Fillable Printable 2012 Form 940 (Schedule A)

Fillable Printable 2012 Form 940 (Schedule A)

2012 Form 940 (Schedule A)

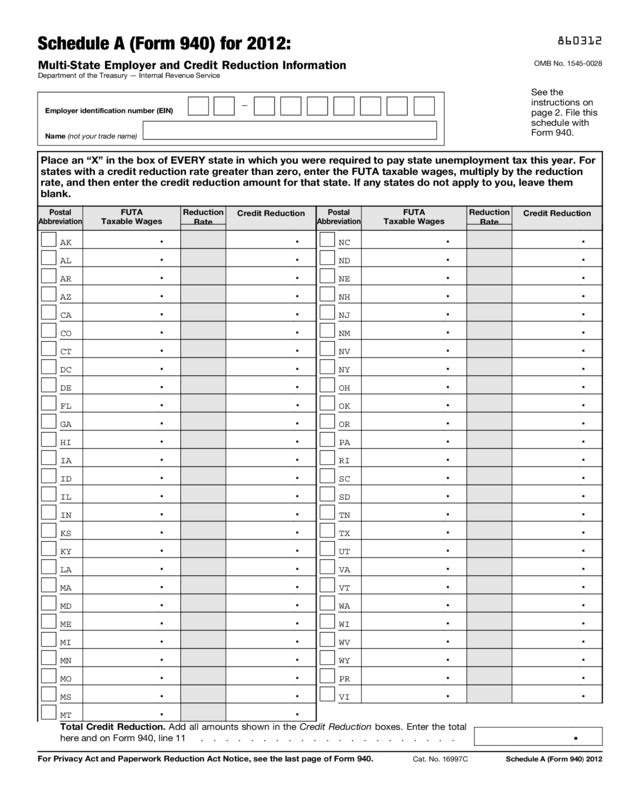

Schedule A (Form 940) for 2012:

Multi-State Employer and Credit Reduction Information

Department of the Treasury — Internal Revenue Service

860312

OMB No. 1545-0028

Employer identification number (EIN)

—

Name (not your trade name)

See the

instructions on

page 2. File this

schedule with

Form 940.

Place an “X” in the box of EVERY state in which you were required to pay state unemployment tax this year. For

states with a credit reduction rate greater than zero, enter the FUTA taxable wages, multiply by the reduction

rate, and then enter the credit reduction amount for that state. If any states do not apply to you, leave them

blank.

Postal

Abbreviation

FUTA

Taxable Wages

Reduction

Rate

Credit Reduction

AK

. .

AL

. .

AR

. .

AZ

. .

CA

. .

CO

. .

CT

. .

DC

. .

DE

. .

FL

. .

GA

. .

HI

. .

IA

. .

ID

. .

IL

. .

IN

. .

KS

. .

KY

. .

LA

. .

MA

. .

MD

. .

ME

. .

MI

. .

MN

. .

MO

. .

MS

. .

MT

. .

Postal

Abbreviation

FUTA

Taxable Wages

Reduction

Rate

Credit Reduction

NC

. .

ND

. .

NE

. .

NH

. .

NJ

. .

NM

. .

NV

. .

NY

. .

OH

. .

OK

. .

OR

. .

PA

. .

RI

. .

SC

. .

SD

. .

TN

. .

TX

. .

UT

. .

VA

. .

VT

. .

WA

. .

WI

. .

WV

. .

WY

. .

PR

. .

VI

. .

Total Credit Reduction. Add all amounts shown in the Credit Reduction boxes. Enter the total

here and on Form 940, line 11 . . . . . . . . . . . . . . . . . . . . .

.

For Privacy Act and Paperwork Reduction Act Notice, see the last page of Form 940.

Cat. No. 16997C Schedule A (Form 940) 2012

Instructions for Schedule A (Form 940) for 2012:

860412

Multi-State Employer and Credit Reduction Information

For more information on completing Schedule A, see the

Frequently Asked Questions, available at www.irs.gov/form940.

Specific Instructions: Completing Schedule A

Step 1. Check the box for every state (including the District

of Columbia, Puerto Rico, and the U.S. Virgin Islands) in

which you were required to pay state unemployment taxes

this year even if the state's credit reduction rate is zero.

Note. Make sure that you have applied for a state

unemployment number for your business. If you do not have an

unemployment account number from a state in which you paid

wages, contact the state office to receive one. For a list of state

unemployment agencies, visit the U.S. Department of Labor's

website at www.workforcesecurity.doleta.gov/unemploy/

agencies.asp.

The table below provides the two-letter postal abbreviations

used on Schedule A.

State

Postal

Abbreviation

Alabama

AL

Alaska AK

Arizona AZ

Arkansas AR

California CA

Colorado CO

Connecticut CT

Delaware DE

District of Columbia DC

Florida FL

Georgia GA

Hawaii HI

Idaho ID

Illinois IL

Indiana IN

Iowa IA

Kansas KS

Kentucky KY

Louisiana LA

Maine ME

Maryland MD

Massachusetts MA

Michigan MI

Minnesota MN

Mississippi MS

Missouri MO

State

Postal

Abbreviation

Montana MT

Nebraska NE

Nevada NV

New Hampshire NH

New Jersey NJ

New Mexico NM

New York NY

North Carolina NC

North Dakota ND

Ohio OH

Oklahoma OK

Oregon OR

Pennsylvania PA

Rhode Island RI

South Carolina SC

South Dakota SD

Tennessee TN

Texas TX

Utah UT

Vermont VT

Virginia VA

Washington WA

West Virginia WV

Wisconsin WI

Wyoming WY

Puerto Rico PR

U.S. Virgin Islands VI

Step 2. You are subject to credit reduction if you paid FUTA

taxable wages that were also subject to state

unemployment taxes in any state listed that has a credit

reduction rate greater than zero.

If you paid FUTA taxable wages that were also subject to state

unemployment taxes in any states that are subject to credit

reduction, find the lines for each state.

In the FUTA Taxable Wages box, enter the total FUTA taxable

wages that you paid in that state. (The FUTA wage base for all

states is $7,000.) However, do not include in the FUTA Taxable

Wages box wages that were excluded from state unemployment

tax.

Note. Do not enter your state unemployment wages in the FUTA

Taxable Wages box.

Then multiply the total taxable FUTA wages by the reduction

rate.

Enter your total in the Credit Reduction box at the end of the

line.

Step 3. Total credit reduction

To calculate the total credit reduction, add up all of the Credit

Reduction boxes and enter the amount in the Total Credit

Reduction box.

Then enter the total credit reduction on Form 940, line 11.

Example 1

You paid $20,000 in wages to each of three employees in State A. State

A is subject to credit reduction at a rate of .003 (.3%). Because you paid

wages in a state that is subject to credit reduction, you must complete

Schedule A and file it with Form 940.

Total payments to all employees in State A . . . . . . $60,000

Payments exempt from FUTA tax

(see the Instructions for Form 940) . . . . . . . . . . $0

Total payments made to each employee in

excess of $7,000 (3 x ($20,000 - $7,000)) . . . . . . . $39,000

Total taxable FUTA wages you paid in State A entered in the FUTA

Taxable Wages box ($60,000 - $0 - $39,000) . . . . . . $21,000

Credit reduction rate for State A . . . . . . . . . . .003

Total credit reduction for State A ($21,000 x .003) . . . . . $63

Caution. Do not include in the FUTA Taxable Wages box wages in

excess of the $7,000 wage base for each employee subject to

unemployment insurance in the credit reduction state. The credit

reduction applies only to taxable FUTA wages.

In this case, you would write $63.00 in the Total Credit Reduction box

and then enter that amount on Form 940, line 11.

Example 2

You paid $48,000 ($4,000 a month) in wages to Employee A and no

payments were exempt from FUTA tax. Employee A worked in State B

(not subject to credit reduction) in January and then transferred to State

C (subject to credit reduction) on February 1. Because you paid wages

in more than one state, you must complete Schedule A and file it with

Form 940.

The total payments in State B that are not exempt from FUTA tax are

$4,000. Since this payment to Employee A does not exceed the $7,000

FUTA wage base, the total taxable FUTA wages paid in State B are

$4,000.

The total payments in State C that are not exempt from FUTA tax are

$44,000. However, $4,000 of FUTA taxable wages was paid in State B

with respect to Employee A. Therefore, the total taxable FUTA wages

with respect to Employee A in State C is $3,000 ($7,000 (FUTA wage

base) - $4,000 (total FUTA taxable wages paid in State B)). Enter $3,000

in the FUTA Taxable Wages box, multiply it by the Reduction Rate, and

then enter the result in the Credit Reduction box.

Attach Schedule A to Form 940 when you file your return.

Page 2