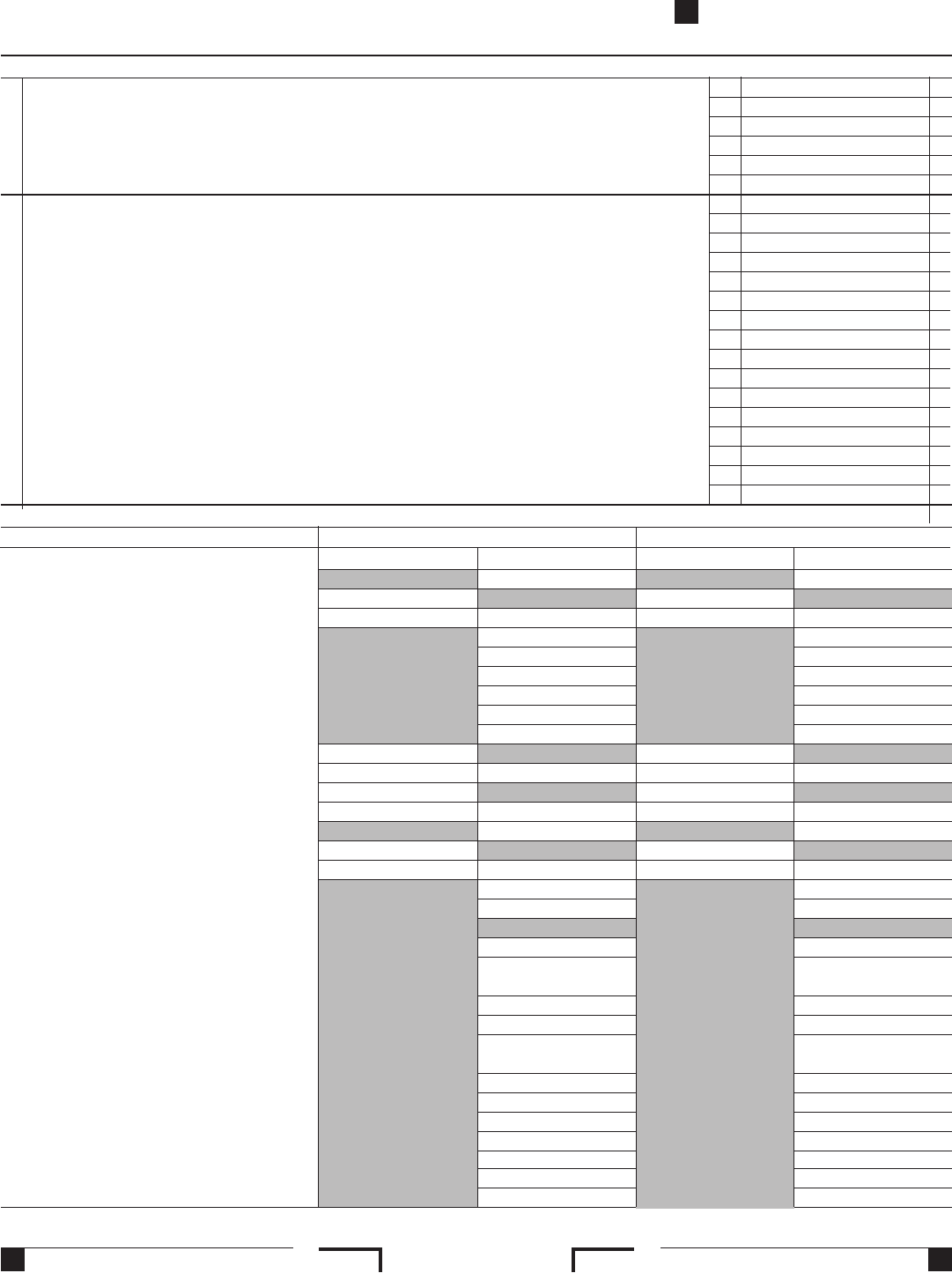

Form 100S C1 2012 Side 33613123

Income

Deductions

1 a) Gross receipts or sales ____________ b) Less returns and allowances _______________ c) Balance .. 1c 00

2 Cost of goods sold from Schedule V, line 8 .................................................... 2 00

3 Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 00

4 Net gain (loss). Attach schedule ............................................................. 4 00

5 Other income (loss). Attach schedule....................................................... 5 00

6 Total income (loss). Combine line 3 through line 5.............................................. 6 00

Schedule F Computation of Trade or Business Income. See instructions.

Schedule L Balance Sheet Beginning of taxable year End of taxable year

Assets (a) (b) (c) (d)

1 Cash..................................

2 a Trade notes and accounts receivable .......

b Less allowance for bad debts ............

3 Inventories .............................

4 Federal and state government obligations .....

5 Other current assets. Attach schedule(s) ......

6 Loans to shareholders. Attach schedule(s) ....

7 Mortgage and real estate loans .............

8 Other investments. Attach schedule(s)........

9 a Buildings and other fixed depreciable assets.

b Less accumulated depreciation ...........

10 a Depletable assets......................

b Less accumulated depletion .............

11 Land (net of any amortization) ..............

12 a Intangible assets (amortizable only) .......

b Less accumulated amortization ...........

13 Other assets. Attach schedule(s) ............

14 Total assets. ...........................

Liabilities and shareholders’ equity

15 Accounts payable ........................

16 Mortgages, notes, bonds payable in less

than 1 year .............................

17 Other current liabilities. Attach schedule(s) ....

18 Loans from shareholders. Attach schedule(s) ..

19 Mortgages, notes, bonds payable in

1 year or more ..........................

20 Other liabilities. Attach schedule(s) ..........

21 Capital stock............................

22 Paid-in or capital surplus ..................

23 Retained earnings .......................

24 Adjustments. Attach schedule(s) ............

25 Less cost of treasury stock ................

26 Total liabilities and shareholders’ equity ....

The corporation may not be required to complete Schedule L and Schedule M-1. See Schedule L and Schedule M-1 instructions for reporting requirements.

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

7 Compensation of officers. Attach schedule. See instructions ....................................... 7 00

8 Salaries and wages..................................................................... 8 00

9 Repairs ................................................................................ 9 00

10 Bad debts .............................................................................. 10 00

11 Rents ............................................................................... 11 00

12 Taxes ................................................................................. 12 00

13 Interest ................................................................................ 13 00

14 a) Depreciation __________ b) Less depreciation reported elsewhere on return __________ c) Balance .. 14c 00

15 Depletion .............................................................................. 15 00

16 Advertising ............................................................................. 16 00

17 Pension, profit-sharing plans, etc. ......................................................... 17 00

18 Employee benefit programs .............................................................. 18 00

19 a) Total travel and entertainment _________________________________ b) Deductible amount ......... 19b 00

20 Other deductions. Attach schedule ......................................................... 20 00

21 Total deductions. Add line 7 through line 20 ................................................. 21 00

22 Ordinary income (loss) from trade or business. Subtract line 21 from line 6. Enter here and on Side 1, line 1 . 22 00

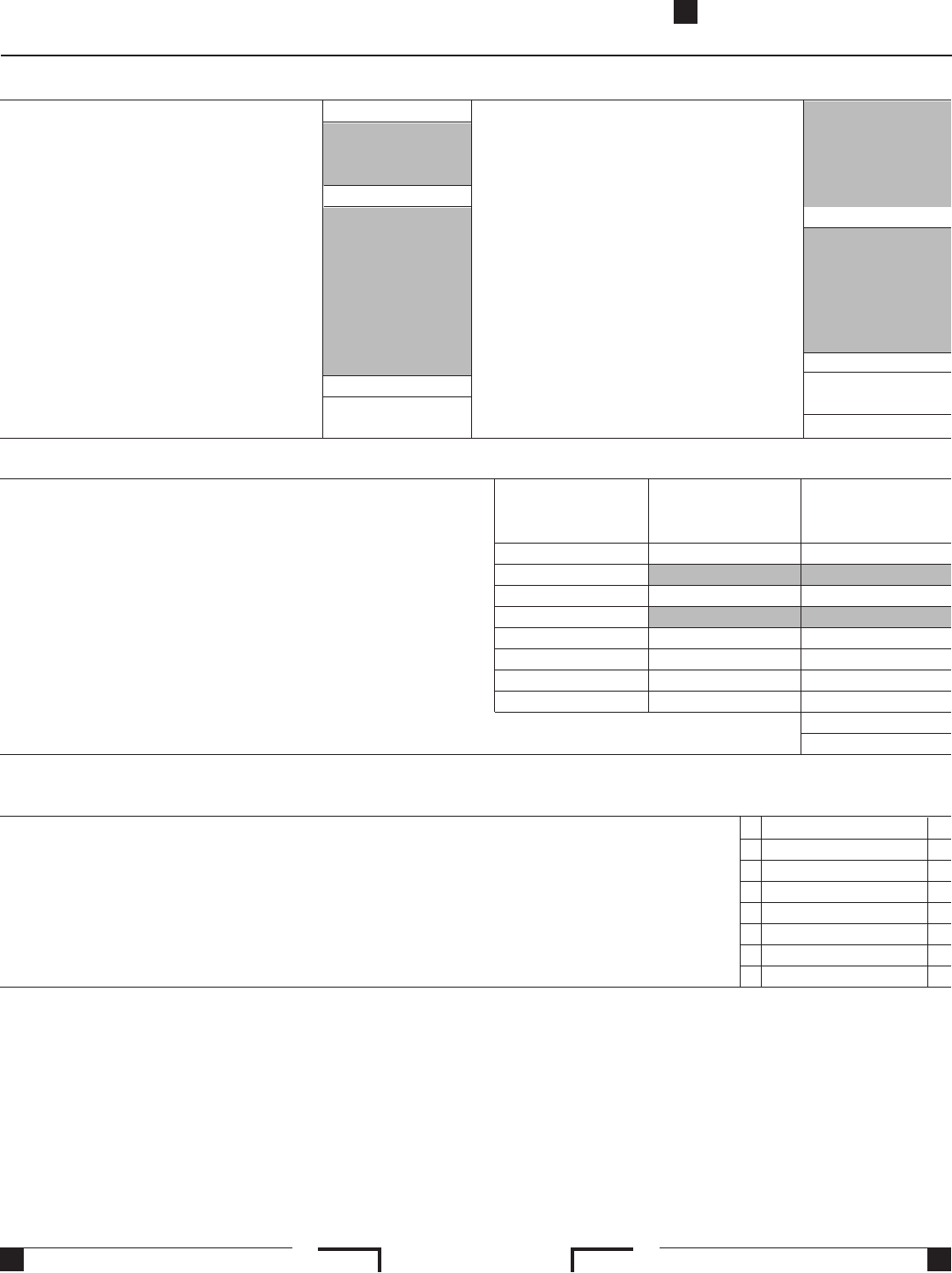

Side 4 Form 100S C1 2012 3614123

Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return.

If the S corporation completed federal Schedule M-3 (Form 1120S). See instructions.

1 Net income per books .....................

2 Income included on Schedule K, line 1 through

line 10b, not recorded on books this year

(itemize)______________________________

_______________________________________

3 Expenses recorded on books this year not

included on Schedule K, line 1 through

line 12e (itemize)

a Depreciation .....$____________________

b State taxes ......$____________________

c Travel and

entertainment ....$____________________

d Other ...........$____________________

e Total. Add line 3a through line 3d ........

4 Total. Add line 1 through line 3e .............

Schedule M-2 CA Accumulated Adjustments Account, Other Adjustments Account, and Other Retained Earnings. See instructions.

(a)

Accumulated

adjustments

account

(b)

Other adjustments

account

(c)

Other retained earnings

(see instructions)

Important: Use California figures and federal procedures.

1 Balance at beginning of year ....................................

2 Ordinary income from Form 100S, Side 1, line 1 .......................

3 Other additions.................................................

4 Loss from Form 100S, Side 1, line 1 ................................

5 Other reductions ...............................................

6 Combine line 1 through line 5 .....................................

7 Distributions other than dividend distributions ......................

8 Balance at end of year. Subtract line 7 from line 6 ....................

9 Retained earnings at end of year. Add line 8, column (a) through column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If the corp. has C corp. E&P at the end of the taxable year, check the box and enter the amount. See instructions .........

5 Income recorded on books this year not

included on Schedule K, line 1 through

line 10b (itemize)

a Tax-exempt interest $___________________

b Other $______________________________

c Total. Add line 5a and line 5b ...........

6 Deductions included on Schedule K, line 1

through line 12e, not charged against

book income this year (itemize)

a Depreciation $ ________________________

b State tax refunds $ _____________________

c Other $______________________________

d Total. Add line 6a through line 6c ........

7 Total. Add line 5c and line 6d ................

8 Income (loss) (Schedule K, line 19, col. d).

Line 4 less line 7 .......................

( )

( ) ( ) ( )

Schedule V Cost of Goods Sold

1 Inventory at beginning of year....................................................................... 1 00

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 00

3 Cost of labor .................................................................................. 3 00

4 Other IRC Section 263A costs. Attach schedule ....................................................... 4 00

5 Other costs. Attach schedule........................................................................ 5 00

6 Total. Add line 1 through line 5 ...................................................................... 6 00

7 Inventory at end of year...............................................................................7 00

8 Cost of goods sold. Subtract line 7 from line 6 ........................................................ 8 00

Was there any change in determining quantities, costs, or valuations between opening and closing inventory? ............................. Yes No

If “Yes,’’ attach an explanation. Enter California seller’s permit number, if any _______________________________________ Method of inventory valuation

______________________________________________________________________________________________________________

Check if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 ..............................

If the LIFO inventory method was used for this taxable year, enter the amount of closing inventory computed under LIFO ......________________________

Form 100S C1 2012 Side 5

13 a Low-income housing credit. See instructions ...................... 13a

b Credits related to rental real estate activities. Attach schedule. ......... 13b

c Credits related to other rental activities. See instructions. Attach schedule 13c

d Other credits. Attach schedule .................................. 13d

e New jobs credit.............................................. 13e

14 Total withholding allocated to all shareholders ........................ 14

18 a Type of income __________________________________________ ... 18a

b Name of state ___________________________________________ ... 18b

c Total gross income from sources outside California. Attach schedule .... 18c

d Total applicable deductions and losses. Attach schedule .............. 18d

e Total other state taxes. Check one: Paid Accrued ....... 18e

17 a Investment income. See instructions ............................. 17a

b Investment expenses. See instructions ........................... 17b

c Total dividend distributions paid from accumulated earnings and profits.. 17c

d

Other items and amounts not included in lines 1 - 17b and lines 18a-e

that are required to be reported separately to shareholders. Attach schedule

.. 17d

15 a Depreciation adjustment on property placed in service after 12/31/86.... 15a

b Adjusted gain or loss. See instructions ........................... 15b

c Depletion (other than oil and gas) ............................... 15c

d 1 Gross income from oil, gas, and geothermal properties............. 15d1

2 Deductions allocable to oil, gas, and geothermal properties.......... 15d2

e Other AMT items ............................................ 15e

Income (Loss)

3615123

Other

Income

(Loss)

DeductionsCredits

Alternative Minimum

Tax (AMT) Items

Items affecting

Shareholder Basis

Schedule K S Corporation Shareholder’s Shares of Income, Deductions, Credits, etc.

Other

Information

Other

State Taxes

Recon-

ciliation

(a)

Pro-rata share items

(b)

Amount from

federal K (112OS)

(c)

California

Adjustment

(d)

Total amounts using

California law

1 Ordinary business income (loss)................................... 1

2 Net rental real estate income (loss). Attach federal Form 8825 .............. 2

3 a Other gross rental income (loss) ................................ 3a

b Expenses from other rental activities. Attach schedule................ 3b

c

Other net rental income (loss). Subtract line 3b from line 3a

........... 3c

4 Interest income ................................................ 4

5 Dividends. See instructions ....................................... 5

6 Royalties ..................................................... 6

7 Net short-term capital gain (loss). Attach Schedule D (100S) ............. 7

8 Net long-term capital gain (loss). Attach Schedule D (100S) ............. 8

9 Net Section 1231 gain (loss) ...................................... 9

10 a Other portfolio income (loss). Attach schedule ..................... 10a

b Other income (loss). Attach schedule............................. 10b

11 Expense deduction for recovery property (IRC Section 179 and

R&TC Sections 17267.2, 17267.6 and 17268) Attach Schedule B (100S).... 11

12 a Charitable contributions ....................................... 12a

b Investment interest expense.................................... 12b

c 1 Section 59(e)(2) expenditures ................................ 12c1

2 Type of expenditures ______________________________________ 12c2

d Deductions-portfolio. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12d

e Other deductions. Attach schedule ................................ 12e

16 a Tax-exempt interest income .................................... 16a

b Other tax-exempt income ...................................... 16b

c Nondeductible expenses....................................... 16c

d Total property distributions (including cash) other than dividends

distribution reported on line 17c ................................ 16d

19 Income (loss) (required only if Schedule M-1 must be completed).

Combine line 1, line 2, and line 3c through line 10b. From the result,

subtract the sum of lines 11, 12a, 12b, 12c1, 12d and 12e

............... 19