Fillable Printable 2012 Form 5 - Wisconsin Department Of Revenue

Fillable Printable 2012 Form 5 - Wisconsin Department Of Revenue

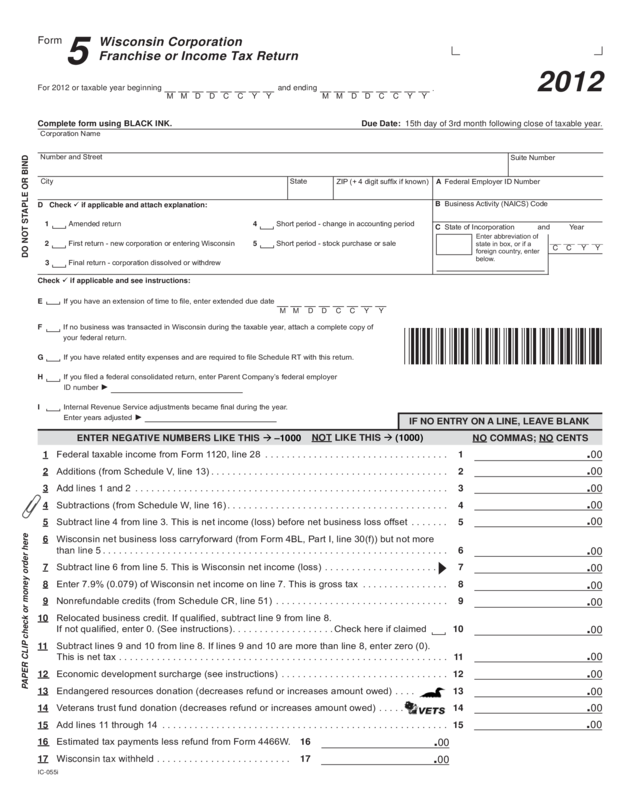

2012 Form 5 - Wisconsin Department Of Revenue

2012

For 2012 or taxable year beginning and ending

5

Wisconsin Corporation

Franchise or Income Tax Return

Form

M Y Y C C M Y

Y

C C

.

D D M M D D

IC-055i

DO NOT STAPLE OR BIND

Check if applicable and see instructions:

E

Ifyouhaveanextensionoftimetole,enterextendedduedate

M D

Y

M D Y C C

F IfnobusinesswastransactedinWisconsinduringthetaxableyear,attachacompletecopyof

your federal return.

G IfyouhaverelatedentityexpensesandarerequiredtoleScheduleRTwiththisreturn.

H Ifyouledafederalconsolidatedreturn,enterParentCompany’sfederalemployer

ID number ►

D Check if applicable and attach explanation:

2 Firstreturn-newcorporationorenteringWisconsin

1 Amended return

4 Shortperiod-changeinaccountingperiod

5 Shortperiod-stockpurchaseorsale

Complete form using BLACK INK.

CorporationName

NumberandStreet

City State

Due Date: 15th day of 3rd month following close of taxable year.

BBusinessActivity(NAICS)Code

A FederalEmployerIDNumber

ZIP(+4digitsufxifknown)

CStateofIncorporation and Year

Enter abbreviation of

stateinbox,orifa

foreigncountry,enter

below.

3 Finalreturn-corporationdissolvedorwithdrew

C C Y Y

SuiteNumber

IF NO ENTRY ON A LINE, LEAVE BLANK

NOT LIKE THIS (1000)

ENTER NEGATIVE NUMBERS LIKE THIS –1000

NO COMMAS; NO CENTS

1 FederaltaxableincomefromForm1120,line28 ................................ . . 1

2 Additions(fromScheduleV,line13) .......................................... . . 2

3 Add lines 1 and 2 ........................................................ . . 3

4 Subtractions(fromScheduleW,line16) ....................................... . . 4

5 Subtractline4fromline3.Thisisnetincome(loss)beforenetbusinesslossoffset ..... . . 5

6 Wisconsinnetbusinesslosscarryforward(fromForm4BL,PartI,line30(f))butnotmore

than line 5 .............................................................. . . 6

7 Subtractline6fromline5.ThisisWisconsinnetincome(loss) ..................... 7

8 Enter7.9%(0.079)ofWisconsinnetincomeonline7.Thisisgrosstax .............. . . 8

9 Nonrefundablecredits(fromScheduleCR,line51) .............................. . . 9

10 Relocatedbusinesscredit.Ifqualied,subtractline9fromline8.

Ifnotqualied,enter0.(Seeinstructions) ...................Checkhereifclaimed 10

11

Subtractlines9and10fromline8.Iflines9and10aremorethanline8,enterzero(0).

Thisisnettax ............................................................. 11

12 Economicdevelopmentsurcharge(seeinstructions) ............................... 12

13

Endangeredresourcesdonation(decreasesrefundorincreasesamountowed) .... 13

14

Veteranstrustfunddonation(decreasesrefundorincreasesamountowed) ........... 14

15

Addlines11through14 ..................................................... 15

16 EstimatedtaxpaymentslessrefundfromForm4466W. 16

17

Wisconsin tax withheld ......................... 17

.00

.00

.00

.00

.00

.00

PAPER CLIP check or money order here

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

I InternalRevenueServiceadjustmentsbecamenalduringtheyear.

Enteryearsadjusted►

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

Go to Page 2

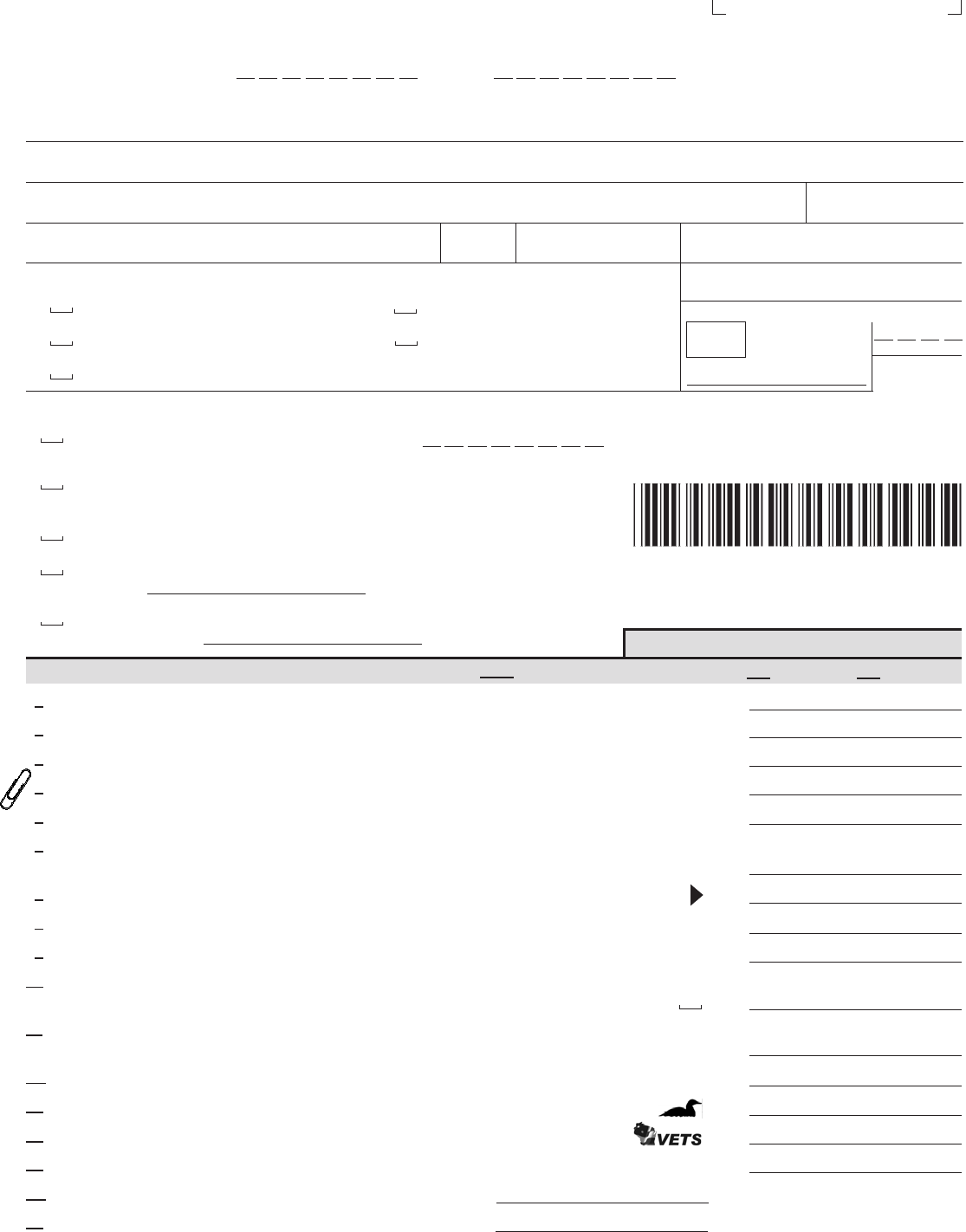

18 Refundablecredits(fromScheduleCR,line54) ........ 18

19

AmendedReturnOnly–amountpreviouslypaid ....... 19

20

Addlines16through19 ...................................................... 20

21 AmendedReturnOnly–amountpreviouslyrefunded ... 21

22

Subtractline21from20 ..................................................... 22

23

Interest,penalty,andlatefeedue(fromForm4U,line17or26)

IfyouannualizedincomeonForm4U,check()thespaceafterthearrow ...... 23

24

Tax Due.Ifthetotaloflines15and23isgreaterthanline22,subtractline22fromthetotal

of lines 15 and 23 .......................................................... 24

25 Overpayment.Ifline22islargerthanthetotaloflines15and23,subtractthetotalof

lines 15 and 23 from line 22 ................................................... 25

26

Enter amount from line 25 you want credited on 2013 estimated tax ................... 26

27

Subtractline26fromline25.This is your refund ................................. 27

28 Entertotalcompanygrossreceiptsfromallactivities(seeinstructions) ................. 28

29 EntertotalcompanyassetsfromfederalForm1120 ............................... 29

30 Ifthecorporationisthesoleownerofanylimitedliabilitycompanies(LLCs),enterthenamesandFEINsofthoseLLCsbelow.

Submitanadditionalscheduleifnecessary.

31 DidyouincludetheincomeoftheLLCslistedonline30onthisreturn? Yes No

32 DidyoulefederalScheduleUTP–UncertainTaxPositionStatementwiththeInternalRevenueService?

Yes NoIfyes,enclosefederalScheduleUTPwithyourWisconsintaxreturn.

33 DidyoulefederalForm8886–ReportableTransactionDisclosureStatementwiththeInternalRevenueService?

Yes NoIfyes,enclosefederalForm8886withyourWisconsintaxreturn.

2012Form5 Page2 of 2

Name of LLC

FEIN

Ifyouarenotlingyourreturnelectronically,

makeyourcheckpayabletoandmailyourreturnto:

WisconsinDepartmentofRevenue

POBox8908

Madison,WI53708-8908

You must le a copy of your federal return with Form 5, even if no Wisconsin activity.

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

SignatureofOfcer

Preparer’sSignature

Date

Date

Title

Preparer’sFederalEmployerIDNumber

Additional Information Required

1 Persontocontactconcerningthisreturn: Phone#: Fax#:

2 Cityandstatewherebooksandrecordsarelocatedforauditpurposes:

3 Didyoupurchaseanytaxabletangiblepersonalpropertyortaxableservicesforstorage,use,orconsumptioninWisconsinwithoutpayment

ofastatesalesorusetax? Yes No Ifyes,youoweWisconsinusetax.Seeinstructionsforhowtoreportusetax.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Return to Page 1